Key Insights

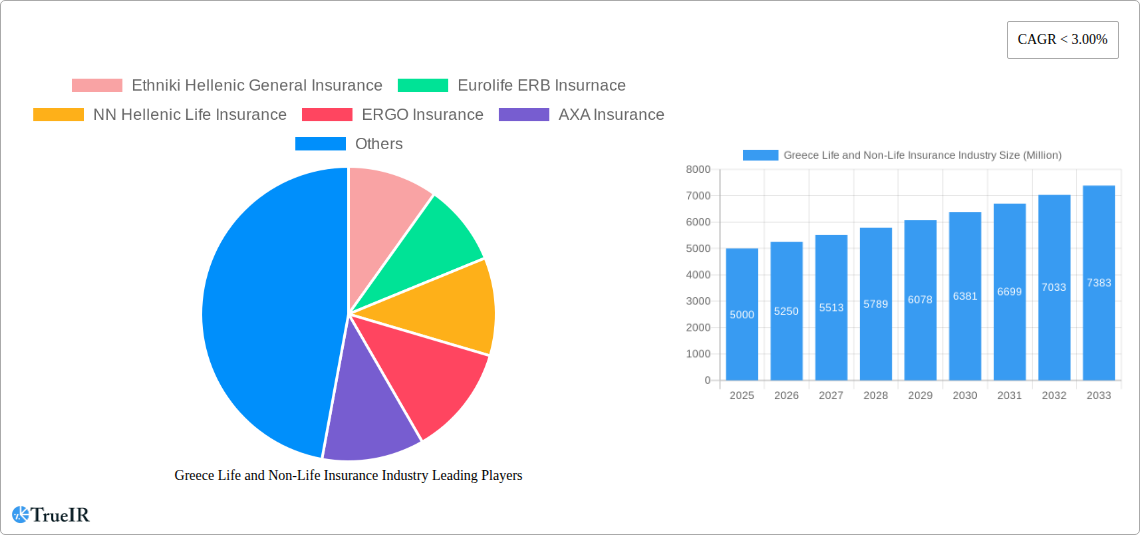

The Greek life and non-life insurance market is poised for significant expansion, driven by post-pandemic recovery and enhanced risk awareness. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 34.51%, fueled by increased insurance product penetration in under-served segments, a growing middle class, and the adoption of digital insurance platforms. Government initiatives promoting financial inclusion and sector support will further bolster this growth. The estimated market size in 2025 is 6.66 billion. The non-life segment, including motor, property, and liability insurance, is projected to lead growth due to rising vehicle ownership and stricter regulations. The life insurance segment will benefit from increased focus on long-term financial planning and retirement security. The Greek insurance market offers substantial opportunities for domestic and international players, especially those leveraging digital technologies and addressing evolving consumer needs.

Greece Life and Non-Life Insurance Industry Market Size (In Billion)

The projected CAGR reflects a sustainable growth trajectory, responding positively to economic stability and consumer confidence. Strategic adaptation will be key to navigating the competitive landscape and capitalizing on evolving consumer preferences. This includes prioritizing customer experience, developing innovative products, and implementing data-driven strategies for risk management and underwriting. Collaboration with Fintech companies will be essential for enhancing efficiency and customer engagement through technology.

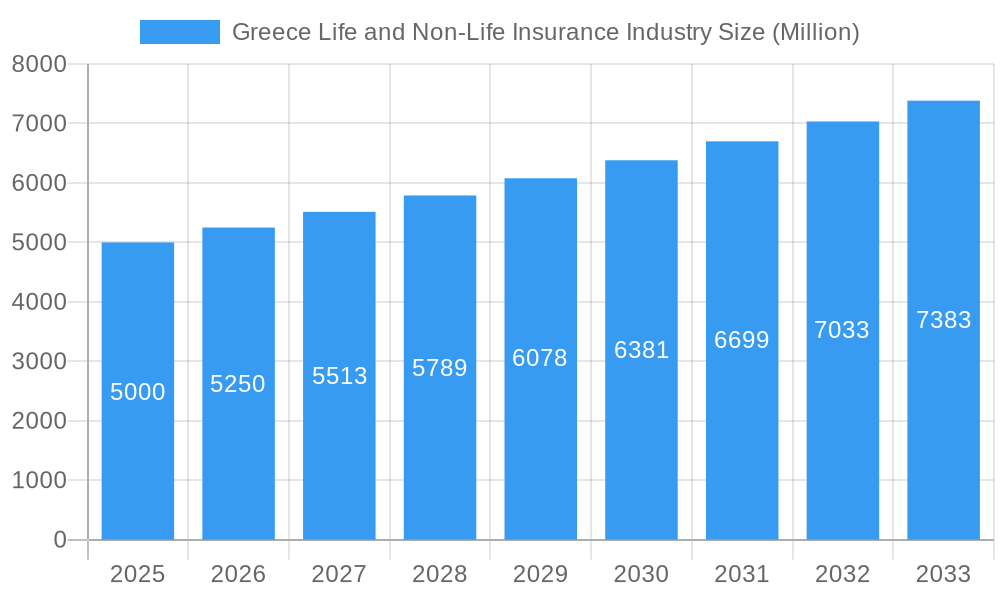

Greece Life and Non-Life Insurance Industry Company Market Share

Greece Life and Non-Life Insurance Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Greek life and non-life insurance market, covering the period 2019-2033. It examines market structure, competitive dynamics, key players, and future growth prospects, offering invaluable insights for industry stakeholders, investors, and strategic planners. The report leverages robust data and analysis to forecast market trends and identify lucrative opportunities within this dynamic sector. The base year for this report is 2025, with the forecast period spanning from 2025 to 2033.

Greece Life and Non-Life Insurance Industry Market Structure & Competitive Landscape

The Greek insurance market exhibits a moderately concentrated structure, with several major players dominating the landscape. Key factors influencing market dynamics include regulatory changes, technological advancements, and intense competitive pressures. The market concentration ratio (CR4) in 2024 was estimated to be around xx%, indicating a relatively consolidated market. However, the entry of new players and the increasing adoption of Insurtech solutions are gradually altering this structure.

Market Concentration: The market shows signs of consolidation, influenced by recent mergers and acquisitions (M&A) activity. The total M&A value in the period 2019-2024 reached approximately €xx Million. This trend is expected to continue, driven by the pursuit of economies of scale and broader market reach.

Innovation Drivers: Technological advancements, particularly in areas like digitalization and Insurtech, are driving innovation. Insurers are adopting advanced analytics, AI, and data-driven strategies to enhance efficiency and customer experience.

Regulatory Impacts: The regulatory environment plays a significant role, influencing pricing, product development, and market access. Recent regulatory changes have focused on consumer protection and financial stability.

Product Substitutes: The increasing availability of alternative financial products poses a challenge. Insurers are responding by developing innovative product offerings and tailoring solutions to specific customer needs.

End-User Segmentation: The market is segmented based on customer demographics, risk profiles, and product preferences. This segmentation enables insurers to offer targeted products and services.

M&A Trends: The M&A landscape is characterized by both domestic and international transactions. Foreign investors are increasingly targeting Greek insurance companies, attracted by growth opportunities in the region.

Greece Life and Non-Life Insurance Industry Market Trends & Opportunities

The Greek life and non-life insurance market is expected to witness robust growth throughout the forecast period (2025-2033), driven by factors such as increasing insurance awareness, economic recovery, and favorable regulatory policies. The market size is projected to reach €xx Million by 2033, registering a compound annual growth rate (CAGR) of xx% during the forecast period. Market penetration rates, particularly in the life insurance segment, are also expected to increase.

Technological advancements like AI, big data, and blockchain are significantly influencing market trends. Consumers are increasingly adopting digital channels for insurance purchases and claims management. Insurers are responding by investing heavily in digital platforms and improving their customer service capabilities.

Changing consumer preferences, including increasing demand for personalized products and flexible coverage options, are shaping the competitive landscape. Insurers are striving to offer tailored solutions to meet these evolving customer demands. The competitive dynamics are intensely influenced by pricing strategies, product innovation, and customer acquisition costs. The market is also witnessing the rise of Insurtech startups, challenging established players.

Dominant Markets & Segments in Greece Life and Non-Life Insurance Industry

The dominant segment in the Greek insurance market is currently the non-life segment which represents approximately xx% of the market share and its increasing adoption of digital channels by the insurers contributes to its dominance. This is driven by mandatory insurance requirements (like motor insurance) and the relatively higher penetration rates in this segment. Life insurance has been witnessing growth but lags behind in terms of market share and penetration rates. However, future growth opportunities are prevalent in the life insurance segment with an expected growth of xx% over the next few years.

- Key Growth Drivers for Non-Life:

- Increasing vehicle ownership and mandatory motor insurance.

- Growing awareness of property insurance and its importance.

- Expansion of the tourism and hospitality sector.

- Key Growth Drivers for Life:

- Rising disposable incomes and greater awareness of financial planning.

- Growing demand for retirement and health insurance.

- Government initiatives promoting financial inclusion.

The geographic distribution of insurance activities is largely concentrated in the major urban centers. However, insurers are increasingly targeting regional markets as they realize the importance of untapped market potential. The increasing penetration in rural areas is expected to drive future growth in the market as a whole.

Greece Life and Non-Life Insurance Industry Product Analysis

The Greek insurance market offers a wide range of products, including traditional life and non-life policies, as well as innovative products tailored to specific customer needs. Recent product innovations focus on leveraging technology to enhance customer experience and efficiency. Insurers are increasingly incorporating digital features into their policies, providing online platforms for policy management, claims filing, and customer support. This improves efficiency and reduces administrative costs, making the insurance process more accessible and user-friendly. Some companies are also offering specialized products catering to the needs of specific demographics or market segments. The competitive advantage hinges on the ability to innovate and adapt to the evolving demands of the insurance market.

Key Drivers, Barriers & Challenges in Greece Life and Non-Life Insurance Industry

Key Drivers:

- Economic Growth: Improving economic conditions lead to increased disposable income, encouraging higher insurance penetration.

- Government Regulations: Favorable regulatory policies stimulate market growth and attract investment.

- Technological Advancements: Digitalization and technological innovation enhance efficiency and create new opportunities.

Key Challenges:

- High Unemployment: Limited employment reduces consumer purchasing power, leading to decreased demand for insurance.

- Stringent Regulations: Strict regulations can increase compliance costs for insurers and limit market entry.

- Economic Volatility: Fluctuations in the economy can negatively affect demand for insurance services. The impact of the 2008 financial crisis is still noticeable, making consumers more risk averse and less inclined to invest in insurance.

Growth Drivers in the Greece Life and Non-Life Insurance Industry Market

The growth of the Greek insurance market is primarily fueled by the increasing awareness of risk management among businesses and consumers, accompanied by economic recovery and technological advancements which drives greater penetration of innovative insurance products. Government policies that promote financial inclusion and encourage insurance adoption also contribute significantly to market expansion. Furthermore, the ongoing digital transformation enhances operational efficiencies and improves customer experiences.

Challenges Impacting Greece Life and Non-Life Insurance Industry Growth

The growth of the Greek insurance market faces obstacles such as persistent high unemployment rates, creating a considerable challenge to the industry's expansion. The economic climate, marked by ongoing volatility, also restricts the consumers' willingness to invest in insurance. Additionally, complex and stringent regulations increase compliance costs and can impede the entry of new market players. The legacy of the 2008 crisis also continues to affect consumer confidence and purchasing behavior.

Key Players Shaping the Greece Life and Non-Life Insurance Industry Market

- Ethniki Hellenic General Insurance

- Eurolife ERB Insurnace

- NN Hellenic Life Insurance

- ERGO Insurance

- AXA Insurance

- European Relaince General

- MetLife

- General Hellas

- Allianz Hellas

- Griupama Phoenix Hellenic Insurance

Significant Greece Life and Non-Life Insurance Industry Industry Milestones

- 2020: Generali acquired AXA's Greek operations, signifying significant consolidation in the market.

- 2021: CVC Capital Partners acquired a 90.01% stake in Ethniki Insurance from NBG, marking a major shift in ownership within a leading player.

Future Outlook for Greece Life and Non-Life Insurance Industry Market

The Greek life and non-life insurance market is poised for continued growth, driven by economic recovery, technological advancements, and increasing insurance awareness. Strategic opportunities exist for insurers to leverage digital technologies, offer personalized products, and expand into underserved markets. The market is expected to experience substantial growth in the coming years, presenting considerable potential for both established players and new entrants. The focus will be on digital transformation, customer-centric approaches, and innovation to meet evolving customer needs and competitive pressures.

Greece Life and Non-Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-Life Insurances

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Greece Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Greece

Greece Life and Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Greece Life and Non-Life Insurance Industry

Greece Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-Life Insurances

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethniki Hellenic General Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eurolife ERB Insurnace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NN Hellenic Life Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ERGO Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AXA Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 European Relaince General

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MetLife

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Hellas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allianz Hellas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Griupama Phoenix Hellenic Insurance*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ethniki Hellenic General Insurance

List of Figures

- Figure 1: Greece Life and Non-Life Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Greece Life and Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Greece Life and Non-Life Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Life and Non-Life Insurance Industry?

The projected CAGR is approximately 34.51%.

2. Which companies are prominent players in the Greece Life and Non-Life Insurance Industry?

Key companies in the market include Ethniki Hellenic General Insurance, Eurolife ERB Insurnace, NN Hellenic Life Insurance, ERGO Insurance, AXA Insurance, European Relaince General, MetLife, General Hellas, Allianz Hellas, Griupama Phoenix Hellenic Insurance*List Not Exhaustive.

3. What are the main segments of the Greece Life and Non-Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.66 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Penetration Ratio of Insurance Premium and their Investments to GDP Increased Greece Life & Non-Life Insurance Industry Size.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Greek Insurance Conglomerate Ethniki Sold to Private Fund. Through its subsidiaries Garanta and Ethniki Asfalistiki Cyprus, it has a significant and dynamic presence in Romania and Cyprus, respectively. Its growth has attracted the interest of several foreign funds recently. In a statement, CVC Capital announced that it has entered into a definitive agreement to acquire 90.01% of Ethniki Insurance from NBG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Greece Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence