Key Insights

The Mexico home equity loan market is poised for significant expansion, propelled by a growing middle class, increasing homeownership, and consistent demand for home renovations and debt consolidation. Projections indicate a Compound Annual Growth Rate (CAGR) of 4.56%, forecasting a market size of 747.9 million by the base year 2024. Key growth catalysts include supportive government initiatives for homeownership, a wide array of financing solutions from major financial institutions and regional lenders, and a heightened recognition of home equity as a valuable financial asset. The market is segmented by loan type (fixed-rate, variable-rate, HELOCs), loan value, and borrower profiles.

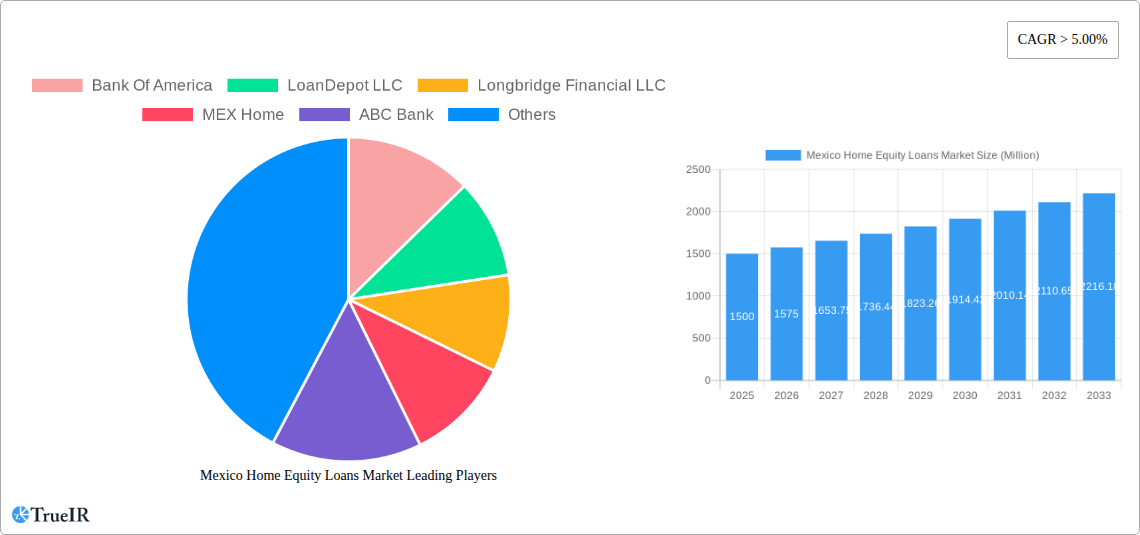

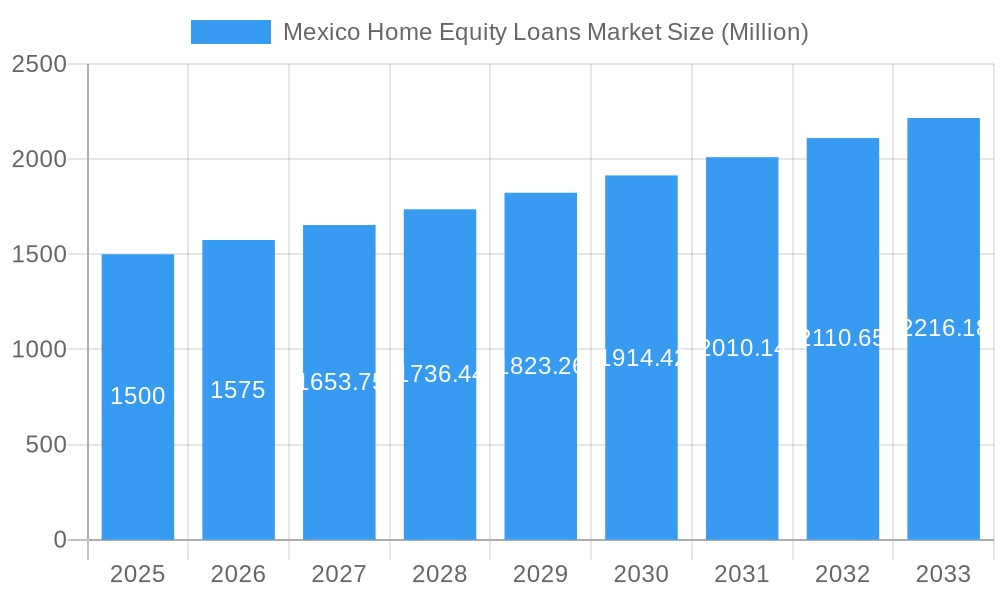

Mexico Home Equity Loans Market Market Size (In Million)

Despite strong growth prospects, the market encounters certain challenges. Economic instability and fluctuating interest rates can impact borrowing decisions. Rigorous lending standards and credit score requirements may restrict access for some individuals. Additionally, limited financial literacy surrounding home equity loans in certain demographics could hinder market penetration. To leverage growth opportunities, financial institutions should focus on innovative product development, enhanced customer engagement, and competitive interest rates. This involves customizing loan products for diverse demographic needs and utilizing technology to streamline application and approval processes. The competitive environment features a mix of national and regional players, presenting avenues for differentiation through specialized offerings and targeted marketing strategies.

Mexico Home Equity Loans Market Company Market Share

Mexico Home Equity Loans Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Mexico Home Equity Loans Market, offering invaluable insights for investors, lenders, and industry professionals. With a comprehensive study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report leverages high-volume keywords to ensure maximum search visibility and engagement. Discover key trends, growth drivers, challenges, and the competitive landscape shaping this evolving market. The report's detailed segmentation and analysis of market leaders provides a clear understanding of future opportunities within the Mexico Home Equity Loans Market. The market is expected to reach xx Million by 2033.

Mexico Home Equity Loans Market Structure & Competitive Landscape

The Mexico Home Equity Loans Market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, the market also features numerous smaller regional and niche lenders. This dynamic is influenced by several factors:

- Market Concentration: The top five players (Bank of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, and ABC Bank) collectively hold an estimated xx% market share in 2025, indicating moderate concentration. This is expected to increase slightly by 2033 to xx%.

- Innovation Drivers: Technological advancements, particularly in digital lending platforms and automated underwriting, are driving efficiency and increasing market accessibility. Fintech companies are also emerging as disruptive forces, introducing innovative products and services.

- Regulatory Impacts: Regulatory changes concerning lending practices, interest rates, and consumer protection significantly impact market operations. Stricter regulations can limit growth but enhance market stability.

- Product Substitutes: Other forms of financing, such as personal loans or credit lines, compete with home equity loans. The competitive advantage of home equity loans lies in lower interest rates and larger loan amounts.

- End-User Segmentation: The market caters to diverse segments, including homeowners with varying credit scores, income levels, and property values. This segmentation necessitates a diverse range of product offerings.

- M&A Trends: The recent acquisition of Legacy Mortgage by Guild Mortgage in February 2023 exemplifies the ongoing consolidation in the market, driven by the desire for scale and enhanced product offerings. An estimated xx M&A transactions occurred between 2019 and 2024, with a projected xx in the forecast period.

Mexico Home Equity Loans Market Trends & Opportunities

The Mexico Home Equity Loans Market is characterized by robust growth, driven by several key trends:

The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising homeownership rates, increasing property values, and a growing awareness of home equity loans as a viable financing option. Technological advancements are also playing a key role, with digital lending platforms improving accessibility and efficiency. Consumer preferences are shifting towards online applications, faster processing times, and personalized loan offerings. The increasing competition among lenders is resulting in more competitive interest rates and improved customer service. Market penetration rates are expected to rise from xx% in 2025 to xx% in 2033.

Dominant Markets & Segments in Mexico Home Equity Loans Market

While detailed regional data is unavailable for the Mexican market specifically, we can infer potential trends based on similar markets in the United States. Assuming similar patterns, we can expect the following:

Key Growth Drivers:

- Increasing Homeownership: Higher homeownership rates drive demand for home equity loans.

- Rising Property Values: Appreciating property values increase the available equity for borrowing.

- Favorable Economic Conditions: Positive economic conditions and employment growth contribute to increased borrowing.

- Government Initiatives: Government policies supporting homeownership and mortgage lending can stimulate the market.

Market Dominance: Urban areas with higher property values and higher concentrations of homeowners are likely to experience greater demand for home equity loans. Areas with robust economic activity and supportive regulatory frameworks would also witness higher market dominance.

Mexico Home Equity Loans Market Product Analysis

The market features a range of home equity loan products, including fixed-rate and adjustable-rate loans, with varying terms and interest rates. Technological advancements have led to online application processes, digital loan management tools, and automated underwriting systems. These improvements streamline the lending process, enhance customer experience, and improve efficiency. The competitive advantage lies in offering competitive interest rates, flexible terms, and a seamless digital experience tailored to individual customer needs.

Key Drivers, Barriers & Challenges in Mexico Home Equity Loans Market

Key Drivers:

- Rising Homeownership Rates: An increasing number of homeowners translates to a larger pool of potential borrowers.

- Technological Advancements: Digital lending platforms are simplifying the application process and improving efficiency.

- Favorable Economic Conditions: A strong economy and stable employment contribute to higher borrower confidence and increased lending.

Challenges & Restraints:

- Regulatory Hurdles: Complex and evolving regulatory requirements can increase compliance costs and hinder market growth. Stricter lending standards might reduce loan approvals.

- Economic Downturns: Economic instability can lead to decreased borrower confidence and a rise in loan defaults.

- Competitive Pressures: Intense competition among lenders forces them to offer more competitive interest rates and services, affecting profitability.

Growth Drivers in the Mexico Home Equity Loans Market

Several factors propel growth within the Mexico Home Equity Loan Market, namely: Increasing homeownership rates; Technological innovation in lending platforms leading to faster and more efficient loan processing; Government policies supporting housing and homeownership; Favorable economic conditions promoting confidence among borrowers.

Challenges Impacting Mexico Home Equity Loans Market Growth

Growth is impeded by several challenges, such as: Stringent regulatory requirements leading to increased compliance costs; Potential economic downturns impacting borrower confidence and loan defaults; Intense competition forcing lenders to reduce margins.

Key Players Shaping the Mexico Home Equity Loans Market

- Bank of America

- LoanDepot LLC (LoanDepot)

- Longbridge Financial LLC

- MEX Home

- ABC Bank

- WaFd Bank

- Bank of Albuquerque

- Mexlend

- Pinnacle Bank

- New Mexico Bank And Trust

Significant Mexico Home Equity Loans Market Industry Milestones

- August 2022: Rocket Mortgage launches a home equity loan, expanding access to debt consolidation options for American homeowners.

- February 2023: Guild Mortgage acquires Legacy Mortgage, strengthening its presence in the Southwest and offering a wider range of loan products in New Mexico.

Future Outlook for Mexico Home Equity Loans Market

The Mexico Home Equity Loans Market is poised for continued growth, driven by ongoing technological innovation, favorable economic conditions (assuming a stable economic environment), and increased consumer awareness of home equity loans. Strategic opportunities exist for lenders to leverage digital technologies, expand product offerings, and target specific market segments to capture a larger share of this expanding market. The increasing adoption of digital lending platforms will streamline the borrowing process and improve overall customer experience, contributing to stronger market expansion.

Mexico Home Equity Loans Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Commercial Banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other Creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

Mexico Home Equity Loans Market Segmentation By Geography

- 1. Mexico

Mexico Home Equity Loans Market Regional Market Share

Geographic Coverage of Mexico Home Equity Loans Market

Mexico Home Equity Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.3. Market Restrains

- 3.3.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.4. Market Trends

- 3.4.1. Financial And Socioeconomic Factors Favouring The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Equity Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Commercial Banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other Creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank Of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LoanDepot LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longbridge Financial LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEX Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABC Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WaFd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Albuquerque

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mexlend

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinnacle Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Mexico Bank And Trust**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Of America

List of Figures

- Figure 1: Mexico Home Equity Loans Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Home Equity Loans Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 2: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 3: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 4: Mexico Home Equity Loans Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 6: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 7: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 8: Mexico Home Equity Loans Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Equity Loans Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Mexico Home Equity Loans Market?

Key companies in the market include Bank Of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, New Mexico Bank And Trust**List Not Exhaustive.

3. What are the main segments of the Mexico Home Equity Loans Market?

The market segments include Types, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 747.9 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

6. What are the notable trends driving market growth?

Financial And Socioeconomic Factors Favouring The Market.

7. Are there any restraints impacting market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

8. Can you provide examples of recent developments in the market?

On August 2022, Rocket Mortgage, Mexico's largest mortgage lender and a part of Rocket Companies introduced a home equity loan to give Americans one more way to pay off debt that has risen along with inflation. Detroit-based Rocket Mortgage is enabling the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Equity Loans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Equity Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Equity Loans Market?

To stay informed about further developments, trends, and reports in the Mexico Home Equity Loans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence