Key Insights

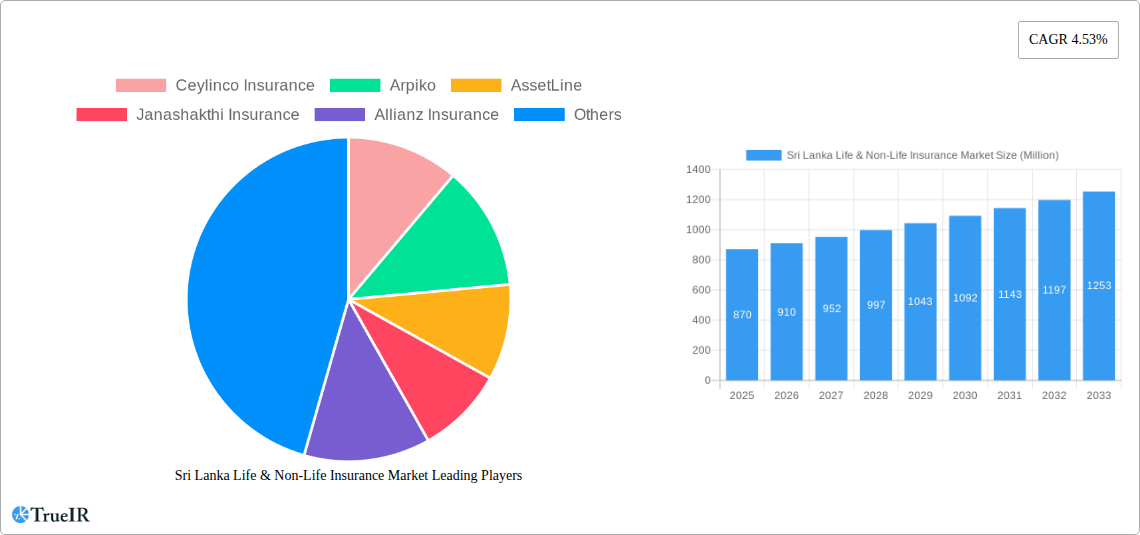

The Sri Lanka life and non-life insurance market, valued at $870 million in 2025, is projected to experience robust growth, driven by increasing awareness of insurance products, rising disposable incomes, and a growing middle class. The market's Compound Annual Growth Rate (CAGR) of 4.53% from 2025 to 2033 indicates a steady expansion, with significant opportunities for both life and non-life insurers. The life insurance segment, encompassing individual and group policies, is expected to dominate the market due to the increasing demand for financial security and retirement planning solutions. Non-life insurance, covering areas like property, motor, and health, will also see substantial growth, fueled by government initiatives promoting insurance penetration and the rising frequency of weather-related events. Distribution channels like agency networks, banks, and direct sales play a crucial role in market penetration, with digital distribution channels gaining traction. Key players like Ceylinco Insurance, AIA Insurance, and Sri Lanka Insurance are actively shaping market dynamics through innovative product offerings and enhanced customer service. Competitive pressures and regulatory changes will continue to influence the market landscape.

Sri Lanka Life & Non-Life Insurance Market Market Size (In Million)

The market segmentation shows a diversified landscape. While precise segment breakdowns are unavailable, a reasonable estimate based on industry trends suggests a significant portion is held by the life insurance segment, potentially accounting for 60-70% of the market value, driven by the need for long-term financial security. The remaining share is attributed to the non-life insurance segment, with distribution channels like agency networks and banks holding a significant market share, indicative of the strong reliance on traditional distribution methods. However, the 'other distribution channels' segment will see notable growth owing to increasing digital adoption. The Asia-Pacific region, particularly countries like India and China, represents a significant benchmark for market expansion strategies, offering insights into successful growth trajectories. Continued economic development in Sri Lanka will undoubtedly stimulate further growth in the insurance sector.

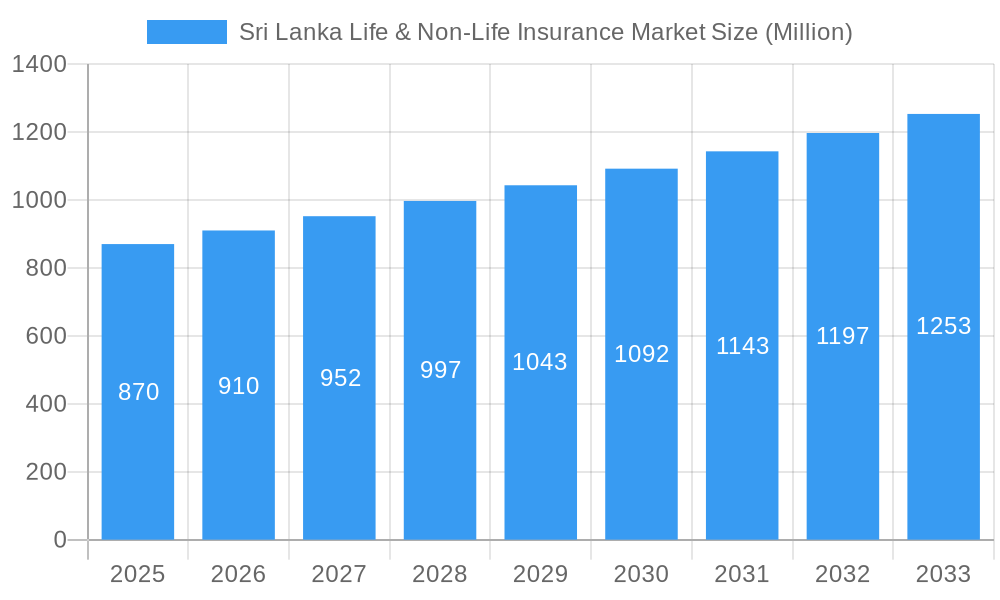

Sri Lanka Life & Non-Life Insurance Market Company Market Share

Sri Lanka Life & Non-Life Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Sri Lanka life and non-life insurance market, offering invaluable insights for investors, insurers, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth potential. The study analyzes key players like Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka, AIA Insurance, Union Assurance, and MSBL Insurance (list not exhaustive), across various segments including life and non-life insurance, and diverse distribution channels.

Sri Lanka Life & Non-Life Insurance Market Structure & Competitive Landscape

The Sri Lankan life and non-life insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for the life insurance sector is estimated at xx, indicating a xx level of concentration in 2025. The non-life sector shows a slightly higher concentration, with an estimated HHI of xx. Innovation is driven primarily by the need to adapt to evolving consumer preferences and technological advancements, such as digital insurance platforms and personalized offerings. Regulatory frameworks, including the Insurance Regulatory Commission of Sri Lanka (IRCSL) guidelines, play a significant role in shaping market dynamics. Product substitutes, such as alternative investment vehicles, pose a moderate competitive threat. End-user segmentation includes individual consumers, corporate entities (SME and large corporations), and various government institutions. M&A activity has been relatively moderate in recent years, with an estimated xx Million USD worth of deals recorded between 2019 and 2024, reflecting a strategic approach to market consolidation among key players.

- Market Concentration: HHI (Life): xx, HHI (Non-Life): xx (2025 estimates)

- Innovation Drivers: Digitalization, personalized products, customer-centric services

- Regulatory Impacts: IRCSL guidelines, compliance standards, licensing requirements

- Product Substitutes: Alternative investment options, self-insurance schemes

- End-User Segmentation: Individuals, SMEs, Large Corporates, Government

- M&A Trends: xx Million USD in deals (2019-2024), focus on strategic consolidation

Sri Lanka Life & Non-Life Insurance Market Trends & Opportunities

The Sri Lankan life and non-life insurance market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market size in 2025 is estimated at xx Million USD, expanding to xx Million USD by 2033. This growth is fueled by increasing insurance awareness, rising disposable incomes, expanding middle class, and government initiatives to promote financial inclusion. Technological advancements, such as artificial intelligence (AI) and big data analytics, are transforming operations and customer engagement. Consumer preferences are shifting towards digital channels, personalized products, and value-added services. Competitive dynamics are intensifying with the entry of new players and strategic partnerships. The market penetration rate for life insurance remains relatively low, presenting significant untapped potential. Opportunities exist in expanding product offerings (micro-insurance, health insurance) , improving distribution networks in rural areas, and harnessing technological innovations for increased efficiency and customer satisfaction.

Dominant Markets & Segments in Sri Lanka Life & Non-Life Insurance Market

While precise regional breakdown data is unavailable, the Colombo district and other major urban centers are expected to dominate both the life and non-life insurance markets due to higher population density, income levels, and greater insurance awareness.

By Type:

- Life Insurance: Growth is driven by rising health consciousness, increasing life expectancy, and demand for retirement planning solutions.

- Non-Life Insurance: Growth stems from increasing vehicle ownership, expanding infrastructure projects, and higher awareness of property and casualty risks.

By Distribution Channel:

- Agency: Remains the dominant distribution channel, despite the growth of digital platforms. Key growth drivers include established agent networks, trust, and personalized service.

- Banks: Banks are increasingly leveraging their customer base to offer insurance products, contributing to the growth of bancassurance.

- Direct & Other Channels: Digital platforms and other channels are gaining traction, but still hold a smaller market share compared to traditional channels.

Sri Lanka Life & Non-Life Insurance Market Product Analysis

Product innovation is focused on developing customized solutions catering to specific demographics and risk profiles, using technology-driven innovations like telematics for motor insurance. Several insurers offer digital platforms for policy purchases, claims processing, and customer service. The competitive landscape is defined by product differentiation, pricing strategies, and distribution reach. The market shows increasing demand for health, travel and micro-insurance products to suit growing consumer needs.

Key Drivers, Barriers & Challenges in Sri Lanka Life & Non-Life Insurance Market

Key Drivers:

- Rising disposable incomes and a growing middle class are increasing demand for insurance products.

- Government initiatives promoting financial inclusion expand market accessibility.

- Technological advancements improve efficiency and customer experiences.

Challenges:

- Low insurance penetration remains a major challenge, especially in rural areas (estimated at xx% in 2025).

- Regulatory complexities and compliance requirements can hinder market expansion.

- Intense competition and pricing pressures impact profitability.

Growth Drivers in the Sri Lanka Life & Non-Life Insurance Market Market

The key growth drivers are similar to the previously described Key Drivers, focusing on economic expansion, rising middle class, increasing awareness of risk management, and the adoption of technology for enhanced efficiency and customer engagement. Government policies supporting financial inclusion also play a vital role.

Challenges Impacting Sri Lanka Life & Non-Life Insurance Market Growth

Challenges include low insurance penetration, regulatory hurdles, competition from international players, and the need to overcome consumer skepticism and build trust, especially in underserved areas. Economic instability and fluctuating currency values also present significant risks.

Key Players Shaping the Sri Lanka Life & Non-Life Insurance Market Market

- Ceylinco Insurance

- Arpiko

- AssetLine

- Janashakthi Insurance

- Allianz Insurance

- Sri Lanka Insurance

- Continental Insurance Lanka

- AIA Insurance

- Union Assurance

- MSBL Insurance

Significant Sri Lanka Life & Non-Life Insurance Market Industry Milestones

- March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to launch the CABE program, fostering agricultural entrepreneurship and expanding insurance reach within the agricultural sector. This initiative signals a move towards specialized insurance products and a wider reach into underserved communities.

- January 2022: Ceylinco General Insurance launched 'Drive Thru Claims,' enhancing customer service efficiency and improving claim processing speed. This technological advancement highlights the adoption of innovative solutions to improve customer experience.

Future Outlook for Sri Lanka Life & Non-Life Insurance Market Market

The Sri Lanka life and non-life insurance market holds significant promise. Continued economic growth, increasing insurance awareness, technological advancements, and supportive government policies will drive substantial expansion in the coming years. Strategic partnerships, product diversification, and the adoption of innovative technologies will be crucial for success. The market is expected to see increased competition and a focus on digital transformation as insurers strive to meet evolving consumer expectations and gain a competitive edge.

Sri Lanka Life & Non-Life Insurance Market Segmentation

-

1. Type

-

1.1. Life Insurances

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurances

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Other Non-Life Insurance

-

1.1. Life Insurances

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Sri Lanka Life & Non-Life Insurance Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Sri Lanka Life & Non-Life Insurance Market

Sri Lanka Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life Insurances

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurances

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Other Non-Life Insurance

- 5.1.1. Life Insurances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceylinco Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arpiko

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AssetLine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janashakthi Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sri Lanka Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental Insurance Lanka**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIA Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Union Assurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MSBL Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ceylinco Insurance

List of Figures

- Figure 1: Sri Lanka Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sri Lanka Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Sri Lanka Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Sri Lanka Life & Non-Life Insurance Market?

Key companies in the market include Ceylinco Insurance, Arpiko, AssetLine, Janashakthi Insurance, Allianz Insurance, Sri Lanka Insurance, Continental Insurance Lanka**List Not Exhaustive, AIA Insurance, Union Assurance, MSBL Insurance.

3. What are the main segments of the Sri Lanka Life & Non-Life Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Rising Digital Personalization in Life and Non-Life Insurance at Sri Lanka.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

March 2023: Sri Lanka Insurance partnered with SLIM Agrisaviya to nurture the agriculture sector. The Certificate in Agri-Business and Entrepreneurship (CABE) program is a first-of-its-kind qualification available in Sri Lanka to transform farmers into “Agriprenuers.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence