Key Insights

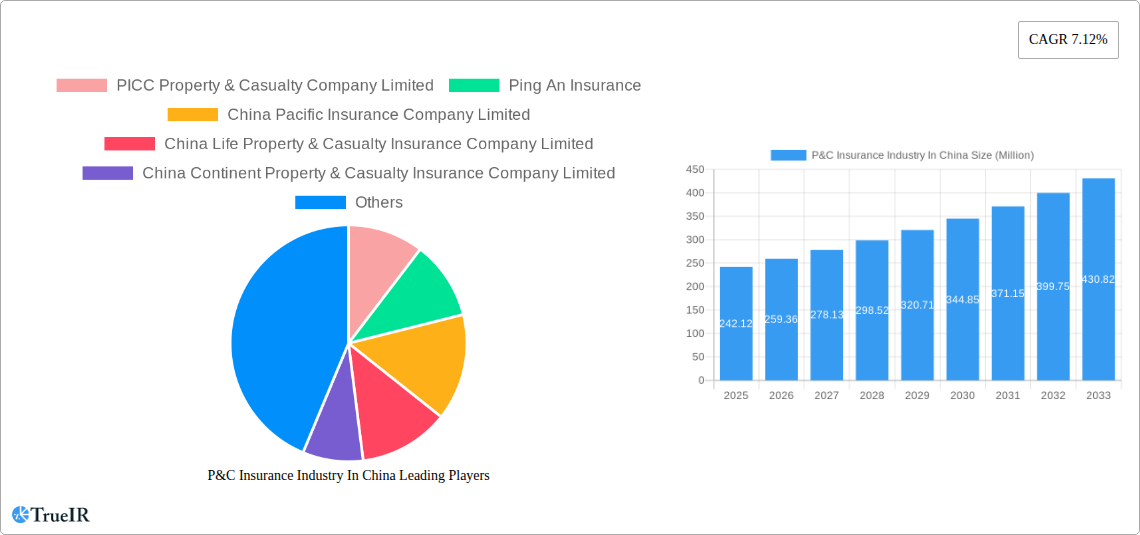

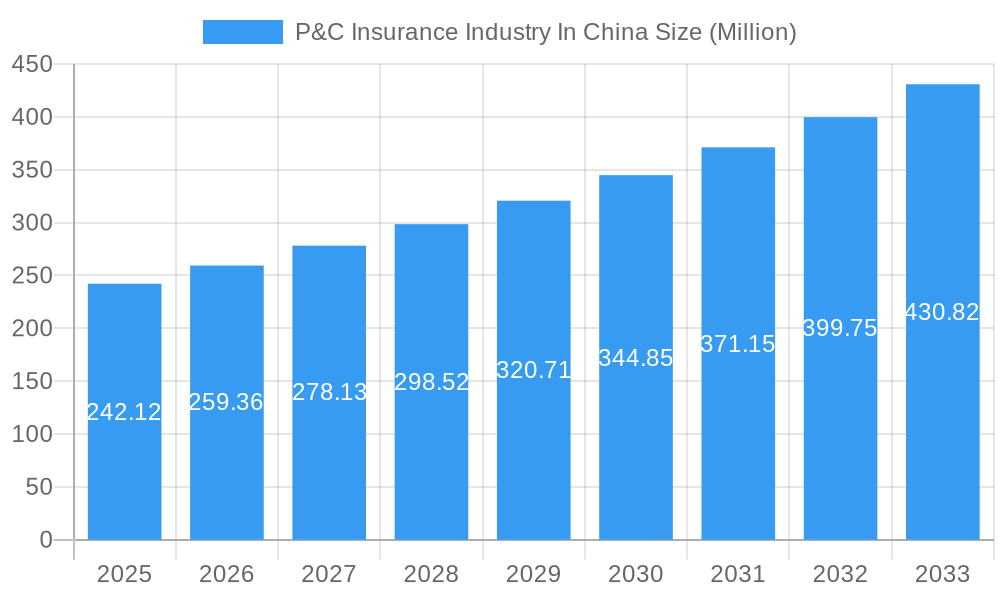

The Chinese Property & Casualty (P&C) insurance market presents a compelling investment opportunity, exhibiting robust growth potential. With a 2025 market size of $242.12 million and a Compound Annual Growth Rate (CAGR) of 7.12% projected from 2025 to 2033, the sector is poised for significant expansion. This growth is fueled by several key drivers. Rising middle-class incomes are leading to increased disposable income and a greater awareness of risk mitigation, driving demand for insurance products. Government initiatives promoting financial inclusion and the expansion of insurance penetration in underserved rural areas further contribute to market expansion. Furthermore, the increasing adoption of digital technologies, including online insurance platforms and mobile apps, is enhancing accessibility and convenience, fostering market growth. While regulatory changes and intense competition among established players like PICC Property & Casualty Company Limited, Ping An Insurance, and China Life Property & Casualty Insurance Company Limited pose challenges, the overall market outlook remains positive. The industry is also witnessing a shift towards innovative product offerings tailored to specific consumer needs, such as specialized coverage for emerging technologies and personalized risk assessments. This trend, coupled with continued economic growth in China, positions the P&C insurance sector for sustained, long-term growth.

P&C Insurance Industry In China Market Size (In Million)

The market segmentation within the Chinese P&C insurance sector offers opportunities for specialized providers. While precise segment data is unavailable, we can reasonably infer the existence of significant segments based on industry trends. These likely include motor insurance (a large component in most developed markets), health insurance (driven by an aging population and increased health awareness), and property insurance (covering residential and commercial properties). The competitive landscape, although dominated by large established players, provides space for smaller niche insurers to focus on specific segments and build market share through specialized products and targeted marketing. The future success of players in this dynamic market will depend on their ability to adapt to evolving customer needs, leverage technological advancements, and effectively navigate the regulatory environment. The long-term forecast indicates a substantial expansion of the market, presenting ample opportunities for both established and emerging players.

P&C Insurance Industry In China Company Market Share

Dynamic Report: P&C Insurance Industry in China (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic P&C insurance market in China, offering invaluable insights for investors, insurers, and industry stakeholders. We delve into market structure, competitive dynamics, emerging trends, and future growth projections for the period 2019-2033, with a focus on the key players shaping this rapidly evolving landscape. This report leverages extensive data analysis and incorporates recent significant industry milestones to deliver actionable intelligence.

P&C Insurance Industry In China Market Structure & Competitive Landscape

The Chinese P&C insurance market exhibits a moderately concentrated structure, dominated by several large state-owned and privately-held enterprises. The top five players account for approximately xx% of the market share in 2025 (estimated). While market concentration is high, we observe increasing competition from both established players and new entrants, fueled by technological innovation and changing consumer preferences. Regulatory changes, particularly those impacting foreign investment and cross-sector partnerships, significantly impact the competitive dynamics.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2025.

- Innovation Drivers: Digitalization, Insurtech advancements, and data analytics are driving product innovation and operational efficiency.

- Regulatory Impacts: Stringent regulatory oversight by the China Banking and Insurance Regulatory Commission (CBIRC) influences market entry, product offerings, and pricing strategies.

- Product Substitutes: Alternative risk management solutions and peer-to-peer insurance platforms pose a growing competitive threat.

- End-User Segmentation: The market is segmented by individual consumers, corporations, and various industry verticals, each with unique needs and risk profiles.

- M&A Trends: Consolidation is evident, with notable mergers and acquisitions (M&A) activity, particularly involving foreign investment and domestic companies seeking expansion. The total M&A volume in the last five years was approximately xx Million USD.

P&C Insurance Industry In China Market Trends & Opportunities

The Chinese P&C insurance market is experiencing robust growth, driven by a combination of factors. Rising disposable incomes, increased awareness of insurance products, and expanding urban populations contribute to higher demand. Technological advancements, particularly the adoption of digital channels and data analytics, are transforming the industry. Insurtech companies are disrupting traditional business models, while established players are investing heavily in digital transformation. These trends present substantial opportunities for innovation and market expansion. The market is anticipated to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. Market penetration rates are projected to increase from xx% in 2025 to xx% by 2033. Competitive dynamics are shaped by both price competition and product differentiation strategies.

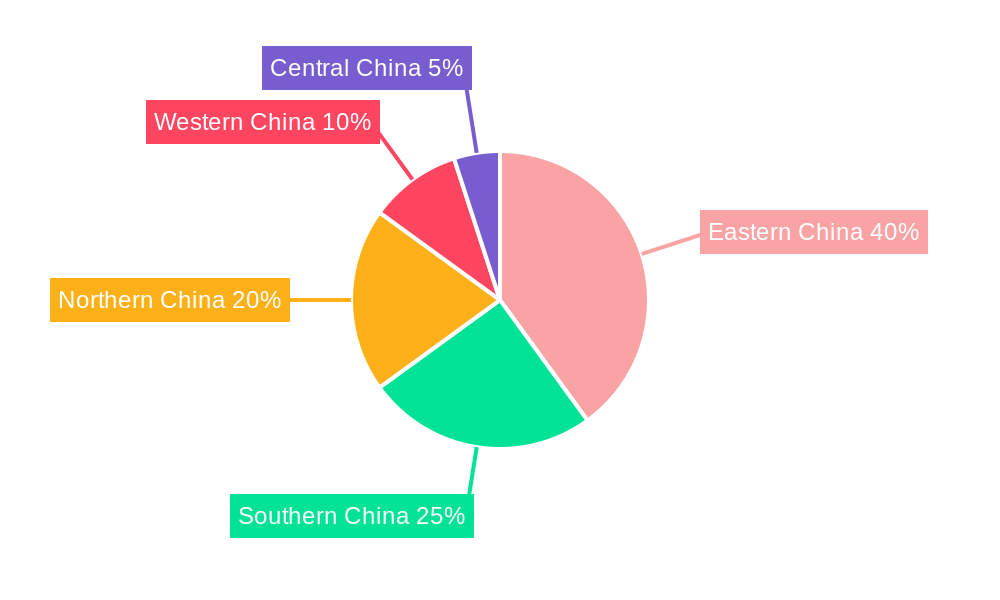

Dominant Markets & Segments in P&C Insurance Industry In China

While the market is relatively well distributed geographically, several regions demonstrate faster-than-average growth. Coastal provinces with developed economies and high urban density tend to lead in terms of insurance penetration. Significant growth is anticipated in less developed regions as infrastructure improves and financial literacy increases.

- Key Growth Drivers:

- Rapid Urbanization: The ongoing migration from rural to urban areas fuels demand for various insurance products.

- Infrastructure Development: Massive infrastructure projects across China generate associated insurance needs.

- Government Policies: Supportive government regulations and initiatives aimed at promoting financial inclusion are key growth catalysts.

- Rising Middle Class: The expanding middle class, with increased disposable income, demonstrates a higher propensity to purchase insurance.

The motor insurance segment constitutes the largest portion of the P&C market, driven by rapid vehicle ownership growth. Other high-growth segments include property insurance, health insurance, and liability insurance.

P&C Insurance Industry In China Product Analysis

Product innovation in the Chinese P&C insurance market is heavily influenced by technological advancements. The use of AI, big data, and IoT enables the development of personalized products, efficient claims processing, and improved risk assessment. Innovative products are emerging to cater to specific consumer needs and preferences, such as micro-insurance for low-income segments and customized offerings for high-net-worth individuals. The competitive advantage lies in offering superior customer experience, leveraging technology, and providing tailored solutions to address evolving risk landscapes.

Key Drivers, Barriers & Challenges in P&C Insurance Industry In China

Key Drivers: Technological advancements (AI, big data), economic growth and rising middle class, supportive government policies (financial inclusion), and increasing awareness of insurance benefits drive market growth.

Challenges: Intense competition, stringent regulations by CBIRC creating hurdles for market entry and operations, supply chain disruptions impacting claims processing, and fraud remain significant barriers. Furthermore, a lack of insurance awareness in certain segments and trust issues can limit market penetration.

Growth Drivers in the P&C Insurance Industry In China Market

Technological advancements, particularly in AI, big data, and digital distribution channels, are revolutionizing the industry, driving efficiency and creating new product opportunities. Economic growth and a rising middle class are fueling demand for insurance products. Supportive government policies encouraging financial inclusion also contribute to this expansion.

Challenges Impacting P&C Insurance Industry In China Growth

Regulatory complexities, including strict licensing requirements and compliance standards, pose a substantial challenge. Supply chain disruptions and inadequate infrastructure in certain regions can hinder efficient claims processing. Intense competition among established players and new entrants necessitates innovative business models and efficient operations to maintain profitability.

Key Players Shaping the P&C Insurance Industry In China Market

- PICC Property & Casualty Company Limited

- Ping An Insurance

- China Pacific Insurance Company Limited

- China Life Property & Casualty Insurance Company Limited

- China Continent Property & Casualty Insurance Company Limited

- China United Insurance Service Inc

- Sunshine Insurance Group

- China Taiping Insurance Group Ltd

- China Export & Credit Insurance Corporation

- Tian an Property Insurance Company

Significant P&C Insurance Industry In China Industry Milestones

- May 2023: BYD acquired Yi'an P&C Insurance Co., signifying a shift towards greater corporate involvement in the insurance sector. This acquisition demonstrates a strategic move to consolidate within the financial industry and potentially integrate insurance with automotive products.

- January 2024: Generali's acquisition of its remaining stake in its Chinese subsidiary signals increased foreign investment confidence in the Chinese P&C insurance market and suggests potential for further consolidation and growth in the sector.

Future Outlook for P&C Insurance Industry In China Market

The Chinese P&C insurance market presents a robust growth trajectory, driven by technological innovation, economic expansion, and increasing insurance awareness. Strategic opportunities abound for players who can leverage technology, adapt to changing consumer preferences, and navigate regulatory complexities effectively. The market's immense potential positions it as a key sector within the broader Chinese economy.

P&C Insurance Industry In China Segmentation

-

1. Line of Business

- 1.1. Motor Insurance

- 1.2. Enterprise Property Insurance

- 1.3. Home Insurance

- 1.4. Liability Insurance

- 1.5. Marine Insurance

- 1.6. Other Non-Life Insurance

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Individual Agency

- 2.3. Online

- 2.4. Bancassurance

- 2.5. Other Distribution Channels

P&C Insurance Industry In China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

P&C Insurance Industry In China Regional Market Share

Geographic Coverage of P&C Insurance Industry In China

P&C Insurance Industry In China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth and Rising Awareness of Risk Management

- 3.3. Market Restrains

- 3.3.1. Economic Growth and Rising Awareness of Risk Management

- 3.4. Market Trends

- 3.4.1. Online Insurance and Digitalization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Line of Business

- 5.1.1. Motor Insurance

- 5.1.2. Enterprise Property Insurance

- 5.1.3. Home Insurance

- 5.1.4. Liability Insurance

- 5.1.5. Marine Insurance

- 5.1.6. Other Non-Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Individual Agency

- 5.2.3. Online

- 5.2.4. Bancassurance

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Line of Business

- 6. North America P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Line of Business

- 6.1.1. Motor Insurance

- 6.1.2. Enterprise Property Insurance

- 6.1.3. Home Insurance

- 6.1.4. Liability Insurance

- 6.1.5. Marine Insurance

- 6.1.6. Other Non-Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct Sales

- 6.2.2. Individual Agency

- 6.2.3. Online

- 6.2.4. Bancassurance

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Line of Business

- 7. South America P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Line of Business

- 7.1.1. Motor Insurance

- 7.1.2. Enterprise Property Insurance

- 7.1.3. Home Insurance

- 7.1.4. Liability Insurance

- 7.1.5. Marine Insurance

- 7.1.6. Other Non-Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct Sales

- 7.2.2. Individual Agency

- 7.2.3. Online

- 7.2.4. Bancassurance

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Line of Business

- 8. Europe P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Line of Business

- 8.1.1. Motor Insurance

- 8.1.2. Enterprise Property Insurance

- 8.1.3. Home Insurance

- 8.1.4. Liability Insurance

- 8.1.5. Marine Insurance

- 8.1.6. Other Non-Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct Sales

- 8.2.2. Individual Agency

- 8.2.3. Online

- 8.2.4. Bancassurance

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Line of Business

- 9. Middle East & Africa P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Line of Business

- 9.1.1. Motor Insurance

- 9.1.2. Enterprise Property Insurance

- 9.1.3. Home Insurance

- 9.1.4. Liability Insurance

- 9.1.5. Marine Insurance

- 9.1.6. Other Non-Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct Sales

- 9.2.2. Individual Agency

- 9.2.3. Online

- 9.2.4. Bancassurance

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Line of Business

- 10. Asia Pacific P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Line of Business

- 10.1.1. Motor Insurance

- 10.1.2. Enterprise Property Insurance

- 10.1.3. Home Insurance

- 10.1.4. Liability Insurance

- 10.1.5. Marine Insurance

- 10.1.6. Other Non-Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct Sales

- 10.2.2. Individual Agency

- 10.2.3. Online

- 10.2.4. Bancassurance

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Line of Business

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PICC Property & Casualty Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ping An Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Pacific Insurance Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Life Property & Casualty Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Continent Property & Casualty Insurance Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China United Insurance Service Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunshine Insurance Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Taiping Insurance Group Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Export & Credit Insurance Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tian an Property Insurance Company **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PICC Property & Casualty Company Limited

List of Figures

- Figure 1: Global P&C Insurance Industry In China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global P&C Insurance Industry In China Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 4: North America P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 5: North America P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 6: North America P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 7: North America P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: North America P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 12: North America P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 13: North America P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 15: South America P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 16: South America P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 17: South America P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 18: South America P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 19: South America P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: South America P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 24: South America P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 25: South America P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 28: Europe P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 29: Europe P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 30: Europe P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 31: Europe P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: Europe P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 40: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 41: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 42: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 43: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 52: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 53: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 54: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 55: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 2: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 3: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global P&C Insurance Industry In China Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global P&C Insurance Industry In China Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 8: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 9: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 20: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 21: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 32: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 33: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 56: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 57: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 74: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 75: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the P&C Insurance Industry In China?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the P&C Insurance Industry In China?

Key companies in the market include PICC Property & Casualty Company Limited, Ping An Insurance, China Pacific Insurance Company Limited, China Life Property & Casualty Insurance Company Limited, China Continent Property & Casualty Insurance Company Limited, China United Insurance Service Inc, Sunshine Insurance Group, China Taiping Insurance Group Ltd, China Export & Credit Insurance Corporation, Tian an Property Insurance Company **List Not Exhaustive.

3. What are the main segments of the P&C Insurance Industry In China?

The market segments include Line of Business, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 242.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth and Rising Awareness of Risk Management.

6. What are the notable trends driving market growth?

Online Insurance and Digitalization is Driving the Market.

7. Are there any restraints impacting market growth?

Economic Growth and Rising Awareness of Risk Management.

8. Can you provide examples of recent developments in the market?

January 2024: Generali announced that it would be acquiring a 100% stake in its Chinese property-casualty (P&C) insurance subsidiary, previously 49% owned by the Italian group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "P&C Insurance Industry In China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the P&C Insurance Industry In China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the P&C Insurance Industry In China?

To stay informed about further developments, trends, and reports in the P&C Insurance Industry In China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence