Key Insights

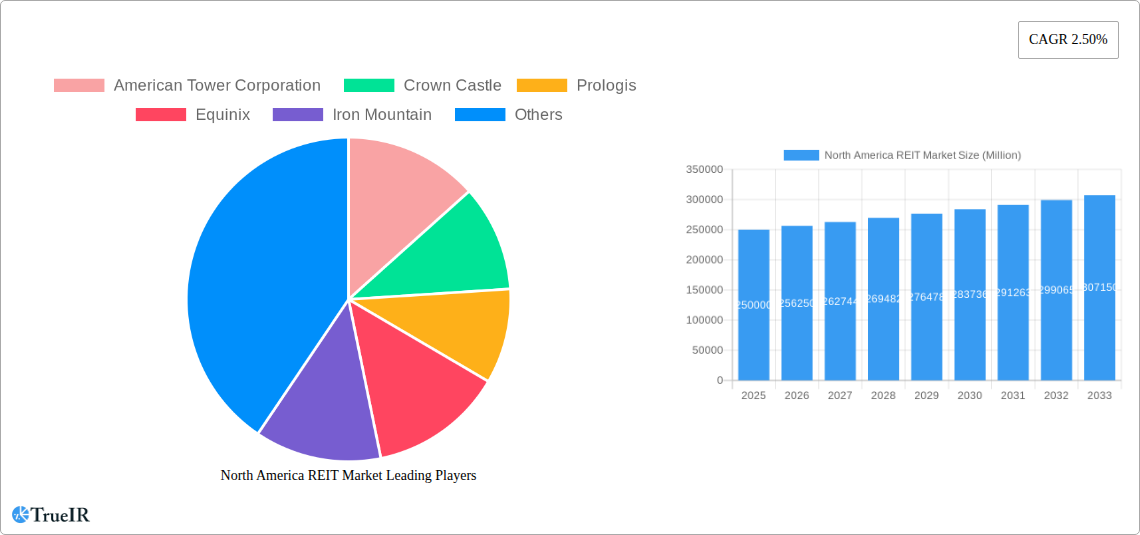

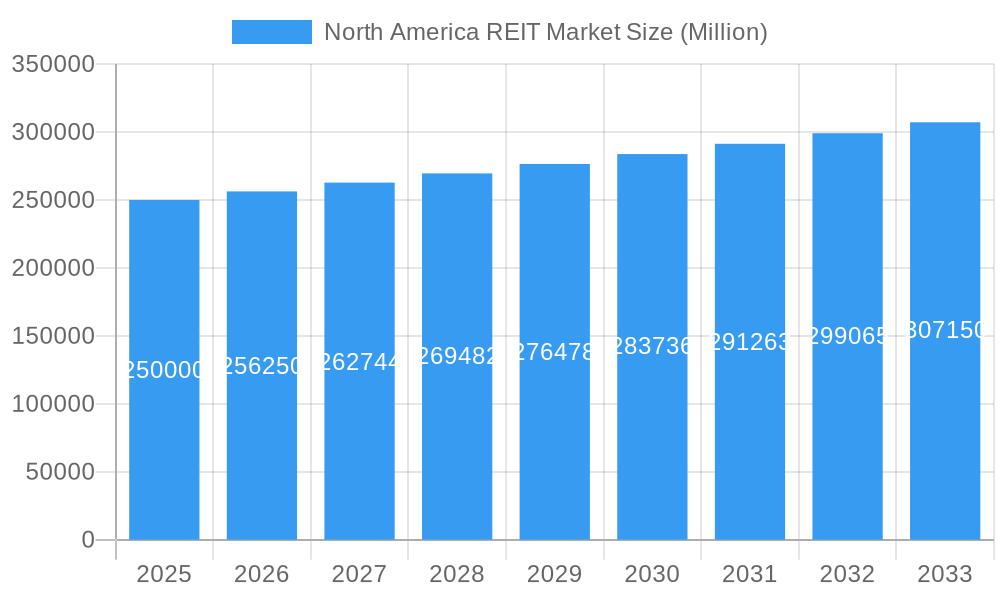

The North American Real Estate Investment Trust (REIT) market, encompassing the United States, Canada, and Mexico, presents a compelling investment landscape characterized by steady growth and diversification. Driven by factors such as increasing urbanization, robust e-commerce fueling industrial REIT demand, and a persistent need for diverse housing options, the market is projected to maintain a Compound Annual Growth Rate (CAGR) of 2.50% from 2025 to 2033. The market's segmentation reveals significant opportunities within various property sectors. While the office sector faces ongoing challenges related to hybrid work models, the residential and industrial sectors are expected to experience robust growth, driven by population growth and supply chain adjustments, respectively. Equity REITs, focused on direct ownership of properties, will likely remain a dominant segment, alongside a growing presence of hybrid REITs that offer diversified investment strategies. The dominance of the United States within the North American market is expected to continue, fueled by its large and dynamic economy. However, Canada and Mexico also offer significant growth potential driven by their respective economic growth and expanding middle classes. The robust performance of major players like American Tower Corporation, Prologis, and Public Storage underscores the sector's resilience and attractiveness to investors seeking stable returns and long-term capital appreciation. Despite potential economic headwinds, the consistent demand for diversified real estate assets across various sectors suggests a positive outlook for the North American REIT market throughout the forecast period.

North America REIT Market Market Size (In Billion)

The competitive landscape is marked by both established REIT giants and emerging players vying for market share within distinct property sectors. Strategies for expansion often include mergers and acquisitions, development of new properties, and technological investments aimed at optimizing operations and enhancing investor returns. Regulatory changes and interest rate fluctuations present ongoing challenges, requiring REITs to adapt and refine their investment strategies. Moreover, environmental, social, and governance (ESG) factors are becoming increasingly important to investors, influencing REIT investment decisions and impacting the operational priorities of these companies. The focus on sustainability, transparency, and social responsibility will likely shape the future of the North American REIT market, attracting investors seeking alignment with their values alongside financial returns. Successful REITs will be those that successfully navigate these evolving dynamics and capitalize on emerging trends within the industry.

North America REIT Market Company Market Share

North America REIT Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the North America REIT market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and competitive dynamics across key segments. The report leverages extensive data analysis to project a xx Million market valuation by 2033, showcasing significant growth opportunities within the sector.

North America REIT Market Structure & Competitive Landscape

The North America REIT market is characterized by a moderately concentrated landscape, with a few dominant players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2025, indicating a moderately concentrated market structure. Key innovation drivers include technological advancements in property management, the increasing adoption of sustainable building practices, and the emergence of new REIT investment strategies. Regulatory impacts, such as tax policies and zoning regulations, significantly influence market dynamics. Product substitutes, such as private equity investments in real estate, exert competitive pressure. The market is segmented by end-user type (individual investors, institutional investors, etc.) reflecting diverse investment needs and risk tolerance. M&A activity has been robust, with an estimated xx Million in transactions in 2024, signifying consolidation and strategic expansion within the market.

- Concentration Ratio (CR4): xx% (2025)

- M&A Volume (2024): xx Million

- Key Regulatory Impacts: Tax laws, zoning regulations, environmental regulations

North America REIT Market Market Trends & Opportunities

The North America REIT market is experiencing robust growth, driven by several factors. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, such as proptech solutions and data analytics, are improving operational efficiency and enhancing investment decision-making. Shifting consumer preferences towards experience-driven retail and flexible workspaces are influencing property demand. The competitive landscape remains dynamic, with increased competition from private equity firms and the emergence of innovative REIT strategies. Market penetration rates vary across segments and geographies, with the highest penetration observed in the US industrial and residential sectors.

Dominant Markets & Segments in North America REIT Market

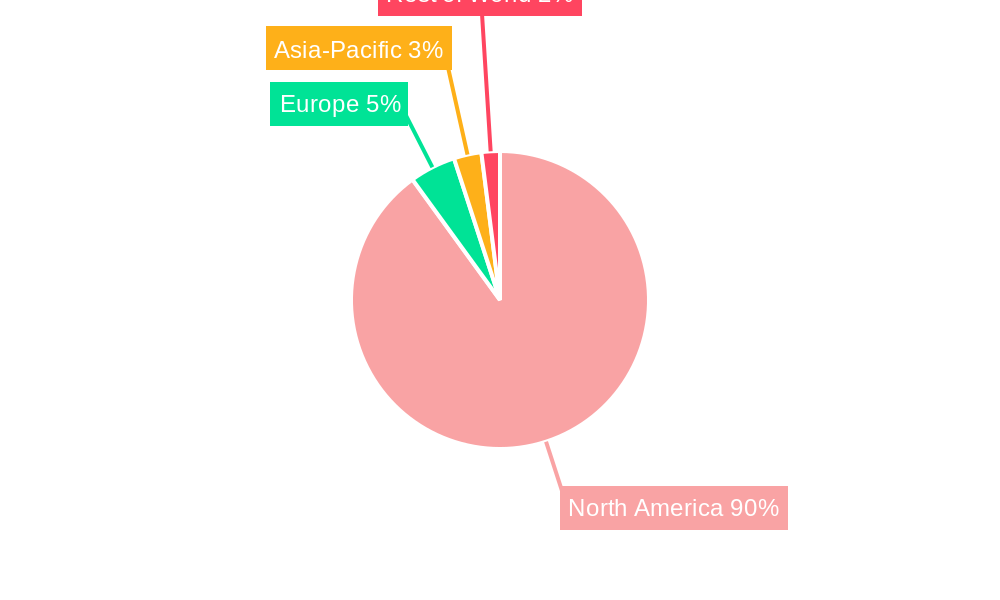

The United States dominates the North America REIT market, accounting for the largest market share across all segments. Within the investment holding segment, Equity REITs constitute the most significant portion, followed by Hybrid REITs and Mortgage REITs. The industrial property sector exhibits the strongest growth trajectory, driven by the expansion of e-commerce and the increasing demand for logistics facilities.

- Leading Region: United States

- Fastest-Growing Segment (By Investment Holdings): Equity REITs

- Fastest-Growing Segment (By Property Sector): Industrial

Key Growth Drivers:

- United States: Robust economic growth, favorable regulatory environment, and high demand for various property types.

- Canada: Strong immigration, urban development initiatives and government incentives.

- Mexico: Growing middle class, increasing foreign investment, and infrastructure development.

- Costa Rica: Tourism growth, expanding business sectors, stable political climate.

- Industrial Sector: E-commerce boom, supply chain optimization, and manufacturing expansion.

- Residential Sector: Population growth, urbanization, and increasing demand for rental housing.

North America REIT Market Product Analysis

The North America REIT market offers diverse products encompassing various property types and investment strategies. Technological advancements are driving product innovation, including the use of smart building technologies to enhance efficiency and sustainability. Key competitive advantages stem from portfolio diversification, strong management teams, and access to capital. The market exhibits a strong fit for investors seeking stable income streams and long-term capital appreciation.

Key Drivers, Barriers & Challenges in North America REIT Market

Key Drivers:

- Increasing urbanization and population growth, driving demand for residential and commercial properties.

- Robust e-commerce growth, fueling demand for logistics and warehousing space.

- Favorable interest rates and increasing institutional investments.

Key Challenges:

- Economic uncertainties and potential interest rate hikes.

- Supply chain disruptions impacting construction and development timelines.

- Increased competition from private equity firms and alternative investment vehicles.

- Regulatory changes and potential policy adjustments.

Growth Drivers in the North America REIT Market Market

The North America REIT market is primarily driven by economic growth, urbanization, technological advancements, and favorable government policies. Population growth in major cities is increasing the demand for residential and commercial properties. Technological innovations like proptech solutions optimize operations and improve tenant experiences.

Challenges Impacting North America REIT Market Growth

The market faces challenges including interest rate volatility, inflation pressures, supply chain constraints, and competition from private real estate investment. Economic downturns may reduce demand, and regulatory changes can impact investment returns.

Key Players Shaping the North America REIT Market Market

Significant North America REIT Market Industry Milestones

- 2021: Prologis acquires Duke Realty in a major industry consolidation.

- 2022: Increased adoption of ESG (Environmental, Social, and Governance) standards by REITs.

- 2023: Significant investment in data center infrastructure.

Future Outlook for North America REIT Market Market

The North America REIT market is poised for continued growth, driven by the long-term trends of urbanization, technological innovation, and a growing demand for diversified real estate investment opportunities. Strategic acquisitions, technological advancements, and focus on sustainable practices will be key factors shaping market dynamics. The market exhibits strong potential for expansion, with opportunities arising from emerging technologies, demographic shifts, and increasing infrastructure development.

North America REIT Market Segmentation

-

1. Investment Holdings

- 1.1. Equity REITs

- 1.2. Mortagage REITs

- 1.3. Hybrid REITs

-

2. Property Sector

- 2.1. Office

- 2.2. Retail

- 2.3. Residential

- 2.4. Industrial

- 2.5. Others

North America REIT Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America REIT Market Regional Market Share

Geographic Coverage of North America REIT Market

North America REIT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. REITs prominence in Senior Housing & Care Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America REIT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 5.1.1. Equity REITs

- 5.1.2. Mortagage REITs

- 5.1.3. Hybrid REITs

- 5.2. Market Analysis, Insights and Forecast - by Property Sector

- 5.2.1. Office

- 5.2.2. Retail

- 5.2.3. Residential

- 5.2.4. Industrial

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Tower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Crown Castle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prologis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Iron Mountain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Public Storage

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Tower Corporation

List of Figures

- Figure 1: North America REIT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America REIT Market Share (%) by Company 2025

List of Tables

- Table 1: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 2: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 3: North America REIT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 5: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 6: North America REIT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America REIT Market?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the North America REIT Market?

Key companies in the market include American Tower Corporation , Crown Castle, Prologis , Equinix , Iron Mountain , Public Storage.

3. What are the main segments of the North America REIT Market?

The market segments include Investment Holdings, Property Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

REITs prominence in Senior Housing & Care Market in United States.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America REIT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America REIT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America REIT Market?

To stay informed about further developments, trends, and reports in the North America REIT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence