Key Insights

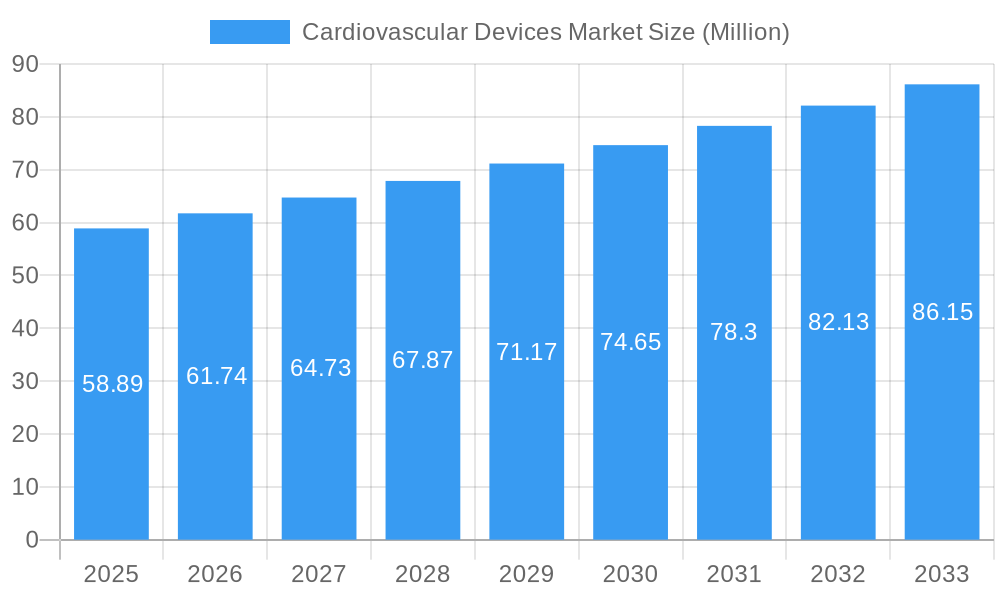

The global Cardiovascular Devices Market is poised for robust expansion, projected to reach a significant size of USD 58.89 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.97% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of cardiovascular diseases (CVDs) globally, driven by factors such as aging populations, sedentary lifestyles, and the rising incidence of conditions like hypertension and diabetes. Technological advancements in diagnostic and monitoring devices, including sophisticated ECG machines and advanced remote cardiac monitoring systems, are enabling earlier and more accurate detection of cardiac issues. Concurrently, innovation in therapeutic and surgical devices, such as next-generation cardiac assist devices, minimally invasive cardiac rhythm management solutions, advanced catheters, and innovative heart valves and stents, is improving patient outcomes and expanding treatment options. The demand for these life-saving technologies is further amplified by heightened healthcare expenditure and increasing patient awareness regarding cardiovascular health.

Cardiovascular Devices Market Market Size (In Million)

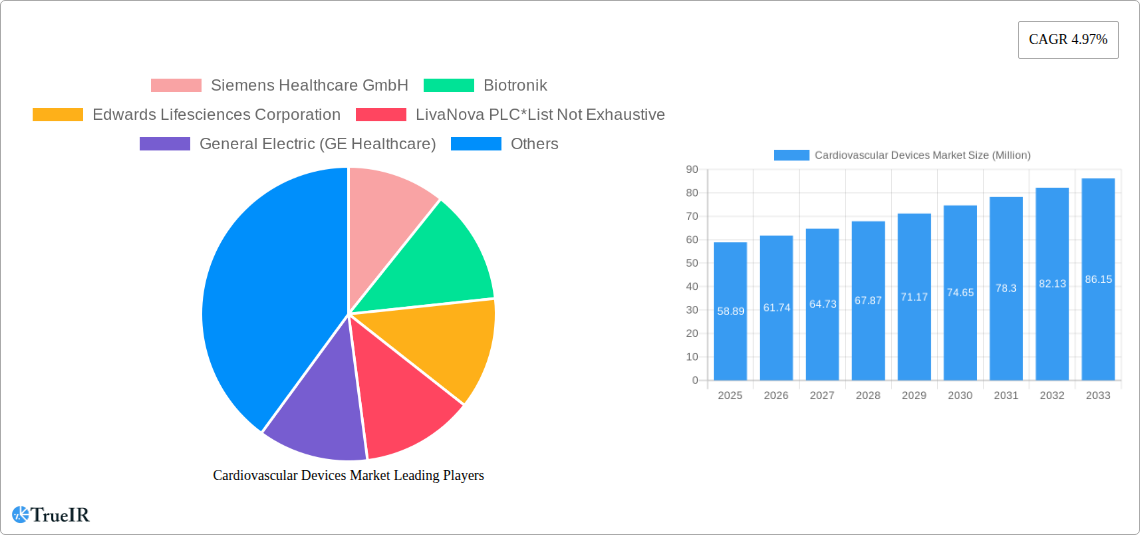

The market's trajectory is also shaped by key trends such as the growing adoption of wearable and implantable cardiovascular monitoring devices, which offer continuous patient data and facilitate proactive intervention. The surge in minimally invasive surgical procedures, supported by the development of advanced catheter-based technologies and grafts, is contributing to shorter recovery times and reduced patient discomfort, thereby boosting market demand. Furthermore, the expansion of healthcare infrastructure in emerging economies and the increasing focus on preventative cardiology are creating substantial growth opportunities. However, certain restraints may impact the market, including the high cost of advanced cardiovascular devices, stringent regulatory approvals, and the need for specialized training for healthcare professionals. Despite these challenges, the market is expected to witness steady growth, with significant contributions from leading companies such as Medtronic, Abbott, Boston Scientific Corporation, and Siemens Healthcare GmbH, who are actively involved in research and development to introduce innovative solutions and expand their global reach.

Cardiovascular Devices Market Company Market Share

This in-depth report offers a strategic analysis of the global Cardiovascular Devices Market, forecasting its trajectory from 2019 to 2033, with a base year of 2025. Dive into the intricate dynamics of this vital sector, understanding market size, key trends, competitive landscapes, and emerging opportunities driven by rising cardiovascular disease prevalence and technological advancements. With an estimated market size projected to reach $XXX Million by 2025 and an anticipated CAGR of XX% during the forecast period (2025-2033), this report provides actionable intelligence for stakeholders.

Cardiovascular Devices Market Market Structure & Competitive Landscape

The Cardiovascular Devices Market exhibits a moderately concentrated structure, characterized by the presence of both large multinational corporations and smaller specialized players. Innovation drivers are predominantly technological advancements in miniaturization, biocompatibility, and data analytics, alongside increasing demand for minimally invasive procedures. Regulatory impacts are significant, with stringent FDA and EMA approvals shaping product development and market access. Product substitutes exist, particularly for less critical applications, but advanced therapeutic and diagnostic devices offer distinct advantages. End-user segmentation includes hospitals, clinics, ambulatory surgical centers, and home healthcare settings, each with evolving purchasing patterns and technology adoption rates. Mergers and acquisitions (M&A) are a recurring theme, with an estimated XX M&A deals recorded in the historical period (2019-2024) aimed at consolidating market share, acquiring innovative technologies, and expanding product portfolios. Key players actively pursue strategic partnerships and collaborations to accelerate product development and market penetration.

Cardiovascular Devices Market Market Trends & Opportunities

The global Cardiovascular Devices Market is poised for substantial growth, fueled by a confluence of escalating cardiovascular disease (CVD) rates worldwide and remarkable technological breakthroughs. The market is projected to witness an impressive expansion, driven by an aging global population, increasingly sedentary lifestyles, and a greater emphasis on preventative healthcare. Technological innovation is a dominant trend, with a sharp focus on developing smart, connected devices that enable continuous patient monitoring, remote diagnostics, and personalized treatment plans. The rise of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing diagnostic capabilities, leading to earlier and more accurate detection of cardiac abnormalities.

Minimally invasive surgical techniques are gaining significant traction, consequently boosting the demand for sophisticated catheters, interventional devices, and advanced imaging systems. This shift not only enhances patient outcomes by reducing recovery times and complications but also aligns with healthcare providers' efforts to optimize hospital resources. The increasing adoption of wearable and implantable cardiac monitoring devices is another prominent trend, empowering patients with real-time health data and facilitating proactive management of chronic cardiac conditions.

Opportunities abound in emerging economies, where the growing middle class and expanding healthcare infrastructure are creating a burgeoning demand for advanced cardiovascular solutions. Furthermore, the market is ripe for innovation in areas such as novel biomaterials for implants, biodegradable stents, and next-generation cardiac assist devices. The competitive landscape is dynamic, with companies continually investing in research and development to gain a competitive edge. Strategic collaborations, product launches, and regulatory approvals are key determinants of market leadership. The overall market penetration rate for advanced cardiovascular devices is still considerable, indicating ample room for further growth and market expansion.

Dominant Markets & Segments in Cardiovascular Devices Market

The Cardiovascular Devices Market is segmented by device type into Diagnostic and Monitoring Devices and Therapeutic and Surgical Devices, with further sub-categorization within each. Within Diagnostic and Monitoring Devices, Electrocardiogram (ECG) devices and Remote Cardiac Monitoring solutions are experiencing robust growth. ECG devices, from portable Holter monitors to sophisticated 12-lead systems, remain foundational in diagnosing arrhythmias and other cardiac electrical abnormalities. The increasing prevalence of heart conditions and the need for continuous patient oversight are driving the demand for advanced remote cardiac monitoring systems, which leverage wearable sensors and cloud-based platforms for real-time data transmission and analysis.

The Therapeutic and Surgical Devices segment represents a significant portion of the market, encompassing a wide array of life-saving technologies. Cardiac Rhythm Management Devices, such as pacemakers and implantable cardioverter-defibrillators (ICDs), continue to be crucial for managing life-threatening arrhythmias. Heart Valves, both mechanical and bioprosthetic, are in high demand due to an aging population and the rising incidence of valvular heart disease. The development of transcatheter aortic valve implantation (TAVI) and similar percutaneous interventions has revolutionized treatment options for many patients.

Catheters, particularly those used in interventional cardiology and electrophysiology procedures, are indispensable tools. Innovations in stent technology, including drug-elated stents (DES) and bioresorbable vascular scaffolds, are continually improving outcomes for coronary artery disease patients. Cardiac Assist Devices, such as ventricular assist devices (VADs), are increasingly used as a bridge to transplant or as a destination therapy for heart failure patients.

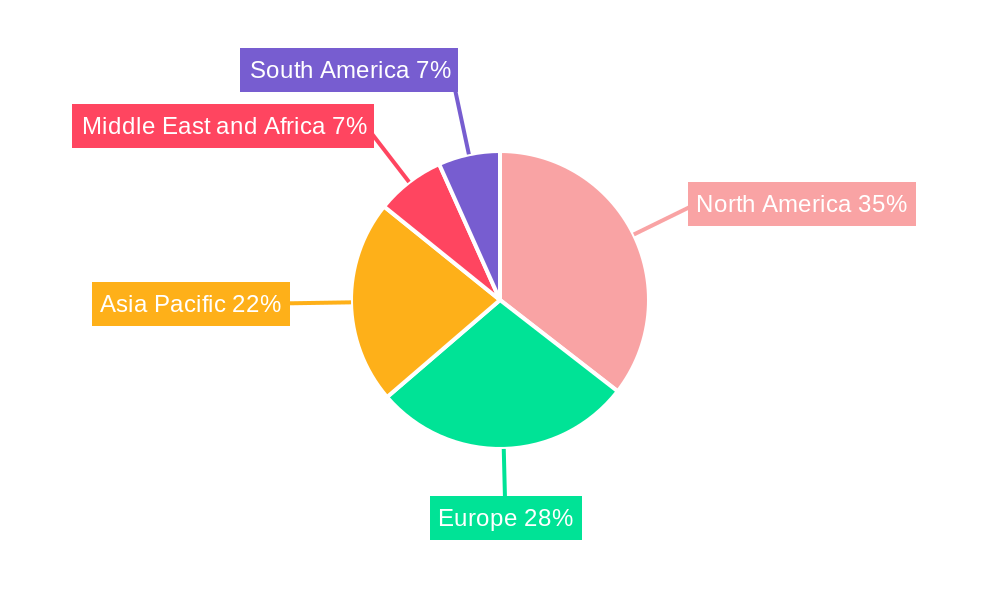

Geographically, North America currently dominates the Cardiovascular Devices Market, driven by high healthcare expenditure, advanced technological adoption, and a large patient pool with cardiovascular conditions. The United States, in particular, is a key market, with substantial investments in cardiovascular research and development. Europe follows closely, with strong healthcare systems and a significant number of established medical device manufacturers. Asia Pacific is emerging as a high-growth region, propelled by improving healthcare infrastructure, increasing disposable incomes, and a rising awareness of cardiovascular health. Key growth drivers in these regions include favorable government policies, robust reimbursement frameworks, and a strong emphasis on medical device innovation.

Cardiovascular Devices Market Product Analysis

Product innovation in the Cardiovascular Devices Market is characterized by a relentless pursuit of miniaturization, enhanced functionality, and improved patient outcomes. Advancements in materials science have led to the development of biocompatible and durable implantable devices, while sophisticated algorithms are enhancing the diagnostic precision of monitoring equipment. The integration of AI and connectivity is transforming traditional devices into smart, data-driven solutions. These innovations are not only expanding the therapeutic options for complex cardiac conditions but also enabling more personalized and less invasive treatment approaches, offering significant competitive advantages to manufacturers leading in these technological advancements.

Key Drivers, Barriers & Challenges in Cardiovascular Devices Market

Key Drivers:

- Rising Global Prevalence of Cardiovascular Diseases: Aging populations and lifestyle changes are leading to an increased incidence of heart conditions, directly driving demand for cardiovascular devices.

- Technological Advancements: Continuous innovation in areas like miniaturization, AI integration, and minimally invasive technologies fuels market growth and creates new treatment possibilities.

- Growing Demand for Minimally Invasive Procedures: Patients and healthcare providers increasingly favor procedures with shorter recovery times and fewer complications, boosting the market for interventional devices.

- Expanding Healthcare Infrastructure in Emerging Economies: Improving access to healthcare and increasing disposable incomes in developing nations are creating significant market opportunities.

Key Barriers & Challenges:

- Stringent Regulatory Hurdles: The lengthy and complex approval processes for medical devices in major markets like the US and Europe can significantly impact time-to-market and development costs.

- High Cost of Advanced Devices: The significant price of sophisticated cardiovascular devices can be a barrier to widespread adoption, especially in resource-limited settings.

- Reimbursement Policies and Healthcare Reforms: Changes in healthcare policies and reimbursement rates can influence market access and profitability for device manufacturers.

- Supply Chain Disruptions and Raw Material Costs: Global supply chain vulnerabilities and fluctuations in raw material prices can affect production and lead to increased costs.

Growth Drivers in the Cardiovascular Devices Market Market

The Cardiovascular Devices Market is propelled by several potent growth drivers. The unabating rise in cardiovascular diseases globally, exacerbated by an aging demographic and evolving lifestyle factors, creates a constant and escalating demand for advanced medical interventions. Technological innovation remains a cornerstone, with continuous breakthroughs in areas such as electrophysiology mapping, cardiac rhythm management, and interventional cardiology. The increasing preference for minimally invasive surgical procedures is a significant catalyst, driving the adoption of sophisticated catheters, stents, and valves that offer improved patient outcomes and reduced hospital stays. Furthermore, favorable government initiatives and expanding healthcare infrastructure, particularly in emerging economies, are opening up new avenues for market penetration and growth.

Challenges Impacting Cardiovascular Devices Market Growth

The Cardiovascular Devices Market faces several significant challenges that could impede its growth trajectory. Foremost among these are the stringent and evolving regulatory landscapes across different geographies, demanding extensive clinical trials and compliance measures that can prolong product development cycles. The substantial cost associated with research, development, and manufacturing of cutting-edge cardiovascular devices contributes to their high price point, which can limit accessibility for a broader patient population and strain healthcare budgets. Furthermore, intense competition among established players and emerging innovators can lead to price erosion and impact profit margins. Navigating complex reimbursement policies and securing favorable coverage from payers remains a persistent hurdle for market access.

Key Players Shaping the Cardiovascular Devices Market Market

- Siemens Healthcare GmbH

- Biotronik

- Edwards Lifesciences Corporation

- LivaNova PLC

- General Electric (GE Healthcare)

- Medtronic

- W L Gore & Associates Inc

- Cardinal Health

- Abbott

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- B Braun SE

Significant Cardiovascular Devices Market Industry Milestones

- October 2022: Medtronic plc received United States FDA approval for expanded labeling of a cardiac lead that taps into the heart's natural electrical system, giving patients needed therapy while avoiding complications sometimes associated with traditional pacing methods, such as cardiomyopathy.

- October 2022: Biosense Webster, Inc., part of Johnson & Johnson MedTech launched the HELIOSTAR Balloon Ablation Catheter in Europe. The HELIOSTAR Balloon Ablation Catheter is indicated for use in the catheter-based cardiac electrophysiological mapping (stimulating and recording) of the atria and, when used with a compatible multi-channel RF generator, for cardiac ablation.

Future Outlook for Cardiovascular Devices Market Market

The future outlook for the Cardiovascular Devices Market is exceptionally promising, driven by continued technological innovation, an expanding global patient base suffering from cardiovascular diseases, and a growing emphasis on preventative and personalized healthcare. The integration of artificial intelligence and data analytics will further refine diagnostic capabilities and treatment strategies. The market will witness a sustained demand for minimally invasive devices and advanced therapeutic solutions, alongside significant growth in emerging economies as healthcare access improves. Strategic collaborations and targeted acquisitions will remain key to navigating the competitive landscape and capitalizing on evolving market needs, ensuring continued robust growth and improved patient care.

Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Cardiovascular Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cardiovascular Devices Market Regional Market Share

Geographic Coverage of Cardiovascular Devices Market

Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Technological Advancements; Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Product Recalls; High Cost of Instruments and Procedures

- 3.4. Market Trends

- 3.4.1. The Electrocardiogram (ECG) Under Diagnostic and Monitoring Devices Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Diagnostic and Monitoring Devices

- 6.1.1.1. Electrocardiogram (ECG)

- 6.1.1.2. Remote Cardiac Monitoring

- 6.1.1.3. Other Diagnostic and Monitoring Devices

- 6.1.2. Therapeutic and Surgical Devices

- 6.1.2.1. Cardiac Assist Devices

- 6.1.2.2. Cardiac Rhythm Management Devices

- 6.1.2.3. Catheters

- 6.1.2.4. Grafts

- 6.1.2.5. Heart Valves

- 6.1.2.6. Stents

- 6.1.2.7. Other Therapeutic and Surgical Devices

- 6.1.1. Diagnostic and Monitoring Devices

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Diagnostic and Monitoring Devices

- 7.1.1.1. Electrocardiogram (ECG)

- 7.1.1.2. Remote Cardiac Monitoring

- 7.1.1.3. Other Diagnostic and Monitoring Devices

- 7.1.2. Therapeutic and Surgical Devices

- 7.1.2.1. Cardiac Assist Devices

- 7.1.2.2. Cardiac Rhythm Management Devices

- 7.1.2.3. Catheters

- 7.1.2.4. Grafts

- 7.1.2.5. Heart Valves

- 7.1.2.6. Stents

- 7.1.2.7. Other Therapeutic and Surgical Devices

- 7.1.1. Diagnostic and Monitoring Devices

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Diagnostic and Monitoring Devices

- 8.1.1.1. Electrocardiogram (ECG)

- 8.1.1.2. Remote Cardiac Monitoring

- 8.1.1.3. Other Diagnostic and Monitoring Devices

- 8.1.2. Therapeutic and Surgical Devices

- 8.1.2.1. Cardiac Assist Devices

- 8.1.2.2. Cardiac Rhythm Management Devices

- 8.1.2.3. Catheters

- 8.1.2.4. Grafts

- 8.1.2.5. Heart Valves

- 8.1.2.6. Stents

- 8.1.2.7. Other Therapeutic and Surgical Devices

- 8.1.1. Diagnostic and Monitoring Devices

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Middle East and Africa Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Diagnostic and Monitoring Devices

- 9.1.1.1. Electrocardiogram (ECG)

- 9.1.1.2. Remote Cardiac Monitoring

- 9.1.1.3. Other Diagnostic and Monitoring Devices

- 9.1.2. Therapeutic and Surgical Devices

- 9.1.2.1. Cardiac Assist Devices

- 9.1.2.2. Cardiac Rhythm Management Devices

- 9.1.2.3. Catheters

- 9.1.2.4. Grafts

- 9.1.2.5. Heart Valves

- 9.1.2.6. Stents

- 9.1.2.7. Other Therapeutic and Surgical Devices

- 9.1.1. Diagnostic and Monitoring Devices

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South America Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Diagnostic and Monitoring Devices

- 10.1.1.1. Electrocardiogram (ECG)

- 10.1.1.2. Remote Cardiac Monitoring

- 10.1.1.3. Other Diagnostic and Monitoring Devices

- 10.1.2. Therapeutic and Surgical Devices

- 10.1.2.1. Cardiac Assist Devices

- 10.1.2.2. Cardiac Rhythm Management Devices

- 10.1.2.3. Catheters

- 10.1.2.4. Grafts

- 10.1.2.5. Heart Valves

- 10.1.2.6. Stents

- 10.1.2.7. Other Therapeutic and Surgical Devices

- 10.1.1. Diagnostic and Monitoring Devices

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siemens Healthcare GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biotronik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Edwards Lifesciences Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LivaNova PLC*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric (GE Healthcare)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medtronic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 W L Gore & Associates Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cardinal Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Canon Medical Systems Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boston Scientific Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 B Braun SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Global Cardiovascular Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cardiovascular Devices Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Cardiovascular Devices Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: North America Cardiovascular Devices Market Volume (K Units), by Device Type 2025 & 2033

- Figure 5: North America Cardiovascular Devices Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America Cardiovascular Devices Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: North America Cardiovascular Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Cardiovascular Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 9: North America Cardiovascular Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Cardiovascular Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Cardiovascular Devices Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Cardiovascular Devices Market Volume (K Units), by Device Type 2025 & 2033

- Figure 13: Europe Cardiovascular Devices Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Cardiovascular Devices Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Cardiovascular Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Cardiovascular Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 17: Europe Cardiovascular Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cardiovascular Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Cardiovascular Devices Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Asia Pacific Cardiovascular Devices Market Volume (K Units), by Device Type 2025 & 2033

- Figure 21: Asia Pacific Cardiovascular Devices Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Asia Pacific Cardiovascular Devices Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Asia Pacific Cardiovascular Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Cardiovascular Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Asia Pacific Cardiovascular Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cardiovascular Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Cardiovascular Devices Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: Middle East and Africa Cardiovascular Devices Market Volume (K Units), by Device Type 2025 & 2033

- Figure 29: Middle East and Africa Cardiovascular Devices Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Middle East and Africa Cardiovascular Devices Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: Middle East and Africa Cardiovascular Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East and Africa Cardiovascular Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 33: Middle East and Africa Cardiovascular Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cardiovascular Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Cardiovascular Devices Market Revenue (Million), by Device Type 2025 & 2033

- Figure 36: South America Cardiovascular Devices Market Volume (K Units), by Device Type 2025 & 2033

- Figure 37: South America Cardiovascular Devices Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: South America Cardiovascular Devices Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: South America Cardiovascular Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Cardiovascular Devices Market Volume (K Units), by Country 2025 & 2033

- Figure 41: South America Cardiovascular Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Cardiovascular Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Global Cardiovascular Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cardiovascular Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: Global Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: United States Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 11: Canada Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 13: Mexico Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 16: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 17: Global Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Germany Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: France Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Italy Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Spain Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 32: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 33: Global Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 35: China Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Japan Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: India Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Australia Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Australia Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 48: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 49: Global Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 51: GCC Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: GCC Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: South Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 58: Global Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 59: Global Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Brazil Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Argentina Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Cardiovascular Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Cardiovascular Devices Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cardiovascular Devices Market?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Cardiovascular Devices Market?

Key companies in the market include Siemens Healthcare GmbH, Biotronik, Edwards Lifesciences Corporation, LivaNova PLC*List Not Exhaustive, General Electric (GE Healthcare), Medtronic, W L Gore & Associates Inc, Cardinal Health, Abbott, Canon Medical Systems Corporation, Boston Scientific Corporation, B Braun SE.

3. What are the main segments of the Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 58.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Technological Advancements; Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

The Electrocardiogram (ECG) Under Diagnostic and Monitoring Devices Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Product Recalls; High Cost of Instruments and Procedures.

8. Can you provide examples of recent developments in the market?

October 2022: Medtronic plc received United States FDA approval for expanded labeling of a cardiac lead that taps into the heart's natural electrical system, giving patients needed therapy while avoiding complications sometimes associated with traditional pacing methods, such as cardiomyopathy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence