Key Insights

The global Cell Culture Protein Surface Coatings Market is projected for significant expansion, reaching an estimated market size of $1,076.08 million by 2025 and exhibiting a CAGR of 8.6% through 2033. This growth is driven by escalating demand for advanced cell culture solutions in life science research and biopharmaceutical applications. Key factors include the rising prevalence of chronic diseases, necessitating extensive research into novel therapeutics and diagnostics, and the biopharmaceutical industry's focus on developing biologics, vaccines, and cell-based therapies. Advancements in protein engineering and biomaterials are enhancing cell viability and differentiation, while increased government funding for life science research and the importance of in vitro models for drug discovery are further catalysts.

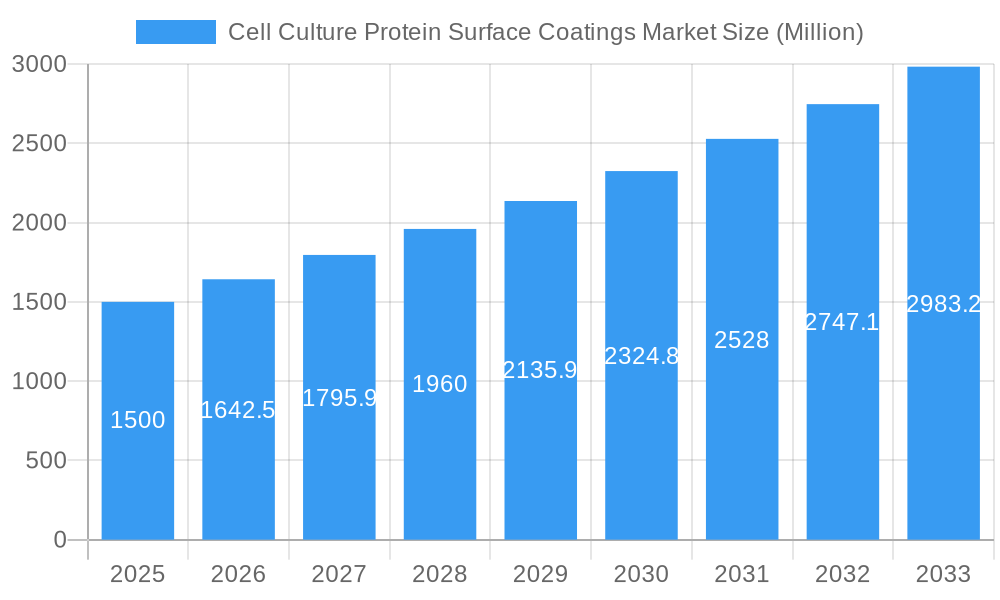

Cell Culture Protein Surface Coatings Market Market Size (In Billion)

Market segmentation reveals diverse opportunities across protein sources (Animal-derived, Human-derived, Synthetic, Plant-derived) and pre-coating types (microwell plates, petri dishes, flasks, slides), catering to specific research needs and workflow efficiencies. High R&D costs and stringent regulatory processes present market restraints. However, the adoption of single-use technologies in biomanufacturing and expanding applications of cell-based assays in regenerative medicine and personalized healthcare are expected to mitigate these challenges. North America and Europe currently lead the market due to robust research infrastructure, with Asia Pacific emerging as a rapidly growing region driven by increasing R&D expenditure.

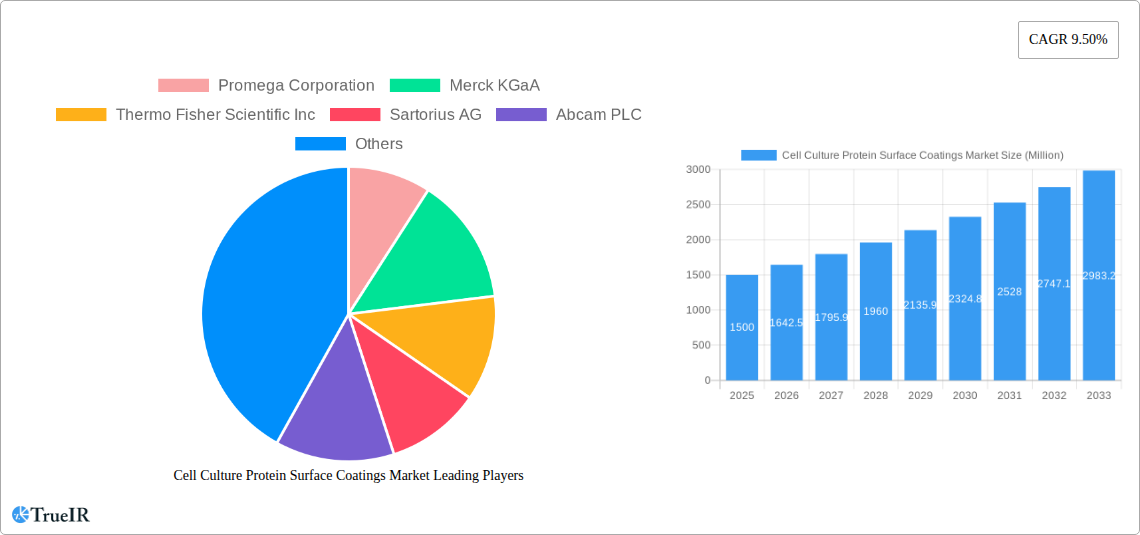

Cell Culture Protein Surface Coatings Market Company Market Share

Cell Culture Protein Surface Coatings Market Analysis: Growth, Trends, and Forecast (2025-2033)

This comprehensive report offers in-depth insights into the Cell Culture Protein Surface Coatings Market from 2025 to 2033. Featuring a base year of 2025, the analysis details market dynamics, growth trajectories, and future opportunities. We examine key segments including Protein Source (Animal-derived Protein, Human-derived Protein, Synthetic Protein, Plant-derived Protein) and Type of Coating (Self-coating, Pre-coating including Microwell Plates, Petri Dish, Flask, Slides, and Other Types of Pre-coatings). This report is essential for researchers, manufacturers, investors, and stakeholders navigating the life sciences industry.

Cell Culture Protein Surface Coatings Market Market Structure & Competitive Landscape

The Cell Culture Protein Surface Coatings Market exhibits a moderately concentrated structure, characterized by the strategic presence of established global players and emerging innovators. Innovation drivers are primarily fueled by the burgeoning demand for advanced cell-based therapies, regenerative medicine, and drug discovery platforms. Regulatory frameworks, while evolving, play a significant role in dictating product development and market entry, particularly concerning the safety and efficacy of protein coatings derived from animal or human sources. Product substitutes, though limited in direct replacement, can emerge from advancements in synthetic biomaterials and novel cell culture technologies. The end-user segmentation is diverse, encompassing academic research institutions, pharmaceutical and biotechnology companies, contract research organizations (CROs), and diagnostic laboratories. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating portfolios, expanding market reach, and acquiring specialized technologies. For instance, the sector has witnessed an average of 2-4 significant M&A activities per year over the historical period, reflecting a drive towards synergy and competitive advantage. The market's competitive intensity is further shaped by factors such as pricing strategies, intellectual property, and the ability to offer customized coating solutions.

Cell Culture Protein Surface Coatings Market Market Trends & Opportunities

The global Cell Culture Protein Surface Coatings Market is poised for significant expansion, driven by a confluence of technological advancements and increasing demand across various life science applications. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period, expanding from an estimated USD 1.8 Billion in 2025 to over USD 3.8 Billion by 2033. This impressive growth trajectory is underpinned by several key trends. Firstly, the escalating adoption of 3D cell culture techniques, including organoids and spheroids, necessitates specialized protein coatings that can mimic in vivo microenvironments, thereby enhancing cellular behavior and functionality. Secondly, the rapid progress in stem cell research, cell therapy development, and regenerative medicine is creating a substantial demand for biocompatible and functionalized surface coatings that support cell viability, differentiation, and proliferation. Technological shifts are leaning towards the development of synthetic and peptide-based coatings, offering greater control, reproducibility, and reduced lot-to-lot variability compared to animal-derived proteins, while also addressing ethical concerns. Consumer preferences are increasingly shifting towards cost-effective, high-performance, and application-specific coating solutions. The competitive dynamics are intensifying, with companies focusing on product differentiation through enhanced bioactivity, ease of use, and scalability for commercial applications. Opportunities abound in developing novel coatings for specific cell types, addressing challenges in bioprinting, and creating integrated solutions that combine coatings with advanced cell culture platforms. The increasing investment in drug discovery and development pipelines globally further fuels the demand for reliable cell culture tools, including protein surface coatings, to enable accurate and predictive preclinical testing.

Dominant Markets & Segments in Cell Culture Protein Surface Coatings Market

The Animal-derived Protein segment currently dominates the Cell Culture Protein Surface Coatings Market, accounting for an estimated 55% of the market share in 2025. This dominance is attributed to its long-standing availability, established efficacy, and cost-effectiveness in a wide range of cell culture applications. Key growth drivers within this segment include its widespread use in basic research, vaccine production, and the manufacturing of biologics where established protocols are in place. However, concerns regarding potential viral contamination and lot-to-lot variability are gradually driving a shift towards alternatives.

The Pre-coating type of coating is the leading segment, holding an estimated 70% of the market in 2025. This preference is driven by the convenience and standardization offered by pre-coated consumables.

- Microwell Plates: This sub-segment is particularly dominant due to its extensive use in high-throughput screening, drug discovery, and diagnostic assays, representing a significant portion of the pre-coated market.

- Flasks and Petri Dishes: These remain essential consumables for routine cell culture, with pre-coated options offering enhanced cell attachment and growth.

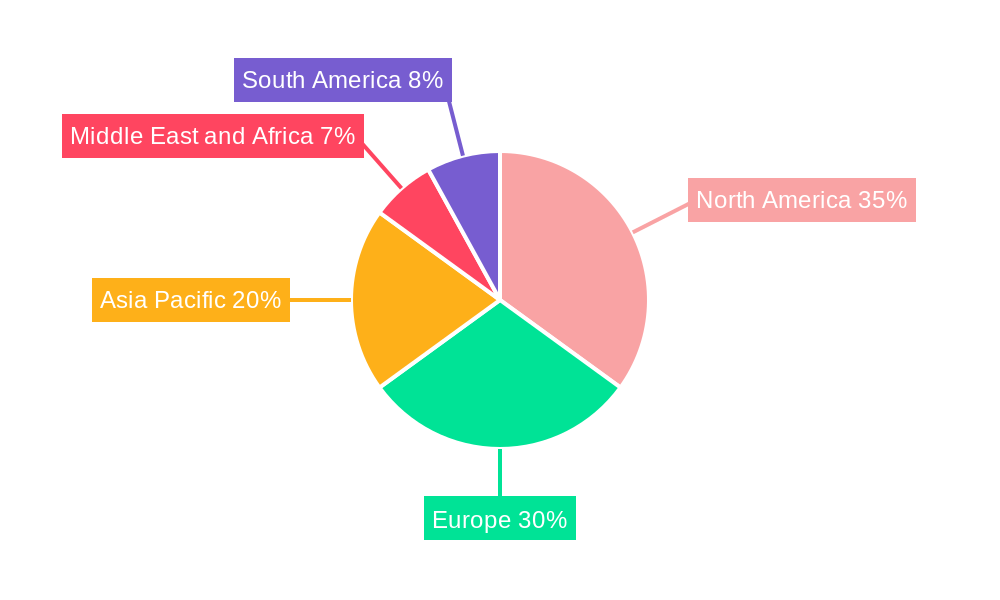

Geographically, North America is the leading market, driven by its robust pharmaceutical and biotechnology industry, significant R&D investments, and a high prevalence of academic research institutions. The United States, in particular, contributes substantially to market growth through its advanced healthcare infrastructure and early adoption of new technologies. Europe follows closely, with strong contributions from countries like Germany, the UK, and Switzerland, fueled by a growing focus on cell and gene therapies and a well-established life sciences ecosystem. The Asia-Pacific region is emerging as the fastest-growing market, propelled by increasing healthcare expenditure, expanding biopharmaceutical manufacturing capabilities, and growing government support for R&D activities in countries like China and India.

Cell Culture Protein Surface Coatings Market Product Analysis

Product innovation in the Cell Culture Protein Surface Coatings Market is characterized by a strong emphasis on enhancing cell adhesion, proliferation, and differentiation. Advances include the development of recombinant proteins, synthetic peptides, and surface chemistries that precisely mimic the extracellular matrix (ECM). These innovations offer improved lot-to-lot consistency, reduced immunogenicity, and greater control over cellular behavior compared to traditional animal-derived coatings. Applications span across drug discovery, regenerative medicine, stem cell research, and tissue engineering, enabling more physiologically relevant cell culture models. Competitive advantages are derived from offering tailored solutions for specific cell types and applications, ensuring superior performance and scalability for both research and therapeutic manufacturing.

Key Drivers, Barriers & Challenges in Cell Culture Protein Surface Coatings Market

Key Drivers: The Cell Culture Protein Surface Coatings Market is propelled by the escalating demand for advanced cell therapies, regenerative medicine, and personalized medicine approaches. Increased R&D investments in the biopharmaceutical sector, particularly in drug discovery and development pipelines, create a consistent need for reliable cell culture tools. The growing trend of 3D cell culture technologies, including organoids and spheroids, necessitates sophisticated protein coatings to mimic in vivo environments. Furthermore, advancements in synthetic biology and biomaterials are enabling the development of novel, highly functionalized coatings with improved performance and reproducibility.

Barriers & Challenges: Despite robust growth, the market faces challenges such as the stringent regulatory approval processes for cell-based therapies, which indirectly impact the adoption of associated consumables. The cost of developing and manufacturing high-quality, specialized protein coatings can be substantial, potentially limiting accessibility for smaller research labs. Supply chain disruptions, particularly for raw materials used in animal-derived proteins, can pose risks. Moreover, the inherent variability in biological materials and the complexity of replicating in vivo conditions in vitro remain ongoing challenges for coating developers. Competitive pressures also necessitate continuous innovation and cost optimization.

Growth Drivers in the Cell Culture Protein Surface Coatings Market Market

The Cell Culture Protein Surface Coatings Market is experiencing significant growth driven by several key factors. The burgeoning field of cell and gene therapy development is a primary catalyst, demanding highly specific and biocompatible coatings to support therapeutic cell expansion and differentiation. Increased global investment in life sciences research and development, particularly in oncology and neurodegenerative diseases, fuels the need for advanced cell culture solutions. Technological advancements in recombinant protein production and synthetic biomaterials are leading to the creation of more consistent, controllable, and application-specific coatings. Furthermore, the growing adoption of automation and high-throughput screening in drug discovery further necessitates reliable and scalable cell culture consumables, including pre-coated plates and dishes.

Challenges Impacting Cell Culture Protein Surface Coatings Market Growth

Several challenges impact the growth trajectory of the Cell Culture Protein Surface Coatings Market. The stringent and evolving regulatory landscape for cell-based products can slow down the adoption of novel coatings, especially those derived from or intended for therapeutic applications. Supply chain vulnerabilities for essential raw materials, particularly for certain animal-derived proteins, can lead to price volatility and availability issues. The high cost associated with the development of highly specialized and functionalized coatings can present a barrier to entry for smaller companies and limit their widespread adoption in cost-sensitive research environments. Intense competition among players also pressures profit margins, requiring continuous innovation and efficient manufacturing processes to maintain market share.

Key Players Shaping the Cell Culture Protein Surface Coatings Market Market

- Promega Corporation

- Merck KGaA

- Thermo Fisher Scientific Inc

- Sartorius AG

- Abcam PLC

- Greiner AG (Greiner Bio-One International GmbH)

- Qiagen NV

- Viogene

- Corning Incorporated

Significant Cell Culture Protein Surface Coatings Market Industry Milestones

- April 2022: Molecular Devices LLC has been continuing its investment since April 2021 in Organoid Innovation Center, adding cell engineering capabilities to an automated 3D cell culture platform.

- December 2021: DenovoMATRIX launched its new product, isoMATRIX, a high-yield MSC isolation technology for cell and gene therapy. It has the efficiency to get nearly 35% more stem cells with better quality and faster growth.

Future Outlook for Cell Culture Protein Surface Coatings Market Market

The future outlook for the Cell Culture Protein Surface Coatings Market is exceptionally promising, fueled by the relentless pace of innovation in biotechnology and medicine. The continued growth of regenerative medicine, cell therapies, and personalized treatments will be a significant market catalyst. We anticipate a further shift towards synthetic and chemically defined coatings, offering enhanced reproducibility and reduced batch-to-batch variability, which are critical for therapeutic applications. The increasing integration of protein coatings with advanced cell culture technologies, such as microfluidics and bioprinting, will unlock new possibilities for in vitro modeling and drug development. Strategic collaborations and partnerships between coating manufacturers and leading biopharmaceutical companies will be crucial for developing application-specific solutions and accelerating market penetration. The market is poised for sustained growth, driven by the fundamental need for optimized cell culture environments to advance human health.

Cell Culture Protein Surface Coatings Market Segmentation

-

1. Protein Source

- 1.1. Animal-derived Protein

- 1.2. Human-derived Protein

- 1.3. Synthetic Protein

- 1.4. Plant-derived Protein

-

2. Type of Coating

- 2.1. Self-coating

-

2.2. Pre-coating

- 2.2.1. Microwell Plates

- 2.2.2. Petri Dish

- 2.2.3. Flask

- 2.2.4. Slides

- 2.2.5. Other Types of Pre-coatings

Cell Culture Protein Surface Coatings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. United Kingsom

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell Culture Protein Surface Coatings Market Regional Market Share

Geographic Coverage of Cell Culture Protein Surface Coatings Market

Cell Culture Protein Surface Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Stem Cell Research Activities; Increasing Demand of Protein Therapeutics and Targeted Therapy; Growing Preference for 3D Cell Cultures over 2D Cell Cultures

- 3.3. Market Restrains

- 3.3.1. High Cost of Cell Culture Protein Surface Coatings Products; Restriction Against Use of Animal Source Protein Coating Material

- 3.4. Market Trends

- 3.4.1. Microwell Plates Under Pre-coatings Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Protein Source

- 5.1.1. Animal-derived Protein

- 5.1.2. Human-derived Protein

- 5.1.3. Synthetic Protein

- 5.1.4. Plant-derived Protein

- 5.2. Market Analysis, Insights and Forecast - by Type of Coating

- 5.2.1. Self-coating

- 5.2.2. Pre-coating

- 5.2.2.1. Microwell Plates

- 5.2.2.2. Petri Dish

- 5.2.2.3. Flask

- 5.2.2.4. Slides

- 5.2.2.5. Other Types of Pre-coatings

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Protein Source

- 6. North America Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Protein Source

- 6.1.1. Animal-derived Protein

- 6.1.2. Human-derived Protein

- 6.1.3. Synthetic Protein

- 6.1.4. Plant-derived Protein

- 6.2. Market Analysis, Insights and Forecast - by Type of Coating

- 6.2.1. Self-coating

- 6.2.2. Pre-coating

- 6.2.2.1. Microwell Plates

- 6.2.2.2. Petri Dish

- 6.2.2.3. Flask

- 6.2.2.4. Slides

- 6.2.2.5. Other Types of Pre-coatings

- 6.1. Market Analysis, Insights and Forecast - by Protein Source

- 7. Europe Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Protein Source

- 7.1.1. Animal-derived Protein

- 7.1.2. Human-derived Protein

- 7.1.3. Synthetic Protein

- 7.1.4. Plant-derived Protein

- 7.2. Market Analysis, Insights and Forecast - by Type of Coating

- 7.2.1. Self-coating

- 7.2.2. Pre-coating

- 7.2.2.1. Microwell Plates

- 7.2.2.2. Petri Dish

- 7.2.2.3. Flask

- 7.2.2.4. Slides

- 7.2.2.5. Other Types of Pre-coatings

- 7.1. Market Analysis, Insights and Forecast - by Protein Source

- 8. Asia Pacific Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Protein Source

- 8.1.1. Animal-derived Protein

- 8.1.2. Human-derived Protein

- 8.1.3. Synthetic Protein

- 8.1.4. Plant-derived Protein

- 8.2. Market Analysis, Insights and Forecast - by Type of Coating

- 8.2.1. Self-coating

- 8.2.2. Pre-coating

- 8.2.2.1. Microwell Plates

- 8.2.2.2. Petri Dish

- 8.2.2.3. Flask

- 8.2.2.4. Slides

- 8.2.2.5. Other Types of Pre-coatings

- 8.1. Market Analysis, Insights and Forecast - by Protein Source

- 9. Middle East and Africa Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Protein Source

- 9.1.1. Animal-derived Protein

- 9.1.2. Human-derived Protein

- 9.1.3. Synthetic Protein

- 9.1.4. Plant-derived Protein

- 9.2. Market Analysis, Insights and Forecast - by Type of Coating

- 9.2.1. Self-coating

- 9.2.2. Pre-coating

- 9.2.2.1. Microwell Plates

- 9.2.2.2. Petri Dish

- 9.2.2.3. Flask

- 9.2.2.4. Slides

- 9.2.2.5. Other Types of Pre-coatings

- 9.1. Market Analysis, Insights and Forecast - by Protein Source

- 10. South America Cell Culture Protein Surface Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Protein Source

- 10.1.1. Animal-derived Protein

- 10.1.2. Human-derived Protein

- 10.1.3. Synthetic Protein

- 10.1.4. Plant-derived Protein

- 10.2. Market Analysis, Insights and Forecast - by Type of Coating

- 10.2.1. Self-coating

- 10.2.2. Pre-coating

- 10.2.2.1. Microwell Plates

- 10.2.2.2. Petri Dish

- 10.2.2.3. Flask

- 10.2.2.4. Slides

- 10.2.2.5. Other Types of Pre-coatings

- 10.1. Market Analysis, Insights and Forecast - by Protein Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Promega Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermo Fisher Scientific Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sartorius AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abcam PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Greiner AG (Greiner Bio-One International GmbH)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qiagen NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Viogene

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Corning Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Promega Corporation

List of Figures

- Figure 1: Global Cell Culture Protein Surface Coatings Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Cell Culture Protein Surface Coatings Market Revenue (million), by Protein Source 2025 & 2033

- Figure 3: North America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Protein Source 2025 & 2033

- Figure 4: North America Cell Culture Protein Surface Coatings Market Revenue (million), by Type of Coating 2025 & 2033

- Figure 5: North America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Type of Coating 2025 & 2033

- Figure 6: North America Cell Culture Protein Surface Coatings Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cell Culture Protein Surface Coatings Market Revenue (million), by Protein Source 2025 & 2033

- Figure 9: Europe Cell Culture Protein Surface Coatings Market Revenue Share (%), by Protein Source 2025 & 2033

- Figure 10: Europe Cell Culture Protein Surface Coatings Market Revenue (million), by Type of Coating 2025 & 2033

- Figure 11: Europe Cell Culture Protein Surface Coatings Market Revenue Share (%), by Type of Coating 2025 & 2033

- Figure 12: Europe Cell Culture Protein Surface Coatings Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Cell Culture Protein Surface Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue (million), by Protein Source 2025 & 2033

- Figure 15: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue Share (%), by Protein Source 2025 & 2033

- Figure 16: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue (million), by Type of Coating 2025 & 2033

- Figure 17: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue Share (%), by Type of Coating 2025 & 2033

- Figure 18: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Cell Culture Protein Surface Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue (million), by Protein Source 2025 & 2033

- Figure 21: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue Share (%), by Protein Source 2025 & 2033

- Figure 22: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue (million), by Type of Coating 2025 & 2033

- Figure 23: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue Share (%), by Type of Coating 2025 & 2033

- Figure 24: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cell Culture Protein Surface Coatings Market Revenue (million), by Protein Source 2025 & 2033

- Figure 27: South America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Protein Source 2025 & 2033

- Figure 28: South America Cell Culture Protein Surface Coatings Market Revenue (million), by Type of Coating 2025 & 2033

- Figure 29: South America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Type of Coating 2025 & 2033

- Figure 30: South America Cell Culture Protein Surface Coatings Market Revenue (million), by Country 2025 & 2033

- Figure 31: South America Cell Culture Protein Surface Coatings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 2: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 3: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 5: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 6: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 11: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 12: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: France Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Germany Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: United Kingsom Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 20: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 21: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 22: China Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Japan Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Australia Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 29: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 30: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: GCC Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Protein Source 2020 & 2033

- Table 35: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Type of Coating 2020 & 2033

- Table 36: Global Cell Culture Protein Surface Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 37: Brazil Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Cell Culture Protein Surface Coatings Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Culture Protein Surface Coatings Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Cell Culture Protein Surface Coatings Market?

Key companies in the market include Promega Corporation, Merck KGaA, Thermo Fisher Scientific Inc, Sartorius AG, Abcam PLC, Greiner AG (Greiner Bio-One International GmbH), Qiagen NV, Viogene, Corning Incorporated.

3. What are the main segments of the Cell Culture Protein Surface Coatings Market?

The market segments include Protein Source, Type of Coating.

4. Can you provide details about the market size?

The market size is estimated to be USD 1076.08 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Stem Cell Research Activities; Increasing Demand of Protein Therapeutics and Targeted Therapy; Growing Preference for 3D Cell Cultures over 2D Cell Cultures.

6. What are the notable trends driving market growth?

Microwell Plates Under Pre-coatings Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Cell Culture Protein Surface Coatings Products; Restriction Against Use of Animal Source Protein Coating Material.

8. Can you provide examples of recent developments in the market?

April 2022: Molecular Devices LLC has been continuing its investment since April 2021 in Organoid Innovation Center, adding cell engineering capabilities to an automated 3D cell culture platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Culture Protein Surface Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Culture Protein Surface Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Culture Protein Surface Coatings Market?

To stay informed about further developments, trends, and reports in the Cell Culture Protein Surface Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence