Key Insights

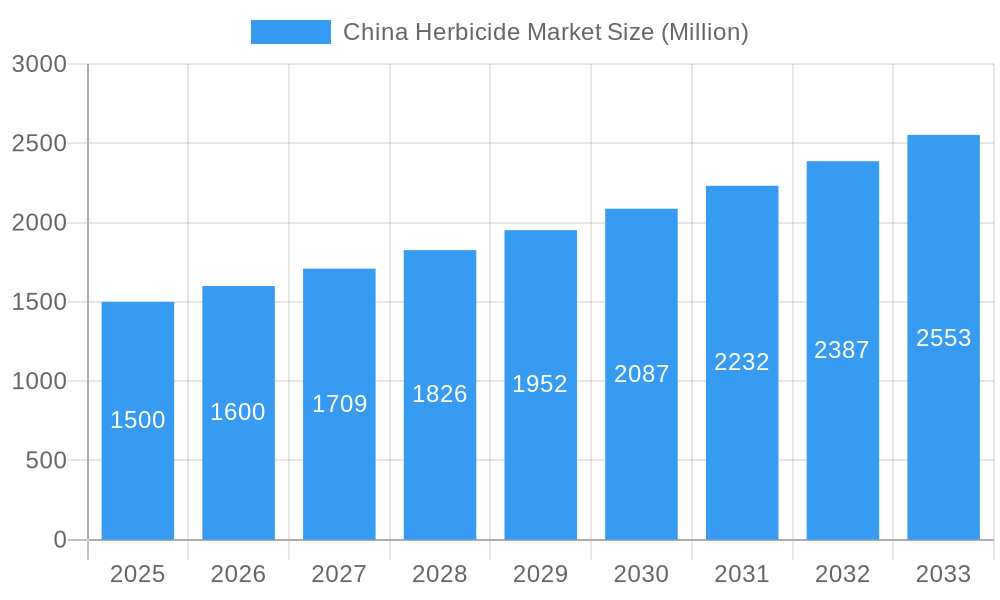

The China herbicide market, estimated at 2.12 billion in 2025, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.82% between 2025 and 2033. This significant expansion is attributed to the rising intensity of Chinese agriculture, demanding efficient weed management for optimal crop yields. The increasing adoption of precision application techniques, such as chemigation and foliar spraying, further fuels market growth. Demand is also boosted by the expanding cultivation of commercial crops, fruits, vegetables, grains, and cereals. The market is segmented by application mode (chemigation, foliar, fumigation, soil treatment) and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), addressing diverse agricultural needs. Key industry players including Rainbow Agro, Nutrichem Co Ltd, Bayer AG, and UPL Limited are driving innovation and competition with a comprehensive range of herbicide solutions.

China Herbicide Market Market Size (In Billion)

Despite growth prospects, the market confronts challenges from increasingly stringent environmental regulations on herbicide use. Fluctuations in raw material prices and the growing concern over herbicide resistance in weeds also present obstacles for manufacturers and farmers. Nonetheless, the outlook for the China herbicide market remains positive, driven by the critical need for enhanced food production and agricultural efficiency. Opportunities for sustained growth lie in the adoption of sustainable and integrated pest management practices, coupled with advancements in herbicide formulation and application technology. Manufacturers are expected to prioritize the development of environmentally conscious and highly effective herbicides to align with market demands and evolving regulatory landscapes.

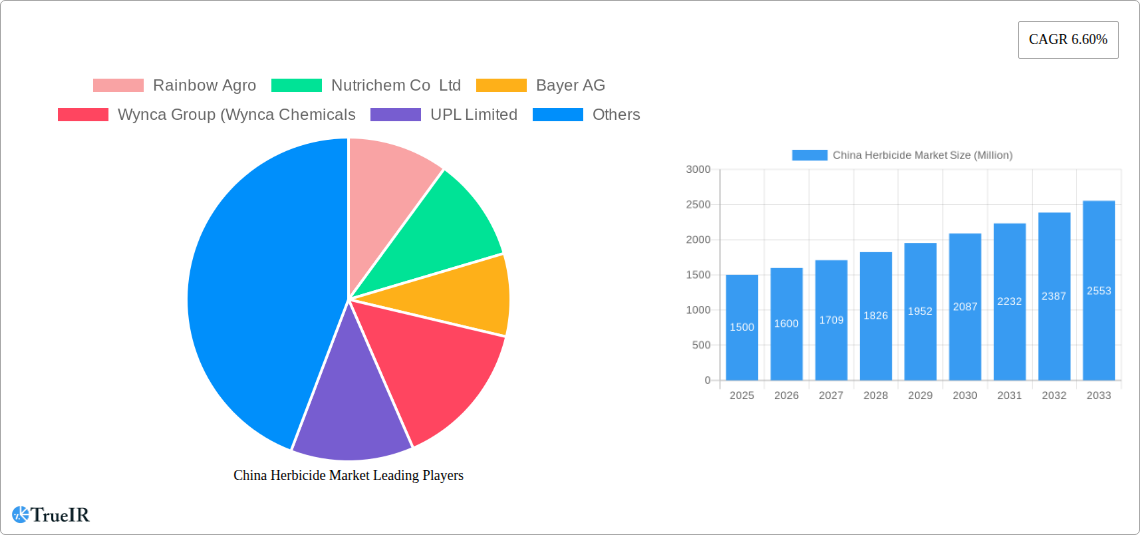

China Herbicide Market Company Market Share

China Herbicide Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the China herbicide market, offering invaluable insights for stakeholders across the agricultural and chemical industries. With a detailed examination of market trends, competitive dynamics, and future projections, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by application mode (chemigation, foliar, fumigation, soil treatment) and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental). Key players analyzed include Rainbow Agro, Nutrichem Co Ltd, Bayer AG, Wynca Group (Wynca Chemicals), UPL Limited, Lianyungang Liben Crop Technology Co Ltd, BASF SE, FMC Corporation, Jiangsu Yangnong Chemical Co Ltd, and Corteva Agriscience. The report projects a market value of xx Million by 2033, representing a CAGR of xx%.

China Herbicide Market Market Structure & Competitive Landscape

The China herbicide market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share in 2024. Market concentration is influenced by factors such as economies of scale, technological advancements, and access to distribution networks. Innovation is a key driver, with companies investing heavily in R&D to develop more effective, eco-friendly, and targeted herbicides. Stringent regulatory frameworks, including those related to environmental protection and human health, significantly impact market dynamics. The availability of bio-herbicides and other sustainable alternatives acts as a substitute, gradually influencing market preferences. End-user segmentation is primarily driven by crop type and farming practices, with significant demand from the grains & cereals and fruits & vegetables sectors. Mergers and acquisitions (M&A) activity has been relatively moderate, with a total M&A volume of approximately xx Million in the last five years, reflecting strategic alliances and expansion strategies among key players.

China Herbicide Market Market Trends & Opportunities

The China herbicide market is experiencing robust growth, driven by factors such as increasing agricultural production, rising demand for high-yield crops, and adoption of modern farming techniques. The market size expanded from xx Million in 2019 to xx Million in 2024. This growth trajectory is expected to continue, with a projected market size of xx Million by 2033, indicating a significant market expansion opportunity. Technological shifts towards precision agriculture, including the use of drones and GPS-guided application systems, are increasing efficiency and reducing herbicide usage. Changing consumer preferences towards organically grown produce are also influencing market trends, leading to a growing demand for bio-herbicides and integrated pest management strategies. The competitive landscape is characterized by intense rivalry among multinational and domestic players, fostering innovation and driving prices downwards. Market penetration rate for technologically advanced herbicides remains relatively low, indicating a significant scope for future growth.

Dominant Markets & Segments in China Herbicide Market

Leading Application Mode: Foliar application currently dominates the market, accounting for approximately xx% of the total market share in 2024. This is attributed to its ease of application, cost-effectiveness, and broad applicability across various crop types.

Leading Crop Type: The grains & cereals segment accounts for the largest market share, driven by the extensive cultivation of rice, wheat, and corn in China. The high demand for these crops necessitates large-scale herbicide usage.

Key Growth Drivers:

- Increasing government support for agricultural modernization and sustainable farming practices.

- Expanding acreage under cultivation for high-value crops.

- Rising awareness among farmers regarding the benefits of integrated pest management (IPM).

The dominance of these segments is expected to persist throughout the forecast period, although the relative shares may shift slightly due to government initiatives promoting diversification of crops and sustainable farming methods.

China Herbicide Market Product Analysis

The Chinese herbicide market showcases a diverse range of products, including pre-emergent, post-emergent, and systemic herbicides. Technological advancements have led to the development of more targeted herbicides with improved efficacy and reduced environmental impact. This includes the introduction of herbicides with enhanced selectivity and reduced drift potential. The market is witnessing a shift towards the adoption of bio-herbicides and other eco-friendly alternatives, driven by stricter environmental regulations and growing consumer demand for sustainable agriculture practices. The competitive advantage lies in developing and marketing herbicides with superior efficacy, ease of use, and environmental sustainability.

Key Drivers, Barriers & Challenges in China Herbicide Market

Key Drivers: Technological advancements in herbicide formulation and application methods, increasing adoption of precision agriculture, and government policies promoting agricultural intensification contribute to market growth. Government subsidies and incentives encourage farmers to adopt new technologies.

Key Challenges: Stringent regulatory approvals and environmental concerns related to herbicide usage pose significant barriers. Supply chain disruptions due to geopolitical factors and the volatile pricing of raw materials also impact market stability. Competition among numerous domestic and multinational players creates price pressure and necessitates ongoing innovation. These challenges, if not effectively addressed, could impede the market’s growth trajectory. The cost of herbicide application, especially in remote areas, presents another challenge.

Growth Drivers in the China Herbicide Market Market

Several factors fuel the expansion of China's herbicide market: The rising demand for food crops, coupled with limited arable land, necessitates efficient weed control. Government initiatives focusing on agricultural modernization and enhanced productivity encourage herbicide use. Technological innovations—including the development of more effective and eco-friendly herbicides—drive adoption. The increasing awareness among farmers of integrated pest management (IPM) strategies which often include herbicides plays a key role.

Challenges Impacting China Herbicide Market Growth

Environmental regulations and concerns regarding herbicide residues in food products present significant challenges. The fluctuating prices of raw materials and potential supply chain disruptions affect production costs and profitability. Competition from both established multinational corporations and smaller domestic producers intensifies market rivalry, impacting pricing strategies. Finally, the need for continuous innovation to meet evolving farmer needs and environmental standards presents an ongoing challenge.

Key Players Shaping the China Herbicide Market Market

- Rainbow Agro

- Nutrichem Co Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- UPL Limited

- Lianyungang Liben Crop Technology Co Ltd

- BASF SE

- FMC Corporation

- Jiangsu Yangnong Chemical Co Ltd

- Corteva Agriscience

Significant China Herbicide Market Industry Milestones

- January 2023: Bayer partnered with Oerth Bio to develop eco-friendly crop protection solutions, signaling a shift towards sustainability.

- August 2022: BASF and Corteva Agriscience collaborated on advanced soybean weed control, highlighting the trend of strategic alliances for innovation.

- January 2022: Rainbow Agro opened a new R&D center in Ningxia, demonstrating commitment to developing new pesticides and expanding its technological capabilities.

Future Outlook for China Herbicide Market Market

The China herbicide market is poised for continued growth, driven by increasing agricultural production, technological advancements, and supportive government policies. Strategic opportunities exist for companies focusing on sustainable and environmentally friendly solutions, as well as those offering precision agriculture technologies. The market’s potential is significant, with substantial opportunities for expansion and innovation across various crop types and application modes. The increasing demand for high-yield and high-quality crops will continue to drive market growth in the coming years.

China Herbicide Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

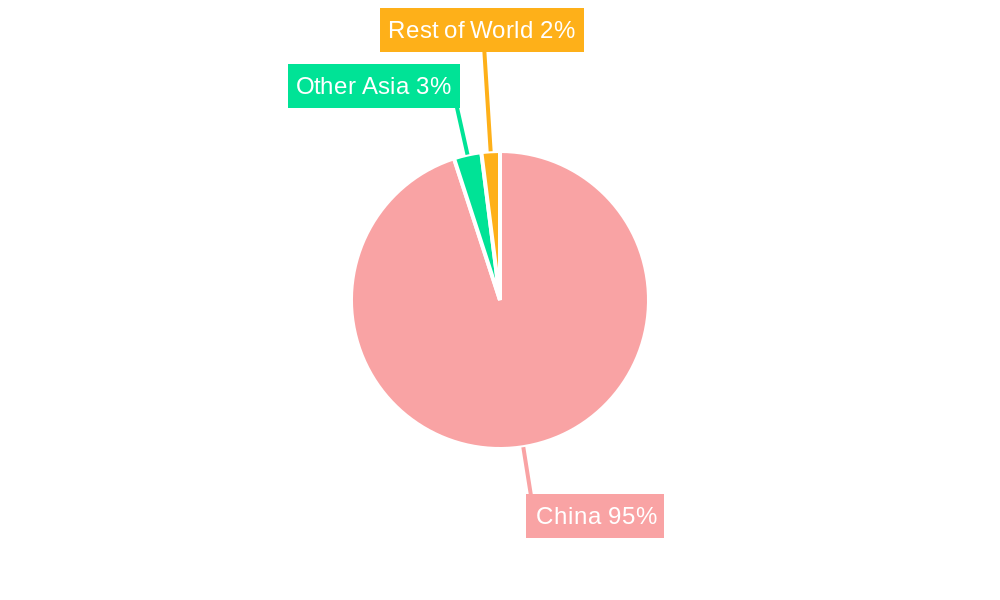

China Herbicide Market Segmentation By Geography

- 1. China

China Herbicide Market Regional Market Share

Geographic Coverage of China Herbicide Market

China Herbicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. The market is driven by the need for effective control of herbicides

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Herbicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rainbow Agro

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nutrichem Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wynca Group (Wynca Chemicals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lianyungang Liben Crop Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FMC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jiangsu Yangnong Chemical Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rainbow Agro

List of Figures

- Figure 1: China Herbicide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Herbicide Market Share (%) by Company 2025

List of Tables

- Table 1: China Herbicide Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Herbicide Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Herbicide Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Herbicide Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Herbicide Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Herbicide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: China Herbicide Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: China Herbicide Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Herbicide Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Herbicide Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Herbicide Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Herbicide Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Herbicide Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the China Herbicide Market?

Key companies in the market include Rainbow Agro, Nutrichem Co Ltd, Bayer AG, Wynca Group (Wynca Chemicals, UPL Limited, Lianyungang Liben Crop Technology Co Ltd, BASF SE, FMC Corporation, Jiangsu Yangnong Chemical Co Ltd, Corteva Agriscience.

3. What are the main segments of the China Herbicide Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

The market is driven by the need for effective control of herbicides.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.January 2022: In the Chinese region of Ningxia, Rainbow opened a new R&D Center, which has strengthened its R&D capabilities to develop new pesticides.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Herbicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Herbicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Herbicide Market?

To stay informed about further developments, trends, and reports in the China Herbicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence