Key Insights

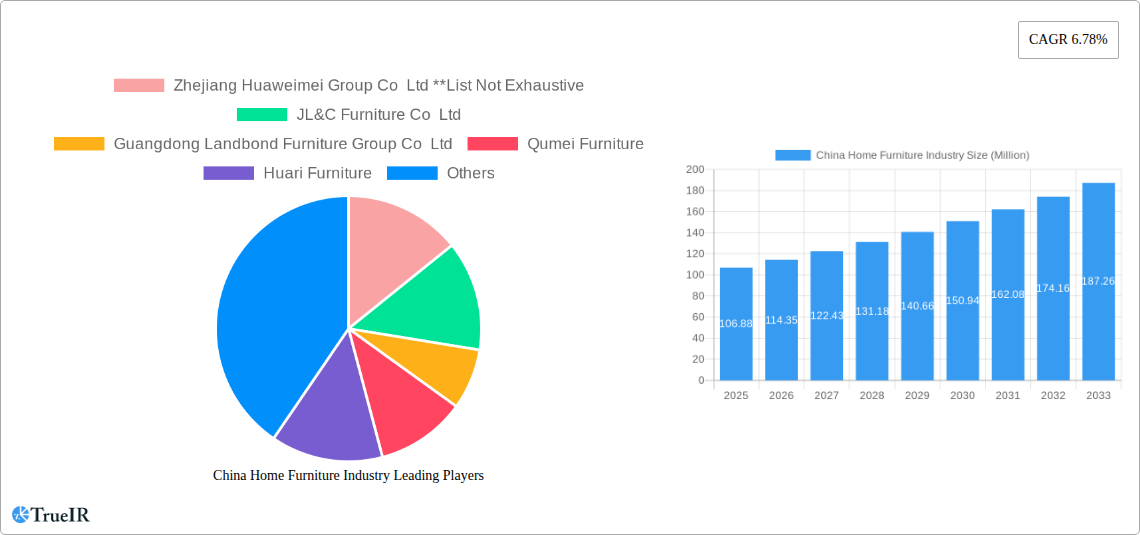

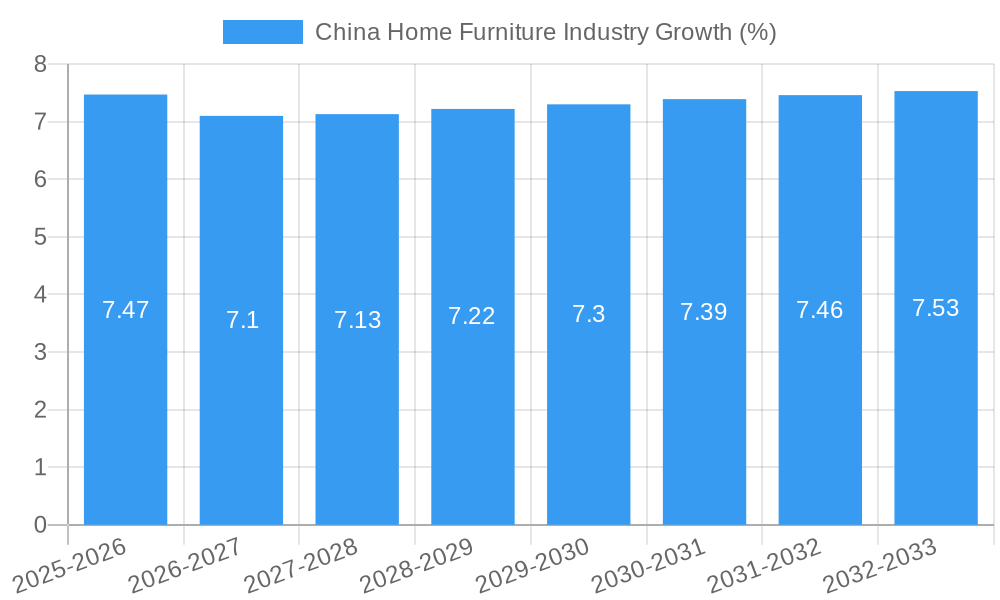

The China home furniture market, valued at $106.88 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.78% from 2025 to 2033. This growth is fueled by several key drivers. Rising disposable incomes among China's burgeoning middle class are driving increased demand for higher-quality, stylish furniture. Urbanization continues to fuel housing construction, creating a consistent need for new furniture. Furthermore, evolving consumer preferences towards modern and minimalist designs, alongside the increasing adoption of online retail channels, are significantly shaping the market landscape. The market is segmented by product type (living room, bedroom, kitchen, lighting, and other furniture) and distribution channels (supermarkets/hypermarkets, specialty stores, and online retail stores), each exhibiting unique growth trajectories. While the dominance of established players like IKEA and local giants like Zhejiang Huaweimei Group and Qumei Furniture is undeniable, the market also accommodates smaller, specialized brands catering to niche preferences. Competition is fierce, emphasizing the need for innovative designs, competitive pricing, and strong supply chain management. Potential restraints include fluctuating raw material costs and government regulations concerning environmental sustainability and manufacturing processes. However, the overall outlook for the China home furniture market remains positive, with significant growth opportunities for both established players and new entrants in the coming years.

The significant growth trajectory is likely driven by the ongoing expansion of China's middle class, increasing disposable incomes, and a preference shift toward improving home aesthetics. The dominance of online retail, mirroring global trends, will likely accelerate this growth. However, challenges such as managing supply chain complexities, ensuring product quality, and responding to evolving consumer tastes, will necessitate strategic planning and adaptive business models for sustained success. Understanding regional variations in preferences and effectively utilizing digital marketing strategies to reach a vast consumer base will be critical for companies aiming to capture a larger market share. The continued expansion of e-commerce and the growth of smart home technology presents additional opportunities to integrate technology into furniture designs and purchasing processes.

China Home Furniture Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic China home furniture industry, projecting a market value exceeding XX Million by 2033. We analyze market structure, competitive dynamics, key trends, and future growth potential, offering invaluable insights for businesses and investors alike. The report covers the period 2019-2033, with a focus on the estimated year 2025.

China Home Furniture Industry Market Structure & Competitive Landscape

The China home furniture market is characterized by a complex interplay of established players and emerging businesses. Market concentration is moderately high, with a few large players holding significant market share. However, the presence of numerous smaller and medium-sized enterprises (SMEs) contributes to intense competition.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the industry in 2024 is estimated at xx, indicating a moderately concentrated market. This is influenced by factors including economies of scale, brand recognition, and access to distribution networks.

Innovation Drivers: Technological advancements such as 3D printing, smart home integration, and sustainable material utilization are driving innovation, enabling companies to create more efficient production processes and offer unique products to consumers.

Regulatory Impacts: Government regulations concerning environmental protection and product safety significantly influence manufacturing processes and product design. Compliance requirements can add costs but are crucial for sustaining market access.

Product Substitutes: The industry faces competition from substitute materials and products, including modular furniture systems and refurbished furniture. These alternatives cater to specific consumer needs and preferences.

End-User Segmentation: The market caters to diverse end-user segments, including residential consumers, commercial entities (hotels, offices), and institutional buyers. Each segment exhibits unique purchasing behavior and preferences.

M&A Trends: The sector has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx transactions recorded between 2019 and 2024. These deals aim to consolidate market share, enhance technological capabilities, and expand distribution networks. The total value of these transactions is estimated at approximately XX Million.

China Home Furniture Industry Market Trends & Opportunities

The China home furniture market is experiencing robust growth, driven by rising disposable incomes, urbanization, and evolving consumer preferences. The market size is expected to reach XX Million in 2025, growing at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is influenced by several factors:

- Rising Disposable Incomes: Increased purchasing power allows consumers to invest more in home furnishings.

- Urbanization: Rapid urbanization fuels the demand for new housing and home improvement, driving significant demand.

- Evolving Consumer Preferences: A shift toward modern aesthetics, ergonomic designs, and sustainable products is reshaping the market.

- Technological Advancements: Smart home technologies and customized furniture designs are enhancing the overall experience.

- E-commerce Expansion: Online retail channels offer convenient access to a broader selection of furniture.

- Government Initiatives: Policies supporting sustainable housing and improving living standards have a positive impact.

Market penetration rates for online retail channels are steadily increasing, with an estimated xx% of furniture sales now being conducted online. The competition is intense, with both domestic and international brands vying for market share. This creates several opportunities for innovation, product differentiation, and efficient supply chain management.

Dominant Markets & Segments in China Home Furniture Industry

The Guangdong province dominates the China home furniture market due to its well-established manufacturing infrastructure, skilled labor pool, and access to key distribution channels. Within the product segments, Living Room and Dining Room Furniture, followed by Bedroom Furniture, consistently exhibits the highest revenue generation. Online retail stores demonstrate the highest growth in distribution channels.

Key Growth Drivers:

- Robust Manufacturing Infrastructure: Guangdong's established manufacturing base and experienced workforce offer cost-effectiveness.

- Favorable Government Policies: Regional and national policies supporting industrial growth stimulate market expansion.

- Developed Distribution Network: Efficient transportation and logistics networks enable easy access to wider markets.

Market Dominance Analysis:

- Living Room and Dining Room Furniture: This segment commands a significant market share due to the inherent need for this furniture category in most homes.

- Bedroom Furniture: This segment also exhibits consistent demand, boosted by rising incomes and the focus on personalized comfort.

- Online Retail Stores: The rapid adoption of online shopping boosts this segment. Consumer convenience and broader product selection are primary drivers.

Other segments, including Kitchen Furniture, Lamps and Lighting Furniture, and Plastic and Other Furniture, exhibit steady growth, although at a comparatively slower pace than the leading segments.

China Home Furniture Industry Product Analysis

Technological advancements have led to innovative products characterized by smart features, personalized designs, and sustainable materials. Modular furniture, adaptable to changing lifestyles and space constraints, has seen significant growth. The use of eco-friendly materials appeals to environmentally conscious consumers. The integration of smart home technology, such as voice-controlled lighting and automated storage systems, offers enhanced functionality and convenience. The competitive advantage lies in efficient manufacturing, cost-effectiveness, unique designs, and strong branding.

Key Drivers, Barriers & Challenges in China Home Furniture Industry

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for higher quality and more stylish furniture.

- Urbanization and Housing Development: Growing urbanization generates a continuous need for new furniture.

- Government Support for Sustainable Housing: Policies encouraging sustainable practices drive innovation.

Challenges and Restraints:

- Supply Chain Disruptions: Global events can disrupt supply chains, affecting raw material availability and production.

- Intense Competition: The presence of many domestic and international players creates pressure on profit margins.

- Environmental Regulations: Stringent environmental regulations impose compliance costs on manufacturers. The impact of non-compliance can result in substantial fines, estimated at xx Million annually on average for major violations.

Growth Drivers in the China Home Furniture Industry Market

The primary growth drivers are similar to those described above in the "Key Drivers, Barriers & Challenges" section. The continued increase in disposable incomes, urbanization, and the ongoing development of sustainable housing initiatives will remain significant factors influencing the market's growth trajectory. Government policies supporting the development of smart cities and technological advancement will further contribute to market expansion.

Challenges Impacting China Home Furniture Industry Growth

The main challenges mirror those discussed previously, including persistent supply chain vulnerabilities, stiff competition from both domestic and international brands, and the financial burden of complying with stringent environmental regulations. These factors can significantly constrain market growth if not effectively addressed.

Key Players Shaping the China Home Furniture Industry Market

- Zhejiang Huaweimei Group Co Ltd

- JL&C Furniture Co Ltd

- Guangdong Landbond Furniture Group Co Ltd

- Qumei Furniture

- Huari Furniture

- IKEA

- Chengdu Sunhoo Industrial Co Ltd

- Kinwai Group

- Interi Furniture

- Red Apple Furniture

Significant China Home Furniture Industry Industry Milestones

- September 2023: IKEA announces a 6.3 billion yuan investment in enhancing its offerings and lowering prices on over 300 products.

- January 2024: Kuka Home launches its flagship store in India, marking its expansion into a new market.

Future Outlook for China Home Furniture Industry Market

The China home furniture market is poised for continued expansion, driven by rising incomes, urbanization, and evolving consumer preferences. Strategic opportunities exist for companies focusing on sustainable products, smart home integration, and personalized furniture solutions. The market's future success will depend on navigating supply chain challenges, adapting to evolving consumer demands, and effectively addressing environmental regulations. The market is projected to experience a steady rise, with increasing demand for higher quality, customized, and sustainably sourced furniture.

China Home Furniture Industry Segmentation

-

1. Product

- 1.1. Living Room and Dining Room Furniture

- 1.2. Bedroom Furniture

- 1.3. Kitchen Furniture

- 1.4. Lamps and Lighting Furniture

- 1.5. Plastic and Other Furniture

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

China Home Furniture Industry Segmentation By Geography

- 1. China

China Home Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Improved Ventilation in GCC Countries

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increase in Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Living Room and Dining Room Furniture

- 5.1.2. Bedroom Furniture

- 5.1.3. Kitchen Furniture

- 5.1.4. Lamps and Lighting Furniture

- 5.1.5. Plastic and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zhejiang Huaweimei Group Co Ltd **List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JL&C Furniture Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Guangdong Landbond Furniture Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qumei Furniture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huari Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chengdu Sunhoo Industrial Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kinwai Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Interi Furniture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Red Apple Furniture

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Huaweimei Group Co Ltd **List Not Exhaustive

List of Figures

- Figure 1: China Home Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Home Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: China Home Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: China Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Home Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 7: China Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: China Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Home Furniture Industry?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the China Home Furniture Industry?

Key companies in the market include Zhejiang Huaweimei Group Co Ltd **List Not Exhaustive, JL&C Furniture Co Ltd, Guangdong Landbond Furniture Group Co Ltd, Qumei Furniture, Huari Furniture, IKEA, Chengdu Sunhoo Industrial Co Ltd, Kinwai Group, Interi Furniture, Red Apple Furniture.

3. What are the main segments of the China Home Furniture Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 106.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Improved Ventilation in GCC Countries.

6. What are the notable trends driving market growth?

Increase in Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In September 2023, IKEA gears up to lower prices and invest 6.3 billion yuan (USD 0.88 billion) in enhancing professional home solutions, personalized services, and omni-channel ecological construction. Additionally, the brand reveals plans to slash prices on over 300 products and introduce installment payment services for Chinese consumers in fiscal year 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Home Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Home Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Home Furniture Industry?

To stay informed about further developments, trends, and reports in the China Home Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence