Key Insights

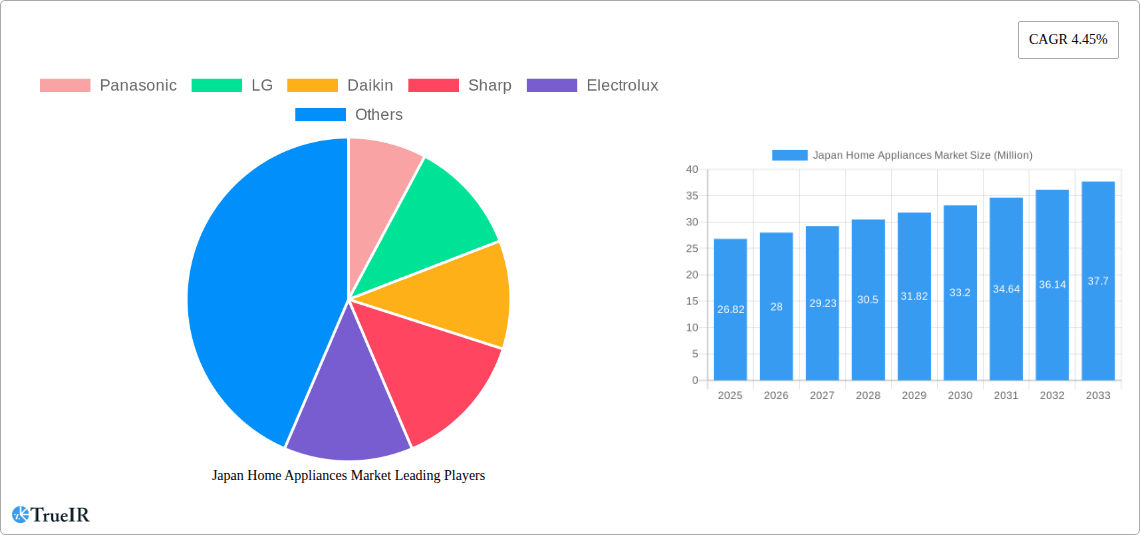

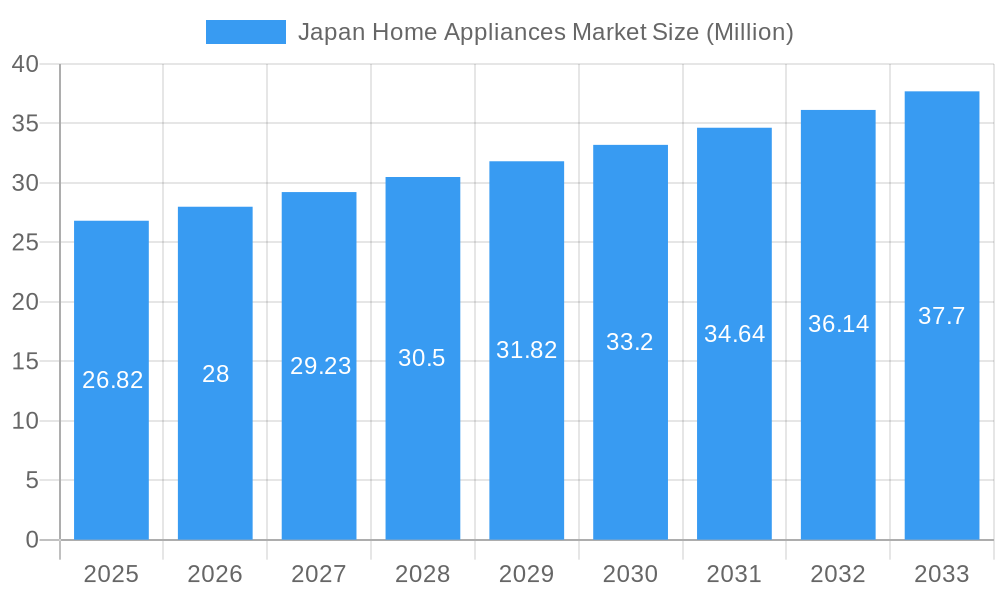

The Japan Home Appliances Market is poised for robust growth, projected to reach an estimated USD 26.82 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.45% anticipated to sustain this momentum through 2033. This expansion is fueled by several key drivers, including a growing demand for energy-efficient and smart home appliances, driven by increasing environmental consciousness and a desire for greater convenience. Technological advancements, such as IoT integration and AI-powered features, are transforming traditional appliances into connected devices, enhancing user experience and attracting a tech-savvy consumer base. Furthermore, an aging population in Japan, while presenting unique needs for accessible and user-friendly appliances, also contributes to sustained demand for essential home goods. The market is also benefiting from government initiatives promoting energy conservation and smart city development, which indirectly encourage the adoption of advanced home appliances.

Japan Home Appliances Market Market Size (In Million)

The market segmentation reveals a healthy balance between major and small appliances, with both categories expected to contribute significantly to overall growth. Within major appliances, refrigerators and air conditioners are likely to remain dominant segments, driven by replacement cycles and the need for advanced climate control solutions. Small appliances, particularly coffee makers and vacuum cleaners, are witnessing a surge in popularity due to changing lifestyle preferences and the increasing adoption of urban living. The distribution landscape is evolving, with online channels gaining substantial traction alongside traditional multi-brand and exclusive stores. This shift towards e-commerce is facilitated by convenient shopping experiences and wider product accessibility. Leading companies such as Panasonic, LG, Daikin, and Haier are actively innovating and expanding their product portfolios to cater to these evolving consumer demands and capitalize on the growth opportunities within the Japanese market.

Japan Home Appliances Market Company Market Share

Here's a comprehensive, SEO-optimized report description for the Japan Home Appliances Market:

Japan Home Appliances Market: Comprehensive Insights, Trends, and Future Projections (2019-2033)

Dive deep into the dynamic Japan home appliances market with this in-depth report. Covering the historical period from 2019-2024 and projecting growth through 2033, this analysis provides unparalleled insights into market structure, evolving trends, dominant segments, and key player strategies. Essential for manufacturers, suppliers, investors, and industry stakeholders seeking to understand the competitive landscape and capitalize on emerging opportunities in one of Asia's most sophisticated consumer markets. The report offers detailed segmentation across major and small appliances, distribution channels, and provides a forward-looking perspective on technological advancements and consumer preferences, crucial for strategic decision-making in this high-value sector.

Japan Home Appliances Market Market Structure & Competitive Landscape

The Japan home appliances market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Innovation is a key driver, fueled by a relentless pursuit of energy efficiency, smart home integration, and enhanced user experience. Regulatory impacts, particularly concerning environmental standards and product safety, play a crucial role in shaping product development and market entry strategies. The presence of readily available product substitutes, especially in the small appliances segment, necessitates continuous product differentiation and value addition. End-user segmentation reveals a strong demand for premium, technologically advanced products driven by a discerning Japanese consumer base. Mergers and acquisitions (M&A) are becoming increasingly strategic, aiming to consolidate market positions, acquire new technologies, and expand product portfolios. For instance, the acquisition of Integrated Systems and Controls by Daikin indicates a move towards integrated service offerings. The Japan Home Appliances Market is experiencing strategic consolidation. The overall M&A volume is projected to be in the range of $500 Million to $1 Billion within the forecast period, reflecting a growing trend of consolidation. Concentration ratios for the top 3 players are estimated to be around 45%, with the top 5 players holding approximately 65% of the market share.

Japan Home Appliances Market Market Trends & Opportunities

The Japan home appliances market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and a robust economy. The market size is projected to reach USD 85 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.8% from its 2025 estimated value. This growth is underpinned by increasing disposable incomes, a strong emphasis on domestic comfort and convenience, and the pervasive integration of smart technologies. Consumer preferences are shifting towards energy-efficient, eco-friendly, and connected appliances that offer seamless integration into the smart home ecosystem. The demand for premium, feature-rich products that enhance lifestyle and provide convenience is a significant trend. Technological shifts are leading to the development of advanced features such as AI-powered diagnostics, voice control integration, and sophisticated energy management systems. Opportunities abound in the development of innovative kitchen appliances, advanced air purification systems, and smart laundry solutions that cater to the specific needs of Japanese households, which often have space constraints and a high demand for hygiene. The market penetration rate for smart home-enabled appliances is projected to rise from 25% in 2025 to over 55% by 2033. The focus on sustainable living is also creating a burgeoning market for refurbished and eco-conscious appliances. The increasing elderly population presents an opportunity for user-friendly, accessible appliance designs. Furthermore, the re-emergence of interest in traditional cooking methods, albeit with modern conveniences, is creating niche markets for specialized appliances. The repair and maintenance services sector is also expected to witness significant growth, driven by the longevity of Japanese appliances and a consumer preference for repair over replacement. The strategic focus on developing energy-saving technologies in refrigerators and air conditioners will continue to be a major differentiator. The increasing adoption of induction cooktops and advanced oven technologies will also contribute to market expansion. The demand for specialized small appliances, such as high-performance coffee makers and advanced food processors, is also on the rise, reflecting a growing interest in gourmet experiences at home. The competitive dynamics are intense, with both global giants and established local players vying for market share through continuous innovation and strategic marketing. The report estimates a total market size of USD 62 Billion in the base year 2025, with significant growth projected over the forecast period.

Dominant Markets & Segments in Japan Home Appliances Market

Within the Japan home appliances market, Major Appliances consistently hold the largest market share, driven by essential household needs and higher purchase values. Among these, Air Conditioners represent a dominant segment, owing to Japan's distinct climate zones and the widespread need for both heating and cooling. The market for refrigerators also remains robust, with consumers prioritizing energy efficiency, advanced food preservation technologies, and sleek, modern designs. The penetration of dishwashing machines, while historically lower than in Western countries, is steadily increasing as consumer lifestyles evolve and demand for convenience grows. Washing machines, particularly those offering advanced fabric care and energy-saving features, continue to be a staple.

- Air Conditioners: Driven by technological advancements in inverter technology and smart climate control, as well as government initiatives promoting energy efficiency. The segment is expected to grow at a CAGR of 5.2% during the forecast period.

- Refrigerators: High demand for innovative storage solutions, energy efficiency, and smart connectivity. The market for premium models with advanced cooling systems is particularly strong.

- Washing Machines: Focus on space-saving designs, advanced washing programs, and eco-friendly operation.

- Small Appliances: While individually smaller in market value, this segment shows strong growth potential due to increasing consumer interest in culinary experiences and home convenience. Coffee or Tea Makers are experiencing a surge in demand, with consumers investing in high-quality, automated machines. Vacuum Cleaners, especially robotic and cordless models, are also gaining traction due to their convenience and efficiency.

The Online distribution channel is witnessing exponential growth, overtaking traditional retail in certain product categories. This trend is fueled by convenience, competitive pricing, and the availability of detailed product information and reviews. However, Multi-brand Stores and Exclusive Stores continue to play a vital role, offering personalized customer service, hands-on product experience, and expert advice, particularly for higher-value appliances. The synergy between online and offline channels, known as omnichannel retail, is becoming increasingly important for a holistic customer journey. The estimated market size for the online distribution channel is projected to reach USD 20 Billion by 2033.

Japan Home Appliances Market Product Analysis

Product innovation in the Japan home appliances market is largely centered on enhancing energy efficiency, smart connectivity, and user-centric design. Manufacturers are investing heavily in R&D to develop appliances that not only perform optimally but also integrate seamlessly into the evolving smart home ecosystem. Features like AI-driven diagnostics, voice command capabilities, and advanced sensor technologies are becoming standard in premium offerings. Competitive advantages are being carved out through superior build quality, unique functionalities that address specific Japanese household needs (e.g., compact designs, advanced sterilization for humid climates), and a strong emphasis on after-sales service and support. The application of these innovations spans from sophisticated refrigerators with customizable temperature zones to intelligent washing machines with fabric-specific care programs and air purifiers with multi-stage filtration systems, all aimed at delivering enhanced convenience, health benefits, and sustainable living.

Key Drivers, Barriers & Challenges in Japan Home Appliances Market

Key Drivers: The Japan home appliances market is propelled by several key factors. Technological innovation, particularly in energy efficiency and smart home integration, is a primary driver. Growing consumer demand for convenience and comfort, coupled with rising disposable incomes, further fuels market expansion. Government initiatives promoting energy conservation and smart city development also provide a significant impetus. The aging population is also creating a demand for user-friendly, accessible appliance designs.

Key Barriers & Challenges: Despite the positive outlook, the market faces several challenges. Intense competition from both domestic and international players leads to price pressures and necessitates continuous product differentiation. Supply chain disruptions, particularly for imported components, can impact production and pricing. Stringent regulatory requirements for energy efficiency and product safety, while beneficial for consumers, can increase manufacturing costs and R&D investment. The high cost of advanced technologies can also be a barrier to widespread adoption in certain segments. For example, the estimated cost impact of stringent energy regulations on manufacturing can add 5-8% to production costs.

Growth Drivers in the Japan Home Appliances Market Market

Key growth drivers in the Japan home appliances market are manifold. Technologically, the relentless pursuit of energy efficiency and the integration of smart home capabilities are paramount. Consumers are increasingly seeking appliances that not only reduce their environmental footprint but also offer seamless connectivity and remote control via smartphones. Economically, rising disposable incomes and a strong consumer confidence in the Japanese economy translate into a higher propensity to invest in premium and technologically advanced home appliances. Regulatory factors, such as government incentives for energy-efficient product purchases and the push for smart city infrastructure, also act as significant growth catalysts. The increasing adoption of these drivers is estimated to contribute to a 6% increase in market revenue for smart appliances by 2027.

Challenges Impacting Japan Home Appliances Market Growth

Several challenges impact the growth trajectory of the Japan home appliances market. Supply chain complexities remain a persistent concern, with potential disruptions affecting the availability and cost of critical components. Intense competitive pressures necessitate continuous innovation and aggressive pricing strategies, which can squeeze profit margins. Regulatory hurdles, while aimed at ensuring safety and environmental standards, can also add to the cost of product development and compliance. Furthermore, economic uncertainties, though less pronounced in Japan compared to some other markets, can still influence consumer spending patterns on discretionary items like high-end appliances. The estimated cost impact of supply chain disruptions can lead to a 3-5% increase in product prices.

Key Players Shaping the Japan Home Appliances Market Market

- Panasonic

- LG

- Daikin

- Sharp

- Electrolux

- Haier

- Bosch

- Toshiba

- Midea group

- Hitachi

Significant Japan Home Appliances Market Industry Milestones

- July 2023: AirReps, a Daikin Comfort Technologies North America, Inc. subsidiary, purchased the business and personnel of Integrated Systems and Controls, LLC (Integrated) and InControl. Both companies are operating long and are presently based in the Seattle metropolitan area. Integrated Systems is well-known nationwide for providing OEM warranty support and setup assistance. They deal with some of the trickiest locations and circumstances when it comes to sophisticated machinery and applications. This acquisition signals Daikin's strategic expansion into integrated service and support, enhancing their value proposition in the North American market and potentially influencing service models globally.

- April 2022: The Italian manufacturer of hydraulic equipment Duplomatic MS S.p.A. was purchased by Daikin Industries, Ltd. USD 239 million was the acquisition price. This move diversifies Daikin's portfolio beyond HVAC and demonstrates a strategic intent to broaden its industrial and technological capabilities, potentially leading to innovations in connected appliance systems and manufacturing processes.

Future Outlook for Japan Home Appliances Market Market

The future outlook for the Japan home appliances market is exceptionally bright, driven by sustained innovation and evolving consumer demands. Growth catalysts include the increasing adoption of AI and IoT technologies for enhanced functionality and convenience, a growing emphasis on sustainability and energy efficiency, and the continued expansion of the online retail channel. Strategic opportunities lie in developing hyper-personalized appliance experiences, catering to the growing single-person households, and further integrating appliances into comprehensive smart home ecosystems. The market is projected to witness a steady increase in the adoption of premium and specialized appliances, reflecting a consumer base that values quality, performance, and cutting-edge technology, with an estimated market growth of USD 23 Billion over the forecast period.

Japan Home Appliances Market Segmentation

-

1. Major Appliances

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Ovens

- 1.6. Air Conditioners

- 1.7. Other Major Appliances

-

2. Small Appliances

- 2.1. Coffee or Tea Makers

- 2.2. Food Processors

- 2.3. Grills & Roasters

- 2.4. Vacuum Cleaners

- 2.5. Other Small Appliances

-

3. Distribution Channel

- 3.1. Multi-brand Stores

- 3.2. Exclusive Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Japan Home Appliances Market Segmentation By Geography

- 1. Japan

Japan Home Appliances Market Regional Market Share

Geographic Coverage of Japan Home Appliances Market

Japan Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Online Retail and E-Commerce Platforms

- 3.3. Market Restrains

- 3.3.1. The Risk of Fire and Electrical Short-Circuit in Electrical Appliances; High Power Consumption by Major Household Appliances

- 3.4. Market Trends

- 3.4.1. Smart Home Appliances is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Major Appliances

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Other Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Small Appliances

- 5.2.1. Coffee or Tea Makers

- 5.2.2. Food Processors

- 5.2.3. Grills & Roasters

- 5.2.4. Vacuum Cleaners

- 5.2.5. Other Small Appliances

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-brand Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Major Appliances

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sharp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Japan Home Appliances Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Home Appliances Market Revenue Million Forecast, by Major Appliances 2020 & 2033

- Table 2: Japan Home Appliances Market Volume K Unit Forecast, by Major Appliances 2020 & 2033

- Table 3: Japan Home Appliances Market Revenue Million Forecast, by Small Appliances 2020 & 2033

- Table 4: Japan Home Appliances Market Volume K Unit Forecast, by Small Appliances 2020 & 2033

- Table 5: Japan Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Japan Home Appliances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Japan Home Appliances Market Revenue Million Forecast, by Major Appliances 2020 & 2033

- Table 10: Japan Home Appliances Market Volume K Unit Forecast, by Major Appliances 2020 & 2033

- Table 11: Japan Home Appliances Market Revenue Million Forecast, by Small Appliances 2020 & 2033

- Table 12: Japan Home Appliances Market Volume K Unit Forecast, by Small Appliances 2020 & 2033

- Table 13: Japan Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Japan Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Japan Home Appliances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Home Appliances Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Japan Home Appliances Market?

Key companies in the market include Panasonic, LG, Daikin, Sharp, Electrolux, Haier, Bosch, Toshiba, Midea group, Hitachi.

3. What are the main segments of the Japan Home Appliances Market?

The market segments include Major Appliances, Small Appliances, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.82 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Online Retail and E-Commerce Platforms.

6. What are the notable trends driving market growth?

Smart Home Appliances is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

The Risk of Fire and Electrical Short-Circuit in Electrical Appliances; High Power Consumption by Major Household Appliances.

8. Can you provide examples of recent developments in the market?

July 2023: AirReps, a Daikin Comfort Technologies North America, Inc. subsidiary, purchased the business and personnel of Integrated Systems and Controls, LLC (Integrated) and InControl. Both companies are operating long and are presently based in the Seattle metropolitan area. Integrated Systems is well-known nationwide for providing OEM warranty support and setup assistance. They deal with some of the trickiest locations and circumstances when it comes to sophisticated machinery and applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Home Appliances Market?

To stay informed about further developments, trends, and reports in the Japan Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence