Key Insights

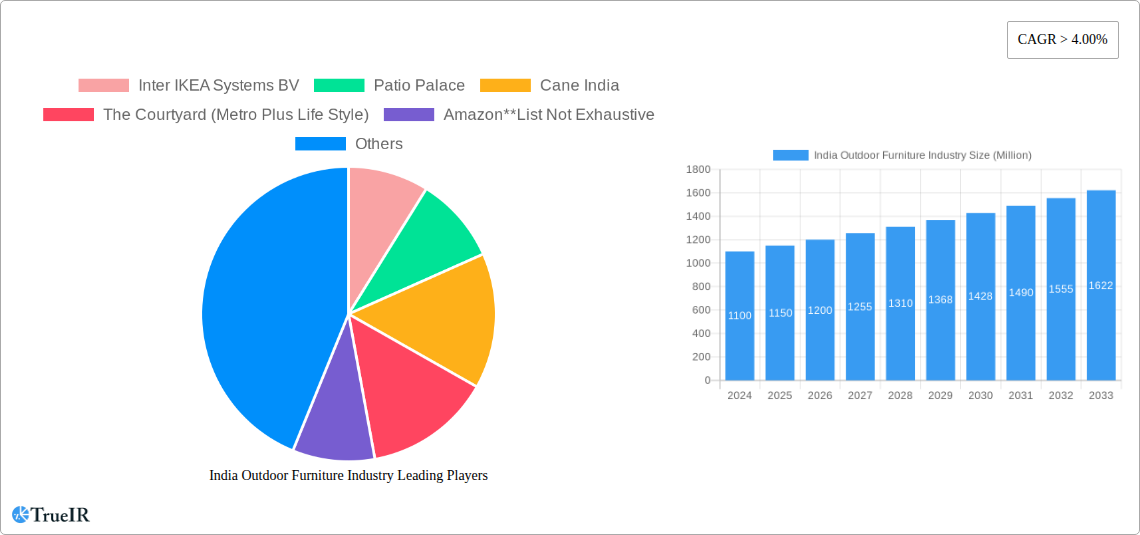

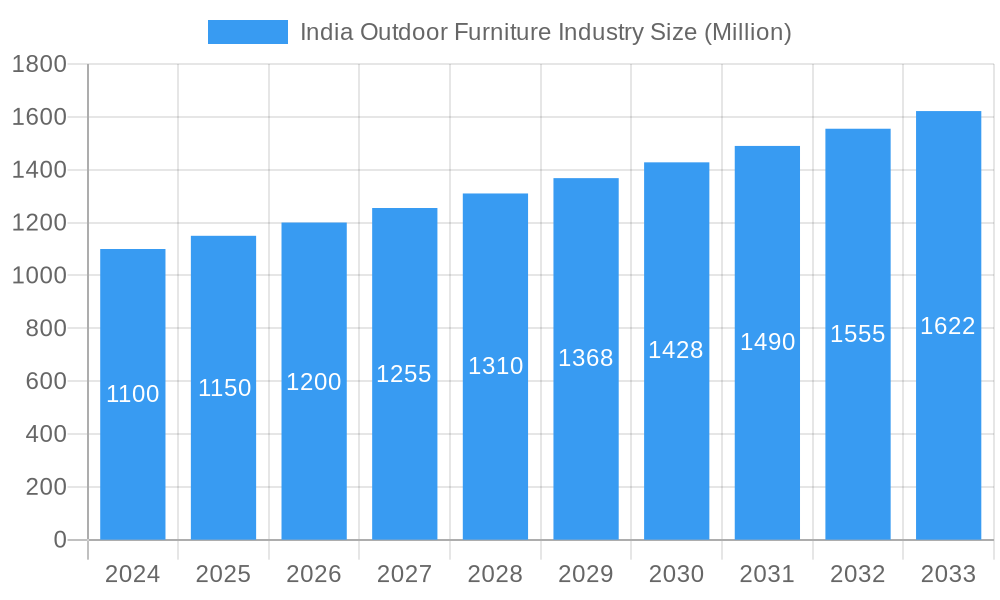

The India Outdoor Furniture Industry is poised for robust growth, projected to exceed ₹XX Crores (approximately $XXX Million, assuming a USD to INR conversion rate of 83) by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00%. This expansion is primarily driven by escalating urbanization, a growing disposable income among Indian households, and a heightened awareness of lifestyle enhancements, particularly post-pandemic. The residential sector is a significant contributor, fueled by the trend of creating comfortable and aesthetically pleasing outdoor living spaces, including balconies, patios, and gardens. Increasing demand for durable, weather-resistant, and aesthetically appealing furniture across both urban and semi-urban areas is also a key factor. Furthermore, the hospitality sector's recovery and expansion, with a focus on enhancing guest experiences through attractive outdoor seating and dining areas, will continue to bolster market performance. Government initiatives promoting tourism and infrastructure development indirectly contribute to the demand for outdoor furniture in public spaces, resorts, and hotels.

India Outdoor Furniture Industry Market Size (In Billion)

The market segmentation reveals a diverse landscape with significant opportunities across various product categories and materials. Wood and metal remain dominant materials due to their durability and aesthetic appeal, while plastic furniture offers a more budget-friendly alternative. Within product segments, chairs and tables are expected to lead the market, followed by seating sets and loungers, catering to the evolving consumer preference for creating relaxed outdoor environments. The increasing adoption of online retail channels is a notable trend, offering convenience and wider product selection for consumers, alongside traditional offline channels like specialty stores and hypermarkets. The organized sector is expected to gain market share due to its ability to offer standardized quality, better designs, and stronger branding, though the unorganized sector will continue to cater to specific niche demands and price-sensitive segments. Leading companies are focusing on product innovation, sustainable sourcing, and expanding their distribution networks to capture a larger share of this dynamic market.

India Outdoor Furniture Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the India Outdoor Furniture Industry, designed for maximum clarity and engagement without placeholders.

This comprehensive report provides an in-depth analysis of the India Outdoor Furniture Industry, encompassing market size, growth drivers, trends, and a detailed competitive landscape. Leveraging high-volume keywords such as "outdoor furniture India," "India patio furniture market," "garden furniture India," and "luxury outdoor furniture India," this report is designed to equip stakeholders with actionable insights. Our Study Period spans from 2019 to 2033, with a Base Year and Estimated Year of 2025, and a robust Forecast Period of 2025–2033, building upon the Historical Period of 2019–2024. Gain a strategic advantage in this rapidly evolving market, valued at an estimated USD 2.5 Billion in 2025, with projections to reach USD 7.0 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 13.8%.

India Outdoor Furniture Industry Market Structure & Competitive Landscape

The India Outdoor Furniture Industry is characterized by a moderate to high market concentration, with a growing influence of organized players. Innovation drivers include the increasing demand for aesthetically pleasing and durable furniture, driven by a rising disposable income and a greater appreciation for outdoor living spaces. Regulatory impacts are primarily related to import duties and material sourcing standards, which can influence pricing and availability. Product substitutes, while present in the form of makeshift solutions, are increasingly being outcompeted by specialized outdoor furniture designed for weather resistance and comfort. End-user segmentation reveals a significant shift towards residential consumers seeking to enhance their balconies, gardens, and patios. Merger and acquisition (M&A) trends are expected to accelerate as larger players aim to consolidate market share and expand their product portfolios. The market is projected to see 5-8 significant M&A activities within the forecast period, primarily focused on acquiring smaller, niche manufacturers and distribution networks. Key competitive advantages lie in product design, material quality, brand reputation, and efficient supply chain management.

India Outdoor Furniture Industry Market Trends & Opportunities

The India Outdoor Furniture Industry is experiencing robust growth, driven by a confluence of economic, social, and technological factors. The market size, estimated at USD 2.5 Billion in 2025, is poised for significant expansion, projected to reach USD 7.0 Billion by 2033 with a healthy CAGR of 13.8%. This growth is fueled by an increasing urban population seeking to maximize their limited living spaces, leading to a surge in demand for functional and stylish outdoor furniture for balconies, terraces, and small gardens. Technological shifts are playing a crucial role, with advancements in material science leading to more weather-resistant, durable, and sustainable outdoor furniture options, such as UV-resistant plastics, treated hardwoods, and innovative metal alloys. The rise of e-commerce has further democratized access to a wider range of products and price points, expanding market reach and consumer choices. Consumer preferences are evolving rapidly, with a growing emphasis on comfort, modularity, and eco-friendly materials. There's a discernible shift from basic utility to design-led pieces that enhance the overall aesthetic of outdoor spaces. The competitive dynamics are intensifying, with both established players and emerging brands vying for market share. Opportunities abound in the segments of sustainable furniture, smart outdoor solutions (e.g., integrated lighting or charging ports), and customizable furniture tailored to specific spatial requirements. The increasing disposable income and aspiration for a premium lifestyle are creating a lucrative market for high-end and luxury outdoor furniture. The "work from home" trend has also contributed to the demand for comfortable and functional outdoor spaces that can double as personal retreats or workspaces.

Dominant Markets & Segments in India Outdoor Furniture Industry

The Residential end-user segment is the dominant force in the India Outdoor Furniture Industry, accounting for an estimated 65% of the market share. This dominance is driven by the burgeoning middle class and a growing aspiration for enhancing home aesthetics and comfort. The Online distribution channel is rapidly gaining traction, projected to capture 35% of the market by 2033, offering unparalleled convenience and product variety. Within product categories, Seating sets, including sofas, chairs, and benches, represent the largest segment, estimated at 30% of the market value, reflecting their central role in creating inviting outdoor living areas. The Wood material segment continues to hold a significant share, estimated at 40%, owing to its natural appeal and aesthetic versatility, though it faces competition from more weather-resistant alternatives.

Dominant End-User: Residential

- Growth Drivers: Increasing urbanization, rising disposable incomes, desire for enhanced home aesthetics, growing popularity of balconies and patios as extensions of living space.

- Market Insight: Consumers are investing in outdoor furniture to create functional and comfortable relaxation, entertainment, and even workspace areas within their homes.

Emerging Distribution Channel: Online

- Growth Drivers: Convenience of shopping from home, wider product selection, competitive pricing, advancements in last-mile delivery logistics, increased digital penetration.

- Market Insight: Online platforms are transforming how consumers purchase outdoor furniture, offering accessibility to a national market and a diverse range of brands and styles.

Dominant Product Category: Seating Sets

- Growth Drivers: Versatility for social gatherings and relaxation, wide range of design options, modularity catering to various space constraints.

- Market Insight: Seating sets are the cornerstone of outdoor living, enabling users to create cohesive and functional outdoor living rooms.

Significant Material Segment: Wood

- Growth Drivers: Traditional appeal, aesthetic warmth, wide availability of treated and sustainable wood options.

- Market Insight: While requiring more maintenance, wood remains a popular choice for its natural beauty and premium feel, especially for consumers prioritizing aesthetics.

Market Type: Organised

- Growth Drivers: Better quality control, wider product range, professional marketing, and customer service, increasing consumer trust.

- Market Insight: Organized players are gaining market share due to their ability to offer consistent quality and a more curated shopping experience, often leveraging online and offline integration.

India Outdoor Furniture Industry Product Analysis

Product innovation in the India Outdoor Furniture Industry is increasingly focused on durability, comfort, and aesthetic appeal. Advances in material science have led to the development of weather-resistant treatments for wood, high-performance synthetic weaves, and robust metal alloys that withstand India's diverse climatic conditions. Modular designs that allow for flexible configurations are gaining traction, catering to varying space constraints and user needs. Furthermore, there is a growing emphasis on sustainable and eco-friendly materials. Smart furniture, incorporating features like integrated lighting or charging ports, represents an emerging frontier. These innovations address the evolving consumer demand for furniture that is not only functional and stylish but also resilient and environmentally conscious, enhancing the overall outdoor living experience.

Key Drivers, Barriers & Challenges in India Outdoor Furniture Industry

Key Drivers: The India Outdoor Furniture Industry is propelled by several key drivers. Technologically, advancements in material durability and weather resistance are making outdoor furniture more practical for diverse climates. Economically, rising disposable incomes and a growing middle class are fueling demand for lifestyle enhancements like well-appointed outdoor spaces. Government policies promoting urban development and green spaces also contribute positively. For instance, initiatives encouraging the development of residential complexes with dedicated outdoor areas indirectly boost furniture sales.

Barriers & Challenges: Despite growth, the industry faces significant challenges. Supply chain issues, including logistical complexities and raw material sourcing, can lead to increased costs and delivery delays, impacting an estimated 5-10% of potential sales. Regulatory hurdles, such as import duties on certain materials or finished goods, can affect pricing and competitiveness. Competitive pressures, particularly from unorganized sectors offering lower-priced alternatives, remain a constant concern. Furthermore, consumer awareness regarding the benefits of specialized outdoor furniture over general-purpose indoor furniture needs continuous nurturing, representing a potential 8-12% market penetration gap.

Growth Drivers in the India Outdoor Furniture Industry Market

The growth of the India Outdoor Furniture Industry is significantly influenced by several key factors. Technological advancements in material science, such as UV-resistant coatings and corrosion-proof metals, are enhancing product longevity and appeal. Economically, rising disposable incomes and an expanding middle-class population are increasing consumer spending on home improvement and lifestyle products, including outdoor furniture. Government initiatives promoting urbanization and the development of residential spaces with balconies and gardens are creating new demand. The increasing popularity of outdoor living, influenced by global trends and a desire for more connected living spaces, acts as a powerful catalyst. For example, the emphasis on wellness and mental health is driving people to create comfortable and inviting outdoor retreats.

Challenges Impacting India Outdoor Furniture Industry Growth

Several challenges are impacting the growth trajectory of the India Outdoor Furniture Industry. Supply chain vulnerabilities, including inconsistent raw material availability and complex logistics across a vast country, can lead to production delays and increased operational costs, potentially affecting 5-8% of planned inventory. Regulatory complexities, such as varied state-level taxes and import duties on specific materials, can create price discrepancies and hinder market expansion. Intense competitive pressures, particularly from unorganized players offering lower price points, necessitate a continuous focus on value proposition and differentiation, impacting profit margins by an estimated 3-5%. Furthermore, a lack of widespread consumer education on the specific benefits of durable, weather-resistant outdoor furniture compared to general-purpose items represents an ongoing hurdle for market penetration.

Key Players Shaping the India Outdoor Furniture Industry Market

- Inter IKEA Systems BV

- Patio Palace

- Cane India

- The Courtyard (Metro Plus Life Style)

- Amazon

- Outdoor India

- Pepperfry

- Urban Ladder

- Wicker Delite

- KERNIG KRAFTS

Significant India Outdoor Furniture Industry Industry Milestones

- Nov 2022: Online Indian furniture brand Pepperfry cooperated with FarEye to improve order visibility and reduce delays throughout the last-mile delivery process, enhancing overall consumer happiness. E-commerce in India is anticipated to expand by 96% between 2021 and 2025, reaching a transaction value of USD 120 billion. Pepperfry's collaboration with FarEye aims to provide real-time visibility, eliminate delivery interruptions, and ensure timely package arrival.

- Nov 2022: IKEA India and electronic music artists Swedish House Mafia launched an exclusive collection, OBEGRNSAD, celebrating music, creativity, and home environments. This limited collection is designed to enable aspiring musicians and digital artists to establish ideal home studios at a fair cost.

Future Outlook for India Outdoor Furniture Industry Market

The future outlook for the India Outdoor Furniture Industry is highly promising, driven by sustained economic growth, increasing urbanization, and evolving consumer lifestyles. Strategic opportunities lie in the expansion of the mid-to-premium segments, focusing on durable, aesthetically pleasing, and sustainable furniture. The continued growth of e-commerce will unlock wider market access and provide platforms for brands to showcase innovative product lines. Investments in localized manufacturing and efficient supply chain networks will be crucial for cost competitiveness and timely delivery. The market is poised for significant expansion as consumers increasingly prioritize creating comfortable and functional outdoor living spaces, transforming their homes into havens of relaxation and entertainment. The projected market value of USD 7.0 Billion by 2033 signifies substantial untapped potential and robust growth catalysts.

India Outdoor Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Chair

- 2.2. Tables

- 2.3. Seating sets

- 2.4. Loungers and Daybeds

- 2.5. Dining Sets

- 2.6. Other Products

-

3. Market Type

- 3.1. Organised

- 3.2. Unorganised

-

4. End User

- 4.1. Commercial

- 4.2. Residential

-

5. Distribution Channel

-

5.1. Offline

- 5.1.1. Retail and Contractors

- 5.1.2. Hypermarkets

- 5.1.3. Supermarkets

- 5.1.4. Specialty Stores

- 5.2. Online

-

5.1. Offline

India Outdoor Furniture Industry Segmentation By Geography

- 1. India

India Outdoor Furniture Industry Regional Market Share

Geographic Coverage of India Outdoor Furniture Industry

India Outdoor Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Wood Furniture is Majorly Preferred by Indians as Outdoor Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Outdoor Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chair

- 5.2.2. Tables

- 5.2.3. Seating sets

- 5.2.4. Loungers and Daybeds

- 5.2.5. Dining Sets

- 5.2.6. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Market Type

- 5.3.1. Organised

- 5.3.2. Unorganised

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Residential

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Offline

- 5.5.1.1. Retail and Contractors

- 5.5.1.2. Hypermarkets

- 5.5.1.3. Supermarkets

- 5.5.1.4. Specialty Stores

- 5.5.2. Online

- 5.5.1. Offline

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inter IKEA Systems BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Patio Palace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cane India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Courtyard (Metro Plus Life Style)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Outdoor India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pepperfry

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Urban Ladder

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wicker Delite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KERNIG KRAFTS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Inter IKEA Systems BV

List of Figures

- Figure 1: India Outdoor Furniture Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Outdoor Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: India Outdoor Furniture Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: India Outdoor Furniture Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: India Outdoor Furniture Industry Revenue undefined Forecast, by Market Type 2020 & 2033

- Table 4: India Outdoor Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: India Outdoor Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Outdoor Furniture Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: India Outdoor Furniture Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: India Outdoor Furniture Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 9: India Outdoor Furniture Industry Revenue undefined Forecast, by Market Type 2020 & 2033

- Table 10: India Outdoor Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: India Outdoor Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: India Outdoor Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Outdoor Furniture Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the India Outdoor Furniture Industry?

Key companies in the market include Inter IKEA Systems BV, Patio Palace, Cane India, The Courtyard (Metro Plus Life Style), Amazon**List Not Exhaustive, Outdoor India, Pepperfry, Urban Ladder, Wicker Delite, KERNIG KRAFTS.

3. What are the main segments of the India Outdoor Furniture Industry?

The market segments include Material, Product, Market Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Wood Furniture is Majorly Preferred by Indians as Outdoor Furniture.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

Nov 2022: Online Indian furniture brand throughout the last-mile delivery process, Pepperfry cooperated with FarEye to improve order visibility, reduce delays, and raise overall consumer happiness. In India, e-commerce is anticipated to expand 96% between 2021 and 2025, reaching a transaction value of USD 120 billion. Pepperfry teamed with FarEye to give real-time visibility throughout the delivery path and eliminate delays and interruptions, ensuring every package arrives on time, every time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Outdoor Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Outdoor Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Outdoor Furniture Industry?

To stay informed about further developments, trends, and reports in the India Outdoor Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence