Key Insights

The Italian furniture market, projected at €822.53 billion in 2025, is poised for substantial expansion. Anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.1% from 2025 to 2033, this growth is propelled by several key factors. An expanding middle class with increasing discretionary income is a primary driver, fostering demand for premium, aesthetically sophisticated furniture. Italy's thriving tourism industry further bolsters this growth, as the hospitality sector consistently invests in modernizing its furnishings. Concurrently, a growing consumer preference for sustainable and eco-friendly materials presents significant opportunities for forward-thinking manufacturers. Robust domestic demand is complemented by a strong export performance, leveraging Italy's globally recognized excellence in high-end design and craftsmanship. However, the market faces challenges including volatility in raw material prices, particularly for wood, and intense global competition, which can impact profit margins. Supply chain disruptions and economic instability also represent potential risks. Market segmentation indicates that home furniture dominates, followed by office and hospitality segments. While wood remains the predominant material, metal and plastic are gaining prominence due to their cost-effectiveness and design versatility. Online sales channels are increasingly vital, yet traditional retail networks, including home centers and specialty stores, retain a significant market share. Leading companies such as Calligaris, Poltrona Frau, and Natuzzi are reinforcing their market leadership through strong brand recognition and design innovation.

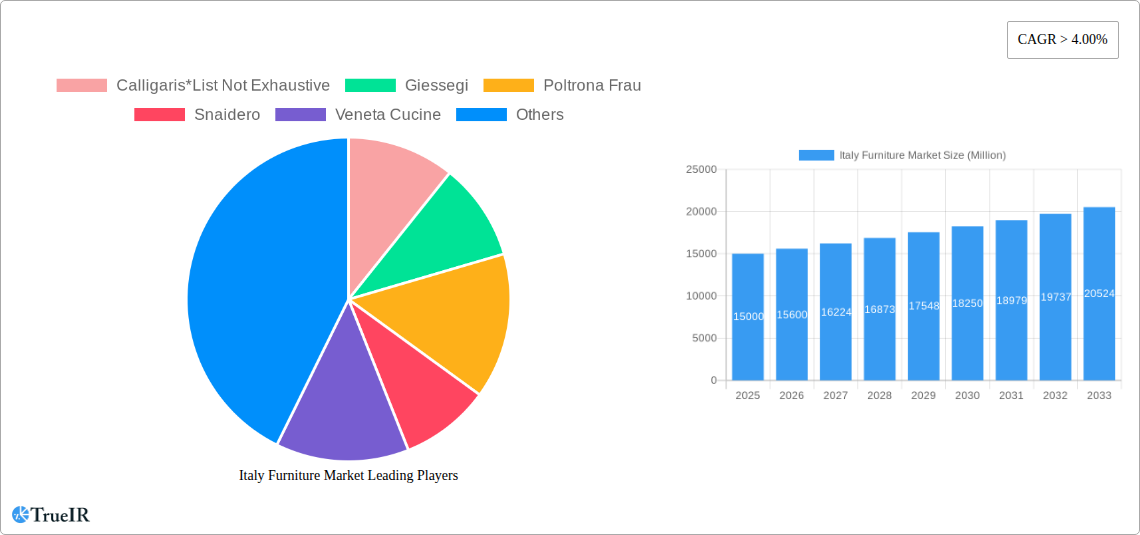

Italy Furniture Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, driven by the aforementioned trends. While economic fluctuations may influence the growth trajectory, the inherent resilience of the Italian furniture sector, underpinned by its reputation for quality and design innovation, suggests a positive outlook. Strategic integration of online sales channels and a commitment to sustainable manufacturing practices will be critical for long-term success in this competitive environment. Focused market segmentation, aimed at understanding evolving consumer needs and tailoring product offerings accordingly, will further enhance competitiveness. Companies are expected to prioritize product portfolio diversification, exploring novel materials and design aesthetics to attract a broader customer base.

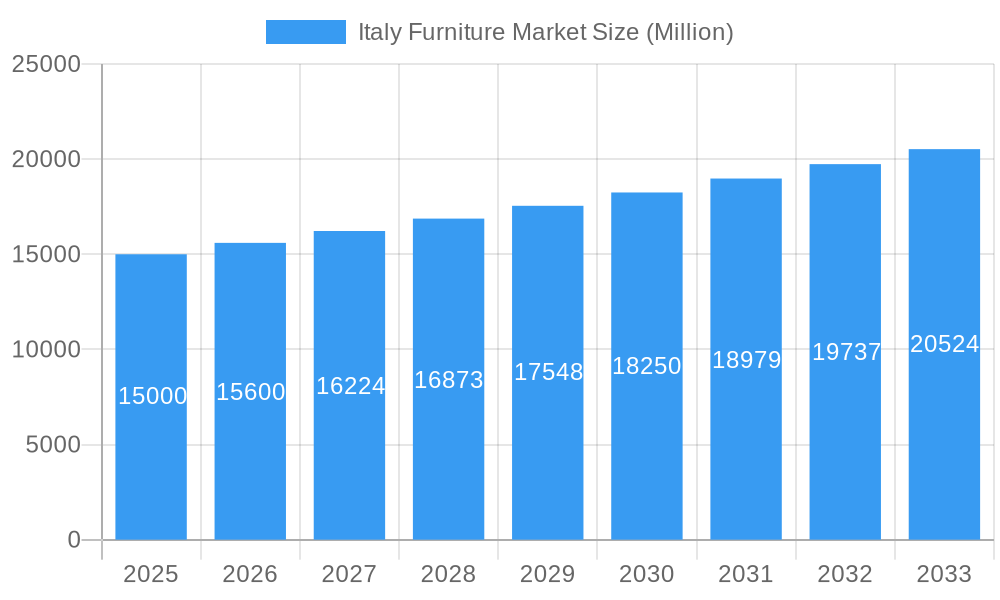

Italy Furniture Market Company Market Share

Italy Furniture Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Italy Furniture Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Leveraging extensive data from 2019-2024 (Historical Period) and incorporating expert forecasts through 2033 (Forecast Period), this report offers a 360° view of this vibrant market. The base year for this analysis is 2025, with estimates also provided for the same year. The report covers key segments, dominant players, and emerging trends, ensuring a comprehensive understanding of the Italy Furniture Market's current state and future potential.

Italy Furniture Market Structure & Competitive Landscape

The Italian furniture market is characterized by a blend of established giants and innovative newcomers, creating a dynamic competitive landscape. Market concentration is moderate, with a few large players holding significant shares, while numerous smaller businesses cater to niche segments. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market.

Innovation is a key driver, with companies continuously investing in new designs, materials, and manufacturing techniques to meet evolving consumer preferences and maintain a competitive edge. Regulatory impacts, primarily related to environmental sustainability and safety standards, influence manufacturing practices and product development. The market sees some degree of substitutability, with consumers having options to choose between domestic and imported furniture.

End-user segmentation is crucial, with distinct needs and preferences across residential, commercial (office), hospitality, and other sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total M&A volume of approximately xx Million in 2024. Key M&A trends include consolidation within specific segments (e.g., kitchen furniture) and expansion into new geographic markets.

- Market Concentration: Moderate (HHI 2024: xx)

- Innovation Drivers: New designs, materials, manufacturing techniques

- Regulatory Impacts: Environmental sustainability, safety standards

- Product Substitutes: Imported furniture, alternative materials

- End-User Segmentation: Home, Office, Hospitality, Other

- M&A Trends: Consolidation, geographic expansion

Italy Furniture Market Market Trends & Opportunities

The Italy Furniture Market exhibits strong growth potential, driven by several key factors. The market size in 2024 is estimated at xx Million, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). This growth is fueled by rising disposable incomes, increasing urbanization, and a growing preference for stylish and functional furniture. Technological advancements, particularly in design software and manufacturing processes, are enhancing efficiency and customization options.

Consumer preferences are shifting towards sustainable and eco-friendly furniture, pushing manufacturers to adopt more sustainable practices and utilize eco-friendly materials. Competitive dynamics are shaped by both established brands and emerging players, fostering innovation and product diversification. Market penetration rates vary significantly across segments, with home furniture maintaining the highest penetration, followed by office and hospitality furniture. The online distribution channel is experiencing rapid growth, driven by increased internet penetration and e-commerce adoption.

Dominant Markets & Segments in Italy Furniture Market

The Italian furniture market is geographically concentrated, with significant sales generated in Northern Italy, driven by higher population density, disposable incomes, and established manufacturing hubs. The Home Furniture segment dominates by application, accounting for the largest share of the market. In terms of materials, wood continues to be the most popular, followed by metal and plastic. The distribution channel is diverse with home centers, specialty stores and online channels all demonstrating significant presence.

Key Growth Drivers:

- Strong Domestic Demand

- Rising Disposable Incomes

- Tourism Sector Growth (for Hospitality Furniture)

- Government Initiatives Promoting Domestic Manufacturing

Dominant Segments:

- By Application: Home Furniture (xx Million in 2024)

- By Material: Wood (xx Million in 2024)

- By Distribution Channel: Specialty Stores (xx Million in 2024)

Italy Furniture Market Product Analysis

Product innovation is a defining characteristic of the Italian furniture market. Companies are focusing on creating stylish, functional, and sustainable furniture using advanced materials and technologies. The integration of smart technology, such as integrated lighting and power outlets, is gaining traction. Competitive advantages are achieved through superior design, quality materials, craftsmanship, and effective branding. The market shows a strong preference for high-quality, bespoke furniture, creating opportunities for both mass-market and luxury brands.

Key Drivers, Barriers & Challenges in Italy Furniture Market

Key Drivers:

- Rising Disposable Incomes

- Growing Urbanization

- Technological Advancements

- Government Support for the Furniture Industry

Key Challenges:

- Increased Raw Material Costs

- Supply Chain Disruptions

- Intense Competition

- Fluctuations in Global Demand

Growth Drivers in the Italy Furniture Market Market

The Italy Furniture Market's growth is primarily driven by increasing disposable incomes amongst the Italian population, fueling demand for higher-quality and more aesthetically pleasing furniture. Technological advancements are simplifying manufacturing processes, leading to greater efficiency and lower costs. Government incentives promoting local manufacturing further boost the sector.

Challenges Impacting Italy Furniture Market Growth

Significant challenges include escalating raw material costs, increasing competition from international furniture brands and the impact of global supply chain vulnerabilities that are leading to delays and increased production costs. These factors combined contribute to price pressures and reduced profit margins.

Key Players Shaping the Italy Furniture Market Market

- Calligaris

- Giessegi

- Poltrona Frau

- Snaidero

- Veneta Cucine

- Club House Italia

- Natuzzi

- Lube

- Gruppo Molteni

- Poliform

- Scavolini

- Arredo

- B&B Italia

- Poltronesofa

Significant Italy Furniture Market Industry Milestones

- October 2023: Tomasella launched the Vulcano collection, featuring high-end dining and bedroom furniture.

- October 2023: Natuzzi Italia unveiled the Colle Sofa, designed by Bjarke Ingels Group.

- October 2023: Poltronesofà announced its acquisition of ScS, expanding its presence in the UK market.

Future Outlook for Italy Furniture Market Market

The Italy Furniture Market is poised for continued growth, driven by ongoing innovation, evolving consumer preferences, and strategic investments by key players. Opportunities exist in developing sustainable and technologically advanced furniture, catering to niche market segments, and expanding into international markets. The market's long-term outlook remains positive, with potential for significant expansion in the coming decade.

Italy Furniture Market Segmentation

-

1. Application

- 1.1. Home Furniture

- 1.2. Office Furniture

- 1.3. Hospitality Furniture

- 1.4. Other Furniture

-

2. Material

- 2.1. Wood

- 2.2. Metal

- 2.3. Plastic and Other Furniture

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Flagship Stores

- 3.4. Online

- 3.5. Other Distribution Channels

Italy Furniture Market Segmentation By Geography

- 1. Italy

Italy Furniture Market Regional Market Share

Geographic Coverage of Italy Furniture Market

Italy Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Interest In Outdoor Recreational Activities Drives The Market; Growing Tourism And Leisure Travelling Drives The Market

- 3.3. Market Restrains

- 3.3.1. Impact of Environmental Concerns; Durability Of Camping Equipment And Furniture

- 3.4. Market Trends

- 3.4.1. E-commerce Sales in the Furniture Industry is Growing in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Furniture

- 5.1.2. Office Furniture

- 5.1.3. Hospitality Furniture

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Metal

- 5.2.3. Plastic and Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Flagship Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Calligaris*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Giessegi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Poltrona Frau

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Snaidero

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Veneta Cucine

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Club House Italia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Natuzzi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lube

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gruppo Molteni

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Poliform

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Scavolini

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Arredo

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 B&B Italia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Poltronesofa

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Calligaris*List Not Exhaustive

List of Figures

- Figure 1: Italy Furniture Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Furniture Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Italy Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Italy Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Italy Furniture Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Furniture Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Italy Furniture Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Italy Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Italy Furniture Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Furniture Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Italy Furniture Market?

Key companies in the market include Calligaris*List Not Exhaustive, Giessegi, Poltrona Frau, Snaidero, Veneta Cucine, Club House Italia, Natuzzi, Lube, Gruppo Molteni, Poliform, Scavolini, Arredo, B&B Italia, Poltronesofa.

3. What are the main segments of the Italy Furniture Market?

The market segments include Application, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 822.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Interest In Outdoor Recreational Activities Drives The Market; Growing Tourism And Leisure Travelling Drives The Market.

6. What are the notable trends driving market growth?

E-commerce Sales in the Furniture Industry is Growing in the Country.

7. Are there any restraints impacting market growth?

Impact of Environmental Concerns; Durability Of Camping Equipment And Furniture.

8. Can you provide examples of recent developments in the market?

October 2023: Tomasella introduced new bedroom and dining introductions at High Point Market, as well as at the Salone del Mobile Milano. New items include the Vulcano collection, which is inspired by Vulcano, a city near Sicily containing three volcanoes. The line includes high-end dining and bedroom pieces with high gloss finishes, sculptured metal bases, and different options for chairs and table tops.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Furniture Market?

To stay informed about further developments, trends, and reports in the Italy Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence