Key Insights

The Indian Concealed Cistern Market is projected for significant expansion, anticipating a market size of 1.7 billion by 2023, with a robust Compound Annual Growth Rate (CAGR) of 12%. This growth is propelled by increasing consumer demand for modern, space-efficient, and aesthetically pleasing bathroom designs, alongside rising disposable incomes that support investment in premium home furnishings. The "With Frame" segment is expected to lead, owing to its enhanced stability and straightforward installation, suiting both new builds and renovations. Residential applications represent the primary consumer segment, as homeowners increasingly adopt concealed cisterns for a minimalist, clutter-free bathroom aesthetic, a trend amplified by the rise of smart homes and integrated bathroom solutions.

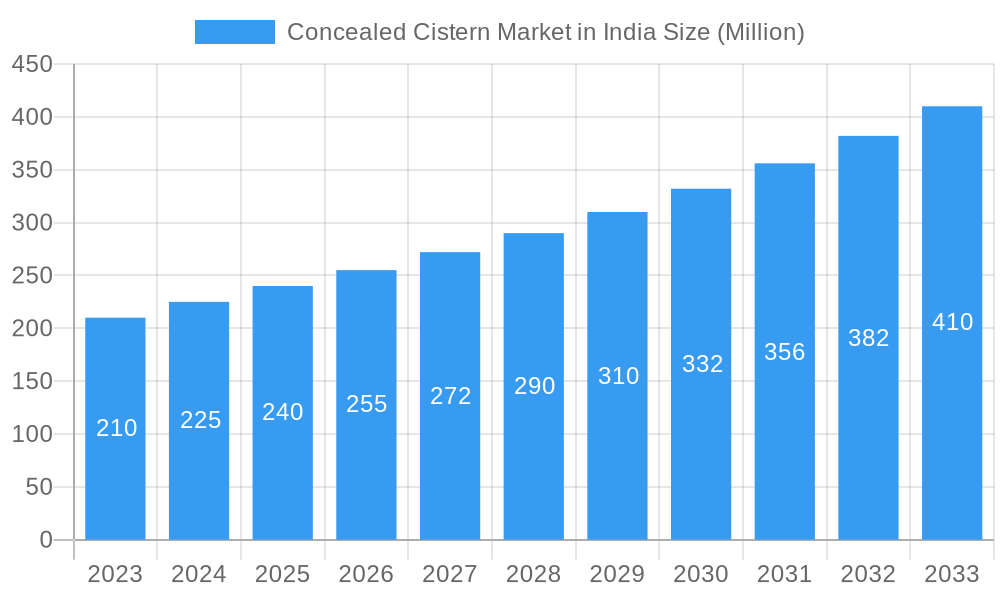

Concealed Cistern Market in India Market Size (In Billion)

Market expansion is further supported by escalating urbanization and the resultant need for efficient space utilization in residential and commercial projects. Key growth drivers include the rising number of luxury hotels, hospitals, and corporate offices prioritizing sophisticated and hygienic bathroom fixtures. While the market exhibits a healthy CAGR, potential challenges include the initial higher cost compared to conventional flushing systems and the requirement for specialized installation, which might deter some price-conscious consumers. Nevertheless, the long-term advantages of durability, ease of maintenance, and water efficiency are increasingly mitigating these initial concerns. Distribution channels are shifting towards online platforms, offering enhanced accessibility and competitive pricing, while home centers and specialty stores maintain a strong presence.

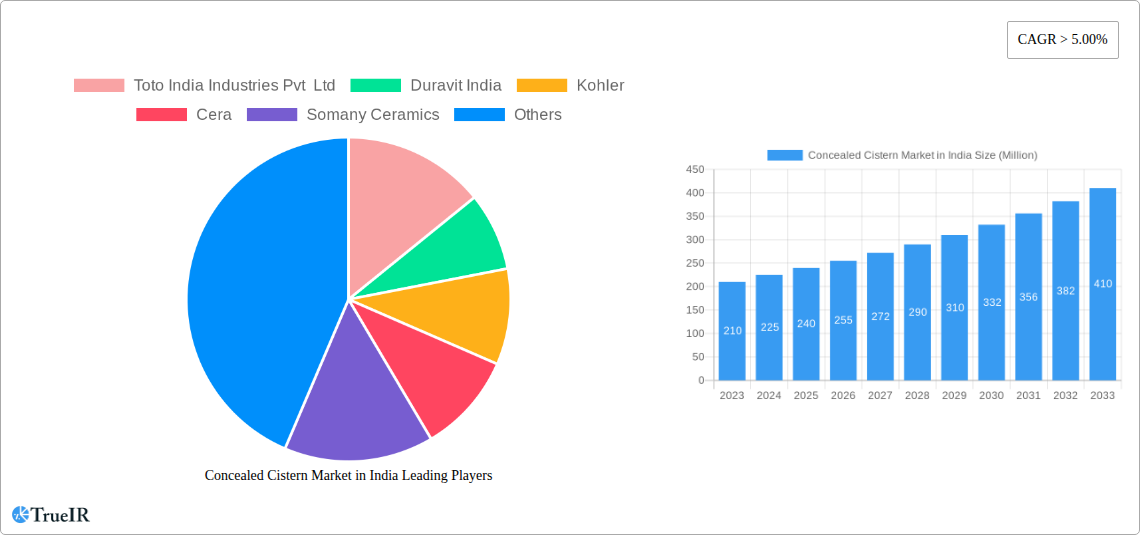

Concealed Cistern Market in India Company Market Share

This comprehensive report offers an in-depth analysis of the dynamic Indian Concealed Cistern Market, providing future projections. It delivers critical insights into market structure, competitive landscape, emerging trends, opportunities, and dominant segments. Optimized for SEO with high-volume keywords such as "concealed cistern India," "wall-hung toilet India," "flush tank India," and "sanitaryware India," this report is essential for industry professionals, manufacturers, distributors, and investors seeking to understand the evolving Indian market.

Concealed Cistern Market in India Market Structure & Competitive Landscape

The Indian concealed cistern market exhibits a moderately consolidated structure. Leading players are investing heavily in product innovation and expanding their distribution networks to capture market share. Key innovation drivers include the growing demand for space-saving and aesthetically pleasing bathroom solutions, driven by urbanization and rising disposable incomes. Regulatory impacts are minimal but evolving, with a focus on water efficiency and sustainable building practices. Product substitutes, primarily traditional cisterns, are gradually being phased out in new constructions and renovations due to the superior design and functionality of concealed systems. The end-user segmentation reveals a strong preference for residential applications, though commercial spaces are rapidly adopting concealed cisterns for their modern appeal and ease of maintenance. Mergers and acquisitions (M&A) are limited but present, indicating a strategic consolidation by larger entities to enhance their product portfolios and market reach. Industry concentration is estimated to be around XX%, with the top 5 players holding a significant share. M&A volumes are projected to be between XX to XX million in the forecast period.

Concealed Cistern Market in India Market Trends & Opportunities

The India concealed cistern market is poised for significant growth, driven by a confluence of factors. The market size is projected to reach approximately $XX Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is fueled by escalating urbanization, a rising trend in modern bathroom designs, and increasing consumer awareness regarding the aesthetic and functional benefits of concealed cisterns. Technological shifts are evident, with manufacturers increasingly focusing on dual-flush mechanisms, water-saving technologies, and smart features for enhanced user convenience and sustainability. Consumer preferences are leaning towards minimalist designs, hygiene, and the creation of sleek, uncluttered bathrooms, directly benefiting the demand for concealed cisterns. Competitive dynamics are intensifying, with both established global brands and burgeoning domestic players vying for market dominance through product differentiation, strategic partnerships, and enhanced customer service. The market penetration rate for concealed cisterns, while still lower than in developed economies, is rapidly increasing, presenting substantial growth opportunities. The increasing focus on premium bathroom fittings in residential and commercial projects, including hotels and office spaces, is a major market driver. Furthermore, government initiatives promoting smart cities and sustainable construction are indirectly boosting the adoption of modern sanitaryware solutions. The shift towards modular construction and prefabricated bathrooms also presents an avenue for increased adoption of concealed cisterns. Opportunities abound for manufacturers to innovate in terms of material, installation ease, and smart connectivity, catering to the evolving needs of Indian consumers and the construction industry. The rising disposable income across Tier 1 and Tier 2 cities further supports the premiumization trend, making concealed cisterns a desirable upgrade for homeowners.

Dominant Markets & Segments in Concealed Cistern Market in India

The concealed cistern market in India is characterized by distinct dominant segments across product types, end-users, and distribution channels.

- Product Type Dominance: The "With Frame" concealed cisterns segment is the most dominant, holding approximately XX% of the market share. This is primarily due to their robust installation support and suitability for various wall constructions, making them a preferred choice for both new builds and renovations. The "Half Frame" segment, while smaller, is growing, offering a balance between structural support and cost-effectiveness. The "Without Frame" segment is the smallest but is anticipated to see steady growth as installation expertise becomes more widespread and specialized.

- End-User Dominance: The Residential segment is the largest consumer of concealed cisterns in India, accounting for approximately XX% of the market. This dominance is driven by an increasing number of new housing projects, urban renovations, and a growing preference for modern, minimalist bathroom aesthetics among homeowners. The Commercial segment, including hotels, restaurants, and office buildings, is a significant and rapidly growing segment, driven by the demand for durable, hygienic, and aesthetically pleasing sanitary solutions. This segment is projected to grow at a CAGR of xx%.

- Distribution Channel Dominance: Home Centers and Specialty Stores currently dominate the distribution landscape, collectively holding around XX% of the market share. These channels offer consumers a tangible product experience and expert advice. However, the Online distribution channel is experiencing the fastest growth, projected at a CAGR of xx%, driven by e-commerce expansion, convenience, and competitive pricing. Other Distribution Channels, including direct sales to large developers and project-specific suppliers, also play a crucial role.

- Geographical Dominance: While the entire Indian market is experiencing growth, Western India (Maharashtra, Gujarat) and Northern India (Delhi NCR, Haryana) are leading regions in terms of market size and adoption rates due to higher urbanization, disposable incomes, and a greater concentration of real estate development.

Concealed Cistern Market in India Product Analysis

Innovations in the Indian concealed cistern market are increasingly focused on enhancing user experience, water efficiency, and ease of installation. Manufacturers are introducing advanced dual-flush systems that allow users to select between different water volumes for liquid and solid waste, significantly contributing to water conservation efforts. The integration of noise reduction technologies ensures a quieter flushing experience, a key differentiator for premium products. Competitive advantages are being built around durability, ease of maintenance, and compatibility with various wall-hung toilet designs. Furthermore, the development of slimmer profiles and adaptable framing systems caters to space constraints in modern Indian bathrooms, making concealed cisterns a versatile and desirable sanitaryware solution.

Key Drivers, Barriers & Challenges in Concealed Cistern Market in India

Key Drivers:

- Urbanization and Real Estate Boom: Rapid urbanization and a thriving real estate sector are driving demand for modern bathroom fittings.

- Growing Disposable Incomes: Increased purchasing power allows consumers to opt for premium and aesthetically superior products.

- Aesthetic Appeal & Space Saving: The desire for minimalist, clutter-free bathrooms and efficient space utilization favors concealed cisterns.

- Water Conservation Awareness: Growing consciousness about water scarcity promotes the adoption of water-efficient flushing systems like dual-flush concealed cisterns.

- Government Initiatives: Smart city projects and sustainable building policies indirectly encourage the adoption of modern sanitary solutions.

Barriers and Challenges:

- Higher Initial Cost: Concealed cisterns generally have a higher upfront cost compared to traditional flushing systems, posing a barrier for price-sensitive consumers.

- Installation Complexity: While improving, installation can still be perceived as more complex, requiring skilled labor.

- Awareness Gap: Despite growing adoption, a segment of the market may still lack awareness about the benefits and functionalities of concealed cisterns.

- Availability of Skilled Labor: The availability of trained plumbers and installers for concealed cistern systems can be a challenge in certain regions, impacting adoption rates.

- Maintenance Concerns: Though designed for minimal maintenance, the perception of complex repairs can be a deterrent for some. The supply chain for specialized spare parts can also be a concern in remote areas.

Growth Drivers in the Concealed Cistern Market in India Market

The concealed cistern market in India is propelled by several key growth drivers. Technologically, advancements in water-saving mechanisms and the development of quieter flushing systems are significant attractors. Economically, the rising disposable incomes across urban and semi-urban India are enabling consumers to invest in premium bathroom fixtures that enhance both aesthetics and functionality. Policy-driven factors, such as government mandates for water-efficient buildings and the development of smart cities, further stimulate the demand for modern sanitary solutions like concealed cisterns. The increasing number of premium residential and commercial construction projects also acts as a crucial catalyst.

Challenges Impacting Concealed Cistern Market in India Growth

The growth of the concealed cistern market in India faces certain challenges. Regulatory complexities, while not a major hurdle currently, could emerge with stricter building codes related to water usage and material standards. Supply chain issues, particularly in ensuring timely availability of specialized components and spare parts across all regions, can impede market expansion. Competitive pressures are intensifying, with both domestic and international players vying for market share, leading to price sensitivities in certain market segments. The perception of a higher initial cost and installation complexity also continues to be a restraining factor for wider adoption, especially in price-conscious markets.

Key Players Shaping the Concealed Cistern Market in India Market

- Toto India Industries Pvt Ltd

- Duravit India

- Kohler

- Cera

- Somany Ceramics

- H&R Johnson (India) Ltd

- Roca

- Parryware Limited

- Jaquar

- Hindware

Significant Concealed Cistern Market in India Industry Milestones

- 2021 (Ongoing): CERA focused on trade expansion and development with brand stores, supporting channel partners by helping them build brand stores like Cera Style Galleries, Cera Style Hub, Cera Style Centre, Cera Tile Galleries, and Cera Tile Centres. This initiative significantly boosted brand visibility and consumer engagement.

- June 2021: Parryware launched its online platform "Parryware Safe-Buy" to provide a contactless buying experience and make its products more accessible amid the COVID-19 pandemic.

Future Outlook for Concealed Cistern Market in India Market

The future outlook for the concealed cistern market in India is exceptionally promising. Strategic opportunities lie in the continued expansion of product portfolios to include smart technologies and enhanced water-saving features, catering to the evolving demands of the discerning Indian consumer. The growing middle class, coupled with increased urbanization and a focus on aspirational living, will continue to drive demand for modern, space-saving, and aesthetically pleasing bathroom solutions. Investments in wider distribution networks, including a stronger online presence and partnerships with modular construction companies, will be crucial for market penetration. The sustained growth in the real estate sector and the government's push for sustainable infrastructure development will further fuel market expansion, positioning India as a key growth market for concealed cisterns globally.

Concealed Cistern Market in India Segmentation

-

1. Product Type

- 1.1. With Frame

- 1.2. Half Frame

- 1.3. Without Frame

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

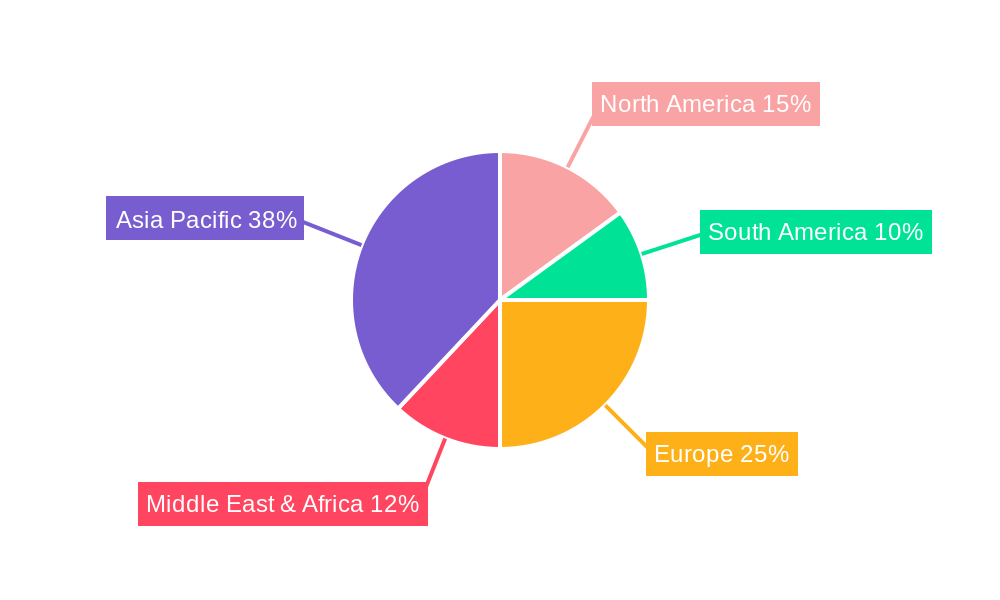

Concealed Cistern Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Concealed Cistern Market in India Regional Market Share

Geographic Coverage of Concealed Cistern Market in India

Concealed Cistern Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs of Wine Coolers Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Real Estate Industry Market Affecting Concealed Cistern Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. With Frame

- 5.1.2. Half Frame

- 5.1.3. Without Frame

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. With Frame

- 6.1.2. Half Frame

- 6.1.3. Without Frame

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. With Frame

- 7.1.2. Half Frame

- 7.1.3. Without Frame

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. With Frame

- 8.1.2. Half Frame

- 8.1.3. Without Frame

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. With Frame

- 9.1.2. Half Frame

- 9.1.3. Without Frame

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Concealed Cistern Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. With Frame

- 10.1.2. Half Frame

- 10.1.3. Without Frame

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toto India Industries Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Duravit India

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kohler

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cera

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Somany Ceramics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 H&R Johnson (India) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Roca

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parryware Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaquar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hindware

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Toto India Industries Pvt Ltd

List of Figures

- Figure 1: Global Concealed Cistern Market in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Concealed Cistern Market in India Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Concealed Cistern Market in India Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Concealed Cistern Market in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Concealed Cistern Market in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Concealed Cistern Market in India Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Concealed Cistern Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 8: North America Concealed Cistern Market in India Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America Concealed Cistern Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Concealed Cistern Market in India Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Concealed Cistern Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Concealed Cistern Market in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 13: North America Concealed Cistern Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Concealed Cistern Market in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Concealed Cistern Market in India Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Concealed Cistern Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Concealed Cistern Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Concealed Cistern Market in India Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Concealed Cistern Market in India Revenue (billion), by Product Type 2025 & 2033

- Figure 20: South America Concealed Cistern Market in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: South America Concealed Cistern Market in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Concealed Cistern Market in India Volume Share (%), by Product Type 2025 & 2033

- Figure 23: South America Concealed Cistern Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 24: South America Concealed Cistern Market in India Volume (K Unit), by End-User 2025 & 2033

- Figure 25: South America Concealed Cistern Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 26: South America Concealed Cistern Market in India Volume Share (%), by End-User 2025 & 2033

- Figure 27: South America Concealed Cistern Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: South America Concealed Cistern Market in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 29: South America Concealed Cistern Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Concealed Cistern Market in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Concealed Cistern Market in India Revenue (billion), by Country 2025 & 2033

- Figure 32: South America Concealed Cistern Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Concealed Cistern Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Concealed Cistern Market in India Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Concealed Cistern Market in India Revenue (billion), by Product Type 2025 & 2033

- Figure 36: Europe Concealed Cistern Market in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Europe Concealed Cistern Market in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Europe Concealed Cistern Market in India Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Europe Concealed Cistern Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 40: Europe Concealed Cistern Market in India Volume (K Unit), by End-User 2025 & 2033

- Figure 41: Europe Concealed Cistern Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Europe Concealed Cistern Market in India Volume Share (%), by End-User 2025 & 2033

- Figure 43: Europe Concealed Cistern Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Europe Concealed Cistern Market in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Europe Concealed Cistern Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe Concealed Cistern Market in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe Concealed Cistern Market in India Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Concealed Cistern Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Concealed Cistern Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Concealed Cistern Market in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Concealed Cistern Market in India Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East & Africa Concealed Cistern Market in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Middle East & Africa Concealed Cistern Market in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East & Africa Concealed Cistern Market in India Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East & Africa Concealed Cistern Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 56: Middle East & Africa Concealed Cistern Market in India Volume (K Unit), by End-User 2025 & 2033

- Figure 57: Middle East & Africa Concealed Cistern Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Middle East & Africa Concealed Cistern Market in India Volume Share (%), by End-User 2025 & 2033

- Figure 59: Middle East & Africa Concealed Cistern Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa Concealed Cistern Market in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa Concealed Cistern Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa Concealed Cistern Market in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Concealed Cistern Market in India Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa Concealed Cistern Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Concealed Cistern Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Concealed Cistern Market in India Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Concealed Cistern Market in India Revenue (billion), by Product Type 2025 & 2033

- Figure 68: Asia Pacific Concealed Cistern Market in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Asia Pacific Concealed Cistern Market in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Asia Pacific Concealed Cistern Market in India Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Asia Pacific Concealed Cistern Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 72: Asia Pacific Concealed Cistern Market in India Volume (K Unit), by End-User 2025 & 2033

- Figure 73: Asia Pacific Concealed Cistern Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Asia Pacific Concealed Cistern Market in India Volume Share (%), by End-User 2025 & 2033

- Figure 75: Asia Pacific Concealed Cistern Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific Concealed Cistern Market in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific Concealed Cistern Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific Concealed Cistern Market in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Concealed Cistern Market in India Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific Concealed Cistern Market in India Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Concealed Cistern Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Concealed Cistern Market in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Concealed Cistern Market in India Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Concealed Cistern Market in India Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Concealed Cistern Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Concealed Cistern Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Concealed Cistern Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Concealed Cistern Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 41: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Concealed Cistern Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Concealed Cistern Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 64: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 66: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 67: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Concealed Cistern Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Concealed Cistern Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Concealed Cistern Market in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 84: Global Concealed Cistern Market in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 85: Global Concealed Cistern Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 86: Global Concealed Cistern Market in India Volume K Unit Forecast, by End-User 2020 & 2033

- Table 87: Global Concealed Cistern Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global Concealed Cistern Market in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global Concealed Cistern Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global Concealed Cistern Market in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Concealed Cistern Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Concealed Cistern Market in India Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Concealed Cistern Market in India?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Concealed Cistern Market in India?

Key companies in the market include Toto India Industries Pvt Ltd, Duravit India, Kohler, Cera, Somany Ceramics, H&R Johnson (India) Ltd, Roca, Parryware Limited, Jaquar, Hindware.

3. What are the main segments of the Concealed Cistern Market in India?

The market segments include Product Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Wine Consumption Culture is Driving the Wine Cooler Market; Increasing Hospitality Industry's Wine Offering is Driving the Market.

6. What are the notable trends driving market growth?

Real Estate Industry Market Affecting Concealed Cistern Market.

7. Are there any restraints impacting market growth?

High Initial Costs of Wine Coolers Act as a Restraint.

8. Can you provide examples of recent developments in the market?

In 2021, for trade expansion and development with brand stores, CERA focused to support channel partners by helping them to build brand stores - Cera Style Galleries, Cera Style Hub, Cera Style Centre, Cera Tile Galleries and Cera Tile Centres. This created strong brand visibility in the market and also give consumers an experience to remember and facilitate better decision-making.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Concealed Cistern Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Concealed Cistern Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Concealed Cistern Market in India?

To stay informed about further developments, trends, and reports in the Concealed Cistern Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence