Key Insights

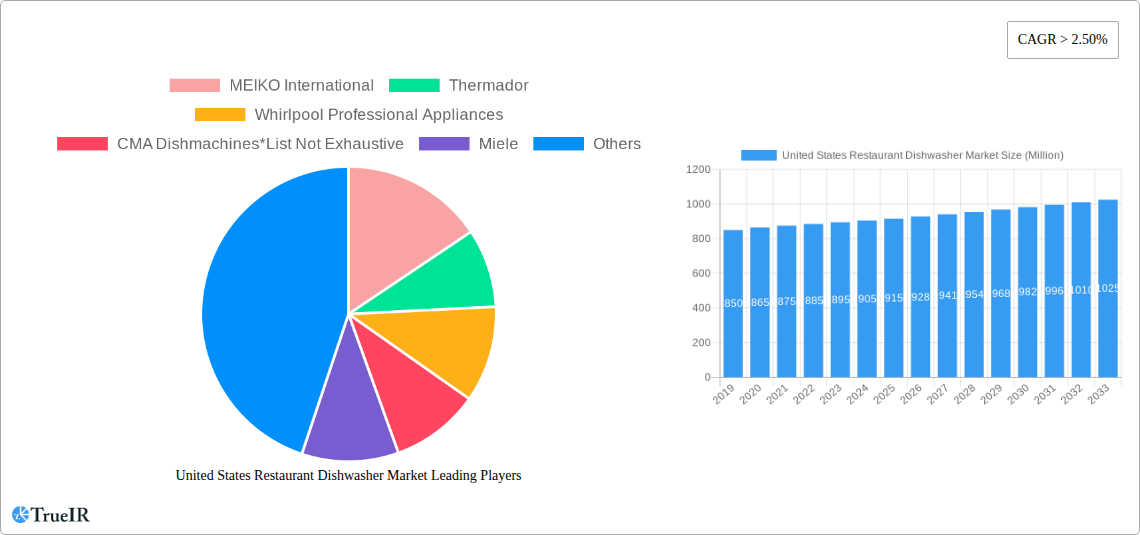

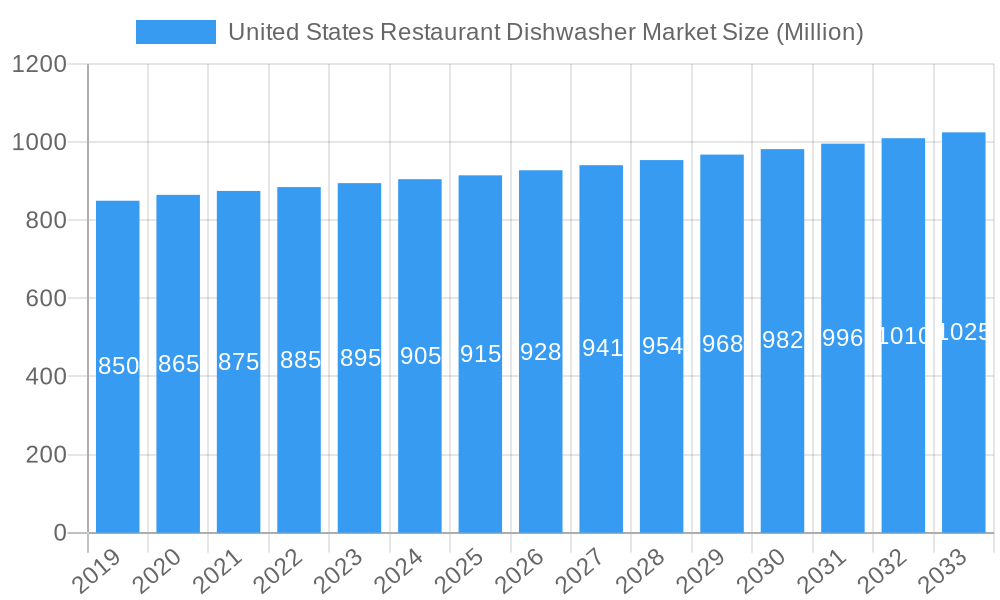

The United States restaurant dishwasher market is projected for robust expansion, driven by escalating demand for efficient and hygienic warewashing solutions within the food service sector. With an estimated market size of $8.2 billion in the base year of 2025, the sector anticipates a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. Key growth catalysts include the expanding restaurant industry, heightened emphasis on food safety regulations, and continuous technological advancements in dishwasher efficiency and sustainability. Modern establishments are prioritizing high-performance dishwashers that deliver faster cycle times, reduced water and energy consumption, and superior sanitation, leading to operational cost savings and improved customer satisfaction. Market segmentation encompasses production, consumption, import/export analysis, and pricing trends, offering a holistic view of market dynamics. Leading industry players such as MEIKO International, Thermador, Whirlpool Professional Appliances, Miele, and Hobart are actively innovating to address the diverse needs of restaurants, from small eateries to large-scale catering operations.

United States Restaurant Dishwasher Market Market Size (In Billion)

Distinct trends shaping the United States restaurant dishwasher market include the adoption of energy-efficient and water-saving technologies, integration of smart features for remote monitoring, and a preference for compact, space-optimizing units. While higher initial investment costs for advanced features and capacity may present a potential restraint, long-term operational benefits and compliance with stringent health codes generally outweigh these concerns. The import market significantly contributes, with comprehensive value and volume analyses highlighting a strong international presence in supplying specialized equipment, complementing domestic production. Price trend analysis indicates a stable to moderately increasing trajectory, influenced by raw material costs, technological innovation, and competitive market pressures. The United States represents a substantial regional market, with ongoing investments in food service infrastructure ensuring sustained demand for durable and reliable restaurant dishwashing solutions.

United States Restaurant Dishwasher Market Company Market Share

United States Restaurant Dishwasher Market: Comprehensive Analysis and Future Projections

This comprehensive report provides a dynamic and SEO-optimized analysis of the United States restaurant dishwasher market, utilizing high-volume keywords for enhanced search visibility. Covering a detailed study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report delivers unparalleled insights into market structure, trends, opportunities, product analysis, key drivers, barriers, and the competitive landscape. Gain access to essential quantitative data and qualitative insights crucial for strategic decision-making in this expanding sector.

United States Restaurant Dishwasher Market Market Structure & Competitive Landscape

The United States restaurant dishwasher market exhibits a moderately consolidated structure, with a notable presence of both established global players and specialized domestic manufacturers. Market concentration is influenced by factors such as the capital investment required for advanced manufacturing and the increasing demand for energy-efficient and technologically sophisticated solutions. Innovation drivers are predominantly centered on reducing operational costs for restaurants, enhancing hygiene standards, and complying with stringent environmental regulations. Product substitutes, while present in the form of manual dishwashing, are rapidly losing ground due to labor shortages and the inherent inefficiencies compared to automated solutions. The end-user segmentation is broad, encompassing quick-service restaurants (QSRs), full-service restaurants, hotels, catering facilities, and institutional kitchens. Merger and acquisition (M&A) trends in the market, estimated to be around 3-5 significant deals annually over the historical period, indicate a strategic consolidation aimed at expanding market share, acquiring technological capabilities, and achieving economies of scale. For instance, the acquisition of smaller, niche dishwasher manufacturers by larger corporations is a recurring theme, bolstering their product portfolios and geographical reach. The competitive landscape is characterized by a strong emphasis on product differentiation through features like advanced water filtration, reduced energy consumption, faster wash cycles, and smart connectivity.

United States Restaurant Dishwasher Market Market Trends & Opportunities

The United States restaurant dishwasher market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust growth is fueled by several converging trends. The increasing demand for efficiency and cost savings in restaurant operations, particularly in light of rising labor costs and shortages, is a primary catalyst. Restaurants are increasingly recognizing the long-term economic benefits of investing in efficient commercial dishwashers that reduce labor hours and water/energy consumption. Technological shifts are revolutionizing the sector, with a growing emphasis on smart dishwashers equipped with IoT capabilities. These features allow for remote monitoring, predictive maintenance, optimized wash cycles based on soil levels, and enhanced energy management, appealing to forward-thinking restaurateurs. Consumer preferences are also indirectly influencing the market; diners expect higher hygiene standards, and restaurants equipped with modern, efficient dishwashing systems can more reliably meet and exceed these expectations. Competitive dynamics are intensifying, with manufacturers focusing on developing differentiated products that address specific restaurant needs, such as high-volume throughput for QSRs or specialized cleaning for fine dining establishments. Opportunities abound in the development of eco-friendly dishwasher models that boast reduced water usage and energy consumption, aligning with both regulatory pressures and growing consumer demand for sustainability. The market penetration rate of commercial dishwashers in smaller, independent restaurants, which remains relatively lower compared to larger chains, presents a significant untapped opportunity for growth. Furthermore, the ongoing demand for specialized dishwashing solutions for diverse food service applications, including bakeries, cafeterias, and healthcare facilities, offers further avenues for market expansion. The increasing adoption of automation across the entire food service industry creates a fertile ground for the proliferation of advanced dishwashing technologies, as businesses seek to streamline operations and minimize manual intervention. The shift towards more compact and energy-efficient models is also a key trend, catering to the needs of smaller establishments with limited space and budgets.

Dominant Markets & Segments in United States Restaurant Dishwasher Market

In the United States restaurant dishwasher market, a detailed examination of Production Analysis reveals that the Midwest region, with its established manufacturing base and access to skilled labor, often leads in production volume. Key growth drivers in this segment include government incentives for domestic manufacturing and the presence of major appliance component suppliers. The Consumption Analysis highlights the Southern and Northeastern regions as dominant markets due to the higher density of restaurants, hotels, and food service establishments. Economic growth, increased tourism, and a robust culinary scene in these areas directly contribute to a higher demand for commercial dishwashers. Infrastructure development, such as the expansion of dining facilities and hospitality services, further fuels consumption.

For the Import Market Analysis (Value & Volume), the coastal regions, particularly the East and West Coasts, represent significant import hubs. This is driven by the demand for specialized or technologically advanced dishwashers that may be more readily available or competitively priced from international manufacturers. Factors influencing import dominance include trade agreements, currency exchange rates, and the specific product offerings from global brands. The import market is valued at approximately $650 Million, with a volume of around 300,000 units in the estimated year.

Conversely, the Export Market Analysis (Value & Volume) is more dispersed, with manufacturers in regions with strong production capabilities exporting to neighboring countries and, to a lesser extent, to other international markets seeking American-made quality and innovation. While the overall export volume is lower, estimated at around 50,000 units with a value of $150 Million, the value per unit can be higher due to specialized or high-end product exports.

The Price Trend Analysis indicates a gradual upward trend, influenced by raw material costs, technological advancements, and inflationary pressures. The average price for a commercial dishwasher in the United States is projected to be around $2,100 in the estimated year. This trend is particularly evident in segments incorporating advanced features such as energy efficiency, water-saving technologies, and digital controls. Fluctuations in energy prices and stricter environmental regulations also play a role in shaping pricing strategies for manufacturers and, consequently, the retail prices for end-users.

United States Restaurant Dishwasher Market Product Analysis

Product innovations in the United States restaurant dishwasher market are significantly shaping its competitive landscape. Manufacturers are increasingly focusing on developing energy-efficient models that comply with Energy Star standards, thereby reducing operational costs for restaurants and appealing to environmentally conscious businesses. Advancements in water-saving technologies, such as high-pressure spray arms and efficient filtration systems, are also a key focus. Furthermore, the integration of smart technology, including IoT capabilities for remote monitoring, diagnostics, and cycle optimization, offers enhanced convenience and operational efficiency. Competitive advantages are being gained through superior build quality, durability, faster wash and dry cycles, and specialized features catering to diverse food service segments.

Key Drivers, Barriers & Challenges in United States Restaurant Dishwasher Market

Key Drivers:

- Rising Labor Costs & Shortages: The increasing cost and scarcity of labor are compelling restaurants to adopt automated dishwashing solutions to improve efficiency and reduce operational expenses.

- Demand for Hygiene & Food Safety: Stringent health regulations and growing consumer awareness necessitate efficient and reliable dishwashing systems to maintain high hygiene standards.

- Technological Advancements: Innovations in energy efficiency, water conservation, and smart connectivity are enhancing the appeal and functionality of commercial dishwashers.

Barriers & Challenges:

- High Initial Investment: The upfront cost of purchasing commercial-grade dishwashers can be a significant barrier for small and medium-sized restaurants with limited capital.

- Maintenance & Repair Costs: Ongoing maintenance, potential repair costs, and the need for specialized technicians can deter some businesses.

- Space Constraints: Smaller establishments often face challenges with the physical space required for the installation and operation of commercial dishwashers.

- Supply Chain Volatility: Disruptions in the supply chain for raw materials and components can impact production, lead times, and pricing.

Growth Drivers in the United States Restaurant Dishwasher Market Market

The United States restaurant dishwasher market is propelled by several key growth drivers. Technological innovation, particularly in energy and water efficiency, is a significant factor, as restaurants aim to reduce their operational footprint and comply with evolving environmental regulations. The economic imperative of labor cost optimization, especially in the face of widespread labor shortages across the food service industry, is driving the adoption of automated dishwashing solutions. Furthermore, a robust increase in the number of new restaurant openings and expansions, particularly within the fast-casual and QSR segments, directly translates to increased demand for commercial kitchen equipment, including dishwashers. Government incentives and certifications, such as Energy Star ratings, also play a role in encouraging the adoption of more sustainable and efficient models.

Challenges Impacting United States Restaurant Dishwasher Market Growth

Several challenges are impacting the growth of the United States restaurant dishwasher market. The significant upfront capital expenditure required for purchasing commercial-grade dishwashers can be a considerable barrier for smaller, independent restaurants or those operating on tight margins. Ongoing maintenance and repair costs, coupled with the need for specialized technicians, can also present a financial strain. Supply chain disruptions, affecting the availability of raw materials and manufactured components, can lead to increased lead times and price volatility for these essential pieces of equipment. Moreover, space limitations in many urban and older restaurant establishments pose a practical challenge for the installation of larger, industrial dishwashers.

Key Players Shaping the United States Restaurant Dishwasher Market Market

- MEIKO International

- Thermador

- Whirlpool Professional Appliances

- CMA Dishmachines

- Miele

- Hobart

- Jackson WWS

- Electrolux AB

- Insinger Machine Company

- Fagor America

Significant United States Restaurant Dishwasher Market Industry Milestones

- 2019: Increased adoption of Energy Star certified dishwashers driven by sustainability initiatives.

- 2020: Introduction of enhanced sanitization features in response to heightened hygiene concerns.

- 2021: Rise in demand for compact, high-efficiency models for smaller food service operations.

- 2022: Growing integration of IoT and smart technology for remote monitoring and operational insights.

- 2023: Focus on water conservation technologies and reduced cycle times to boost kitchen throughput.

- 2024: Emergence of models with advanced self-cleaning and maintenance alert systems.

Future Outlook for United States Restaurant Dishwasher Market Market

The future outlook for the United States restaurant dishwasher market is exceptionally promising, driven by the persistent demand for operational efficiency, hygiene, and sustainability. Strategic opportunities lie in the further integration of AI and machine learning for predictive maintenance and optimized energy consumption, alongside continued innovation in water-saving technologies. The growing trend of ghost kitchens and delivery-only food services also presents a unique market segment requiring specialized, high-volume dishwashing solutions. As labor costs continue to rise and technological advancements make advanced dishwashers more accessible, market penetration is expected to deepen across all restaurant segments, solidifying the indispensable role of efficient commercial dishwashers in the modern food service industry.

United States Restaurant Dishwasher Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Restaurant Dishwasher Market Segmentation By Geography

- 1. United States

United States Restaurant Dishwasher Market Regional Market Share

Geographic Coverage of United States Restaurant Dishwasher Market

United States Restaurant Dishwasher Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advent of Smart Laundry Technologies to Spur Market Growth; Rise in Lodging Services and Travel Accommodation

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Human Resources

- 3.4. Market Trends

- 3.4.1. Rise in Number of Restaurants is Driving the Market for Commercial Dishwashers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Restaurant Dishwasher Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MEIKO International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermador

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Whirlpool Professional Appliances

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA Dishmachines*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miele

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hobart

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jackson WWS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Insinger Machine Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fagor America

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 MEIKO International

List of Figures

- Figure 1: United States Restaurant Dishwasher Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Restaurant Dishwasher Market Share (%) by Company 2025

List of Tables

- Table 1: United States Restaurant Dishwasher Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Restaurant Dishwasher Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Restaurant Dishwasher Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Restaurant Dishwasher Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Restaurant Dishwasher Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Restaurant Dishwasher Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: United States Restaurant Dishwasher Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Restaurant Dishwasher Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Restaurant Dishwasher Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Restaurant Dishwasher Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Restaurant Dishwasher Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Restaurant Dishwasher Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Restaurant Dishwasher Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the United States Restaurant Dishwasher Market?

Key companies in the market include MEIKO International, Thermador, Whirlpool Professional Appliances, CMA Dishmachines*List Not Exhaustive, Miele, Hobart, Jackson WWS, Electrolux AB, Insinger Machine Company, Fagor America.

3. What are the main segments of the United States Restaurant Dishwasher Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Advent of Smart Laundry Technologies to Spur Market Growth; Rise in Lodging Services and Travel Accommodation.

6. What are the notable trends driving market growth?

Rise in Number of Restaurants is Driving the Market for Commercial Dishwashers.

7. Are there any restraints impacting market growth?

Shortage of Skilled Human Resources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Restaurant Dishwasher Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Restaurant Dishwasher Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Restaurant Dishwasher Market?

To stay informed about further developments, trends, and reports in the United States Restaurant Dishwasher Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence