Key Insights

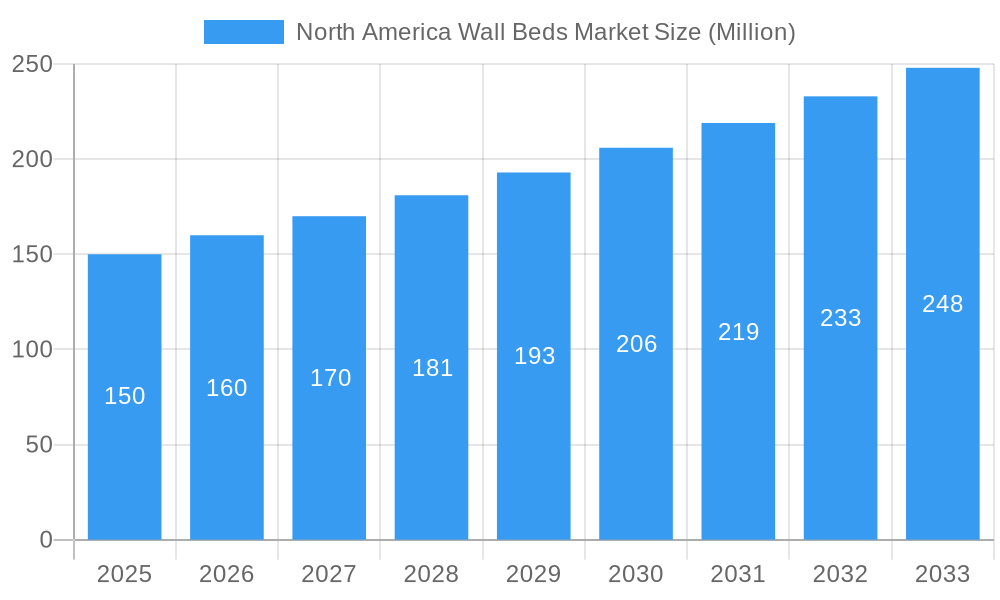

The North American wall bed market is projected to reach $2.95 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 6.6% from the base year 2024. Key growth catalysts include the escalating demand for space-saving furniture solutions in urban environments and the rising adoption of multifunctional, aesthetically pleasing home furnishings. Technological advancements in design, durability, and style are further propelling market expansion. Market segmentation indicates a preference for king and queen-sized beds, with automated and hybrid operational mechanisms gaining significant traction. Online distribution channels are experiencing robust growth, aligning with evolving consumer purchasing behaviors. While high initial costs and durability concerns present restraints, they are offset by long-term space optimization benefits and increasing consumer affordability. The United States holds the largest market share, followed by Canada and Mexico, with consistent growth anticipated across all regions.

North America Wall Beds Market Market Size (In Billion)

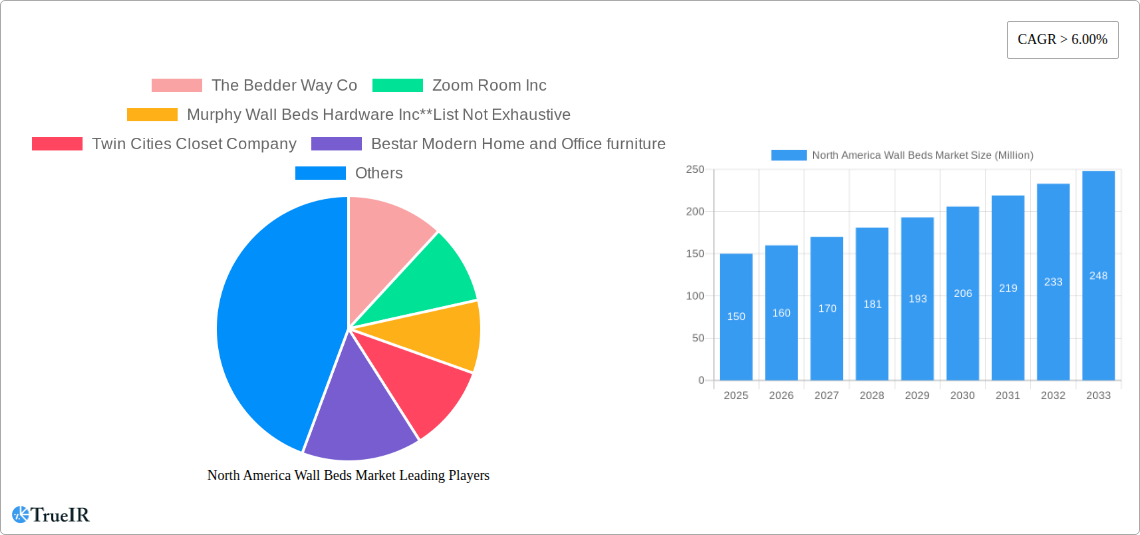

Leading market participants such as The Bedder Way Co, Zoom Room Inc, and Murphy Wall Beds Hardware Inc are prioritizing product innovation, strategic collaborations, and targeted marketing strategies to enhance market share. Differentiation through distinctive designs, diverse material selections (with wood remaining dominant but metal and other materials emerging), and superior functionality are critical competitive differentiators. Understanding market segmentation by material, capacity, operation type, and distribution channel is vital for businesses aiming to penetrate niche segments effectively. Future growth will be driven by continued urbanization, ongoing technological advancements in design and functionality, and the introduction of sophisticated hybrid models. The North American wall bed market presents a compelling investment opportunity for companies capable of capitalizing on these trends and addressing evolving consumer needs.

North America Wall Beds Market Company Market Share

North America Wall Beds Market: A Comprehensive Analysis (2019-2033)

This dynamic report provides a thorough examination of the North America wall beds market, offering invaluable insights for businesses, investors, and industry stakeholders. We delve into market size, segmentation, competitive landscape, key trends, and future projections, covering the period from 2019 to 2033. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence and strategic recommendations. The estimated market value in 2025 is xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

North America Wall Beds Market Structure & Competitive Landscape

The North America wall beds market exhibits a moderately fragmented structure, with several key players and numerous smaller regional manufacturers competing for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a moderate level of competition. Innovation plays a crucial role, with companies continuously developing new designs, materials, and functionalities to cater to evolving consumer preferences and enhance space-saving solutions. Regulatory impacts, particularly concerning safety and environmental standards, influence manufacturing practices and product design. While there are some substitute products, such as traditional beds and sofa beds, wall beds provide a unique combination of space-saving functionality and aesthetic appeal, thus maintaining their competitive position. End-user segmentation primarily includes residential customers seeking space optimization solutions, and commercial entities like hotels and studios aiming for compact and efficient furniture.

Key Market Dynamics:

- Market Concentration: Moderate fragmentation with CR4 at xx%.

- Innovation Drivers: Continuous improvement in design, materials, and automated mechanisms.

- Regulatory Impacts: Adherence to safety and environmental regulations.

- Product Substitutes: Traditional beds, sofa beds, but with limited space-saving capabilities.

- End-User Segmentation: Residential, Hotels, Studios, and other commercial applications.

- M&A Trends: A moderate volume of mergers and acquisitions, with larger players strategically acquiring smaller companies to expand market presence (e.g., SICO's acquisition of Bush Industries). The number of M&A deals between 2019 and 2024 is estimated at xx.

North America Wall Beds Market Market Trends & Opportunities

The North America wall beds market is experiencing robust growth driven by several key factors. The increasing popularity of compact living spaces in urban areas and the rising demand for space-saving furniture are significant drivers. Technological advancements in materials, mechanisms, and automation are leading to more efficient and user-friendly wall beds. Consumer preferences are shifting towards customizable and aesthetically pleasing options, creating opportunities for innovative product designs. Competitive dynamics are shaped by product differentiation, pricing strategies, and brand building. The market size has grown significantly over the past few years, with a market size of xx Million in 2024. The market is expected to continue its growth trajectory, driven by favorable economic conditions, increasing urbanization, and rising consumer disposable incomes. The market penetration rate for wall beds in the residential sector is estimated at xx% in 2025, with significant growth potential in other segments such as the hospitality sector.

Dominant Markets & Segments in North America Wall Beds Market

The North American wall beds market is dominated by the United States, with Canada representing a significant secondary market. Within the market segments:

- By Material: Wood remains the most popular material, accounting for xx% of the market share in 2025, followed by Metal (xx%) and Other Materials (xx%). The preference for wood stems from its aesthetic appeal and durability.

- By Capacity: Queen size beds currently hold the largest market share (xx%), followed by King size (xx%) and Other Sizes (xx%). This indicates a preference for standard bed sizes.

- By Operation: Manual wall beds constitute the majority market share in 2025 (xx%), but automatic (xx%) and hybrid (xx%) systems are witnessing rising adoption due to enhanced convenience.

- By Distribution Channel: Specialty stores continue to dominate sales (xx%), followed by online retailers (xx%) and multi-brand stores (xx%). The increasing prevalence of online shopping continues to drive growth in the online sales segment.

Key Growth Drivers by Segment:

- Wood Material Segment: Appeal for aesthetics and durability.

- Queen Size Segment: Preference for common bed size.

- Automatic Operation Segment: Enhanced convenience and ease of use.

- Specialty Store Segment: High customer engagement and product selection.

North America Wall Beds Market Product Analysis

Recent product innovations focus on enhancing functionality, aesthetics, and user experience. Advanced mechanisms, improved storage solutions integrated into the bed design, and a wider variety of finishes and styles are key advancements. The market is witnessing a trend towards sleek, modern designs that seamlessly integrate into contemporary interiors, offering competitive advantages to manufacturers focusing on sophisticated aesthetics and functionality. The market fit for innovative wall beds is strong, driven by both practical needs (space optimization) and aesthetic desires (stylish furniture).

Key Drivers, Barriers & Challenges in North America Wall Beds Market

Key Drivers:

- Rising urbanization and the demand for space-saving furniture in urban apartments and condos.

- Increasing disposable incomes and a willingness to invest in high-quality, space-efficient furniture.

- Technological advancements leading to more efficient and user-friendly wall bed mechanisms.

Key Challenges:

- Supply chain disruptions causing material cost fluctuations and production delays.

- Competition from other space-saving furniture options like sofa beds or convertible furniture.

- Maintaining consistent quality while managing production costs and ensuring affordable pricing. Estimates suggest that supply chain issues have contributed to a xx% increase in production costs in 2024.

Growth Drivers in the North America Wall Beds Market Market

The market is experiencing considerable growth due to increasing urbanization, leading to a higher demand for space-saving furniture in urban areas. Advances in technology such as automated mechanisms and improved designs enhance the functionality and appeal of wall beds. Furthermore, evolving consumer preferences drive demand for sophisticated and customizable options.

Challenges Impacting North America Wall Beds Market Growth

Significant challenges include supply chain disruptions causing material cost increases and production delays. Also, intense competition from alternative space-saving solutions and the need for continuous product innovation to maintain market relevance are prominent obstacles to growth. Regulatory compliance and adherence to safety standards add to the complexity of operations.

Key Players Shaping the North America Wall Beds Market Market

- The Bedder Way Co

- Zoom Room Inc

- Murphy Wall Beds Hardware Inc

- Twin Cities Closet Company

- Bestar Modern Home and Office furniture

- Wall Beds Manufacturing

- B O F F Wall Beds

- SICO

- Wallbeds & Closets North West

- Wilding Wallbeds

Significant North America Wall Beds Market Industry Milestones

- January 2023: Bestar Modern Home and Office Furniture announced a private equity partnership with MB Capital, significantly boosting their expansion capabilities.

- March 2022: SICO and Office Furniture acquired Bush Industries, expanding their market reach and product portfolio.

Future Outlook for North America Wall Beds Market Market

The future of the North America wall beds market appears bright, driven by sustained urbanization trends, ongoing technological innovation, and the enduring appeal of space-saving furniture. Strategic opportunities lie in developing customized and technologically advanced products, expanding distribution channels, and targeting niche markets. The market's potential for growth remains substantial, particularly in the online sales segment and expanding product lines with multi-functional features.

North America Wall Beds Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

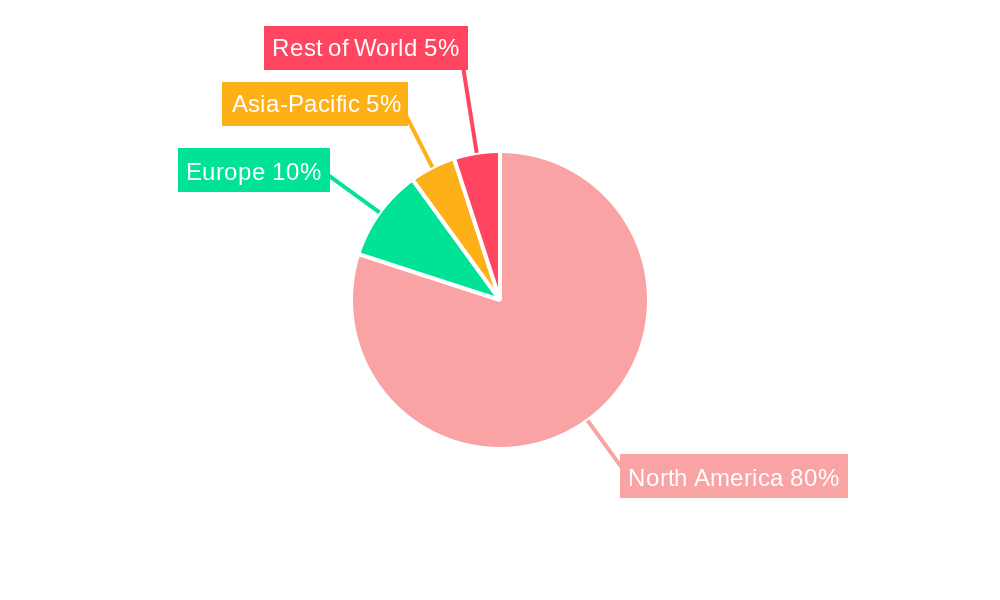

North America Wall Beds Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Wall Beds Market Regional Market Share

Geographic Coverage of North America Wall Beds Market

North America Wall Beds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Customizing of Wall Beds are Driving the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Population and Widespread Concept of Co-Living

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wall Beds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Bedder Way Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zoom Room Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Murphy Wall Beds Hardware Inc**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Twin Cities Closet Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bestar Modern Home and Office furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wall Beds Manufacturing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B O F F Wall Beds

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SICO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wallbeds & Closets North West

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wilding Wallbeds

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Bedder Way Co

List of Figures

- Figure 1: North America Wall Beds Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Wall Beds Market Share (%) by Company 2025

List of Tables

- Table 1: North America Wall Beds Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Wall Beds Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Wall Beds Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Wall Beds Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Wall Beds Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Wall Beds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Wall Beds Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Wall Beds Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Wall Beds Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Wall Beds Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Wall Beds Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Wall Beds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Wall Beds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Wall Beds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Wall Beds Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wall Beds Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Wall Beds Market?

Key companies in the market include The Bedder Way Co, Zoom Room Inc, Murphy Wall Beds Hardware Inc**List Not Exhaustive, Twin Cities Closet Company, Bestar Modern Home and Office furniture, Wall Beds Manufacturing, B O F F Wall Beds, SICO, Wallbeds & Closets North West, Wilding Wallbeds.

3. What are the main segments of the North America Wall Beds Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Customizing of Wall Beds are Driving the Market.

6. What are the notable trends driving market growth?

Rising Population and Widespread Concept of Co-Living.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

January 2023: Bestar Modern Home and Office Furniture announced a private equity partnership with MB Capital, marking a significant milestone in their business expansion efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wall Beds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wall Beds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wall Beds Market?

To stay informed about further developments, trends, and reports in the North America Wall Beds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence