Key Insights

Vietnam's Home Improvement Market is projected to experience substantial growth, fueled by strong economic expansion, rising disposable incomes, and an expanding middle class prioritizing residential enhancements. The market is estimated to reach $1522.6 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 2.39% from the base year 2025 through 2033. This steady upward trend is driven by the increasing demand for modern living spaces, a growing emphasis on energy-efficient and sustainable construction, and a surge in both new residential builds and renovation projects. The adoption of premium finishes and smart home technologies further enhances market value, complemented by government initiatives supporting urban development and housing upgrades.

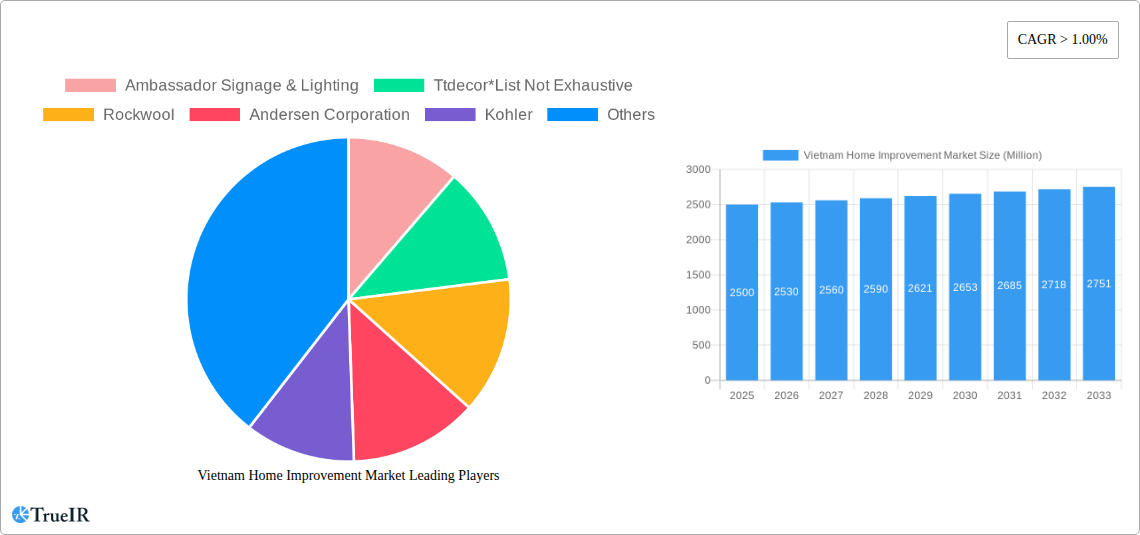

Vietnam Home Improvement Market Market Size (In Billion)

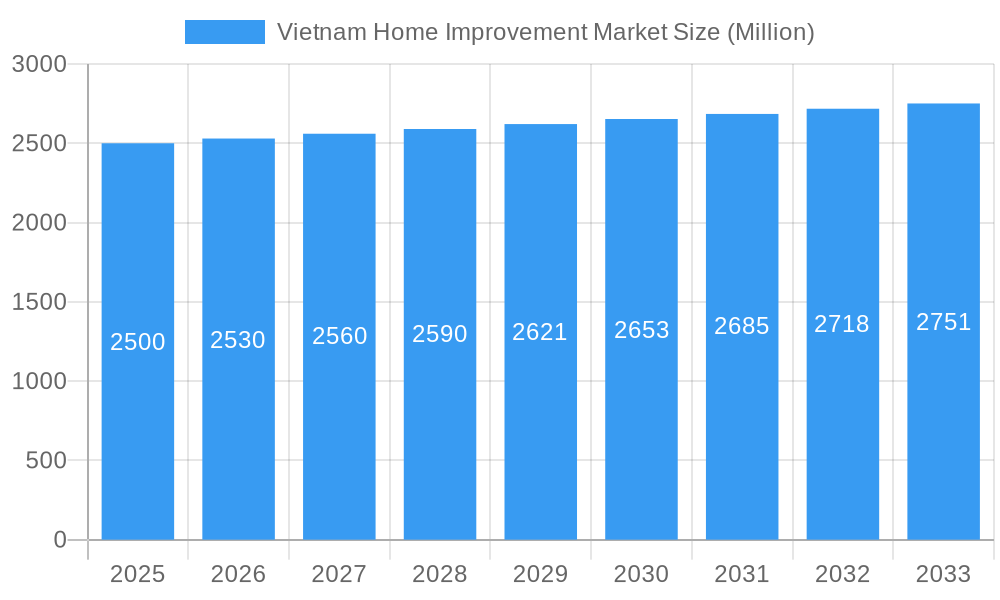

The market is segmented to serve both professional contractors and DIY consumers. Key segments include Kitchen and Bath Improvements, which significantly impact property value and lifestyle. System Upgrades, emphasizing energy efficiency and smart technologies, are gaining prominence. Exterior and Interior Replacements are vital for maintenance, aesthetics, and value enhancement. Property Improvements, encompassing extensive renovations, cater to the demand for larger, more functional homes. While Disaster Repairs are reactive, their consistent occurrence highlights their importance. Leading companies such as Andersen Corporation, Kohler, and DuPont Building Innovations compete in this market, which is primarily concentrated within Vietnam.

Vietnam Home Improvement Market Company Market Share

Vietnam Home Improvement Market: Unlocking Growth and Innovation (2019–2033)

Gain unparalleled insights into the dynamic Vietnam Home Improvement Market with this comprehensive report. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis dives deep into market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, leading players, and future outlook. Essential for industry professionals, investors, and stakeholders seeking to capitalize on Vietnam's burgeoning home renovation and construction sector.

Vietnam Home Improvement Market Market Structure & Competitive Landscape

The Vietnam Home Improvement Market is characterized by a moderately fragmented structure, with a mix of established multinational corporations and a significant number of local players. Concentration ratios are estimated to be around 35-40% for the top 5-7 companies, indicating substantial competition but also room for niche players and new entrants. Innovation drivers are primarily fueled by increasing disposable incomes, a growing middle class demanding higher quality living spaces, and a rising awareness of energy efficiency and sustainable building materials. Regulatory impacts, while evolving, are generally supportive of market growth, with policies aimed at modernizing construction standards and encouraging foreign investment. Product substitutes are present across various categories, from different types of paints and coatings to alternative flooring materials, forcing companies to focus on quality, design, and branding. End-user segmentation reveals a strong demand from both individual homeowners (DIY segment) and professional contractors and developers (DIFM segment). Mergers and acquisitions (M&A) trends are nascent but expected to gain traction as larger players seek to consolidate market share and expand their product portfolios. We anticipate approximately 10-15 significant M&A activities within the forecast period, driven by strategic expansion and market consolidation.

Vietnam Home Improvement Market Market Trends & Opportunities

The Vietnam Home Improvement Market is poised for robust expansion, driven by a confluence of economic development, shifting consumer preferences, and technological advancements. The market size is projected to grow from an estimated $25,000 Million in the base year 2025 to over $60,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12-15%. This impressive growth is underpinned by a burgeoning middle class with increasing disposable incomes, leading to a greater willingness to invest in upgrading and renovating their homes. The increasing urbanization trend, with a significant portion of the population migrating to cities, fuels demand for new housing and subsequently, home improvement services and products.

Technological shifts are playing a pivotal role in shaping the market. The adoption of smart home technologies, energy-efficient appliances, and sustainable building materials is on the rise. Consumers are increasingly seeking solutions that offer convenience, comfort, and cost savings in the long run. This translates into demand for products like advanced insulation materials, smart lighting systems, water-saving fixtures, and durable, low-maintenance finishes. Online channels are emerging as a significant retail avenue, offering greater accessibility to a wider range of products and brands, particularly for the DIY segment. The rise of e-commerce platforms and dedicated home improvement online stores is enhancing market penetration rates, making renovations more accessible to a broader consumer base.

Consumer preferences are evolving from basic functionality to aesthetic appeal and personalized living spaces. There is a growing demand for customized solutions, modern design aesthetics, and high-quality finishes. This shift is being influenced by exposure to global trends through media and social platforms. Furthermore, a growing awareness of environmental sustainability is driving the demand for eco-friendly products and practices, presenting a significant opportunity for companies offering green building solutions. The DIFM segment, encompassing contractors and developers, is benefiting from the government's focus on urban development and infrastructure projects, which in turn stimulates demand for construction and renovation materials. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Strategic partnerships, product diversification, and enhanced customer service are becoming crucial for sustained success. The market penetration rate for organized home improvement retail is expected to rise from an estimated 45% in 2025 to over 65% by 2033, indicating a significant shift towards professionalized retail and service offerings.

Dominant Markets & Segments in Vietnam Home Improvement Market

The Vietnam Home Improvement Market exhibits distinct patterns of dominance across various segments, reflecting the country's unique development trajectory and consumer needs.

Dominant Regions and Countries

While the entire nation is experiencing growth, the Southern region, particularly Ho Chi Minh City and surrounding provinces, stands out as the dominant geographical market. This dominance is driven by:

- Highest Disposable Income: Southern Vietnam boasts the highest concentration of high-income households and a robust urban economy, leading to greater spending power on home improvements.

- Rapid Urbanization and New Housing Construction: Continuous influx of population into urban centers necessitates new housing, which subsequently drives demand for renovations and upgrades.

- Foreign Investment and Expatriate Population: A significant presence of foreign companies and expatriates leads to a demand for international-standard housing and renovation services.

- Established Retail Infrastructure: The region possesses a more developed retail network, including large format home improvement stores and a strong e-commerce presence, facilitating easier access to products.

Dominant Segments by Project Type

DIFM (Do It For Me) Segment: Currently, the DIFM segment holds a larger market share, estimated at around 60-65% of the total market value in the base year 2025. This is primarily due to:

- Complex Projects: Larger renovation projects, structural changes, and new additions often require professional expertise and labor.

- Time Constraints: Busy urban professionals prefer to outsource renovation work to save time and effort.

- Availability of Skilled Labor: While quality varies, a growing pool of contractors and skilled tradespeople caters to this demand.

- Focus on Quality and Durability: For significant investments, homeowners often rely on professionals to ensure the quality and longevity of the work.

DIY (Do It Yourself) Segment: While smaller, the DIY segment is experiencing rapid growth, projected to outpace the DIFM segment in terms of percentage growth. Key growth drivers include:

- Increasing Accessibility of Information: Online tutorials, DIY blogs, and social media platforms provide ample guidance for smaller projects.

- Cost Savings: DIY appeals to budget-conscious consumers looking to reduce labor costs.

- Growing Trend of Personalization: Many homeowners enjoy the creative aspect of personalizing their living spaces.

- Availability of Ready-to-Install Products: Many home improvement products are now designed for easier installation by consumers.

Dominant Segments by Type of Improvement

Kitchen Improvement & Additions: This segment is a significant contributor, estimated to account for 20-25% of the market.

- High Impact on Home Value: Kitchen renovations are known to significantly increase a property's resale value.

- Modern Living Standards: As families spend more time at home, the kitchen is becoming a central hub, leading to demand for functional and aesthetically pleasing upgrades.

- Technological Integration: Demand for modern appliances, modular cabinetry, and smart kitchen features is growing.

Bath Improvement & Additions: Following closely, this segment represents approximately 15-20% of the market.

- Focus on Comfort and Hygiene: Consumers are investing in creating more relaxing and hygienic bathroom spaces.

- Upgrades for Aging Properties: Many older homes require modern plumbing and fixtures, driving demand for bath renovations.

- Water-Saving Technologies: Growing environmental consciousness leads to demand for efficient fixtures.

Interior Replacements: This broad category, encompassing flooring, painting, and fixtures, holds a substantial share of the market, estimated at 25-30%.

- Aesthetic Updates: Consumers frequently update interior finishes to keep pace with design trends.

- Maintenance and Repair: Wear and tear necessitate regular replacement of interior elements.

- Demand for Durable Materials: Increasing interest in long-lasting and easy-to-maintain materials.

System Upgrades: This segment, including electrical, plumbing, and HVAC upgrades, is crucial for property functionality and longevity. It accounts for approximately 10-15% of the market.

- Energy Efficiency: Consumers are increasingly investing in upgrades that reduce energy consumption.

- Safety and Reliability: Older systems often require upgrades for safety and to prevent failures.

Exterior Replacements & Property Improvements: These segments, including roofing, windows, doors, and landscaping, collectively represent around 10-15% of the market.

- Durability and Protection: Focus on materials that can withstand Vietnam's climate.

- Curb Appeal: Homeowners are investing in enhancing the external appearance of their properties.

Disaster Repairs & Other Room Additions & Alterations: These segments are more opportunistic but significant, accounting for the remaining 5-10%.

- Climate Resilience: Demand for repairs and upgrades following natural events like storms and floods.

- Growing Family Needs: Homeowners are creating additional living spaces to accommodate growing families or changing lifestyle needs.

Vietnam Home Improvement Market Product Analysis

The Vietnam Home Improvement Market is experiencing a surge in product innovation focused on enhanced functionality, aesthetic appeal, and sustainability. Key advancements include the introduction of smart home integration in lighting and security systems, offering remote control and automation for increased convenience. Advanced material science is yielding more durable, eco-friendly paints and coatings with improved air quality certifications. Modular and customizable cabinetry and fixtures are gaining traction, allowing homeowners to personalize their kitchens and bathrooms with greater ease. The market is also seeing a rise in energy-efficient appliances and building envelopes, driven by growing environmental awareness and rising utility costs. Competitive advantages are increasingly tied to a combination of high-quality products, innovative features, and strong brand reputation.

Key Drivers, Barriers & Challenges in Vietnam Home Improvement Market

Key Drivers:

- Economic Growth & Rising Incomes: Increasing disposable incomes fuel consumer spending on home upgrades.

- Urbanization: Migration to cities drives demand for new housing and subsequent renovations.

- Growing Middle Class: A larger demographic seeks improved living standards and aesthetic enhancements.

- Government Support for Urban Development: Infrastructure projects stimulate construction and renovation activities.

- Technological Advancements: Introduction of smart home solutions, energy-efficient products, and innovative materials.

Barriers & Challenges:

- Supply Chain Disruptions: Global and local supply chain issues can impact material availability and costs.

- Skilled Labor Shortages: A lack of sufficiently skilled and trained tradespeople can lead to project delays and quality concerns.

- Regulatory Complexity: Navigating building codes and permit processes can be challenging for both consumers and businesses.

- Informal Sector Dominance: A significant portion of the market operates informally, making it difficult to track and regulate.

- Price Sensitivity: A segment of the consumer base remains highly price-sensitive, impacting the adoption of premium products.

- Economic Uncertainty: Fluctuations in the global economy can affect consumer confidence and spending on non-essential home improvements.

Growth Drivers in the Vietnam Home Improvement Market Market

Key growth drivers in the Vietnam Home Improvement Market are multifaceted, stemming from robust economic development and evolving consumer aspirations. Increasing disposable incomes and the expansion of the middle class are paramount, enabling more households to invest in enhancing their living spaces. Rapid urbanization continues to fuel demand for new construction and subsequent renovations. Government initiatives focusing on urban modernization and infrastructure development also play a crucial role by stimulating overall construction activity. Furthermore, the growing awareness and adoption of energy-efficient technologies and sustainable building materials present a significant growth avenue, driven by both environmental concerns and the desire for long-term cost savings. The increasing influence of digital platforms and e-commerce is democratizing access to home improvement products and ideas, further propelling market growth.

Challenges Impacting Vietnam Home Improvement Market Growth

Several challenges significantly impact the growth trajectory of the Vietnam Home Improvement Market. Supply chain vulnerabilities, exacerbated by global events, can lead to material shortages and price volatility, affecting project timelines and budgets. The shortage of skilled labor remains a persistent hurdle, leading to potential quality compromises and increased labor costs. Navigating complex and evolving regulatory frameworks for construction and renovations can be a deterrent for both consumers and businesses. The prevalence of the informal sector complicates market standardization and consumer protection efforts. Moreover, price sensitivity among a considerable consumer segment can limit the adoption of premium and innovative products, requiring a careful balance between value and cost. Economic uncertainty and potential downturns can also dampen consumer confidence, leading to postponed or scaled-back renovation projects.

Key Players Shaping the Vietnam Home Improvement Market Market

- Ambassador Signage & Lighting

- Ttdecor

- Rockwool

- Andersen Corporation

- Kohler

- Kaze Interior Design Studio

- DuPont Building Innovations

- Truong Thanh

- 3M Vietnam Co Ltd

- Luca Interior Design Company Limited

- Innoci Viet Nam Co Ltd

- Caeser

Significant Vietnam Home Improvement Market Industry Milestones

- 2019: Increased government focus on sustainable building practices, leading to initial incentives for green construction materials.

- 2020 (Early): Rise in home renovation projects as lockdowns increased focus on living spaces.

- 2020 (Late): Initial disruptions in global supply chains impacting import of certain construction materials.

- 2021: Growth in online home decor and DIY product sales as e-commerce penetration deepened.

- 2022: Launch of several new showrooms by international brands catering to the premium home improvement segment.

- 2023: Increased investment in smart home technology solutions by domestic and international companies.

- 2024 (Early): Announcement of new urban development plans by the government, signaling future construction and renovation opportunities.

- 2024 (Mid): Growing consumer demand for personalized interior design services and modular furniture.

Future Outlook for Vietnam Home Improvement Market Market

The future outlook for the Vietnam Home Improvement Market is exceptionally bright, driven by sustained economic growth and a rising middle class with increasing aspirations for enhanced living standards. Strategic opportunities lie in capitalizing on the growing demand for sustainable and energy-efficient solutions, as well as the integration of smart home technologies. The DIFM segment will continue to dominate for complex projects, while the DIY segment offers significant growth potential with the proliferation of online resources and simplified product offerings. Companies that prioritize product innovation, quality assurance, and customer-centric service will be best positioned to thrive. Continued government support for urbanization and a focus on modernizing building standards will provide a fertile ground for market expansion, with an estimated market size projected to reach $60,000 Million by 2033.

Vietnam Home Improvement Market Segmentation

-

1. Project

- 1.1. DIY

- 1.2. DIFM

-

2. Type

- 2.1. Kitchen Improvement & Additions

- 2.2. Bath Improvement & Additions

- 2.3. System Upgrades

- 2.4. Exterior Replacements

- 2.5. Interior Replacements

- 2.6. Property Improvements

- 2.7. Disaster Repairs

- 2.8. Other Room Additions & Alterations

Vietnam Home Improvement Market Segmentation By Geography

- 1. Vietnam

Vietnam Home Improvement Market Regional Market Share

Geographic Coverage of Vietnam Home Improvement Market

Vietnam Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure

- 3.3. Market Restrains

- 3.3.1. Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Project

- 5.1.1. DIY

- 5.1.2. DIFM

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Kitchen Improvement & Additions

- 5.2.2. Bath Improvement & Additions

- 5.2.3. System Upgrades

- 5.2.4. Exterior Replacements

- 5.2.5. Interior Replacements

- 5.2.6. Property Improvements

- 5.2.7. Disaster Repairs

- 5.2.8. Other Room Additions & Alterations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Project

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ambassador Signage & Lighting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ttdecor*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rockwool

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Andersen Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kohler

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kaze Interior Design Studio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DuPont Building Innovations

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Truong Thanh

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 3M Vietnam Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luca Interior Design Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Innoci Viet Nam Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Caeser

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Ambassador Signage & Lighting

List of Figures

- Figure 1: Vietnam Home Improvement Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Vietnam Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Home Improvement Market Revenue million Forecast, by Project 2020 & 2033

- Table 2: Vietnam Home Improvement Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Vietnam Home Improvement Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Home Improvement Market Revenue million Forecast, by Project 2020 & 2033

- Table 5: Vietnam Home Improvement Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Vietnam Home Improvement Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Home Improvement Market?

The projected CAGR is approximately 2.39%.

2. Which companies are prominent players in the Vietnam Home Improvement Market?

Key companies in the market include Ambassador Signage & Lighting, Ttdecor*List Not Exhaustive, Rockwool, Andersen Corporation, Kohler, Kaze Interior Design Studio, DuPont Building Innovations, Truong Thanh, 3M Vietnam Co Ltd, Luca Interior Design Company Limited, Innoci Viet Nam Co Ltd, Caeser.

3. What are the main segments of the Vietnam Home Improvement Market?

The market segments include Project, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1522.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Home Improvement Market?

To stay informed about further developments, trends, and reports in the Vietnam Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence