Key Insights

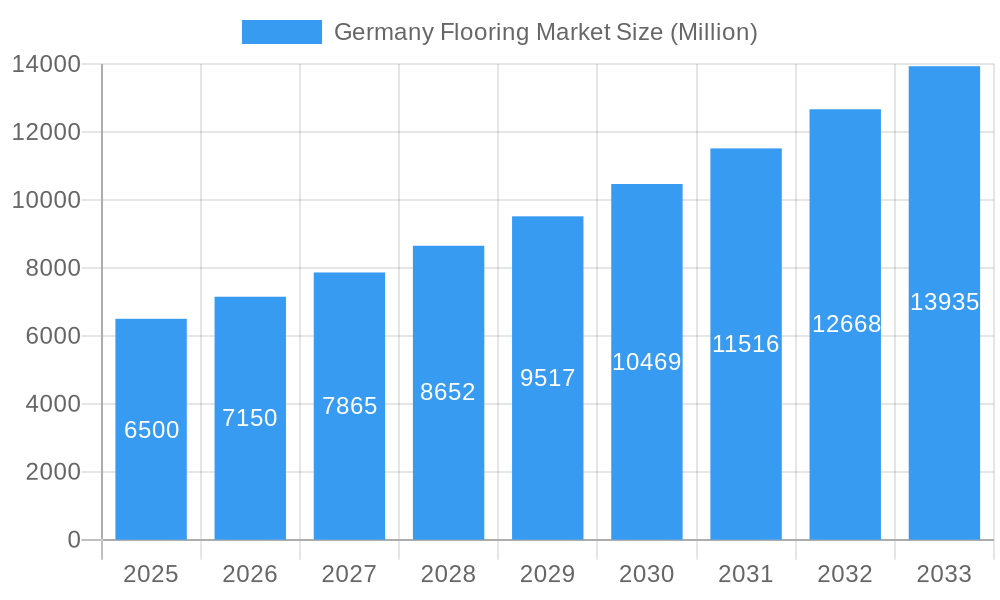

The German flooring market is projected for significant expansion, with an estimated market size of 16.3 billion by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 1.9% from 2019 to 2033. Key growth drivers include robust demand from both residential and commercial construction sectors, a rising preference for aesthetically pleasing and durable flooring, and increasing consumer awareness of sustainable and eco-friendly materials. Government initiatives supporting energy-efficient buildings and urban regeneration also contribute to market stimulation. Luxury Vinyl Tiles (LVT) and Vinyl Sheets are leading segments due to their versatility, cost-effectiveness, and ease of maintenance. Interior design trends and home improvement initiatives, amplified by digital media, are further influencing consumer choices and driving market growth.

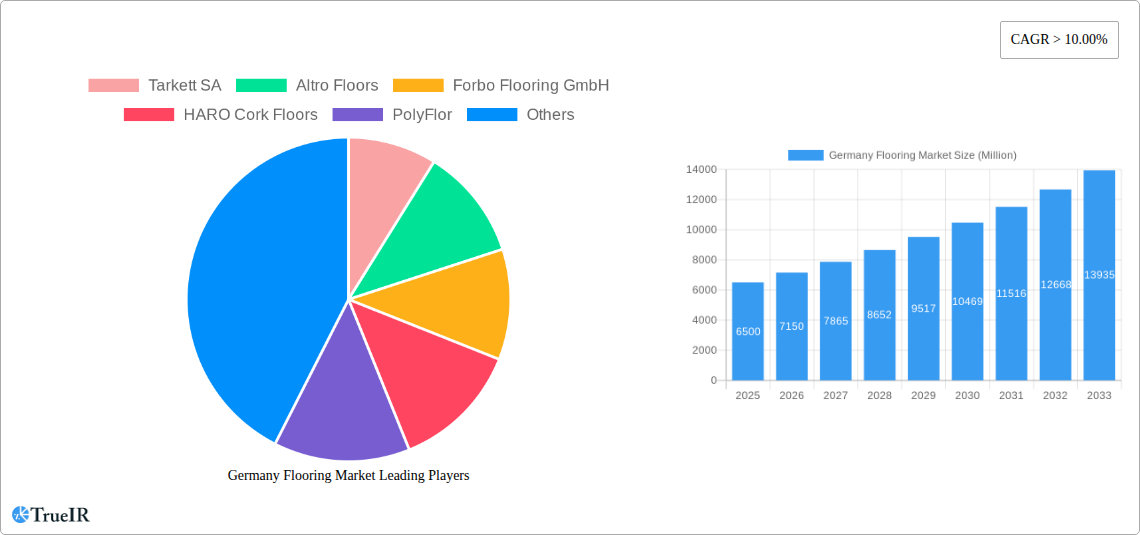

Germany Flooring Market Market Size (In Billion)

The competitive environment features major global players and domestic manufacturers, including Tarkett SA, Forbo Flooring GmbH, and Gerflor, alongside specialized providers like Altro Floors and Nora Systems GmbH. These companies are prioritizing product innovation, focusing on sustainable materials, enhanced performance, and diverse design offerings. Distribution is shifting towards online channels, complementing traditional retail. Potential challenges include raw material price volatility, intensified competition, and evolving environmental regulations. However, strong market fundamentals and continuous innovation are expected to ensure sustained growth.

Germany Flooring Market Company Market Share

This comprehensive report offers an SEO-optimized analysis of the German flooring market, targeting industry professionals, investors, and decision-makers. It provides critical insights and strategic forecasts for the period 2019-2033, with a base year of 2025.

Germany Flooring Market Market Structure & Competitive Landscape

The Germany flooring market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized domestic players vying for market share. Innovation is a key differentiator, driven by evolving consumer preferences for sustainable, durable, and aesthetically pleasing flooring solutions. Regulatory impacts, particularly those concerning environmental standards and building codes, significantly influence product development and material choices. Product substitutes, such as advancements in natural stone and concrete finishes, present ongoing challenges, necessitating continuous product innovation and differentiation from established manufacturers.

The competitive landscape is shaped by:

- Key Players: Tarkett SA, Altro Floors, Forbo Flooring GmbH, HARO Cork Floors, PolyFlor, mbb-Ihr Bodenausstatter GmbH, Milliken Flooring, Nora Systems GmbH, Amtico International Germany, Gerflor.

- Mergers & Acquisitions (M&A): A notable trend in M&A activity is driven by the pursuit of enhanced market reach, technological integration, and portfolio diversification. For instance, the acquisition of Zebra-chem GmbH by Milliken signifies a strategic move to strengthen its chemical masterbatch capabilities, directly impacting flooring material innovation.

- End-User Segmentation: The market is broadly segmented into Residential and Commercial end-users, each with distinct demands and purchasing behaviors.

- Product Innovation: Continuous investment in R&D to develop eco-friendly materials, enhanced performance characteristics (e.g., acoustic properties, slip resistance), and design versatility is crucial for maintaining a competitive edge.

Germany Flooring Market Market Trends & Opportunities

The Germany flooring market is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period of 2025-2033. This expansion is fueled by a confluence of factors including a robust construction sector, increasing renovation activities, and a heightened consumer awareness of sustainable building materials. Technological advancements are transforming the market, with innovations in Luxury Vinyl Tile (LVT) and sustainable linoleum formulations leading the charge. LVT, in particular, continues to gain traction due to its durability, design flexibility, and ease of installation, making it a preferred choice for both residential and commercial applications. The increasing emphasis on eco-friendly construction and renovation projects presents a significant opportunity for manufacturers offering products with recycled content and low VOC emissions.

Consumer preferences are shifting towards flooring solutions that are not only aesthetically appealing but also contribute to healthier indoor environments and align with sustainable living principles. This trend is driving demand for natural materials like linoleum and cork, as well as for recycled and recyclable vinyl products. The rise of e-commerce platforms is also reshaping distribution channels, offering greater accessibility and convenience for consumers, while simultaneously challenging traditional brick-and-mortar retailers to adapt their strategies. The commercial segment, encompassing offices, retail spaces, healthcare facilities, and educational institutions, remains a primary driver of market growth, driven by new construction projects and extensive refurbishment initiatives aimed at modernizing existing infrastructure and improving workplace environments. The strategic integration of smart technologies into flooring solutions, such as those offering enhanced durability and maintenance, further presents emerging opportunities.

Dominant Markets & Segments in Germany Flooring Market

The Germany flooring market is characterized by the dominance of specific product types, end-user segments, and distribution channels, each contributing significantly to overall market dynamics. Luxury Vinyl Tile (LVT) stands out as a leading product segment, driven by its versatility, aesthetic appeal, and robust performance characteristics. Its ability to mimic natural materials like wood and stone at a more accessible price point, coupled with its inherent durability and water resistance, makes it a popular choice across various applications. The growing demand for aesthetically pleasing and low-maintenance flooring in both residential and commercial spaces directly fuels LVT's market penetration.

Product Type Dominance:

- LVT: Continues to lead due to its design flexibility, durability, and cost-effectiveness, catering to both residential and commercial needs.

- Vinyl Sheets: Remains a strong contender, particularly in high-traffic commercial areas and healthcare settings where hygiene and ease of cleaning are paramount.

- Linoleum: Experiences resurgence driven by its eco-friendly credentials, natural composition, and inherent antibacterial properties, appealing to the sustainability-conscious market.

- Rubber Flooring: Dominates niche applications requiring high impact absorption and safety, such as gyms, playgrounds, and industrial environments.

End User Dominance:

- Commercial: This segment represents a significant portion of the market, propelled by ongoing infrastructure development, office renovations, retail space upgrades, and the expansion of healthcare and educational facilities. The demand for durable, easy-to-maintain, and aesthetically pleasing flooring solutions in these environments is a key growth driver.

- Residential: While a substantial segment, its growth is influenced by new home construction, renovation trends, and disposable income levels. The increasing preference for durable, stylish, and eco-friendly options in homes is a notable trend.

Distribution Channel Dominance:

- Offline Stores: Traditional flooring retailers and specialized showrooms continue to hold a dominant position, offering expert advice, product visualization, and installation services, which are crucial for many consumers.

- Online Stores: While growing rapidly, online channels are increasingly becoming supplementary for product research and smaller purchases, with many consumers preferring to finalize decisions after physical inspection and consultation.

Germany Flooring Market Product Analysis

The Germany flooring market is witnessing a surge in product innovations driven by sustainability and enhanced performance. Luxury Vinyl Tile (LVT) continues to lead, offering advanced designs that closely replicate natural materials while providing superior durability and water resistance. Innovations in linoleum focus on bio-based formulations and enhanced resilience, catering to the growing demand for eco-friendly solutions. Fiberglass flooring offers enhanced dimensional stability and moisture resistance, making it ideal for demanding environments. These product advancements are crucial for meeting stringent environmental regulations and evolving consumer expectations for healthier, more sustainable, and aesthetically versatile flooring options.

Key Drivers, Barriers & Challenges in Germany Flooring Market

Key Drivers: The German flooring market is propelled by robust economic growth, sustained demand in the construction and renovation sectors, and a strong consumer preference for sustainable and high-performance flooring solutions. Government initiatives promoting energy-efficient buildings and increasing investment in infrastructure development further stimulate market expansion. Technological advancements leading to innovative materials like advanced LVT and eco-friendly linoleum also act as significant growth catalysts.

Barriers & Challenges: Despite the positive outlook, the market faces challenges such as fluctuating raw material prices, which can impact manufacturing costs and pricing strategies. Intense competition among numerous domestic and international players leads to pricing pressures and necessitates continuous product differentiation. Furthermore, evolving regulatory landscapes concerning VOC emissions and recycling mandates require manufacturers to adapt their product portfolios and manufacturing processes. Supply chain disruptions, as witnessed in recent global events, also pose a potential threat to market stability and timely product delivery.

Growth Drivers in the Germany Flooring Market Market

Key growth drivers in the Germany flooring market stem from a strong domestic economy supporting both new construction and extensive renovation projects. The escalating demand for sustainable building materials, driven by consumer consciousness and regulatory incentives for eco-friendly construction, is a major catalyst. Technological innovations, particularly in LVT and eco-friendly alternatives like linoleum, are creating new market opportunities by offering enhanced aesthetics and performance. Increased investment in commercial infrastructure, including offices, retail spaces, and public facilities, further fuels the demand for durable and aesthetically pleasing flooring solutions.

Challenges Impacting Germany Flooring Market Growth

The Germany flooring market faces several challenges that could impede its growth trajectory. Fluctuations in raw material costs, such as PVC and natural oils, can significantly impact profit margins and necessitate price adjustments, potentially affecting demand. Intensifying competition from both established players and emerging brands can lead to price wars and reduced market share for individual companies. Navigating complex and evolving environmental regulations regarding VOC emissions, recyclability, and waste management requires continuous adaptation of product formulations and manufacturing processes, incurring additional research and development costs. Supply chain disruptions, from global logistics to localized availability of components, can lead to production delays and impact delivery timelines, affecting customer satisfaction and market responsiveness.

Key Players Shaping the Germany Flooring Market Market

- Tarkett SA

- Altro Floors

- Forbo Flooring GmbH

- HARO Cork Floors

- PolyFlor

- mbb-Ihr Bodenausstatter GmbH

- Milliken Flooring

- Nora Systems GmbH

- Amtico International Germany

- Gerflor

Significant Germany Flooring Market Industry Milestones

- March 2021: Milliken & Company ('Milliken'), a globally diversified manufacturer with more than a century and a half of materials science expertise, formally acquired Zebra-chem GmbH (Zebra-chem), a global chemicals company known for its peroxide and blowing agent masterbatches. This acquisition enhances Milliken's capabilities in material innovation, potentially impacting the development of advanced flooring materials.

- May 2020: Interface's luxury vinyl tiles (LVTs) started being made with 39% pre-consumer recycled content. With this significant move, Interface expanded the use of recycled content across its product portfolio, furthering its Climate Take Back™ mission to reverse global warming. This initiative highlights the growing importance of sustainability and circular economy principles in the flooring industry.

Future Outlook for Germany Flooring Market Market

The future outlook for the Germany flooring market is overwhelmingly positive, driven by a sustained demand for high-quality, sustainable, and aesthetically versatile flooring solutions. Strategic opportunities lie in expanding product offerings with advanced eco-friendly materials, leveraging digital platforms for enhanced customer engagement and distribution, and focusing on product innovations that cater to niche applications within the commercial and residential sectors. The increasing emphasis on indoor air quality and healthy living environments will further boost demand for natural and low-VOC flooring options. Continued investment in R&D and strategic partnerships will be crucial for navigating market dynamics and capitalizing on emerging trends, ensuring robust growth and market leadership in the coming years.

Germany Flooring Market Segmentation

-

1. Product Type

- 1.1. LVT

- 1.2. Vinyl Sheets

- 1.3. Linoluem

- 1.4. Rubber

- 1.5. Fiberglass

- 1.6. Other Product Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

Germany Flooring Market Segmentation By Geography

- 1. Germany

Germany Flooring Market Regional Market Share

Geographic Coverage of Germany Flooring Market

Germany Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances

- 3.3. Market Restrains

- 3.3.1. High power consumption from smart home appliances; Limited spaces in households for appliances

- 3.4. Market Trends

- 3.4.1. Rapid Growth in the Construction Industry and Increasing Infrastructure Activities are the Key Factors for Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. LVT

- 5.1.2. Vinyl Sheets

- 5.1.3. Linoluem

- 5.1.4. Rubber

- 5.1.5. Fiberglass

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tarkett SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Altro Floors

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Forbo Flooring GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HARO Cork Floors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PolyFlor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 mbb-Ihr Bodenausstatter GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milliken Flooring

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nora Systems GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amtico International Germany*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gerflor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tarkett SA

List of Figures

- Figure 1: Germany Flooring Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Flooring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Germany Flooring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Germany Flooring Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Flooring Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Flooring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Germany Flooring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Germany Flooring Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Germany Flooring Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Flooring Market?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Germany Flooring Market?

Key companies in the market include Tarkett SA, Altro Floors, Forbo Flooring GmbH, HARO Cork Floors, PolyFlor, mbb-Ihr Bodenausstatter GmbH, Milliken Flooring, Nora Systems GmbH, Amtico International Germany*List Not Exhaustive, Gerflor.

3. What are the main segments of the Germany Flooring Market?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances.

6. What are the notable trends driving market growth?

Rapid Growth in the Construction Industry and Increasing Infrastructure Activities are the Key Factors for Growth.

7. Are there any restraints impacting market growth?

High power consumption from smart home appliances; Limited spaces in households for appliances.

8. Can you provide examples of recent developments in the market?

In March 2021, Milliken & Company ('Milliken'), a globally diversified manufacturer with more than a century and a half of materials science expertise, formally acquired Zebra-chem GmbH (Zebra-chem), a global chemicals company known for its peroxide and blowing agent masterbatches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Flooring Market?

To stay informed about further developments, trends, and reports in the Germany Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence