Key Insights

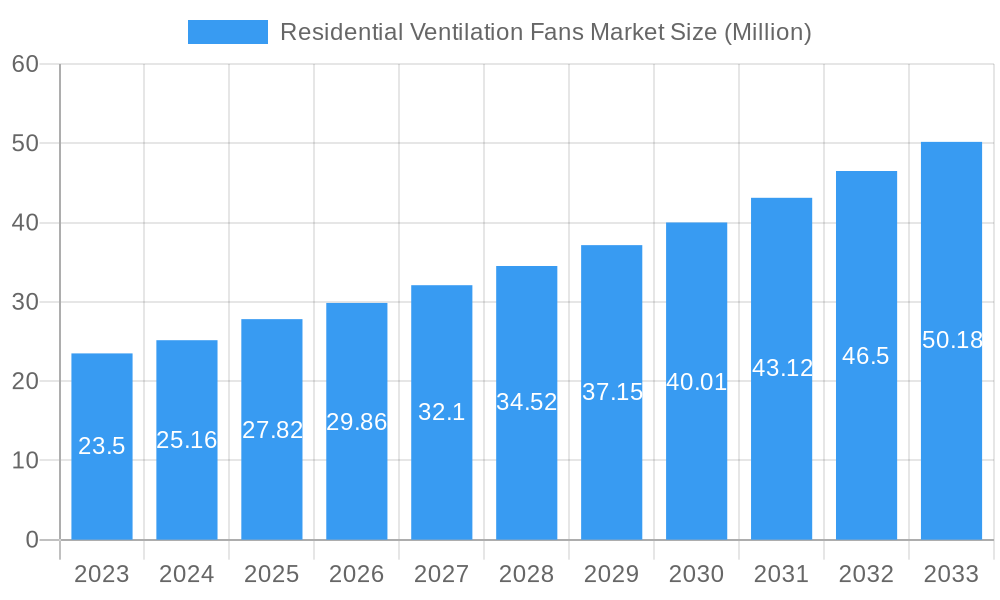

The global Residential Ventilation Fans Market is poised for robust growth, with a projected market size of USD 27.82 million and an impressive Compound Annual Growth Rate (CAGR) exceeding 7.00% through 2033. This expansion is primarily fueled by increasing awareness of indoor air quality (IAQ) and the associated health benefits of proper ventilation. Growing urbanization, coupled with a rising demand for energy-efficient solutions, is further accelerating market penetration. Furthermore, stringent government regulations promoting healthy living environments and energy conservation are acting as significant catalysts. The market is witnessing a notable shift towards advanced ventilation systems that offer superior filtration, humidity control, and energy recovery capabilities, catering to evolving consumer preferences for comfort and well-being in their homes.

Residential Ventilation Fans Market Market Size (In Million)

Key market drivers include the rising incidence of respiratory illnesses and allergies, which directly correlates with the need for enhanced indoor air purification. The ongoing trend of home renovations and new construction projects, particularly in emerging economies, presents substantial opportunities for ventilation system manufacturers. While the initial cost of advanced ventilation systems can be a restraining factor, the long-term energy savings and health benefits are increasingly outweighing this concern for homeowners. The market is segmented across product types like Exhaust Ventilation Systems, Supply Ventilation Systems, Balanced Ventilation Systems, and Energy Recovery Systems, with applications spanning both new decorations and renovations. Leading companies such as Panasonic, LG, Honeywell, and Daikin Industries are actively innovating and expanding their product portfolios to capture market share.

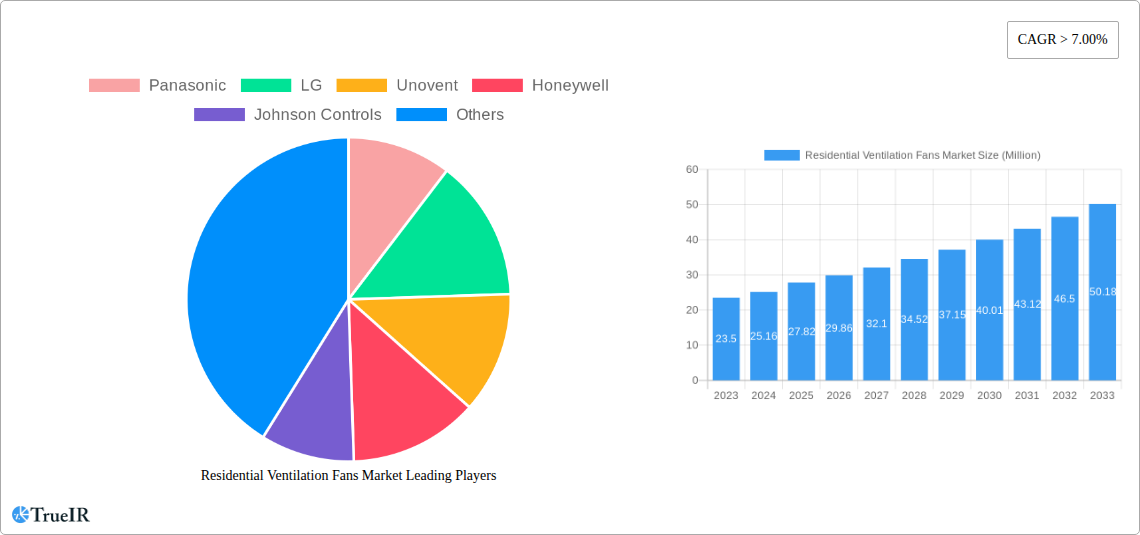

Residential Ventilation Fans Market Company Market Share

This comprehensive report delves into the dynamic Residential Ventilation Fans Market, offering deep insights into market structure, competitive landscape, prevailing trends, dominant segments, product innovations, growth drivers, challenges, and a detailed future outlook. Covering the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis is essential for stakeholders seeking to understand and capitalize on the evolving opportunities within the global residential ventilation sector.

Residential Ventilation Fans Market Market Structure & Competitive Landscape

The Residential Ventilation Fans Market is characterized by a moderately concentrated structure, with key players actively investing in product innovation and strategic partnerships to gain market share. Several factors drive this dynamic landscape, including increasing consumer awareness regarding indoor air quality (IAQ), stringent building codes mandating efficient ventilation, and the growing adoption of smart home technologies. The presence of established brands alongside emerging players fosters intense competition, pushing for advancements in energy efficiency, noise reduction, and integrated IAQ monitoring capabilities.

Key aspects of the market structure include:

- Innovation Drivers:

- Development of high-efficiency, low-noise fans.

- Integration of smart technology for automated control and IAQ monitoring.

- Focus on energy recovery systems to minimize HVAC load.

- Sustainable materials and manufacturing processes.

- Regulatory Impacts:

- Stricter building codes and energy efficiency standards (e.g., ASHRAE 62.2 in North America, EN 13779 in Europe).

- Government incentives for energy-efficient home upgrades.

- Product Substitutes:

- Natural ventilation (window opening) remains a basic substitute but offers limited control and IAQ benefits.

- Centralized HVAC systems with integrated ventilation.

- End-User Segmentation:

- New construction projects.

- Residential renovations and retrofits.

- M&A Trends:

- Consolidation among smaller manufacturers to achieve economies of scale.

- Acquisitions by larger HVAC companies to expand their IAQ portfolios.

- Strategic partnerships for technology development and market access.

The market concentration is influenced by the significant R&D investments required for advanced ventilation solutions. While detailed quantitative data on concentration ratios are proprietary, the competitive landscape suggests that the top 5-7 players command a substantial portion of the market. The M&A activity, though not explicitly detailed in public domain, is anticipated to continue as companies seek to strengthen their product offerings and geographical reach.

Residential Ventilation Fans Market Market Trends & Opportunities

The global Residential Ventilation Fans Market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and increasing environmental consciousness. The market size is projected to reach an estimated $15,000 Million by 2033, experiencing a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year of 2025. This upward trajectory is underpinned by a heightened awareness among homeowners about the critical role of proper indoor air quality in maintaining health and well-being. The increasing prevalence of respiratory ailments, allergies, and the lingering effects of global health events have significantly amplified the demand for effective ventilation solutions.

Technological shifts are revolutionizing the ventilation fan market. The integration of smart technology, including IoT connectivity and AI-powered features, is a dominant trend. Consumers are increasingly seeking ventilation systems that can intelligently monitor and regulate air quality, adjust fan speeds based on occupancy and pollutant levels, and be controlled remotely via smartphone applications. This move towards smart homes enhances user convenience and optimizes energy consumption. Energy recovery ventilators (ERVs) and heat recovery ventilators (HRVs) are gaining significant traction. These systems pre-condition incoming fresh air using the energy from outgoing stale air, thereby reducing the load on heating and cooling systems and contributing to substantial energy savings. This not only appeals to environmentally conscious consumers but also addresses rising energy costs.

Consumer preferences are rapidly shifting towards quieter, more energy-efficient, and aesthetically pleasing ventilation solutions. Manufacturers are responding by developing innovative designs that minimize noise pollution and integrate seamlessly into home interiors. The demand for whisper-quiet operation is particularly strong in bedrooms and living areas. Furthermore, the growing trend of energy-efficient building practices and government mandates for improved IAQ in residential properties are creating a fertile ground for market expansion. Retrofitting older homes with modern ventilation systems presents a substantial opportunity, as many existing structures lack adequate ventilation, leading to issues like moisture buildup, mold growth, and poor IAQ.

Competitive dynamics are intensifying as both established players and new entrants strive to capture market share. Strategic collaborations and partnerships are becoming increasingly important for companies to leverage complementary technologies and expand their distribution networks. For instance, partnerships between ventilation manufacturers and smart home technology providers are becoming more common. The market penetration rate for advanced ventilation systems, particularly in developed economies, is still relatively low, indicating ample room for growth. The focus is shifting from basic exhaust functions to comprehensive IAQ management solutions, creating opportunities for companies that can offer integrated systems.

Dominant Markets & Segments in Residential Ventilation Fans Market

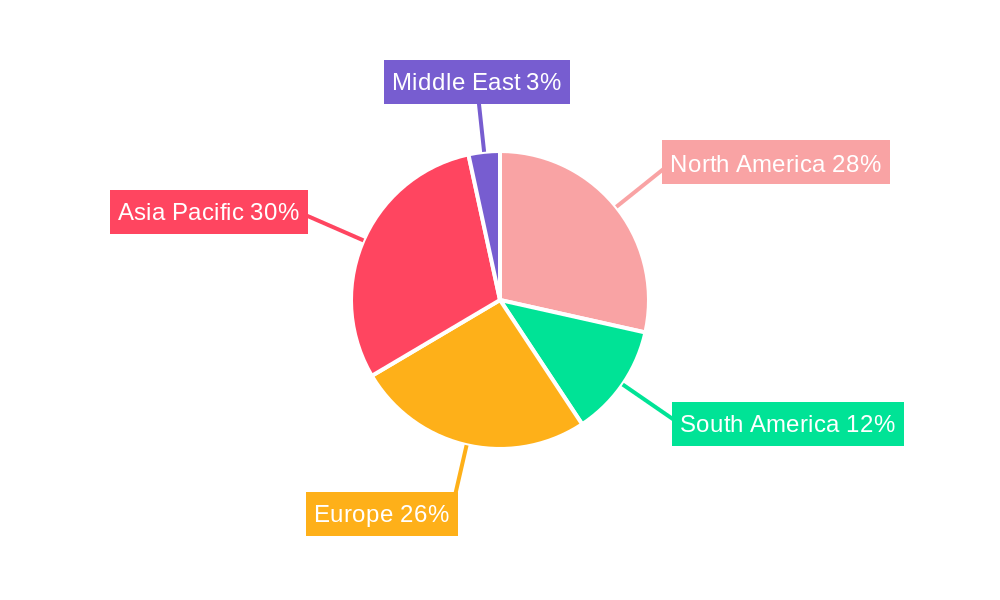

The global Residential Ventilation Fans Market exhibits distinct regional dominance and segment preferences, driven by socio-economic factors, climatic conditions, building codes, and consumer awareness. Asia Pacific currently stands as the dominant region, projected to continue its leadership through the forecast period. This dominance is fueled by rapid urbanization, a burgeoning middle class with increasing disposable incomes, and significant investments in residential construction. Countries like China and India are key contributors, owing to massive housing development projects and a growing emphasis on healthier living environments. The increasing adoption of building energy efficiency standards in these nations further propels the demand for advanced ventilation solutions.

North America and Europe also represent significant markets, characterized by a mature understanding of IAQ benefits and stringent regulatory frameworks. In North America, the United States leads in market size, driven by renovation activities and a strong consumer preference for smart home integration and energy efficiency. Canada also plays a vital role, with government initiatives promoting energy-efficient housing. Europe's market is fragmented, with countries like Germany, the UK, and France showing substantial demand. The strong focus on sustainability and stringent environmental regulations in these European nations are key drivers for the adoption of ventilation fans, particularly energy recovery systems.

Within product types, the Exhaust Ventilation System segment currently holds the largest market share and is expected to maintain its dominance throughout the forecast period. These systems are essential for removing moisture, odors, and pollutants from specific areas like kitchens and bathrooms, offering a fundamental solution for IAQ improvement. However, the Energy Recovery System segment is witnessing the fastest growth. This surge is attributable to the increasing emphasis on energy efficiency and cost savings. As energy prices fluctuate and environmental concerns intensify, homeowners are actively seeking solutions that reduce their carbon footprint and utility bills. ERVs and HRVs are at the forefront of this trend, providing a dual benefit of fresh air supply and energy conservation.

The Balanced Ventilation System segment is also projected for steady growth, offering a more comprehensive approach by providing both supply and exhaust functions, thereby ensuring controlled airflow and improved IAQ. The Supply Ventilation System segment, while important, is expected to grow at a more moderate pace compared to energy recovery and balanced systems.

In terms of application, New Decoration projects represent a significant driver for the market. Builders and homeowners are increasingly incorporating advanced ventilation systems from the initial stages of construction to ensure optimal IAQ and meet building code requirements. The Renovation segment is equally crucial, presenting substantial opportunities as older homes are retrofitted with modern amenities and energy-efficient solutions. The growing awareness about the health implications of poor IAQ in existing homes is a key catalyst for this segment's expansion.

Residential Ventilation Fans Market Product Analysis

Product innovation in the Residential Ventilation Fans Market is centered on enhancing efficiency, reducing noise, and integrating smart capabilities. Manufacturers are continuously developing fans with higher airflow rates and lower power consumption, thereby improving energy efficiency significantly. The introduction of brushless DC motors has been a game-changer, enabling quieter operation, longer lifespan, and precise speed control. Smart features, including Wi-Fi connectivity, app-based control, and integration with smart home ecosystems like Amazon Alexa and Google Assistant, are becoming standard offerings. These innovations allow for personalized ventilation schedules, real-time IAQ monitoring (e.g., VOCs, CO2, humidity), and automatic adjustments based on environmental conditions. Product differentiation also stems from advanced filtration technologies incorporated into some ventilation systems, offering an additional layer of protection against airborne pollutants.

Key Drivers, Barriers & Challenges in Residential Ventilation Fans Market

Key Drivers: The Residential Ventilation Fans Market is propelled by several critical factors:

- Growing Health and Wellness Concerns: Increased awareness of IAQ’s impact on respiratory health, allergies, and overall well-being is a primary driver.

- Stringent Building Codes and Regulations: Mandates for efficient ventilation in new constructions and renovations are creating sustained demand.

- Energy Efficiency Imperatives: The global push for reduced energy consumption and lower utility bills favors advanced, energy-saving ventilation solutions.

- Smart Home Adoption: The integration of IoT and AI in homes makes smart ventilation systems highly desirable for convenience and control.

Barriers & Challenges: Despite the positive outlook, the market faces several restraints:

- High Initial Cost: Advanced ventilation systems, particularly ERVs and smart fans, can have a higher upfront cost, posing a barrier for some consumers.

- Lack of Consumer Awareness: In some regions, awareness about the benefits of mechanical ventilation and IAQ is still developing, requiring more educational initiatives.

- Installation Complexity: Proper installation is crucial for optimal performance, and a shortage of skilled installers can hinder market growth.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components, affecting production timelines and pricing.

- Competitive Pressures: Intense competition among manufacturers can lead to price wars, potentially impacting profit margins.

Growth Drivers in the Residential Ventilation Fans Market Market

The growth drivers for the Residential Ventilation Fans Market are multifaceted, encompassing technological advancements, evolving economic landscapes, and supportive policy frameworks. Technologically, the continuous innovation in motor efficiency, noise reduction mechanisms, and the seamless integration of smart sensors for IAQ monitoring are key catalysts. Economically, rising disposable incomes in emerging economies, coupled with increasing property values and a greater willingness of homeowners to invest in home comfort and health, are significant growth enablers. Policy-driven factors, such as government incentives for green building certifications and stricter IAQ standards, are also playing a crucial role. For instance, the growing emphasis on reducing household energy consumption and improving indoor environments aligns perfectly with the benefits offered by advanced ventilation systems.

Challenges Impacting Residential Ventilation Fans Market Growth

Several challenges can impede the growth of the Residential Ventilation Fans Market. Regulatory complexities, while driving adoption in some regions, can also create hurdles if standards are inconsistent or difficult to comply with across different jurisdictions. Supply chain issues, as witnessed globally in recent years, can lead to material shortages, increased lead times, and price volatility for essential components, impacting manufacturing capacity and product availability. Competitive pressures, especially from lower-cost alternatives or less sophisticated solutions, can also challenge market growth by affecting pricing strategies and profit margins. Furthermore, a significant challenge lies in educating a broader consumer base about the long-term benefits of investing in proper ventilation, as the perceived immediate cost can sometimes overshadow the future health and energy savings.

Key Players Shaping the Residential Ventilation Fans Market Market

- Panasonic

- LG

- Unovent

- Honeywell

- Johnson Controls

- Lennox

- Carrier

- Atlantic

- Samsung

- Daikin Industries

Significant Residential Ventilation Fans Market Industry Milestones

- February 2023: enVerid Systems, the leader in sustainable indoor air quality (IAQ) solutions, expanded its partnership with SCG, a leading business conglomerate in the ASEAN region, signaling a growing focus on IAQ solutions in developing markets.

- January 2022: LG launched PuriCare AeroTower, which was widely recognized for being one of the most exciting products of CES 2022 on behalf of its home appliance offerings. Its newest ventilation system, which features LG's enhanced Artificial Intelligence Direct Drive, was also recognized by leading lifestyle publications, highlighting the growing consumer interest in advanced and stylish home appliances that contribute to IAQ.

Future Outlook for Residential Ventilation Fans Market Market

The future outlook for the Residential Ventilation Fans Market is exceptionally promising, driven by persistent and intensifying factors. The increasing global emphasis on sustainability and energy efficiency will continue to fuel demand for advanced ventilation technologies, particularly Energy Recovery Systems (ERS). As climate change concerns grow and energy costs remain a significant household expense, consumers and builders will increasingly opt for solutions that offer both fresh air and substantial energy savings. The burgeoning smart home ecosystem presents a significant growth catalyst, as integrated ventilation systems become a standard feature in connected living spaces, offering unparalleled convenience and control. Furthermore, evolving building codes worldwide, mandating higher standards for indoor air quality, will create a sustained demand for effective residential ventilation. The growing awareness of IAQ’s critical role in health and well-being, especially post-pandemic, will ensure that ventilation fans are no longer viewed as optional but as essential components of a healthy home. The market is set for continued innovation, with a focus on user-friendly interfaces, advanced IAQ sensing, and aesthetically pleasing designs that blend seamlessly into modern interiors, positioning the Residential Ventilation Fans Market for significant expansion in the coming years.

Residential Ventilation Fans Market Segmentation

-

1. Product Type

- 1.1. Exhaust Ventilation System

- 1.2. Supply Ventilation System

- 1.3. Balanced Ventilation System

- 1.4. Energy Recovery System

-

2. Application

- 2.1. New Decoration

- 2.2. Renovation

Residential Ventilation Fans Market Segmentation By Geography

- 1. North America

- 2. South America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East

Residential Ventilation Fans Market Regional Market Share

Geographic Coverage of Residential Ventilation Fans Market

Residential Ventilation Fans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Regulations and Standards in Some Regions

- 3.4. Market Trends

- 3.4.1. Innovations in Cost-Effective Energy Recovery Ventilation (ERV)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Exhaust Ventilation System

- 5.1.2. Supply Ventilation System

- 5.1.3. Balanced Ventilation System

- 5.1.4. Energy Recovery System

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. New Decoration

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Exhaust Ventilation System

- 6.1.2. Supply Ventilation System

- 6.1.3. Balanced Ventilation System

- 6.1.4. Energy Recovery System

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. New Decoration

- 6.2.2. Renovation

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Exhaust Ventilation System

- 7.1.2. Supply Ventilation System

- 7.1.3. Balanced Ventilation System

- 7.1.4. Energy Recovery System

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. New Decoration

- 7.2.2. Renovation

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Exhaust Ventilation System

- 8.1.2. Supply Ventilation System

- 8.1.3. Balanced Ventilation System

- 8.1.4. Energy Recovery System

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. New Decoration

- 8.2.2. Renovation

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Asia Pacific Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Exhaust Ventilation System

- 9.1.2. Supply Ventilation System

- 9.1.3. Balanced Ventilation System

- 9.1.4. Energy Recovery System

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. New Decoration

- 9.2.2. Renovation

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Residential Ventilation Fans Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Exhaust Ventilation System

- 10.1.2. Supply Ventilation System

- 10.1.3. Balanced Ventilation System

- 10.1.4. Energy Recovery System

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. New Decoration

- 10.2.2. Renovation

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unovent

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Controls

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lennox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carrier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlantic**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Daikin Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Residential Ventilation Fans Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Residential Ventilation Fans Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Residential Ventilation Fans Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Residential Ventilation Fans Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Residential Ventilation Fans Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Residential Ventilation Fans Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Residential Ventilation Fans Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Residential Ventilation Fans Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America Residential Ventilation Fans Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Residential Ventilation Fans Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America Residential Ventilation Fans Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America Residential Ventilation Fans Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Residential Ventilation Fans Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Residential Ventilation Fans Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Residential Ventilation Fans Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Residential Ventilation Fans Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Residential Ventilation Fans Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Residential Ventilation Fans Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Residential Ventilation Fans Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Residential Ventilation Fans Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Residential Ventilation Fans Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Residential Ventilation Fans Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Residential Ventilation Fans Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Residential Ventilation Fans Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Residential Ventilation Fans Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Residential Ventilation Fans Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East Residential Ventilation Fans Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Residential Ventilation Fans Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East Residential Ventilation Fans Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Residential Ventilation Fans Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Residential Ventilation Fans Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Residential Ventilation Fans Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Residential Ventilation Fans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Residential Ventilation Fans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Residential Ventilation Fans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Residential Ventilation Fans Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Residential Ventilation Fans Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Residential Ventilation Fans Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Residential Ventilation Fans Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Ventilation Fans Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Residential Ventilation Fans Market?

Key companies in the market include Panasonic, LG, Unovent, Honeywell, Johnson Controls, Lennox, Carrier, Atlantic**List Not Exhaustive, Samsung, Daikin Industries.

3. What are the main segments of the Residential Ventilation Fans Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes.

6. What are the notable trends driving market growth?

Innovations in Cost-Effective Energy Recovery Ventilation (ERV).

7. Are there any restraints impacting market growth?

Lack of Proper Regulations and Standards in Some Regions.

8. Can you provide examples of recent developments in the market?

February 2023: enVerid Systems, the leader in sustainable indoor air quality (IAQ) solutions, expanded its partnership with SCG, a leading business conglomerate in the ASEAN region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Ventilation Fans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Ventilation Fans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Ventilation Fans Market?

To stay informed about further developments, trends, and reports in the Residential Ventilation Fans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence