Key Insights

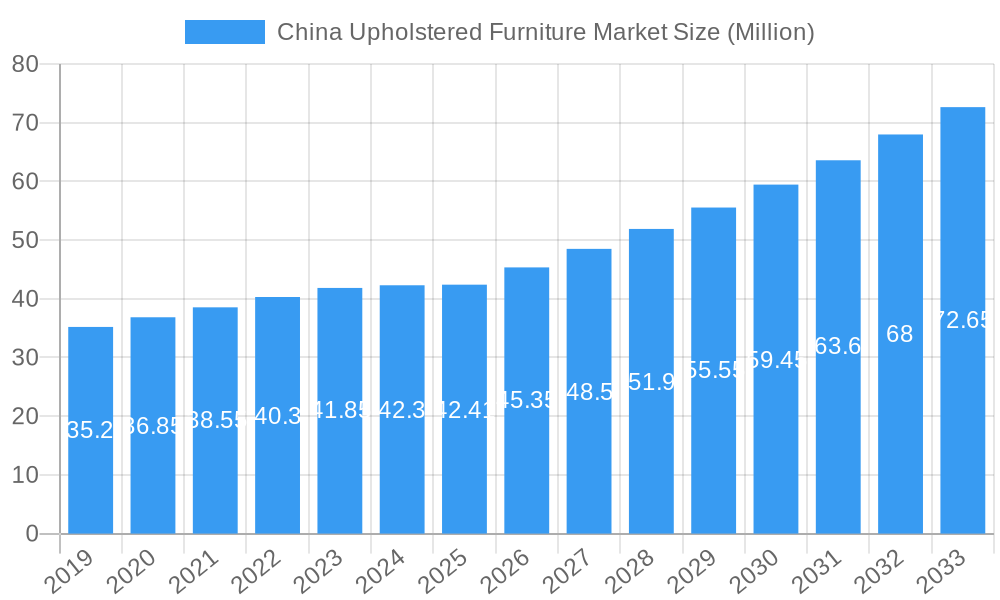

The China Upholstered Furniture Market is experiencing robust growth, driven by evolving consumer lifestyles and increasing disposable incomes. With a current market size estimated at approximately 42.41 million units in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.97% through 2033. This growth is fueled by several key drivers, including the burgeoning middle class's demand for more comfortable and aesthetically pleasing home environments, a significant increase in housing construction and renovation projects, and the growing influence of interior design trends popularized by e-commerce platforms and social media. The residential sector remains the dominant application, benefiting from these factors, while commercial applications, such as hotels, offices, and retail spaces, are also contributing to market expansion as businesses invest in creating more inviting customer and employee experiences.

China Upholstered Furniture Market Market Size (In Million)

Key trends shaping the China Upholstered Furniture Market include a rising preference for sustainable and eco-friendly materials, a demand for customized and modular furniture solutions that cater to smaller living spaces, and the integration of smart technologies into furniture pieces. The distribution landscape is also transforming, with e-commerce channels witnessing substantial growth due to their convenience and wider product selection, complementing traditional retail formats like specialty stores and, to a lesser extent, supermarkets and hypermarkets. Major players such as IKEA, Red Star Macalline, and Oppein are actively competing and innovating to capture market share. However, the market faces certain restraints, including rising raw material costs, potential supply chain disruptions, and intense price competition among manufacturers, which could temper the overall growth trajectory.

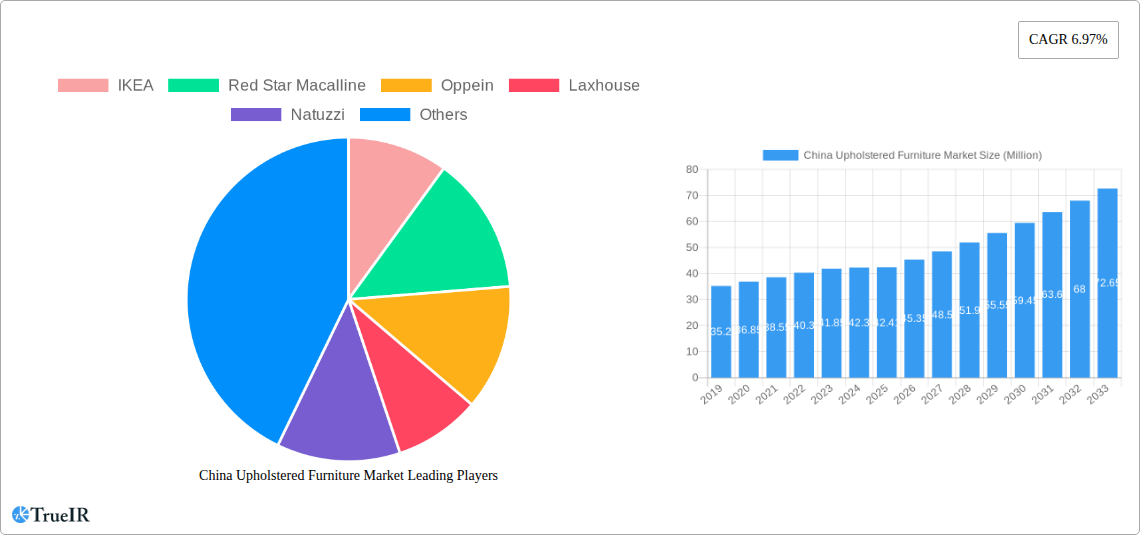

China Upholstered Furniture Market Company Market Share

China Upholstered Furniture Market: Comprehensive Analysis and Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the China upholstered furniture market, offering critical insights into market structure, competitive landscape, emerging trends, and future growth trajectories. Leveraging extensive data and expert analysis, the report is designed for industry stakeholders seeking to understand and capitalize on the dynamic opportunities within this expansive market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year, and the forecast period extending from 2025 to 2033, building upon historical data from 2019-2024.

China Upholstered Furniture Market Market Structure & Competitive Landscape

The China upholstered furniture market exhibits a moderately concentrated structure, characterized by the presence of both established global giants and robust domestic players. Innovation is primarily driven by evolving consumer preferences for comfort, aesthetics, and functionality, alongside advancements in material science and sustainable manufacturing processes. Regulatory impacts, while present, are largely geared towards environmental standards and consumer safety, with no significant barriers to market entry for compliant businesses. Product substitutes, such as non-upholstered furniture and DIY customization options, exist but hold a minor market share due to the inherent demand for comfort and design offered by upholstered pieces. End-user segmentation reveals a strong dominance of residential applications, driven by rising disposable incomes and a growing emphasis on home décor. The commercial segment, encompassing hospitality and office spaces, also presents significant growth potential. Mergers and acquisitions (M&A) activity is a key feature of the competitive landscape, with consolidation aimed at expanding market reach, acquiring technological capabilities, and diversifying product portfolios. For instance, in the historical period, M&A volumes averaged approximately 5 to 10 transactions annually, with deal values ranging from a few million to over a hundred million USD, reflecting strategic realignments. Concentration ratios are estimated to be around 45% for the top five players, indicating a competitive yet manageable market.

China Upholstered Furniture Market Market Trends & Opportunities

The China upholstered furniture market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This expansion is fueled by a confluence of powerful trends and lucrative opportunities. The increasing urbanization rate and the subsequent rise of the middle and upper-middle class are primary growth catalysts, leading to enhanced disposable incomes and a greater propensity to invest in home furnishings. Consumers are increasingly prioritizing comfort, aesthetics, and functionality in their upholstered furniture choices. This has led to a surge in demand for personalized and customizable options, encouraging manufacturers to offer a wider range of fabrics, colors, designs, and configurations. The influence of e-commerce has been transformative, breaking down geographical barriers and providing consumers with unprecedented access to a vast array of products from both domestic and international brands. This has also created opportunities for online-exclusive brands and innovative direct-to-consumer models. Technological shifts are evident in the integration of smart features, such as built-in charging ports and adjustable reclining mechanisms, catering to the evolving digital lifestyles of consumers. Furthermore, sustainability is no longer a niche concern; it is becoming a mainstream expectation. The demand for eco-friendly materials, ethical sourcing, and durable products is on the rise, presenting opportunities for manufacturers who can authentically incorporate these principles into their offerings. Competitive dynamics are characterized by a blend of intense price competition in the mass market segment and a focus on premiumization and design innovation in the higher-end segments. The rise of influencer marketing and social media trends plays a significant role in shaping consumer preferences and driving product adoption. The expansion of the housing market, coupled with ongoing renovations and upgrades in existing homes, provides a continuous stream of demand. The report estimates the market size to reach over 150 billion RMB by 2033, driven by these dynamic forces. Market penetration rates for upholstered furniture are expected to reach 85% in urban households by 2030.

Dominant Markets & Segments in China Upholstered Furniture Market

The Residential Application segment is unequivocally the dominant force within the China upholstered furniture market. This dominance stems from fundamental societal shifts and evolving consumer aspirations. The burgeoning middle class, coupled with a sustained period of economic growth, has empowered households to allocate significant portions of their income towards enhancing their living spaces. The cultural emphasis on family and home as a sanctuary further amplifies the demand for comfortable and aesthetically pleasing furniture. Within the residential segment, Sofas represent the largest product category, followed closely by Beds. This is attributed to their central role in living rooms and bedrooms, areas that are focal points for relaxation, entertainment, and family gatherings. The growing trend towards smaller living spaces in urban areas also necessitates multi-functional and space-saving sofa designs.

E-commerce has emerged as the leading distribution channel, revolutionizing how consumers discover, purchase, and receive upholstered furniture. This channel's dominance is driven by its unparalleled convenience, extensive product selection, competitive pricing, and the ability to reach consumers across all geographical locations within China. Online platforms provide a visual and interactive shopping experience, often enhanced by virtual try-on features and customer reviews, mitigating the traditional barriers of needing to physically inspect large furniture items.

Key growth drivers within these dominant segments include:

- Rising Disposable Incomes: Increased purchasing power directly translates into higher expenditure on home furnishings.

- Urbanization and Housing Development: Continued migration to cities and the construction of new residential units create a constant influx of first-time furniture buyers.

- Evolving Lifestyles and Home Décor Trends: Consumers are increasingly influenced by global design trends and aspire to create stylish and comfortable living environments.

- Digital Connectivity and Online Shopping Habits: The pervasive adoption of smartphones and the internet has ingrained online purchasing as a preferred mode of consumption.

- Government Policies Supporting Consumption: Initiatives aimed at boosting domestic consumption indirectly benefit the furniture sector.

The Specialty Stores segment, while facing competition from e-commerce, remains significant due to its ability to offer personalized customer service, expert advice, and a tactile experience for discerning buyers. Brands often leverage these physical outlets for brand building and showcasing premium product lines. The Supermarkets and Hypermarkets channel caters more to budget-conscious consumers and impulse purchases of smaller upholstered items or accessories.

China Upholstered Furniture Market Product Analysis

Product innovations in the China upholstered furniture market are largely focused on enhancing comfort, durability, and aesthetic appeal. Advancements in fabric technology, including stain-resistant, antimicrobial, and sustainable materials, are gaining traction. Smart furniture integration, incorporating features like USB charging ports and recline functions, is a growing trend, particularly in the sofa segment. Competitive advantages are being carved out through unique design aesthetics, modularity for adaptable living spaces, and emphasis on ergonomic support. The market also sees a growing demand for customizable options, allowing consumers to tailor upholstery choices, colors, and configurations to their specific preferences, thereby increasing product fit and consumer satisfaction.

Key Drivers, Barriers & Challenges in China Upholstered Furniture Market

Key Drivers:

- Economic Growth and Rising Disposable Incomes: Sustained economic prosperity directly fuels consumer spending on home furnishings, with upholstered furniture being a significant discretionary purchase.

- Urbanization and Housing Market Expansion: Continuous growth in urban populations and new housing construction create a perpetual demand for furniture.

- Evolving Consumer Preferences: A growing emphasis on home comfort, aesthetics, and personalized living spaces drives demand for stylish and functional upholstered pieces.

- E-commerce Proliferation: The widespread adoption of online shopping provides unparalleled access and convenience for consumers, expanding market reach.

- Government Support for Domestic Consumption: Policies aimed at stimulating consumer spending indirectly benefit the furniture sector.

Key Barriers & Challenges:

- Intense Price Competition: The market, particularly the mass segment, faces significant price pressures, impacting profit margins. Supply chain disruptions, such as material shortages or logistics delays, can increase production costs and affect timely delivery, with estimated impacts of up to 15% on operational costs during peak disruption periods.

- Regulatory Compliance: Adhering to evolving environmental standards and safety regulations can necessitate investment in new manufacturing processes and materials.

- Counterfeiting and Intellectual Property Infringement: Protecting brand design and quality from imitations remains a persistent challenge.

- Consumer Price Sensitivity: While demand is high, a segment of the market remains highly price-sensitive, influencing purchasing decisions.

- Logistical Complexity: The large size of upholstered furniture presents unique challenges in terms of warehousing, transportation, and last-mile delivery, contributing to approximately 10-12% of the product's final cost.

Growth Drivers in the China Upholstered Furniture Market Market

The China upholstered furniture market's growth is propelled by a powerful synergy of economic, social, and technological factors. Robust economic expansion translates into higher disposable incomes, empowering a larger segment of the population to invest in quality home furnishings. The relentless pace of urbanization and the ongoing construction of new residential properties create a constant demand for furniture. Furthermore, a significant shift in consumer preferences towards comfort, personalized living spaces, and aesthetically pleasing designs is a primary driver. The increasing influence of digital media and e-commerce platforms has revolutionized accessibility, allowing consumers to explore a vast array of styles and brands from the comfort of their homes. Government initiatives aimed at stimulating domestic consumption also provide a favorable economic climate for the sector.

Challenges Impacting China Upholstered Furniture Market Growth

Despite its robust growth, the China upholstered furniture market faces several impediments. Intense competition, particularly in the mid-to-lower price segments, exerts considerable pressure on profit margins, often leading to price wars. Supply chain vulnerabilities, ranging from raw material availability to logistical bottlenecks, can disrupt production and increase costs. The evolving landscape of environmental regulations necessitates continuous adaptation and investment in sustainable manufacturing practices. Furthermore, the persistent issue of product counterfeiting and intellectual property infringement can undermine brand value and consumer trust. Lastly, while consumer spending power is growing, a significant portion of the market remains price-sensitive, posing a challenge for premiumization strategies.

Key Players Shaping the China Upholstered Furniture Market Market

- IKEA

- Red Star Macalline

- Oppein

- Laxhouse

- Natuzzi

- Mengtai

- H&M Home

- Lazzoni

- Furniture Clan

- D&D Italian

Significant China Upholstered Furniture Market Industry Milestones

- September 2023: IKEA China announced its “Growth+” strategy, committing an investment of 6.3 billion RMB (USD 863.98 million) over the next three years to enhance professional home solutions, personalized services, and an omnichannel approach. This strategic move is expected to deepen IKEA's market penetration and customer engagement in China.

- July 2023: Oppein, Asia's largest cabinet manufacturer, collaborated with Ironside, an Australian construction specialist, to complete a benchmark residential building project. This milestone project showcases the integration of modern and trendy design elements, highlighting Oppein's capabilities beyond cabinetry and marking a significant step in international construction collaborations.

Future Outlook for China Upholstered Furniture Market Market

The future outlook for the China upholstered furniture market is exceptionally bright, driven by enduring consumer demand for comfort, style, and personalization. Continued economic growth and urbanization will underpin sustained market expansion. Innovations in smart furniture, sustainable materials, and modular designs will cater to evolving consumer lifestyles and environmental consciousness. The e-commerce channel will continue to dominate distribution, fostering direct-to-consumer models and enhancing market accessibility. Strategic opportunities lie in the premiumization of products, the development of eco-friendly offerings, and the seamless integration of online and offline customer experiences. The market is poised for continued growth, with a particular focus on delivering value through design, quality, and customer-centric solutions.

China Upholstered Furniture Market Segmentation

-

1. Type

- 1.1. Chair

- 1.2. Sofa

- 1.3. Bed

- 1.4. Other Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channels

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty stores

- 3.3. E-commerce

- 3.4. Other Distribution Channels

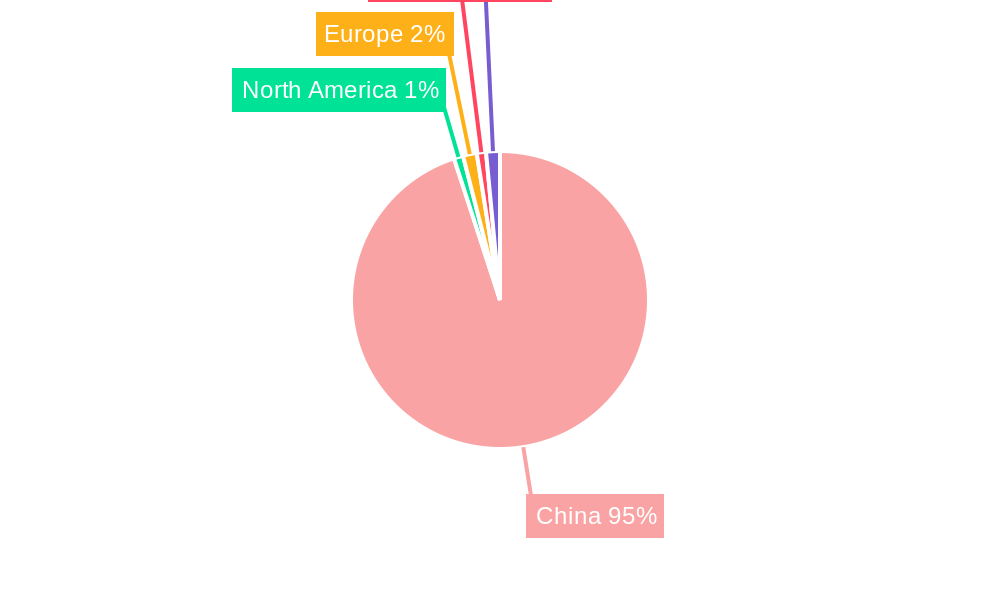

China Upholstered Furniture Market Segmentation By Geography

- 1. China

China Upholstered Furniture Market Regional Market Share

Geographic Coverage of China Upholstered Furniture Market

China Upholstered Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Home Furnishing; Growing Awareness of Interior Design Trends

- 3.3. Market Restrains

- 3.3.1. Fluctuating Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. E-commerce Sales is Escalating in China Upholstered Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chair

- 5.1.2. Sofa

- 5.1.3. Bed

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty stores

- 5.3.3. E-commerce

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IKEA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Red Star Macalline

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oppein

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Laxhouse

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Natuzzi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mengtai

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 H&M Home

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lazzoni

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Furniture Clan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 D&D Italian

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IKEA

List of Figures

- Figure 1: China Upholstered Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Upholstered Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: China Upholstered Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Upholstered Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: China Upholstered Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: China Upholstered Furniture Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: China Upholstered Furniture Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 6: China Upholstered Furniture Market Volume K Unit Forecast, by Distribution Channels 2020 & 2033

- Table 7: China Upholstered Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Upholstered Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: China Upholstered Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: China Upholstered Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: China Upholstered Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: China Upholstered Furniture Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: China Upholstered Furniture Market Revenue Million Forecast, by Distribution Channels 2020 & 2033

- Table 14: China Upholstered Furniture Market Volume K Unit Forecast, by Distribution Channels 2020 & 2033

- Table 15: China Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Upholstered Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Upholstered Furniture Market?

The projected CAGR is approximately 6.97%.

2. Which companies are prominent players in the China Upholstered Furniture Market?

Key companies in the market include IKEA, Red Star Macalline, Oppein, Laxhouse, Natuzzi, Mengtai, H&M Home, Lazzoni, Furniture Clan, D&D Italian.

3. What are the main segments of the China Upholstered Furniture Market?

The market segments include Type, Application, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Home Furnishing; Growing Awareness of Interior Design Trends.

6. What are the notable trends driving market growth?

E-commerce Sales is Escalating in China Upholstered Furniture Market.

7. Are there any restraints impacting market growth?

Fluctuating Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

September 2023: IKEA China has announced its “Growth+” strategy, committing to an investment of 6.3 billion RMB (USD 863.98 million) over the next three years in professional home solutions, personalized services, and an omnichannel approach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Upholstered Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Upholstered Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Upholstered Furniture Market?

To stay informed about further developments, trends, and reports in the China Upholstered Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence