Key Insights

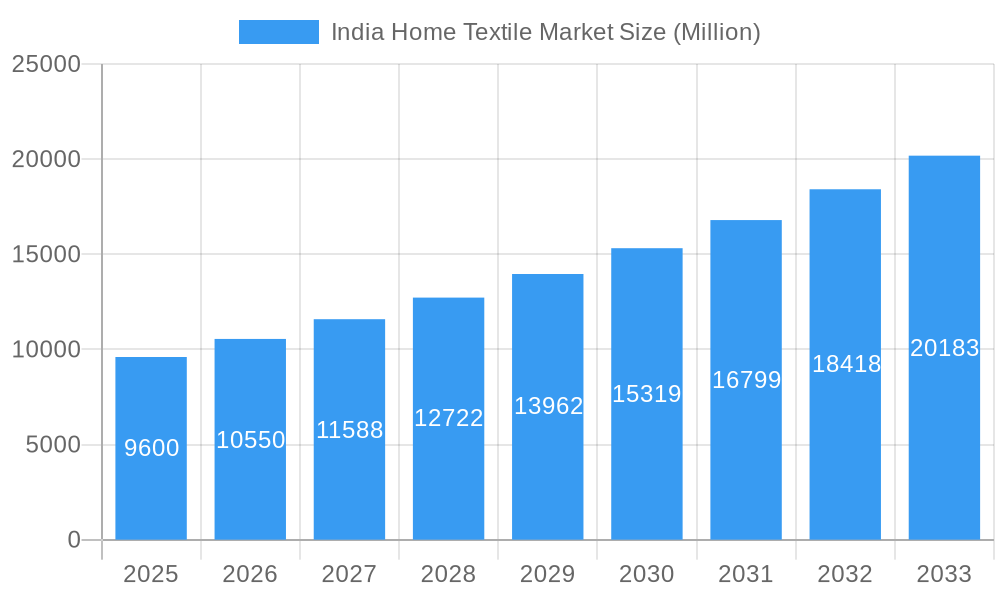

The India home textile market, valued at approximately $9.6 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.84% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes and a burgeoning middle class are fueling increased demand for home furnishings, particularly among younger demographics prioritizing aesthetics and comfort. The increasing popularity of online shopping provides convenient access to a wider range of products, boosting market penetration. Furthermore, the growth of organized retail, including supermarkets and hypermarkets, provides wider distribution channels for home textile brands. While factors such as fluctuating raw material prices and intense competition among established and emerging players pose challenges, the overall market outlook remains positive.

India Home Textile Market Market Size (In Billion)

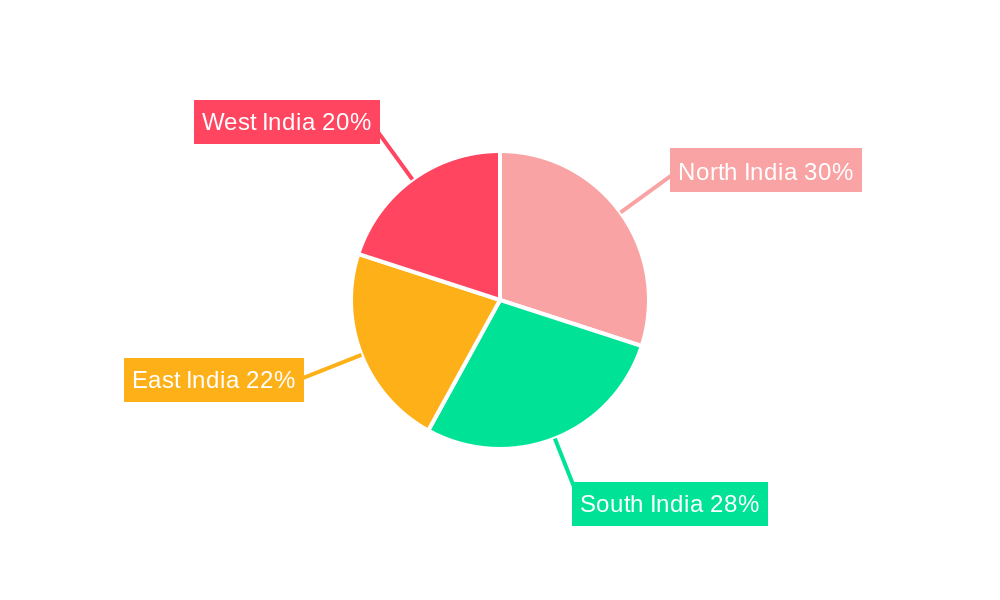

The market segmentation reveals significant opportunities. Bed linen, bath linen, and kitchen linen consistently hold strong positions, driven by their essential nature and frequent replacement. Upholstery and floor coverings, while potentially lower in frequency of purchase, are experiencing growth due to rising urbanization and consumer preference for aesthetically pleasing homes. Online channels are gaining traction as a dominant distribution method, surpassing traditional retail outlets in terms of growth rate, though physical stores maintain significant market share. Key players like IKEA, Bombay Dyeing, and Welspun are leveraging their brand recognition and product diversification to maintain a competitive edge. Regional variations exist, with North and South India showing stronger initial growth due to factors like higher disposable incomes and a more developed retail infrastructure, though the market's penetration is expanding across all regions. The forecast period anticipates a significant expansion of the market, reaching an estimated value of approximately $25.5 Billion (projection based on a 9.84% CAGR applied to the 2025 value for 8 years) by 2033.

India Home Textile Market Company Market Share

India Home Textile Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic India Home Textile Market, offering valuable insights for businesses, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the year 2025, utilizing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Expect detailed analysis of market size, growth trajectory, key players, and emerging trends, enabling informed decision-making in this rapidly evolving sector.

India Home Textile Market Market Structure & Competitive Landscape

The Indian home textile market exhibits a moderately concentrated structure, with a few large players like Welspun Group and Trident Limited holding significant market share. However, a large number of smaller and medium-sized enterprises also contribute significantly. The market is characterized by intense competition, driven by factors such as increasing consumer demand, technological advancements, and the emergence of new players.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. The top 5 players account for approximately xx% of the total market revenue in 2025.

- Innovation Drivers: Technological advancements in manufacturing processes, such as automation and digital printing, are major innovation drivers. The increasing demand for sustainable and eco-friendly products is also fostering innovation in material sourcing and manufacturing techniques.

- Regulatory Impacts: Government policies related to textile exports, import duties, and labor laws significantly impact market dynamics. Recent changes in these policies have created both opportunities and challenges for businesses operating in the sector.

- Product Substitutes: The market faces competition from substitutes like synthetic fabrics and imported home textiles. However, the inherent advantages of natural fibers in terms of comfort and durability continue to support market growth.

- End-User Segmentation: The market is segmented by product (bed linen, bath linen, kitchen linen, upholstery, floor covering) and distribution channel (supermarkets & hypermarkets, specialty stores, online, other distribution channels). The increasing popularity of online retail is reshaping the distribution landscape.

- M&A Trends: The past few years have witnessed a rise in mergers and acquisitions (M&As). For example, the acquisition of GHCL Ltd.’s home textile business by Indo Count Industries in 2022 demonstrates a consolidation trend in the market. The total value of M&A transactions in the home textile industry during 2019-2024 is estimated at xx Million.

India Home Textile Market Market Trends & Opportunities

The Indian home textile market is experiencing robust growth, driven by rising disposable incomes, changing lifestyles, and increasing urbanization. The market size is projected to reach xx Million by 2025 and xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Technological advancements are transforming the industry, with the adoption of automation, digital printing, and sustainable manufacturing practices gaining momentum. Consumer preferences are shifting towards premium quality, eco-friendly, and aesthetically appealing products, creating opportunities for brands that cater to these trends. E-commerce is rapidly expanding its reach, offering new avenues for businesses to reach consumers. The market is witnessing increased competition, both from domestic and international players, leading to price wars and increased emphasis on product differentiation and brand building. Market penetration rates for online channels are projected to reach xx% by 2033, while overall market penetration is expected to exceed xx%.

Dominant Markets & Segments in India Home Textile Market

The bed linen segment currently dominates the Indian home textile market, accounting for the largest share of revenue, followed by bath linen and upholstery. This dominance is primarily attributed to the high demand for comfortable and aesthetically pleasing bedding products. The online distribution channel is growing rapidly, reflecting changing consumer behavior and increased internet penetration.

- Key Growth Drivers for Bed Linen:

- Increasing disposable incomes

- Rising urbanization and changing lifestyles

- Growing preference for premium quality and designer bed linen

- Key Growth Drivers for Online Distribution:

- Increased internet and smartphone penetration

- Convenience and wider product selection offered by online retailers

- Targeted advertising and personalized shopping experiences

The southern and western regions of India show higher per capita consumption of home textiles, driven by factors such as higher disposable incomes and a preference for premium products. Government initiatives promoting textile exports and investments in infrastructure also support market growth in these regions.

India Home Textile Market Product Analysis

The Indian home textile market showcases continuous product innovation, with a strong emphasis on incorporating technologically advanced features and sustainable materials. This includes advanced weaving techniques, the use of innovative fabrics like bamboo and organic cotton, and the integration of smart features into some products. The market is witnessing a growing demand for customizable and personalized home textiles, enabling consumers to personalize their interiors. This trend is further driving growth in niches such as designer bed linen and bespoke upholstery.

Key Drivers, Barriers & Challenges in India Home Textile Market

Key Drivers: Rising disposable incomes, urbanization, and changing lifestyles are key drivers. Technological advancements in manufacturing and increased availability of affordable, high-quality products also contribute significantly. Government initiatives supporting textile exports further fuel market growth.

Challenges: Fluctuations in raw material prices, intense competition, and supply chain disruptions pose significant challenges. Stricter environmental regulations and labor laws add complexities for businesses. The impact of these challenges on profitability is estimated to be around xx%.

Growth Drivers in the India Home Textile Market Market

The increasing demand for home textiles due to rising urbanization and disposable incomes is a key driver. Technological innovations, such as the introduction of new, sustainable materials and advanced manufacturing processes, also contribute to market growth. Government support through various initiatives and favorable trade policies further enhance market expansion.

Challenges Impacting India Home Textile Market Growth

Supply chain vulnerabilities, particularly disruptions related to raw material sourcing and logistics, present a major challenge. Competition from both domestic and international players puts pressure on margins. Regulatory hurdles, such as stringent environmental regulations and labor compliance, add to the operational complexities.

Key Players Shaping the India Home Textile Market Market

- IKEA Systems B V

- Bombay Dyeing

- Alok Industries Ltd

- Himatsingka

- Trident Limited

- William Sanoma Inc

- S Kumars Nationwide Limited

- Vardhman Textiles Limited

- Raymond Group

- Indo Count Industries Ltd

- Welspun Group

- DCM Textiles

- Bed Bath & Beyond Inc

Significant India Home Textile Market Industry Milestones

- November 2023: Raymond launched "Regio Italia," a luxury wool suiting fabric, signaling a move towards premium products.

- April 2022: Indo Count Industries Limited acquired GHCL Ltd.'s home textile business, expanding its market reach and production capacity.

- January 2022: Vandewiele NV and Savio India merged, creating a stronger entity providing integrated services to the Indian textile industry.

Future Outlook for India Home Textile Market Market

The Indian home textile market is poised for continued growth, driven by sustained economic expansion and evolving consumer preferences. Strategic opportunities exist for companies that focus on innovation, sustainability, and e-commerce. The market's potential is vast, with opportunities for both domestic and international players to capitalize on the growing demand for high-quality, stylish, and affordable home textiles.

India Home Textile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Home Textile Market Segmentation By Geography

- 1. India

India Home Textile Market Regional Market Share

Geographic Coverage of India Home Textile Market

India Home Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket

- 3.2.2 they are investing in home furnishings and textiles to improve their living conditions.

- 3.3. Market Restrains

- 3.3.1 Price sensitivity among Indian consumers

- 3.3.2 particularly in lower-income segments

- 3.3.3 can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton

- 3.4.2 recycled materials

- 3.4.3 and eco-friendly dyes

- 3.4.4 reflecting a broader global trend towards environmental consciousness.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Textile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IKEA Systems B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bombay Dyeing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alok Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Himatsingka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trident Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 William Sanoma Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 S Kumars Nationwide Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vardhman Textiles Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Raymond Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indo Count Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Welspun Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DCM Textiles

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bed Bath & Beyond Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 IKEA Systems B V

List of Figures

- Figure 1: India Home Textile Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Home Textile Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Home Textile Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Home Textile Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Textile Market?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the India Home Textile Market?

Key companies in the market include IKEA Systems B V, Bombay Dyeing, Alok Industries Ltd, Himatsingka, Trident Limited, William Sanoma Inc, S Kumars Nationwide Limited, Vardhman Textiles Limited, Raymond Group, Indo Count Industries Ltd, Welspun Group, DCM Textiles, Bed Bath & Beyond Inc.

3. What are the main segments of the India Home Textile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.60 Million as of 2022.

5. What are some drivers contributing to market growth?

The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket. they are investing in home furnishings and textiles to improve their living conditions..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton. recycled materials. and eco-friendly dyes. reflecting a broader global trend towards environmental consciousness..

7. Are there any restraints impacting market growth?

Price sensitivity among Indian consumers. particularly in lower-income segments. can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand.

8. Can you provide examples of recent developments in the market?

In November 2023, Raymond launched an international range of luxury suiting fabrics, "Regio Italia". Regio Italia is a luxury wool suiting fabric crafted and designed in Italy to meet the demand in India for international luxury fashion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Textile Market?

To stay informed about further developments, trends, and reports in the India Home Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence