Key Insights

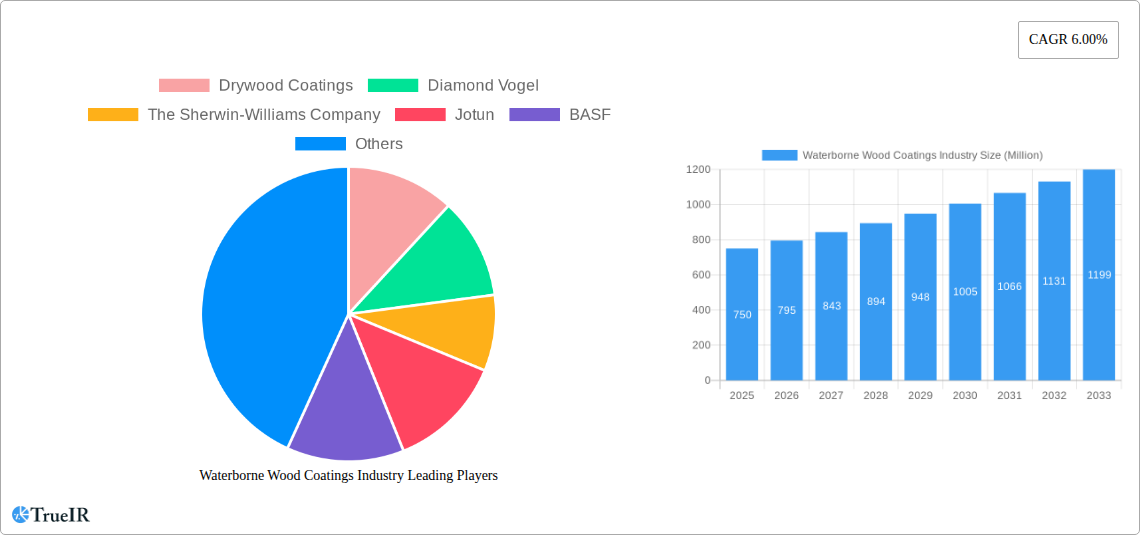

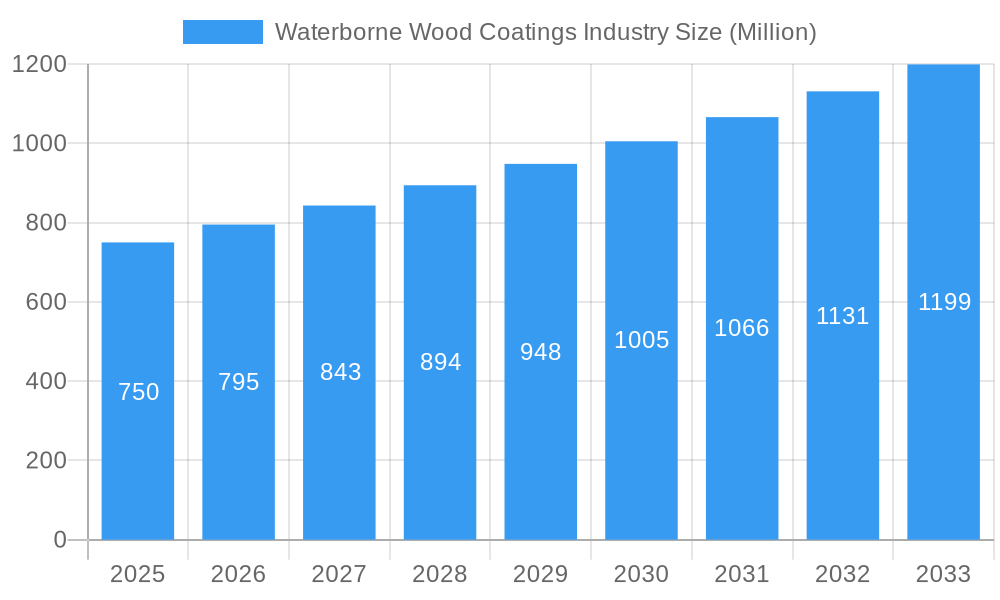

The global Waterborne Wood Coatings market is poised for substantial growth, projected to reach a market size of approximately USD XX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.00% anticipated through 2033. This upward trajectory is largely propelled by increasing environmental regulations and a growing consumer preference for sustainable and low-VOC (Volatile Organic Compound) solutions. The demand for waterborne coatings is amplified by their reduced toxicity and faster drying times compared to traditional solvent-borne alternatives. Key drivers include a strong emphasis on green building practices in the residential sector, coupled with a rising trend in commercial interior design that favors durable and aesthetically pleasing finishes for furniture, cabinetry, and architectural elements. The versatility of waterborne coatings, catering to diverse application methods and substrate types, further bolsters their market penetration.

Waterborne Wood Coatings Industry Market Size (In Million)

The market segmentation reveals a dynamic landscape where Product innovations like advanced waterborne formulations and radiation-cured coatings are gaining traction, offering enhanced performance and specialized properties. End-user segments, including Residential and Commercial applications, are experiencing parallel growth. The Residential sector is driven by renovations and new construction projects prioritizing health and eco-friendliness. Simultaneously, the Commercial sector, encompassing hospitality, retail, and office spaces, is adopting waterborne coatings to meet stringent sustainability standards and create healthier indoor environments. While the market benefits from strong growth drivers, potential restraints such as the initial perceived higher cost of some advanced formulations and the need for specific application expertise could present challenges. However, the long-term cost savings and environmental benefits are increasingly outweighing these concerns, signaling a sustained expansion for waterborne wood coatings globally.

Waterborne Wood Coatings Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Waterborne Wood Coatings market, providing critical insights into market structure, competitive landscape, trends, opportunities, and future projections. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for stakeholders seeking to navigate this dynamic industry.

Waterborne Wood Coatings Industry Market Structure & Competitive Landscape

The Waterborne Wood Coatings market exhibits a moderate to high level of concentration, with a significant presence of large, established chemical manufacturers and specialized coatings providers. Key innovation drivers include the relentless pursuit of eco-friendly formulations, enhanced performance characteristics such as durability and faster drying times, and adherence to increasingly stringent environmental regulations globally. Regulatory impacts are a pivotal force, with governments worldwide promoting the adoption of low-VOC (Volatile Organic Compound) coatings, directly benefiting the waterborne segment. Product substitutes, primarily solvent-borne coatings, are steadily losing market share due to these regulatory shifts and growing environmental consciousness. The end-user segmentation, encompassing Residential, Commercial, and Industrial applications, displays varying adoption rates and performance demands. Mergers and Acquisitions (M&A) trends are notable, as larger entities seek to consolidate their market position, expand their product portfolios, and gain access to new technologies or geographical markets. For instance, strategic acquisitions have allowed companies to integrate advanced waterborne technologies and broaden their sustainable product offerings. The market has witnessed approximately xx M&A deals in the historical period, with an estimated xx occurring in the base year, indicating ongoing consolidation. Concentration ratios in key segments suggest that the top 5 players hold an estimated xx% of the market share, highlighting both competition and the influence of leading manufacturers.

Waterborne Wood Coatings Industry Market Trends & Opportunities

The Waterborne Wood Coatings market is poised for substantial growth and transformation over the forecast period of 2025-2033. The global market size is projected to reach USD $xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% from its estimated value of USD $xx Million in 2025. This robust expansion is fueled by a confluence of compelling trends. Technological shifts are paramount, with ongoing research and development focused on creating waterborne coatings with enhanced performance attributes that rival or surpass traditional solvent-borne counterparts. Innovations in binder technologies, cross-linking mechanisms, and additive formulations are leading to improved scratch resistance, chemical resistance, and aesthetic appeal. Consumer preferences are increasingly leaning towards sustainable and healthier living environments, driving demand for low-VOC and odor-free wood coatings. This trend is particularly evident in residential and commercial spaces where indoor air quality is a significant concern. Competitive dynamics are intensifying, with manufacturers differentiating themselves through product innovation, sustainability credentials, and tailored solutions for specific end-use applications. The rising demand for durable and aesthetically pleasing finishes in furniture, cabinetry, and architectural elements across residential and commercial sectors presents significant market penetration opportunities. Furthermore, the industrial segment, encompassing automotive and marine applications, is witnessing a gradual but steady adoption of waterborne technologies due to environmental mandates and performance improvements. The market penetration rate for waterborne coatings is expected to increase from xx% in 2024 to xx% by 2033, reflecting a significant shift in industry preference.

Dominant Markets & Segments in Waterborne Wood Coatings Industry

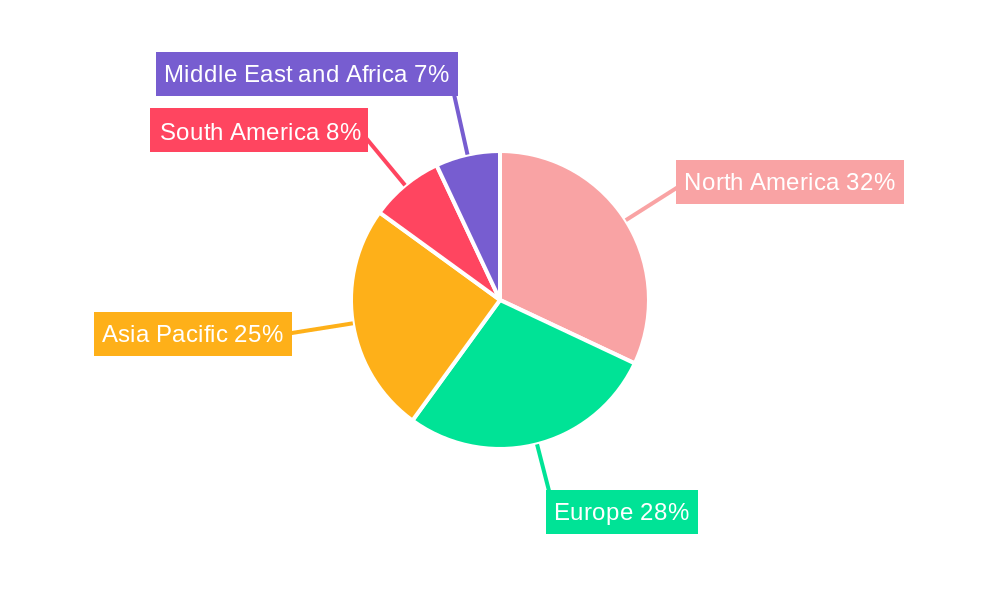

The Waterborne Wood Coatings industry is experiencing dominant growth driven by specific regions and product segments.

Leading Region:

- North America and Europe currently lead the market, largely due to stringent environmental regulations and a well-established demand for sustainable products. Government initiatives promoting green building and indoor air quality standards in these regions are key growth drivers. The United States and Germany are at the forefront of this adoption, supported by policies encouraging the reduction of VOC emissions. Infrastructure development and renovation projects further bolster demand in these mature markets.

Dominant Product Segment:

- Water-borne Coatings are the undisputed leaders and the primary focus of this market analysis. Their dominance is a direct result of their inherent low-VOC content, reduced flammability, and easier cleanup compared to solvent-borne alternatives. The increasing environmental consciousness among consumers and businesses actively drives the demand for these coatings.

- Key Growth Drivers for Water-borne Coatings:

- Stringent VOC regulations (e.g., EPA in the US, REACH in Europe).

- Growing consumer preference for eco-friendly and healthy home environments.

- Advancements in performance, now matching or exceeding solvent-borne coatings in durability and aesthetics.

- Ease of use and lower flammability risks during application and storage.

- Key Growth Drivers for Water-borne Coatings:

Dominant End-User Segment:

- Residential applications represent a significant and consistently growing segment for waterborne wood coatings. Homeowners are increasingly prioritizing products that contribute to a healthier indoor environment and are less harmful during application. The desire for aesthetically pleasing and durable finishes for furniture, cabinetry, and interior woodwork fuels this demand.

- Key Growth Drivers for Residential Segment:

- Increased consumer awareness of indoor air quality and health impacts.

- Growing trend in DIY projects and home renovations utilizing eco-friendly materials.

- Aesthetic demand for a wide range of colors and finishes achievable with waterborne technologies.

- Government incentives for energy-efficient and sustainable housing.

- Key Growth Drivers for Residential Segment:

While Commercial applications are also substantial, with demand from offices, hotels, and retail spaces seeking to improve their environmental footprint and worker safety, the Residential segment is currently demonstrating a more rapid and widespread adoption of waterborne wood coatings due to direct consumer influence and a focus on personal well-being. Industry applications, while present, are often more specialized and may still rely on higher-performance solvent-borne options for extreme durability requirements, though this is gradually changing.

Waterborne Wood Coatings Industry Product Analysis

Innovations in waterborne wood coatings are primarily focused on enhancing performance while maintaining their eco-friendly profile. Advancements in acrylic and polyurethane dispersions have led to coatings with superior scratch, abrasion, and chemical resistance, rivaling traditional solvent-based systems. These formulations offer faster drying and curing times, improving application efficiency. Key applications span a wide range, including furniture, cabinetry, flooring, and architectural millwork. The competitive advantage lies in their low VOC content, reduced odor, and ease of cleanup, making them ideal for residential and commercial interiors.

Key Drivers, Barriers & Challenges in Waterborne Wood Coatings Industry

Key Drivers:

The Waterborne Wood Coatings industry is propelled by several significant forces. Technologically, advancements in resin chemistry and additive formulations are continuously improving performance, making waterborne options increasingly competitive. Economically, the rising cost of volatile organic compounds and stricter regulations on their emissions incentivize a shift towards waterborne technologies. Policy-driven factors, such as government mandates for sustainable building materials and incentives for eco-friendly products, are major catalysts. For example, the widespread adoption of LEED (Leadership in Energy and Environmental Design) certification standards in commercial construction directly boosts demand for low-VOC coatings.

Barriers & Challenges:

Despite strong growth, the industry faces key challenges. Historically, a perception of inferior performance compared to solvent-borne coatings has been a barrier, although this is rapidly diminishing. Regulatory complexities, while a driver, can also be challenging to navigate across different global markets. Supply chain issues, particularly in securing consistent quality raw materials, can impact production and cost. Competitive pressures from established solvent-borne coatings manufacturers and the ongoing development of alternative sustainable technologies also present challenges. Quantifiably, supply chain disruptions in the historical period led to an estimated xx% increase in raw material costs, impacting profit margins for some manufacturers.

Growth Drivers in the Waterborne Wood Coatings Industry Market

Key growth drivers for the Waterborne Wood Coatings market are deeply rooted in technological advancements, economic incentives, and supportive policies. Technologically, the development of high-solids waterborne formulations and novel cross-linking agents is crucial, enabling coatings with enhanced durability, scratch resistance, and faster drying times. Economically, the escalating price of solvent-borne raw materials and growing concerns over their environmental impact are pushing manufacturers and end-users towards more cost-effective and sustainable waterborne alternatives. Regulatory frameworks, such as stricter VOC emission standards enforced by environmental agencies worldwide, act as significant catalysts, compelling industries to adopt compliant coating solutions. The increasing emphasis on green building certifications and sustainable construction practices further amplifies the demand for waterborne wood coatings.

Challenges Impacting Waterborne Wood Coatings Industry Growth

Several challenges can impede the growth trajectory of the Waterborne Wood Coatings industry. Regulatory complexities, while a driver, can also present a hurdle, with varying standards and enforcement across different regions requiring significant adaptation from manufacturers. Supply chain vulnerabilities, particularly concerning the availability and consistent quality of key raw materials like acrylic and polyurethane dispersions, can lead to production disruptions and price volatility. Competitive pressures from established solvent-borne coatings, which still hold a significant market share in certain niche applications requiring extreme durability, and the emergence of other eco-friendly coating technologies pose ongoing challenges. Quantifiable impacts include an estimated xx% increase in manufacturing costs due to supply chain disruptions experienced in the historical period, affecting profit margins.

Key Players Shaping the Waterborne Wood Coatings Industry Market

The Waterborne Wood Coatings industry is shaped by a competitive landscape of global and regional players. These companies are at the forefront of innovation and market expansion:

- Drywood Coatings

- Diamond Vogel

- The Sherwin-Williams Company

- Jotun

- BASF

- The Dow Chemical Company

- Benjamin Moore & Co

- Helios Group

- Rust-Oleum

- IVM Chemicals

- PPG Industries

- Royal DSM

- Akzo Nobel

- KAPCI Coatings

Significant Waterborne Wood Coatings Industry Industry Milestones

- 2019: Increased regulatory scrutiny on VOC emissions globally, leading to accelerated R&D in waterborne formulations.

- 2020: Launch of new high-performance waterborne clear coats for cabinetry and furniture, enhancing durability and aesthetics.

- 2021: Major acquisition of a specialized waterborne coatings technology company by a large chemical conglomerate, signaling industry consolidation.

- 2022: Significant advancements in bio-based binders for waterborne wood coatings, further enhancing sustainability credentials.

- 2023: Growing consumer demand for DIY-friendly, low-odor, and environmentally friendly wood finishing products.

- 2024: Introduction of UV-curable waterborne coatings offering rapid curing times and enhanced scratch resistance.

Future Outlook for Waterborne Wood Coatings Industry Market

The future outlook for the Waterborne Wood Coatings market is exceptionally promising, driven by a confluence of sustainability imperatives and technological advancements. Strategic opportunities lie in the continuous development of waterborne coatings that match or exceed the performance of solvent-borne alternatives, particularly in demanding industrial applications. The growing global emphasis on indoor air quality and green building practices will further solidify the market position of low-VOC and eco-friendly solutions. Manufacturers that focus on innovation, sustainable sourcing, and tailored product offerings for specific end-user needs will be well-positioned to capture significant market share. The market potential is substantial, with an anticipated continued upward trajectory driven by both regulatory push and consumer pull towards healthier and more environmentally responsible choices in wood finishing.

Waterborne Wood Coatings Industry Segmentation

-

1. Product

- 1.1. Solvent-borne Coatings

- 1.2. Water-borne Coatings

- 1.3. Radiation-cured Coatings

- 1.4. Powder coating Coatings

-

2. End User

- 2.1. Residential

- 2.2. Commercial

Waterborne Wood Coatings Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Waterborne Wood Coatings Industry Regional Market Share

Geographic Coverage of Waterborne Wood Coatings Industry

Waterborne Wood Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urabanization is Impacting the Market; Modular Kitchens are Booming the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Costs

- 3.4. Market Trends

- 3.4.1. Solvent-borne Coatings Segment is the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Solvent-borne Coatings

- 5.1.2. Water-borne Coatings

- 5.1.3. Radiation-cured Coatings

- 5.1.4. Powder coating Coatings

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Solvent-borne Coatings

- 6.1.2. Water-borne Coatings

- 6.1.3. Radiation-cured Coatings

- 6.1.4. Powder coating Coatings

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Solvent-borne Coatings

- 7.1.2. Water-borne Coatings

- 7.1.3. Radiation-cured Coatings

- 7.1.4. Powder coating Coatings

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Solvent-borne Coatings

- 8.1.2. Water-borne Coatings

- 8.1.3. Radiation-cured Coatings

- 8.1.4. Powder coating Coatings

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Solvent-borne Coatings

- 9.1.2. Water-borne Coatings

- 9.1.3. Radiation-cured Coatings

- 9.1.4. Powder coating Coatings

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Waterborne Wood Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Solvent-borne Coatings

- 10.1.2. Water-borne Coatings

- 10.1.3. Radiation-cured Coatings

- 10.1.4. Powder coating Coatings

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Drywood Coatings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Diamond Vogel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Sherwin-Williams Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jotun

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Dow Chemical Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Benjamin Moore & Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Helios Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rust-Oleum**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IVM Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PPG Industries

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Royal DSM

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Akzo Nobel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KAPCI Coatings

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Drywood Coatings

List of Figures

- Figure 1: Global Waterborne Wood Coatings Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 21: South America Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: South America Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Waterborne Wood Coatings Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Waterborne Wood Coatings Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Waterborne Wood Coatings Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waterborne Wood Coatings Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Waterborne Wood Coatings Industry?

Key companies in the market include Drywood Coatings, Diamond Vogel, The Sherwin-Williams Company, Jotun, BASF, The Dow Chemical Company, Benjamin Moore & Co, Helios Group, Rust-Oleum**List Not Exhaustive, IVM Chemicals, PPG Industries, Royal DSM, Akzo Nobel, KAPCI Coatings.

3. What are the main segments of the Waterborne Wood Coatings Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urabanization is Impacting the Market; Modular Kitchens are Booming the Market.

6. What are the notable trends driving market growth?

Solvent-borne Coatings Segment is the Largest Segment.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waterborne Wood Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waterborne Wood Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waterborne Wood Coatings Industry?

To stay informed about further developments, trends, and reports in the Waterborne Wood Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence