Key Insights

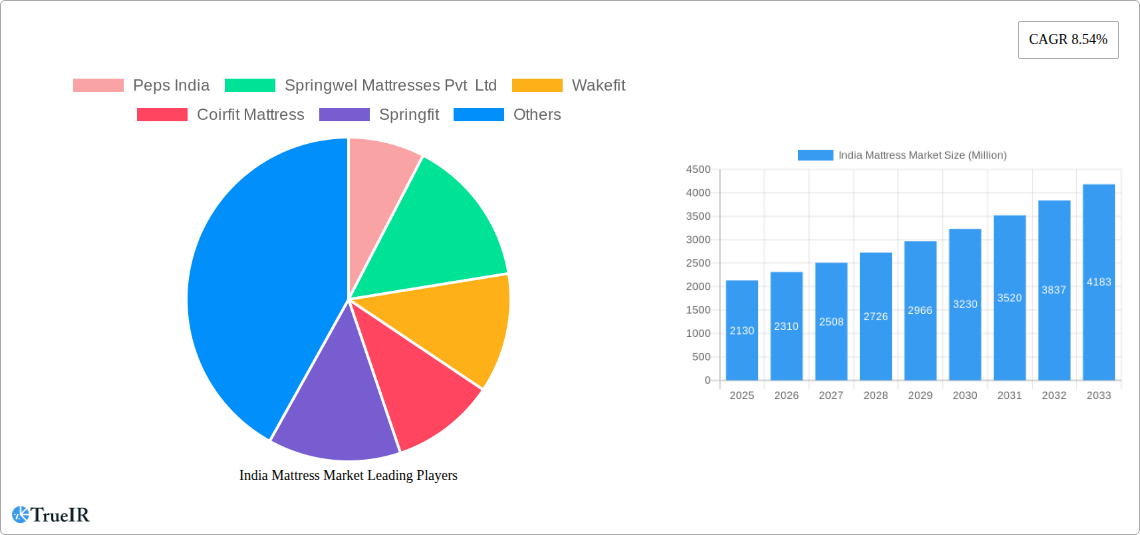

The Indian mattress market is poised for robust growth, projected to reach a market size of approximately USD 2,130 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.54% anticipated to continue through 2033. This expansion is fueled by a confluence of evolving consumer preferences and increasing disposable incomes, leading to a greater emphasis on sleep quality and comfort. Key drivers include a growing awareness of the health benefits associated with quality sleep, the rise of the nuclear family structure, and the increasing urbanization, which correlates with higher spending on home furnishings. Furthermore, the influx of international brands and the innovative product launches by domestic players are significantly shaping the market landscape, offering a wider array of choices from traditional innerspring to advanced memory foam and latex mattresses. The distribution channels are also diversifying, with a notable shift towards online sales platforms and a strong presence maintained by specialty and multi-brand stores.

India Mattress Market Market Size (In Billion)

The market's growth trajectory is further bolstered by the increasing penetration of organized retail and the e-commerce boom, making mattresses more accessible to a wider consumer base across India. Residential applications continue to dominate, driven by new home constructions and the renovation trend, while the commercial segment, encompassing hotels and healthcare facilities, also presents substantial opportunities. Despite the positive outlook, certain restraints such as price sensitivity among a segment of the population and the unorganized sector's competition are present. However, the sustained demand for premium and technologically advanced mattresses, coupled with effective marketing strategies by leading companies like Sheela Foam, Duroflex, and Wakefit, are expected to drive innovation and sustain the market's upward momentum. The strategic focus on product differentiation, ergonomic designs, and sustainable materials will be crucial for players to capitalize on this dynamic and expanding market.

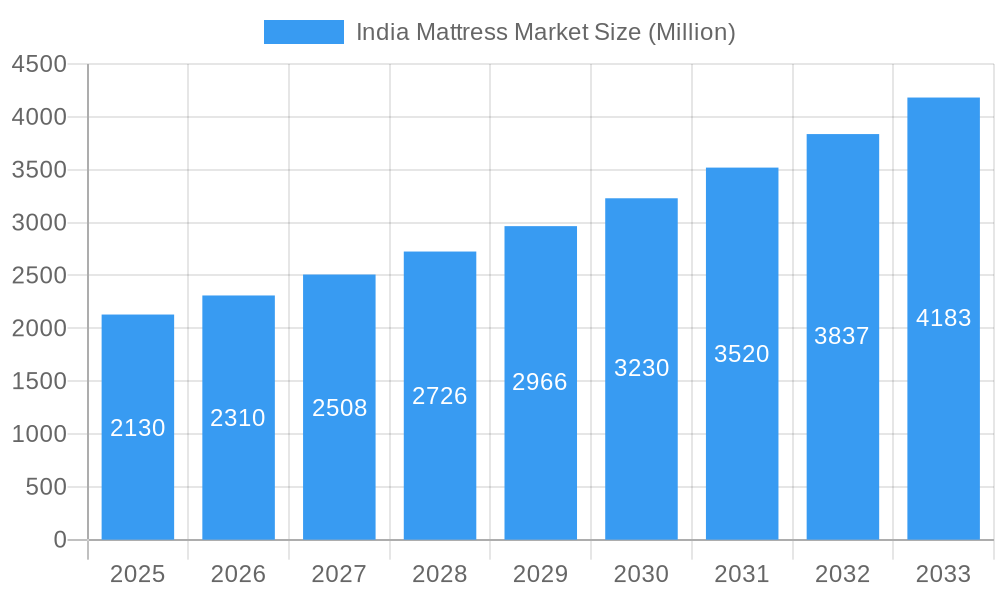

India Mattress Market Company Market Share

Unlock deep insights into India's burgeoning mattress market with this definitive report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, emerging trends, competitive strategies, and future growth trajectories. Explore key segments, dominant players, and strategic developments that are reshaping the Indian bedding industry. This report is essential for manufacturers, suppliers, investors, and stakeholders seeking to capitalize on the vast opportunities within this rapidly expanding sector.

India Mattress Market Market Structure & Competitive Landscape

The India mattress market exhibits a dynamic structure characterized by moderate to high concentration, with a few dominant players holding significant market share. Innovation is a key driver, fueled by increasing consumer demand for comfort, health benefits, and technologically advanced bedding solutions. Regulatory impacts are primarily focused on product safety standards and material certifications, ensuring a baseline quality for consumers. The presence of product substitutes, such as futons and sleeping bags, is minimal within the primary mattress market but influences the budget segment. End-user segmentation reveals a strong emphasis on the residential sector, driven by urbanization and rising disposable incomes, with a growing, albeit smaller, commercial application in hospitality. Mergers and acquisitions (M&A) are shaping the competitive landscape, with companies strategically consolidating their market positions and expanding their product portfolios. For instance, the acquisition of Kurlon Enterprise Limited by Sheela Foam in July 2023 underscores this trend, further strengthening leadership in the modern mattress segment. While quantitative data like concentration ratios fluctuate, the trend indicates ongoing consolidation and strategic alliances aimed at capturing greater market share and fostering innovation.

- Market Concentration: Moderate to high, with leading players like Sheela Foam and Duroflex dominating market share.

- Innovation Drivers: Consumer demand for comfort, orthopedic support, cooling technologies, and sustainable materials.

- Regulatory Impacts: Focus on product safety, flammability standards, and material certifications.

- Product Substitutes: Limited impact on the core mattress market; primarily affects budget or temporary bedding solutions.

- End-User Segmentation: Predominantly residential, with growing commercial applications in hotels and healthcare.

- M&A Trends: Strategic acquisitions and partnerships aimed at market expansion and portfolio enhancement.

India Mattress Market Market Trends & Opportunities

The India mattress market is poised for significant expansion, driven by a confluence of favorable economic, demographic, and lifestyle trends. The market size is projected to grow at a robust Compound Annual Growth Rate (CAGR) of approximately 10-12% from 2025 to 2033. This growth is underpinned by increasing disposable incomes, a burgeoning middle class with a greater propensity to invest in home comfort, and a rising awareness of the importance of quality sleep for overall health and well-being. Technological shifts are a significant trend, with a notable surge in the adoption of memory foam and latex mattresses, catering to consumers seeking personalized comfort and superior orthopedic support. The online retail channel is witnessing exponential growth, disrupting traditional distribution models and offering consumers greater convenience and wider product choices. This shift has been propelled by the increasing penetration of internet access and e-commerce platforms across India.

Furthermore, the "health and wellness" trend is profoundly influencing consumer preferences. Consumers are actively seeking mattresses that offer therapeutic benefits, such as pressure point relief, spinal alignment, and improved air circulation, leading to increased demand for specialized mattresses. The COVID-19 pandemic also played a pivotal role in accentuating the importance of home comfort and creating a conducive sleep environment, further accelerating the adoption of premium mattresses. The market penetration of modern mattresses, especially in Tier 2 and Tier 3 cities, is still relatively low, presenting substantial untapped potential. This presents a significant opportunity for manufacturers to expand their reach and cater to a wider demographic. The rise of direct-to-consumer (DTC) brands, such as Wakefit, has democratized the market, offering quality products at competitive price points and challenging established players. This competitive dynamic is fostering innovation and pushing the boundaries of product development.

The Indian government's focus on improving living standards and promoting domestic manufacturing through initiatives like "Make in India" also provides a supportive ecosystem for the mattress industry. The growing real estate sector, with increased housing construction, directly translates to higher demand for home furnishings, including mattresses. Urbanization continues to be a dominant theme, with metropolitan areas acting as key consumption hubs, but the potential for growth in semi-urban and rural areas remains immense as incomes rise and consumer awareness spreads. The trend towards customization and personalization in home décor is also extending to mattresses, with consumers seeking options that cater to their specific sleeping positions and comfort preferences. The increasing adoption of smart home technologies might also pave the way for connected mattresses offering sleep tracking and personalized adjustments in the future.

- Market Size Growth: Projected to grow at a CAGR of 10-12% between 2025 and 2033.

- Technological Shifts: Increasing demand for memory foam, latex, and hybrid mattresses.

- Consumer Preferences: Growing emphasis on health, wellness, orthopedic support, and personalized comfort.

- Competitive Dynamics: Rise of DTC brands, aggressive online sales, and strategic partnerships.

- Market Penetration Rates: Significant untapped potential in Tier 2 and Tier 3 cities.

- Distribution Channel Evolution: Exponential growth of online sales channels.

- Government Initiatives: Supportive policies for domestic manufacturing and housing development.

Dominant Markets & Segments in India Mattress Market

The India mattress market is characterized by distinct regional dominance and segment leadership, driven by socio-economic factors, infrastructure development, and evolving consumer lifestyles.

Dominant Regions:

While national trends are important, certain regions consistently exhibit higher mattress consumption due to a combination of factors:

- Southern India: States like Tamil Nadu, Karnataka, and Kerala often lead in mattress sales. This is attributed to a higher disposable income, a more established furniture retail infrastructure, and a greater awareness of health and comfort among consumers. The presence of major manufacturing hubs also contributes to market activity.

- Western India: Maharashtra and Gujarat are also significant markets, driven by rapid urbanization, a strong industrial base, and a cosmopolitan population with a penchant for modern lifestyle products. Mumbai and Pune, in particular, are key consumption centers.

- Northern India: Delhi NCR and Punjab represent substantial markets, fueled by a growing population, increasing disposable incomes, and a burgeoning real estate sector.

Dominant Segments:

Within the broader mattress market, specific product types, applications, and distribution channels are experiencing significant growth and dominance:

- Type: Memory Foam Mattress: This segment is experiencing phenomenal growth, driven by consumer demand for pressure relief, motion isolation, and contouring comfort. Memory foam mattresses are perceived as premium and offer significant therapeutic benefits, aligning with the growing health and wellness trend.

- Application: Residential: The residential sector remains the bedrock of the India mattress market. Factors like increasing nuclear families, rising homeownership rates, and a greater focus on home improvement and comfort are fueling demand. The growing trend of upgrading existing mattresses also contributes significantly.

- Distribution Channel: Online: The online channel has emerged as a dominant and rapidly growing distribution route. E-commerce platforms offer unparalleled convenience, wider product selection, competitive pricing, and direct-to-consumer (DTC) models that bypass traditional retail overheads. This has democratized access to quality mattresses across India.

Key Growth Drivers for Dominant Markets and Segments:

- Infrastructure Development: Enhanced connectivity and logistics in Tier 2 and Tier 3 cities are enabling wider market reach for manufacturers and retailers.

- Government Policies: Initiatives promoting housing construction and manufacturing indirectly boost mattress demand.

- Urbanization and Disposable Income: Rising urban populations and increasing per capita income directly translate to higher consumer spending on home comfort products.

- Health and Wellness Awareness: Growing consumer understanding of the link between quality sleep and overall health is driving demand for specialized and orthopedic mattresses.

- Digitalization and E-commerce Penetration: The widespread adoption of smartphones and internet services has facilitated the growth of online mattress sales.

- Real Estate Growth: The continuous expansion of the residential real estate sector directly fuels the demand for new home furnishings, including mattresses.

India Mattress Market Product Analysis

The India mattress market is characterized by a diverse range of product innovations aimed at enhancing comfort, support, and sleep quality. Memory foam mattresses lead in popularity due to their excellent contouring and pressure-relieving properties. Innerspring mattresses, while a traditional segment, are evolving with improved coil technologies for better support and durability. Latex mattresses are gaining traction for their natural, breathable, and hypoallergenic qualities. The market also sees a rise in hybrid constructions, combining the benefits of innerspring support with the comfort layers of foam. Competitive advantages are being carved out through features like cooling gel infusions, advanced edge support, and specialized orthopedic designs. Brands are increasingly focusing on sustainable and eco-friendly materials to cater to the growing environmentally conscious consumer base.

Key Drivers, Barriers & Challenges in India Mattress Market

Key Drivers:

The India mattress market is propelled by several key drivers. Increasing disposable incomes and a growing middle class are leading to higher spending on home comfort. The rising awareness of health and wellness, particularly the importance of quality sleep, is driving demand for orthopedic and specialized mattresses. Urbanization and a burgeoning real estate sector directly translate to increased demand for home furnishings. Furthermore, technological advancements in mattress materials like memory foam and latex, coupled with innovative designs, are attracting consumers. The growth of e-commerce and direct-to-consumer (DTC) models is expanding market access and offering competitive pricing.

Barriers & Challenges:

Despite the positive outlook, the market faces significant barriers and challenges. Price sensitivity, especially in non-metro areas and for lower-income groups, remains a constraint. Intense competition from both organized and unorganized players, including local manufacturers, can lead to price wars and pressure on margins. Supply chain complexities, particularly for raw material sourcing and efficient distribution across a vast country, pose logistical hurdles. Counterfeiting and quality concerns associated with unorganized players can impact consumer trust and brand perception. Evolving consumer preferences and the rapid pace of innovation require continuous investment in R&D and marketing to stay competitive.

Growth Drivers in the India Mattress Market Market

The India mattress market is experiencing robust growth fueled by several key factors. Rising disposable incomes are enabling a larger segment of the population to invest in premium and comfortable bedding solutions. The increasing health consciousness among consumers, who understand the critical role of quality sleep in overall well-being, is a significant driver for orthopedic and therapeutic mattresses. The continuous expansion of the real estate sector, with new housing projects and a focus on home improvement, directly boosts the demand for mattresses. Technological innovations in materials such as memory foam, latex, and hybrid constructions are creating new product categories and enhancing consumer appeal. The digitalization of retail, with the explosive growth of e-commerce and DTC brands, is expanding market reach and offering competitive pricing strategies. Government initiatives promoting domestic manufacturing also contribute to a favorable growth environment.

Challenges Impacting India Mattress Market Growth

Several challenges impact the growth trajectory of the India mattress market. Price sensitivity remains a significant restraint, particularly in semi-urban and rural areas where affordability is a primary concern. The market is characterized by intense competition, with numerous organized and unorganized players vying for market share, leading to pressure on profit margins. Supply chain inefficiencies, including the sourcing of raw materials and the logistics of distributing products across a geographically diverse nation, can lead to increased costs and delivery delays. Counterfeiting and the prevalence of low-quality products from unorganized manufacturers can erode consumer trust and brand equity. Furthermore, rapidly evolving consumer preferences necessitate continuous product development and marketing efforts, requiring substantial investment. Regulatory hurdles related to manufacturing standards and environmental compliance, though generally supportive, can also present complexities for businesses.

Key Players Shaping the India Mattress Market Market

- Peps India

- Springwel Mattresses Pvt Ltd

- Wakefit

- Coirfit Mattress

- Springfit

- Sheela Foam

- Duroflex

- Wink and Nod

- Coirfoam (India) Pvt Ltd

Significant India Mattress Market Industry Milestones

- August 2023: Springfit Mattress announced plans to open 150–200 Springfit Lounge showrooms in the next year, indicating expansion in physical retail presence.

- July 2023: Sheela Foam approved the acquisition of a 94.6% stake in Kurlon Enterprise Limited (KEL), significantly strengthening its leadership position in the modern mattress market through consolidation.

- March 2023: VFI Group partnered with Setra Simmons, a US-based company, to produce luxurious bedding in India, signaling a move towards premium product offerings and international collaborations.

Future Outlook for India Mattress Market Market

The future outlook for the India mattress market remains exceptionally bright, fueled by sustained economic growth, increasing urbanization, and a heightened consumer focus on health and well-being. The ongoing shift towards premiumization, with consumers willing to invest more in quality sleep solutions, will continue to drive demand for memory foam, latex, and hybrid mattresses. The digital revolution will further empower consumers through enhanced accessibility and transparency, with e-commerce and DTC channels playing an even more significant role. Opportunities lie in expanding reach into Tier 2 and Tier 3 cities, where market penetration is still nascent. Innovations in smart mattress technology, sustainable materials, and personalized comfort solutions will shape future product development. Strategic partnerships and acquisitions are likely to continue as companies seek to consolidate market share and expand their product portfolios. The overall trajectory indicates a robust growth phase, making the India mattress market a highly attractive investment and business landscape.

India Mattress Market Segmentation

-

1. Type

- 1.1. Innerspring Mattress

- 1.2. Memory Foam Mattress

- 1.3. Latex Mattress

- 1.4. Other Ty

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Multi-Brand Stores

- 3.3. Online

- 3.4. Other Di

India Mattress Market Segmentation By Geography

- 1. India

India Mattress Market Regional Market Share

Geographic Coverage of India Mattress Market

India Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends

- 3.3. Market Restrains

- 3.3.1 Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2

- 3.3.2 3 cities

- 3.4. Market Trends

- 3.4.1. Rising Residential Space In India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring Mattress

- 5.1.2. Memory Foam Mattress

- 5.1.3. Latex Mattress

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Multi-Brand Stores

- 5.3.3. Online

- 5.3.4. Other Di

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peps India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Springwel Mattresses Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wakefit

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coirfit Mattress

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Springfit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheela Foam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duroflex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wink and Nod

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Coirfoam (India) Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Peps India

List of Figures

- Figure 1: India Mattress Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: India Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: India Mattress Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Mattress Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: India Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Mattress Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Mattress Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: India Mattress Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Mattress Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: India Mattress Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: India Mattress Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: India Mattress Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Mattress Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Mattress Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Mattress Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the India Mattress Market?

Key companies in the market include Peps India, Springwel Mattresses Pvt Ltd, Wakefit, Coirfit Mattress, Springfit, Sheela Foam, Duroflex, Wink and Nod, Coirfoam (India) Pvt Ltd.

3. What are the main segments of the India Mattress Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends.

6. What are the notable trends driving market growth?

Rising Residential Space In India is Driving the Market.

7. Are there any restraints impacting market growth?

Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2. 3 cities.

8. Can you provide examples of recent developments in the market?

In August 2023, Springfit Mattress announced it is planning to open 150–200 Springfit Lounge showrooms in the next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Mattress Market?

To stay informed about further developments, trends, and reports in the India Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence