Key Insights

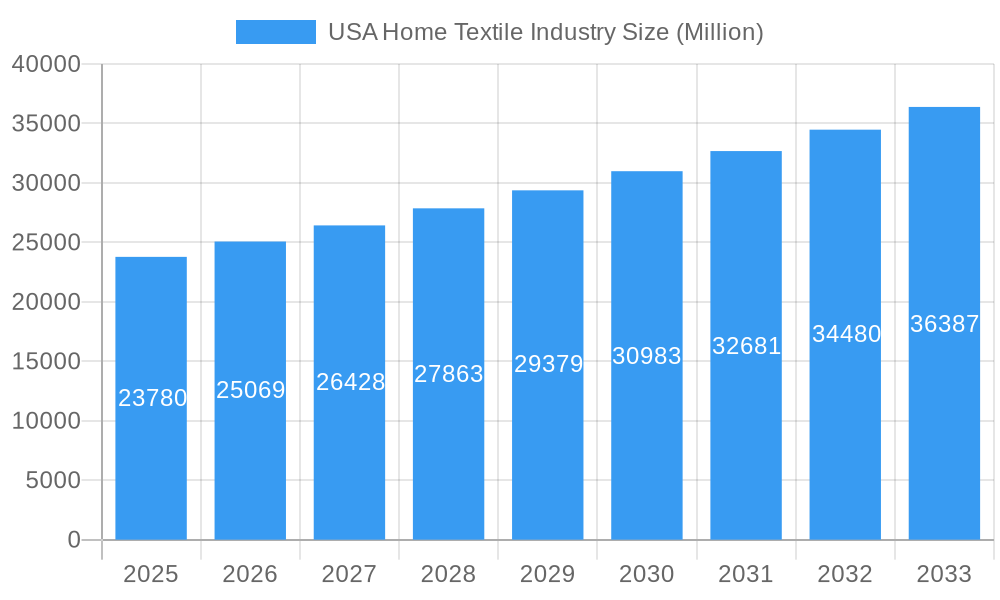

The United States home textile market is a robust and dynamic sector, currently valued at approximately $23.78 billion. Projected to expand at a Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2033, the market is poised for significant growth, reaching an estimated value well over $35 billion by the end of the forecast period. This expansion is fueled by a confluence of factors, including rising disposable incomes and an increasing consumer focus on home décor and comfort. The demand for premium and aesthetically pleasing home textiles, from luxurious bed linens to durable upholstery, is a key driver. Furthermore, the growing trend of "nesting" and enhancing living spaces, particularly post-pandemic, has amplified consumer spending on home furnishings. Technological advancements in textile manufacturing, leading to more sustainable and functional materials, also contribute to market vibrancy. The shift towards online retail channels is particularly pronounced, offering consumers wider choices and convenience.

USA Home Textile Industry Market Size (In Billion)

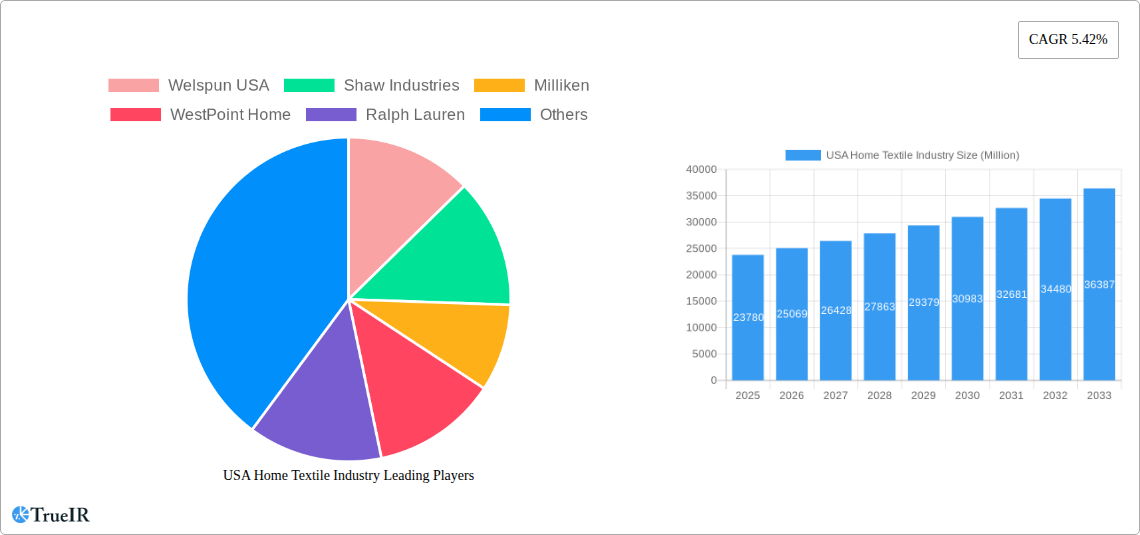

The market is segmented across various product categories, with Bed Linen and Bath Linen segments holding significant market share due to their consistent replacement cycles and strong demand for comfort and hygiene. Upholstery and Floor Covering also represent substantial segments, driven by home renovation and interior design trends. While supermarkets and hypermarkets cater to everyday needs, specialty stores and online platforms are increasingly becoming go-to destinations for premium and niche home textile products. Key players such as Welspun USA, Shaw Industries, and Ralph Lauren are actively innovating and expanding their offerings to capture market share. Emerging trends like the demand for eco-friendly and sustainable textiles, as well as smart home textile integration, are shaping the competitive landscape and presenting new avenues for growth. Despite the positive outlook, challenges such as fluctuating raw material prices and intense competition could pose potential restraints to market expansion.

USA Home Textile Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the USA Home Textile Industry, designed for immediate use without further modification.

USA Home Textile Industry Market Analysis Report: Trends, Opportunities, and Competitive Landscape (2019–2033)

This comprehensive report provides an in-depth analysis of the USA Home Textile Industry, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025–2033, this report leverages high-volume keywords to ensure maximum visibility and engagement for industry professionals. Explore key segments, dominant markets, product innovations, and the strategic moves of leading players.

USA Home Textile Industry Market Structure & Competitive Landscape

The USA Home Textile Industry exhibits a moderately concentrated market structure, with a few dominant players alongside a significant number of smaller enterprises. Innovation drivers are primarily focused on sustainable materials, smart textiles, and enhanced comfort and functionality. Regulatory impacts, while present, tend to focus on safety standards and labeling rather than outright market entry barriers. Product substitutes are readily available, ranging from natural fibers to synthetic alternatives, influencing pricing strategies and product differentiation. End-user segmentation highlights the strong demand from the residential sector, followed by the hospitality and commercial segments. Mergers & Acquisitions (M&A) trends are active, reflecting a drive for market consolidation, product portfolio expansion, and the acquisition of innovative technologies. For instance, the acquisition of Vitromex by Mohawk Industries for approximately $293 Million in June 2022 underscores this trend, integrating ceramic tile businesses to bolster market share. The industry is characterized by a competitive intensity that necessitates continuous product development and efficient supply chain management. Concentration ratios are estimated to be around XX% for the top 5 players, indicating a significant but not entirely monopolistic landscape. M&A deal volumes have averaged around $XXX Million annually over the historical period.

USA Home Textile Industry Market Trends & Opportunities

The USA Home Textile Industry is poised for substantial growth, driven by evolving consumer preferences and technological advancements. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This growth is fueled by increasing disposable incomes, a strong housing market, and a growing consumer emphasis on home décor and comfort. Technological shifts are transforming the industry, with the integration of smart textiles offering features like temperature regulation and health monitoring. The rise of e-commerce has also dramatically reshaped distribution channels, leading to increased online sales and direct-to-consumer models.

Consumer preferences are increasingly leaning towards sustainable and eco-friendly products. This includes a demand for organic cotton, recycled materials, and ethically sourced textiles. Furthermore, there's a growing appreciation for artisanal and handcrafted items, creating niche market opportunities. The COVID-19 pandemic accelerated the trend of home improvement and comfortable living, boosting demand for home textiles.

Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Companies are focusing on product differentiation through design, quality, and sustainability. The market penetration rate for high-performance and eco-friendly home textiles is expected to rise steadily. Opportunities exist in expanding product lines to cater to diverse demographic needs, investing in digital marketing and online sales platforms, and developing innovative, sustainable textile solutions. The integration of advanced manufacturing techniques, such as 3D printing for customized textile applications, also presents a frontier for innovation. Market growth is anticipated to be robust across all segments, with particular strength in bed linen and upholstery due to increased spending on home renovations and furniture upgrades. The trend of smaller, more frequent purchases of decorative items also contributes to sustained market activity.

Dominant Markets & Segments in USA Home Textile Industry

The Bed Linen segment currently holds dominant market share within the USA Home Textile Industry, driven by consistent replacement cycles and a strong consumer focus on bedroom aesthetics and comfort. Its market dominance is further bolstered by the sheer volume of households requiring these essential items.

- Key Growth Drivers for Bed Linen:

- Consumer Demand for Comfort and Aesthetics: Growing importance of bedrooms as personal sanctuaries.

- Innovation in Fabrics: Introduction of breathable, hypoallergenic, and wrinkle-resistant materials.

- Seasonal Trends and Decorations: Frequent updates to bedding to reflect changing seasons and décor styles.

- Online Retail Growth: Increased accessibility and variety through e-commerce platforms.

The Online distribution channel is rapidly emerging as a leading force, challenging traditional retail models. Its agility, reach, and ability to offer a vast selection of products make it increasingly preferred by consumers.

- Key Growth Drivers for Online Distribution:

- Convenience and Accessibility: 24/7 shopping availability from anywhere.

- Price Competitiveness: Direct-to-consumer models and comparison shopping capabilities.

- Personalization and Customization: Enhanced ability to filter and find specific product attributes.

- Efficient Logistics and Delivery Networks: Improved speed and reliability of order fulfillment.

While Bed Linen leads in current market value, the Upholstery segment is experiencing significant growth, driven by the booming furniture industry and home renovation trends. The Floor Covering segment, encompassing rugs and carpets, also demonstrates robust performance, influenced by both residential and commercial construction and interior design preferences. The Supermarkets and Hypermarkets channel continues to hold a significant share, catering to impulse buys and basic home textile needs, though its growth is outpaced by the online segment. Specialty Stores remain crucial for premium and niche products, offering curated selections and expert advice.

The overall market dominance is a dynamic interplay of essential demand (Bed Linen), evolving lifestyle choices (Upholstery, Floor Covering), and shifting consumer purchasing behaviors (Online Distribution).

USA Home Textile Industry Product Analysis

Product innovation in the USA Home Textile Industry is characterized by a focus on enhanced functionality, sustainability, and aesthetic appeal. Advancements in material science have led to the development of performance fabrics offering superior durability, stain resistance, and antimicrobial properties. For instance, infused bedding technologies provide enhanced cooling or heating capabilities. Furthermore, the increasing demand for eco-friendly products has driven the adoption of recycled polyester, organic cotton, and bamboo-based textiles, appealing to environmentally conscious consumers. Smart textiles are also gaining traction, integrating sensors for health monitoring or ambient adjustments. Competitive advantages are being carved out through unique designs, certifications (e.g., OEKO-TEX), and the seamless integration of technology into everyday home textiles.

Key Drivers, Barriers & Challenges in USA Home Textile Industry

Key Drivers:

- Rising Disposable Income: Increased consumer spending on home décor and comfort.

- Home Renovation Boom: Growing investment in home improvement projects.

- Sustainability Trend: Consumer preference for eco-friendly and ethically produced textiles.

- E-commerce Growth: Expanded reach and convenience for consumers.

- Technological Advancements: Development of smart textiles and innovative fabric technologies.

Key Barriers & Challenges:

- Supply Chain Disruptions: Volatility in raw material sourcing and logistics, leading to potential delays and increased costs. For example, global shipping container shortages can impact import volumes.

- Intense Competition: Presence of numerous domestic and international manufacturers, leading to price pressures and the need for constant differentiation.

- Raw Material Price Volatility: Fluctuations in the cost of cotton, polyester, and other key fibers can affect profit margins.

- Regulatory Compliance: Adherence to evolving environmental and safety standards can incur additional costs and complexities.

Growth Drivers in the USA Home Textile Industry Market

The USA Home Textile Industry is propelled by several key growth drivers. Increasing consumer spending on home improvement and interior design remains a primary catalyst, fueled by a strong economy and rising disposable incomes. The persistent trend of personalization and customization in home décor encourages consumers to invest in unique and high-quality textiles. Furthermore, technological innovations are creating new product categories, such as smart textiles with integrated heating or cooling features, or bedding with enhanced hypoallergenic properties. Sustainability concerns are also a significant driver, with a growing demand for organic, recycled, and ethically sourced materials, creating new market niches and brand loyalties. The robust growth of the online retail channel facilitates wider product accessibility and drives sales volume.

Challenges Impacting USA Home Textile Industry Growth

Several challenges are impacting the growth of the USA Home Textile Industry. Persistent supply chain volatility, stemming from global logistical issues and geopolitical factors, leads to unpredictable lead times and increased operational costs. Intense competition, both from established brands and emerging direct-to-consumer companies, exerts downward pressure on prices and necessitates continuous innovation and marketing efforts. Fluctuations in the cost of raw materials, such as cotton and polyester, can significantly impact profit margins and pricing strategies. Additionally, navigating complex and evolving regulatory landscapes, particularly concerning environmental impact and labeling, adds to operational complexities and compliance costs. The need for substantial investment in new technologies and sustainable manufacturing processes also presents a financial hurdle for some players.

Key Players Shaping the USA Home Textile Industry Market

- Welspun USA

- Shaw Industries

- Milliken

- WestPoint Home

- Ralph Lauren

- Standard Textile

- TJX Companies

- Etro Home Collection

- Mohawk Industries

- Jim Thompson Fabrics

Significant USA Home Textile Industry Industry Milestones

- December 2022: Milliken & Company, a diversified global textile manufacturer with more than 70 locations worldwide, plans to expand operations in Cherokee County. The company's $27.4 Million investment will create 75 new jobs.

- June 2022: Mohawk Industries has entered into an agreement to purchase the Vitromex ceramic tile business from Grupo Industrial Saltillo (GIS) for approximately $293 Million in cash. The transaction is expected to close in the second half of 2022 and is subject to the approval of GIS's shareholders, customary government approvals, and closing conditions. The Vitromex business is expected to be accretive to Mohawk's earnings.

Future Outlook for USA Home Textile Industry Market

The future outlook for the USA Home Textile Industry is characterized by sustained growth and evolving consumer demands. Strategic opportunities lie in capitalizing on the increasing demand for sustainable and ethically sourced products, which presents significant brand differentiation potential. The continued expansion of e-commerce platforms will be crucial for market penetration, offering direct access to a broader consumer base and enabling personalized marketing strategies. Investment in smart textiles and functional fabrics will unlock new product categories and premium market segments. Furthermore, companies that can effectively manage supply chain resilience and cost optimization will be well-positioned to thrive. The industry is expected to see continued innovation in areas like home wellness and comfort, driven by shifting lifestyle priorities and technological advancements. Market potential remains robust, particularly in segments catering to customization, performance, and environmental consciousness.

USA Home Textile Industry Segmentation

-

1. Material Type

- 1.1. Bed Linen

- 1.2. Bath Linen

- 1.3. Kitchen Linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Others

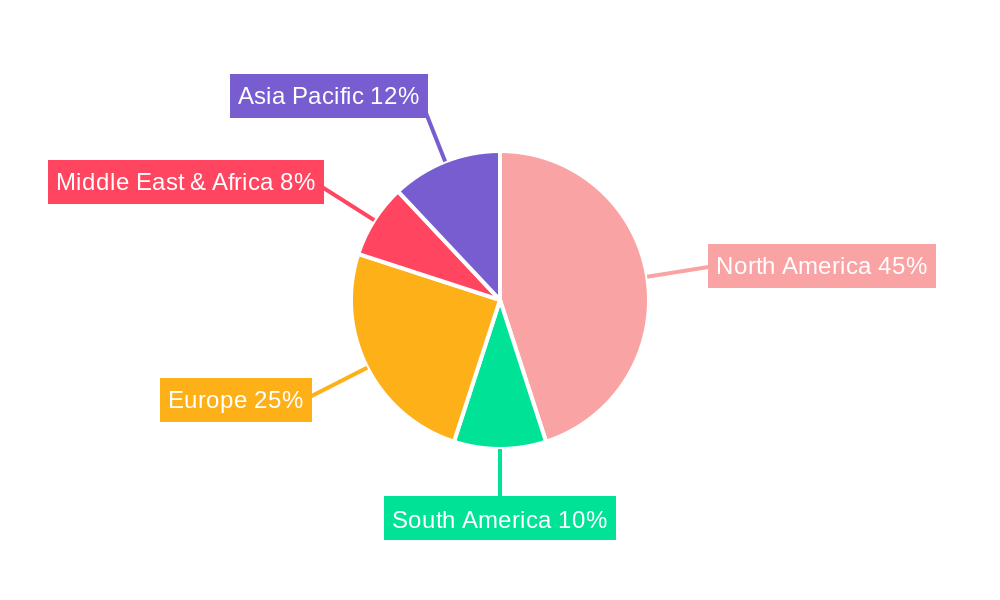

USA Home Textile Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Home Textile Industry Regional Market Share

Geographic Coverage of USA Home Textile Industry

USA Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Resistance to Scratches and Stains Drives the Market; High Durability Drives the Market

- 3.3. Market Restrains

- 3.3.1. Excess Water Damages the Floor Covering; Exposure to Sun Cause Damages to the Floor Covering; Market Oppurtunities4.; Technological Advancements in Floor Covering Market4.; Increasing Demand for Hardwood Floors

- 3.4. Market Trends

- 3.4.1. Increasing Sector of Real Estate is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Bed Linen

- 5.1.2. Bath Linen

- 5.1.3. Kitchen Linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Bed Linen

- 6.1.2. Bath Linen

- 6.1.3. Kitchen Linen

- 6.1.4. Upholstery

- 6.1.5. Floor Covering

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Bed Linen

- 7.1.2. Bath Linen

- 7.1.3. Kitchen Linen

- 7.1.4. Upholstery

- 7.1.5. Floor Covering

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Bed Linen

- 8.1.2. Bath Linen

- 8.1.3. Kitchen Linen

- 8.1.4. Upholstery

- 8.1.5. Floor Covering

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Bed Linen

- 9.1.2. Bath Linen

- 9.1.3. Kitchen Linen

- 9.1.4. Upholstery

- 9.1.5. Floor Covering

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific USA Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Bed Linen

- 10.1.2. Bath Linen

- 10.1.3. Kitchen Linen

- 10.1.4. Upholstery

- 10.1.5. Floor Covering

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets and Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Welspun USA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shaw Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Milliken

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WestPoint Home

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ralph Lauren

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Standard Textile**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TJX Companies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Etro Home Collection

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mohawk Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jim Thompson Fabrics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Welspun USA

List of Figures

- Figure 1: Global USA Home Textile Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Home Textile Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America USA Home Textile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America USA Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America USA Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America USA Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America USA Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Home Textile Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 9: South America USA Home Textile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: South America USA Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America USA Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America USA Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America USA Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Home Textile Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Europe USA Home Textile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe USA Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe USA Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe USA Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe USA Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Home Textile Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Middle East & Africa USA Home Textile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Middle East & Africa USA Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa USA Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa USA Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Home Textile Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Asia Pacific USA Home Textile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific USA Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific USA Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific USA Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Home Textile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global USA Home Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global USA Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global USA Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global USA Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 29: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global USA Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global USA Home Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 38: Global USA Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global USA Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Home Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Home Textile Industry?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the USA Home Textile Industry?

Key companies in the market include Welspun USA, Shaw Industries, Milliken, WestPoint Home, Ralph Lauren, Standard Textile**List Not Exhaustive, TJX Companies, Etro Home Collection, Mohawk Industries, Jim Thompson Fabrics.

3. What are the main segments of the USA Home Textile Industry?

The market segments include Material Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.78 Million as of 2022.

5. What are some drivers contributing to market growth?

High Resistance to Scratches and Stains Drives the Market; High Durability Drives the Market.

6. What are the notable trends driving market growth?

Increasing Sector of Real Estate is Driving the Market.

7. Are there any restraints impacting market growth?

Excess Water Damages the Floor Covering; Exposure to Sun Cause Damages to the Floor Covering; Market Oppurtunities4.; Technological Advancements in Floor Covering Market4.; Increasing Demand for Hardwood Floors.

8. Can you provide examples of recent developments in the market?

December 2022: Milliken & Company, a diversified global textile manufacturer with more than 70 locations worldwide, plans to expand operations in Cherokee County. The company's $27.4 million investment will create 75 new jobs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Home Textile Industry?

To stay informed about further developments, trends, and reports in the USA Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence