Key Insights

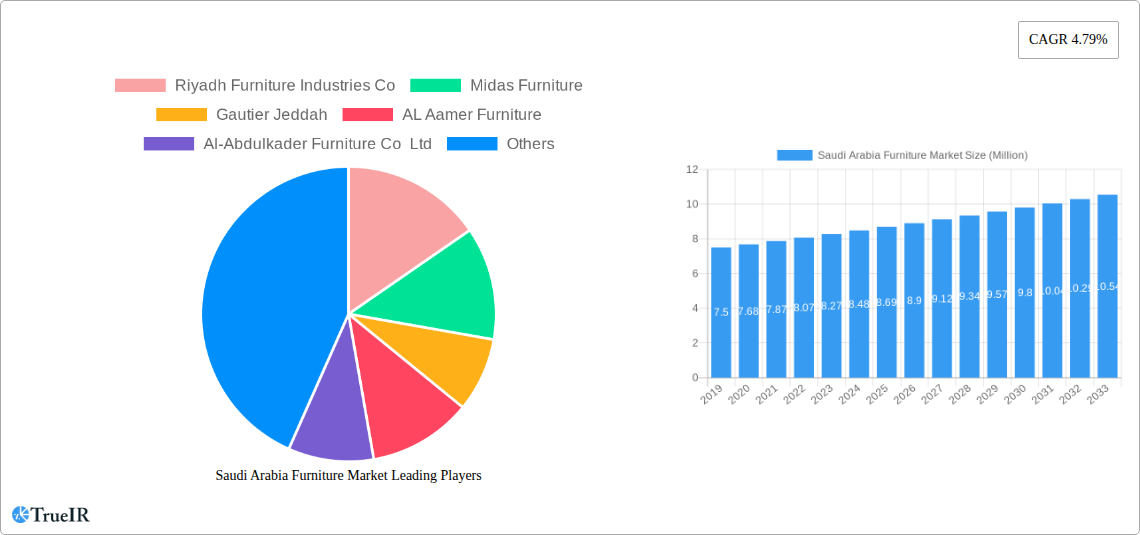

The Saudi Arabian furniture market is poised for significant expansion, projected to reach a substantial market size of USD 8.90 million and grow at a Compound Annual Growth Rate (CAGR) of 4.79% over the forecast period of 2025-2033. This robust growth is primarily fueled by several key drivers. The nation's ambitious Vision 2030 initiative, which includes extensive investment in real estate development, hospitality projects, and commercial infrastructure, is a major catalyst. This translates into a burgeoning demand for both residential and commercial furniture. Furthermore, a growing young population with increasing disposable incomes and a rising preference for modern, aesthetically pleasing, and functional furniture are contributing factors. The increasing trend towards urbanization and the development of new housing projects further solidify the demand for furniture. The market is witnessing a surge in demand for eco-friendly and sustainable furniture options, aligning with global environmental concerns and the Kingdom's own sustainability goals. E-commerce penetration is rapidly expanding, offering consumers greater accessibility and choice, which in turn boosts sales through online channels.

Saudi Arabia Furniture Market Market Size (In Million)

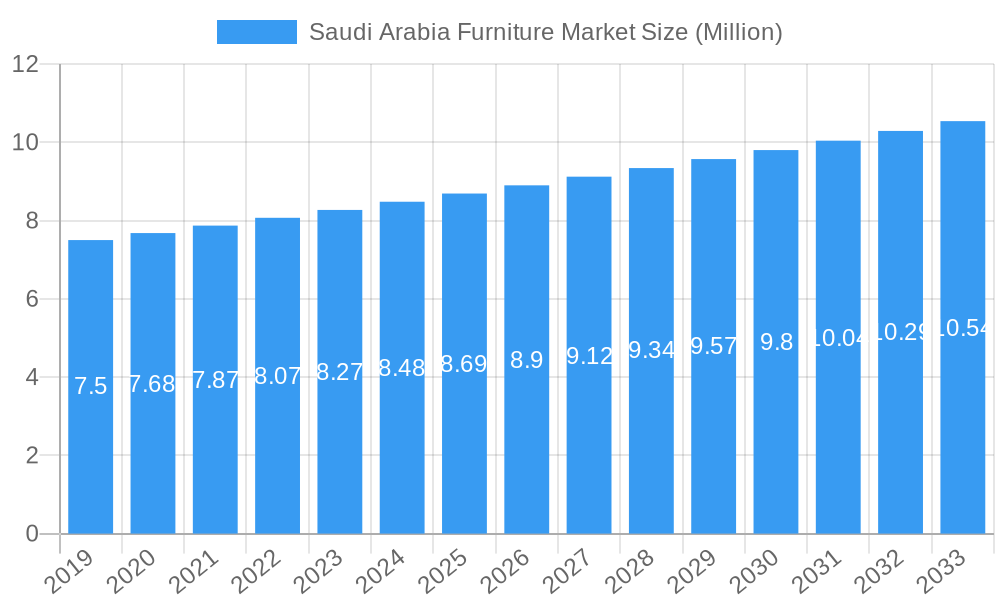

The market is segmented across various materials, applications, and distribution channels. Wood and metal continue to be dominant materials due to their durability and aesthetic appeal, while plastic and other innovative materials are gaining traction for their versatility and affordability. In terms of applications, home furniture remains the largest segment, driven by population growth and rising living standards. The office furniture sector is also experiencing notable growth due to the expansion of businesses and the increasing adoption of modern workspace designs. The hospitality sector, with ongoing investments in hotels and tourism, presents another significant avenue for furniture manufacturers and suppliers. Distribution channels are evolving, with a marked shift towards online sales platforms, supplementing the traditional strength of supermarkets, hypermarkets, and specialty stores. Key players like Riyadh Furniture Industries Co, Midas Furniture, and IKEA are actively shaping the market landscape through product innovation, strategic expansions, and strong brand presence, catering to a diverse range of consumer preferences and project requirements within Saudi Arabia.

Saudi Arabia Furniture Market Company Market Share

Here's a dynamic and SEO-optimized report description for the Saudi Arabia Furniture Market, designed for immediate use.

This in-depth report provides a definitive analysis of the Saudi Arabia Furniture Market, offering critical insights into its structure, trends, opportunities, and competitive landscape. Designed for industry stakeholders, investors, and strategic planners, this report leverages high-volume keywords to enhance search visibility and deliver actionable intelligence. Covering the study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report dissects market dynamics, consumer preferences, and the impact of key industry developments.

Saudi Arabia Furniture Market Market Structure & Competitive Landscape

The Saudi Arabia Furniture Market exhibits a moderate to high concentration, driven by the presence of established global players and robust local manufacturers. Innovation is primarily fueled by evolving consumer lifestyles, smart home integration, and a growing demand for sustainable and aesthetically pleasing furniture. Regulatory frameworks, while supportive of economic diversification, introduce compliance considerations for market entrants. Product substitutes, such as modular furniture and DIY solutions, pose a growing challenge, necessitating continuous product differentiation. End-user segmentation reveals a dominant Home Furniture segment, followed by a rapidly expanding Office Furniture sector driven by corporate expansion and remote work trends. The Hospitality Furniture segment is experiencing significant growth due to Vision 2030 initiatives, boosting tourism and infrastructure development. Mergers and acquisitions (M&A) activity, while currently at a nascent stage, is expected to intensify as larger entities seek to consolidate market share and expand their product portfolios. Quantitative insights suggest a growing M&A volume, projected to reach approximately 500 Million in transaction value by 2030. Concentration ratios are anticipated to shift as new market entrants, particularly those focusing on e-commerce and niche segments, gain traction. The competitive landscape is characterized by intense price competition, a focus on design innovation, and a growing emphasis on customer experience.

Saudi Arabia Furniture Market Market Trends & Opportunities

The Saudi Arabia Furniture Market is poised for substantial growth, projected to reach an estimated 25,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This expansion is fueled by a confluence of factors, including a young and growing population, increasing disposable incomes, and a burgeoning real estate sector. The market is witnessing a significant technological shift, with a pronounced trend towards online furniture sales, which are expected to capture over 30% of the market share by 2028. This digital transformation is driven by consumer demand for convenience, wider product selection, and competitive pricing. Consumer preferences are increasingly leaning towards modern, minimalist designs, customized solutions, and furniture incorporating smart technologies for enhanced functionality and comfort. The Home Furniture segment, in particular, is benefiting from a rise in smaller living spaces, leading to a demand for multi-functional and space-saving furniture. The Office Furniture segment is evolving to support hybrid work models, with an emphasis on ergonomic designs and collaborative workspaces. The Hospitality Furniture segment is experiencing a renaissance, driven by significant government investment in tourism infrastructure and the development of world-class hotels and entertainment venues. Opportunities abound for companies that can offer sustainable, eco-friendly furniture options, capitalizing on a growing environmental consciousness among Saudi consumers. Furthermore, the "Made in Saudi" initiative is creating a favorable environment for local manufacturers, fostering innovation and enhancing domestic production capabilities. The market penetration rate for premium and designer furniture is also on the rise, indicating a growing appetite for high-quality, aesthetically superior products. The integration of Artificial Intelligence (AI) in furniture design and retail, from virtual try-ons to personalized recommendations, is another emerging trend that presents significant growth potential.

Dominant Markets & Segments in Saudi Arabia Furniture Market

The Home Furniture segment stands as the undisputed leader within the Saudi Arabia Furniture Market, driven by continuous urbanization, a growing expatriate population, and the sustained demand for furnishing new homes and renovations. This segment is expected to account for over 60% of the total market revenue by 2028, valued at approximately 15,000 Million. Key growth drivers include:

- Infrastructure Development: The ongoing construction of new residential projects and housing complexes across major cities like Riyadh, Jeddah, and Dammam directly fuels the demand for home furnishings.

- Government Initiatives: Programs aimed at increasing homeownership and supporting young families contribute significantly to the demand for affordable and stylish home furniture.

- Rising Disposable Incomes: A growing middle class with increased purchasing power is opting for higher quality and more diverse furniture options for their homes.

The Office Furniture segment is the second-largest contributor, with a projected market size of 5,000 Million by 2028. This segment's growth is propelled by:

- Economic Diversification: The Kingdom's Vision 2030 initiatives are fostering the growth of new industries and the expansion of existing businesses, leading to increased demand for modern office spaces and furniture.

- Remote and Hybrid Work Trends: The adoption of flexible work arrangements necessitates ergonomic and collaborative office furniture solutions to enhance productivity and employee well-being.

- Corporate Expansion: Major national and international companies are establishing and expanding their presence in Saudi Arabia, creating a robust demand for office fit-outs.

The Hospitality Furniture segment is experiencing the fastest growth, driven by ambitious tourism development plans. Expected to reach 3,000 Million by 2028, its dominance is fueled by:

- Mega-Projects: The development of giga-projects such as NEOM, Red Sea Project, and Qiddiya are creating unprecedented demand for hotel, resort, and entertainment venue furnishings.

- World-Class Events: Saudi Arabia's increasing role as a host for international sporting events, conferences, and cultural festivals necessitates the development of world-class hospitality infrastructure.

In terms of distribution channels, Specialty Stores currently dominate, offering curated selections and personalized customer service. However, the Online channel is rapidly gaining traction, projected to reach approximately 30% market share by 2028, offering convenience and a wider product range.

Saudi Arabia Furniture Market Product Analysis

The Saudi Arabia Furniture Market is witnessing a surge in product innovation characterized by the integration of smart technologies, sustainable materials, and modular designs. Companies are focusing on creating furniture that offers enhanced functionality, comfort, and aesthetic appeal. Key product innovations include smart beds with integrated charging and massage features, modular sofas adaptable to various living spaces, and furniture crafted from recycled and responsibly sourced materials. The competitive advantage lies in offering tailored solutions that cater to evolving consumer lifestyles and environmental consciousness, with an increasing emphasis on durability and longevity.

Key Drivers, Barriers & Challenges in Saudi Arabia Furniture Market

Key Drivers:

- Vision 2030 Implementation: This ambitious national transformation plan is a primary catalyst, driving economic growth, infrastructure development, and significant foreign investment, all of which positively impact furniture demand.

- Young & Growing Population: A large demographic of young adults entering the workforce and forming households creates sustained demand for home and office furniture.

- Urbanization & Real Estate Boom: Rapid city expansion and the construction of new residential and commercial properties directly translate to increased furniture sales.

- E-commerce Growth: The increasing adoption of online shopping platforms provides a convenient and accessible avenue for consumers to purchase furniture, expanding market reach.

Key Barriers & Challenges:

- Supply Chain Disruptions: Global and local supply chain vulnerabilities, including shipping delays and raw material availability, can impact production timelines and costs, potentially affecting prices.

- Regulatory Complexities: Navigating import/export regulations, local manufacturing standards, and evolving building codes can pose challenges for new market entrants.

- Intense Competition: The market features a mix of global brands, established local players, and emerging e-commerce platforms, leading to competitive pricing pressures and the need for strong differentiation.

- Skilled Labor Shortage: A potential shortage of skilled labor in manufacturing and design could impact production quality and innovation capabilities.

Growth Drivers in the Saudi Arabia Furniture Market Market

The Saudi Arabia Furniture Market is experiencing robust growth fueled by several key factors. The Vision 2030 initiative, with its emphasis on economic diversification and infrastructure development, is a paramount driver. This leads to significant investment in the real estate sector, including new residential complexes, commercial spaces, and hospitality projects, all of which require substantial furniture. The country's young and growing population, coupled with increasing disposable incomes, creates a consistent demand for home furnishings and lifestyle enhancements. Furthermore, the rapid expansion of the e-commerce sector is a significant growth accelerator, making furniture more accessible and convenient for consumers. Technological advancements in furniture design, such as the integration of smart home features and sustainable materials, are also appealing to modern consumers, driving demand for innovative products.

Challenges Impacting Saudi Arabia Furniture Market Growth

Despite the positive growth trajectory, the Saudi Arabia Furniture Market faces several challenges. Supply chain vulnerabilities, including global shipping disruptions and fluctuating raw material costs, can lead to increased production expenses and potential delays. Navigating regulatory frameworks and compliance requirements can be complex for both local and international businesses. The market also experiences intense competitive pressure from established global brands, local manufacturers, and the rapidly growing online retail segment, leading to price wars and the need for constant innovation. Additionally, ensuring a consistent supply of skilled labor in design, manufacturing, and logistics remains a potential bottleneck for sustained growth.

Key Players Shaping the Saudi Arabia Furniture Market Market

- Riyadh Furniture Industries Co

- Midas Furniture

- Gautier Jeddah

- AL Aamer Furniture

- Al-Abdulkader Furniture Co Ltd

- Al Jedaie

- IKEA

- Wardeh Salehiya

- BoConcept

- HABITAT FURNITURE CO LTD

- Almutlaq Furniture

- HomeCenter

- Saudi Modern Factory Company

- AL Rugaib Furniture

Significant Saudi Arabia Furniture Market Industry Milestones

- March 2024: Al-Futtaim IKEA launched its "Store of Tomorrow," an innovative retail concept prioritizing play, discovery, and family-oriented experiences, aiming to redefine the customer journey with a focus on accessibility and affordability.

- June 2023: Al Mutlaq Group partnered with Thriwe, a consumer benefits company, to enhance customer experience and bolster its loyalty and rewards program within Saudi Arabia, aiming to foster greater customer engagement and retention.

Future Outlook for Saudi Arabia Furniture Market Market

The Saudi Arabia Furniture Market is set for continued robust growth, driven by ongoing economic diversification, massive infrastructure projects, and evolving consumer lifestyles. The increasing adoption of e-commerce, coupled with a growing demand for sustainable and technologically advanced furniture, presents significant opportunities. Strategic investments in localized production, innovative product development, and enhanced customer experiences will be crucial for market players to capitalize on the expanding market potential. The market is projected to witness further consolidation and the emergence of specialized furniture providers catering to niche segments, ensuring a dynamic and competitive landscape for years to come.

Saudi Arabia Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic & Other Materials

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Saudi Arabia Furniture Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Furniture Market Regional Market Share

Geographic Coverage of Saudi Arabia Furniture Market

Saudi Arabia Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in the Construction Sector Boosting the Demand for Furniture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic & Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riyadh Furniture Industries Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midas Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gautier Jeddah

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AL Aamer Furniture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al-Abdulkader Furniture Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Jedaie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wardeh Salehiya

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BoConcept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HABITAT FURNITURE CO LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Almutlaq Furniture

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HomeCenter**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Modern Factory Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AL Rugaib Furniture

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Riyadh Furniture Industries Co

List of Figures

- Figure 1: Saudi Arabia Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Saudi Arabia Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Saudi Arabia Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Saudi Arabia Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Saudi Arabia Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Furniture Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Saudi Arabia Furniture Market?

Key companies in the market include Riyadh Furniture Industries Co, Midas Furniture, Gautier Jeddah, AL Aamer Furniture, Al-Abdulkader Furniture Co Ltd, Al Jedaie, IKEA, Wardeh Salehiya, BoConcept, HABITAT FURNITURE CO LTD, Almutlaq Furniture, HomeCenter**List Not Exhaustive, Saudi Modern Factory Company, AL Rugaib Furniture.

3. What are the main segments of the Saudi Arabia Furniture Market?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Urbanization; Growing Awareness of Sustainable Furniture.

6. What are the notable trends driving market growth?

Growth in the Construction Sector Boosting the Demand for Furniture Products.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2024: Al-Futtaim IKEA, the region's foremost Swedish home furnishing retailer, is thrilled to introduce its groundbreaking "Store of Tomorrow," which is set to transform the retail industry by prioritizing play, discovery, and family-oriented experiences. With an unwavering dedication to accessibility and affordability, Al-Futtaim IKEA welcomes customers to embark on a journey where playfulness and practicality harmoniously merge, providing a hassle-free shopping experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Furniture Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence