Key Insights

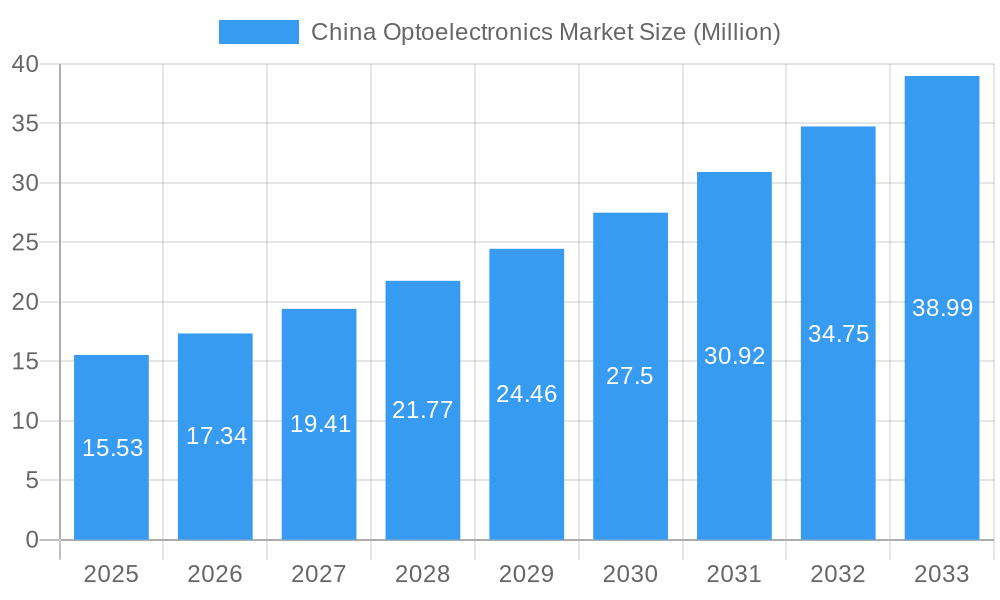

The China Optoelectronics Market is experiencing robust expansion, poised for significant growth in the coming years. The market was valued at 15.53 Million in 2025 and is projected to expand at a Compound Annual Growth Rate (CAGR) of 11.70% between 2025 and 2033. This impressive growth is fueled by several key drivers, including the burgeoning demand for advanced display technologies across consumer electronics and automotive sectors, coupled with the increasing adoption of optoelectronic sensors in smart manufacturing and healthcare applications. The rapid advancements in LED technology, particularly in energy-efficient lighting and high-resolution displays, are further propelling market momentum. Furthermore, the strategic investments by the Chinese government in high-tech industries, including optoelectronics, are creating a favorable ecosystem for innovation and market penetration.

China Optoelectronics Market Market Size (In Million)

Segmentation of the China Optoelectronics Market reveals diverse opportunities. In terms of type, LEDs are expected to dominate, driven by their widespread use in lighting, displays, and signage. Display Panels, including OLED and Micro-LED technologies, are also anticipated to witness substantial growth due to the demand for premium visual experiences in smartphones, televisions, and wearable devices. The application segment highlights strong performance in the Electronics and Automotive industries, where optoelectronics are crucial for components like cameras, sensors, and advanced lighting systems. The Healthcare sector is also emerging as a significant growth area, with increasing applications in medical imaging, diagnostics, and therapeutic devices. Despite the promising outlook, potential restraints such as intense price competition and the need for substantial R&D investment in next-generation technologies could pose challenges, but the overall trajectory points towards a dynamic and expanding market.

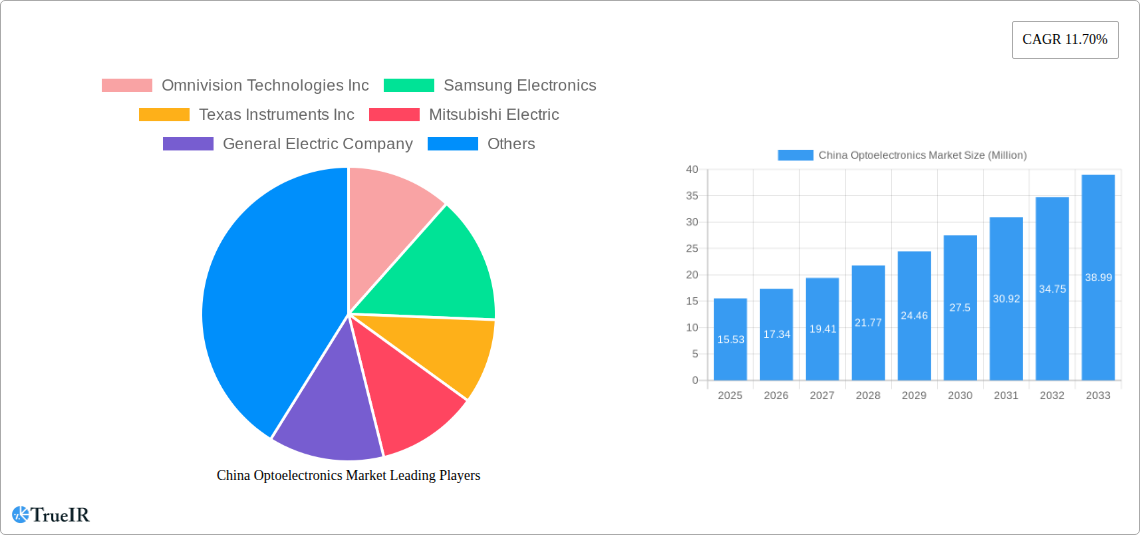

China Optoelectronics Market Company Market Share

Unlocking the Future of Light: China Optoelectronics Market Report 2025-2033

Dive deep into the rapidly evolving China optoelectronics market with this comprehensive, SEO-optimized report. Covering the study period 2019–2033, with a base year of 2025, this analysis provides unparalleled insights into the market dynamics, growth trajectories, and competitive landscape of China's burgeoning optoelectronics industry. Leverage high-volume keywords such as "China optoelectronics," "LED market China," "display panels China," "fiber optics China," "optoelectronic sensors," "automotive optoelectronics," "healthcare optoelectronics," and "industrial optoelectronics" to maximize your search visibility. This report is meticulously structured for clarity and actionable intelligence, requiring no further modifications.

China Optoelectronics Market Market Structure & Competitive Landscape

The China optoelectronics market exhibits a dynamic and evolving structure, characterized by intense competition and a drive for innovation. Market concentration is moderate, with key players vying for dominance across various segments. Innovation drivers are primarily fueled by government initiatives promoting indigenous technology development, substantial R&D investments by leading corporations, and the increasing demand from high-growth application sectors like automotive and healthcare. Regulatory impacts are significant, with policies aimed at fostering domestic production, ensuring quality standards, and promoting energy efficiency influencing market entry and growth. Product substitutes, while present, are often outpaced by the rapid advancements in optoelectronic technologies, leading to continuous product upgrades and differentiation. End-user segmentation reveals a strong reliance on the electronics industry, closely followed by the automotive sector and growing demand from healthcare and industrial applications. Merger and acquisition (M&A) trends are indicative of strategic consolidation and expansion, with an estimated volume of $X Million in M&A activities during the historical period. The competitive landscape is shaped by both established global giants and increasingly capable domestic manufacturers, creating a vibrant ecosystem focused on pushing technological boundaries.

China Optoelectronics Market Market Trends & Opportunities

The China optoelectronics market is poised for substantial expansion, driven by an estimated market size growth projected to reach $XXX Million by 2033. The historical period (2019–2024) saw steady growth, laying the foundation for a robust forecast period (2025–2033) with an anticipated Compound Annual Growth Rate (CAGR) of XX.X%. Technological shifts are a defining characteristic, with rapid advancements in LED technology, the proliferation of high-resolution display panels, the continuous development of high-speed fiber optics, and the increasing sophistication of optoelectronic sensors all contributing to market dynamism. Consumer preferences are increasingly leaning towards energy-efficient, high-performance, and integrated optoelectronic solutions, particularly in consumer electronics and automotive applications. The competitive dynamics are intensifying, with companies focusing on cost optimization, product differentiation, and strategic partnerships to gain market share. Opportunities abound in emerging applications such as smart lighting, advanced automotive lighting systems, next-generation displays for augmented and virtual reality, and precision optoelectronic components for medical devices. The market penetration rate for advanced optoelectronic solutions is steadily increasing, reflecting the growing adoption across diverse industries. The optoelectronics market in China is also a significant contributor to global supply chains, with a strong focus on miniaturization, increased functionality, and enhanced durability. The continuous evolution of visible, infrared, and ultraviolet technologies opens new avenues for specialized applications.

Dominant Markets & Segments in China Optoelectronics Market

The China optoelectronics market showcases dominance across several key regions and segments, driven by a confluence of factors. Within the Type segment, LEDs and Display Panels are currently the most dominant, propelled by massive demand from the consumer electronics, lighting, and television industries. The Application segment sees the Electronics industry leading, followed by a rapidly growing Automotive sector, where optoelectronics are crucial for advanced driver-assistance systems (ADAS), lighting, and in-cabin displays. Healthcare applications are also demonstrating significant growth, driven by demand for diagnostic imaging, surgical equipment, and wearable health monitors.

- Dominant Segments & Growth Drivers:

- LEDs: Driven by government policies promoting energy-efficient lighting, the expansion of smart city infrastructure, and the burgeoning demand for micro-LED and mini-LED displays.

- Display Panels: Fueled by the insatiable appetite for high-definition televisions, smartphones, and the emerging market for flexible and transparent displays.

- Automotive: Propelled by the electrification of vehicles, the increasing integration of ADAS, and the demand for innovative automotive lighting solutions.

- Electronics: Benefiting from the overall growth of China's consumer electronics manufacturing and the increasing complexity of electronic devices requiring advanced optoelectronic components.

The Technology segment sees Visible light technologies holding the largest share due to their widespread use in lighting and displays, but Infrared and Ultraviolet technologies are experiencing significant growth in specialized applications like sensing, sterilization, and medical diagnostics. Policies supporting domestic manufacturing and innovation in advanced semiconductor technologies are critical growth drivers. The vast domestic market size and the presence of major manufacturing hubs further solidify the dominance of specific segments and regions within China.

China Optoelectronics Market Product Analysis

The China optoelectronics market is characterized by a relentless stream of product innovations, enhancing performance, efficiency, and functionality. Key advancements include the development of ultra-high brightness LEDs for superior lighting and display applications, the introduction of advanced display panels with higher refresh rates and resolution, and the miniaturization and increased sensitivity of optoelectronic sensors for a wider range of detection tasks. Fiber optics continue to evolve with higher bandwidth and longer transmission capabilities, supporting the demand for faster data communication. Competitive advantages are derived from superior performance metrics, cost-effectiveness, and seamless integration into existing systems. The market is witnessing a surge in products catering to specific niche applications within automotive, healthcare, and industrial sectors, demonstrating a keen understanding of market needs and technological feasibility.

Key Drivers, Barriers & Challenges in China Optoelectronics Market

Key Drivers: The China optoelectronics market is propelled by strong technological advancements in areas like AI-driven manufacturing and advanced materials, significant government investments in high-tech industries, and supportive policies promoting domestic innovation and production. The burgeoning demand from key application sectors such as automotive (ADAS, EV components), healthcare (medical imaging, diagnostics), and consumer electronics (smart devices, displays) acts as a major catalyst for growth.

Barriers & Challenges: Key challenges include intense global and domestic competition leading to price pressures, sophisticated regulatory hurdles in certain advanced technology sectors, and potential supply chain disruptions for critical raw materials and specialized components. The need for continuous R&D investment to keep pace with rapid technological evolution also presents a significant barrier. Quantifiable impacts include potential delays in product launches due to supply chain issues and reduced profit margins due to competitive pricing.

Growth Drivers in the China Optoelectronics Market Market

The China optoelectronics market is experiencing robust growth fueled by several critical factors. Technological innovation is paramount, with ongoing research and development yielding more efficient, smaller, and higher-performing optoelectronic components. Economic expansion within China continues to drive demand across various sectors, particularly in consumer electronics and automotive. Furthermore, government policies actively support the optoelectronics industry through incentives for R&D, manufacturing localization, and export promotion. Specific examples include the "Made in China 2025" initiative, which prioritizes high-tech sectors like optoelectronics, and significant investments in smart city infrastructure, which boost demand for advanced lighting and sensor technologies.

Challenges Impacting China Optoelectronics Market Growth

Despite strong growth potential, the China optoelectronics market faces significant challenges. Regulatory complexities and evolving standards in rapidly advancing fields can create hurdles for market entry and product certification. Supply chain issues, particularly concerning the availability and cost of specialized raw materials and components, can lead to production delays and increased costs. Intense competitive pressures, both from domestic players and international competitors, result in price erosion and the need for continuous innovation to maintain market share. The rapid pace of technological change necessitates substantial and ongoing investment in research and development, which can be a barrier for smaller companies.

Key Players Shaping the China Optoelectronics Market Market

- Omnivision Technologies Inc

- Samsung Electronics

- Texas Instruments Inc

- Mitsubishi Electric

- General Electric Company

- Osram Licht AG

- Koninklijke Philips N V

- Rohm Semiconductor

- Panasonic Corporation

- Sony Corporation

Significant China Optoelectronics Market Industry Milestones

- April 2023: China's San'an Optoelectronics announced its strategic decision to integrate its proprietary Silicon Carbide chips into automotive manufacturing starting in Q4 2023, addressing the persistent automotive chip shortage and emphasizing domestic production capabilities. The company anticipates an 18-24 month investment and construction cycle for its Silicon Carbide chip projects, with the global shortfall of these critical power chips expected to persist until 2025.

- May 2022: Huawei entered into a significant partnership with National Star Optoelectronics, focusing on the advancement of mini-LED technology. This collaboration leverages Nationstar Optoelectronics' established expertise in LED display and backlight solutions with Huawei's strengths in chip technology, artificial intelligence (AI), and 5G.

Future Outlook for China Optoelectronics Market Market

The future outlook for the China optoelectronics market is exceptionally bright, driven by sustained demand from advanced technology sectors and supportive government policies. Key growth catalysts include the accelerating adoption of optoelectronic components in electric vehicles and autonomous driving systems, the expansion of smart city infrastructure, and the continued innovation in display technologies for consumer electronics and emerging augmented/virtual reality applications. Strategic opportunities lie in further developing domestic capabilities in high-end optoelectronic chip manufacturing and fostering collaborations that bridge the gap between research and commercialization. The market is poised for continued expansion, with a strong emphasis on sustainability, efficiency, and the integration of advanced functionalities.

China Optoelectronics Market Segmentation

-

1. Type

- 1.1. LEDs

- 1.2. Display Panels

- 1.3. Fiber Optics

- 1.4. Sensors

-

2. Technology

- 2.1. Visible

- 2.2. Infrared

- 2.3. Ultraviolet

-

3. Application

- 3.1. Automotive

- 3.2. Electronics

- 3.3. Healthcare

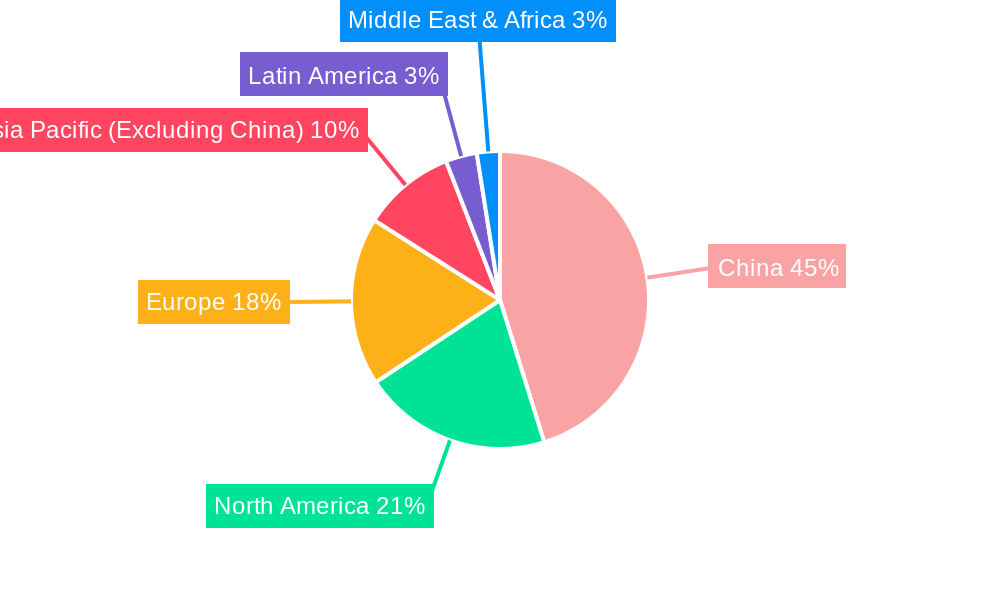

China Optoelectronics Market Segmentation By Geography

- 1. China

China Optoelectronics Market Regional Market Share

Geographic Coverage of China Optoelectronics Market

China Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing demand for Smart Consumer Electronics and Advanced Technologies; Increasing awareness about vehicle safety; Enhanced socio-economic and demographic factors such as urbanization

- 3.2.2 growing population

- 3.2.3 disposable incomes

- 3.3. Market Restrains

- 3.3.1. Limitations in the Use of Non-contact Technologies

- 3.4. Market Trends

- 3.4.1. The Image Sensors Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LEDs

- 5.1.2. Display Panels

- 5.1.3. Fiber Optics

- 5.1.4. Sensors

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Visible

- 5.2.2. Infrared

- 5.2.3. Ultraviolet

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Electronics

- 5.3.3. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Omnivision Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Texas Instruments Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram Licht AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rohm Semiconducto

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Omnivision Technologies Inc

List of Figures

- Figure 1: China Optoelectronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Optoelectronics Market Share (%) by Company 2025

List of Tables

- Table 1: China Optoelectronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Optoelectronics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: China Optoelectronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: China Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Optoelectronics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: China Optoelectronics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: China Optoelectronics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: China Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Optoelectronics Market?

The projected CAGR is approximately 11.70%.

2. Which companies are prominent players in the China Optoelectronics Market?

Key companies in the market include Omnivision Technologies Inc, Samsung Electronics, Texas Instruments Inc, Mitsubishi Electric, General Electric Company, Osram Licht AG, Koninklijke Philips N V, Rohm Semiconducto, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the China Optoelectronics Market?

The market segments include Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Smart Consumer Electronics and Advanced Technologies; Increasing awareness about vehicle safety; Enhanced socio-economic and demographic factors such as urbanization. growing population. disposable incomes.

6. What are the notable trends driving market growth?

The Image Sensors Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Limitations in the Use of Non-contact Technologies.

8. Can you provide examples of recent developments in the market?

April 2023: China's San'anOptoelectronics announced that it would utilize its own Silicon Carbide chips in cars from the fourth quarter of 2023. As per the company, the automobile industry is still short of chips, and manufacturing them domestically is one of the ways to solve shortages. The investment and construction period of silicon carbide chip projects is anticipated to be between 18 and 24 months, while the shortfall of silicon carbide power chips will last until 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Optoelectronics Market?

To stay informed about further developments, trends, and reports in the China Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence