Key Insights

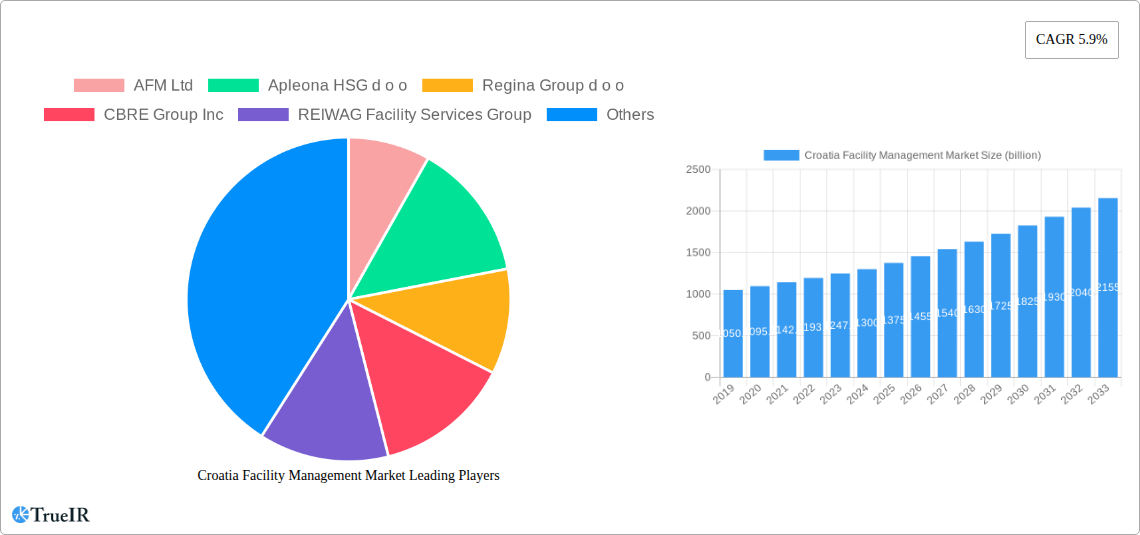

The Croatian Facility Management (FM) market is poised for significant expansion, currently valued at an estimated 1.27 billion USD in 2024. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033. A primary driver for this upward trajectory is the increasing adoption of integrated and bundled facility management services. As businesses in Croatia, particularly within the commercial and industrial sectors, focus on core competencies, they are increasingly outsourcing non-core functions like building maintenance, security, and catering. This trend is further amplified by a growing awareness of the cost efficiencies and performance improvements that professional FM providers can deliver. Furthermore, the ongoing modernization of infrastructure and the development of new commercial and institutional spaces are creating a sustained demand for comprehensive FM solutions. The market is experiencing a shift towards technology-driven FM, with smart building solutions and data analytics playing a crucial role in optimizing operations and enhancing user experience.

Croatia Facility Management Market Market Size (In Billion)

The facility management landscape in Croatia is diversifying, with a clear segmentation across various operational models and service offerings. In-house facility management continues to hold a share, but the rapid growth is observed in outsourced models, including single, bundled, and integrated FM. Bundled and integrated FM services, which offer a more holistic approach to managing a property's lifecycle, are gaining substantial traction due to their ability to streamline operations and reduce overall expenditure. In terms of offerings, both Hard FM (technical services like HVAC, electrical systems) and Soft FM (cleaning, security, landscaping) are integral. However, the demand for integrated solutions that encompass both is a notable trend. The end-user spectrum is broad, with commercial establishments and institutional buildings representing key segments driving demand, followed by public/infrastructure and industrial sectors. Major players such as CBRE Group Inc., Atalian Global Services, and Apleona HSG d.o.o. are actively shaping the market through strategic investments and service innovation.

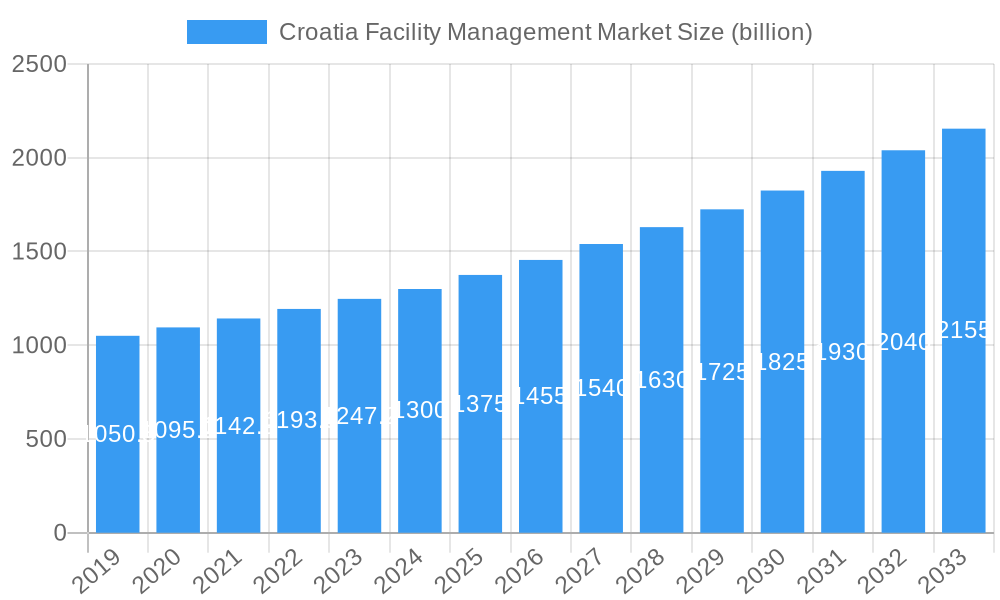

Croatia Facility Management Market Company Market Share

Croatia Facility Management Market: Comprehensive Industry Analysis and Forecast 2019-2033

This in-depth report provides a granular analysis of the Croatia Facility Management market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a detailed forecast period of 2025-2033, this study leverages high-volume keywords such as "Croatia facility management services," "FM market growth Croatia," "outsourced facility management Croatia," and "commercial facility management Croatia" to ensure optimal SEO performance. We delve into market structure, trends, dominant segments, product innovation, key drivers, challenges, and the competitive landscape, offering unparalleled insights for industry stakeholders. The report covers a historical period from 2019 to 2024, with an estimated year of 2025, providing a robust foundation for future projections. Expect to find quantitative data, qualitative analysis, and expert perspectives on this rapidly evolving sector.

Croatia Facility Management Market Market Structure & Competitive Landscape

The Croatia Facility Management market exhibits a moderately concentrated structure, with a few key players dominating significant market shares. The presence of both large international entities and established local service providers contributes to a dynamic competitive environment. Innovation in this sector is largely driven by technological advancements, particularly in areas like smart building technologies, integrated FM software, and energy efficiency solutions. Regulatory frameworks, while evolving, are increasingly focusing on sustainability and service quality, influencing operational standards and market entry for new players. Product substitutes are limited in the core FM offerings, but clients may explore partial in-house management for certain functions. End-user segmentation reveals a strong reliance on the Commercial and Institutional sectors, with growing potential in Public/Infrastructure. Mergers and acquisitions (M&A) are emerging as a significant trend, signaling consolidation and expansion strategies. For instance, the acquisition of SITIM by TSG in April 2021 highlights the ongoing consolidation and the strategic importance of integrated service providers. M&A volumes are projected to increase as companies seek to expand their service portfolios and geographical reach. Concentration ratios, while not explicitly detailed here due to the report's nature, are expected to see shifts as strategic alliances and acquisitions reshape the market.

- Market Concentration: Moderately concentrated with a mix of international and local players.

- Innovation Drivers: Smart building technologies, energy efficiency, digital FM platforms.

- Regulatory Impacts: Increasing focus on sustainability, service quality standards.

- Product Substitutes: Limited for core FM services; partial in-house management is an alternative.

- End-User Dominance: Commercial and Institutional sectors leading, with Public/Infrastructure showing growth.

- M&A Trends: Growing, driven by consolidation and expansion goals.

Croatia Facility Management Market Market Trends & Opportunities

The Croatia Facility Management market is poised for substantial growth, driven by an increasing recognition of the strategic value of efficient facility operations. The market size is projected to reach USD 10 billion by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year of 2025. This expansion is fueled by a confluence of factors including the modernization of commercial and industrial infrastructure, a growing demand for specialized FM services, and favorable government initiatives promoting efficient resource management and sustainability. Technological shifts are at the forefront of market evolution. The integration of Internet of Things (IoT) devices for predictive maintenance, the adoption of Building Information Modeling (BIM) for streamlined project management, and the deployment of AI-powered analytics for operational optimization are transforming how facilities are managed. These advancements offer significant opportunities for FM providers to enhance service delivery, reduce operational costs for clients, and create more responsive and intelligent building environments.

Consumer preferences are also evolving. Businesses are increasingly seeking integrated FM solutions that consolidate multiple services under a single contract, simplifying vendor management and ensuring greater accountability. This shift from single-service contracts to bundled and integrated FM models presents a significant opportunity for providers capable of offering comprehensive service portfolios. The demand for "green" FM services, focusing on energy conservation, waste reduction, and sustainable practices, is also on the rise, aligning with both corporate social responsibility goals and stricter environmental regulations. The competitive dynamics are characterized by a drive for differentiation through service excellence, technological innovation, and specialized expertise. Companies that can demonstrate a clear return on investment for their clients, coupled with a commitment to sustainability and cutting-edge technology, will be best positioned to capture market share.

Opportunities abound in niche segments, such as the management of specialized industrial facilities, the maintenance of public infrastructure, and the provision of security and cleaning services for healthcare and educational institutions. The increasing trend of outsourcing non-core functions by businesses seeking to focus on their primary competencies further fuels this market's expansion. Furthermore, the development of smart city initiatives across Croatia will likely necessitate sophisticated FM services for urban infrastructure and public spaces, creating new avenues for growth and innovation. The market penetration rate for outsourced FM services is expected to climb steadily as more organizations understand the cost savings and efficiency gains associated with professional FM management.

Dominant Markets & Segments in Croatia Facility Management Market

Within the Croatia Facility Management market, Outsourced Facility Management emerges as the dominant segment, commanding a substantial market share and projected to grow significantly throughout the forecast period. This dominance is primarily attributed to the increasing realization among businesses of the strategic advantages of delegating non-core operational tasks to specialized providers. Within outsourced FM, Integrated FM is experiencing the most robust growth, reflecting a clear industry trend towards consolidating multiple services under a single, comprehensive contract. This approach offers clients enhanced efficiency, streamlined communication, and greater accountability, leading to cost savings and improved operational oversight.

The Commercial end-user segment is another powerhouse in the Croatian FM market. This includes a wide array of businesses such as office buildings, retail spaces, and hospitality venues, all of which require a consistent and high level of facility maintenance and operational support to ensure optimal business continuity and customer satisfaction. The ongoing development and modernization of commercial real estate in Croatia directly translate into increased demand for professional FM services.

In terms of offerings, Soft FM services, encompassing cleaning, security, catering, landscaping, and reception services, are currently the most prevalent. However, Hard FM services, which involve the maintenance and repair of building systems and infrastructure such as HVAC, plumbing, and electrical systems, are witnessing accelerated growth. This surge is driven by an aging infrastructure in some areas and a growing emphasis on proactive, preventative maintenance to avoid costly downtime and ensure regulatory compliance.

The Public/Infrastructure end-user segment is also a significant contributor and holds immense growth potential. This category encompasses the management of public buildings, transportation hubs, utilities, and other critical infrastructure. As government entities strive for greater operational efficiency and cost-effectiveness, the outsourcing of facility management for these assets is becoming increasingly attractive. Investments in infrastructure development and upgrades across Croatia are further bolstering demand for specialized FM expertise in this segment.

- Facility Management Type Dominance: Outsourced Facility Management, with Integrated FM as the fastest-growing sub-segment.

- Key Growth Drivers for Outsourced FM: Focus on core business activities, cost efficiencies, access to specialized expertise.

- Key Growth Drivers for Integrated FM: Streamlined vendor management, enhanced accountability, holistic operational oversight.

- End-User Dominance: Commercial segment leads, driven by office spaces, retail, and hospitality.

- Key Growth Drivers for Commercial: Real estate development, need for attractive and functional business environments, tenant satisfaction.

- Offerings Dominance: Soft FM currently leads, with Hard FM showing strong growth.

- Key Growth Drivers for Soft FM: Maintaining operational efficiency, occupant comfort and safety, brand image.

- Key Growth Drivers for Hard FM: Aging infrastructure, preventative maintenance needs, regulatory compliance.

- Emerging Segment Potential: Public/Infrastructure, driven by modernization and efficiency drives.

- Key Growth Drivers for Public/Infrastructure: Government cost-saving initiatives, infrastructure investment, smart city development.

Croatia Facility Management Market Product Analysis

The Croatia Facility Management market is characterized by a continuous evolution of service offerings, driven by technological advancements and a growing demand for integrated solutions. Innovations are focused on enhancing efficiency, sustainability, and occupant experience. Smart building technologies, including IoT sensors for real-time monitoring of environmental conditions and equipment performance, are becoming integral to Hard FM services, enabling predictive maintenance and reducing energy consumption. Software solutions, such as integrated FM platforms and mobile applications, are streamlining service requests, resource allocation, and performance tracking, improving communication between FM providers and clients. For Soft FM, advancements include the adoption of eco-friendly cleaning products and methods, and sophisticated security systems leveraging AI for threat detection. The competitive advantage for FM providers lies in their ability to offer tailored solutions that address specific client needs while leveraging these technological innovations to deliver measurable value, cost savings, and improved operational outcomes.

Key Drivers, Barriers & Challenges in Croatia Facility Management Market

The Croatia Facility Management market is propelled by several key drivers. Technologically driven advancements, such as smart building solutions and digital FM platforms, are enhancing operational efficiency and predictive maintenance capabilities. Economic factors, including an increasing emphasis on cost optimization and the realization that outsourcing FM can lead to significant savings, are encouraging wider adoption of professional services. Policy-driven initiatives promoting energy efficiency and sustainable building practices are also creating new opportunities and demanding more sophisticated FM approaches.

However, the market faces significant barriers and challenges. Regulatory complexities and evolving compliance standards can pose hurdles for both new entrants and established players. Supply chain issues, particularly for specialized equipment and skilled labor, can impact service delivery timelines and costs. Intense competitive pressures, especially from a growing number of local and international service providers, can lead to price wars and margin erosion. The perceived high upfront cost of adopting advanced FM technologies can also be a restraint for some businesses, particularly SMEs.

- Key Drivers:

- Technological advancements (smart buildings, digital platforms).

- Economic focus on cost optimization and outsourcing benefits.

- Sustainability and energy efficiency policies.

- Key Barriers & Challenges:

- Regulatory complexities and compliance issues.

- Supply chain disruptions and skilled labor shortages.

- Intense competition and price pressures.

- High upfront investment for technology adoption.

Growth Drivers in the Croatia Facility Management Market Market

Several key drivers are fueling the growth of the Croatia Facility Management market. Technologically, the adoption of IoT for predictive maintenance and smart building management is enhancing operational efficiency and reducing downtime. Economically, businesses are increasingly recognizing the cost benefits of outsourcing non-core facility functions, leading to a greater demand for professional FM services. Regulatory advancements, such as stricter environmental standards and mandates for energy efficiency, are also compelling organizations to seek expert FM solutions that can ensure compliance and promote sustainability. The modernization of existing infrastructure and the development of new commercial and public facilities further stimulate demand for comprehensive FM services.

Challenges Impacting Croatia Facility Management Market Growth

Despite the positive growth trajectory, the Croatia Facility Management market encounters several challenges that can impede its expansion. Regulatory complexities and evolving legal frameworks can create uncertainty and increase the burden of compliance for FM providers. Supply chain issues, particularly concerning the availability of specialized materials and qualified technicians, can lead to project delays and increased operational costs. Competitive pressures are significant, with a growing number of local and international players vying for market share, often leading to intense price competition and impacting profit margins. Furthermore, the initial investment required for adopting advanced FM technologies can be a barrier for some businesses, slowing down the adoption rate of innovative solutions.

Key Players Shaping the Croatia Facility Management Market Market

- AFM Ltd

- Apleona HSG d o o

- Regina Group d o o

- CBRE Group Inc

- REIWAG Facility Services Group

- BFM d o o

- Atalian Global Services

- Asura Group

- Diversey Holdings LTD

- PRS-FM d o o

Significant Croatia Facility Management Market Industry Milestones

- April 2021: TSG announced the acquisition of SITIM, a Company based in Zagreb/Croatia. SITIM operates in Croatia, where it offers complete management, maintenance, and support to infrastructures solutions, integrating all engineering professions to enable the development and implementation of concepts for technical Facility Management according to customers' needs. In 2020 SITIM realized a turnover of EUR 10 million with 90 people. This acquisition signifies a strategic move to expand service offerings and market reach within the Croatian FM landscape.

Future Outlook for Croatia Facility Management Market Market

The future outlook for the Croatia Facility Management market is highly optimistic, driven by a continued emphasis on operational efficiency, technological integration, and sustainability. The increasing adoption of smart building technologies and digital FM platforms will further optimize service delivery and create new value propositions for clients. As businesses increasingly prioritize focusing on their core competencies, the trend towards outsourcing facility management is expected to accelerate, particularly for integrated and bundled service models. Growth catalysts will include ongoing infrastructure development, the expansion of the commercial real estate sector, and the adoption of green building practices. Strategic opportunities lie in expanding service portfolios to include specialized areas like energy management and smart facility solutions, and in further consolidating the market through strategic partnerships and acquisitions. The market is set to witness sustained growth and innovation in the coming years.

Croatia Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Croatia Facility Management Market Segmentation By Geography

- 1. Croatia

Croatia Facility Management Market Regional Market Share

Geographic Coverage of Croatia Facility Management Market

Croatia Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of Facility Management; Increasing Investments in Commercial Properties

- 3.3. Market Restrains

- 3.3.1. Lower Awareness about Facility Management Solutions Compared to Other European Countries

- 3.4. Market Trends

- 3.4.1. Increasing investment in Smart City Infrastructure to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Croatia Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Croatia

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AFM Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apleona HSG d o o

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Regina Group d o o

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 REIWAG Facility Services Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BFM d o o

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atalian Global Services

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Asura Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Diversey Holdings LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PRS-FM d o o

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AFM Ltd

List of Figures

- Figure 1: Croatia Facility Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Croatia Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Croatia Facility Management Market Revenue billion Forecast, by Facility Management Type 2020 & 2033

- Table 2: Croatia Facility Management Market Volume K Unit Forecast, by Facility Management Type 2020 & 2033

- Table 3: Croatia Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 4: Croatia Facility Management Market Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 5: Croatia Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Croatia Facility Management Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Croatia Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Croatia Facility Management Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Croatia Facility Management Market Revenue billion Forecast, by Facility Management Type 2020 & 2033

- Table 10: Croatia Facility Management Market Volume K Unit Forecast, by Facility Management Type 2020 & 2033

- Table 11: Croatia Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 12: Croatia Facility Management Market Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 13: Croatia Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Croatia Facility Management Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Croatia Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Croatia Facility Management Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Croatia Facility Management Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Croatia Facility Management Market?

Key companies in the market include AFM Ltd, Apleona HSG d o o, Regina Group d o o, CBRE Group Inc, REIWAG Facility Services Group, BFM d o o, Atalian Global Services, Asura Group, Diversey Holdings LTD, PRS-FM d o o.

3. What are the main segments of the Croatia Facility Management Market?

The market segments include Facility Management Type, Offerings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of Facility Management; Increasing Investments in Commercial Properties.

6. What are the notable trends driving market growth?

Increasing investment in Smart City Infrastructure to Drive the Growth.

7. Are there any restraints impacting market growth?

Lower Awareness about Facility Management Solutions Compared to Other European Countries.

8. Can you provide examples of recent developments in the market?

April 2021 - TSG announced the acquisition of SITIM, a Company based in Zagreb/Croatia. SITIM operates in Croatia, where it offers complete management, maintenance, and support to infrastructures solutions, integrating all engineering professions to enable the development and implementation of concepts for technical Facility Management according to customers' needs. In 2020 SITIM realized a turnover of EUR 10 million with 90 people.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Croatia Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Croatia Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Croatia Facility Management Market?

To stay informed about further developments, trends, and reports in the Croatia Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence