Key Insights

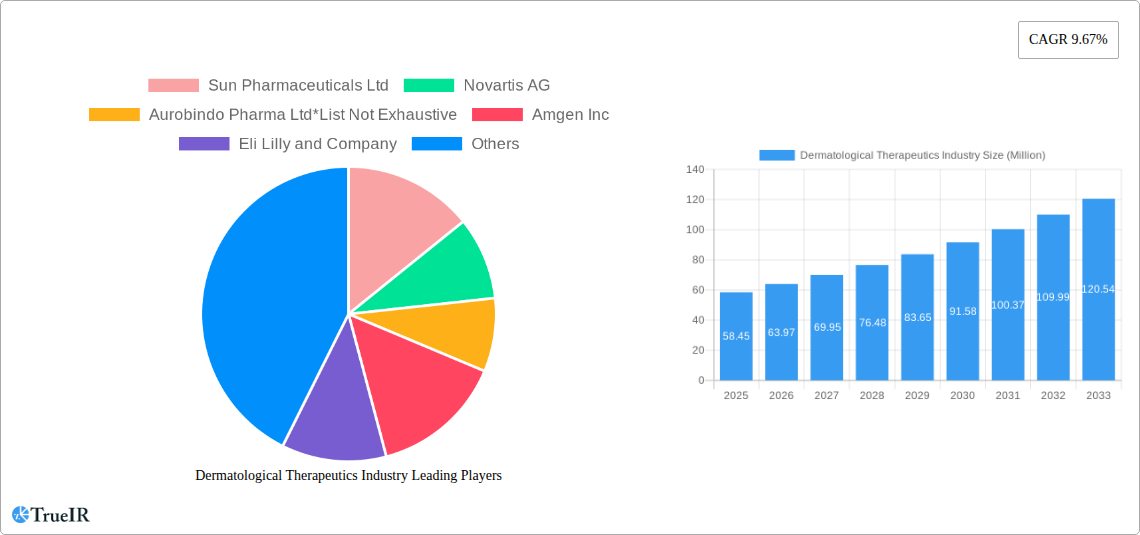

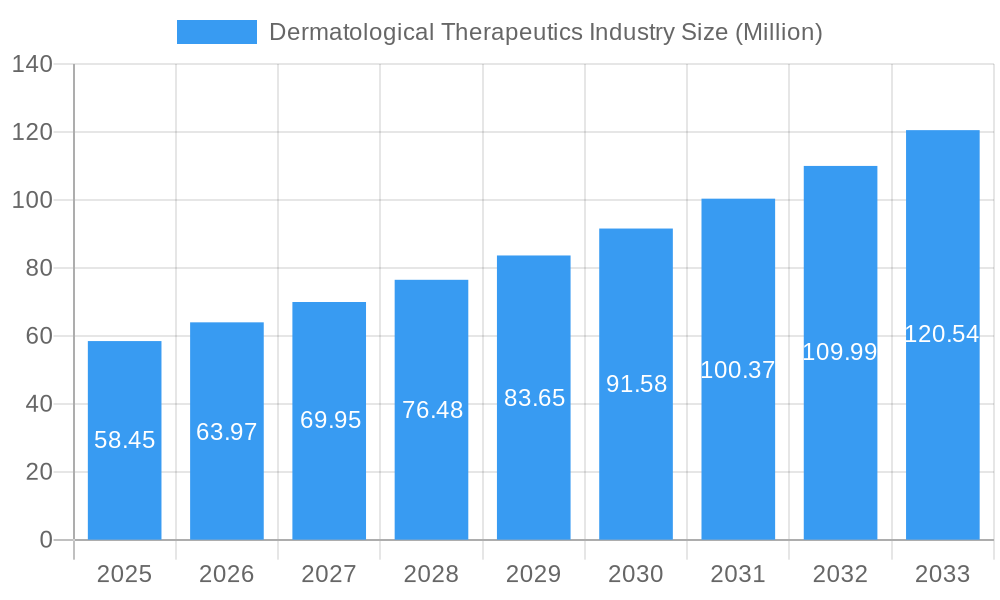

The global Dermatological Therapeutics market is poised for significant expansion, projected to reach USD 45.17 million with a robust Compound Annual Growth Rate (CAGR) of 9.67% from 2019 to 2033. This growth is propelled by a confluence of factors, including the increasing prevalence of chronic skin conditions like psoriasis, atopic dermatitis, and rosacea, driven by an aging global population and evolving lifestyle choices. Furthermore, advancements in drug discovery and the development of novel therapeutic classes such as calcineurin inhibitors and targeted biologics are addressing unmet needs, thereby fueling market demand. The rising awareness among patients and healthcare providers regarding effective treatment options, coupled with increasing healthcare expenditure globally, particularly in emerging economies, further underscores the optimistic outlook for this sector. Innovation in drug delivery systems and a greater focus on personalized medicine are also expected to play a crucial role in shaping the market's trajectory.

Dermatological Therapeutics Industry Market Size (In Million)

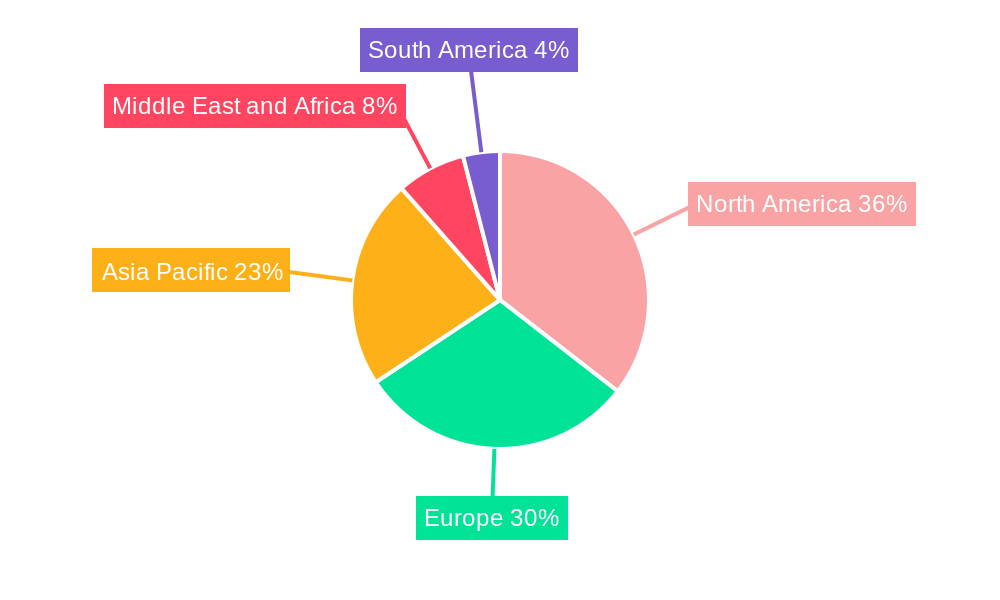

The market's segmentation reveals diverse opportunities across various applications and drug classes. Alopecia, herpes, and atopic dermatitis represent key application areas exhibiting strong growth potential due to their widespread incidence and the continuous development of advanced treatments. In terms of drug classes, while corticosteroids remain a cornerstone of dermatological therapy, the rising adoption of anti-infectives, retinoids, and specialized calcineurin inhibitors for autoimmune-driven conditions signals a shift towards more targeted and effective interventions. Geographically, North America and Europe currently dominate the market, owing to sophisticated healthcare infrastructure and high patient awareness. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by a large patient pool, increasing disposable income, and expanding healthcare access. Key players such as Novartis AG, Sun Pharmaceuticals Ltd, and Johnson & Johnson are actively investing in research and development to introduce innovative therapies and expand their market reach, further solidifying the competitive landscape.

Dermatological Therapeutics Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the global Dermatological Therapeutics Industry. Leveraging high-volume keywords such as "dermatology market," "skin disease treatments," "psoriasis drugs," "atopic dermatitis therapy," and "alopecia solutions," this research offers critical insights for industry stakeholders, investors, and pharmaceutical companies. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a comprehensive forecast period extending to 2033. This report is designed for immediate use without requiring further modification, offering unparalleled clarity and actionable intelligence.

Dermatological Therapeutics Industry Market Structure & Competitive Landscape

The dermatology therapeutics market exhibits a moderately concentrated structure, with a significant share held by a few multinational pharmaceutical giants. Innovation remains a primary driver, fueled by advancements in biologics, gene therapies, and targeted drug delivery systems, leading to a robust pipeline of novel treatments for conditions like psoriasis and atopic dermatitis. Regulatory frameworks, particularly stringent FDA and EMA approvals, shape market entry and product development, necessitating significant investment in clinical trials and evidence generation. The threat of product substitutes is growing, especially with the advent of advanced biologics and the increasing accessibility of generic dermatological products. End-user segmentation is crucial, with distinct needs arising from patients with chronic conditions such as psoriasis and atopic dermatitis, versus those seeking treatments for acute issues like herpes or rosacea. Mergers and acquisitions (M&A) are actively reshaping the competitive landscape, with approximately 50-70 significant M&A deals valued in the multi-million dollar range occurring annually over the historical period, indicating consolidation and strategic portfolio expansion. Concentration ratios for the top 5 players are estimated to be around 35-45%, with a steady influx of innovative smaller players contributing to market dynamism.

Dermatological Therapeutics Industry Market Trends & Opportunities

The global dermatology therapeutics market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7-9% projected during the forecast period (2025-2033). This expansion is driven by a confluence of factors including an aging global population, increasing prevalence of chronic skin conditions such as atopic dermatitis and psoriasis, and rising disposable incomes leading to greater healthcare expenditure. Technological advancements are revolutionizing treatment paradigms; the development of targeted biologics and immunomodulators has significantly improved patient outcomes for moderate-to-severe plaque psoriasis and atopic dermatitis, driving market penetration rates for these advanced therapies. Consumer preferences are shifting towards more convenient and effective treatment options, with a growing demand for topical formulations and less invasive systemic treatments. This trend presents a significant opportunity for companies developing novel drug delivery systems and personalized medicine approaches. The competitive dynamics are intensifying, with established players focusing on lifecycle management and pipeline expansion, while emerging biotechs are leveraging cutting-edge research in immunology and genetics. The market penetration for advanced therapies targeting chronic inflammatory skin diseases is expected to rise from approximately 20-25% in the base year to over 40-45% by the end of the forecast period, highlighting a key growth opportunity. The increasing awareness and diagnosis rates of dermatological conditions also contribute to market expansion.

Dominant Markets & Segments in Dermatological Therapeutics Industry

The dermatology therapeutics market is characterized by strong regional dominance and segment-specific growth trajectories. North America, particularly the United States, continues to be the leading region due to high healthcare spending, advanced regulatory frameworks, and a high prevalence of skin disorders like psoriasis and atopic dermatitis. Within the United States, the market for psoriasis treatments is particularly robust, driven by significant unmet needs and the availability of innovative therapies, accounting for an estimated market share of over 25-30% of the overall dermatology therapeutics market.

Application Segment Dominance:

- Psoriasis: This segment is a major revenue generator, driven by the chronic nature of the condition and the continuous introduction of novel biologic and small molecule therapies. The market size for psoriasis treatments is projected to exceed $20 Billion by 2030.

- Atopic Dermatitis: Exhibiting rapid growth, this segment benefits from increased diagnosis rates and the approval of new systemic and topical treatments. Its market share is expected to grow significantly, reaching over $15 Billion by 2030.

- Alopecia: While historically smaller, this segment is experiencing a surge in interest and investment due to new therapeutic approaches targeting hair loss.

- Herpes and Rosacea: These segments represent a stable yet significant portion of the market, with established treatment options and ongoing research for improved therapies.

Drug Class Dominance:

- Corticosteroids: Remain a foundational drug class, particularly for mild to moderate conditions, offering a cost-effective treatment.

- Biologics (Immunomodulators): These have revolutionized the treatment of moderate-to-severe inflammatory skin diseases like psoriasis and atopic dermatitis, commanding a significant and growing market share, estimated to be over 40-50% of the prescription dermatology market.

- Anti-infectives: Essential for managing secondary infections associated with various dermatological conditions.

- Retinoids and Calcineurin Inhibitors: Crucial for acne and specific inflammatory conditions, respectively, with ongoing innovation in topical formulations.

The growing prevalence of autoimmune skin diseases, coupled with advancements in targeted therapies, positions psoriasis and atopic dermatitis as dominant application segments. Similarly, the efficacy and market penetration of biologics in treating these chronic conditions underscore their dominance within drug classes. Infrastructure development in emerging economies and supportive government policies aimed at increasing access to advanced dermatological care are also key growth drivers in these dominant segments.

Dermatological Therapeutics Industry Product Analysis

The dermatology therapeutics industry is witnessing a wave of product innovation focused on enhancing efficacy, improving safety profiles, and offering convenient administration. Key advancements include the development of targeted biologics that modulate specific immune pathways, leading to more effective treatment of moderate-to-severe plaque psoriasis and atopic dermatitis with fewer systemic side effects. Novel topical formulations, such as PDE4 inhibitors and new corticosteroid combinations, offer improved patient adherence and reduced systemic exposure. Innovations in drug delivery, including extended-release formulations and novel excipients, are also enhancing the therapeutic advantages of existing and new molecules, ensuring better market fit and competitive advantages.

Key Drivers, Barriers & Challenges in Dermatological Therapeutics Industry

Key Drivers:

- Rising Prevalence of Chronic Skin Diseases: Increasing incidence of psoriasis, atopic dermatitis, and other chronic inflammatory skin conditions drives demand for effective treatments.

- Technological Advancements: Development of novel biologics, targeted therapies, and advanced drug delivery systems offers significant therapeutic improvements.

- Growing Healthcare Expenditure: Increased investment in healthcare globally, coupled with rising disposable incomes, fuels market growth.

- Favorable Regulatory Landscape for Innovation: Regulatory bodies are increasingly streamlining approval processes for promising new dermatological therapies.

Barriers & Challenges:

- High Research and Development Costs: The long and expensive process of developing new drugs, including extensive clinical trials, poses a significant financial hurdle.

- Stringent Regulatory Approvals: Meeting rigorous safety and efficacy standards required by regulatory agencies can delay market entry.

- Patent Expirations and Generic Competition: The expiry of patents for blockbuster drugs leads to increased competition from lower-priced generics, impacting revenue streams.

- Side Effects and Patient Adherence: Managing potential side effects of powerful treatments and ensuring long-term patient adherence remain critical challenges. Supply chain disruptions, estimated to cause delays of 10-15% in product launches, also pose a challenge.

Growth Drivers in the Dermatological Therapeutics Industry Market

Several key factors are propelling the dermatological therapeutics industry market. Technological innovation, particularly in biologics and targeted therapies, is a primary growth driver, enabling more effective treatments for complex skin conditions like psoriasis and atopic dermatitis. Economic factors, including increasing global healthcare expenditure and a growing middle class in emerging economies, are expanding access to advanced dermatological treatments. Policy-driven initiatives, such as government support for medical research and development and efforts to improve healthcare access, further bolster market expansion. The increasing understanding of the underlying mechanisms of various skin diseases is also a significant catalyst for developing novel therapeutic strategies.

Challenges Impacting Dermatological Therapeutics Industry Growth

The dermatological therapeutics industry faces several significant challenges that can impact its growth trajectory. Regulatory complexities, including lengthy and costly approval processes for new drugs, represent a major hurdle. Supply chain issues, exacerbated by global events, can lead to drug shortages and delayed market access. Competitive pressures are intense, with numerous companies vying for market share in key therapeutic areas like psoriasis and atopic dermatitis. The high cost of advanced therapies, such as biologics, can also limit patient access and create reimbursement challenges, thereby impacting overall market penetration.

Key Players Shaping the Dermatological Therapeutics Industry Market

- Sun Pharmaceuticals Ltd

- Novartis AG

- Aurobindo Pharma Ltd

- Amgen Inc

- Eli Lilly and Company

- Galderma SA

- Abbvie Inc

- Almirall SA

- Johnson & Johnson

- Bausch Health Companies Inc

- LEO Pharma AS

- Aclaris Therapeutics Inc

- Bristol-Myers Squibb Company

- GlaxoSmithKline PLC

- Pfizer Inc

Significant Dermatological Therapeutics Industry Industry Milestones

- September 2022: The US FDA approved Sotyktu (deucravacitinib), an oral treatment for adults with moderate-to-severe plaque psoriasis who are candidates for systemic therapy or phototherapy, marking a significant advancement in psoriasis management.

- July 2022: The FDA approved roflumilast cream (ZORYVE) 0.3%, a topical phosphodiesterase-4 (PDE4) inhibitor, as a treatment for plaque psoriasis in patients aged 12 years and above, offering a new topical therapeutic option.

- January 2022: Abbvie announced that the FDA approved Rinvoq to treat people aged 12 years and older with refractory, moderate-to-severe atopic dermatitis who do not respond to or cannot take previous oral or injectable systemic medications, expanding treatment options for this chronic condition.

Future Outlook for Dermatological Therapeutics Industry Market

The future outlook for the dermatological therapeutics industry is exceptionally promising, driven by continuous innovation and a growing understanding of skin biology. Strategic opportunities lie in the development of personalized medicine approaches, leveraging advancements in genomics and biomarker identification to tailor treatments for individual patients, particularly for chronic conditions like psoriasis and atopic dermatitis. The increasing focus on biologics and novel small molecules with targeted mechanisms of action will continue to expand treatment efficacy and patient access. Furthermore, the growing demand for treatments addressing aesthetic dermatological concerns and the burgeoning markets in Asia-Pacific present significant growth potential for market expansion. The market is projected to see sustained growth fueled by unmet needs in less-addressed dermatological conditions and advancements in drug delivery systems.

Dermatological Therapeutics Industry Segmentation

-

1. Application

- 1.1. Alopecia

- 1.2. Herpes

- 1.3. Psoriasis

- 1.4. Rosacea

- 1.5. Atopic Dermatitis

- 1.6. Other Applications

-

2. Drug Class

- 2.1. Anti-infectives

- 2.2. Corticosteroids

- 2.3. Anti-acne

- 2.4. Calcineurin Inhibitors

- 2.5. Retinoids

- 2.6. Other Drug Classes

Dermatological Therapeutics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dermatological Therapeutics Industry Regional Market Share

Geographic Coverage of Dermatological Therapeutics Industry

Dermatological Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Dermatology Diseases; Increasing Awareness Levels of Disease Progression and Etiology; Increasing Elderly Population

- 3.3. Market Restrains

- 3.3.1. Serious Side Effects for Certain Classes of Therapeutic Drugs

- 3.4. Market Trends

- 3.4.1. Psoriasis Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Alopecia

- 5.1.2. Herpes

- 5.1.3. Psoriasis

- 5.1.4. Rosacea

- 5.1.5. Atopic Dermatitis

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Drug Class

- 5.2.1. Anti-infectives

- 5.2.2. Corticosteroids

- 5.2.3. Anti-acne

- 5.2.4. Calcineurin Inhibitors

- 5.2.5. Retinoids

- 5.2.6. Other Drug Classes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Alopecia

- 6.1.2. Herpes

- 6.1.3. Psoriasis

- 6.1.4. Rosacea

- 6.1.5. Atopic Dermatitis

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Drug Class

- 6.2.1. Anti-infectives

- 6.2.2. Corticosteroids

- 6.2.3. Anti-acne

- 6.2.4. Calcineurin Inhibitors

- 6.2.5. Retinoids

- 6.2.6. Other Drug Classes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Alopecia

- 7.1.2. Herpes

- 7.1.3. Psoriasis

- 7.1.4. Rosacea

- 7.1.5. Atopic Dermatitis

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Drug Class

- 7.2.1. Anti-infectives

- 7.2.2. Corticosteroids

- 7.2.3. Anti-acne

- 7.2.4. Calcineurin Inhibitors

- 7.2.5. Retinoids

- 7.2.6. Other Drug Classes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Alopecia

- 8.1.2. Herpes

- 8.1.3. Psoriasis

- 8.1.4. Rosacea

- 8.1.5. Atopic Dermatitis

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Drug Class

- 8.2.1. Anti-infectives

- 8.2.2. Corticosteroids

- 8.2.3. Anti-acne

- 8.2.4. Calcineurin Inhibitors

- 8.2.5. Retinoids

- 8.2.6. Other Drug Classes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Alopecia

- 9.1.2. Herpes

- 9.1.3. Psoriasis

- 9.1.4. Rosacea

- 9.1.5. Atopic Dermatitis

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Drug Class

- 9.2.1. Anti-infectives

- 9.2.2. Corticosteroids

- 9.2.3. Anti-acne

- 9.2.4. Calcineurin Inhibitors

- 9.2.5. Retinoids

- 9.2.6. Other Drug Classes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Dermatological Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Alopecia

- 10.1.2. Herpes

- 10.1.3. Psoriasis

- 10.1.4. Rosacea

- 10.1.5. Atopic Dermatitis

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Drug Class

- 10.2.1. Anti-infectives

- 10.2.2. Corticosteroids

- 10.2.3. Anti-acne

- 10.2.4. Calcineurin Inhibitors

- 10.2.5. Retinoids

- 10.2.6. Other Drug Classes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sun Pharmaceuticals Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aurobindo Pharma Ltd*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly and Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Galderma SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbvie Inc (Allergan PLC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Almirall SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bausch Health Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LEO Pharma AS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aclaris Therapeutics Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bristol-Myers Squibb Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GlaxoSmithKline PLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pfizer Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Sun Pharmaceuticals Ltd

List of Figures

- Figure 1: Global Dermatological Therapeutics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Dermatological Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Dermatological Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Dermatological Therapeutics Industry Revenue (Million), by Drug Class 2025 & 2033

- Figure 5: North America Dermatological Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Dermatological Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Dermatological Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Dermatological Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Dermatological Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Dermatological Therapeutics Industry Revenue (Million), by Drug Class 2025 & 2033

- Figure 11: Europe Dermatological Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 12: Europe Dermatological Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Dermatological Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Dermatological Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Dermatological Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Dermatological Therapeutics Industry Revenue (Million), by Drug Class 2025 & 2033

- Figure 17: Asia Pacific Dermatological Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 18: Asia Pacific Dermatological Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Dermatological Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Dermatological Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Middle East and Africa Dermatological Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East and Africa Dermatological Therapeutics Industry Revenue (Million), by Drug Class 2025 & 2033

- Figure 23: Middle East and Africa Dermatological Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 24: Middle East and Africa Dermatological Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Dermatological Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Dermatological Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: South America Dermatological Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Dermatological Therapeutics Industry Revenue (Million), by Drug Class 2025 & 2033

- Figure 29: South America Dermatological Therapeutics Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 30: South America Dermatological Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Dermatological Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 3: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 6: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 12: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 21: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 30: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 36: Global Dermatological Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Dermatological Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dermatological Therapeutics Industry?

The projected CAGR is approximately 9.67%.

2. Which companies are prominent players in the Dermatological Therapeutics Industry?

Key companies in the market include Sun Pharmaceuticals Ltd, Novartis AG, Aurobindo Pharma Ltd*List Not Exhaustive, Amgen Inc, Eli Lilly and Company, Galderma SA, Abbvie Inc (Allergan PLC), Almirall SA, Johnson & Johnson, Bausch Health Companies Inc, LEO Pharma AS, Aclaris Therapeutics Inc, Bristol-Myers Squibb Company, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Dermatological Therapeutics Industry?

The market segments include Application, Drug Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Dermatology Diseases; Increasing Awareness Levels of Disease Progression and Etiology; Increasing Elderly Population.

6. What are the notable trends driving market growth?

Psoriasis Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Serious Side Effects for Certain Classes of Therapeutic Drugs.

8. Can you provide examples of recent developments in the market?

In September 2022, the US FDA approved Sotyktu (deucravacitinib), an oral treatment for adults with moderate-to-severe plaque psoriasis who are candidates for systemic therapy or phototherapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dermatological Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dermatological Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dermatological Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Dermatological Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence