Key Insights

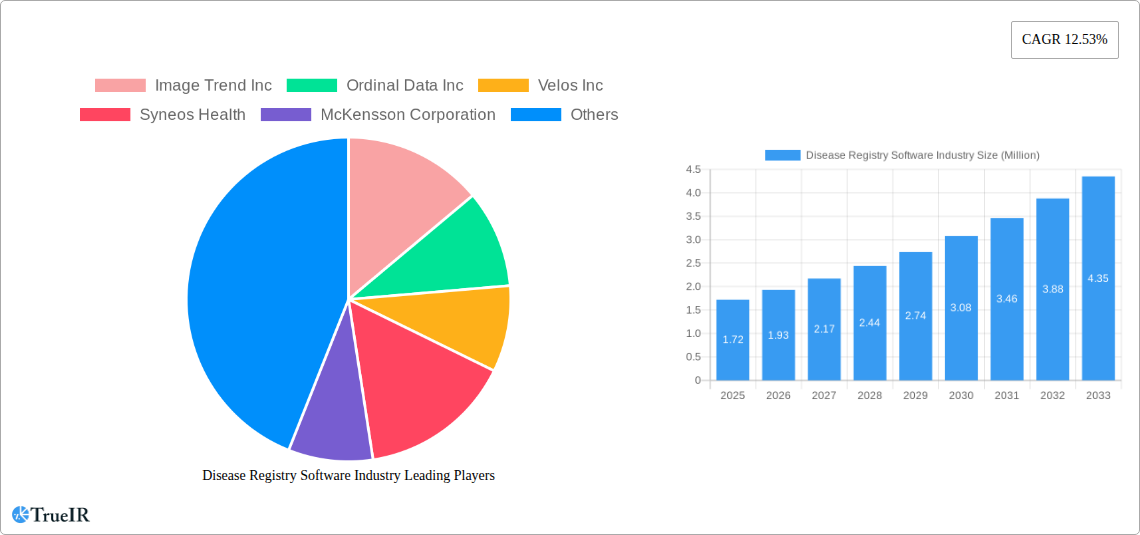

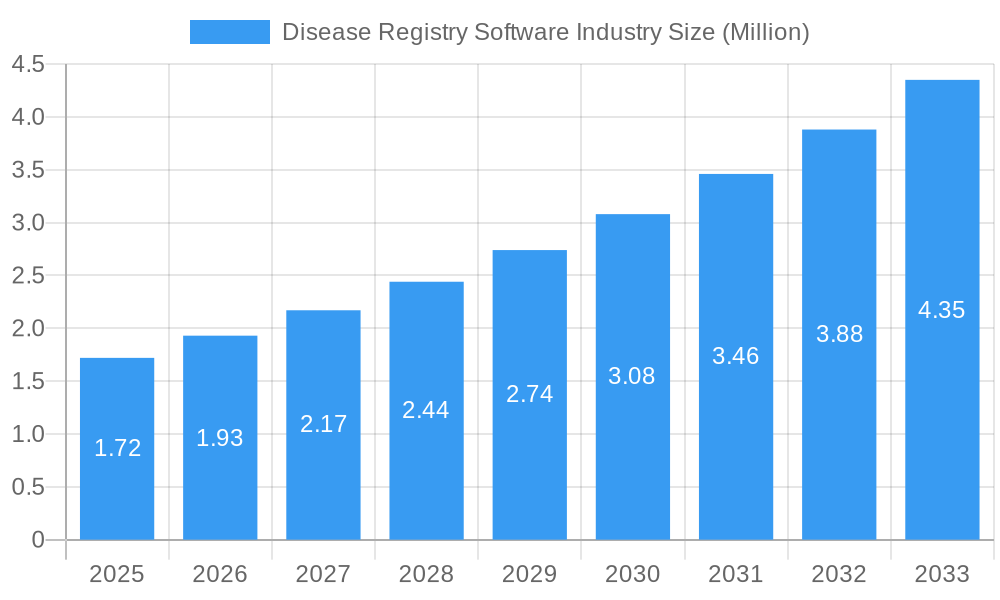

The global Disease Registry Software market is poised for significant expansion, projected to reach a substantial 1.72 million by the estimated year of 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 12.53% throughout the forecast period of 2025-2033. A primary driver for this ascent is the increasing emphasis on public health initiatives and the critical need for comprehensive data collection and analysis to track disease prevalence, monitor treatment efficacy, and inform public health policies. The growing adoption of electronic health records (EHRs) and the push towards interoperability within healthcare systems are further accelerating the integration and utilization of disease registry software. Furthermore, the rising incidence of chronic diseases globally, coupled with advancements in data analytics and AI, is creating a fertile ground for sophisticated registry solutions.

Disease Registry Software Industry Market Size (In Million)

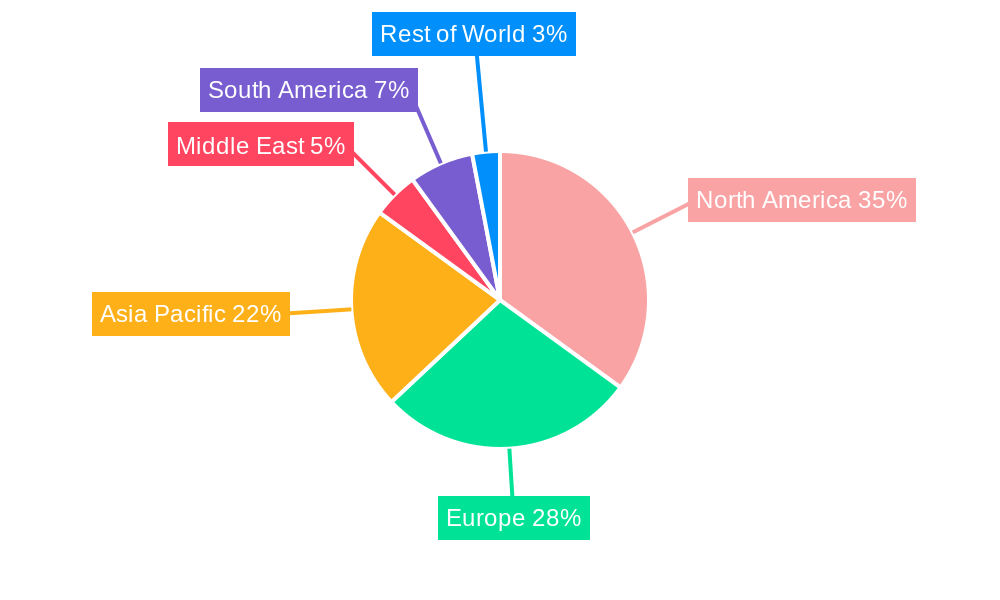

The market is segmented across various disease types, health service registries, and product registries, reflecting the diverse applications of this technology. The software itself is available in both stand-alone and integrated formats, catering to different organizational needs. Key end-users include hospitals, government agencies, pharmaceutical companies, and other healthcare providers, each leveraging registry software for distinct purposes such as clinical trial management, pharmacovigilance, and epidemiological research. Geographically, North America is anticipated to lead the market, driven by strong healthcare infrastructure and significant investments in health IT. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by increasing healthcare spending and a rising awareness of the importance of disease surveillance. Restraints include data privacy concerns and the initial cost of implementation, but these are being addressed through evolving regulatory frameworks and the demonstrable return on investment from improved patient outcomes and operational efficiencies.

Disease Registry Software Industry Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the global Disease Registry Software market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. The study covers the period from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period of 2025–2033. Historical data from 2019–2024 is also thoroughly examined.

Disease Registry Software Industry Market Structure & Competitive Landscape

The Disease Registry Software industry exhibits a moderately consolidated market structure. Innovation is driven by the increasing demand for advanced data analytics, patient-centric care, and precision medicine. Regulatory impacts, such as HIPAA compliance and data privacy laws, are significant factors shaping product development and market entry. Product substitutes, including Electronic Health Records (EHRs) with basic registry functionalities, pose a competitive challenge. End-user segmentation reveals a strong reliance on hospitals and government entities, followed by pharmaceutical companies. Mergers and acquisitions (M&A) trends are observed as larger players aim to expand their portfolios and market reach, with an estimated 5 M&A activities in the historical period. Concentration ratios, particularly among top players, indicate that the top 5 companies hold approximately 60% of the market share.

- Innovation Drivers: AI-powered data analysis, interoperability, cloud-based solutions, real-time reporting.

- Regulatory Impacts: Data security standards, patient consent management, compliance with healthcare regulations.

- Product Substitutes: Advanced EHR modules, bespoke database solutions.

- End-User Segmentation: Hospitals (dominant), Government, Pharmaceutical Companies, Research Institutions, Other Healthcare Providers.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and portfolio diversification.

Disease Registry Software Industry Market Trends & Opportunities

The Disease Registry Software market is poised for substantial growth, projected to reach an estimated value of USD 5 Million by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Technological advancements are revolutionizing how patient data is collected, analyzed, and utilized. The increasing prevalence of chronic diseases globally, coupled with growing government initiatives to improve public health outcomes, is a primary catalyst. Furthermore, the push towards personalized medicine and the need for robust real-world evidence (RWE) are creating significant opportunities for sophisticated registry solutions. Cloud-based software offerings are gaining traction due to their scalability, accessibility, and cost-effectiveness. The demand for integrated software solutions that seamlessly connect with existing healthcare IT infrastructure is also rising, reflecting a growing preference for interoperability and streamlined data management. Consumer preferences are shifting towards platforms that empower patients with access to their health data and facilitate active participation in research. Competitive dynamics are intensifying, with established players investing heavily in R&D and new entrants focusing on niche market segments and specialized functionalities. The market penetration rate for advanced disease registry software is estimated to be XX% in 2025. The increasing adoption of big data analytics and artificial intelligence within healthcare is further augmenting the demand for comprehensive registry software capable of handling vast datasets and deriving actionable insights. The evolving landscape of clinical research and drug development necessitates efficient and accurate data collection mechanisms, which disease registry software effectively provides. This creates a fertile ground for innovation and market expansion, as organizations seek to leverage data for improved patient care, evidence-based decision-making, and the advancement of medical knowledge.

Dominant Markets & Segments in Disease Registry Software Industry

The Disease Registry Software market exhibits significant dominance in North America, driven by a robust healthcare infrastructure, high adoption of advanced technologies, and strong government support for research and public health initiatives. The United States, in particular, stands out as a leading country due to its extensive healthcare system and a high volume of clinical research activities.

By Type of Registry:

- Disease Registries: This segment is the most dominant, accounting for an estimated XX% of the market share in 2025. The increasing incidence of chronic diseases like cancer, cardiovascular diseases, and diabetes fuels the demand for specialized disease registries to track patient outcomes, treatment efficacy, and epidemiological trends.

- Health Service Registries: Growing in importance, these registries focus on the delivery and quality of healthcare services. They are crucial for performance measurement and quality improvement initiatives within healthcare organizations.

- Product Registries: These registries track the safety and effectiveness of medical devices and pharmaceuticals post-market surveillance, playing a vital role in regulatory compliance and patient safety.

By Type of Software:

- Integrated Software: This segment is experiencing rapid growth, estimated to capture XX% of the market by 2025. The seamless integration with existing EHR systems and other healthcare IT platforms offers enhanced efficiency and data consistency.

- Stand-alone Software: While still significant, this segment is projected to see a slower growth rate compared to integrated solutions, catering to organizations with specific, isolated registry needs.

By End User:

- Hospitals: Hospitals represent the largest end-user segment, utilizing disease registry software for clinical care management, research, and quality reporting, estimated at XX% of the market in 2025.

- Government: Government agencies leverage these platforms for public health surveillance, policy development, and population health management.

- Pharmaceutical Companies: Pharmacies utilize registries for post-market surveillance, clinical trial data management, and real-world evidence generation.

- Other End Users: This includes research institutions, academic centers, and patient advocacy groups.

Key growth drivers include significant investments in healthcare IT infrastructure, favorable government policies promoting data collection and analysis, and the increasing emphasis on evidence-based medicine and personalized healthcare. The sheer volume of patient data generated daily necessitates sophisticated software solutions for effective management and utilization.

Disease Registry Software Industry Product Analysis

Product innovations in the Disease Registry Software industry are primarily focused on enhancing data accuracy, security, and analytical capabilities. Key advancements include the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and pattern recognition, as well as the adoption of cloud-based platforms for scalability and accessibility. Applications span from tracking rare diseases and epidemiological surveillance to monitoring treatment outcomes and facilitating clinical research. Competitive advantages are being carved out by vendors offering highly customizable solutions, seamless interoperability with existing healthcare IT ecosystems, and robust data visualization tools.

Key Drivers, Barriers & Challenges in Disease Registry Software Industry

Key Drivers:

- Technological Advancements: AI/ML integration for advanced analytics, cloud adoption for scalability and accessibility.

- Government Initiatives: Growing focus on public health, disease surveillance, and outcome-based healthcare.

- Increasing Chronic Disease Burden: Rising prevalence of chronic conditions necessitates better tracking and management.

- Demand for Real-World Evidence (RWE): Pharmaceutical companies and researchers increasingly rely on real-world data for drug development and validation.

Barriers & Challenges:

- Regulatory Hurdles: Stringent data privacy laws (e.g., HIPAA, GDPR) and compliance requirements can be complex and costly.

- Integration Complexity: Integrating new registry software with legacy IT systems in healthcare institutions can be challenging and time-consuming.

- Data Security Concerns: Protecting sensitive patient data from cyber threats is paramount and requires substantial investment.

- Cost of Implementation and Maintenance: The initial investment and ongoing maintenance costs can be a significant barrier for smaller organizations.

- Lack of Skilled Personnel: A shortage of professionals with expertise in both healthcare data management and software analytics can hinder adoption.

Growth Drivers in the Disease Registry Software Industry Market

Growth in the Disease Registry Software market is predominantly propelled by technological innovations, such as the integration of AI and machine learning for sophisticated data analysis and predictive modeling, which aids in identifying disease patterns and patient risks. Economically, the rising global healthcare expenditure and the increasing emphasis on value-based care models incentivize healthcare providers to invest in solutions that can demonstrate improved patient outcomes. Regulatory bodies are increasingly mandating robust data collection and reporting mechanisms for public health initiatives, thereby driving the adoption of comprehensive registry software. The growing demand for real-world evidence (RWE) from pharmaceutical companies for drug development and post-market surveillance also acts as a significant growth catalyst.

Challenges Impacting Disease Registry Software Industry Growth

The Disease Registry Software industry faces several critical challenges that can impede its growth. Regulatory complexities, particularly concerning data privacy and security across different geographical regions, necessitate continuous adaptation and compliance efforts, impacting development timelines and costs. Supply chain issues, though less direct, can affect hardware components and the availability of skilled IT personnel for implementation and support. Competitive pressures are intense, with both established players and emerging startups vying for market share, leading to price sensitivity and a need for continuous innovation to maintain differentiation. The substantial investment required for software development, implementation, and ongoing maintenance can also be a significant barrier, especially for smaller healthcare organizations with limited budgets. Furthermore, ensuring data interoperability and seamless integration with diverse existing healthcare IT infrastructures remains a persistent technical challenge.

Key Players Shaping the Disease Registry Software Industry Market

- Image Trend Inc

- Ordinal Data Inc

- Velos Inc

- Syneos Health

- McKensson Corporation

- Cerner Corporation

- IQVIA

- Dacima Software Inc

- Global Vision Technologies Inc

- FIGmd Inc

- IBM

- ArborMetrix

Significant Disease Registry Software Industry Industry Milestones

- April 2022: Quantori, LLC launched a Registry Science Practice, focusing on the creation of registry programs for patients, clinicians, and researchers, aimed at accelerating data-driven insights.

- January 2022: Seqster partnered with the National Pancreas Foundation (NPF) to establish the nation's largest dynamic pancreatic patient disease database, designed to accelerate cutting-edge research compared to traditional methods.

Future Outlook for Disease Registry Software Industry Market

The future outlook for the Disease Registry Software industry is exceptionally bright, driven by an increasing demand for data-driven healthcare solutions. Strategic opportunities lie in the continued development of AI-powered analytics for predictive disease management, personalized treatment planning, and enhanced clinical trial efficiency. The expanding adoption of cloud-based and mobile registry platforms will further democratize access to sophisticated data management tools. As healthcare systems globally prioritize population health management and the generation of robust real-world evidence, disease registry software will play an indispensable role in achieving these objectives. Investments in interoperability standards and data standardization will be crucial for unlocking the full potential of these systems, leading to improved patient outcomes and accelerated medical innovation.

Disease Registry Software Industry Segmentation

-

1. Type of Registry

- 1.1. Disease Registries

- 1.2. Health Service Registries

- 1.3. Product Registries

-

2. Type of Software

- 2.1. Stand-alone Software

- 2.2. Integrated Software

-

3. End User

- 3.1. Hospitals

- 3.2. Governme

- 3.3. Pharmace

- 3.4. Other End Users

Disease Registry Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Disease Registry Software Industry Regional Market Share

Geographic Coverage of Disease Registry Software Industry

Disease Registry Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of Government Initiatives to Build Patient Registries; Rising Adoption of Electronic Health Records (EHR); Increasing Use of Patient Registry Data for Post-marketing Surveillance

- 3.3. Market Restrains

- 3.3.1. Privacy and Data Security-related Concerns; Lack of Trained and Skilled Resources

- 3.4. Market Trends

- 3.4.1. Integrated Software Segment is is Expected to Hold a Major Market Share in the Patient Registry Software Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Registry

- 5.1.1. Disease Registries

- 5.1.2. Health Service Registries

- 5.1.3. Product Registries

- 5.2. Market Analysis, Insights and Forecast - by Type of Software

- 5.2.1. Stand-alone Software

- 5.2.2. Integrated Software

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Governme

- 5.3.3. Pharmace

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. GCC

- 5.4.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Registry

- 6. North America Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Registry

- 6.1.1. Disease Registries

- 6.1.2. Health Service Registries

- 6.1.3. Product Registries

- 6.2. Market Analysis, Insights and Forecast - by Type of Software

- 6.2.1. Stand-alone Software

- 6.2.2. Integrated Software

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Governme

- 6.3.3. Pharmace

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Registry

- 7. Europe Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Registry

- 7.1.1. Disease Registries

- 7.1.2. Health Service Registries

- 7.1.3. Product Registries

- 7.2. Market Analysis, Insights and Forecast - by Type of Software

- 7.2.1. Stand-alone Software

- 7.2.2. Integrated Software

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Governme

- 7.3.3. Pharmace

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Registry

- 8. Asia Pacific Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Registry

- 8.1.1. Disease Registries

- 8.1.2. Health Service Registries

- 8.1.3. Product Registries

- 8.2. Market Analysis, Insights and Forecast - by Type of Software

- 8.2.1. Stand-alone Software

- 8.2.2. Integrated Software

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Governme

- 8.3.3. Pharmace

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Registry

- 9. Middle East Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Registry

- 9.1.1. Disease Registries

- 9.1.2. Health Service Registries

- 9.1.3. Product Registries

- 9.2. Market Analysis, Insights and Forecast - by Type of Software

- 9.2.1. Stand-alone Software

- 9.2.2. Integrated Software

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Governme

- 9.3.3. Pharmace

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Registry

- 10. GCC Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Registry

- 10.1.1. Disease Registries

- 10.1.2. Health Service Registries

- 10.1.3. Product Registries

- 10.2. Market Analysis, Insights and Forecast - by Type of Software

- 10.2.1. Stand-alone Software

- 10.2.2. Integrated Software

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Governme

- 10.3.3. Pharmace

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Registry

- 11. South America Disease Registry Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Registry

- 11.1.1. Disease Registries

- 11.1.2. Health Service Registries

- 11.1.3. Product Registries

- 11.2. Market Analysis, Insights and Forecast - by Type of Software

- 11.2.1. Stand-alone Software

- 11.2.2. Integrated Software

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospitals

- 11.3.2. Governme

- 11.3.3. Pharmace

- 11.3.4. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type of Registry

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Image Trend Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ordinal Data Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Velos Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Syneos Health

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 McKensson Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cerner Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 IQVIA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dacima Software Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Global Vision Technologies Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FIGmd Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 IBM

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ArborMetrix

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Image Trend Inc

List of Figures

- Figure 1: Global Disease Registry Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 3: North America Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 4: North America Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 5: North America Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 6: North America Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 11: Europe Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 12: Europe Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 13: Europe Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 14: Europe Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 19: Asia Pacific Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 20: Asia Pacific Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 21: Asia Pacific Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 22: Asia Pacific Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 27: Middle East Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 28: Middle East Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 29: Middle East Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 30: Middle East Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: GCC Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 35: GCC Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 36: GCC Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 37: GCC Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 38: GCC Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: GCC Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: GCC Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: GCC Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Disease Registry Software Industry Revenue (Million), by Type of Registry 2025 & 2033

- Figure 43: South America Disease Registry Software Industry Revenue Share (%), by Type of Registry 2025 & 2033

- Figure 44: South America Disease Registry Software Industry Revenue (Million), by Type of Software 2025 & 2033

- Figure 45: South America Disease Registry Software Industry Revenue Share (%), by Type of Software 2025 & 2033

- Figure 46: South America Disease Registry Software Industry Revenue (Million), by End User 2025 & 2033

- Figure 47: South America Disease Registry Software Industry Revenue Share (%), by End User 2025 & 2033

- Figure 48: South America Disease Registry Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Disease Registry Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 2: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 3: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Disease Registry Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 6: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 7: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 13: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 14: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 23: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 24: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South korea Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 33: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 34: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 37: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 38: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: South Africa Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Registry 2020 & 2033

- Table 43: Global Disease Registry Software Industry Revenue Million Forecast, by Type of Software 2020 & 2033

- Table 44: Global Disease Registry Software Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global Disease Registry Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Brazil Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Argentina Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of South America Disease Registry Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disease Registry Software Industry?

The projected CAGR is approximately 12.53%.

2. Which companies are prominent players in the Disease Registry Software Industry?

Key companies in the market include Image Trend Inc, Ordinal Data Inc, Velos Inc, Syneos Health, McKensson Corporation, Cerner Corporation, IQVIA, Dacima Software Inc, Global Vision Technologies Inc, FIGmd Inc, IBM, ArborMetrix.

3. What are the main segments of the Disease Registry Software Industry?

The market segments include Type of Registry, Type of Software, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of Government Initiatives to Build Patient Registries; Rising Adoption of Electronic Health Records (EHR); Increasing Use of Patient Registry Data for Post-marketing Surveillance.

6. What are the notable trends driving market growth?

Integrated Software Segment is is Expected to Hold a Major Market Share in the Patient Registry Software Market.

7. Are there any restraints impacting market growth?

Privacy and Data Security-related Concerns; Lack of Trained and Skilled Resources.

8. Can you provide examples of recent developments in the market?

In April 2022, Quantori, LLC launched a Registry Science Practice focusing on the creation of registry programs for patients, clinicians, and researchers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disease Registry Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disease Registry Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disease Registry Software Industry?

To stay informed about further developments, trends, and reports in the Disease Registry Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence