Key Insights

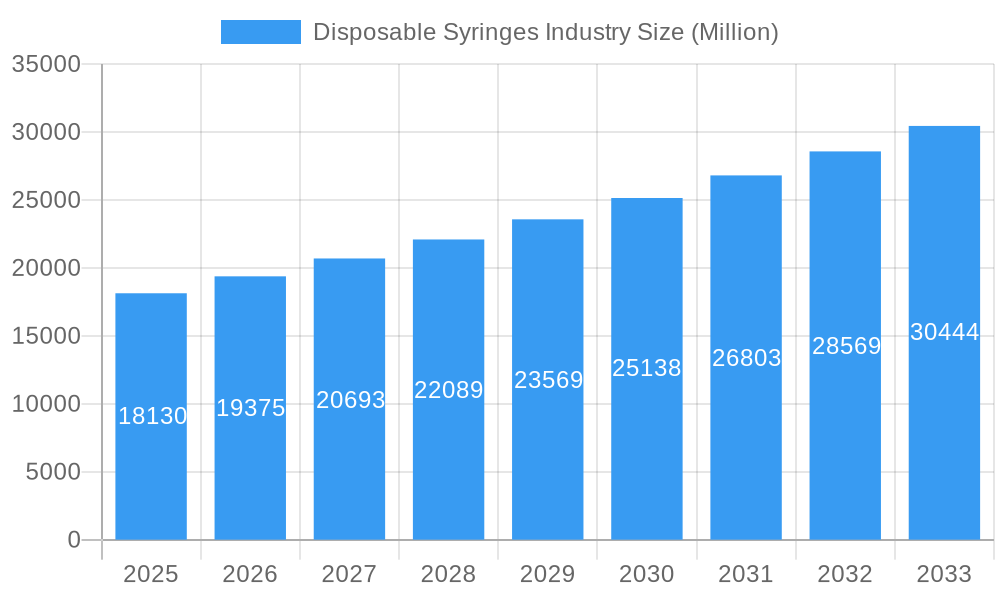

The global Disposable Syringes market is poised for substantial growth, projected to reach an estimated USD 18.13 billion in 2025. This expansion is driven by a compelling Compound Annual Growth Rate (CAGR) of 6.8% anticipated from 2025 to 2033. A primary catalyst for this upward trajectory is the increasing prevalence of chronic diseases and the subsequent rise in demand for routine medical procedures and vaccinations. Enhanced healthcare infrastructure, particularly in emerging economies, coupled with a growing awareness of infection control practices, further fuels this market. The shift towards advanced safety syringes, designed to prevent needlestick injuries, is a significant trend, with manufacturers actively investing in research and development to introduce innovative, user-friendly, and cost-effective solutions. This focus on patient and healthcare worker safety is a key driver for the adoption of sophisticated disposable syringe technologies.

Disposable Syringes Industry Market Size (In Billion)

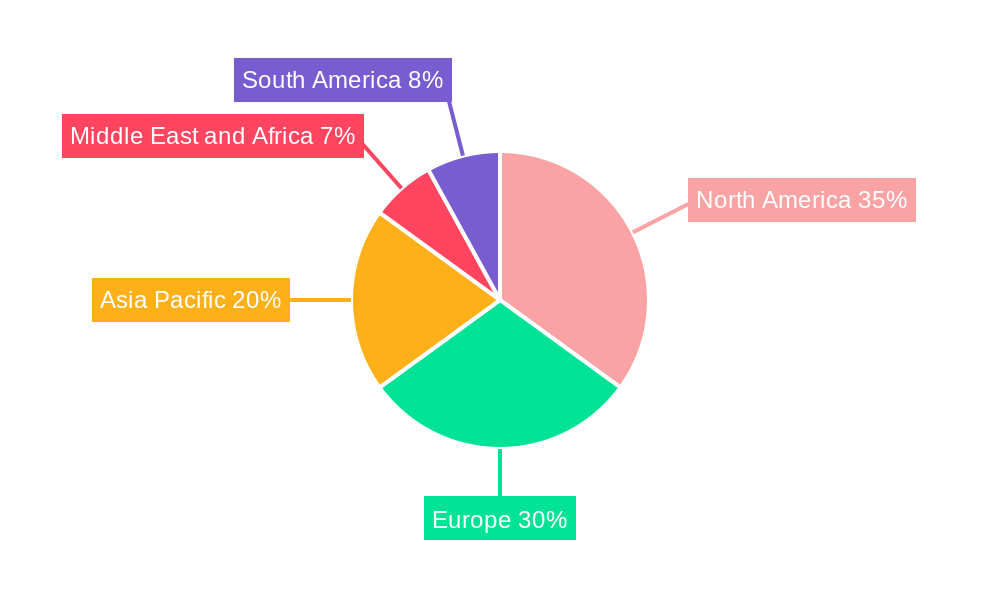

The market is segmented into Conventional Syringes and Safety Syringes, with safety syringes, including retractable and non-retractable variants, gaining significant traction due to regulatory mandates and a heightened focus on occupational safety. End-users are primarily Hospitals and Diagnostic Laboratories, which represent the largest consumers of disposable syringes. Other end-users, such as clinics and home healthcare settings, also contribute to market demand. Geographically, North America and Europe currently dominate the market, owing to well-established healthcare systems and high healthcare expenditure. However, the Asia Pacific region is expected to witness the fastest growth, fueled by a large population, increasing healthcare access, and a growing domestic manufacturing base for medical devices. Restraints in the market include stringent regulatory approvals for new products and potential price fluctuations in raw materials, which could impact manufacturing costs.

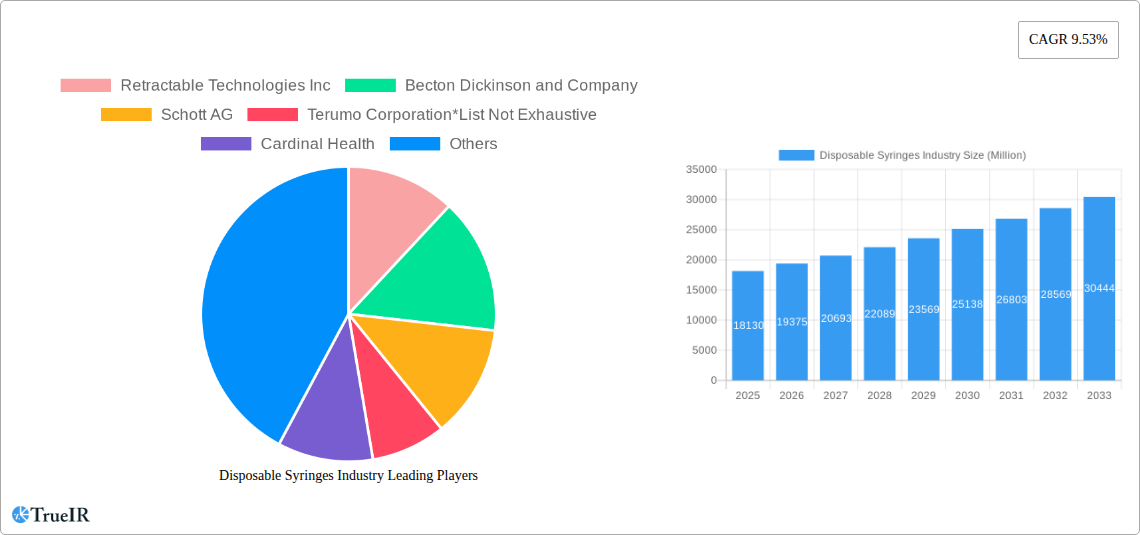

Disposable Syringes Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global disposable syringes market, a critical segment of the healthcare industry valued in the billions. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this study offers unparalleled insights into market dynamics, growth drivers, and emerging opportunities. Leveraging high-volume SEO keywords such as "disposable syringes," "medical syringes," "safety syringes," "healthcare consumables," "injection devices," and "pharmaceutical packaging," this report is meticulously designed to enhance search rankings and engage a wide spectrum of industry professionals, investors, and stakeholders.

Disposable Syringes Industry Market Structure & Competitive Landscape

The disposable syringes market is characterized by a moderately consolidated structure, with key players focusing on innovation and strategic partnerships to maintain a competitive edge. Market concentration is influenced by the significant capital investment required for advanced manufacturing facilities and the stringent regulatory approvals necessary for medical devices. Innovation drivers include the increasing demand for enhanced patient safety, the development of safety syringes to prevent needle-stick injuries, and the growing adoption of ready-to-use and pre-filled syringes. Regulatory impacts, such as FDA and CE marking requirements, play a crucial role in market entry and product development, often driving manufacturers towards compliance and higher quality standards. Product substitutes, while limited in core functionality, include alternative drug delivery systems and reusable injection devices in specific niche applications.

- Market Concentration: Dominated by a few large multinational corporations and a growing number of regional players.

- Innovation Drivers:

- Development of advanced safety syringes (retractable and non-retractable).

- Focus on plastic syringes and polymer-based materials.

- Integration of smart features for dosage accuracy and tracking.

- Regulatory Impacts: Strict adherence to international quality standards (ISO, FDA, EMA) is paramount.

- Product Substitutes: Limited, but include reusable syringes and alternative drug delivery mechanisms.

- End-User Segmentation: Driven by demand from hospitals, diagnostic laboratories, and other healthcare providers.

- M&A Trends: Anticipated to continue as companies seek to expand product portfolios, geographical reach, and manufacturing capabilities. The volume of M&A activities in the historical period was approximately 3 billion USD.

Disposable Syringes Industry Market Trends & Opportunities

The global disposable syringes market is poised for substantial growth, driven by an expanding healthcare infrastructure, an aging global population, and the increasing prevalence of chronic diseases requiring regular medication. The market size is projected to reach several hundred billion dollars by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. Technological shifts are heavily leaning towards the adoption of safety syringes, including retractable safety syringes and non-retractable safety syringes, to mitigate the risk of needle-stick injuries, a significant concern in healthcare settings worldwide. Consumer preferences are evolving to favor devices that offer enhanced safety, ease of use, and reduced waste. The growing demand for ready-to-administer drug formulations and pre-fillable syringes is also a major trend, simplifying clinical workflows and improving patient compliance.

Competitive dynamics are intensifying, with companies investing heavily in research and development to introduce novel syringe designs and materials. The focus on plastic syringes is increasing due to their cost-effectiveness, disposability, and the potential for advanced designs. Opportunities abound in emerging economies due to the expansion of healthcare access and the rising disposable incomes, leading to increased demand for medical consumables. The pharmaceutical industry's reliance on efficient and safe drug delivery mechanisms ensures a sustained demand for high-quality disposable syringes. Furthermore, the ongoing development of new biopharmaceuticals and vaccines will continue to fuel the need for specialized injection devices. The penetration rate of safety syringes is expected to surge beyond 70% by 2030, driven by regulatory mandates and healthcare provider awareness.

Dominant Markets & Segments in Disposable Syringes Industry

North America and Europe currently represent the dominant markets for disposable syringes, driven by well-established healthcare systems, high healthcare expenditure, and stringent patient safety regulations. The United States, in particular, leads in terms of market size and adoption of advanced safety syringes. Asia Pacific is emerging as the fastest-growing region, fueled by improving healthcare infrastructure, increasing medical tourism, and a burgeoning population demanding accessible healthcare solutions.

- Dominant Region: North America, followed closely by Europe.

- Fastest Growing Region: Asia Pacific.

- Dominant Segment by Type: Safety Syringes: This segment is experiencing rapid growth due to:

- Retractable Safety Syringes: Offering superior protection against needlestick injuries by automatically retracting the needle after use.

- Non-retractable Safety Syringes: Providing a more accessible and cost-effective safety mechanism.

- Regulatory mandates and healthcare organization policies promoting their use.

- Increased awareness among healthcare professionals regarding infection control.

- Dominant Segment by End User: Hospitals: Hospitals represent the largest end-user segment due to the high volume of inpatient and outpatient procedures requiring injections and infusions.

- Increasing patient admissions and surgical procedures.

- Widespread use in emergency departments, intensive care units, and general wards.

- Growing Segment by End User: Diagnostic Laboratories: The expansion of diagnostic testing and screening programs, particularly in response to global health events, is driving demand from this segment.

- Increased blood sample collection and administration of diagnostic reagents.

- Growth in specialized diagnostic services.

- Other End Users: This segment includes clinics, ambulatory surgical centers, home healthcare providers, and veterinary practices, all contributing to the overall market demand.

Disposable Syringes Industry Product Analysis

Product innovation in the disposable syringes industry is primarily focused on enhancing patient and healthcare worker safety, improving user-friendliness, and optimizing drug delivery. The development of safety syringes, such as retractable and non-retractable designs, has revolutionized the market by significantly reducing the incidence of needle-stick injuries, a major occupational hazard. Manufacturers are increasingly utilizing advanced polymers to create lighter, more durable, and cost-effective syringes. The trend towards ready-to-administer platforms and pre-filled syringes streamlines clinical workflows, minimizes medication errors, and ensures precise dosing. These innovations provide a competitive advantage by meeting the evolving demands of healthcare providers for efficiency, safety, and improved patient outcomes, making them essential components in modern healthcare delivery.

Key Drivers, Barriers & Challenges in Disposable Syringes Industry

The disposable syringes industry is propelled by several key drivers, including the growing global demand for healthcare services, the increasing prevalence of chronic diseases, and a strong emphasis on infection control and patient safety. Technological advancements in safety syringes and materials science contribute to market expansion.

- Key Drivers:

- Expanding global healthcare access and rising patient populations.

- Increasing incidence of chronic diseases requiring ongoing medication.

- Technological innovation in safety syringe designs and plastic syringe materials.

- Government initiatives promoting vaccination programs and public health awareness.

Conversely, the industry faces significant barriers and challenges. Stringent regulatory approval processes can delay product launches and increase development costs. Supply chain disruptions, as evidenced by recent global events, can impact the availability and pricing of raw materials and finished goods. Intense competition among manufacturers, particularly in the price-sensitive segments, exerts pressure on profit margins.

- Key Barriers & Challenges:

- Strict and evolving regulatory compliance requirements.

- Supply chain vulnerabilities and raw material price volatility.

- Intense price competition from numerous market players.

- Waste management and environmental concerns associated with disposable products.

Growth Drivers in the Disposable Syringes Industry Market

The sustained growth of the disposable syringes market is underpinned by several critical factors. The expanding global healthcare infrastructure, particularly in developing economies, is a primary growth catalyst. The rising incidence of chronic diseases such as diabetes, cardiovascular diseases, and cancer necessitates regular medication, driving consistent demand for injection devices. Technological advancements are continuously introducing safer and more efficient safety syringes, including retractable and non-retractable designs, thereby enhancing patient care and reducing occupational hazards. Furthermore, government initiatives focused on public health, such as extensive vaccination programs, significantly boost the demand for disposable syringes. The ongoing development of new pharmaceutical products and biologics also fuels market expansion.

Challenges Impacting Disposable Syringes Industry Growth

Despite the robust growth trajectory, the disposable syringes industry encounters several challenges. The highly regulated nature of medical devices necessitates lengthy and costly approval processes, potentially delaying market entry for new products. Volatility in the prices of raw materials, particularly plastics and specialized components, can impact manufacturing costs and profit margins. Global supply chain disruptions, as experienced recently, can lead to shortages and increased lead times, affecting product availability. The competitive landscape is fierce, with numerous players vying for market share, leading to price pressures and the need for continuous innovation to maintain differentiation. Environmental concerns surrounding the disposal of billions of single-use medical devices also pose a growing challenge, driving research into more sustainable materials and disposal methods.

Key Players Shaping the Disposable Syringes Industry Market

- Retractable Technologies Inc

- Becton Dickinson and Company

- Schott AG

- Terumo Corporation

- Cardinal Health

- Hindustan Syringes & Medical Devices Ltd

- Nipro

- Baxter International Inc

- B Braun SE

- Gerresheimer AG

Significant Disposable Syringes Industry Industry Milestones

- March 2023: Genixus planned to build a 30,000-square-foot manufacturing facility in North Carolina, United States, outfitted with automated manufacturing equipment to support the KinetiX syringe, a ready-to-administer platform made from plastic. This expansion signifies a move towards advanced manufacturing and innovative plastic syringe solutions.

- May 2022: SCHOTT Pharma inaugurated its new manufacturing facility for pre-fillable syringes made of high-end polymer in Müllheim, Germany. This development highlights the growing importance of polymer-based pre-fillable syringes and the industry's commitment to advanced materials and expanded production capacity.

Future Outlook for Disposable Syringes Industry Market

The future outlook for the disposable syringes market remains exceptionally bright, driven by ongoing global healthcare expansion and technological advancements. The increasing adoption of safety syringes will continue to be a major growth catalyst, supported by regulatory mandates and heightened awareness of occupational safety. The demand for pre-filled syringes and ready-to-administer drug delivery systems is expected to surge, driven by the need for greater efficiency and reduced medication errors in clinical settings. Emerging economies represent significant untapped potential, with improving healthcare infrastructure and rising patient populations poised to drive substantial market growth. Investments in innovative materials, such as advanced plastics and biodegradable components, will also shape the future landscape, addressing environmental concerns and enhancing product performance. Strategic collaborations and mergers are anticipated to further consolidate the market, enabling companies to leverage economies of scale and expand their global reach. The overall market trajectory points towards continued robust growth and innovation in the coming years.

Disposable Syringes Industry Segmentation

-

1. Type

- 1.1. Conventional Syringes

-

1.2. Safety Syringes

- 1.2.1. Retractable Safety Syringes

- 1.2.2. Non-retractable Safety Syringes

-

2. End Users

- 2.1. Hospitals

- 2.2. Diagnostic Laboratories

- 2.3. Other End Users

Disposable Syringes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Disposable Syringes Industry Regional Market Share

Geographic Coverage of Disposable Syringes Industry

Disposable Syringes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Activities by Various NGO's that Create Awareness for the Use of Disposable Syringes; Need to Control the Spread of Diseases like HIV; Rising Demand of Injectable Drugs

- 3.3. Market Restrains

- 3.3.1. Comparatively High One-time Cost; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Retractable Safety Syringes Segment Expected to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Conventional Syringes

- 5.1.2. Safety Syringes

- 5.1.2.1. Retractable Safety Syringes

- 5.1.2.2. Non-retractable Safety Syringes

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals

- 5.2.2. Diagnostic Laboratories

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Conventional Syringes

- 6.1.2. Safety Syringes

- 6.1.2.1. Retractable Safety Syringes

- 6.1.2.2. Non-retractable Safety Syringes

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals

- 6.2.2. Diagnostic Laboratories

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Conventional Syringes

- 7.1.2. Safety Syringes

- 7.1.2.1. Retractable Safety Syringes

- 7.1.2.2. Non-retractable Safety Syringes

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals

- 7.2.2. Diagnostic Laboratories

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Conventional Syringes

- 8.1.2. Safety Syringes

- 8.1.2.1. Retractable Safety Syringes

- 8.1.2.2. Non-retractable Safety Syringes

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals

- 8.2.2. Diagnostic Laboratories

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Conventional Syringes

- 9.1.2. Safety Syringes

- 9.1.2.1. Retractable Safety Syringes

- 9.1.2.2. Non-retractable Safety Syringes

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. Hospitals

- 9.2.2. Diagnostic Laboratories

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Disposable Syringes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Conventional Syringes

- 10.1.2. Safety Syringes

- 10.1.2.1. Retractable Safety Syringes

- 10.1.2.2. Non-retractable Safety Syringes

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. Hospitals

- 10.2.2. Diagnostic Laboratories

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Retractable Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schott AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Terumo Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cardinal Health

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hindustan Syringes & Medical Devices Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nipro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Baxter International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B Braun SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gerresheimer AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Retractable Technologies Inc

List of Figures

- Figure 1: Global Disposable Syringes Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Disposable Syringes Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Disposable Syringes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Disposable Syringes Industry Revenue (undefined), by End Users 2025 & 2033

- Figure 5: North America Disposable Syringes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 6: North America Disposable Syringes Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Disposable Syringes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Disposable Syringes Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Disposable Syringes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Disposable Syringes Industry Revenue (undefined), by End Users 2025 & 2033

- Figure 11: Europe Disposable Syringes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 12: Europe Disposable Syringes Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Disposable Syringes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Disposable Syringes Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Disposable Syringes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Disposable Syringes Industry Revenue (undefined), by End Users 2025 & 2033

- Figure 17: Asia Pacific Disposable Syringes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 18: Asia Pacific Disposable Syringes Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Disposable Syringes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Disposable Syringes Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East and Africa Disposable Syringes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Disposable Syringes Industry Revenue (undefined), by End Users 2025 & 2033

- Figure 23: Middle East and Africa Disposable Syringes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Middle East and Africa Disposable Syringes Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Disposable Syringes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Disposable Syringes Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Disposable Syringes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Disposable Syringes Industry Revenue (undefined), by End Users 2025 & 2033

- Figure 29: South America Disposable Syringes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 30: South America Disposable Syringes Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Disposable Syringes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 3: Global Disposable Syringes Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 6: Global Disposable Syringes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 12: Global Disposable Syringes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 21: Global Disposable Syringes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 30: Global Disposable Syringes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Disposable Syringes Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Disposable Syringes Industry Revenue undefined Forecast, by End Users 2020 & 2033

- Table 36: Global Disposable Syringes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Disposable Syringes Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Syringes Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Disposable Syringes Industry?

Key companies in the market include Retractable Technologies Inc, Becton Dickinson and Company, Schott AG, Terumo Corporation*List Not Exhaustive, Cardinal Health, Hindustan Syringes & Medical Devices Ltd, Nipro, Baxter International Inc, B Braun SE, Gerresheimer AG.

3. What are the main segments of the Disposable Syringes Industry?

The market segments include Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Activities by Various NGO's that Create Awareness for the Use of Disposable Syringes; Need to Control the Spread of Diseases like HIV; Rising Demand of Injectable Drugs.

6. What are the notable trends driving market growth?

Retractable Safety Syringes Segment Expected to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

Comparatively High One-time Cost; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

March 2023: Genixus planned to build a 30,000-square-foot manufacturing facility in North Carolina, United States, outfitted with automated manufacturing equipment to support the KinetiX syringe, a ready-to-administer platform made from plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disposable Syringes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disposable Syringes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disposable Syringes Industry?

To stay informed about further developments, trends, and reports in the Disposable Syringes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence