Key Insights

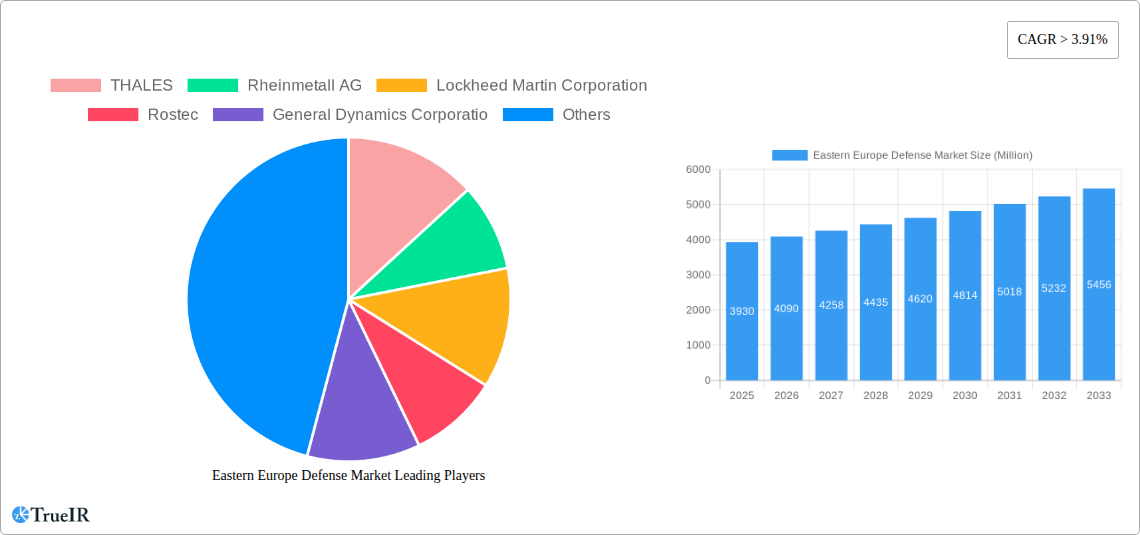

The Eastern European defense market, valued at $3.93 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and a renewed focus on national security within the region. The Compound Annual Growth Rate (CAGR) exceeding 3.91% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key drivers include increased defense budgets across countries like Poland, Russia, and Ukraine, modernization of aging military equipment, and the growing adoption of advanced technologies such as artificial intelligence and unmanned aerial vehicles. Market segmentation reveals a strong demand for personnel training and protection, communication systems, and weapons and ammunition, reflecting a prioritization of enhanced military readiness and operational capabilities. While economic fluctuations and potential shifts in geopolitical alliances could present some restraints, the overall trajectory points towards sustained growth, particularly in countries actively bolstering their defense capabilities in response to regional instability.

Eastern Europe Defense Market Market Size (In Billion)

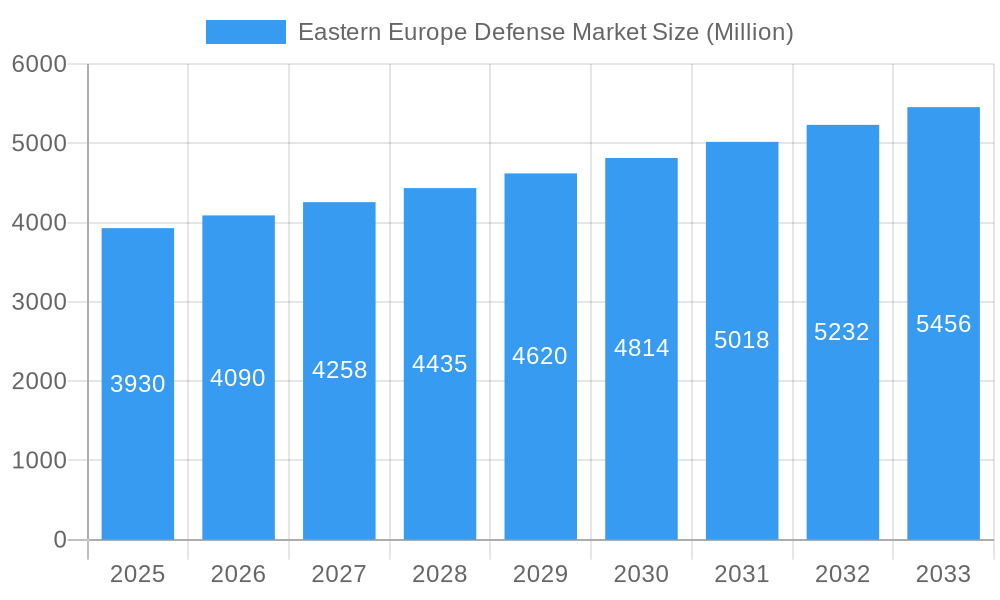

The market's structure is characterized by the presence of both major international defense contractors such as Thales, Rheinmetall, Lockheed Martin, and Rostec, as well as regional players. Competition is intense, with companies vying for contracts related to equipment upgrades, new acquisitions, and ongoing military modernization programs. The substantial investments in defense infrastructure and technological advancements are further fueling market growth. Countries like Poland and Romania are particularly noteworthy for their significant investments in defense modernization, contributing significantly to the overall market expansion. The Rest of Eastern Europe segment also presents substantial growth potential driven by various national security concerns and increasing military spending across numerous smaller nations. Further research into specific technological advancements within each segment will reveal greater insights into the evolving landscape of the Eastern European defense market.

Eastern Europe Defense Market Company Market Share

Eastern Europe Defense Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Eastern Europe defense market, offering invaluable insights for industry stakeholders, investors, and policymakers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Expect detailed market sizing, segmentation, competitive landscape analysis, and future projections, all supported by rigorous data and expert analysis. The report also highlights recent significant industry developments and forecasts future market trends.

Eastern Europe Defense Market Structure & Competitive Landscape

The Eastern European defense market exhibits a complex structure characterized by a mix of state-owned enterprises, multinational corporations, and smaller specialized firms. Market concentration is moderate, with a few dominant players like Rostec and others holding significant market share, but a diverse range of smaller companies also contributing significantly. Concentration ratios are estimated at xx% for the top 5 players in 2025 and projected to reach xx% by 2033. This relatively lower concentration reflects the market's fragmented nature and the presence of several national defense industries.

Innovation in areas like cyber warfare, AI-integrated systems, and unmanned aerial vehicles (UAVs) is a key driver, impacting product development cycles and competitiveness. Strict regulatory frameworks and defense-specific policies in each Eastern European country influence market access and operations. Product substitution, driven by technological advancements and cost considerations, is also increasingly relevant. The market is primarily segmented by end-users, including national armies, air forces, navies, and border security agencies.

Mergers and acquisitions (M&A) activity, although not as frequent as in other regions, is crucial in shaping the market landscape. The total value of M&A deals in the Eastern European defense sector reached approximately USD xx Million in 2024, and is projected to increase to USD xx Million by 2033, driven primarily by consolidation among smaller firms and strategic acquisitions by larger players.

Eastern Europe Defense Market Market Trends & Opportunities

The Eastern European defense market is projected to experience significant growth during the forecast period (2025-2033). Driven by geopolitical instability, rising defense budgets, and modernization efforts, the market size is estimated at USD xx Million in 2025 and is forecasted to reach USD xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by technological advancements, notably in areas like autonomous systems, precision-guided munitions, and cybersecurity.

Consumer preferences (national governments) are shifting towards advanced, technologically sophisticated defense systems capable of countering evolving threats. This is reflected in an increasing market penetration rate for high-tech defense solutions, expected to increase from xx% in 2025 to xx% in 2033. Competitive dynamics are characterized by increased focus on innovation, strategic partnerships, and government contracts. The market is experiencing a shift toward collaborative defense projects and joint ventures, reflecting a growing need for technological cooperation and cost-effectiveness.

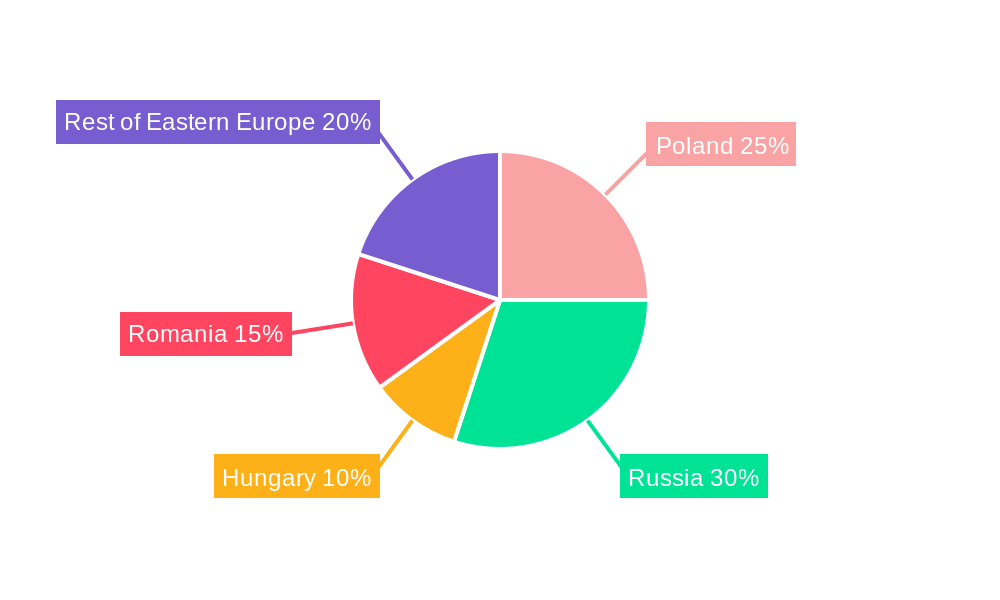

Dominant Markets & Segments in Eastern Europe Defense Market

By Country: Russia currently dominates the Eastern European defense market, due to its large defense budget and extensive domestic defense industry. However, Poland and Romania are showing rapid growth, driven by increased NATO investment and their commitment to modernizing their armed forces. Other countries, like Hungary, are also increasing their defense spending, though at a slower rate. The "Rest of Eastern Europe" segment represents a significant market with opportunities for growth.

By Type: The Weapons and Ammunition segment holds the largest share of the market, driven by continuous demand for modernized weaponry and the ongoing geopolitical tensions in the region. The Vehicles segment is also experiencing substantial growth due to the demand for modern armored vehicles and military transport solutions. The Personnel Training and Protection and Communication Systems segments are anticipated to grow steadily, reflecting the importance of trained personnel and secure communication capabilities for defense operations.

Key growth drivers for the region include:

- Increased Geopolitical Instability: The ongoing conflict in Ukraine has significantly increased defense spending and modernization efforts across Eastern Europe.

- NATO Membership and Expansion: The expansion of NATO's influence in Eastern Europe is driving investment in defense infrastructure and interoperability with allied forces.

- Rising Defense Budgets: Governments in the region are allocating more resources to strengthen their defense capabilities, creating substantial market opportunities.

Eastern Europe Defense Market Product Analysis

The Eastern European defense market is witnessing the adoption of advanced technologies such as AI, big data analytics, and autonomous systems, leading to the development of sophisticated defense products. These innovations are enhancing the performance, effectiveness, and efficiency of defense systems, particularly in areas such as target acquisition, situational awareness, and threat neutralization. The market is also characterized by a strong focus on product customization to meet the specific needs and requirements of individual countries, leading to a diverse range of defense products tailored to regional defense strategies.

Key Drivers, Barriers & Challenges in Eastern Europe Defense Market

Key Drivers: Technological advancements in defense systems, increasing geopolitical instability leading to higher defense spending, and government initiatives to modernize armed forces are significant drivers of market growth. Specific examples include the increasing adoption of drone technology and investments in cyber defense capabilities.

Challenges: The market faces challenges including potential supply chain disruptions due to geopolitical tensions, regulatory hurdles related to defense procurement processes, and intense competition among both domestic and international players. The impact of these challenges can be quantified through potential project delays and increased procurement costs.

Growth Drivers in the Eastern Europe Defense Market Market

The Eastern European defense market growth is fueled by technological advancements, notably in AI, cyber defense, and autonomous systems. Economic factors, including rising defense budgets and government incentives, also play a crucial role. Furthermore, favorable regulatory frameworks supporting defense industry development and foreign direct investment contribute significantly.

Challenges Impacting Eastern Europe Defense Market Growth

Significant challenges impacting market growth include geopolitical instability that disrupts supply chains, complex regulatory compliance requirements for defense contracts, and intense competition from established international defense firms. These factors can lead to increased costs, delayed projects, and decreased market share for certain players.

Key Players Shaping the Eastern Europe Defense Market Market

- THALES

- Rheinmetall AG

- Lockheed Martin Corporation

- Rostec

- General Dynamics Corporation

- Airbus SE

- RTX Corporation

- BAE Systems plc

- United Shipbuilding Corporation

- Northrop Grumman Corporation

- MESKO

Significant Eastern Europe Defense Market Industry Milestones

- December 2023: PGZ-Amunicja Consortium and the Armament Agency signed a PLN 11 billion (USD 2.75 billion) agreement for 300,000 155-mm artillery ammunition units, impacting the Weapons and Ammunition segment significantly.

- December 2023: The Romanian Ministry of Defense contracted Rheinmetall for EUR 328 million (USD 350 million) to modernize its Oerlikon GDF 103 air defense systems, demonstrating investment in air defense capabilities.

Future Outlook for Eastern Europe Defense Market Market

The Eastern European defense market is poised for continued growth, driven by ongoing geopolitical uncertainties, sustained modernization efforts, and technological advancements. Strategic partnerships, innovation in defense technologies, and increased defense spending across the region are key catalysts for future market expansion. Opportunities exist for companies offering advanced technological solutions and those capable of navigating the complexities of the regional defense landscape.

Eastern Europe Defense Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Eastern Europe Defense Market Segmentation By Geography

-

1. Eastern Europe

- 1.1. Poland

- 1.2. Czech Republic

- 1.3. Hungary

- 1.4. Romania

- 1.5. Bulgaria

- 1.6. Slovakia

- 1.7. Ukraine

- 1.8. Serbia

- 1.9. Croatia

Eastern Europe Defense Market Regional Market Share

Geographic Coverage of Eastern Europe Defense Market

Eastern Europe Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Vehicles Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Eastern Europe Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rheinmetall AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rostec

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Dynamics Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BAE Systems plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 United Shipbuilding Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MESKO

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Eastern Europe Defense Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Eastern Europe Defense Market Share (%) by Company 2025

List of Tables

- Table 1: Eastern Europe Defense Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Eastern Europe Defense Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Eastern Europe Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Eastern Europe Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Eastern Europe Defense Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Eastern Europe Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Eastern Europe Defense Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Eastern Europe Defense Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Eastern Europe Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Eastern Europe Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Eastern Europe Defense Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Eastern Europe Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Poland Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Czech Republic Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Hungary Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Romania Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bulgaria Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Slovakia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ukraine Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Serbia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Croatia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eastern Europe Defense Market?

The projected CAGR is approximately > 3.91%.

2. Which companies are prominent players in the Eastern Europe Defense Market?

Key companies in the market include THALES, Rheinmetall AG, Lockheed Martin Corporation, Rostec, General Dynamics Corporatio, Airbus SE, RTX Corporation, BAE Systems plc, United Shipbuilding Corporation, Northrop Grumman Corporation, MESKO.

3. What are the main segments of the Eastern Europe Defense Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.93 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Vehicles Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

December 2023: PGZ-Amunicja Consortium (Poland's state-owned group) and the Armament Agency signed an agreement for 300,000 155-mm artillery ammunition units as part of the National Ammunition Reserve initiative. This particular contract stood out historically due to its substantial order size and estimated worth of close to PLN 11 billion (USD 2.75 billion). The scheduled delivery of ammunition is set to occur between 2024 and 2029.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eastern Europe Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eastern Europe Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eastern Europe Defense Market?

To stay informed about further developments, trends, and reports in the Eastern Europe Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence