Key Insights

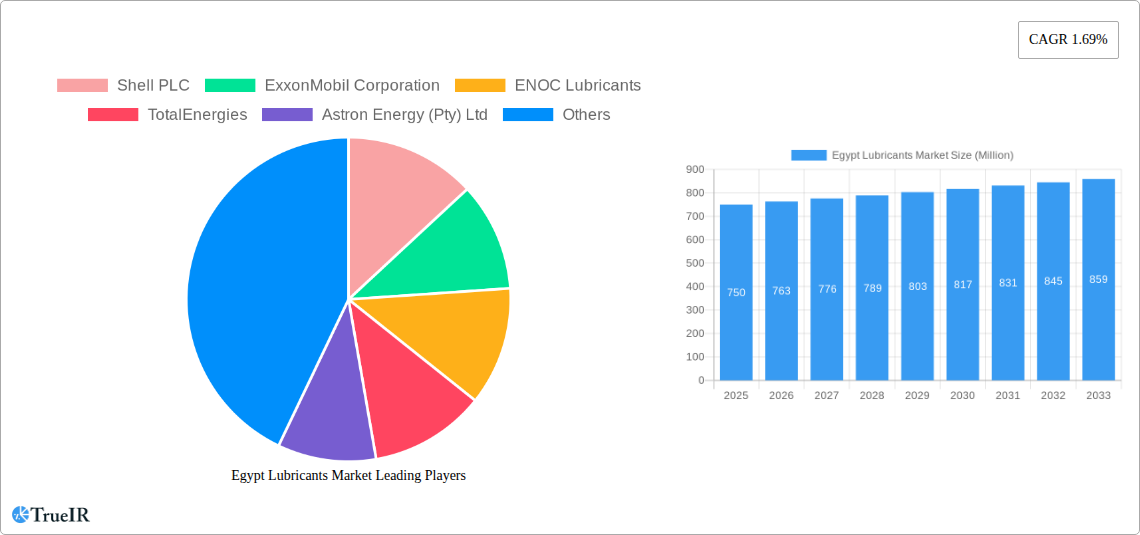

The Egyptian lubricants market is poised for steady growth, projected to reach a valuation of approximately $750 million by 2025 and continue its upward trajectory through 2033, driven by a Compound Annual Growth Rate (CAGR) of 1.69%. This expansion is primarily fueled by the robust performance of the automotive and other transportation sectors, which continue to be the dominant end-user industries. The increasing vehicle parc, coupled with ongoing infrastructure development and industrialization, necessitates a consistent demand for engine oils, transmission fluids, and hydraulic oils. Furthermore, the power generation sector, with its ongoing expansion and modernization initiatives, also presents a significant growth opportunity, requiring specialized lubricants for turbines and heavy machinery. The demand for greases, essential for reducing friction and wear in various industrial applications, is also expected to see sustained interest.

Egypt Lubricants Market Market Size (In Million)

While the market is characterized by consistent demand, certain factors could influence its growth trajectory. The adoption of electric vehicles (EVs) in the long term might present a gradual shift in the demand for traditional engine oils, though the immediate impact is expected to be minimal given Egypt's current automotive landscape. Moreover, fluctuating raw material prices for base oils and additives can introduce cost pressures for manufacturers, potentially impacting profit margins and pricing strategies. However, the sustained need for maintenance and operational efficiency across key sectors like construction, manufacturing, and agriculture will continue to underpin the market's resilience. Strategic initiatives by major players like Shell PLC, ExxonMobil Corporation, and TotalEnergies, focusing on product innovation and expanding distribution networks, are expected to further consolidate their market positions and drive overall market expansion. The competitive landscape is characterized by a mix of multinational corporations and established local players, all vying for market share through product quality, pricing, and service.

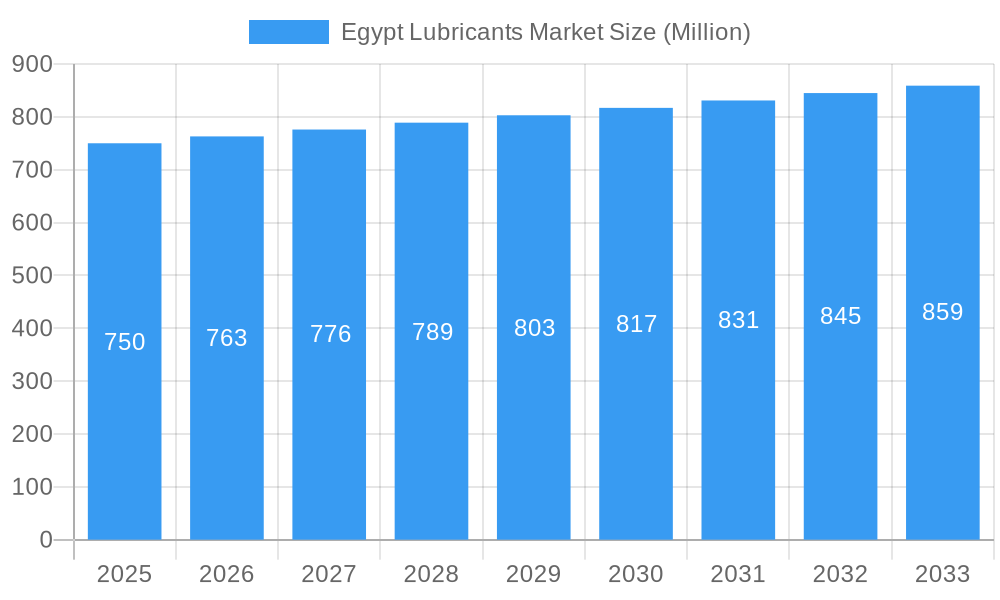

Egypt Lubricants Market Company Market Share

This comprehensive report delves into the dynamic Egypt Lubricants Market, providing in-depth analysis and future projections from 2019 to 2033. With a base year of 2025 and an extensive forecast period extending to 2033, this study offers unparalleled insights into market dynamics, competitive landscapes, and emerging opportunities. We meticulously examine key segments, from Engine Oil and Transmission Fluids to General Industrial Oils and Greases, across vital end-user industries including Automotive, Power Generation, and Heavy Equipment. Leveraging high-volume SEO keywords such as "Egypt lubricants market size," "automotive lubricants Egypt," "industrial lubricants Egypt," and "lubricant demand Egypt," this report is designed to rank prominently and engage industry professionals, investors, and stakeholders seeking a definitive understanding of this burgeoning market.

Egypt Lubricants Market Market Structure & Competitive Landscape

The Egypt Lubricants Market is characterized by a moderate level of concentration, with a few major international players holding significant market share alongside a growing number of domestic manufacturers. Key innovation drivers include the demand for high-performance, fuel-efficient lubricants that meet stringent environmental regulations and evolving automotive and industrial specifications. Regulatory impacts, such as fuel economy standards and emission control mandates, are shaping product development and consumer choices. Product substitutes, while present in some lower-tier applications, are increasingly being displaced by advanced synthetic and semi-synthetic formulations that offer superior protection and extended drain intervals.

The end-user segmentation reveals a strong reliance on the automotive and other transportation sectors, followed by heavy equipment and power generation. Mergers and acquisitions (M&A) activity, while not as prevalent as in more mature markets, is expected to play a crucial role in consolidating market share and expanding product portfolios. For instance, strategic partnerships or acquisitions by companies like Shell PLC or ExxonMobil Corporation could significantly alter the competitive landscape. The market's growth trajectory is also influenced by government initiatives promoting industrialization and infrastructure development, which directly boost demand for industrial and automotive lubricants.

Egypt Lubricants Market Market Trends & Opportunities

The Egypt Lubricants Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including a growing automotive parc, increasing industrialization, and significant investments in infrastructure projects. The base year of 2025 sees the market valued at an estimated USD 1,500 Million, with projections indicating a value of over USD 2,500 Million by the end of the forecast period.

Technological shifts are a major trend, with a discernible move towards synthetic and semi-synthetic lubricants. These advanced formulations offer superior performance characteristics, including enhanced thermal stability, reduced friction, and extended drain intervals, leading to lower operational costs and reduced environmental impact. Consumer preferences are increasingly aligned with these premium products, driven by a desire for improved engine protection, fuel efficiency, and extended equipment lifespan. The automotive sector, in particular, is a significant contributor to this trend, with the increasing adoption of modern engine technologies demanding specialized lubricant solutions.

Competitive dynamics are evolving, with international giants such as Shell PLC, ExxonMobil Corporation, and TotalEnergies maintaining a strong presence, leveraging their global expertise and established brands. Simultaneously, local players like Misr Petroleum Company are strategically expanding their offerings and distribution networks to capture a larger share of the domestic market. ENOC Lubricants and Astron Energy (Pty) Ltd are also key contenders, actively seeking to broaden their footprint. The market penetration rate for high-performance lubricants is expected to rise as awareness and demand for premium products grow. Opportunities abound in catering to the burgeoning automotive after-market, the increasing demand for specialized industrial lubricants for manufacturing and energy sectors, and the development of environmentally friendly lubricant solutions. The ongoing expansion of the Egyptian economy, coupled with government efforts to attract foreign investment in manufacturing and energy, presents a fertile ground for lubricant manufacturers and distributors to capitalize on.

Dominant Markets & Segments in Egypt Lubricants Market

The Egypt Lubricants Market is dominated by the Automotive and Other Transportation end-user industry, accounting for an estimated 45% of the total market share in 2025. This segment's dominance is driven by a steadily growing vehicle parc, including passenger cars, commercial vehicles, and motorcycles, coupled with ongoing investments in public transportation infrastructure and logistics networks. The increasing demand for reliable and efficient transportation fuels the need for high-quality engine oils, transmission fluids, and greases.

Within the Product Type segmentation, Engine Oil stands as the leading category, representing approximately 35% of the market in 2025. This is directly attributable to its fundamental role in internal combustion engines across all vehicle types. The demand for advanced engine oils that offer improved fuel economy, enhanced wear protection, and extended drain intervals is a key growth driver.

The Heavy Equipment sector is another significant contributor, projected to hold around 20% of the market share in 2025. This segment's growth is intrinsically linked to the robust infrastructure development projects underway in Egypt, including the construction of new cities, roads, and industrial complexes. These projects necessitate the extensive use of heavy machinery, which in turn drives the demand for high-performance hydraulic fluids, gear oils, and engine oils designed for demanding operating conditions.

Power Generation, while a smaller segment currently at approximately 15% market share in 2025, presents substantial future growth potential. Egypt's increasing energy demands and ongoing investments in power plants, including renewable energy projects, are creating a growing need for specialized industrial lubricants for turbines, generators, and associated equipment.

The Transmission and Hydraulic Fluid segment is expected to capture around 15% of the market in 2025, driven by the needs of both automotive and industrial applications. General Industrial Oil and Gear Oil together are estimated to constitute about 10% of the market, serving a diverse range of manufacturing and processing industries. Grease and Other Product Types collectively account for the remaining market share.

Key growth drivers across these dominant segments include government policies supporting industrial growth, urbanization trends, and the adoption of modern, fuel-efficient machinery and vehicles. The increasing focus on sustainability and operational efficiency is also pushing the adoption of premium lubricant products, further solidifying the dominance of higher-value segments.

Egypt Lubricants Market Product Analysis

Product innovations in the Egypt Lubricants Market are increasingly focused on enhancing performance, extending equipment life, and meeting stringent environmental regulations. The development of advanced synthetic and semi-synthetic formulations for engine oils offers superior wear protection, reduced friction for improved fuel economy, and exceptional thermal stability across a wide range of operating temperatures. In transmission and hydraulic fluids, innovations are geared towards improved viscosity stability, oxidation resistance, and enhanced shear stability, crucial for the smooth operation of complex machinery in demanding environments. For industrial applications, specialized gear oils with extreme pressure additives and industrial greases designed for high-load, high-temperature, and corrosive conditions are gaining traction. These product advancements are directly driven by technological evolution in automotive engines, manufacturing equipment, and the growing emphasis on sustainability and operational efficiency within end-user industries.

Key Drivers, Barriers & Challenges in Egypt Lubricants Market

Key drivers propelling the Egypt Lubricants Market include a burgeoning automotive sector with increasing vehicle sales and a growing demand for advanced lubricants, alongside significant government investment in infrastructure and industrialization, which spurs demand for heavy-duty and industrial lubricants. Technological advancements leading to more fuel-efficient vehicles and machinery necessitate higher-performance lubricants. Furthermore, increasing awareness among end-users regarding the benefits of premium lubricants, such as extended drain intervals and improved equipment protection, is a significant growth catalyst.

Challenges impacting Egypt Lubricants Market growth include a complex regulatory environment that can hinder product approvals and market entry for new formulations. Supply chain disruptions, particularly for imported base oils and additives, can lead to price volatility and availability issues. Intense competition from both established international players and emerging local brands can put pressure on profit margins. Counterfeit lubricants also pose a significant threat, eroding market trust and impacting the sales of genuine products.

Growth Drivers in the Egypt Lubricants Market Market

The Egypt Lubricants Market is experiencing robust growth driven by several pivotal factors. A primary driver is the substantial expansion of the automotive sector, fueled by increasing disposable incomes and a growing population, leading to higher vehicle sales and a greater demand for engine oils, transmission fluids, and other automotive lubricants. Significant government initiatives focused on infrastructure development, including new cities, transportation networks, and industrial zones, are boosting the demand for heavy-duty lubricants used in construction and mining equipment. Technological advancements in automotive and industrial machinery are also playing a crucial role, necessitating the use of high-performance synthetic and semi-synthetic lubricants that offer superior protection, extended drain intervals, and improved fuel efficiency.

Challenges Impacting Egypt Lubricants Market Growth

Despite the positive growth trajectory, the Egypt Lubricants Market faces several significant challenges. The presence of a substantial informal sector and the circulation of counterfeit lubricants pose a considerable threat to market integrity and the revenue streams of legitimate manufacturers and distributors. Supply chain vulnerabilities, including reliance on imported base oils and raw materials, can lead to price volatility and potential disruptions, impacting profitability and product availability. Navigating a complex regulatory landscape, which may include varying standards and approval processes for different lubricant types, can also present hurdles for market entrants and product development. Furthermore, intense price competition, particularly in the more commoditized segments, can limit the ability of companies to invest in research and development for advanced lubricant technologies.

Key Players Shaping the Egypt Lubricants Market Market

- Shell PLC

- ExxonMobil Corporation

- ENOC Lubricants

- TotalEnergies

- Astron Energy (Pty) Ltd

- LUKOIL

- Pakelo Motor Oil S r l

- FUCHS

- Castrol Limited

- EOG

- Misr Petroleum Company

Significant Egypt Lubricants Market Industry Milestones

- December 2023: Lukoil announced the USD 73 million investment in Egypt’s West Esh El Mallaha Oil Field to enhance oil reserves and increase production capacity, supporting the Egyptian economy.

- October 2023: ExxonMobil, the United States-based oil and gas company, announced the expansion of its operations in Egypt; these developments affirm ExxonMobil's ongoing commitment to its operations in Egypt and its pivotal role in the country's energy landscape.

Future Outlook for Egypt Lubricants Market Market

The future outlook for the Egypt Lubricants Market is exceptionally bright, driven by sustained economic growth and strategic investments in key sectors. The ongoing expansion of the automotive industry, coupled with the increasing adoption of advanced vehicle technologies, will continue to fuel demand for premium engine oils and transmission fluids. The government's ambitious infrastructure development plans will ensure a consistent demand for heavy-duty lubricants essential for construction and mining operations. Furthermore, the growing industrial base, particularly in manufacturing and energy production, will create significant opportunities for specialized industrial lubricants. The increasing awareness and preference for high-performance, environmentally friendly lubricant solutions will also act as a major growth catalyst. Lubricant manufacturers that focus on innovation, product quality, and efficient distribution networks are well-positioned to capitalize on the substantial market potential in Egypt over the coming years.

Egypt Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oil

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Other Transportation

- 2.3. Heavy Equipment

- 2.4. Food and Beverage

- 2.5. Other End-user Industries

Egypt Lubricants Market Segmentation By Geography

- 1. Egypt

Egypt Lubricants Market Regional Market Share

Geographic Coverage of Egypt Lubricants Market

Egypt Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Volatility in Crude Oil Prices; Increasing Counterfit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Engine Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oil

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Other Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Food and Beverage

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ENOC Lubricants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astron Energy (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LUKOIL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pakelo Motor Oil S r l

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUCHS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Castrol Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EOG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Misr Petroleum Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Lubricants Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Egypt Lubricants Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Egypt Lubricants Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Egypt Lubricants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Egypt Lubricants Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Egypt Lubricants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Egypt Lubricants Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Egypt Lubricants Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Egypt Lubricants Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Egypt Lubricants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Egypt Lubricants Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Lubricants Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Egypt Lubricants Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, ENOC Lubricants, TotalEnergies, Astron Energy (Pty) Ltd, LUKOIL, Pakelo Motor Oil S r l, FUCHS, Castrol Limited, EOG, Misr Petroleum Company.

3. What are the main segments of the Egypt Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand for Engine Oil.

7. Are there any restraints impacting market growth?

Volatility in Crude Oil Prices; Increasing Counterfit Products.

8. Can you provide examples of recent developments in the market?

December 2023: Lukoil announced the USD 73 million investment in Egypt’s West Esh El Mallaha Oil Field to enhance oil reserves and increase production capacity, supporting the Egyptian economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Lubricants Market?

To stay informed about further developments, trends, and reports in the Egypt Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence