Key Insights

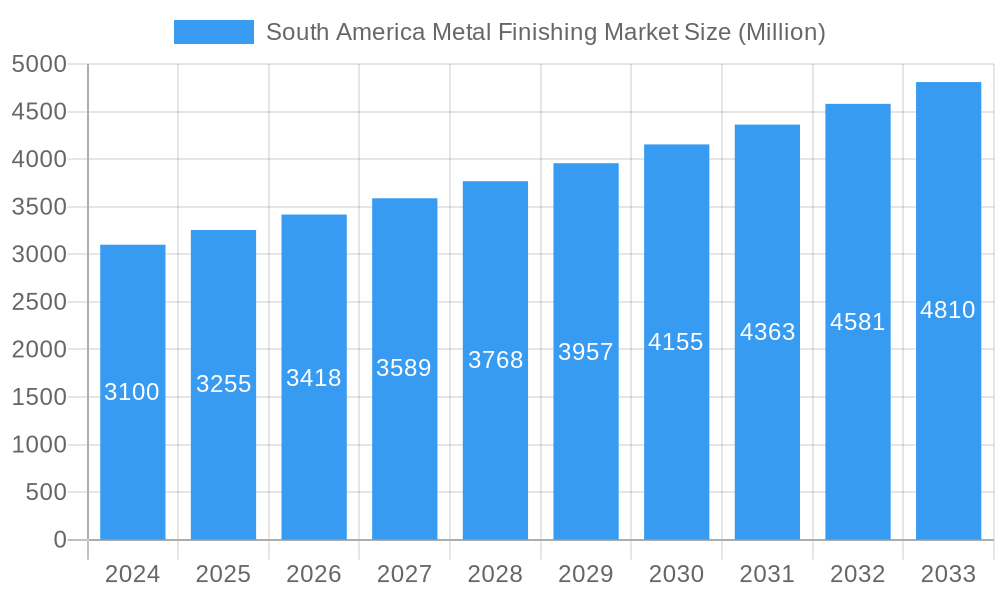

The South America Metal Finishing Market is poised for significant expansion, reaching an estimated USD 3.1 billion in 2024. This growth is propelled by a robust CAGR of 5%, indicating a dynamic and expanding sector. The increasing demand from the automotive and electronics industries, driven by consumerism and technological advancements, is a primary catalyst. Furthermore, the growing emphasis on durability, corrosion resistance, and aesthetic appeal across various applications, including construction and hardware, fuels the adoption of advanced metal finishing techniques. The burgeoning manufacturing sector in countries like Brazil and Colombia is also contributing to this upward trajectory.

South America Metal Finishing Market Market Size (In Billion)

Key drivers fueling this market expansion include the rising demand for high-performance coatings that enhance product longevity and reduce maintenance costs, especially in challenging environments prevalent in South America. Technological innovations in electroplating, galvanization, and conversion coatings are offering more efficient and environmentally friendly solutions, addressing regulatory pressures and sustainability concerns. While restraints such as fluctuating raw material prices and the need for skilled labor are present, the overarching demand for superior metal finishing solutions, coupled with increasing industrialization and infrastructure development across the region, ensures a promising future for the market.

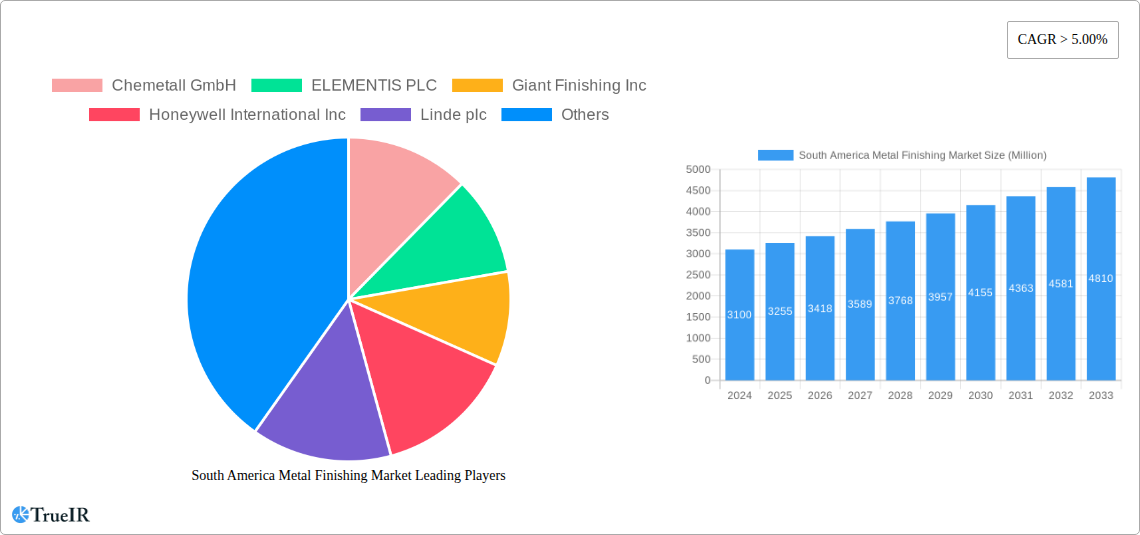

South America Metal Finishing Market Company Market Share

South America Metal Finishing Market: Comprehensive Industry Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the South America Metal Finishing Market, a critical sector projected to reach XX billion USD by 2033. Spanning the historical period from 2019 to 2024 and a robust forecast period from 2025 to 2033, with 2025 serving as the base and estimated year, this study leverages high-volume keywords to offer unparalleled insights for industry stakeholders. The analysis delves into market dynamics, competitive strategies, and emerging opportunities across inorganic, organic, and hybrid metal finishing types, catering to diverse applications including automotive, aerospace, electronics, and medical devices.

South America Metal Finishing Market Market Structure & Competitive Landscape

The South America Metal Finishing Market exhibits a moderately concentrated structure, with key players like Chemetall GmbH, ELEMENTIS PLC, and Honeywell International Inc. holding significant market share. Innovation is a primary driver, fueled by advancements in plating technologies and the development of eco-friendly finishing solutions. Regulatory impacts, particularly those concerning environmental compliance and hazardous substance reduction, are shaping market strategies and driving the adoption of sustainable practices. The threat of product substitutes, while present in certain niche applications, is mitigated by the inherent performance and durability benefits of advanced metal finishing. End-user segmentation reveals a strong reliance on the automotive and construction sectors, with growing contributions from electronics and medical devices. Mergers and acquisitions (M&A) activity is expected to increase, as companies seek to expand their geographic reach, diversify their product portfolios, and acquire cutting-edge technologies. Anticipated M&A volumes are estimated at XX billion USD over the forecast period, reflecting a trend towards consolidation. Concentration ratios are projected to shift, with larger entities gaining further dominance.

South America Metal Finishing Market Market Trends & Opportunities

The South America Metal Finishing Market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, driving the market value towards XX billion USD. This robust growth is underpinned by several evolving trends. Technological advancements are at the forefront, with a notable shift towards advanced plating processes that offer enhanced corrosion resistance, durability, and aesthetic appeal. The increasing demand for lightweight materials in the automotive and aerospace industries, for instance, necessitates specialized metal finishing solutions to maintain structural integrity and performance. Consumer preferences are also playing a crucial role, with a growing emphasis on aesthetically pleasing and high-performance finishes across various applications, from consumer electronics to architectural hardware.

Competitive dynamics are intensifying, characterized by strategic collaborations, product innovations, and a keen focus on sustainability. Companies are investing heavily in research and development to create environmentally friendly finishing chemicals and processes, aligning with global sustainability initiatives and increasingly stringent environmental regulations. The market penetration rates for specialized finishing techniques, such as nano-coating and additive manufacturing-integrated finishing, are expected to rise. Emerging opportunities lie in the burgeoning renewable energy sector, which requires corrosion-resistant coatings for infrastructure and components, and the growing medical device industry, demanding biocompatible and sterile finishing solutions. Furthermore, the increasing urbanization and infrastructure development projects across South America will fuel demand for durable and protective metal finishes in construction and heavy equipment applications. The adoption of smart manufacturing and Industry 4.0 principles is also creating opportunities for enhanced process control, efficiency, and quality in metal finishing operations.

Dominant Markets & Segments in South America Metal Finishing Market

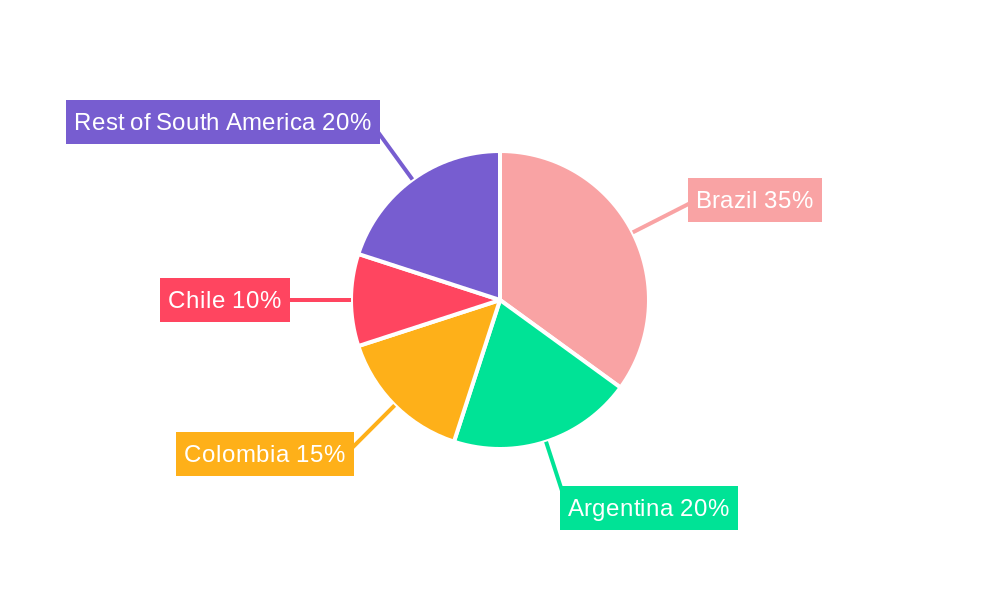

Brazil is firmly established as the dominant market within the South America Metal Finishing landscape, driven by its large industrial base, significant automotive manufacturing sector, and ongoing infrastructure development projects. The country's substantial economic activity and investment in manufacturing contribute to a higher demand for a wide array of metal finishing services.

Dominant Segments by Type:

- Inorganic Metal Finishing: This segment, valued at XX billion USD in 2025, commands the largest market share.

- Electroplating: Continues to be a cornerstone, driven by its versatility in providing corrosion resistance and decorative finishes for automotive parts, hardware, and appliances.

- Galvanization: Essential for protecting steel structures in construction and heavy equipment against corrosion, particularly in Brazil's diverse climate.

- Pretreatment/Surface Preparation: A critical upstream process, indispensable for ensuring the adhesion and performance of subsequent finishing layers across all applications.

- Conversion Coatings: Widely used in automotive and appliance manufacturing for enhanced corrosion resistance and paint adhesion.

- Anodizing: Growing in demand for aluminum components in automotive, aerospace, and architectural applications due to its durability and aesthetic options.

- Organic Metal Finishing: Expected to see significant growth due to the demand for powder coatings and liquid paints offering a balance of cost-effectiveness and protection.

- Hybrid Metal Finishing: Emerging as a key growth area, combining the benefits of both inorganic and organic coatings for superior performance characteristics, particularly in demanding applications like aerospace and medical devices.

Dominant Segments by Application:

- Automotive: Remains the leading application segment, accounting for a substantial portion of the market. The robust automotive manufacturing presence in Brazil and Argentina fuels demand for plating, coating, and surface preparation services.

- Construction: Driven by infrastructure development and urbanization across the region, requiring protective and durable metal finishes for building materials and components.

- Appliances: A consistent demand driver, with manufacturers utilizing metal finishing for aesthetic appeal and corrosion resistance in household appliances.

- Heavy Equipment: Essential for industrial machinery and agricultural equipment, where durability and protection against harsh environments are paramount.

- Electronics: A rapidly growing segment, requiring specialized finishing for components to ensure conductivity, corrosion resistance, and miniaturization.

- Aerospace: While smaller in volume, this segment commands high value due to stringent quality and performance requirements for specialized coatings and finishes.

- Medical Devices: A niche but high-growth area, demanding biocompatible, sterile, and highly precise metal finishes.

South America Metal Finishing Market Product Analysis

The South America Metal Finishing Market is characterized by a continuous stream of product innovations aimed at enhancing performance, sustainability, and cost-effectiveness. Key advancements include the development of eco-friendly chrome-free conversion coatings that offer excellent corrosion protection while adhering to stricter environmental regulations. In electroplating, innovations focus on higher efficiency baths and the development of novel alloys that provide superior wear resistance and reduced environmental impact. For organic finishes, advancements in powder coating formulations are yielding improved durability, UV resistance, and a wider range of aesthetic options. The competitive advantage for manufacturers lies in their ability to offer customized solutions that address the specific performance requirements of diverse applications, from the high-performance demands of the aerospace sector to the cost-sensitive needs of the hardware industry.

Key Drivers, Barriers & Challenges in South America Metal Finishing Market

Key Drivers:

- Industrial Growth and Diversification: Expansion in manufacturing sectors like automotive, aerospace, and electronics directly fuels demand for metal finishing.

- Infrastructure Development: Government initiatives and private investments in infrastructure projects necessitate corrosion-resistant coatings and durable finishes for construction materials and heavy equipment.

- Technological Advancements: The adoption of new plating technologies, eco-friendly chemicals, and advanced coating processes enhances product performance and market competitiveness.

- Increasing Demand for Durability and Aesthetics: End-users across various industries are seeking finishes that offer longevity, enhanced protection, and improved visual appeal.

Key Barriers & Challenges:

- Stringent Environmental Regulations: Compliance with evolving environmental laws regarding hazardous substances and waste disposal can increase operational costs and necessitate significant investment in new technologies.

- Supply Chain Volatility: Disruptions in the availability and pricing of raw materials, such as specialty chemicals and metals, can impact production costs and lead times.

- Economic Instability: Fluctuations in regional economies and currency exchange rates can affect investment decisions and consumer spending, thereby influencing market demand.

- Skilled Labor Shortage: The availability of trained personnel for operating advanced metal finishing equipment and implementing new technologies can be a constraint.

Growth Drivers in the South America Metal Finishing Market Market

The growth of the South America Metal Finishing Market is propelled by several interconnected factors. Technologically, the continuous innovation in plating baths, conversion coatings, and organic finishes, offering enhanced corrosion resistance, durability, and aesthetic appeal, is a significant driver. Economically, expanding industrial sectors, particularly automotive manufacturing, construction, and the burgeoning electronics industry, directly translate into increased demand for finishing services. Government support for industrial development and infrastructure projects further bolsters this growth. Regulatory drivers are also playing a role; while posing challenges, the push for more sustainable and environmentally friendly finishing processes is spurring investment in innovative, compliant technologies. The increasing focus on product lifecycle extension and performance enhancement across all applications is also a key catalyst.

Challenges Impacting South America Metal Finishing Market Growth

Several challenges impact the growth trajectory of the South America Metal Finishing Market. Regulatory complexities surrounding the use and disposal of certain chemicals, particularly heavy metals, present significant hurdles for manufacturers, often requiring substantial investments in compliant equipment and processes. Supply chain issues, including the volatility in the cost and availability of raw materials such as nickel, chromium, and specialty chemicals, can disrupt production and affect profitability. Competitive pressures, both from established players and emerging localized providers, necessitate continuous innovation and cost optimization. Furthermore, economic uncertainties and political instability in some South American nations can dampen investor confidence and reduce demand for capital-intensive finishing solutions. The scarcity of skilled labor capable of operating and maintaining advanced finishing technologies also poses a significant restraint.

Key Players Shaping the South America Metal Finishing Market Market

- Chemetall GmbH

- ELEMENTIS PLC

- Giant Finishing Inc

- Honeywell International Inc

- Linde plc

- OC Oerlikon Management AG

- POSCO

- TIB Chemicals AG

Significant South America Metal Finishing Market Industry Milestones

- 2019: Increased investment in R&D for chrome-free conversion coatings to meet evolving environmental standards.

- 2020: Introduction of advanced robotic finishing systems to improve efficiency and precision in automotive applications.

- 2021: Growing adoption of eco-friendly pretreatment solutions across the appliance manufacturing sector.

- 2022: Mergers and acquisitions aimed at expanding service offerings and geographic reach within Brazil and Colombia.

- 2023: Development and commercialization of novel alloys for high-performance electroplating in aerospace and medical device applications.

- 2024: Focus on digitalization and automation within finishing plants to enhance quality control and reduce operational costs.

Future Outlook for South America Metal Finishing Market Market

The future outlook for the South America Metal Finishing Market is exceptionally promising, driven by continued industrial expansion and technological innovation. Strategic opportunities lie in the growing demand for advanced surface treatments in the aerospace and medical device sectors, where precision and performance are paramount. The increasing emphasis on sustainability will further propel the adoption of green finishing technologies and biodegradable materials. Furthermore, the expansion of the electric vehicle market will create new avenues for specialized coatings that enhance battery performance and protect critical components. Investments in R&D for smart coatings with self-healing or sensing capabilities are also expected to open new market frontiers. The consolidation of the market through strategic partnerships and acquisitions will likely continue, leading to more integrated and comprehensive service providers.

South America Metal Finishing Market Segmentation

-

1. Type

-

1.1. Inorganic Metal Finishing

- 1.1.1. Cladding

- 1.1.2. Pretreatment/Surface Preparation

- 1.1.3. Consumables and Spares

- 1.1.4. Electroplating

- 1.1.5. Galvanization

- 1.1.6. Electro Less Plating

- 1.1.7. Conversion Coatings

- 1.1.8. Anodizing

- 1.1.9. Electro Polishing

- 1.2. Organic Metal Finishing

- 1.3. Hybrid Metal Finishing

-

1.1. Inorganic Metal Finishing

-

2. Application

- 2.1. Automotive

- 2.2. Appliances

- 2.3. Hardware

- 2.4. Jewelry

- 2.5. Aerospace

- 2.6. Heavy Equipment

- 2.7. Medical Devices

- 2.8. Electronics

- 2.9. Construction

- 2.10. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Metal Finishing Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Metal Finishing Market Regional Market Share

Geographic Coverage of South America Metal Finishing Market

South America Metal Finishing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Requirement for Durable

- 3.2.2 Wear-resistant

- 3.2.3 and Long-lasting Metal Products; Supporting Governmental Fiscal Policies in Countries Like Argentina and Brazil

- 3.3. Market Restrains

- 3.3.1 ; Increasing Requirement for Durable

- 3.3.2 Wear-resistant

- 3.3.3 and Long-lasting Metal Products; Supporting Governmental Fiscal Policies in Countries Like Argentina and Brazil

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inorganic Metal Finishing

- 5.1.1.1. Cladding

- 5.1.1.2. Pretreatment/Surface Preparation

- 5.1.1.3. Consumables and Spares

- 5.1.1.4. Electroplating

- 5.1.1.5. Galvanization

- 5.1.1.6. Electro Less Plating

- 5.1.1.7. Conversion Coatings

- 5.1.1.8. Anodizing

- 5.1.1.9. Electro Polishing

- 5.1.2. Organic Metal Finishing

- 5.1.3. Hybrid Metal Finishing

- 5.1.1. Inorganic Metal Finishing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Appliances

- 5.2.3. Hardware

- 5.2.4. Jewelry

- 5.2.5. Aerospace

- 5.2.6. Heavy Equipment

- 5.2.7. Medical Devices

- 5.2.8. Electronics

- 5.2.9. Construction

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inorganic Metal Finishing

- 6.1.1.1. Cladding

- 6.1.1.2. Pretreatment/Surface Preparation

- 6.1.1.3. Consumables and Spares

- 6.1.1.4. Electroplating

- 6.1.1.5. Galvanization

- 6.1.1.6. Electro Less Plating

- 6.1.1.7. Conversion Coatings

- 6.1.1.8. Anodizing

- 6.1.1.9. Electro Polishing

- 6.1.2. Organic Metal Finishing

- 6.1.3. Hybrid Metal Finishing

- 6.1.1. Inorganic Metal Finishing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Appliances

- 6.2.3. Hardware

- 6.2.4. Jewelry

- 6.2.5. Aerospace

- 6.2.6. Heavy Equipment

- 6.2.7. Medical Devices

- 6.2.8. Electronics

- 6.2.9. Construction

- 6.2.10. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inorganic Metal Finishing

- 7.1.1.1. Cladding

- 7.1.1.2. Pretreatment/Surface Preparation

- 7.1.1.3. Consumables and Spares

- 7.1.1.4. Electroplating

- 7.1.1.5. Galvanization

- 7.1.1.6. Electro Less Plating

- 7.1.1.7. Conversion Coatings

- 7.1.1.8. Anodizing

- 7.1.1.9. Electro Polishing

- 7.1.2. Organic Metal Finishing

- 7.1.3. Hybrid Metal Finishing

- 7.1.1. Inorganic Metal Finishing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Appliances

- 7.2.3. Hardware

- 7.2.4. Jewelry

- 7.2.5. Aerospace

- 7.2.6. Heavy Equipment

- 7.2.7. Medical Devices

- 7.2.8. Electronics

- 7.2.9. Construction

- 7.2.10. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inorganic Metal Finishing

- 8.1.1.1. Cladding

- 8.1.1.2. Pretreatment/Surface Preparation

- 8.1.1.3. Consumables and Spares

- 8.1.1.4. Electroplating

- 8.1.1.5. Galvanization

- 8.1.1.6. Electro Less Plating

- 8.1.1.7. Conversion Coatings

- 8.1.1.8. Anodizing

- 8.1.1.9. Electro Polishing

- 8.1.2. Organic Metal Finishing

- 8.1.3. Hybrid Metal Finishing

- 8.1.1. Inorganic Metal Finishing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Appliances

- 8.2.3. Hardware

- 8.2.4. Jewelry

- 8.2.5. Aerospace

- 8.2.6. Heavy Equipment

- 8.2.7. Medical Devices

- 8.2.8. Electronics

- 8.2.9. Construction

- 8.2.10. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Chile South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inorganic Metal Finishing

- 9.1.1.1. Cladding

- 9.1.1.2. Pretreatment/Surface Preparation

- 9.1.1.3. Consumables and Spares

- 9.1.1.4. Electroplating

- 9.1.1.5. Galvanization

- 9.1.1.6. Electro Less Plating

- 9.1.1.7. Conversion Coatings

- 9.1.1.8. Anodizing

- 9.1.1.9. Electro Polishing

- 9.1.2. Organic Metal Finishing

- 9.1.3. Hybrid Metal Finishing

- 9.1.1. Inorganic Metal Finishing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Appliances

- 9.2.3. Hardware

- 9.2.4. Jewelry

- 9.2.5. Aerospace

- 9.2.6. Heavy Equipment

- 9.2.7. Medical Devices

- 9.2.8. Electronics

- 9.2.9. Construction

- 9.2.10. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of South America South America Metal Finishing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inorganic Metal Finishing

- 10.1.1.1. Cladding

- 10.1.1.2. Pretreatment/Surface Preparation

- 10.1.1.3. Consumables and Spares

- 10.1.1.4. Electroplating

- 10.1.1.5. Galvanization

- 10.1.1.6. Electro Less Plating

- 10.1.1.7. Conversion Coatings

- 10.1.1.8. Anodizing

- 10.1.1.9. Electro Polishing

- 10.1.2. Organic Metal Finishing

- 10.1.3. Hybrid Metal Finishing

- 10.1.1. Inorganic Metal Finishing

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive

- 10.2.2. Appliances

- 10.2.3. Hardware

- 10.2.4. Jewelry

- 10.2.5. Aerospace

- 10.2.6. Heavy Equipment

- 10.2.7. Medical Devices

- 10.2.8. Electronics

- 10.2.9. Construction

- 10.2.10. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chemetall GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ELEMENTIS PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giant Finishing Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Linde plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OC Oerlikon Management AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 POSCO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TIB Chemicals AG*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Chemetall GmbH

List of Figures

- Figure 1: Global South America Metal Finishing Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Brazil South America Metal Finishing Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Brazil South America Metal Finishing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Brazil South America Metal Finishing Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Brazil South America Metal Finishing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Brazil South America Metal Finishing Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Brazil South America Metal Finishing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil South America Metal Finishing Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Brazil South America Metal Finishing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina South America Metal Finishing Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Argentina South America Metal Finishing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Argentina South America Metal Finishing Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: Argentina South America Metal Finishing Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Argentina South America Metal Finishing Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Argentina South America Metal Finishing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina South America Metal Finishing Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Argentina South America Metal Finishing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Colombia South America Metal Finishing Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Colombia South America Metal Finishing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Colombia South America Metal Finishing Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Colombia South America Metal Finishing Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Colombia South America Metal Finishing Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Colombia South America Metal Finishing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Colombia South America Metal Finishing Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Colombia South America Metal Finishing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Chile South America Metal Finishing Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Chile South America Metal Finishing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Chile South America Metal Finishing Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Chile South America Metal Finishing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Chile South America Metal Finishing Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Chile South America Metal Finishing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Chile South America Metal Finishing Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Chile South America Metal Finishing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of South America South America Metal Finishing Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Rest of South America South America Metal Finishing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Rest of South America South America Metal Finishing Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: Rest of South America South America Metal Finishing Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of South America South America Metal Finishing Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Rest of South America South America Metal Finishing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of South America South America Metal Finishing Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of South America South America Metal Finishing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global South America Metal Finishing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global South America Metal Finishing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global South America Metal Finishing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global South America Metal Finishing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global South America Metal Finishing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global South America Metal Finishing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global South America Metal Finishing Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global South America Metal Finishing Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global South America Metal Finishing Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Metal Finishing Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the South America Metal Finishing Market?

Key companies in the market include Chemetall GmbH, ELEMENTIS PLC, Giant Finishing Inc, Honeywell International Inc, Linde plc, OC Oerlikon Management AG, POSCO, TIB Chemicals AG*List Not Exhaustive.

3. What are the main segments of the South America Metal Finishing Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Requirement for Durable. Wear-resistant. and Long-lasting Metal Products; Supporting Governmental Fiscal Policies in Countries Like Argentina and Brazil.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Requirement for Durable. Wear-resistant. and Long-lasting Metal Products; Supporting Governmental Fiscal Policies in Countries Like Argentina and Brazil.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Metal Finishing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Metal Finishing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Metal Finishing Market?

To stay informed about further developments, trends, and reports in the South America Metal Finishing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence