Key Insights

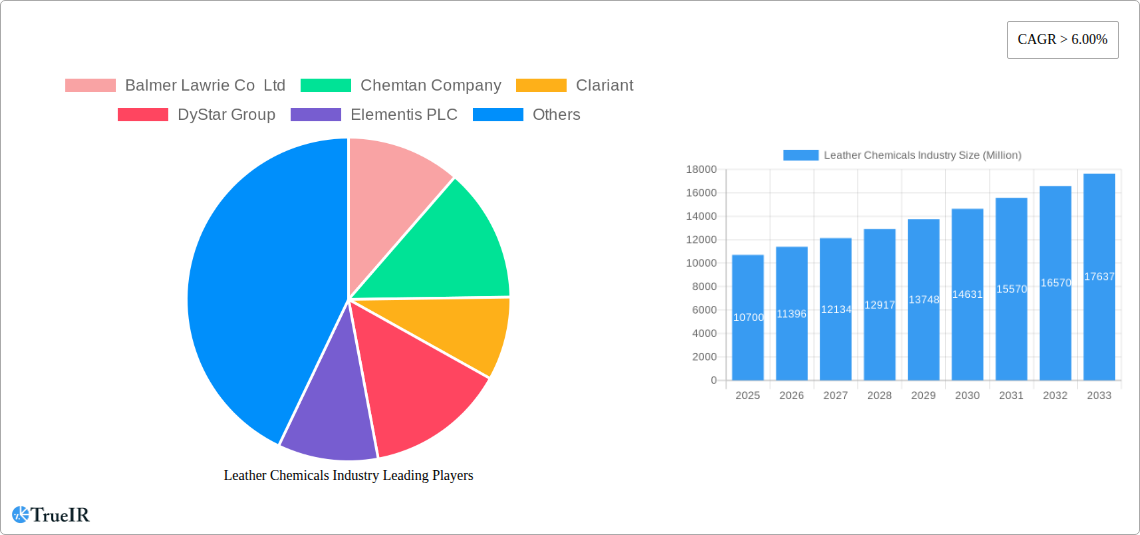

The global leather chemicals market is poised for robust expansion, projected to reach approximately USD 10.7 billion in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. This significant market size underscores the essential role of specialized chemicals in the leather processing industry, from initial beamhouse operations to the final finishing stages. The demand is primarily driven by the increasing global consumption of leather goods across various end-user sectors, including footwear, furniture, automotive upholstery, and the dynamic textile and fashion industries. Innovations in chemical formulations that offer improved sustainability, enhanced leather quality, and reduced environmental impact are also playing a crucial role in shaping market dynamics. Furthermore, the growing trend towards premium and customized leather products fuels the need for advanced chemical solutions that can deliver specific aesthetics and performance characteristics.

Leather Chemicals Industry Market Size (In Billion)

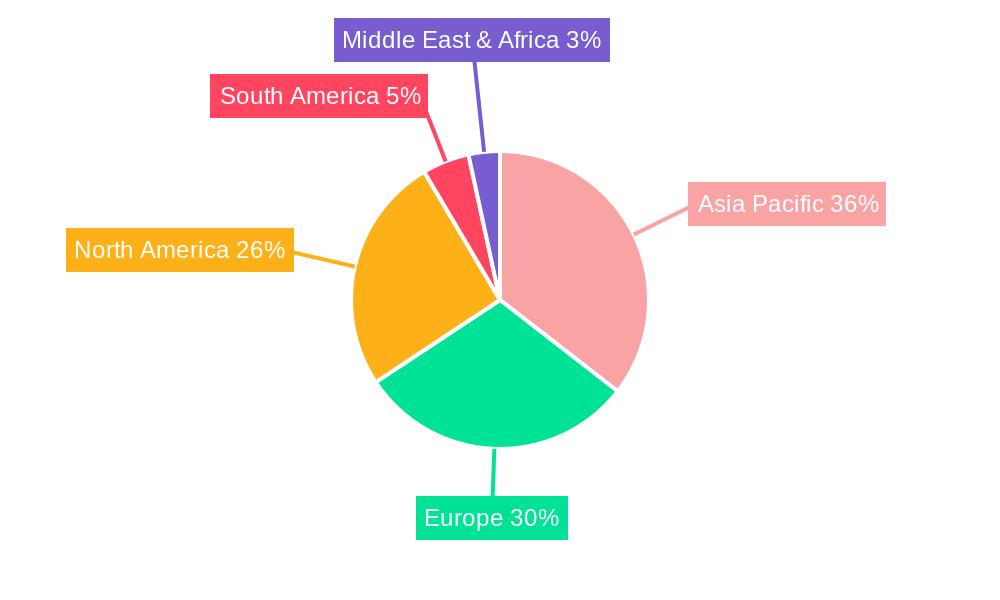

The market's trajectory is also influenced by evolving regulatory landscapes concerning chemical usage and environmental discharge, prompting manufacturers to invest in greener and more efficient chemical alternatives. Restraints such as fluctuating raw material prices and the availability of synthetic alternatives are present, yet the inherent desirability and performance of genuine leather, coupled with ongoing technological advancements in chemical synthesis and application, are expected to outweigh these challenges. Key product segments like tanning and dyeing chemicals, beam house chemicals, and finishing chemicals will witness consistent demand, with a notable surge anticipated in specialized finishing agents that impart unique textures and functionalities. The Asia Pacific region, particularly China and India, is expected to remain a dominant force due to its substantial manufacturing base and burgeoning consumer markets.

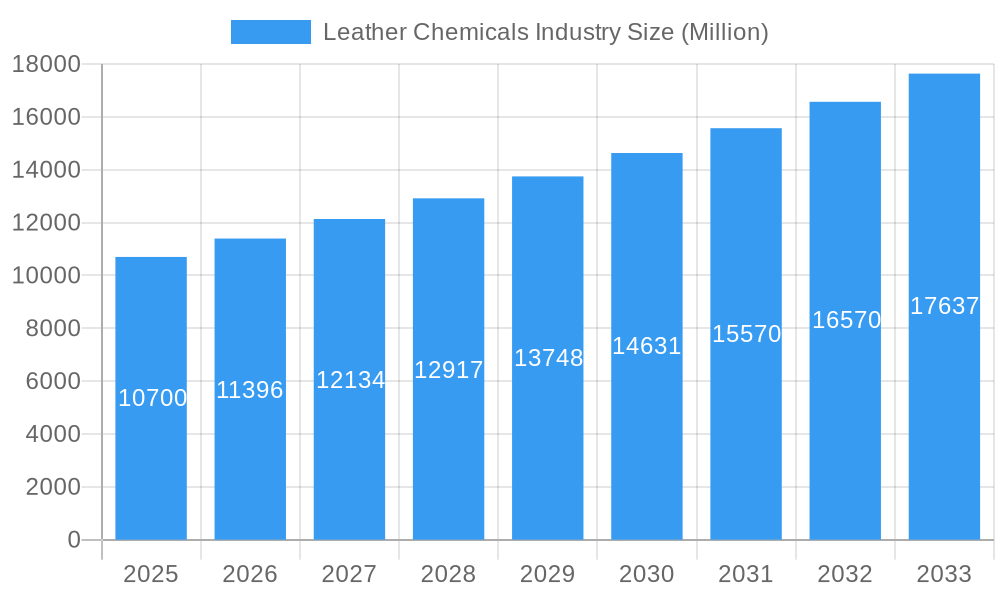

Leather Chemicals Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Leather Chemicals Industry, incorporating high-volume keywords and the requested structure and details.

Leather Chemicals Industry Market Structure & Competitive Landscape

The global leather chemicals market exhibits a moderately consolidated structure, driven by the strategic imperatives of key players and a consistent pursuit of innovation. Concentration ratios, while varying by specific chemical segments, are influenced by the substantial market presence of multinational corporations and specialized chemical manufacturers. Innovation in the leather chemicals sector is predominantly fueled by demands for enhanced sustainability, improved performance characteristics, and compliance with stringent environmental regulations. Companies are investing heavily in research and development to create eco-friendly tanning agents, water-based finishing chemicals, and advanced dyeing solutions that minimize waste and reduce the carbon footprint of leather production. Regulatory impacts, particularly from initiatives like REACH and ZDHC, are shaping product formulations and manufacturing processes, favoring chemical suppliers with robust compliance frameworks. Product substitutes, such as synthetic alternatives and plant-based materials, present an ongoing competitive pressure, necessitating continuous product differentiation and value addition by leather chemical manufacturers. End-user segmentation reveals a dynamic interplay between traditional sectors like footwear and furniture and emerging applications in automotive interiors and fashion accessories. Mergers and acquisitions (M&A) activity, estimated at over a billion dollars annually in the broader specialty chemicals landscape, are a significant trend, enabling market expansion, technology acquisition, and enhanced supply chain integration for leading companies. For instance, the acquisition of smaller, specialized firms by larger entities helps in consolidating market share and expanding product portfolios. The competitive landscape is characterized by intense R&D efforts, strategic partnerships, and a focus on customer-centric solutions.

Leather Chemicals Industry Market Trends & Opportunities

The global leather chemicals market is poised for significant expansion, driven by a confluence of evolving consumer preferences, technological advancements, and burgeoning end-user industries. The market size is projected to reach trillions of dollars by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6-8% during the forecast period of 2025–2033. This robust growth is intrinsically linked to the increasing demand for high-quality leather products across various sectors, most notably footwear, furniture, automotive, and textile & fashion. Technological shifts are profoundly influencing the market, with a strong emphasis on the development and adoption of sustainable and bio-based leather chemicals. Innovations such as chrome-free tanning agents, low-VOC finishing formulations, and water-saving dyeing processes are gaining traction, driven by both regulatory pressures and growing consumer awareness regarding environmental impact. The market penetration rate of eco-friendly alternatives is steadily increasing, presenting a substantial opportunity for chemical manufacturers that can offer compliant and high-performing solutions. Consumer preferences are increasingly leaning towards ethically sourced and environmentally responsible products, compelling the leather industry to adopt greener manufacturing practices. This shift directly translates into a higher demand for specialized leather chemicals that facilitate such production. Competitive dynamics are intensifying, with established players and emerging innovators vying for market share. Strategic collaborations and partnerships are becoming crucial for companies to leverage shared expertise, expand market reach, and accelerate the development of next-generation leather chemicals. The automotive sector, in particular, is a significant growth engine, with its continuous demand for durable, aesthetically pleasing, and increasingly sustainable leather interiors. Similarly, the booming textile and fashion industry, with its fast-paced trend cycles, requires a diverse range of finishing and dyeing chemicals to achieve desired textures, colors, and performance attributes. The furniture industry also continues to be a substantial contributor, with a rising demand for premium leather upholstery. Opportunities abound for companies that can innovate in areas such as digital printing on leather, advanced surface treatments for enhanced durability, and the development of bio-receptive materials for specialized applications. The global leather chemicals market is thus a dynamic and promising arena for investment and innovation, with a clear trajectory towards sustainability and performance excellence.

Dominant Markets & Segments in Leather Chemicals Industry

The Leather Chemicals Industry is characterized by distinct dominant markets and segments, each contributing significantly to its overall growth and evolution.

Dominant Product Type Segments:

Tanning and Dyeing Chemicals: This segment typically holds the largest market share, accounting for over 40% of the total market value.

- Key Growth Drivers:

- Evergreen Demand for Leather: Footwear, apparel, and upholstery industries ensure a constant need for these foundational chemicals.

- Color and Finish Innovation: The fashion and textile industries drive demand for a wide spectrum of colors and finishes, requiring advanced dyeing and finishing agents.

- Sustainability Initiatives: Growing pressure for eco-friendly tanning processes fuels innovation in chrome-free and vegetable tanning agents.

- Detailed Analysis: Tanning chemicals, including chrome salts, vegetable tannins, and synthetic tanning agents, are crucial for converting raw hides into stable leather. Dyeing chemicals, encompassing a vast array of synthetic and natural dyes, are essential for imparting desired colors and aesthetics. The increasing complexity of fashion trends and the demand for unique leather finishes further propel innovation and market expansion within this segment.

- Key Growth Drivers:

Beam House Chemicals: This segment, representing approximately 25-30% of the market, encompasses chemicals used in the initial stages of leather processing.

- Key Growth Drivers:

- Raw Hide Preparation: Essential for cleaning, dehairing, and liming hides, ensuring optimal quality for subsequent stages.

- Efficiency and Automation: Demand for chemicals that facilitate faster and more efficient beam house operations.

- Environmental Compliance: Development of less hazardous and more biodegradable beam house chemicals.

- Detailed Analysis: Chemicals such as soaking agents, liming agents, bating enzymes, and deliming agents are critical for preparing hides for tanning. The efficiency and effectiveness of these chemicals directly impact the quality and yield of the final leather product. Advances in enzyme technology and optimized chemical formulations are key trends.

- Key Growth Drivers:

Finishing Chemicals: This segment, comprising around 30-35% of the market, includes lacquers, binders, pigments, and other surface treatments that enhance the appearance and performance of leather.

- Key Growth Drivers:

- Aesthetic Enhancement: Demand for special effects, textures, and high-gloss finishes in fashion and automotive sectors.

- Performance Improvement: Need for chemicals that offer scratch resistance, water repellency, and UV protection.

- Digitalization: Development of finishing chemicals compatible with digital printing technologies.

- Detailed Analysis: Finishing chemicals are vital for achieving the desired aesthetic appeal and functional properties of leather. The automotive industry, in particular, demands high-performance finishes that can withstand wear and tear. Innovation in water-based and low-VOC finishing systems is a significant trend, driven by environmental regulations and consumer demand for healthier products.

- Key Growth Drivers:

Dominant End-user Industry Segments:

Footwear: Historically the largest end-user, accounting for approximately 40-45% of leather consumption.

- Key Growth Drivers:

- Global Population Growth: A continuous and expanding consumer base for footwear.

- Fashion Trends: Dynamic fashion cycles requiring a diverse range of leather types and finishes.

- Rise of Athleisure: Increased demand for stylish and comfortable leather casual and sports footwear.

- Detailed Analysis: The footwear industry's reliance on leather for durability, comfort, and style makes it a bedrock for the leather chemicals market. Demand fluctuates with economic conditions and fashion cycles but remains consistently strong.

- Key Growth Drivers:

Automotive: A rapidly growing segment, currently representing around 20-25% of the market.

- Key Growth Drivers:

- Luxury Vehicle Production: Increasing demand for premium leather interiors in high-end vehicles.

- Sustainability Focus: Growing preference for sustainable and eco-friendly leather in vehicle manufacturing.

- Technological Integration: Demand for durable and aesthetically pleasing leather for advanced interior designs.

- Detailed Analysis: The automotive sector's stringent quality and performance requirements drive innovation in durable, scratch-resistant, and aesthetically superior leather finishes. The push for sustainability is also a significant factor, influencing material choices.

- Key Growth Drivers:

Furniture: A mature but stable segment, contributing around 15-20% of the market.

- Key Growth Drivers:

- Home Furnishing Trends: Demand for high-quality, durable, and aesthetically pleasing leather upholstery.

- Commercial Applications: Use of leather in hospitality and office furniture.

- Renovation and Interior Design: Ongoing demand from the renovation and interior design sectors.

- Detailed Analysis: The furniture industry values the inherent durability, comfort, and premium feel of leather. Demand is influenced by construction activity, disposable income, and interior design trends.

- Key Growth Drivers:

Textile & Fashion (Apparel & Accessories): This segment, accounting for 10-15% of the market, is driven by trend-driven demand.

- Key Growth Drivers:

- Fast Fashion Cycles: Constant need for new colors, textures, and finishes for apparel and accessories.

- Designer Collections: Innovation and experimentation with unique leather treatments.

- Growth in Leather Accessories: Increasing popularity of leather bags, wallets, and other accessories.

- Detailed Analysis: The textile and fashion sector requires a wide array of specialty chemicals to achieve the diverse looks and feels demanded by consumers and designers. This segment is highly responsive to global fashion trends.

- Key Growth Drivers:

Other End-user Industries: This category includes diverse applications such as technical leather, bookbinding, and musical instruments, representing the remaining market share.

Leather Chemicals Industry Product Analysis

The leather chemicals industry is witnessing a surge in product innovations aimed at enhancing sustainability, performance, and aesthetic appeal. Key advancements include the development of advanced chrome-free tanning systems that significantly reduce the environmental impact associated with traditional chrome tanning. Water-based finishing formulations are gaining prominence, offering lower VOC emissions and improved worker safety. Furthermore, novel dyeing agents provide brighter, more consistent colors with reduced water consumption. These innovations are driven by the demand for eco-friendly and high-performance leather across diverse applications, from premium footwear and automotive interiors to luxury fashion accessories. Competitive advantages are being forged through a focus on product differentiation, regulatory compliance, and the ability to tailor solutions to specific customer needs, ensuring market relevance and driving industry growth.

Key Drivers, Barriers & Challenges in Leather Chemicals Industry

Key Drivers:

The Leather Chemicals Industry is propelled by several key drivers. Growing global demand for leather goods, particularly in emerging economies, fuels consumption. Increasing consumer awareness regarding sustainability pushes manufacturers towards eco-friendly chemical solutions, driving innovation in chrome-free tanning and bio-based formulations. Technological advancements in chemical synthesis and application methods lead to improved product performance and efficiency. Furthermore, stringent environmental regulations are forcing the adoption of greener chemicals and processes. The expansion of end-user industries like automotive and fashion further stimulates demand.

Barriers & Challenges:

Despite growth, the industry faces significant challenges. Stringent and evolving environmental regulations across different regions create compliance complexities and increase operational costs. Fluctuations in raw material prices, particularly for key inputs like chromium salts and petrochemical derivatives, can impact profitability. Supply chain disruptions due to geopolitical instability or logistical issues can hinder production and delivery. Intense competition from both established players and new entrants, coupled with the threat of synthetic alternatives to leather, necessitates continuous innovation and cost-effectiveness.

Growth Drivers in the Leather Chemicals Industry Market

The Leather Chemicals Industry Market is experiencing robust growth driven by several interconnected factors. The escalating global demand for premium leather products across footwear, automotive, and furniture sectors forms a foundational growth catalyst. Furthermore, a pronounced shift towards sustainability and eco-friendly practices is compelling manufacturers to invest in and adopt green chemical alternatives, such as chrome-free tanning agents and water-based finishing solutions. Continuous technological innovation in chemical formulations and application technologies enables the development of higher-performing, more efficient, and environmentally conscious products. Government initiatives and increasing regulatory pressures favoring sustainable manufacturing processes also act as significant growth drivers.

Challenges Impacting Leather Chemicals Industry Growth

Several factors present significant barriers and challenges to the sustained growth of the Leather Chemicals Industry. The complexity and ever-changing landscape of environmental regulations across diverse global markets pose a considerable challenge, necessitating continuous adaptation and investment in compliance. Volatile raw material prices and supply chain vulnerabilities, influenced by geopolitical events and economic fluctuations, can lead to unpredictable cost structures and production delays. Intense competition, both from established global players and agile regional manufacturers, puts pressure on pricing and margins. Moreover, the persistent threat and ongoing development of synthetic leather alternatives, which sometimes offer lower price points and different performance characteristics, require continuous product differentiation and innovation in the natural leather segment.

Key Players Shaping the Leather Chemicals Industry Market

- Balmer Lawrie Co Ltd

- Chemtan Company

- Clariant

- DyStar Group

- Elementis PLC

- Indofil Industries Ltd

- Lanxess

- Papertex Specialty Chemicals Pvt Ltd

- Schill Seilacher GmbH Co

- Stahl International BV

- TASA Group International

- TEXAPEL

- Zschimmer Schwarz Co KG

Significant Leather Chemicals Industry Industry Milestones

- January 2023: LANXESS and TotalEnergies entered into a cooperation on the supply of bio-circular styrene. By partnering with TotalEnergies, the company can offer its customers sustainable solutions and raw materials with a low carbon footprint.

- October 2022: Chem-MAP is pleased to share that Texapel was granted ZDHC Level 3 certification for their leather chemicals, the highest certification offered by the ZDHC Road Map to Zero program.

Future Outlook for Leather Chemicals Industry Market

The future outlook for the Leather Chemicals Industry Market is marked by sustained growth, primarily driven by a strong emphasis on sustainability and circular economy principles. The market is expected to witness continued innovation in bio-based and biodegradable chemical formulations, reducing the environmental footprint of leather production. Strategic partnerships and collaborations will likely play a crucial role in developing and scaling up these eco-friendly solutions. The increasing demand for high-performance leather in the automotive and premium fashion sectors will also fuel growth, necessitating advanced finishing and dyeing chemicals. Furthermore, the industry will likely see greater adoption of digital technologies for optimizing chemical usage and enhancing supply chain transparency, positioning the market for a more sustainable and efficient future.

Leather Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Tanning and Dyeing Chemicals

- 1.2. Beam House Chemicals

- 1.3. Finishing Chemicals

-

2. End-user Industry

- 2.1. Footwear

- 2.2. Furniture

- 2.3. Automotive

- 2.4. Textile & Fashion

- 2.5. Other End-user Industries

Leather Chemicals Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Leather Chemicals Industry Regional Market Share

Geographic Coverage of Leather Chemicals Industry

Leather Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery

- 3.3. Market Restrains

- 3.3.1. Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery

- 3.4. Market Trends

- 3.4.1. Textile Industry to Witness Higher Potential Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tanning and Dyeing Chemicals

- 5.1.2. Beam House Chemicals

- 5.1.3. Finishing Chemicals

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Footwear

- 5.2.2. Furniture

- 5.2.3. Automotive

- 5.2.4. Textile & Fashion

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tanning and Dyeing Chemicals

- 6.1.2. Beam House Chemicals

- 6.1.3. Finishing Chemicals

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Footwear

- 6.2.2. Furniture

- 6.2.3. Automotive

- 6.2.4. Textile & Fashion

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tanning and Dyeing Chemicals

- 7.1.2. Beam House Chemicals

- 7.1.3. Finishing Chemicals

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Footwear

- 7.2.2. Furniture

- 7.2.3. Automotive

- 7.2.4. Textile & Fashion

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tanning and Dyeing Chemicals

- 8.1.2. Beam House Chemicals

- 8.1.3. Finishing Chemicals

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Footwear

- 8.2.2. Furniture

- 8.2.3. Automotive

- 8.2.4. Textile & Fashion

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tanning and Dyeing Chemicals

- 9.1.2. Beam House Chemicals

- 9.1.3. Finishing Chemicals

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Footwear

- 9.2.2. Furniture

- 9.2.3. Automotive

- 9.2.4. Textile & Fashion

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Tanning and Dyeing Chemicals

- 10.1.2. Beam House Chemicals

- 10.1.3. Finishing Chemicals

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Footwear

- 10.2.2. Furniture

- 10.2.3. Automotive

- 10.2.4. Textile & Fashion

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Leather Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Tanning and Dyeing Chemicals

- 11.1.2. Beam House Chemicals

- 11.1.3. Finishing Chemicals

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Footwear

- 11.2.2. Furniture

- 11.2.3. Automotive

- 11.2.4. Textile & Fashion

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Balmer Lawrie Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chemtan Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Clariant

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DyStar Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Elementis PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Indofil Industries Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lanxess

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Papertex Specialty Chemicals Pvt Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schill Seilacher GmbH Co

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stahl International BV

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 TASA Group International

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 TEXAPEL

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Zschimmer Schwarz Co KG*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Balmer Lawrie Co Ltd

List of Figures

- Figure 1: Global Leather Chemicals Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 35: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Saudi Arabia Leather Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Leather Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Leather Chemicals Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Spain Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 28: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Brazil Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Argentina Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Leather Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 37: Global Leather Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Leather Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: South Africa Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Leather Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Leather Chemicals Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Leather Chemicals Industry?

Key companies in the market include Balmer Lawrie Co Ltd, Chemtan Company, Clariant, DyStar Group, Elementis PLC, Indofil Industries Ltd, Lanxess, Papertex Specialty Chemicals Pvt Ltd, Schill Seilacher GmbH Co, Stahl International BV, TASA Group International, TEXAPEL, Zschimmer Schwarz Co KG*List Not Exhaustive.

3. What are the main segments of the Leather Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery.

6. What are the notable trends driving market growth?

Textile Industry to Witness Higher Potential Growth.

7. Are there any restraints impacting market growth?

Growing Footwear and Textile Industries in Asia-Pacific; Increasing Demand for Automotive Upholstery.

8. Can you provide examples of recent developments in the market?

January 2023: LANXESS and TotalEnergies entered into a cooperation on the supply of bio-circular styrene. By partnering with TotalEnergies, the company can offer its customers sustainable solutions and raw materials with a low carbon footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Leather Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Leather Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Leather Chemicals Industry?

To stay informed about further developments, trends, and reports in the Leather Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence