Key Insights

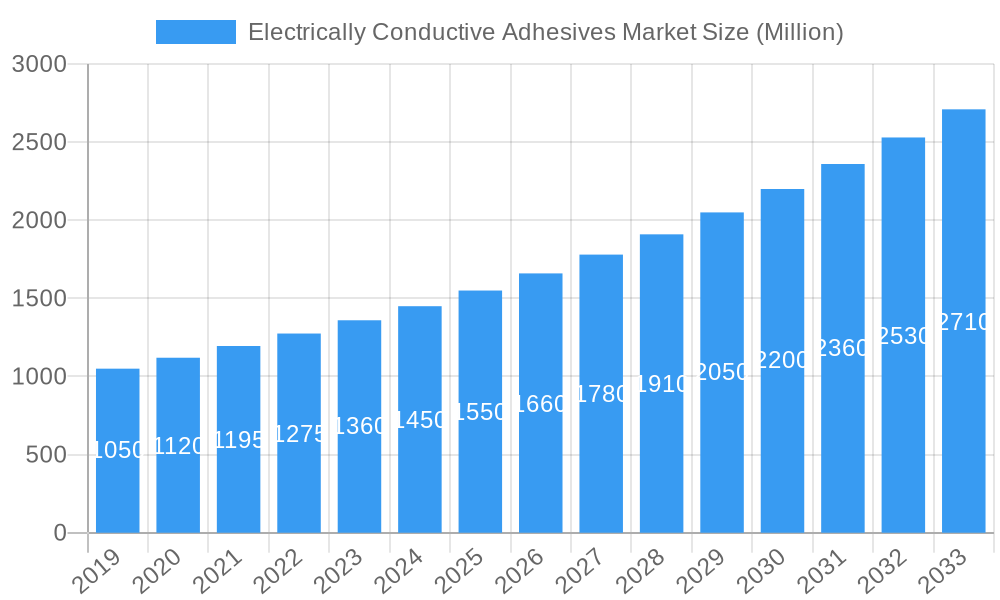

The Electrically Conductive Adhesives (ECA) market is projected for substantial growth, fueled by escalating demand from advanced electronics, automotive, and aerospace sectors. This dynamic market is anticipated to reach a size of $1712 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 1.4%. Key growth drivers include the ongoing miniaturization of electronic components, the increasing adoption of electric vehicles (EVs) requiring reliable conductive bonding, and continuous innovation in smart devices and wearable technology. ECAs offer advantages over traditional soldering, such as ease of application, versatility in bonding dissimilar materials, and superior thermal and electrical conductivity, making them ideal for semiconductor packaging, display assembly, EMI shielding, and thermal management solutions.

Electrically Conductive Adhesives Market Market Size (In Billion)

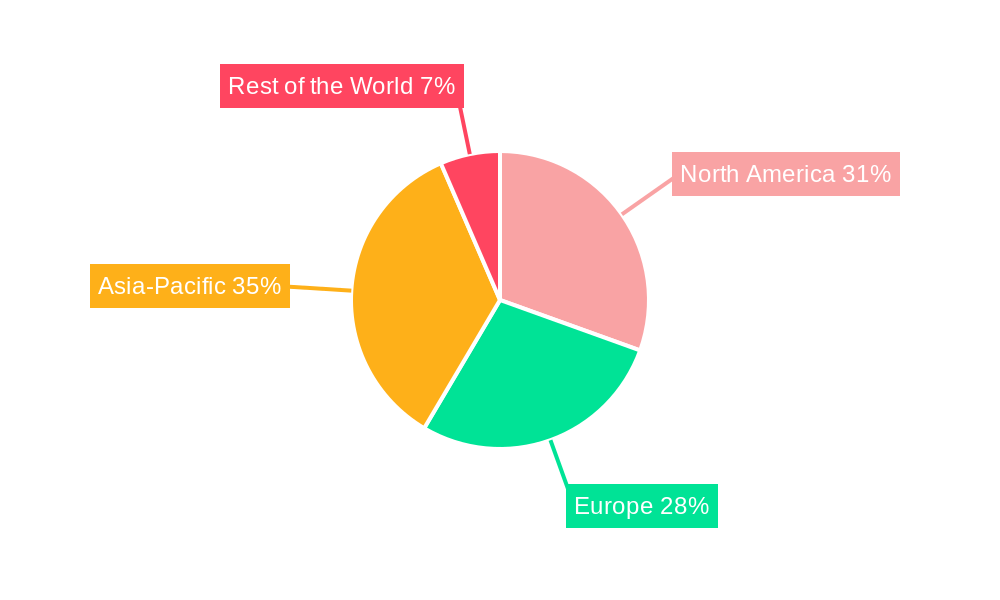

Market expansion is further supported by research and development efforts focused on enhancing adhesive properties like conductivity, flexibility, and durability. Emerging applications in 5G infrastructure, medical devices, and renewable energy systems are expected to create new growth opportunities. Geographically, North America and Europe hold significant market positions due to established technological ecosystems. However, the Asia-Pacific region is emerging as a primary growth engine, driven by its robust electronics manufacturing base and expanding automotive sector, particularly in EVs. This landscape highlights a market characterized by innovation, strategic collaborations, and sustained demand for high-performance conductive bonding materials.

Electrically Conductive Adhesives Market Company Market Share

This report provides a comprehensive analysis of the Electrically Conductive Adhesives (ECA) market, covering its structure, trends, opportunities, and future outlook for the period 2019-2033, with a base year of 2025. Insights are offered for stakeholders navigating this evolving industry, driven by the increasing demand for advanced electronic components and miniaturization across diverse sectors.

Electrically Conductive Adhesives Market Market Structure & Competitive Landscape

The Electrically Conductive Adhesives market exhibits a moderately consolidated structure, with key players like Henkel AG & Co KGaA, 3M, and Dow holding significant market share. The competitive landscape is characterized by a strong emphasis on innovation, particularly in developing novel adhesive formulations with enhanced conductivity, flexibility, and reliability. Major innovation drivers include the pursuit of higher performance standards for miniaturized electronic devices and the integration of ECAs in next-generation technologies such as flexible electronics and advanced battery systems.

Regulatory impacts, while not overly restrictive, are gradually influencing material choices, pushing for environmentally friendly and RoHS-compliant formulations. The threat of product substitutes, such as conductive inks and solders, exists but ECAs offer unique advantages in specific applications, including thermal management, vibration resistance, and EMI shielding. End-user segmentation highlights the dominance of the automotive electronics and consumer electronics sectors, followed by solar cells and LED lighting. Mergers and acquisitions (M&A) are a notable trend, with strategic acquisitions aimed at expanding product portfolios, gaining access to new technologies, and strengthening market presence. For instance, recent M&A activities have focused on acquiring specialized ECA manufacturers with expertise in niche applications. The overall market concentration is moderate, with leading players investing heavily in R&D to maintain a competitive edge.

Electrically Conductive Adhesives Market Market Trends & Opportunities

The Electrically Conductive Adhesives market is poised for robust growth, projected to reach a market size of over $5,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025. This expansion is fueled by the relentless miniaturization of electronic devices and the increasing integration of sophisticated functionalities across a wide array of industries. Technological shifts are profoundly influencing market dynamics, with a growing demand for adhesives that offer superior electrical conductivity, enhanced thermal management properties, and improved mechanical flexibility. The evolution of 5G technology, the proliferation of the Internet of Things (IoT) devices, and the rapid advancements in electric vehicles (EVs) and autonomous driving systems are creating unprecedented opportunities for ECA manufacturers.

Consumer preferences are increasingly leaning towards compact, powerful, and energy-efficient electronic products, necessitating the use of advanced bonding solutions like ECAs for intricate circuitry and component assembly. The development of novel conductive fillers, such as carbon nanotubes and graphene, is opening new avenues for creating high-performance ECAs with significantly improved conductivity and reduced material costs. Furthermore, the growing emphasis on sustainable manufacturing practices is driving the adoption of eco-friendly and solvent-free ECA formulations.

The competitive dynamics within the market are intensifying, with both established players and emerging startups striving to capture market share through product innovation, strategic partnerships, and targeted marketing efforts. The opportunity lies in developing specialized ECA solutions tailored to the unique requirements of emerging applications, such as wearable electronics, advanced medical devices, and next-generation display technologies. Market penetration rates are expected to rise as the cost-effectiveness and performance benefits of ECAs become more widely recognized and adopted across diverse industrial sectors. The continuous innovation in curing mechanisms, such as UV-curable and dual-cure ECAs, further enhances their applicability in high-volume manufacturing processes, driving market penetration. The rising adoption of advanced packaging technologies in semiconductor manufacturing is also a significant growth catalyst.

Dominant Markets & Segments in Electrically Conductive Adhesives Market

The Electrically Conductive Adhesives market showcases distinct regional and segmental dominance driven by robust industrial activity and technological adoption.

Dominant Regions:

- Asia Pacific: This region is the largest and fastest-growing market for ECAs. Key growth drivers include the massive manufacturing base for consumer electronics, automotive components, and solar panels in countries like China, South Korea, and Japan. Government initiatives supporting the growth of the electronics and automotive industries, coupled with increasing R&D investments, further bolster market dominance.

- North America: A significant market driven by advancements in automotive electronics, aerospace, and medical devices. The strong presence of R&D centers and a high adoption rate of cutting-edge technologies contribute to its market standing.

- Europe: Driven by the automotive sector's transition to electric vehicles and the growing demand for sophisticated industrial automation and medical equipment. Stringent quality standards and a focus on high-performance materials support the demand for premium ECAs.

Dominant Segments:

Chemistry Type: Epoxy

- Key Growth Drivers: Epoxy-based ECAs dominate due to their excellent mechanical strength, thermal stability, and strong adhesion properties. They are widely used in demanding applications requiring high reliability.

- Detailed Analysis: The automotive sector, in particular, relies heavily on epoxy-based ECAs for bonding electronic control units (ECUs), sensors, and power modules. Their versatility in formulations allows for tailored electrical and thermal conductivity.

Type: Isotropic

- Key Growth Drivers: Isotropic conductive adhesives (ICAs) offer uniform conductivity in all directions, making them suitable for a broad range of electronic interconnections, including surface mount technology (SMT) and component bonding.

- Detailed Analysis: The high-volume manufacturing of printed circuit boards (PCBs) and displays significantly drives the demand for ICAs. Their ease of application and cost-effectiveness in certain applications contribute to their widespread use.

Application: Automotive Electronics

- Key Growth Drivers: The rapid growth of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is a primary catalyst. ECAs are crucial for bonding batteries, power electronics, sensors, and infotainment systems in vehicles.

- Detailed Analysis: The need for lightweight, durable, and reliable electronic components in modern vehicles necessitates the use of high-performance ECAs. Their ability to withstand harsh automotive environments and provide electrical connections makes them indispensable.

Application: Solar Cells

- Key Growth Drivers: The global push for renewable energy sources and the expanding solar photovoltaic (PV) industry are significant growth drivers. ECAs are used for interconnecting solar cells and encapsulating modules.

- Detailed Analysis: The cost-effectiveness and long-term reliability offered by ECAs in solar panel manufacturing are critical. Advancements in transparent conductive adhesives are also opening new possibilities for next-generation solar technologies.

Electrically Conductive Adhesives Market Product Analysis

Electrically Conductive Adhesives are undergoing continuous product innovation, driven by the demand for higher performance and specialized functionalities. Advancements focus on developing formulations with enhanced electrical and thermal conductivity, improved flexibility for flexible electronics, and greater reliability under extreme operating conditions. Innovations include novel conductive filler materials like silver nanoparticles, carbon nanotubes, and graphene, offering superior performance and reduced loading requirements. New curing mechanisms, such as UV-curable and dual-cure systems, are enhancing manufacturing efficiency and enabling the assembly of delicate components. Competitive advantages are derived from tailored formulations for specific applications, such as EMI shielding, thermal interface materials, and advanced interconnects in semiconductors and displays.

Key Drivers, Barriers & Challenges in Electrically Conductive Adhesives Market

Key Drivers:

- Miniaturization of Electronics: The relentless drive for smaller, more powerful electronic devices necessitates advanced bonding solutions like ECAs.

- Growth of Electric Vehicles (EVs): The expanding EV market demands high-performance ECAs for battery packs, power electronics, and charging infrastructure.

- Advancements in 5G and IoT: The proliferation of connected devices requires reliable and efficient electrical interconnections, a key role for ECAs.

- Increased Adoption in Renewable Energy: The growing solar and wind power sectors utilize ECAs for component assembly and interconnectivity.

- Technological Innovations: Development of novel conductive fillers and curing technologies enhances ECA performance and applicability.

Barriers & Challenges:

- High Cost of Raw Materials: The price volatility of conductive fillers, particularly silver, can impact the overall cost of ECAs.

- Performance Limitations: Achieving ultra-high conductivity while maintaining flexibility and cost-effectiveness remains a challenge.

- Environmental Regulations: Stringent regulations regarding hazardous materials and VOC emissions require the development of eco-friendly formulations.

- Competition from Traditional Methods: Solders and conductive inks present alternative solutions in certain applications, requiring ECAs to demonstrate clear performance advantages.

- Supply Chain Disruptions: Global supply chain vulnerabilities can affect the availability and cost of critical raw materials.

Growth Drivers in the Electrically Conductive Adhesives Market Market

The Electrically Conductive Adhesives market is propelled by several key growth drivers. Technologically, the miniaturization of electronic devices and the increasing complexity of circuit boards are creating a persistent demand for advanced bonding solutions. The automotive sector's significant shift towards electrification and autonomous driving features is a major economic driver, necessitating reliable ECAs for batteries, power electronics, and sensors. Regulatory drivers include government initiatives promoting renewable energy, such as solar power, which directly increases the demand for ECAs in solar panel manufacturing. Furthermore, the rapid expansion of the 5G network and the proliferation of the Internet of Things (IoT) ecosystem require robust and efficient electrical interconnections, a role ECAs are increasingly fulfilling.

Challenges Impacting Electrically Conductive Adhesives Market Growth

Challenges impacting Electrically Conductive Adhesives market growth include the inherent cost associated with advanced conductive fillers, particularly precious metals like silver, which can make ECAs more expensive than traditional bonding methods. Regulatory complexities surrounding the use of certain chemicals in formulations and the need for compliance with evolving environmental standards can necessitate significant R&D investment and reformulation efforts. Supply chain issues, including the sourcing of critical raw materials and potential geopolitical disruptions, can affect material availability and pricing. Competitive pressures from established alternatives like solders and emerging conductive materials demand continuous innovation and clear demonstration of superior performance benefits for ECAs to maintain and expand market share.

Key Players Shaping the Electrically Conductive Adhesives Market Market

- Henkel AG & Co KGaA

- Aremco

- HITEK Electronic Materials Ltd

- Panacol-Elosol GmbH

- HB Fuller Company

- 3M

- Master Bond Inc

- Dow

- Creative Materials Inc

- Permabond

- MG Chemicals

- Parker Hannifin Corp

Significant Electrically Conductive Adhesives Market Industry Milestones

- 2023: Introduction of novel graphene-based ECAs offering enhanced conductivity and reduced cost by a leading manufacturer.

- 2022: Acquisition of a specialized ECA producer by a global chemical giant to expand its portfolio in advanced electronics.

- 2021: Development of high-temperature resistant ECAs for automotive power electronics by a major player.

- 2020: Launch of solvent-free and UV-curable ECA formulations addressing environmental concerns and improving manufacturing efficiency.

- 2019: Significant increase in R&D investment by key companies focusing on flexible and stretchable conductive adhesives for wearable electronics.

Future Outlook for Electrically Conductive Adhesives Market Market

The future outlook for the Electrically Conductive Adhesives market is exceptionally bright, driven by an ongoing surge in technological innovation and escalating demand across diverse industrial sectors. Strategic opportunities lie in the continued development of ultra-high conductivity, flexible, and thermally conductive ECAs to support the advancement of next-generation electronics, including advanced displays, flexible devices, and high-performance computing. The burgeoning electric vehicle market and the expansion of renewable energy infrastructure will continue to be significant growth catalysts. Furthermore, the increasing adoption of ECAs in medical devices, aerospace, and telecommunications will further diversify market applications. The market is expected to witness sustained growth as manufacturers focus on sustainable formulations and cost-effective solutions, solidifying the indispensable role of ECAs in modern technological advancements.

Electrically Conductive Adhesives Market Segmentation

-

1. Chemistry Type

- 1.1. Epoxy

- 1.2. Silicone

- 1.3. Polyurethane

- 1.4. Acrylic

- 1.5. Other Chemistry Types

-

2. Type

- 2.1. Isotropic

- 2.2. Anisotropic

-

3. Application

- 3.1. Solar Cells

- 3.2. Automotive Electronics

- 3.3. LED Lighting

- 3.4. Printed Circuit Boards

- 3.5. LCD Displays

- 3.6. Other Applications

Electrically Conductive Adhesives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. US

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. UK

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Electrically Conductive Adhesives Market Regional Market Share

Geographic Coverage of Electrically Conductive Adhesives Market

Electrically Conductive Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application in Power Electronics; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Other Restraints

- 3.4. Market Trends

- 3.4.1. Epoxy Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 5.1.1. Epoxy

- 5.1.2. Silicone

- 5.1.3. Polyurethane

- 5.1.4. Acrylic

- 5.1.5. Other Chemistry Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Isotropic

- 5.2.2. Anisotropic

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Solar Cells

- 5.3.2. Automotive Electronics

- 5.3.3. LED Lighting

- 5.3.4. Printed Circuit Boards

- 5.3.5. LCD Displays

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 6. Asia Pacific Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 6.1.1. Epoxy

- 6.1.2. Silicone

- 6.1.3. Polyurethane

- 6.1.4. Acrylic

- 6.1.5. Other Chemistry Types

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Isotropic

- 6.2.2. Anisotropic

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Solar Cells

- 6.3.2. Automotive Electronics

- 6.3.3. LED Lighting

- 6.3.4. Printed Circuit Boards

- 6.3.5. LCD Displays

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 7. North America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 7.1.1. Epoxy

- 7.1.2. Silicone

- 7.1.3. Polyurethane

- 7.1.4. Acrylic

- 7.1.5. Other Chemistry Types

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Isotropic

- 7.2.2. Anisotropic

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Solar Cells

- 7.3.2. Automotive Electronics

- 7.3.3. LED Lighting

- 7.3.4. Printed Circuit Boards

- 7.3.5. LCD Displays

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 8. Europe Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 8.1.1. Epoxy

- 8.1.2. Silicone

- 8.1.3. Polyurethane

- 8.1.4. Acrylic

- 8.1.5. Other Chemistry Types

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Isotropic

- 8.2.2. Anisotropic

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Solar Cells

- 8.3.2. Automotive Electronics

- 8.3.3. LED Lighting

- 8.3.4. Printed Circuit Boards

- 8.3.5. LCD Displays

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 9. South America Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 9.1.1. Epoxy

- 9.1.2. Silicone

- 9.1.3. Polyurethane

- 9.1.4. Acrylic

- 9.1.5. Other Chemistry Types

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Isotropic

- 9.2.2. Anisotropic

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Solar Cells

- 9.3.2. Automotive Electronics

- 9.3.3. LED Lighting

- 9.3.4. Printed Circuit Boards

- 9.3.5. LCD Displays

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 10. Middle East and Africa Electrically Conductive Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 10.1.1. Epoxy

- 10.1.2. Silicone

- 10.1.3. Polyurethane

- 10.1.4. Acrylic

- 10.1.5. Other Chemistry Types

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Isotropic

- 10.2.2. Anisotropic

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Solar Cells

- 10.3.2. Automotive Electronics

- 10.3.3. LED Lighting

- 10.3.4. Printed Circuit Boards

- 10.3.5. LCD Displays

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Chemistry Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aremco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HITEK Electronic Materials Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panacol-Elosol GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HB Fuller Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Master Bond Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Creative Materials Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Permabond*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MG Chemicals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Parker Hannifin Corp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Electrically Conductive Adhesives Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 3: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 4: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 5: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 11: North America Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 12: North America Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 13: North America Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 15: North America Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 19: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 20: Europe Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 21: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 23: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 27: South America Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 28: South America Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 29: South America Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 31: South America Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Chemistry Type 2025 & 2033

- Figure 35: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Chemistry Type 2025 & 2033

- Figure 36: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Electrically Conductive Adhesives Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Electrically Conductive Adhesives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 2: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 6: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 15: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 16: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: US Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 22: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: UK Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 31: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Chemistry Type 2020 & 2033

- Table 38: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Electrically Conductive Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Electrically Conductive Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrically Conductive Adhesives Market?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Electrically Conductive Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, Aremco, HITEK Electronic Materials Ltd, Panacol-Elosol GmbH, HB Fuller Company, 3M, Master Bond Inc, Dow, Creative Materials Inc, Permabond*List Not Exhaustive, MG Chemicals, Parker Hannifin Corp.

3. What are the main segments of the Electrically Conductive Adhesives Market?

The market segments include Chemistry Type, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1712 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application in Power Electronics; Other Drivers.

6. What are the notable trends driving market growth?

Epoxy Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrically Conductive Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrically Conductive Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrically Conductive Adhesives Market?

To stay informed about further developments, trends, and reports in the Electrically Conductive Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence