Key Insights

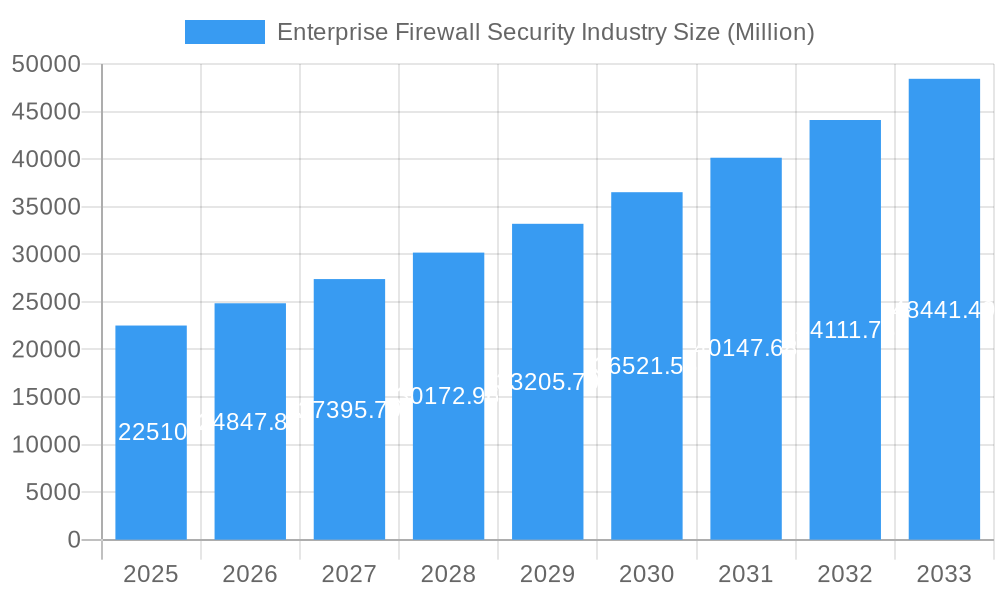

The global Enterprise Firewall Security market is poised for significant expansion, projected to reach $22.51 billion in 2025. This robust growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 10.41% through 2033. Key drivers behind this upward trajectory include the escalating sophistication and frequency of cyber threats, the increasing adoption of cloud-based solutions, and the growing need for advanced network protection in a digitally transformed business landscape. Organizations across all sectors are recognizing the critical role of robust firewall solutions in safeguarding sensitive data, ensuring business continuity, and maintaining regulatory compliance. The demand for advanced security features such as intrusion prevention, threat detection and response, and unified threat management is driving innovation and market penetration.

Enterprise Firewall Security Industry Market Size (In Billion)

The enterprise firewall security market is characterized by diverse segmentation catering to a wide array of organizational needs. Cloud deployment models are rapidly gaining traction, offering scalability and flexibility, while on-premise solutions remain relevant for organizations with specific data sovereignty or control requirements. The solution landscape is evolving beyond traditional hardware to encompass sophisticated software and comprehensive managed services, reflecting the complexity of modern cybersecurity challenges. Small and medium organizations, along with large enterprises, are actively investing in these solutions. Key end-user industries like healthcare, financial services, manufacturing, and government are particularly high on the adoption curve due to the critical nature of their data and operations. Emerging trends like Zero Trust Architecture and AI-powered threat analysis are shaping the future of this dynamic market, pushing innovation and enhancing security postures against evolving cyber risks.

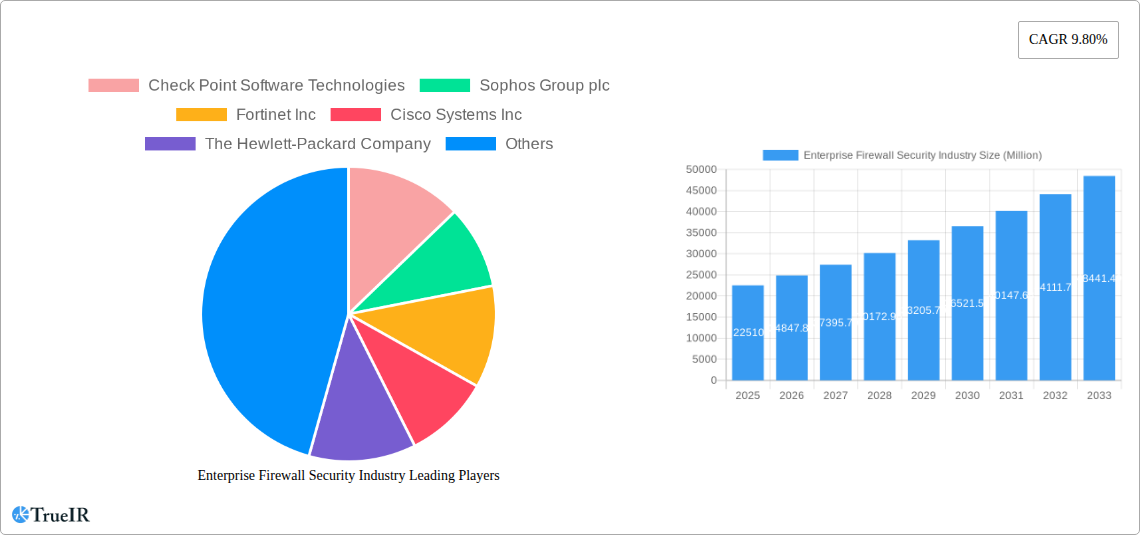

Enterprise Firewall Security Industry Company Market Share

Enterprise Firewall Security Industry Market Structure & Competitive Landscape

The enterprise firewall security market exhibits a moderately consolidated structure, characterized by the presence of both global cybersecurity giants and specialized vendors. Innovation remains a paramount driver, with ongoing advancements in AI-powered threat detection, cloud-native security, and integrated security platforms. Regulatory impacts are significant, as evolving data privacy laws and compliance mandates necessitate robust firewall solutions. Product substitutes, such as Unified Threat Management (UTM) devices and cloud-based security-as-a-service (SaaS) offerings, present a competitive dynamic, pushing firewall vendors to enhance their feature sets and integration capabilities. End-user segmentation reveals diverse needs across industries, from stringent security requirements in financial services and government to scalable solutions for healthcare and manufacturing. Merger and acquisition (M&A) trends are active, with larger players acquiring innovative startups to expand their portfolios and market reach. For instance, over the historical period (2019-2024), an estimated 15 billion USD in M&A deals were completed, consolidating market share and fostering synergistic offerings. Concentration ratios are estimated to be around 65% for the top five vendors by market share in 2025.

Enterprise Firewall Security Industry Market Trends & Opportunities

The enterprise firewall security industry is poised for substantial growth and transformation, driven by an escalating threat landscape and the increasing reliance on digital infrastructure. The market size is projected to reach an estimated 150 billion USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year of 2025. This growth trajectory is fueled by a confluence of factors, including the rapid adoption of cloud computing, the proliferation of IoT devices, and the persistent sophistication of cyberattacks. Technological shifts are fundamentally reshaping the market, with a pronounced move towards Next-Generation Firewalls (NGFWs) that offer advanced threat prevention capabilities, deep packet inspection, and integrated security services. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming a standard feature, enabling real-time anomaly detection, predictive threat intelligence, and automated response mechanisms.

Consumer preferences are increasingly leaning towards flexible, scalable, and easily manageable security solutions. This is driving the demand for both cloud-delivered firewall services and hybrid deployment models that offer the best of both on-premise and cloud environments. The rise of remote work and distributed enterprise networks further accentuates the need for robust, perimeter-less security strategies, where firewalls play a crucial role in enforcing granular access policies and micro-segmentation. Competitive dynamics are intensifying, with established players continuously investing in research and development to introduce innovative features and strengthen their market positions.

The market penetration rate for advanced firewall solutions, such as those incorporating AI/ML capabilities, is estimated to grow from around 40% in 2025 to over 70% by 2033. Opportunities abound for vendors who can offer integrated security platforms that go beyond traditional firewall functionalities, encompassing intrusion prevention systems (IPS), web application firewalls (WAFs), secure web gateways (SWGs), and endpoint security. The increasing complexity of compliance regulations across various end-user industries, such as GDPR, CCPA, and HIPAA, also presents a significant opportunity for firewall solutions that can facilitate compliance and provide auditable security logs. The market is also witnessing a growing demand for specialized firewalls tailored for specific environments, such as cloud-native applications and industrial control systems (ICS). The global market size for enterprise firewall security is estimated to be 100 billion USD in 2025.

Dominant Markets & Segments in Enterprise Firewall Security Industry

The enterprise firewall security industry's dominance is shaped by a complex interplay of deployment types, solutions, organizational sizes, and end-user industries.

Type of Deployment:

- Cloud Deployment: This segment is experiencing the most rapid expansion, driven by the widespread adoption of cloud infrastructure by organizations of all sizes. The scalability, flexibility, and cost-effectiveness of cloud-based firewalls are key growth drivers. The global cloud firewall market is projected to reach over 70 billion USD by 2033, with an estimated market share of approximately 47% of the total enterprise firewall market.

- On-premise Deployment: While cloud is gaining traction, on-premise firewalls continue to hold a significant market share, particularly in highly regulated industries and large enterprises with existing infrastructure investments. These solutions offer greater control and are often favored for their ability to meet stringent data sovereignty requirements.

Solution:

- Software: Software-defined firewalls and virtual firewall appliances are witnessing substantial growth. Their ability to be deployed and managed within virtualized environments and cloud platforms makes them highly adaptable. The software segment is expected to contribute significantly to the overall market value, reaching an estimated 55 billion USD by 2033.

- Hardware: Traditional hardware firewalls remain crucial for many organizations, especially those requiring high performance and dedicated security appliances. However, the trend is moving towards more integrated hardware-software solutions.

- Services: Managed firewall services, including Security-as-a-Service (SaaS) offerings and managed security services providers (MSSPs), are gaining significant traction. Organizations are increasingly outsourcing their firewall management to experts to ensure optimal security posture and reduce operational overhead.

Size of the Organization:

- Large Organizations: These organizations represent a substantial market due to their extensive IT infrastructure, higher security budgets, and greater susceptibility to sophisticated cyber threats. Their demand for advanced, scalable, and integrated firewall solutions is consistently high.

- Small and Medium Organizations (SMOs): The SMO segment is a rapidly growing area. As SMOs increasingly adopt digital technologies, they are becoming more vulnerable to cyberattacks. The availability of cost-effective, cloud-based, and easily manageable firewall solutions is driving adoption in this segment.

End-user Industry:

- Financial Services: This sector is a dominant force due to its stringent regulatory requirements, the high value of data it handles, and the constant threat of financial fraud and cyber espionage. Sophisticated firewall solutions are essential for protecting sensitive customer data and financial transactions.

- Government: Governments worldwide are heavily investing in cybersecurity to protect critical infrastructure, national security, and sensitive citizen data. The demand for robust, highly secure, and compliant firewall solutions is paramount.

- Healthcare: With the increasing digitization of patient records and the rise of telemedicine, the healthcare industry is becoming a prime target for cyberattacks. HIPAA compliance and the need to protect patient privacy are driving the adoption of advanced firewall technologies.

- Manufacturing: The convergence of IT and OT (Operational Technology) in the manufacturing sector, coupled with the proliferation of Industrial IoT (IIoT) devices, necessitates specialized firewall solutions to protect production lines and sensitive intellectual property.

- Communications: Telecommunication companies are critical infrastructure providers and are thus heavily targeted. They require highly scalable and resilient firewall solutions to secure their networks and protect subscriber data.

Enterprise Firewall Security Industry Product Analysis

Product innovation in the enterprise firewall security industry is characterized by the integration of advanced threat intelligence, AI-driven analytics, and seamless cloud connectivity. Next-Generation Firewalls (NGFWs) are at the forefront, offering deep packet inspection, application control, and unified threat management capabilities. Key competitive advantages lie in the ability of these products to provide real-time threat detection, automated incident response, and robust policy enforcement across diverse network environments. The shift towards cloud-native firewalls designed for cloud architectures, such as those on AWS, Azure, and GCP, is a significant trend, emphasizing agility and scalability. Vendors are also focusing on Zero Trust Network Access (ZTNA) capabilities, further enhancing security by verifying every access request.

Key Drivers, Barriers & Challenges in Enterprise Firewall Security Industry

The enterprise firewall security industry is propelled by several key drivers, including the relentless evolution of cyber threats, the increasing adoption of cloud computing and digital transformation initiatives, and the growing regulatory landscape mandating robust data protection. The demand for advanced security features like AI-powered threat detection and Zero Trust architectures are significant technological drivers. Economically, the increasing cost of data breaches and downtime incentivizes organizations to invest in preventive measures.

However, the industry faces considerable barriers and challenges. Supply chain disruptions, particularly for hardware components, can impact delivery timelines and costs. Regulatory hurdles, such as navigating diverse global compliance requirements, can be complex and resource-intensive for vendors. Competitive pressures are intense, with a crowded market demanding continuous innovation and competitive pricing. The skills gap in cybersecurity also presents a challenge, making it difficult for organizations to effectively deploy and manage advanced firewall solutions.

Growth Drivers in the Enterprise Firewall Security Industry Market

The growth of the enterprise firewall security market is primarily driven by the escalating sophistication and volume of cyber threats, compelling organizations to adopt advanced security measures. The widespread migration to cloud environments and the increasing adoption of digital transformation strategies necessitate scalable and flexible firewall solutions. Furthermore, the growing emphasis on regulatory compliance, such as GDPR and CCPA, mandates robust data protection and privacy controls, directly benefiting the firewall market. The proliferation of IoT devices and the remote work paradigm also create new attack surfaces that require comprehensive firewall protection.

Challenges Impacting Enterprise Firewall Security Industry Growth

Despite robust growth drivers, the enterprise firewall security industry faces several challenges that can impede its expansion. Regulatory complexities and the constant need to adapt to evolving data privacy laws across different jurisdictions can be a significant hurdle. Supply chain issues, particularly for hardware-based firewalls, can lead to delays and increased costs, impacting market availability. Intense competitive pressures from a multitude of vendors, including both established players and emerging startups, necessitate continuous innovation and aggressive pricing strategies. Moreover, the shortage of skilled cybersecurity professionals makes it challenging for organizations to effectively implement, manage, and optimize advanced firewall solutions, thus limiting their full potential.

Key Players Shaping the Enterprise Firewall Security Industry Market

- Check Point Software Technologies

- Sophos Group plc

- Fortinet Inc

- Cisco Systems Inc

- The Hewlett-Packard Company

- Juniper Networks

- WatchGuard Technologies

- Dell Inc

- Netasq SA

- Palo Alto Networks

- SonicWall Inc

- McAfee (Intel Security Group)

- Huawei Technologies Inc

Significant Enterprise Firewall Security Industry Industry Milestones

- November 2022: Fortinet launched FortiGate Cloud-Native Firewall (FortiGate CNF) on Amazon Web Services (AWS), an enterprise-grade, managed next-generation firewall service designed for AWS environments, incorporating AI-powered Security Services for real-time threat detection and protection.

- August 2022: Fortinet announced the launch of the FortiGate 4800F series of hyperscale firewalls, focusing on security, scale, performance, and innovation, enabling enterprises and MNOs to concurrently run more applications while reducing their physical footprint and enhancing network security.

Future Outlook for Enterprise Firewall Security Industry Market

The future outlook for the enterprise firewall security industry is exceptionally promising, driven by an ongoing arms race against increasingly sophisticated cyber threats and the accelerating pace of digital innovation. The market will witness a continued surge in demand for AI-powered solutions that offer predictive threat detection and automated remediation. Cloud-native firewalls will become increasingly prevalent as organizations further embrace hybrid and multi-cloud strategies. The integration of firewalls into broader cybersecurity platforms, facilitating a unified and holistic security posture, will also be a key trend. Opportunities will emerge for vendors offering specialized solutions for emerging technologies like 5G, edge computing, and Industrial IoT. Strategic partnerships and acquisitions will continue to shape the competitive landscape, with a focus on expanding technological capabilities and market reach. The market is expected to experience sustained growth, reaching an estimated 150 billion USD by 2033.

Enterprise Firewall Security Industry Segmentation

-

1. Type of Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Solution

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Size of the Organization

- 3.1. Small and Medium Organizations

- 3.2. Large Organizations

-

4. End-user Industry

- 4.1. Healthcare

- 4.2. Manufacturing

- 4.3. Government

- 4.4. Retail

- 4.5. Education

- 4.6. Financial Services

- 4.7. Media

- 4.8. Communications

- 4.9. Other End-user Industries

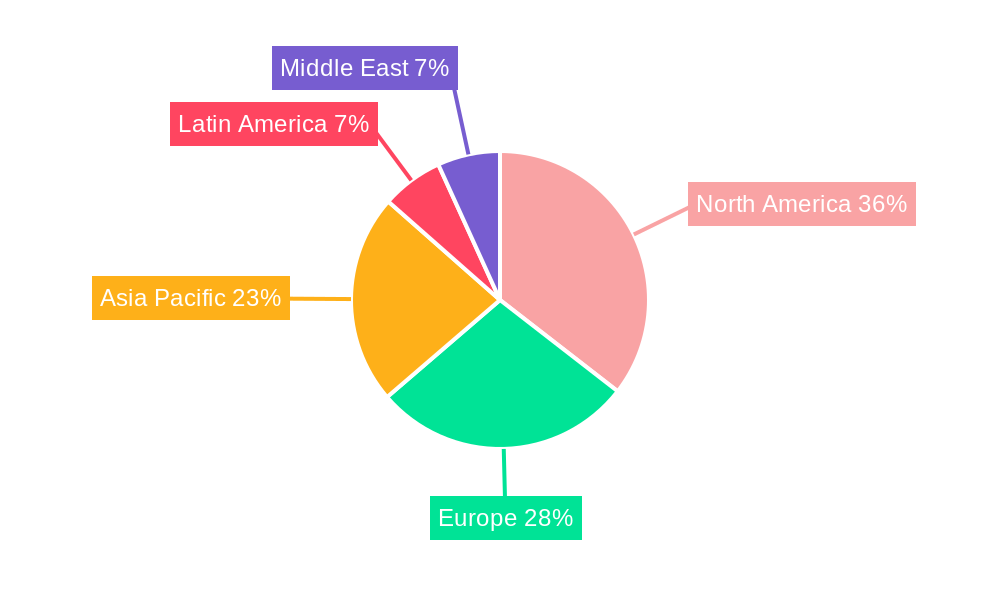

Enterprise Firewall Security Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Enterprise Firewall Security Industry Regional Market Share

Geographic Coverage of Enterprise Firewall Security Industry

Enterprise Firewall Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Threats

- 3.3. Market Restrains

- 3.3.1. Laggard Attitude Towards Security by Some Enterprises

- 3.4. Market Trends

- 3.4.1. Cloud Services to have High Growth Rate due to enhanced adoption of Industry 4.0

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 5.3.1. Small and Medium Organizations

- 5.3.2. Large Organizations

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Healthcare

- 5.4.2. Manufacturing

- 5.4.3. Government

- 5.4.4. Retail

- 5.4.5. Education

- 5.4.6. Financial Services

- 5.4.7. Media

- 5.4.8. Communications

- 5.4.9. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6. North America Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 6.3.1. Small and Medium Organizations

- 6.3.2. Large Organizations

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Healthcare

- 6.4.2. Manufacturing

- 6.4.3. Government

- 6.4.4. Retail

- 6.4.5. Education

- 6.4.6. Financial Services

- 6.4.7. Media

- 6.4.8. Communications

- 6.4.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7. Europe Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 7.3.1. Small and Medium Organizations

- 7.3.2. Large Organizations

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Healthcare

- 7.4.2. Manufacturing

- 7.4.3. Government

- 7.4.4. Retail

- 7.4.5. Education

- 7.4.6. Financial Services

- 7.4.7. Media

- 7.4.8. Communications

- 7.4.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8. Asia Pacific Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 8.3.1. Small and Medium Organizations

- 8.3.2. Large Organizations

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Healthcare

- 8.4.2. Manufacturing

- 8.4.3. Government

- 8.4.4. Retail

- 8.4.5. Education

- 8.4.6. Financial Services

- 8.4.7. Media

- 8.4.8. Communications

- 8.4.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9. Latin America Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 9.3.1. Small and Medium Organizations

- 9.3.2. Large Organizations

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Healthcare

- 9.4.2. Manufacturing

- 9.4.3. Government

- 9.4.4. Retail

- 9.4.5. Education

- 9.4.6. Financial Services

- 9.4.7. Media

- 9.4.8. Communications

- 9.4.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 10. Middle East Enterprise Firewall Security Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Solution

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 10.3.1. Small and Medium Organizations

- 10.3.2. Large Organizations

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Healthcare

- 10.4.2. Manufacturing

- 10.4.3. Government

- 10.4.4. Retail

- 10.4.5. Education

- 10.4.6. Financial Services

- 10.4.7. Media

- 10.4.8. Communications

- 10.4.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Check Point Software Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sophos Group plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortinet Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Hewlett-Packard Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Juniper Networks

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WatchGuard Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dell Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Netasq SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Palo Alto Networks

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SonicWall Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 McAfee (Intel Security Group)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huawei Technologies Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Check Point Software Technologies

List of Figures

- Figure 1: Global Enterprise Firewall Security Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Enterprise Firewall Security Industry Revenue (undefined), by Type of Deployment 2025 & 2033

- Figure 3: North America Enterprise Firewall Security Industry Revenue Share (%), by Type of Deployment 2025 & 2033

- Figure 4: North America Enterprise Firewall Security Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 5: North America Enterprise Firewall Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 6: North America Enterprise Firewall Security Industry Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 7: North America Enterprise Firewall Security Industry Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 8: North America Enterprise Firewall Security Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 9: North America Enterprise Firewall Security Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Enterprise Firewall Security Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Enterprise Firewall Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Enterprise Firewall Security Industry Revenue (undefined), by Type of Deployment 2025 & 2033

- Figure 13: Europe Enterprise Firewall Security Industry Revenue Share (%), by Type of Deployment 2025 & 2033

- Figure 14: Europe Enterprise Firewall Security Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 15: Europe Enterprise Firewall Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 16: Europe Enterprise Firewall Security Industry Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 17: Europe Enterprise Firewall Security Industry Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 18: Europe Enterprise Firewall Security Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 19: Europe Enterprise Firewall Security Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Enterprise Firewall Security Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Enterprise Firewall Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Enterprise Firewall Security Industry Revenue (undefined), by Type of Deployment 2025 & 2033

- Figure 23: Asia Pacific Enterprise Firewall Security Industry Revenue Share (%), by Type of Deployment 2025 & 2033

- Figure 24: Asia Pacific Enterprise Firewall Security Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 25: Asia Pacific Enterprise Firewall Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 26: Asia Pacific Enterprise Firewall Security Industry Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 27: Asia Pacific Enterprise Firewall Security Industry Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 28: Asia Pacific Enterprise Firewall Security Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Enterprise Firewall Security Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Enterprise Firewall Security Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Enterprise Firewall Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Enterprise Firewall Security Industry Revenue (undefined), by Type of Deployment 2025 & 2033

- Figure 33: Latin America Enterprise Firewall Security Industry Revenue Share (%), by Type of Deployment 2025 & 2033

- Figure 34: Latin America Enterprise Firewall Security Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 35: Latin America Enterprise Firewall Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Latin America Enterprise Firewall Security Industry Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 37: Latin America Enterprise Firewall Security Industry Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 38: Latin America Enterprise Firewall Security Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Latin America Enterprise Firewall Security Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Enterprise Firewall Security Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin America Enterprise Firewall Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Enterprise Firewall Security Industry Revenue (undefined), by Type of Deployment 2025 & 2033

- Figure 43: Middle East Enterprise Firewall Security Industry Revenue Share (%), by Type of Deployment 2025 & 2033

- Figure 44: Middle East Enterprise Firewall Security Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 45: Middle East Enterprise Firewall Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 46: Middle East Enterprise Firewall Security Industry Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 47: Middle East Enterprise Firewall Security Industry Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 48: Middle East Enterprise Firewall Security Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 49: Middle East Enterprise Firewall Security Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East Enterprise Firewall Security Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Middle East Enterprise Firewall Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 2: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 3: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 4: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 7: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 8: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 9: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 12: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 13: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 14: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 17: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 18: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 19: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 22: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 23: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 24: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Type of Deployment 2020 & 2033

- Table 27: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 28: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 29: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Enterprise Firewall Security Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Firewall Security Industry?

The projected CAGR is approximately 10.41%.

2. Which companies are prominent players in the Enterprise Firewall Security Industry?

Key companies in the market include Check Point Software Technologies, Sophos Group plc, Fortinet Inc, Cisco Systems Inc, The Hewlett-Packard Company, Juniper Networks, WatchGuard Technologies, Dell Inc, Netasq SA, Palo Alto Networks, SonicWall Inc , McAfee (Intel Security Group), Huawei Technologies Inc.

3. What are the main segments of the Enterprise Firewall Security Industry?

The market segments include Type of Deployment, Solution, Size of the Organization, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Threats.

6. What are the notable trends driving market growth?

Cloud Services to have High Growth Rate due to enhanced adoption of Industry 4.0.

7. Are there any restraints impacting market growth?

Laggard Attitude Towards Security by Some Enterprises.

8. Can you provide examples of recent developments in the market?

November 2022: Fortinet, an integrated and automated cybersecurity solutions provider, announced the launch of FortiGate Cloud-Native Firewall (FortiGate CNF) on Amazon Web Services (AWS), an enterprise-grade, managed next-generation firewall service specifically designed for AWS environments. FortiGate CNF incorporates FortiGuard artificial intelligence (AI)-powered Security Services for real-time detection of and protection against malicious external and internal threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Firewall Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Firewall Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Firewall Security Industry?

To stay informed about further developments, trends, and reports in the Enterprise Firewall Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence