Key Insights

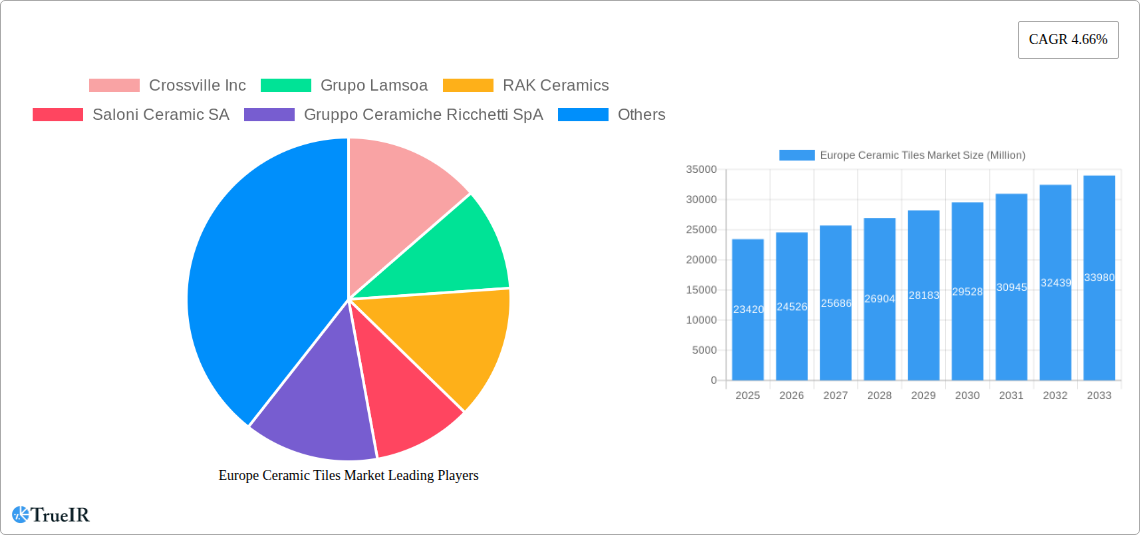

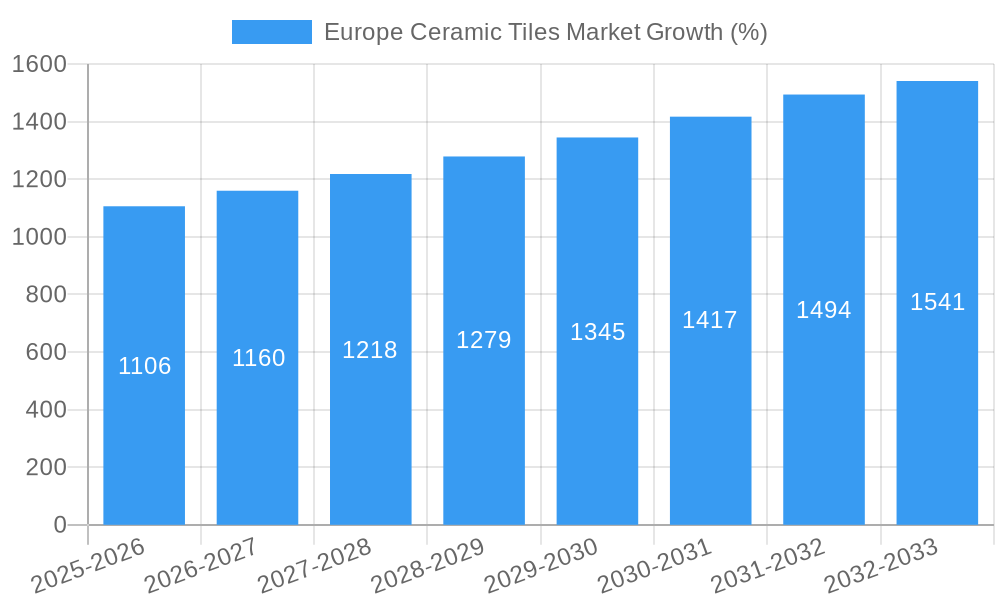

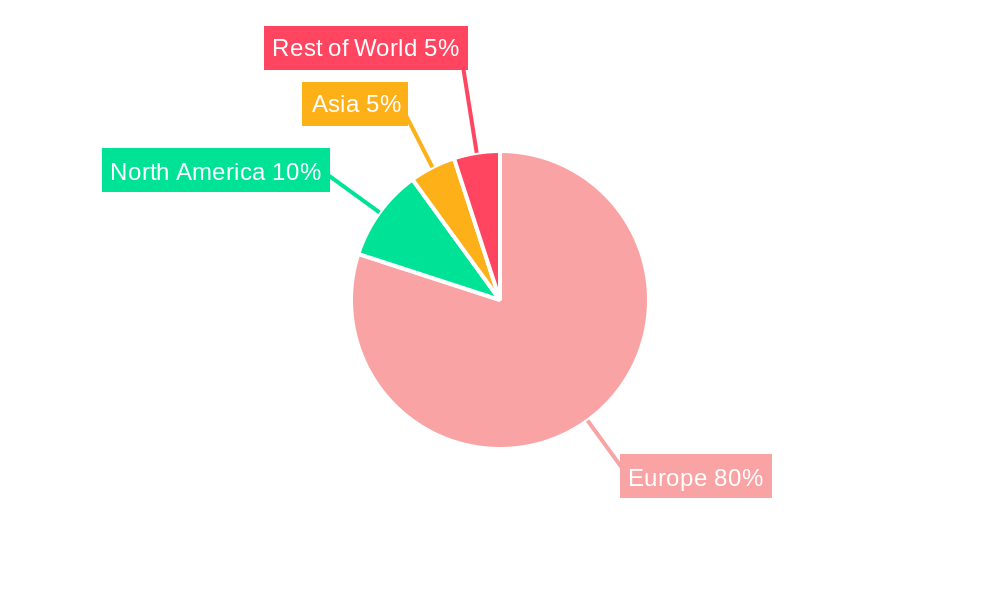

The European ceramic tile market, valued at €23.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the ongoing surge in construction activity across Europe, particularly in new residential and commercial buildings, significantly boosts demand for ceramic tiles. Renovation and replacement projects within existing structures also contribute substantially to market growth. The rising preference for aesthetically pleasing and durable flooring and wall solutions further fuels this demand. Specific product segments like glazed and porcelain tiles continue to dominate market share, owing to their superior properties including water resistance, stain resistance and ease of maintenance. Furthermore, the increasing popularity of large-format tiles and innovative designs are adding a premium element to the market. Germany, France, Italy, and the United Kingdom represent the largest national markets within Europe, reflecting their robust construction sectors and high consumer spending on home improvement.

However, certain restraints influence market growth. Fluctuations in raw material prices, particularly clay and energy costs, can impact production expenses and, consequently, tile prices. Stringent environmental regulations concerning manufacturing processes and waste management also pose challenges for producers. Despite these restraints, the long-term outlook for the European ceramic tile market remains positive, driven by sustained infrastructure development, increasing disposable incomes, and a growing preference for sustainable and high-quality building materials. The market's segmentation by construction type (new construction, renovation), end-user (residential, commercial), product type (glazed, porcelain, scratch-free), and application (floor, wall) provides a nuanced understanding of the diverse market dynamics at play. Key players like Crossville Inc, RAK Ceramics, and Porcelanosa Group are strategically positioned to capitalize on these trends through product innovation, expansion into new markets, and strategic partnerships.

Europe Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Europe ceramic tiles market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study delves into market size, segmentation, competitive landscape, and future growth prospects. Leveraging high-impact keywords like "Europe ceramic tiles market," "ceramic tile market trends," and "European construction materials," this report ensures maximum visibility and relevance for industry professionals. The estimated market size in 2025 is valued at xx Million.

Europe Ceramic Tiles Market Structure & Competitive Landscape

The European ceramic tiles market exhibits a moderately concentrated structure, with a few major players controlling a significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating the presence of both large multinational corporations and smaller regional players. Innovation plays a crucial role, driving the development of new product types like scratch-free tiles and large-format slabs. Regulatory compliance, including environmental regulations concerning material composition and manufacturing processes, presents both challenges and opportunities for market players. Product substitutes, such as engineered stone and vinyl flooring, exert competitive pressure. The end-user segmentation consists primarily of the residential and commercial sectors, with the former currently dominating. M&A activity in the sector has remained moderate in recent years, with an estimated xx Million in deal volume in 2024. This suggests a stable, but not overly consolidated, market landscape.

- Market Concentration: CR4 at xx% (2024)

- Key Innovation Drivers: Development of large-format tiles, scratch-resistant technologies, and eco-friendly materials.

- Regulatory Impacts: Stringent environmental standards and building codes.

- Product Substitutes: Engineered stone, vinyl flooring, and other alternatives.

- End-User Segmentation: Dominated by the residential sector, followed by commercial.

- M&A Trends: Moderate activity in recent years, with a total deal value of approximately xx Million in 2024.

Europe Ceramic Tiles Market Market Trends & Opportunities

The Europe ceramic tiles market is projected to experience significant growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is fueled by several factors including increasing construction activity, particularly in the residential sector of key European markets like Germany, France, and the UK. Technological advancements, such as the introduction of high-tech porcelain tiles and innovative designs, are also driving demand. Shifting consumer preferences toward aesthetically pleasing and durable flooring and wall coverings are creating further opportunities. The market penetration rate for high-end ceramic tiles is increasing steadily, especially in affluent urban areas. This trend, alongside the increasing adoption of large-format tiles for both interior and exterior applications, signals strong growth in this market segment. Intense competition, however, necessitates continuous product innovation and strategic partnerships for companies to maintain their market position.

Dominant Markets & Segments in Europe Ceramic Tiles Market

The residential sector currently commands the largest share within the European ceramic tiles market, representing approximately **xx%** of the total market value. This dominance is fueled by several interconnected factors, including a steady rise in disposable incomes across various European nations, ongoing urbanization trends that necessitate new housing and infrastructure development, and a pervasive consumer preference for enhanced home aesthetics and improved living spaces. Within the construction landscape, the new construction segment continues to be a significant contributor to overall market demand. Concurrently, the replacement & renovation segment is poised for robust and sustained growth. This expansion is driven by a combination of factors, including the natural aging of existing infrastructure requiring upgrades and a burgeoning trend towards home improvement projects, as homeowners invest in modernizing and enhancing their properties.

In terms of product types, glazed and porcelain tiles remain the most popular choices, owing to their versatility, durability, and aesthetic appeal. A notable emerging trend is the steadily increasing demand for scratch-free and highly durable options, reflecting a consumer desire for low-maintenance and long-lasting flooring solutions. The floor tiles segment leads the application areas, a position secured by their inherent functional benefits, such as ease of cleaning and resistance to wear, coupled with their significant contribution to interior design and ambiance.

- Key Growth Drivers (Residential Sector): Rising disposable incomes, increasing urbanization, evolving home improvement trends, and a heightened focus on interior design and aesthetic appeal.

- Key Growth Drivers (New Construction): Sustained construction booms in major European economies, significant investment in infrastructure projects, and the development of new residential and commercial properties.

- Key Growth Drivers (Replacement & Renovation): The aging of existing building stock necessitating upgrades and modernizations, coupled with a significant increase in home renovation and refurbishment activities driven by property owners seeking to enhance value and comfort.

- Dominant Product Type: Glazed tiles and porcelain tiles, with a growing emphasis on enhanced durability and scratch resistance.

- Dominant Application: Floor tiles, favored for their functional performance, aesthetic versatility, and long-term value.

Europe Ceramic Tiles Market Product Analysis

Technological advancements are the bedrock of significant product innovation within the European ceramic tiles market, consistently expanding the possibilities for architects, designers, and homeowners. The introduction of large-format slabs has revolutionized interior and exterior design, offering a seamless and modern aesthetic with fewer grout lines. Furthermore, the development of scratch-resistant and highly durable tiles caters to the growing demand for resilient and low-maintenance surfaces, particularly in high-traffic areas. Advanced manufacturing techniques now enable a wider array of intricate designs, textures, and finishes, from realistic wood and stone effects to bold geometric patterns and sophisticated matte or glossy surfaces. These innovations have significantly broadened the application spectrum of ceramic tiles, creating new opportunities in diverse interior design projects, including wall cladding, countertops, and decorative features.

A critical and increasingly influential aspect of product development is the growing adoption of eco-friendly and sustainable manufacturing processes. Ceramic tile manufacturers are actively investing in technologies that reduce energy consumption, minimize waste, and utilize recycled materials, aligning with the industry's broader environmental commitments and increasing consumer demand for sustainable products. These technological leaps not only enhance the performance and aesthetic appeal of ceramic tiles but also create substantial competitive advantages for companies at the forefront of innovation, directly contributing to the sustained growth and evolution of the market.

Key Drivers, Barriers & Challenges in Europe Ceramic Tiles Market

Key Drivers: The European ceramic tiles market is propelled by several potent growth catalysts. These include the burgeoning construction activities across the continent, driven by economic recovery and urban development; an escalating demand for home improvements and renovations as homeowners invest in enhancing their living spaces; continuous technological advancements that result in innovative, high-performance, and aesthetically superior product offerings; and supportive government policies often aimed at stimulating the construction sector through incentives and infrastructure investments.

Challenges: Despite the positive growth trajectory, the market faces several significant challenges. Fluctuations in raw material prices, such as clay, feldspar, and pigments, can directly impact manufacturing costs and profitability. The market is characterized by intense competition, not only among ceramic tile manufacturers but also from various substitute materials like vinyl, laminate, and natural stone. Furthermore, stringent environmental regulations, while necessary, can increase manufacturing costs and require significant investment in compliance. Finally, disruptions in global supply chains, as witnessed in recent years, can lead to material shortages, increased shipping costs, and delivery delays, collectively impacting market growth and profitability. For illustrative purposes, a hypothetical scenario where raw material costs increase by 10% could potentially lead to a decrease in profit margins of up to xx% for certain producers, highlighting the sensitivity of the market to these external factors.

Growth Drivers in the Europe Ceramic Tiles Market Market

The European ceramic tiles market is experiencing robust growth driven by a confluence of powerful economic and social factors. The primary engines of this expansion include rising disposable incomes across key European nations, which directly translates into increased consumer spending on home renovations, extensions, and new property acquisitions. Urbanization trends continue to play a pivotal role, leading to a sustained demand for housing and commercial spaces, thereby fueling new construction projects that heavily rely on ceramic tiles. Moreover, there is a discernible and growing adoption of sustainable and aesthetically advanced tile technologies. Consumers are increasingly seeking products that are not only visually appealing and offer enhanced durability but also align with environmentally conscious manufacturing practices. This demand for innovation and sustainability is shaping product development and market preferences.

Adding to these organic growth drivers are proactive government initiatives. Many European governments are actively supporting and investing in infrastructure development projects, ranging from transportation networks to public buildings. These large-scale projects create significant demand for building materials, including ceramic tiles, thus further boosting the market's growth trajectory. The synergy between rising consumer wealth, evolving lifestyle preferences, technological innovation, and supportive government policies creates a dynamic and expanding market for ceramic tiles in Europe.

Challenges Impacting Europe Ceramic Tiles Market Growth

Challenges include raw material price volatility, impacting production costs, fierce competition from substitute materials, and potential regulatory hurdles related to sustainable manufacturing practices. Supply chain disruptions due to geopolitical events can also affect availability and timely delivery.

Key Players Shaping the Europe Ceramic Tiles Market Market

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- NITCO

- Atlas Concorde S P A

- Johnson Tiles

- Mohawk Industries Inc

- Siam Cement Group

- Centura Tile Inc

- Blackstone Industrial (Foshan) Ltd

- China Ceramics Co Ltd

Significant Europe Ceramic Tiles Market Industry Milestones

- February 2023: Atlas Concorde launches its new 2023 general catalog, showcasing a wide range of stylish surfaces and design elements to support customers' project needs. This expansion demonstrates the increasing trend toward offering comprehensive design solutions beyond individual tiles.

- March 2022: Johnson Tile's collaboration with the material lab for the Tile Trace Trend & Format Forum highlights the focus on understanding and responding to evolving interior design trends, ensuring product relevance and market competitiveness.

Future Outlook for Europe Ceramic Tiles Market Market

The Europe ceramic tiles market is poised for continued growth, driven by ongoing construction activity, innovation in product design and functionality (e.g., increased durability and sustainability), and a strengthening focus on large-format tiles. Strategic partnerships, mergers and acquisitions, and a greater emphasis on sustainable manufacturing practices will play vital roles in shaping the market's future. The market shows considerable potential for expansion in the coming years, with opportunities for both established players and new entrants.

Europe Ceramic Tiles Market Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Product Types

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential

- 4.2. Commercial

Europe Ceramic Tiles Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

Europe Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Italy is the Major Exporter of Ceramic Tiles in Europe Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Germany

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Russia

- 5.5.6. Belgium

- 5.5.7. Poland

- 5.5.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Other Tiles

- 11.3. Market Analysis, Insights and Forecast - by Construction Type

- 11.3.1. New Construction

- 11.3.2. Replacement & Renovation

- 11.4. Market Analysis, Insights and Forecast - by End-User Type

- 11.4.1. Residential

- 11.4.2. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Glazed

- 12.1.2. Porcelain

- 12.1.3. Scratch Free

- 12.1.4. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Floor Tiles

- 12.2.2. Wall Tiles

- 12.2.3. Other Tiles

- 12.3. Market Analysis, Insights and Forecast - by Construction Type

- 12.3.1. New Construction

- 12.3.2. Replacement & Renovation

- 12.4. Market Analysis, Insights and Forecast - by End-User Type

- 12.4.1. Residential

- 12.4.2. Commercial

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Glazed

- 13.1.2. Porcelain

- 13.1.3. Scratch Free

- 13.1.4. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Floor Tiles

- 13.2.2. Wall Tiles

- 13.2.3. Other Tiles

- 13.3. Market Analysis, Insights and Forecast - by Construction Type

- 13.3.1. New Construction

- 13.3.2. Replacement & Renovation

- 13.4. Market Analysis, Insights and Forecast - by End-User Type

- 13.4.1. Residential

- 13.4.2. Commercial

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 15. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 16. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 17. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 18. Netherlands Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 19. Sweden Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 20. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2019-2031

- 21. Competitive Analysis

- 21.1. Market Share Analysis 2024

- 21.2. Company Profiles

- 21.2.1 Crossville Inc

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Grupo Lamsoa

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 RAK Ceramics

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 Saloni Ceramic SA

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 Gruppo Ceramiche Ricchetti SpA

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 Porcelanosa Group

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.7 NITCO

- 21.2.7.1. Overview

- 21.2.7.2. Products

- 21.2.7.3. SWOT Analysis

- 21.2.7.4. Recent Developments

- 21.2.7.5. Financials (Based on Availability)

- 21.2.8 Atlas Concorde S P A

- 21.2.8.1. Overview

- 21.2.8.2. Products

- 21.2.8.3. SWOT Analysis

- 21.2.8.4. Recent Developments

- 21.2.8.5. Financials (Based on Availability)

- 21.2.9 Johnson Tiles

- 21.2.9.1. Overview

- 21.2.9.2. Products

- 21.2.9.3. SWOT Analysis

- 21.2.9.4. Recent Developments

- 21.2.9.5. Financials (Based on Availability)

- 21.2.10 Mohawk Industries Inc

- 21.2.10.1. Overview

- 21.2.10.2. Products

- 21.2.10.3. SWOT Analysis

- 21.2.10.4. Recent Developments

- 21.2.10.5. Financials (Based on Availability)

- 21.2.11 Siam Cement Group

- 21.2.11.1. Overview

- 21.2.11.2. Products

- 21.2.11.3. SWOT Analysis

- 21.2.11.4. Recent Developments

- 21.2.11.5. Financials (Based on Availability)

- 21.2.12 Centura Tile Inc **List Not Exhaustive

- 21.2.12.1. Overview

- 21.2.12.2. Products

- 21.2.12.3. SWOT Analysis

- 21.2.12.4. Recent Developments

- 21.2.12.5. Financials (Based on Availability)

- 21.2.13 Blackstone Industrial (Foshan) Ltd

- 21.2.13.1. Overview

- 21.2.13.2. Products

- 21.2.13.3. SWOT Analysis

- 21.2.13.4. Recent Developments

- 21.2.13.5. Financials (Based on Availability)

- 21.2.14 China Ceramics Co Ltd

- 21.2.14.1. Overview

- 21.2.14.2. Products

- 21.2.14.3. SWOT Analysis

- 21.2.14.4. Recent Developments

- 21.2.14.5. Financials (Based on Availability)

- 21.2.1 Crossville Inc

List of Figures

- Figure 1: Europe Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Ceramic Tiles Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 5: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 6: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Ceramic Tiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 18: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 19: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 23: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 24: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 28: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 29: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 33: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 34: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 38: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 39: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 41: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 43: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 44: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 46: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 48: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 49: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 51: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 53: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 54: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ceramic Tiles Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Europe Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc **List Not Exhaustive, Blackstone Industrial (Foshan) Ltd, China Ceramics Co Ltd.

3. What are the main segments of the Europe Ceramic Tiles Market?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Italy is the Major Exporter of Ceramic Tiles in Europe Region.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, The Atlas Concorde product system and a stylish assortment of surfaces are both inside to help customers design finished coordinated environments. Large slabs, kitchen counters, tables, and accessories, as well as sinks and bathroom fixtures, are all design elements that can broaden the design options for any intended application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Europe Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence