Key Insights

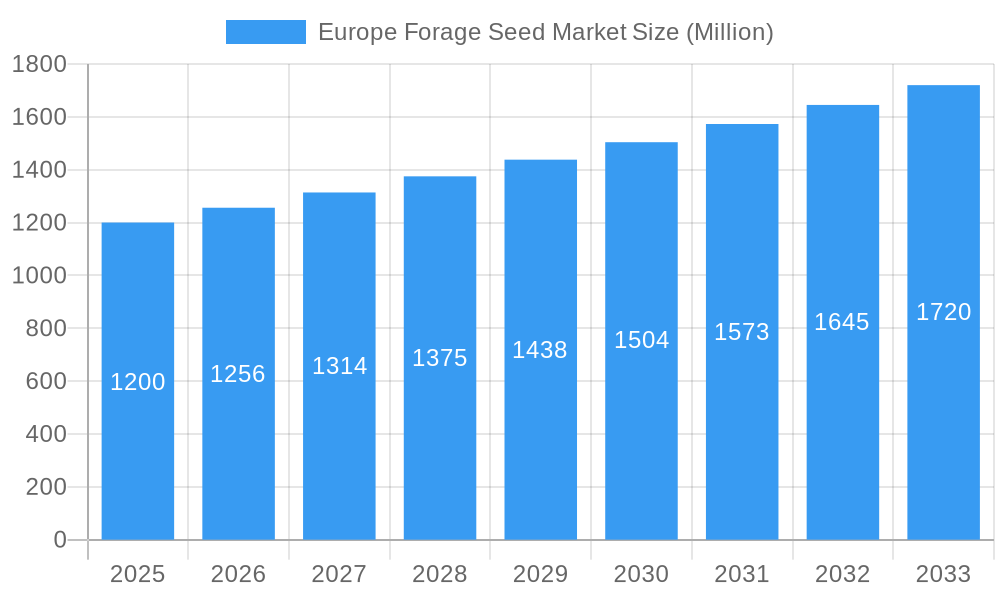

The European forage seed market, valued at approximately €1.32 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.94% from 2025 to 2033. This growth is primarily attributed to increasing demand for high-quality animal feed, driven by a growing global population and rising meat consumption. Advancements in breeding technologies, including hybrid and non-transgenic varieties, are enhancing crop productivity and resilience, further stimulating market expansion. Key forage crops like alfalfa, forage corn, and forage sorghum are experiencing significant demand due to their nutritional value and adaptability. Supportive government policies for sustainable agriculture positively impact the market, though challenges such as unpredictable weather patterns and rising production costs may present short-term limitations. Geographically, Germany, France, and the UK are major consumer markets, with Eastern European countries showing significant growth potential. Leading companies like DLF and Bayer AG are investing in R&D to improve seed quality and introduce innovative products.

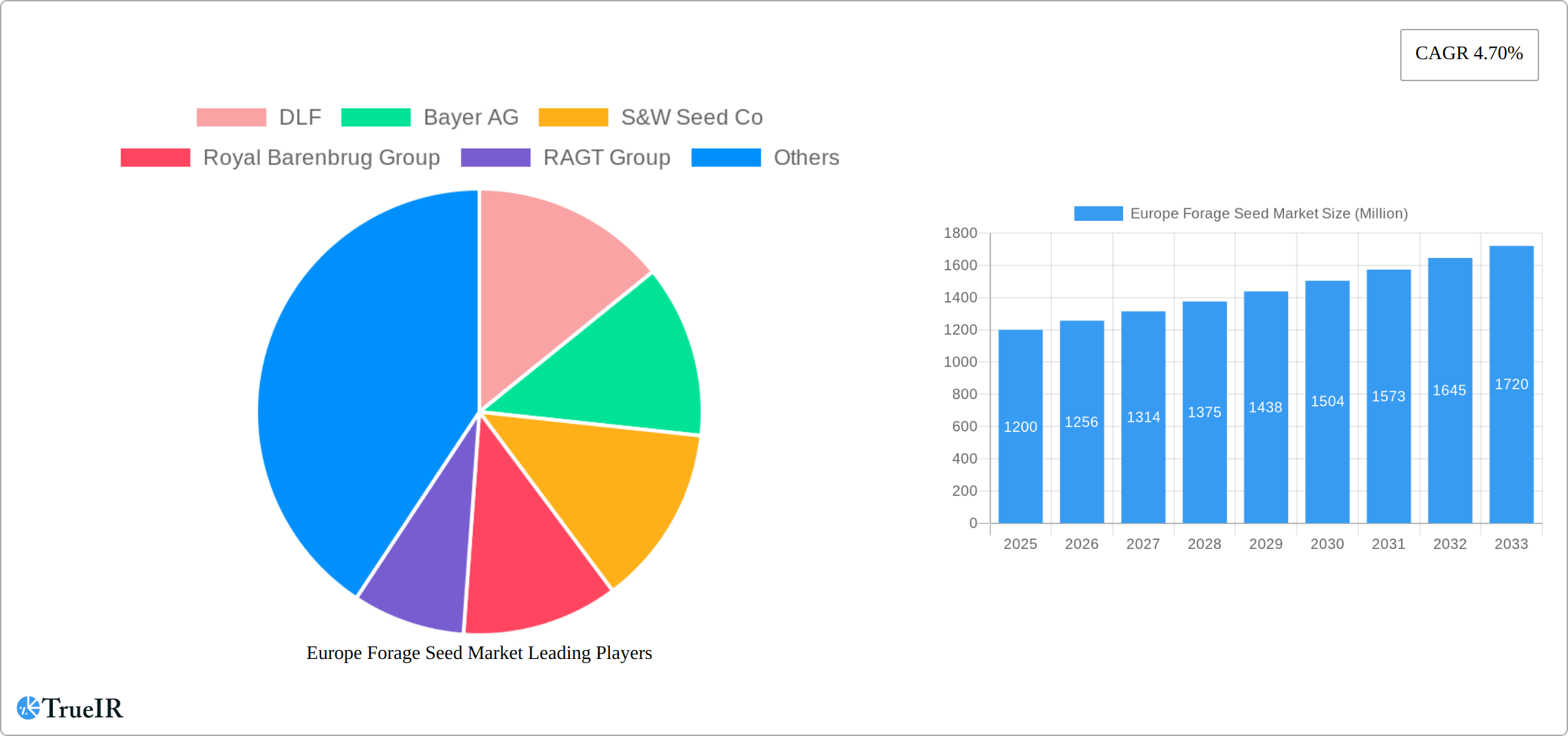

Europe Forage Seed Market Market Size (In Billion)

The competitive landscape features both established multinational corporations and regional players actively pursuing market share through strategic acquisitions, market expansion, and the development of superior seed varieties. A notable trend is the growing demand for seeds that promote soil health and reduce environmental impact, aligning with the shift towards sustainable agricultural practices. This trend is expected to drive further innovation and R&D investment in the forage seed sector, contributing to long-term market growth. The forecast period (2025-2033) anticipates sustained growth driven by technological advancements, sustainable practices, and regional variations in demand influenced by climate and agricultural methods.

Europe Forage Seed Market Company Market Share

Europe Forage Seed Market: Comprehensive Analysis (2025-2033)

This report offers a comprehensive analysis of the European forage seed market, providing critical insights for industry stakeholders. Utilizing extensive data from the historical period (2019-2024) and projecting to 2033, with a base year of 2025, this report meticulously examines market size, growth trends, competitive dynamics, and future opportunities. Key players including DLF, Bayer AG, and S&W Seed Co. are profiled, alongside a detailed segmentation analysis across crop types, breeding technologies, and geographic regions. This report is essential for strategic decision-making in the European forage seed industry.

Europe Forage Seed Market Structure & Competitive Landscape

The European forage seed market exhibits a moderately concentrated structure, with a few major players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, suggesting a moderately competitive landscape. However, this concentration is challenged by the presence of numerous smaller regional players and the constant emergence of innovative technologies. The market is characterized by significant M&A activity, highlighted by recent acquisitions such as Barenbrug's acquisition of Watson Group in March 2023 and S&W Seed's acquisition of DuPont's Pioneer Alfalfa seed business in December 2022. These activities reflect a push for consolidation and expansion within the sector.

- Market Concentration: The HHI for 2024 is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in breeding technologies (hybrids, non-transgenic hybrids, open-pollinated varieties) are driving market growth.

- Regulatory Impacts: EU regulations concerning GMOs and seed certification significantly influence market dynamics.

- Product Substitutes: Limited direct substitutes exist, but alternative forage options and feed sources create indirect competition.

- End-User Segmentation: The market caters primarily to large-scale agricultural businesses, with a growing segment of smaller, specialized farms.

- M&A Trends: A significant increase in M&A activity, with xx major transactions recorded between 2019 and 2024, signaling consolidation and expansion efforts by key players.

Europe Forage Seed Market Market Trends & Opportunities

The European forage seed market is experiencing robust growth, driven by several key factors. Market forecasts indicate substantial expansion, with the market size projected to reach [Insert Updated Market Size in Millions] by 2033 from [Insert Updated Market Size in Millions] in 2024, representing a CAGR of [Insert Updated CAGR]% during the forecast period (2025-2033). This growth is fueled by the increasing demand for high-yielding, disease-resistant, and climate-resilient forage varieties. The burgeoning adoption of sustainable agricultural practices, coupled with supportive government initiatives promoting livestock farming and environmentally conscious agriculture, creates significant opportunities for market expansion. Technological advancements in breeding technologies (such as gene editing and marker-assisted selection) and precision agriculture are further enhancing market potential. The rise of organic farming and consumer demand for sustainably produced livestock products are also driving demand for organic and non-GMO forage seed varieties. Competitive dynamics are complex, shaped by continuous innovation, strategic mergers and acquisitions, and the development of novel seed traits tailored to specific regional needs and diverse climate conditions across Europe. Market penetration rates for high-yield hybrid varieties are steadily increasing, demonstrating the ongoing adoption of advanced seed technologies and their proven benefits to farmers.

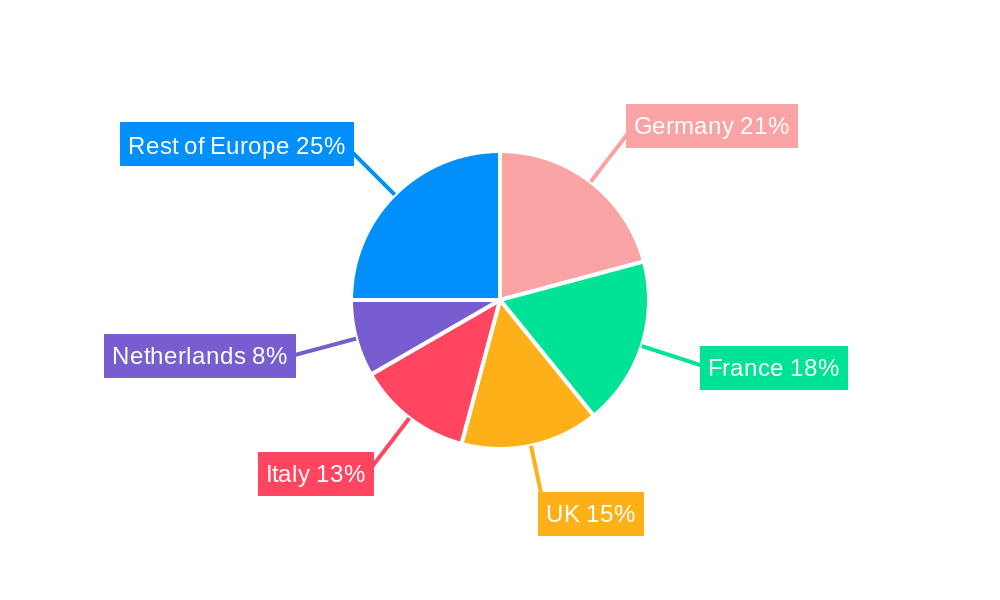

Dominant Markets & Segments in Europe Forage Seed Market

While the entire European market displays significant growth potential, certain segments and regions exhibit particularly robust expansion.

- Key National Markets: France, Germany, and the United Kingdom remain the largest national markets, driven by extensive livestock farming, substantial agricultural land, and established agricultural infrastructure. However, growth is also evident in other countries with increasing livestock production and favorable agricultural conditions.

- Principal Forage Crops: Alfalfa and forage corn continue to dominate the market in terms of volume, followed by forage sorghum and other specialized forage crops. The demand for alfalfa remains strong due to its high nutritional value for dairy cattle, while forage corn plays a crucial role in livestock feed rations. However, the market is also seeing increased diversification into other forage species to improve diet quality and resilience to climate change.

- Leading Seed Technologies: Hybrid varieties maintain their leading position, accounting for [Insert Updated Market Share]% of the market in 2024, due to their superior yield and quality compared to open-pollinated varieties. However, the increasing interest in organic and sustainable farming is driving demand for improved open-pollinated varieties as well.

- Key Growth Catalysts:

- Increased livestock production across Europe, driven by both population growth and evolving dietary habits.

- Government subsidies and agricultural policies promoting sustainable farming practices and climate-resilient agriculture.

- Significant investments in agricultural research and development focused on improving seed varieties and optimizing agricultural practices.

- Growing adoption of precision agriculture techniques, enabling optimized resource use and improved yields.

- Rising consumer awareness of sustainable food production and demand for ethically and sustainably sourced animal products.

The dominance of specific segments and countries is attributable to a complex interplay of factors, including favorable climatic conditions, existing agricultural infrastructure, supportive government policies, and market access. These interconnected elements are expected to continue shaping market dynamics throughout the forecast period.

Europe Forage Seed Market Product Analysis

The market demonstrates continuous product innovation, with a strong focus on developing hybrid varieties exhibiting enhanced traits such as higher yields, improved disease resistance, enhanced nutritional value for livestock, and improved stress tolerance (drought, heat, etc.). Furthermore, there is a significant and growing demand for herbicide-tolerant and non-GMO varieties catering to the expanding organic and sustainable farming sectors. These advancements provide distinct competitive advantages to seed producers, ensuring market relevance and strong demand among farmers who prioritize cost-effectiveness, environmental sustainability, and improved livestock performance. The ongoing introduction of new forage seed varieties with improved traits exemplifies the market's focus on optimizing crop performance and farmer profitability.

Key Drivers, Barriers & Challenges in Europe Forage Seed Market

Key Drivers: Technological advancements in seed breeding, increasing demand for high-yielding forage crops driven by the expanding livestock industry, and supportive government policies promoting sustainable agriculture are key drivers. The growing awareness of climate change and the need for climate-resilient crops further propel market growth.

Challenges: Stringent regulations surrounding GMOs, supply chain disruptions due to geopolitical uncertainties and climate change (leading to xx% reduction in yields in certain regions in 2024), and intense competition from established players are major challenges. Price volatility of raw materials used in seed production and the complexities of managing diverse regional regulations across Europe further complicate the market.

Growth Drivers in the Europe Forage Seed Market Market

Growth is primarily driven by technological advancements in breeding leading to improved yields and disease resistance. Increasing demand from the livestock sector for high-quality forage also fuels expansion. Supportive government policies and research investments contribute to market growth.

Challenges Impacting Europe Forage Seed Market Growth

Regulatory hurdles related to GMOs and seed certification create significant barriers. Supply chain vulnerabilities due to weather events and global instability impact seed availability and pricing. Intense competition among established players necessitates constant innovation and efficient resource management.

Key Players Shaping the Europe Forage Seed Market Market

- DLF

- Bayer AG

- S&W Seed Co

- Royal Barenbrug Group

- RAGT Group

- Groupe Limagrain

- Euralis Semences

- InVivo

- KWS SAAT SE & Co KGaA

- Advanta Seeds - UPL

Significant Europe Forage Seed Market Industry Milestones

- July 2021: Alta Seeds (Advanta Seeds) launched herbicide-tolerant non-GMO forage sorghum seeds ("ADV F848IG").

- December 2022: S&W Seed Company acquired DuPont's Pioneer Alfalfa seed business for USD 42 Million, significantly expanding its alfalfa variety portfolio and market presence.

- March 2023: Barenbrug acquired the UK seed specialist Watson Group, strengthening its position in the UK grass seed market and expanding its reach within the broader European market.

- [Add other relevant milestones here, with dates and brief descriptions]

Future Outlook for Europe Forage Seed Market Market

The future outlook for the European forage seed market remains exceptionally positive, driven by sustained technological innovation, the ever-increasing demand for high-quality and climate-resilient forage, and supportive government policies promoting sustainable agricultural practices. Strategic opportunities abound in developing climate-resilient varieties tailored to specific regional conditions, expanding into the rapidly growing organic and sustainable farming segments, and leveraging the potential of advanced precision agriculture technologies. The market's growth potential is considerable, presenting significant opportunities for companies to capitalize on the increasing demand for efficient, sustainable, and profitable agricultural practices. Further market growth will likely depend on navigating evolving regulatory landscapes, fostering innovation in seed breeding, and meeting the demands of a rapidly changing climate.

Europe Forage Seed Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Forage Seed Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Forage Seed Market Regional Market Share

Geographic Coverage of Europe Forage Seed Market

Europe Forage Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Forage Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DLF

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 S&W Seed Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Barenbrug Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RAGT Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupe Limagrain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Euralis Semences

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 InVivo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KWS SAAT SE & Co KGaA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Advanta Seeds - UPL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DLF

List of Figures

- Figure 1: Europe Forage Seed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Forage Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Forage Seed Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Forage Seed Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Europe Forage Seed Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Europe Forage Seed Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Europe Forage Seed Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Europe Forage Seed Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Europe Forage Seed Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Europe Forage Seed Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Europe Forage Seed Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Europe Forage Seed Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Europe Forage Seed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Europe Forage Seed Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Europe Forage Seed Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Europe Forage Seed Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Europe Forage Seed Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Europe Forage Seed Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Europe Forage Seed Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Europe Forage Seed Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Europe Forage Seed Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Europe Forage Seed Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Europe Forage Seed Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Europe Forage Seed Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Europe Forage Seed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Forage Seed Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: France Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Forage Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Forage Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Forage Seed Market?

The projected CAGR is approximately 3.94%.

2. Which companies are prominent players in the Europe Forage Seed Market?

Key companies in the market include DLF, Bayer AG, S&W Seed Co, Royal Barenbrug Group, RAGT Group, Groupe Limagrain, Euralis Semences, InVivo, KWS SAAT SE & Co KGaA, Advanta Seeds - UPL.

3. What are the main segments of the Europe Forage Seed Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

March 2023: Barenbrug entered an agreement to acquire the UK seed specialist Watson Group, which is expected to enable Barenbrug to continue growing in the grass-seed marketplace in the United Kingdom.December 2022: S&W Seed acquired DuPont’s Pioneer Alfalfa seed business for USD 42 million. As part of the acquisition, S&W will acquire more than 15 DuPont Pioneer alfalfa seed varieties in the market today and more than 60 varieties in the development pipeline.July 2021: Alta Seeds, a subsidiary of Advanta Seeds, introduced new herbicide-tolerant non-GMO forage sorghum seeds, "ADV F848IG," into the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Forage Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Forage Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Forage Seed Market?

To stay informed about further developments, trends, and reports in the Europe Forage Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence