Key Insights

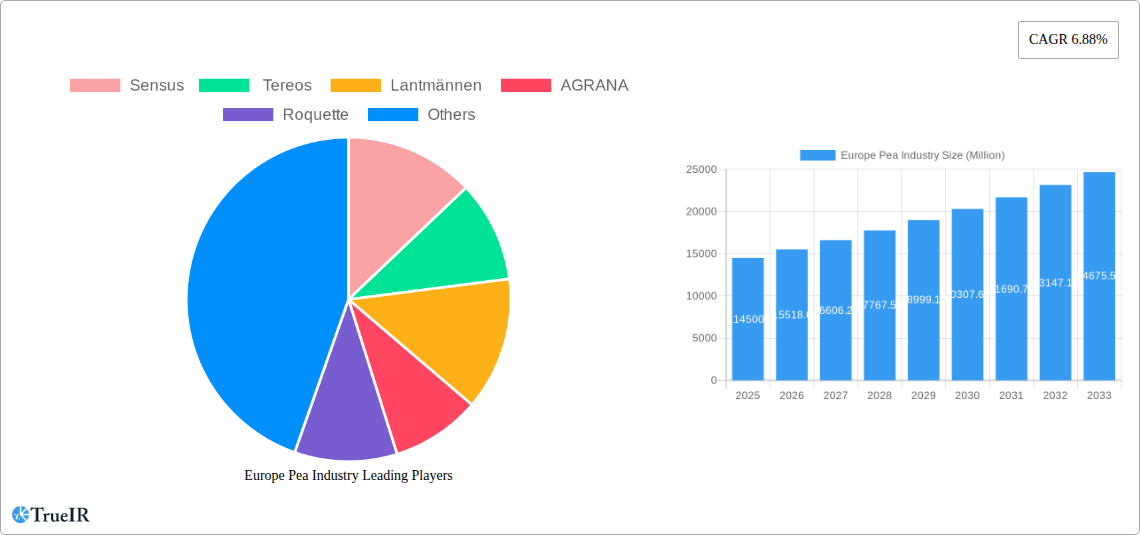

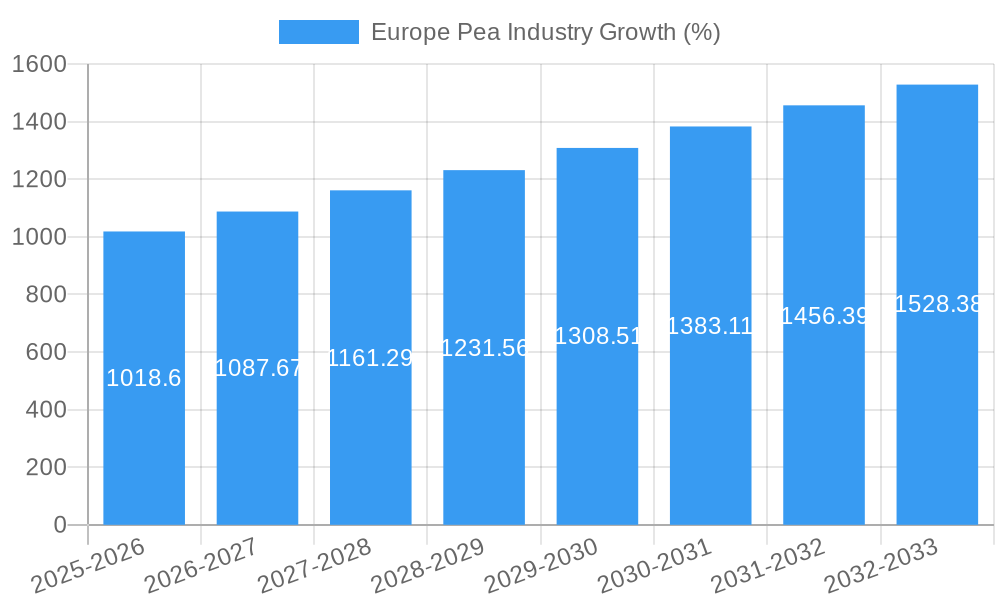

The European pea industry, valued at €14.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.88% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing consumer demand for plant-based proteins fuels the rising popularity of peas as a sustainable and nutritious alternative to meat. This trend is particularly pronounced in health-conscious segments of the population, leading to increased pea consumption in various food applications, including plant-based meat alternatives, protein powders, and snacks. Secondly, the European Union's emphasis on sustainable agriculture and the growing awareness of the environmental benefits of pea cultivation are contributing to increased production. Peas require less water and fertilizer than many other protein crops, making them an attractive option for environmentally conscious farmers. Furthermore, government initiatives promoting sustainable farming practices and supporting the development of pea-based products are bolstering industry growth. However, challenges remain. Fluctuations in agricultural yields due to climate change and potential supply chain disruptions could impact market stability.

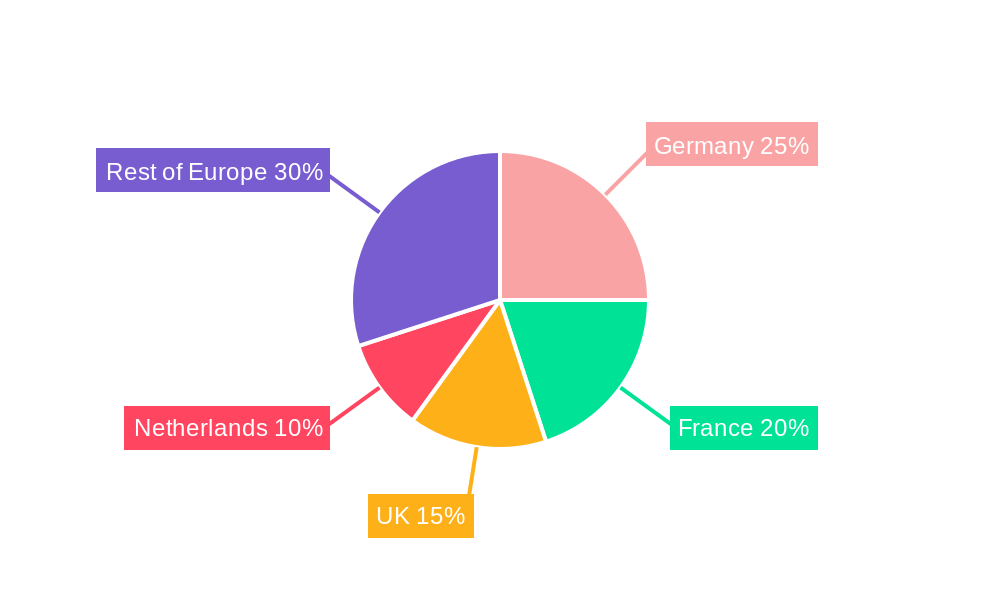

Regional variations within Europe are significant. Germany, France, and the United Kingdom are major players, accounting for a considerable portion of the overall market share. However, smaller countries like the Netherlands and Sweden are also exhibiting significant growth potential due to their advanced agricultural technologies and adoption of sustainable farming practices. Competitive dynamics within the industry are shaped by key players like Sensus, Tereos, Lantmännen, AGRANA, and Roquette, who are constantly innovating to expand their product portfolios and improve production efficiency. The ongoing research and development efforts focusing on developing high-yield pea varieties and improving processing technologies will further propel the growth trajectory of the European pea industry in the coming years. Price trends are influenced by global supply and demand factors, with variations observed across countries like Ukraine, France, Spain, and the Netherlands, reflecting local market conditions and production capacity.

Europe Pea Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European pea industry, encompassing market size, trends, competitive landscape, and future outlook from 2019 to 2033. With a focus on key players like Sensus, Tereos, Lantmännen, AGRANA, and Roquette, this report is essential for businesses seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages extensive data analysis and incorporates recent industry developments to provide actionable insights for strategic decision-making. Download now for a complete understanding of the European pea market.

Europe Pea Industry Market Structure & Competitive Landscape

The European pea industry exhibits a moderately concentrated market structure, with several large players dominating production and processing. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a somewhat consolidated market. Innovation is driven primarily by the increasing demand for plant-based proteins and the development of new pea-derived ingredients, alongside regulatory pressures promoting sustainable agriculture. Key product substitutes include other legumes (soybeans, lentils) and alternative protein sources. End-user segmentation includes food manufacturers, animal feed producers, and the growing nutraceutical sector. M&A activity in the sector has been moderate over the past five years, with approximately xx deals completed, primarily involving smaller companies being acquired by larger players.

- Market Concentration: HHI (2024) estimated at xx.

- Innovation Drivers: Plant-based protein demand, new ingredient development, sustainable agriculture regulations.

- Regulatory Impacts: Growing emphasis on traceability, sustainability certifications, and food safety regulations.

- Product Substitutes: Soybeans, lentils, other plant-based proteins.

- End-User Segmentation: Food manufacturers (xx%), Animal Feed (xx%), Nutraceuticals (xx%).

- M&A Trends: Approximately xx deals completed (2019-2024).

Europe Pea Industry Market Trends & Opportunities

The European pea industry is experiencing robust growth, driven by increasing consumer demand for plant-based foods and a rising awareness of the health benefits associated with pea protein and other pea-derived ingredients. The market size reached approximately €xx Million in 2024 and is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching €xx Million by 2033. This growth is fueled by technological advancements in pea processing, leading to improved product quality and efficiency. Consumer preferences are shifting towards healthier, sustainable, and ethically sourced food products, further bolstering the demand for peas. Competitive dynamics are characterized by ongoing innovation, product diversification, and strategic partnerships among key players. Market penetration of pea-based products in various food categories continues to increase, indicating significant growth potential.

Dominant Markets & Segments in Europe Pea Industry

France, followed by Spain and the Netherlands, represent the leading pea-producing and consuming regions in Europe. Russia also holds significant importance due to its substantial production volumes.

Russia: Production Analysis:

- Pea production in Russia accounts for xx Million tonnes annually, contributing significantly to the overall European production.

- Key growth drivers include government support for agriculture and favorable climatic conditions in certain regions.

Price Trend Analysis:

- Ukraine: Prices experienced significant volatility in recent years, influenced by geopolitical factors and harvest yields.

- France: Prices are relatively stable, influenced by domestic production levels and export demand.

- Spain: Similar to France, prices are moderately stable.

- Netherlands: A relatively high-value market, reflecting specialized processing and higher-quality pea production.

- Rest of Europe: Prices vary according to regional production and demand dynamics.

Europe Pea Industry Product Analysis

The European pea industry offers a diverse range of products including whole peas, split peas, pea flour, pea protein isolates, pea starch, and pea fiber. Technological advancements in processing techniques have led to the development of high-quality, functional ingredients tailored to various food applications. These innovations enhance the taste, texture, and nutritional profile of pea-based products, improving their market appeal and widening their applications in foods ranging from meat alternatives and dairy substitutes to snacks and baked goods. The market is witnessing the emergence of innovative pea-based ingredients, such as textured pea protein, designed to meet the demands of both food manufacturers and consumers.

Key Drivers, Barriers & Challenges in Europe Pea Industry

Key Drivers:

- Growing demand for plant-based proteins.

- Increasing consumer health awareness.

- Technological advancements in pea processing.

- Government support for sustainable agriculture.

Challenges:

- Fluctuations in raw material prices due to weather patterns and global supply chain disruptions. This results in an estimated xx% price volatility annually.

- Competition from other protein sources.

- Regulatory complexities surrounding food labeling and ingredient approvals.

- Ensuring consistent product quality and meeting increasing consumer demand.

Growth Drivers in the Europe Pea Industry Market

The European pea industry’s growth is driven by consumer preference shifts towards plant-based diets, technological improvements in pea processing resulting in higher-quality ingredients, and supportive government policies promoting sustainable agriculture. The rising awareness of the health benefits of pea protein is another significant factor propelling market expansion.

Challenges Impacting Europe Pea Industry Growth

Challenges include fluctuating raw material prices, stiff competition from established protein sources like soy and dairy, and regulatory complexities impacting ingredient approvals and labeling. Supply chain disruptions also pose a major challenge to consistent production and distribution.

Key Players Shaping the Europe Pea Industry Market

Significant Europe Pea Industry Industry Milestones

- May 2022: China and Russia signed a phytosanitary protocol for peas, increasing competition for Canadian exports.

- September 2022: Lantmännen invested over USD 95.7 Million in a new pea protein production facility in Sweden (completion expected in early 2026).

- October 2022: Roquette launched a new line of organic pea ingredients (starch and protein) in the European market.

Future Outlook for Europe Pea Industry Market

The European pea industry is poised for continued growth, driven by sustained demand for plant-based proteins and technological advancements leading to more innovative and cost-effective production methods. Strategic partnerships and investments in research and development will be critical for companies to maintain a competitive edge. The market anticipates strong growth in the coming decade, especially in niche segments like organic and specialty pea ingredients.

Europe Pea Industry Segmentation

-

1. Russia

-

1.1. Production Analysis

- 1.1.1. Consumption Analysis and Market Value

- 1.1.2. Import Market Analysis (Volume and Value)

- 1.1.3. Export Market Analysis (Volume and Value)

- 1.1.4. Price Trend Analysis

- 1.2. Ukraine

- 1.3. France

- 1.4. Spain

- 1.5. Netherlands

- 1.6. Rest of Europe

-

1.1. Production Analysis

-

2. Russia

-

2.1. Production Analysis

- 2.1.1. Consumption Analysis and Market Value

- 2.1.2. Import Market Analysis (Volume and Value)

- 2.1.3. Export Market Analysis (Volume and Value)

- 2.1.4. Price Trend Analysis

- 2.2. Ukraine

- 2.3. France

- 2.4. Spain

- 2.5. Netherlands

- 2.6. Rest of Europe

-

2.1. Production Analysis

Europe Pea Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pea Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Growing Export Opportunity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Russia

- 5.1.1. Production Analysis

- 5.1.1.1. Consumption Analysis and Market Value

- 5.1.1.2. Import Market Analysis (Volume and Value)

- 5.1.1.3. Export Market Analysis (Volume and Value)

- 5.1.1.4. Price Trend Analysis

- 5.1.2. Ukraine

- 5.1.3. France

- 5.1.4. Spain

- 5.1.5. Netherlands

- 5.1.6. Rest of Europe

- 5.1.1. Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Russia

- 5.2.1. Production Analysis

- 5.2.1.1. Consumption Analysis and Market Value

- 5.2.1.2. Import Market Analysis (Volume and Value)

- 5.2.1.3. Export Market Analysis (Volume and Value)

- 5.2.1.4. Price Trend Analysis

- 5.2.2. Ukraine

- 5.2.3. France

- 5.2.4. Spain

- 5.2.5. Netherlands

- 5.2.6. Rest of Europe

- 5.2.1. Production Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Russia

- 6. Germany Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Pea Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Sensus

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tereos

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lantmännen

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AGRANA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Roquette

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 Sensus

List of Figures

- Figure 1: Europe Pea Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pea Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Pea Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pea Industry Volume million units Forecast, by Region 2019 & 2032

- Table 3: Europe Pea Industry Revenue Million Forecast, by Russia 2019 & 2032

- Table 4: Europe Pea Industry Volume million units Forecast, by Russia 2019 & 2032

- Table 5: Europe Pea Industry Revenue Million Forecast, by Russia 2019 & 2032

- Table 6: Europe Pea Industry Volume million units Forecast, by Russia 2019 & 2032

- Table 7: Europe Pea Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Pea Industry Volume million units Forecast, by Region 2019 & 2032

- Table 9: Europe Pea Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Pea Industry Volume million units Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 13: France Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 25: Europe Pea Industry Revenue Million Forecast, by Russia 2019 & 2032

- Table 26: Europe Pea Industry Volume million units Forecast, by Russia 2019 & 2032

- Table 27: Europe Pea Industry Revenue Million Forecast, by Russia 2019 & 2032

- Table 28: Europe Pea Industry Volume million units Forecast, by Russia 2019 & 2032

- Table 29: Europe Pea Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Pea Industry Volume million units Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 35: France Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Pea Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Pea Industry Volume (million units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pea Industry?

The projected CAGR is approximately 6.88%.

2. Which companies are prominent players in the Europe Pea Industry?

Key companies in the market include Sensus, Tereos , Lantmännen , AGRANA, Roquette .

3. What are the main segments of the Europe Pea Industry?

The market segments include Russia, Russia.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Growing Export Opportunity.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

October 2022: Roquette, a global leader in plant-based ingredients and a pioneer of plant proteins, launched a new line of organic pea ingredients: organic pea starch and organic pea protein to the Europe market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in million units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pea Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pea Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pea Industry?

To stay informed about further developments, trends, and reports in the Europe Pea Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence