Key Insights

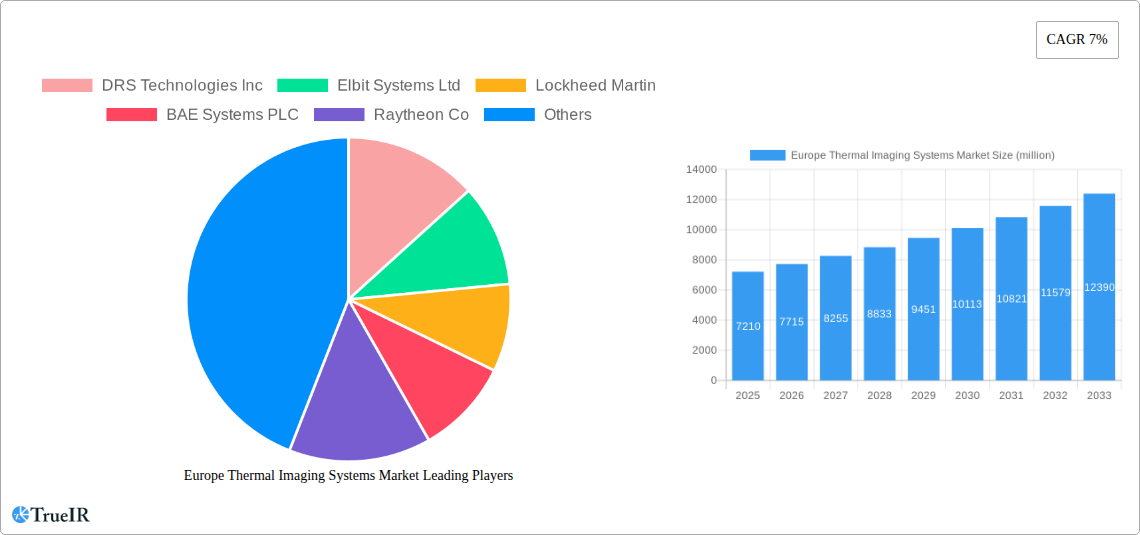

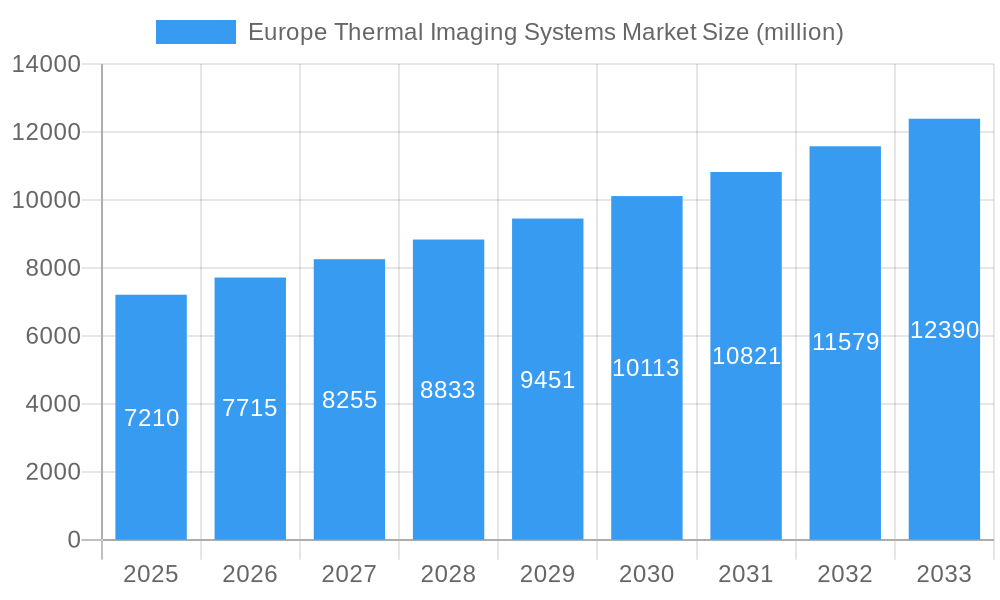

The Europe Thermal Imaging Systems Market is poised for significant expansion, projected to reach an estimated $7,210 million in 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7%, indicating sustained and healthy market development throughout the forecast period of 2025-2033. A primary driver for this expansion is the increasing adoption of thermal imaging technology across various sectors, driven by its inherent capabilities in non-contact temperature measurement, detection of subtle anomalies, and enhanced visibility in challenging environmental conditions. The security and surveillance segment, in particular, is a major contributor, fueled by rising security concerns and the need for advanced monitoring solutions in public spaces, critical infrastructure, and border control. Furthermore, the growing emphasis on predictive maintenance and operational efficiency in industries like oil and gas and manufacturing is also propelling demand for thermal imaging systems.

Europe Thermal Imaging Systems Market Market Size (In Billion)

The market's diverse application spectrum is further bolstered by advancements in hardware, software, and services, with a notable demand for sophisticated fixed and handheld thermal cameras. In the end-user landscape, the aerospace and defense sector continues to be a dominant force, leveraging thermal imaging for target acquisition, reconnaissance, and situational awareness. The automotive industry's increasing integration of thermal cameras for advanced driver-assistance systems (ADAS) and enhanced night vision is another key growth avenue. While the market exhibits strong upward momentum, potential restraints such as high initial investment costs for advanced systems and the need for specialized training for operators could present some challenges. However, ongoing technological innovations and increasing cost-effectiveness are expected to mitigate these factors, ensuring continued market vitality.

Europe Thermal Imaging Systems Market Company Market Share

This in-depth report delivers a dynamic, SEO-optimized analysis of the Europe Thermal Imaging Systems Market, leveraging high-volume keywords to enhance search rankings and provide actionable insights for industry stakeholders. The study covers the period from 2019 to 2033, with a base year of 2025, offering a robust forecast for the coming decade. Gain unparalleled understanding of market size, growth trends, competitive landscape, and emerging opportunities within this critical sector.

Europe Thermal Imaging Systems Market Market Structure & Competitive Landscape

The Europe Thermal Imaging Systems Market is characterized by a moderately concentrated structure, with a few key players dominating market share. Innovation is a primary driver, fueled by continuous advancements in sensor technology, AI integration for enhanced image analysis, and miniaturization of devices. Regulatory impacts are significant, particularly concerning data privacy and security in surveillance applications, as well as evolving standards for automotive safety systems. Product substitutes, while present in niche areas, are largely unable to replicate the unique capabilities of thermal imaging for non-contact temperature measurement and heat detection. End-user segmentation reveals a strong reliance on the aerospace and defense sector, with automotive and industrial monitoring applications showing robust growth potential. Mergers and acquisitions (M&A) activity has been moderate, with companies strategically acquiring smaller innovators to expand their product portfolios and technological expertise. The market's concentration is estimated to be around 60-65%, with an average of 3-4 significant M&A deals annually over the historical period.

Europe Thermal Imaging Systems Market Market Trends & Opportunities

The Europe Thermal Imaging Systems Market is poised for substantial expansion, driven by an increasing adoption across diverse sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, culminating in an estimated market value exceeding €15,000 million by the end of the forecast period. This growth is underpinned by a confluence of technological advancements, evolving consumer preferences, and intensifying competitive dynamics. Key technological shifts include the development of higher resolution thermal sensors, improved image processing algorithms powered by artificial intelligence, and the integration of thermal imaging into more compact and affordable devices. This has broadened the applicability of thermal cameras beyond traditional military and industrial uses into sectors like automotive, healthcare, and smart building management.

Consumer preferences are increasingly leaning towards safety, efficiency, and predictive maintenance solutions. Thermal imaging systems offer a non-destructive and non-contact method for identifying potential issues before they escalate, thus driving demand in areas such as industrial inspections for electrical faults, mechanical wear, and pipeline integrity. In the automotive sector, thermal cameras are becoming integral for enhanced driver assistance systems (ADAS), improving visibility in adverse weather conditions and at night, thereby contributing to road safety and reducing accident rates. The healthcare industry is exploring thermal imaging for early disease detection, patient monitoring, and fever screening, further expanding the market's reach.

Competitive dynamics are characterized by fierce innovation and strategic partnerships. Leading companies are investing heavily in research and development to introduce more sophisticated and user-friendly thermal imaging solutions. The market penetration rate for advanced thermal imaging systems is still relatively low in many segments, presenting a significant opportunity for early adopters and innovative product launches. Opportunities also lie in developing specialized thermal imaging solutions tailored to specific industry needs, such as high-temperature monitoring for the oil and gas sector or low-light surveillance for security applications. The growing emphasis on energy efficiency and sustainability is also creating demand for thermal imaging in building diagnostics and industrial process optimization. The increasing demand for advanced security solutions, coupled with the growing sophistication of threats, is a major catalyst for the proliferation of thermal imaging systems in both public and private sectors. Furthermore, the integration of IoT capabilities with thermal imaging devices is opening up new avenues for remote monitoring and data analysis, driving further market expansion. The market is expected to see a steady increase in demand for both fixed and handheld thermal cameras, catering to a wide array of applications.

Dominant Markets & Segments in Europe Thermal Imaging Systems Market

The Europe Thermal Imaging Systems Market exhibits distinct regional and segment dominance, crucial for understanding growth trajectories. Geographically, Germany stands out as a leading market due to its robust industrial base, significant automotive sector, and strong investment in defense modernization. The United Kingdom and France are also key contributors, driven by their advanced aerospace and defense industries and increasing adoption of thermal imaging for security and infrastructure monitoring.

Solutions: The Hardware segment is currently the largest and most dominant, encompassing the thermal cameras themselves, sensors, and associated components. Its dominance is driven by the fundamental need for the imaging devices. However, the Software segment is experiencing the fastest growth, fueled by advancements in AI-powered analytics, image enhancement algorithms, and cloud-based data management solutions that unlock the full potential of thermal data. The Services segment, including installation, maintenance, and data analysis, is also gaining traction as organizations seek comprehensive solutions and specialized expertise.

Product Type: Fixed Thermal Cameras hold a significant market share, primarily due to their application in continuous monitoring and surveillance in industrial settings, critical infrastructure, and security systems. Handheld Thermal Cameras, while smaller in market share, are witnessing robust growth driven by their portability and versatility for field inspections, maintenance, and troubleshooting across various industries.

Application: Security and Surveillance remains the leading application, owing to the rising global security concerns, border control needs, and the demand for advanced threat detection. Monitoring and Inspection is a rapidly expanding application, encompassing predictive maintenance in industries like oil and gas, power generation, and manufacturing, as well as infrastructure inspection. Detection and Measurement applications are also crucial, particularly in scientific research, healthcare, and quality control processes.

End User: The Aerospace and Defense sector is a traditional stronghold, with thermal imaging vital for targeting, reconnaissance, and situational awareness. The Automotive sector is emerging as a significant growth driver, with increasing integration of thermal cameras for ADAS and autonomous driving functionalities. The Oil and Gas industry relies heavily on thermal imaging for pipeline monitoring, leak detection, and safety inspections in hazardous environments. The Healthcare and Life Sciences sector is showing increasing interest in thermal imaging for diagnostics, patient monitoring, and fever screening. Food and Beverages utilize thermal imaging for quality control and process monitoring.

Europe Thermal Imaging Systems Market Product Analysis

Europe's thermal imaging systems are characterized by rapid product innovation, focusing on enhanced resolution, miniaturization, and intelligent data analysis. Key advancements include the development of uncooled microbolometer sensors offering improved thermal sensitivity and faster response times. Integration of artificial intelligence and machine learning algorithms is enabling sophisticated image processing, automated anomaly detection, and predictive analytics for applications ranging from industrial predictive maintenance to enhanced driver assistance in automotive systems. The competitive advantage lies in offering ruggedized, user-friendly devices with seamless software integration for diverse end-user needs.

Key Drivers, Barriers & Challenges in Europe Thermal Imaging Systems Market

Key Drivers:

- Technological Advancements: Continuous innovation in sensor technology, AI integration, and miniaturization of thermal cameras.

- Increasing Security Concerns: Growing demand for advanced surveillance and threat detection solutions across public and private sectors.

- Focus on Predictive Maintenance: Adoption of thermal imaging for early detection of faults in industrial machinery, infrastructure, and critical assets, leading to cost savings and reduced downtime.

- Automotive Safety Enhancements: Integration of thermal cameras into vehicles for improved driver visibility, pedestrian detection, and autonomous driving capabilities.

- Energy Efficiency Initiatives: Use of thermal imaging for building diagnostics, identifying heat loss, and optimizing energy consumption.

Barriers & Challenges:

- High Initial Cost: The upfront investment for high-performance thermal imaging systems can be a deterrent for some small and medium-sized enterprises.

- Skilled Workforce Requirement: Effective utilization and interpretation of thermal imaging data often require trained personnel, leading to a skills gap in some regions.

- Data Interpretation Complexity: While software is advancing, complex thermal signatures can still require expert knowledge for accurate analysis and decision-making.

- Market Saturation in Niche Areas: Certain traditional applications, like basic industrial inspections, may experience increased competition and pricing pressures.

- Regulatory Hurdles: Evolving regulations concerning data privacy and cybersecurity for networked thermal imaging devices can pose challenges for deployment.

Growth Drivers in the Europe Thermal Imaging Systems Market Market

The Europe Thermal Imaging Systems Market is propelled by several key growth drivers. Technological innovation is paramount, with advancements in sensor sensitivity, resolution, and processing power enabling more accurate and versatile applications. The escalating demand for enhanced security and surveillance solutions, driven by both governmental and private sector needs, is a significant catalyst. Furthermore, the widespread adoption of predictive maintenance strategies across industries, from manufacturing to oil and gas, relies heavily on thermal imaging for early fault detection, thereby minimizing downtime and operational costs. The automotive sector's push towards advanced driver-assistance systems (ADAS) and autonomous driving is creating a substantial new market for thermal camera integration. Regulatory frameworks promoting energy efficiency and safety standards also indirectly fuel the demand for thermal imaging technologies.

Challenges Impacting Europe Thermal Imaging Systems Market Growth

Despite the positive growth outlook, several challenges impact the Europe Thermal Imaging Systems Market. The high initial cost of sophisticated thermal imaging equipment can be a barrier for small and medium-sized enterprises. The interpretation of complex thermal data often necessitates specialized training and expertise, contributing to a potential skills gap in certain regions. While improving, the market still faces competition from alternative technologies in specific applications. Supply chain disruptions, as evidenced by global events, can impact the availability and cost of critical components. Furthermore, evolving data privacy and cybersecurity regulations for connected devices present a complex landscape for manufacturers and end-users to navigate.

Key Players Shaping the Europe Thermal Imaging Systems Market Market

- DRS Technologies Inc

- Elbit Systems Ltd

- Lockheed Martin

- BAE Systems PLC

- Raytheon Co

- L-3 Communications Holdings

- Thermoteknix Systems Ltd

- Flir Systems Inc

- Sofradir Group

Significant Europe Thermal Imaging Systems Market Industry Milestones

- September 2022: Lynred, a developer of infrared detectors, collaborated with Umicore, a 'circular materials technology company,' for the co-development of novel thermal sensing technology aimed at significantly improving the performance of Pedestrian Autonomous Emergency Braking (PAEB) systems in adverse lighting conditions at an affordable cost.

- January 2022: Teledyne FLIR launched online developer support tools for Lepton thermal camera module integration. This initiative, developed in collaboration with engineers, provides an extensive suite of online resources to empower designers, developers, and engineers in creating next-generation devices and applications utilizing the Lepton module.

Future Outlook for Europe Thermal Imaging Systems Market Market

The future outlook for the Europe Thermal Imaging Systems Market is exceptionally positive, driven by sustained innovation and expanding applications. Continued advancements in sensor technology, coupled with the increasing integration of artificial intelligence for data analysis, will unlock new functionalities and drive adoption across a wider spectrum of industries. The growing emphasis on smart infrastructure, industrial automation, and enhanced safety and security measures will further bolster demand. Opportunities lie in developing more affordable and user-friendly thermal imaging solutions for the burgeoning automotive and healthcare sectors, alongside continued growth in established markets like aerospace and defense and oil and gas. The market is projected to witness a significant upward trajectory, with strategic investments in R&D and market penetration being key to capitalizing on future growth catalysts.

Europe Thermal Imaging Systems Market Segmentation

-

1. Solutions

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Product Type

- 2.1. Fixed Thermal Cameras

- 2.2. Handheld Thermal Cameras

-

3. Application

- 3.1. Security and Surveillance

- 3.2. Monitoring and Inspection

- 3.3. Detection and Measurement

-

4. End User

- 4.1. Aerospace and Defense

- 4.2. Automotive

- 4.3. Healthcare and Life Sciences

- 4.4. Oil and Gas

- 4.5. Food and Beverages

- 4.6. Other End Users

Europe Thermal Imaging Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

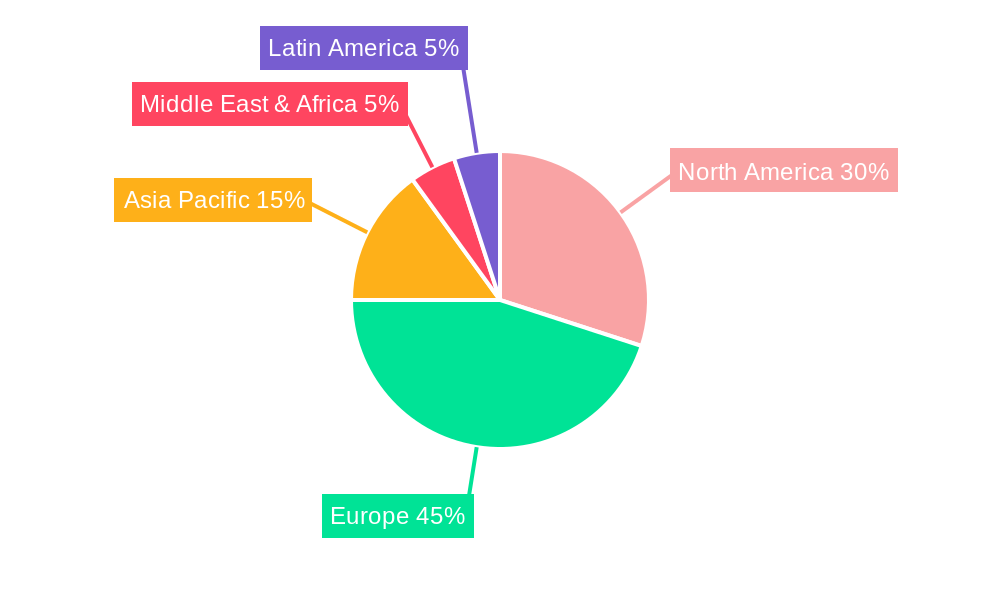

Europe Thermal Imaging Systems Market Regional Market Share

Geographic Coverage of Europe Thermal Imaging Systems Market

Europe Thermal Imaging Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Thermal Imaging is Becoming Increasingly Used in a Variety of Applications; Technological Upgradation in Thermal Imaging Systems

- 3.3. Market Restrains

- 3.3.1. ; Growth of E-commerce has Negatively Impacted the Market

- 3.4. Market Trends

- 3.4.1. Military and Defense Sector is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Thermal Imaging Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Fixed Thermal Cameras

- 5.2.2. Handheld Thermal Cameras

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Security and Surveillance

- 5.3.2. Monitoring and Inspection

- 5.3.3. Detection and Measurement

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Aerospace and Defense

- 5.4.2. Automotive

- 5.4.3. Healthcare and Life Sciences

- 5.4.4. Oil and Gas

- 5.4.5. Food and Beverages

- 5.4.6. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DRS Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elbit Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BAE Systems PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raytheon Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L-3 Communications Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thermoteknix Systems Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flir Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofradir Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 DRS Technologies Inc

List of Figures

- Figure 1: Europe Thermal Imaging Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Thermal Imaging Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Thermal Imaging Systems Market Revenue million Forecast, by Solutions 2020 & 2033

- Table 2: Europe Thermal Imaging Systems Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Europe Thermal Imaging Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe Thermal Imaging Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 5: Europe Thermal Imaging Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Thermal Imaging Systems Market Revenue million Forecast, by Solutions 2020 & 2033

- Table 7: Europe Thermal Imaging Systems Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Thermal Imaging Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 9: Europe Thermal Imaging Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Thermal Imaging Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Thermal Imaging Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Thermal Imaging Systems Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Europe Thermal Imaging Systems Market?

Key companies in the market include DRS Technologies Inc, Elbit Systems Ltd, Lockheed Martin, BAE Systems PLC, Raytheon Co, L-3 Communications Holdings, Thermoteknix Systems Ltd*List Not Exhaustive, Flir Systems Inc, Sofradir Group.

3. What are the main segments of the Europe Thermal Imaging Systems Market?

The market segments include Solutions, Product Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7210 million as of 2022.

5. What are some drivers contributing to market growth?

Thermal Imaging is Becoming Increasingly Used in a Variety of Applications; Technological Upgradation in Thermal Imaging Systems.

6. What are the notable trends driving market growth?

Military and Defense Sector is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; Growth of E-commerce has Negatively Impacted the Market.

8. Can you provide examples of recent developments in the market?

September 2022 - Lynred, a developer of infrared detectors, collaborated with Umicore, a 'circular materials technology company,' for the co-development of the novel thermal sensing technology. The company aims to significantly improve the performance of Pedestrian Autonomous Emergency Braking (PAEB) systems in adverse lighting conditions at an affordable cost.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Thermal Imaging Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Thermal Imaging Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Thermal Imaging Systems Market?

To stay informed about further developments, trends, and reports in the Europe Thermal Imaging Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence