Key Insights

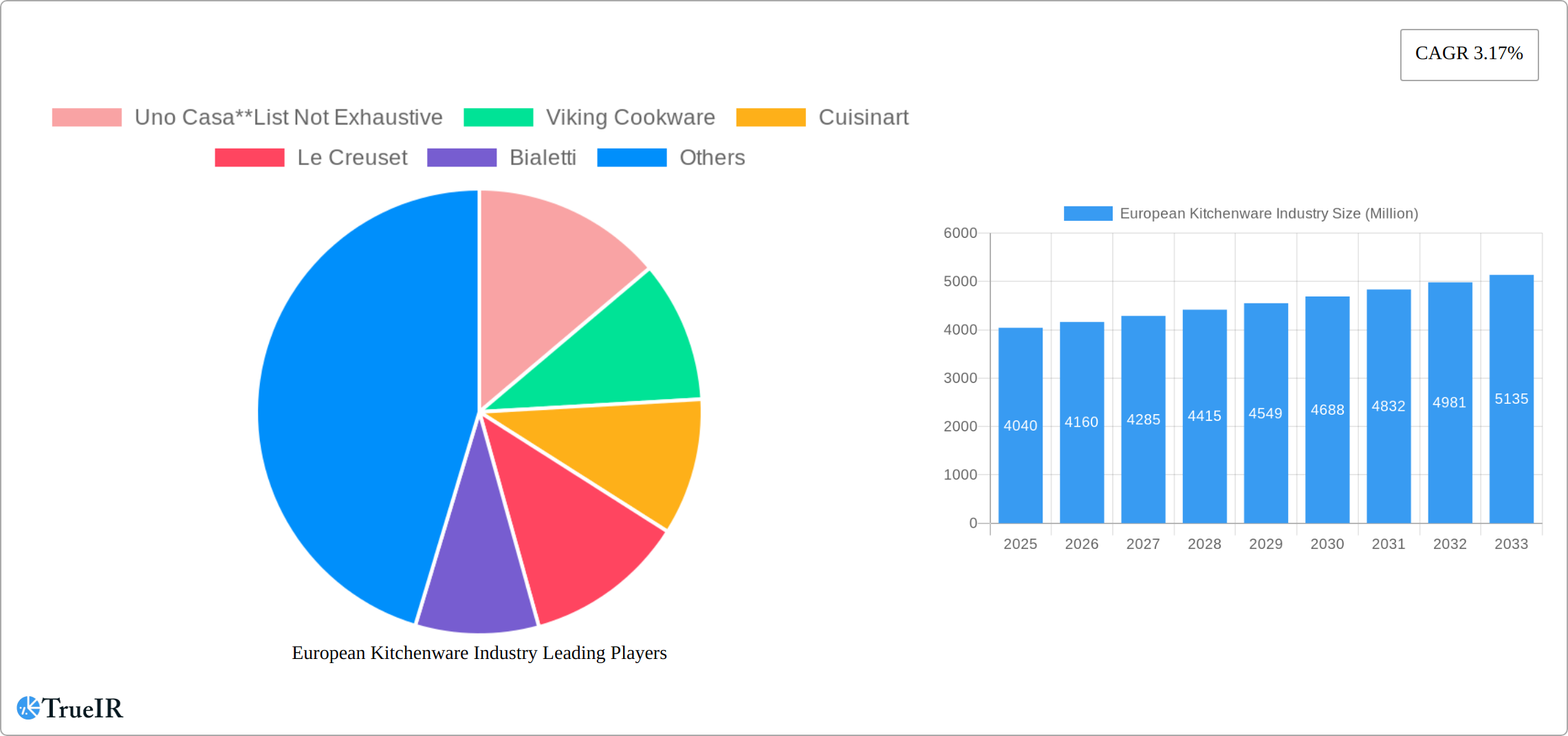

The European kitchenware market, valued at €4.04 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.17% from 2025 to 2033. This growth is driven by several key factors. Increasing disposable incomes across many European nations fuel demand for premium kitchenware, particularly among younger demographics embracing cooking as a hobby and lifestyle. The rise of online retail channels provides greater accessibility and choice for consumers, boosting sales. Furthermore, a growing interest in healthy eating and home cooking, fueled by changing lifestyles and food trends, directly contributes to higher kitchenware purchases. The market is segmented by product type (pots & pans, cooking racks, cooking tools, microwave cookware, pressure cookers), material (stainless steel, aluminum, glass, others), and distribution channel (hypermarkets/supermarkets, specialty stores, online, other). Stainless steel and aluminum remain dominant materials due to their durability and affordability, while online sales are steadily gaining market share, challenging traditional retail channels.

European Kitchenware Industry Market Size (In Billion)

However, the market faces certain restraints. Economic fluctuations and inflation can impact consumer spending on non-essential goods like premium kitchenware. Competition from budget-friendly brands and private labels necessitates innovation and differentiation from established players. Sustainability concerns are also influencing purchasing decisions, leading to greater demand for eco-friendly and ethically sourced materials. The most successful brands will successfully integrate innovation in material science, sustainable sourcing, superior design and effective digital marketing strategies. Key regional markets within Europe include Germany, France, Italy, the United Kingdom, and the Netherlands, each exhibiting distinct consumer preferences and market dynamics. Understanding these nuances is crucial for targeted marketing and product development. The forecast period of 2025-2033 presents significant opportunities for both established players and new entrants, particularly those who can effectively cater to evolving consumer demands and market trends.

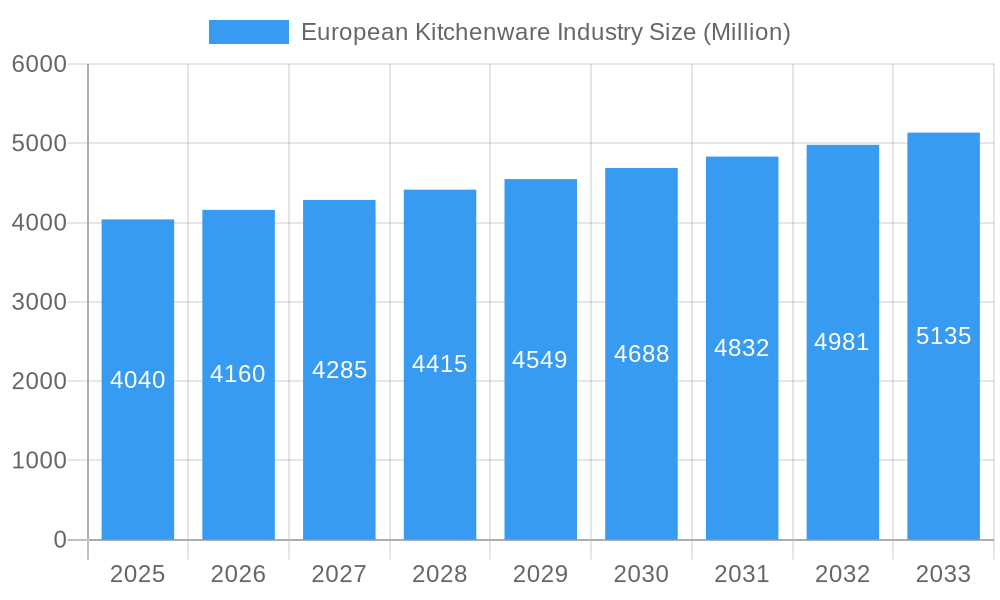

European Kitchenware Industry Company Market Share

European Kitchenware Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European kitchenware industry, offering valuable insights into market trends, competitive dynamics, and future growth prospects. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report utilizes a robust methodology, incorporating both quantitative and qualitative data for a complete understanding. The market size is estimated at €XX Billion in 2025.

European Kitchenware Industry Market Structure & Competitive Landscape

The European kitchenware market is characterized by a moderately concentrated structure, with a few major players holding significant market share, alongside numerous smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Innovation is a key driver, with companies continuously developing new materials, designs, and functionalities to meet evolving consumer demands. Regulatory impacts, such as those related to food safety and environmental sustainability, significantly influence product development and manufacturing processes. The market witnesses a notable presence of product substitutes, primarily from other household goods categories, putting pressure on pricing and differentiation strategies. The end-user segmentation is largely driven by demographics, lifestyles, and cooking habits, with a growing emphasis on convenience and healthy eating influencing purchasing decisions. Mergers and acquisitions (M&A) activity has been relatively low in recent years (estimated at xx deals in 2024), but consolidation is expected to increase as larger companies seek to expand their market reach and product portfolios.

European Kitchenware Industry Market Trends & Opportunities

The European kitchenware market is experiencing steady growth, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes, increasing urbanization, and a growing preference for home-cooked meals. Technological advancements are transforming the industry, with smart kitchen appliances and innovative materials gaining popularity. Consumer preferences are shifting towards sustainable and ethically sourced products, creating opportunities for companies that prioritize environmental responsibility. The competitive landscape is dynamic, with both established brands and emerging players vying for market share. Market penetration rates vary significantly across different product segments and geographic regions. The online distribution channel is witnessing rapid expansion, challenging the dominance of traditional retail channels.

Dominant Markets & Segments in European Kitchenware Industry

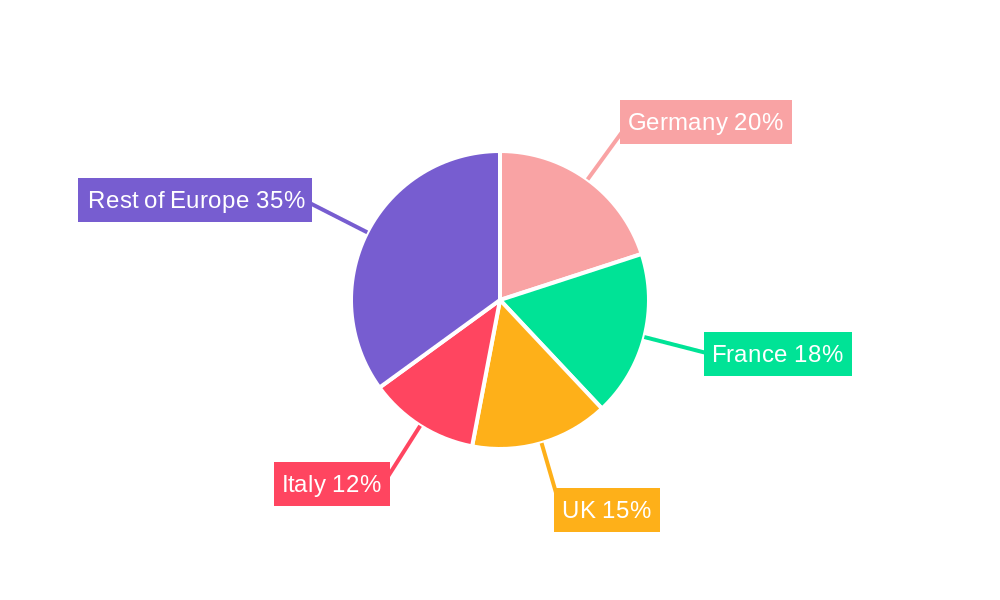

The German market continues to lead the European kitchenware industry, fueled by robust consumer spending, a sophisticated retail landscape, and a strong preference for quality and durability. France and the United Kingdom remain pivotal markets, showcasing consistent demand and influencing broader industry trends.

By Product:

- Pots & Pans: This foundational segment remains the largest, propelled by consistent innovation in advanced materials (e.g., induction-compatible bases, enhanced non-stick technologies) and ergonomic designs that prioritize user experience and longevity.

- Cooking Tools: Demonstrating robust growth, this segment is bolstered by the burgeoning interest in home cooking, culinary exploration, and the influence of social media food trends, leading to demand for specialized and high-performance utensils.

- Pressure Cookers: The market for pressure cookers is experiencing a notable resurgence, attributed to their exceptional convenience, time-saving capabilities, and energy efficiency, aligning with modern lifestyles and a desire for healthier cooking methods.

- Microwave Cookware: This segment shows steady growth, closely tied to the enduring popularity of microwave ovens for quick meal preparation and reheating, with an increasing demand for microwave-safe, aesthetically pleasing, and multi-functional options.

- Cooking Racks & Accessories: This niche yet expanding segment is driven by consumers seeking optimized kitchen organization, space-saving solutions, and versatile tools that enhance the cooking and baking process, from cooling racks to specialized organizers.

By Material:

- Stainless Steel: Remains the undisputed leader due to its exceptional durability, corrosion resistance, hygienic properties, and ease of maintenance, making it a preferred choice for long-lasting cookware.

- Aluminum: Continues to be a popular choice, particularly in its anodized and cast forms, offering excellent heat conductivity and affordability, often enhanced with non-stick coatings.

- Glass & Ceramic: Growing significantly in popularity, these materials are favored for their aesthetic appeal, non-reactive nature, oven-to-table versatility, and increasing availability in sustainable and durable formulations.

- Cast Iron: Maintains a strong presence, valued for its superior heat retention and searing capabilities, particularly for professional and enthusiast home cooks.

By Distribution Channel:

- Hypermarkets and Supermarkets: Continue to be the dominant channel, offering broad accessibility, competitive pricing, and a wide product assortment for everyday needs.

- Online Retail: The fastest-growing and most dynamic channel, driven by convenience, expansive product selections, competitive pricing, and personalized shopping experiences.

- Specialty Kitchenware Stores: Cater to a discerning customer base seeking expert advice, premium brands, innovative products, and a curated selection of high-quality kitchenware.

- Home Improvement & Department Stores: Offer a significant retail footprint, providing a mix of functional and decorative kitchenware alongside other home goods.

European Kitchenware Industry Product Analysis

The European kitchenware industry is experiencing a wave of innovation, with a strong emphasis on advanced materials that offer enhanced performance and sustainability. Innovations include next-generation ceramic non-stick coatings for superior durability and PFOA-free compositions, alongside the integration of smart technology into kitchenware for optimized cooking, precise temperature control, and seamless connectivity. Product development is highly responsive to diverse consumer needs, spanning from attractively priced everyday essentials to high-end, professional-grade items. Competitive advantages are increasingly forged through a combination of exceptional product quality, distinctive and ergonomic designs, robust brand reputation, effective sustainability initiatives, and targeted marketing strategies that resonate with evolving consumer values.

Key Drivers, Barriers & Challenges in European Kitchenware Industry

Key Drivers:

- Rising disposable incomes and increased urbanization contribute to increased demand.

- Technological innovations, such as smart kitchenware, are driving product diversification.

- Growing interest in cooking and culinary arts fuels demand for specialized tools and equipment.

Challenges:

- Increasing raw material costs and supply chain disruptions impact profitability and product availability. (e.g., a 15% increase in stainless steel prices in 2024 led to a xx% increase in final product costs for some manufacturers).

- Intense competition and the emergence of new market entrants exert pressure on pricing and profit margins.

- Stringent regulatory requirements related to food safety and environmental sustainability add to manufacturing complexity and costs.

Growth Drivers in the European Kitchenware Industry Market

Several key factors are propelling the growth of the European kitchenware industry. Technological advancements continue to drive product innovation, leading to more efficient, durable, and user-friendly items. Rising disposable incomes and a persistent trend towards home cooking, fueled by a greater appreciation for culinary arts and healthy eating, are significantly boosting consumer spending. Furthermore, a growing consumer consciousness towards environmental impact is creating a substantial market opportunity for eco-friendly and sustainably produced kitchenware. The continued expansion and sophistication of e-commerce platforms are also critical, democratizing market access and providing consumers with unparalleled convenience and choice.

Challenges Impacting European Kitchenware Industry Growth

Fluctuations in raw material prices, supply chain disruptions, and intense competition are major hurdles. Compliance with evolving environmental regulations poses challenges to manufacturers. Economic downturns also impact consumer spending, reducing demand for non-essential household goods.

Key Players Shaping the European Kitchenware Industry Market

- Uno Casa

- Viking Cookware

- Cuisinart

- Le Creuset

- Bialetti

- Abbio

- Calphalon

- All-Clad

Significant European Kitchenware Industry Industry Milestones

- February 2023: Crucible Cookware enhanced its customer service and operational efficiency across the EU by establishing a strategic partnership with DHL for optimized shipping logistics.

- February 2023: Guardini demonstrated its commitment to environmental responsibility by launching a new line of bakeware crafted from sustainable materials, reinforcing the industry's focus on eco-friendly practices.

Future Outlook for European Kitchenware Industry Market

The European kitchenware market is set for sustained and robust growth, underpinned by continuous technological advancements, evolving consumer preferences that favor health and convenience, and a deepening commitment to sustainability across the value chain. Strategic opportunities abound for manufacturers and retailers who can develop innovative product lines that precisely meet niche consumer demands, effectively leverage digital channels for enhanced marketing and sales, and build resilient supply chains capable of navigating global disruptions. The industry is anticipated to witness an increase in consolidation through mergers and acquisitions, as established players strategically expand their market share, product portfolios, and operational scale to achieve greater competitive advantage and market dominance.

European Kitchenware Industry Segmentation

-

1. Product

- 1.1. Pots and Pans

- 1.2. Cooking Racks

- 1.3. Cooking Tools

- 1.4. Microwave Cookware

- 1.5. Pressure Cookers

-

2. Material

- 2.1. Stainless Steel

- 2.2. Aluminium

- 2.3. Glass

- 2.4. Other Materials

-

3. Distribution Channel

- 3.1. Hypermarkets and Supermarkets

- 3.2. Specialty Store

- 3.3. Online

- 3.4. Other Distribution Channels

European Kitchenware Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Poland

- 5. Italy

- 6. Rest of Europe

European Kitchenware Industry Regional Market Share

Geographic Coverage of European Kitchenware Industry

European Kitchenware Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Non-Stick Cookware is Dominating the Cookware Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Pots and Pans

- 5.1.2. Cooking Racks

- 5.1.3. Cooking Tools

- 5.1.4. Microwave Cookware

- 5.1.5. Pressure Cookers

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Stainless Steel

- 5.2.2. Aluminium

- 5.2.3. Glass

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets and Supermarkets

- 5.3.2. Specialty Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Poland

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Pots and Pans

- 6.1.2. Cooking Racks

- 6.1.3. Cooking Tools

- 6.1.4. Microwave Cookware

- 6.1.5. Pressure Cookers

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Stainless Steel

- 6.2.2. Aluminium

- 6.2.3. Glass

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets and Supermarkets

- 6.3.2. Specialty Store

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Pots and Pans

- 7.1.2. Cooking Racks

- 7.1.3. Cooking Tools

- 7.1.4. Microwave Cookware

- 7.1.5. Pressure Cookers

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Stainless Steel

- 7.2.2. Aluminium

- 7.2.3. Glass

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets and Supermarkets

- 7.3.2. Specialty Store

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Pots and Pans

- 8.1.2. Cooking Racks

- 8.1.3. Cooking Tools

- 8.1.4. Microwave Cookware

- 8.1.5. Pressure Cookers

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Stainless Steel

- 8.2.2. Aluminium

- 8.2.3. Glass

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets and Supermarkets

- 8.3.2. Specialty Store

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Poland European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Pots and Pans

- 9.1.2. Cooking Racks

- 9.1.3. Cooking Tools

- 9.1.4. Microwave Cookware

- 9.1.5. Pressure Cookers

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Stainless Steel

- 9.2.2. Aluminium

- 9.2.3. Glass

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets and Supermarkets

- 9.3.2. Specialty Store

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Pots and Pans

- 10.1.2. Cooking Racks

- 10.1.3. Cooking Tools

- 10.1.4. Microwave Cookware

- 10.1.5. Pressure Cookers

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Stainless Steel

- 10.2.2. Aluminium

- 10.2.3. Glass

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets and Supermarkets

- 10.3.2. Specialty Store

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Pots and Pans

- 11.1.2. Cooking Racks

- 11.1.3. Cooking Tools

- 11.1.4. Microwave Cookware

- 11.1.5. Pressure Cookers

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Stainless Steel

- 11.2.2. Aluminium

- 11.2.3. Glass

- 11.2.4. Other Materials

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Hypermarkets and Supermarkets

- 11.3.2. Specialty Store

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Uno Casa**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Viking Cookware

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cuisinart

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Le Creuset

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bialetti

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abbio

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Calphalon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 All-Clad

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Uno Casa**List Not Exhaustive

List of Figures

- Figure 1: European Kitchenware Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Kitchenware Industry Share (%) by Company 2025

List of Tables

- Table 1: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 3: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Kitchenware Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 11: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 15: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 19: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 22: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 23: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 27: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Kitchenware Industry?

The projected CAGR is approximately 3.17%.

2. Which companies are prominent players in the European Kitchenware Industry?

Key companies in the market include Uno Casa**List Not Exhaustive, Viking Cookware, Cuisinart, Le Creuset, Bialetti, Abbio, Calphalon, All-Clad.

3. What are the main segments of the European Kitchenware Industry?

The market segments include Product, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Non-Stick Cookware is Dominating the Cookware Industry.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

February 2023: Crucible Cookware, a leading manufacturer and supplier of high-quality kitchenware, announced it had signed a contract with DHL for shipping its products within the European Union (EU). DHL is one of the leading logistics companies. This new partnership will allow Crucible Cookware to provide its customers with faster and more efficient shipping options for their orders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Kitchenware Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Kitchenware Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Kitchenware Industry?

To stay informed about further developments, trends, and reports in the European Kitchenware Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence