Key Insights

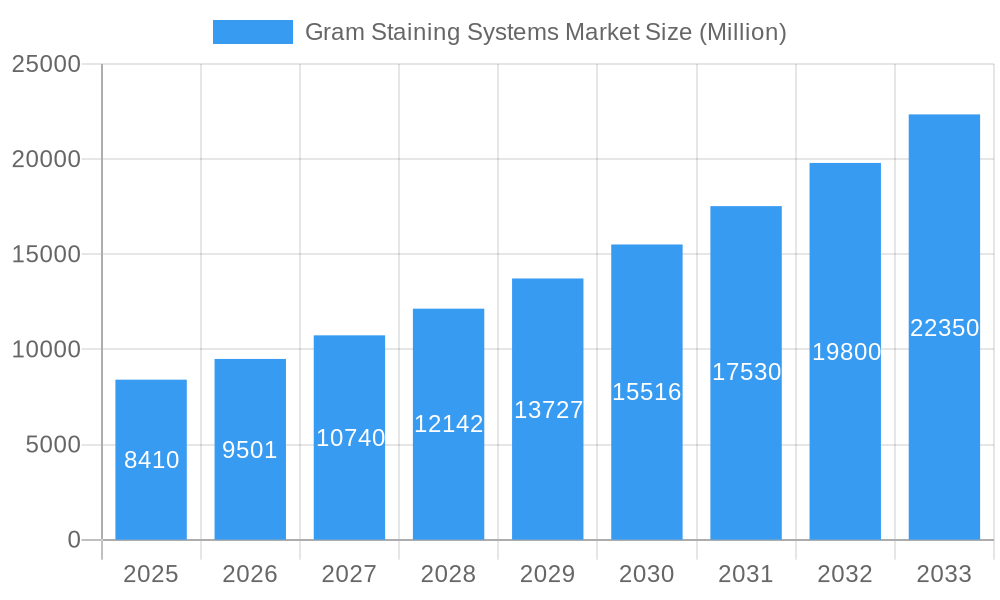

The global Gram Staining Systems Market is poised for significant expansion, projected to reach $8.41 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period of 2025-2033. This substantial growth is primarily fueled by the increasing prevalence of infectious diseases worldwide, necessitating accurate and rapid diagnostic methods. Advancements in staining technology, including automated systems and novel reagent formulations, are enhancing efficiency and precision in laboratories. Furthermore, growing investments in healthcare infrastructure, particularly in emerging economies, and a rising demand for early disease detection are key drivers propelling market expansion. The market’s trajectory is also influenced by an increasing focus on antimicrobial stewardship programs, which rely heavily on Gram staining for effective treatment decisions.

Gram Staining Systems Market Market Size (In Billion)

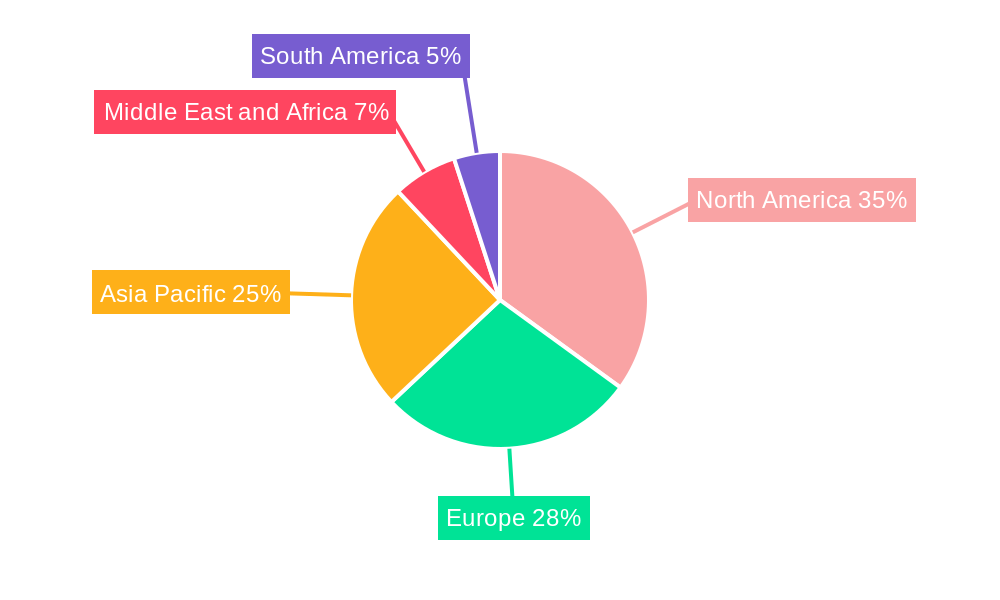

The Gram Staining Systems Market is segmented into Staining Systems, Staining Reagents, and Accessories, catering to a diverse range of end-users including Diagnostic Laboratories, Hospitals, and Other End-Users. North America is anticipated to lead the market, driven by established healthcare infrastructure and high adoption rates of advanced diagnostic technologies. However, the Asia Pacific region is expected to witness the fastest growth, attributed to rapid healthcare development, a growing patient pool, and increasing government initiatives to combat infectious diseases. While the market exhibits strong growth potential, challenges such as the high initial cost of advanced staining systems and the availability of alternative diagnostic methods could pose some restraints. Nevertheless, the continuous innovation in product development and expanding applications of Gram staining in various research and clinical settings are expected to offset these challenges, ensuring sustained market development.

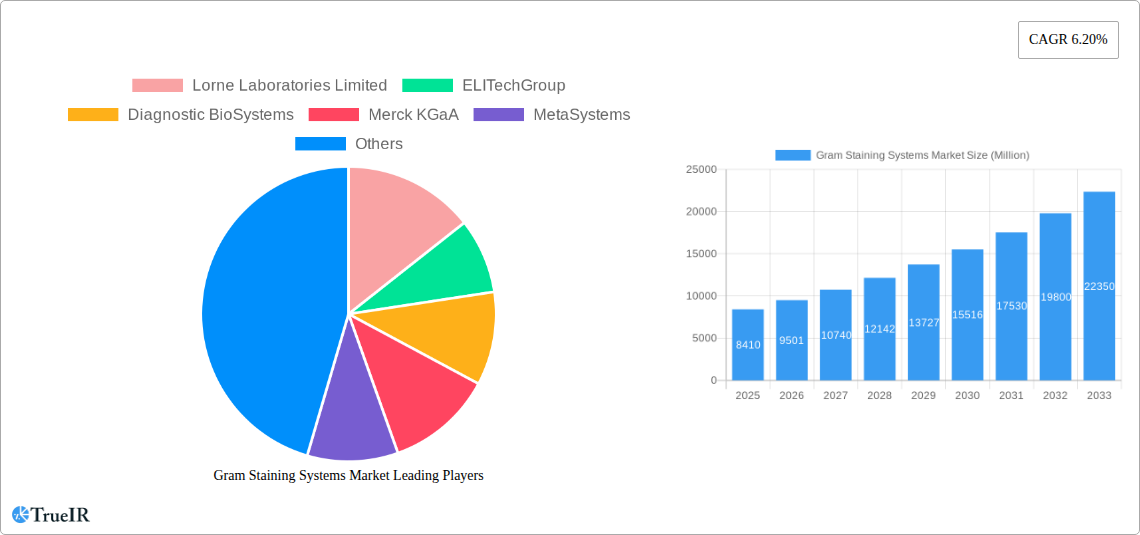

Gram Staining Systems Market Company Market Share

Gram Staining Systems Market: Comprehensive Analysis & Future Projections (2019–2033)

Unlock deep insights into the global Gram Staining Systems market, projected to reach $xx billion by 2033. This in-depth report, covering the study period of 2019–2033 with a base year of 2025, offers a strategic roadmap for stakeholders navigating this critical segment of the in vitro diagnostics industry. Analyze market size, growth drivers, competitive landscapes, technological advancements, and future opportunities, leveraging high-volume keywords such as "gram staining market size," "diagnostic reagents," "clinical laboratories," "bacterial identification," and "infectious disease diagnostics."

Gram Staining Systems Market Market Structure & Competitive Landscape

The Gram Staining Systems market exhibits a moderately concentrated structure, characterized by the presence of established global players and emerging regional manufacturers. Innovation drivers are primarily fueled by the increasing demand for rapid and accurate bacterial identification in clinical diagnostics, alongside advancements in automation and multiplexing capabilities. Regulatory frameworks, particularly those governing in vitro diagnostics, play a crucial role in shaping market entry and product approval processes. Product substitutes, while present in the form of alternative staining techniques and molecular diagnostic methods, have yet to fully displace gram staining due to its cost-effectiveness and established clinical utility. The end-user segmentation highlights the dominance of diagnostic laboratories and hospitals, driven by high patient volumes and the necessity of routine microbiological testing. Mergers and Acquisitions (M&A) trends, while not at an explosive pace, are observed as companies seek to expand their product portfolios, geographical reach, and technological expertise. For instance, strategic acquisitions of smaller reagent manufacturers by larger diagnostic corporations aim to consolidate market share and offer comprehensive staining solutions.

Gram Staining Systems Market Market Trends & Opportunities

The global Gram Staining Systems market is experiencing robust growth, driven by an escalating incidence of infectious diseases and a growing emphasis on rapid point-of-care diagnostics. The market size is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period, fueled by increasing healthcare expenditure and the expansion of laboratory infrastructure in emerging economies. Technological shifts are leaning towards automated gram staining systems that offer enhanced speed, consistency, and reduced manual labor, thereby minimizing human error and improving laboratory efficiency. This includes the development of digital imaging and AI-powered analysis to aid in accurate interpretation. Consumer preferences are increasingly favoring integrated solutions that combine staining systems with reagents and consumables, simplifying procurement and workflow for end-users. Competitive dynamics are intensifying, with key players focusing on product differentiation through enhanced sensitivity, specificity, and faster turnaround times. Opportunities abound in the development of novel gram stain formulations that offer improved safety profiles or target specific microbial characteristics. Furthermore, the growing prevalence of antimicrobial resistance necessitates rapid diagnostic tools for timely and appropriate treatment, presenting a significant growth avenue for advanced gram staining solutions. The penetration of automated gram staining systems is expected to rise as laboratories seek to optimize their throughput and resource allocation. The demand for point-of-care gram staining assays, particularly in resource-limited settings or for urgent diagnostic needs, represents a nascent yet promising market segment poised for significant expansion. The integration of gram staining with other diagnostic modalities, such as mass spectrometry or advanced microscopy, also offers a pathway for future innovation and market penetration.

Dominant Markets & Segments in Gram Staining Systems Market

The North America region currently dominates the global Gram Staining Systems market, with the United States leading in terms of market share and growth potential. This dominance is attributed to several key growth drivers, including a well-established healthcare infrastructure, high adoption rates of advanced diagnostic technologies, and significant investments in research and development by leading pharmaceutical and biotechnology companies. Robust government funding for infectious disease research and public health initiatives further propels the demand for sophisticated diagnostic tools like gram staining systems.

Key Growth Drivers in Dominant Regions:

- Advanced Healthcare Infrastructure: Extensive network of hospitals, diagnostic laboratories, and research institutions equipped with modern facilities.

- High R&D Spending: Significant investment in developing novel diagnostic solutions and improving existing technologies.

- Favorable Regulatory Environment: Supportive policies for the approval and adoption of new medical devices and diagnostic kits.

- Increasing Prevalence of Infectious Diseases: High incidence rates of bacterial infections, driving the demand for accurate and rapid diagnostic methods.

Within the Product Type segmentation, Staining Reagents are projected to hold the largest market share throughout the forecast period. This is primarily due to their consumable nature and the constant need for replenishment in routine laboratory operations. The development of improved staining formulations with enhanced shelf-life, specific staining capabilities for challenging bacteria, and reduced toxicity will continue to drive demand.

Key Growth Drivers for Staining Reagents:

- High Consumption Rates: Essential consumables for all gram staining procedures.

- Innovation in Formulations: Development of safer, more effective, and specialized reagents.

- Cost-Effectiveness: Generally lower cost per test compared to automated systems.

The End-User segment is dominated by Diagnostic Laboratories, which account for a substantial market share. These laboratories, both standalone and integrated within larger healthcare facilities, perform a high volume of microbiological tests daily, making them the primary consumers of gram staining systems and associated reagents.

Key Growth Drivers for Diagnostic Laboratories:

- High Test Volumes: Routine microbiological testing for a wide range of infections.

- Technological Adoption: Early adopters of new and efficient diagnostic tools.

- Focus on Accuracy and Speed: Need for reliable results to guide patient treatment.

Gram Staining Systems Market Product Analysis

The Gram Staining Systems market is characterized by continuous product innovation focused on enhancing efficiency, accuracy, and user-friendliness. Automated staining systems are gaining traction, offering reproducible results and reducing hands-on time for laboratory personnel. Innovations in staining reagents include formulations with improved clarity of results, reduced toxicity, and compatibility with automated platforms. Applications span a broad spectrum of clinical microbiology, from routine bacterial identification in hospitals and diagnostic labs to specialized applications in veterinary diagnostics and food safety testing. Competitive advantages are derived from speed of analysis, ease of use, integration capabilities with laboratory information systems (LIS), and cost-effectiveness per test.

Key Drivers, Barriers & Challenges in Gram Staining Systems Market

Key Drivers:

- Rising Global Infectious Disease Burden: Increased incidence of bacterial infections necessitates rapid and accurate diagnostic tools, driving demand for gram staining systems.

- Technological Advancements: Development of automated staining systems and improved reagent formulations enhances efficiency and accuracy.

- Growing Healthcare Expenditure: Increased investment in healthcare infrastructure and diagnostic capabilities, particularly in emerging economies.

- Point-of-Care Testing Demand: Growing need for rapid diagnostics at the point of patient care, driving innovation in compact and user-friendly gram staining solutions.

Barriers & Challenges:

- Stringent Regulatory Approvals: The time-consuming and complex process for obtaining regulatory clearance for new diagnostic devices and reagents can hinder market entry.

- High Cost of Automated Systems: The initial capital investment for advanced automated gram staining systems can be a barrier for smaller laboratories or those in resource-limited settings.

- Competition from Molecular Diagnostics: The increasing availability and declining costs of molecular diagnostic techniques for pathogen identification pose a competitive threat.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials for staining reagents, affecting production and pricing.

- Skilled Workforce Requirements: While automation aims to reduce manual labor, the operation and maintenance of advanced systems still require skilled personnel.

Growth Drivers in the Gram Staining Systems Market Market

The Gram Staining Systems market is propelled by several pivotal growth drivers. Technologically, the push towards automation is transforming laboratory workflows, offering faster turnaround times and enhanced consistency, thereby boosting efficiency. Economically, rising global healthcare expenditure, particularly in developing nations, is expanding access to diagnostic services and increasing the demand for essential laboratory tools. Policy-driven factors, such as government initiatives promoting infectious disease surveillance and control, also play a significant role by necessitating robust diagnostic capabilities. The increasing prevalence of hospital-acquired infections (HAIs) and the growing awareness of antimicrobial resistance are further amplifying the need for rapid bacterial identification methods offered by gram staining. The development of novel, user-friendly staining kits also contributes by broadening the accessibility of this diagnostic technique.

Challenges Impacting Gram Staining Systems Market Growth

Several challenges can impact the growth trajectory of the Gram Staining Systems market. Regulatory complexities, including lengthy approval processes for new products and evolving compliance standards, can delay market entry and increase development costs. Supply chain issues, such as the availability and cost fluctuations of key raw materials for staining reagents, can affect production volumes and profitability. Competitive pressures from alternative diagnostic methodologies, notably molecular diagnostics, which offer greater specificity and the ability to detect a wider range of pathogens, represent a significant restraint. Furthermore, the high initial capital investment required for sophisticated automated gram staining systems can be a barrier for adoption by smaller laboratories or those operating in cost-sensitive markets. Ensuring consistent quality control and standardization across different manufacturers and regions also remains an ongoing challenge.

Key Players Shaping the Gram Staining Systems Market Market

- Lorne Laboratories Limited

- ELITechGroup

- Diagnostic BioSystems

- Merck KGaA

- MetaSystems

- F Hoffmann-La Roche Ltd

- Hardy Diagnostics

- bioMerieux SA

- Thermo Fisher Scientific

- Labema Oy

Significant Gram Staining Systems Market Industry Milestones

- March 2023: Massachusetts General Hospital and the American Sexually Transmitted Diseases Association launched a pilot randomized controlled trial to assess the efficacy of a rapid 30-minute desktop gram stain assay as a potential point-of-care replacement for current standards in managing urethritis or cervicitis symptoms, marking a significant advancement in STD diagnostics.

- December 2022: ELITechGroup inaugurated its new, state-of-the-art headquarters in Turin, a pivotal milestone reflecting its commitment to advancing in vitro diagnostics and reinforcing its global presence in serving laboratories close to patient populations.

Future Outlook for Gram Staining Systems Market Market

The future outlook for the Gram Staining Systems market is exceptionally promising, driven by several key growth catalysts. The ongoing global surge in infectious diseases, coupled with the persistent threat of antimicrobial resistance, will continue to underpin the demand for reliable and rapid bacterial identification methods. Technological innovations, particularly in the realm of automation and artificial intelligence-assisted image analysis, will enhance diagnostic accuracy and laboratory efficiency, creating significant market opportunities. The increasing focus on point-of-care testing and the expansion of healthcare infrastructure in emerging economies will further fuel market penetration. Strategic collaborations and partnerships among key players, aimed at developing integrated diagnostic solutions and expanding geographical reach, are expected to shape the competitive landscape. The market is poised for sustained growth, offering substantial potential for companies that can innovate and adapt to evolving clinical needs and technological advancements.

Gram Staining Systems Market Segmentation

-

1. Product Type

- 1.1. Staining Systems

- 1.2. Staining Reagents

- 1.3. Accessories

-

2. End-User

- 2.1. Diagnostic Laboratories

- 2.2. Hospitals

- 2.3. Other End-Users

Gram Staining Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Gram Staining Systems Market Regional Market Share

Geographic Coverage of Gram Staining Systems Market

Gram Staining Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Prevalence of Infectious Diseases; Technological Advancements in Staining Systems and Increase in Funding for Clinical Research

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of the Systems

- 3.4. Market Trends

- 3.4.1. Diagnostic Laboratories is the Fastest Growing End User Segment in the Gram Staining Systems Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Staining Systems

- 5.1.2. Staining Reagents

- 5.1.3. Accessories

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Diagnostic Laboratories

- 5.2.2. Hospitals

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Staining Systems

- 6.1.2. Staining Reagents

- 6.1.3. Accessories

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Diagnostic Laboratories

- 6.2.2. Hospitals

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Staining Systems

- 7.1.2. Staining Reagents

- 7.1.3. Accessories

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Diagnostic Laboratories

- 7.2.2. Hospitals

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Staining Systems

- 8.1.2. Staining Reagents

- 8.1.3. Accessories

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Diagnostic Laboratories

- 8.2.2. Hospitals

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Staining Systems

- 9.1.2. Staining Reagents

- 9.1.3. Accessories

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Diagnostic Laboratories

- 9.2.2. Hospitals

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Gram Staining Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Staining Systems

- 10.1.2. Staining Reagents

- 10.1.3. Accessories

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Diagnostic Laboratories

- 10.2.2. Hospitals

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lorne Laboratories Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ELITechGroup

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Diagnostic BioSystems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MetaSystems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F Hoffmann-La Roche Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hardy Diagnostics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 bioMerieux SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fisher Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Labema Oy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lorne Laboratories Limited

List of Figures

- Figure 1: Global Gram Staining Systems Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Gram Staining Systems Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Gram Staining Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Gram Staining Systems Market Revenue (undefined), by End-User 2025 & 2033

- Figure 5: North America Gram Staining Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Gram Staining Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Gram Staining Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gram Staining Systems Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Gram Staining Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Gram Staining Systems Market Revenue (undefined), by End-User 2025 & 2033

- Figure 11: Europe Gram Staining Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Gram Staining Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Gram Staining Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gram Staining Systems Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Gram Staining Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Gram Staining Systems Market Revenue (undefined), by End-User 2025 & 2033

- Figure 17: Asia Pacific Gram Staining Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Gram Staining Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Gram Staining Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Gram Staining Systems Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Gram Staining Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Gram Staining Systems Market Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Middle East and Africa Gram Staining Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East and Africa Gram Staining Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Gram Staining Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gram Staining Systems Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Gram Staining Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Gram Staining Systems Market Revenue (undefined), by End-User 2025 & 2033

- Figure 29: South America Gram Staining Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Gram Staining Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Gram Staining Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Global Gram Staining Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Global Gram Staining Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 12: Global Gram Staining Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 21: Global Gram Staining Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 30: Global Gram Staining Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Gram Staining Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 35: Global Gram Staining Systems Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 36: Global Gram Staining Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Gram Staining Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gram Staining Systems Market?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the Gram Staining Systems Market?

Key companies in the market include Lorne Laboratories Limited, ELITechGroup, Diagnostic BioSystems, Merck KGaA, MetaSystems, F Hoffmann-La Roche Ltd, Hardy Diagnostics, bioMerieux SA, Thermo Fisher Scientific, Labema Oy.

3. What are the main segments of the Gram Staining Systems Market?

The market segments include Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Prevalence of Infectious Diseases; Technological Advancements in Staining Systems and Increase in Funding for Clinical Research.

6. What are the notable trends driving market growth?

Diagnostic Laboratories is the Fastest Growing End User Segment in the Gram Staining Systems Market.

7. Are there any restraints impacting market growth?

Lack of Awareness of the Systems.

8. Can you provide examples of recent developments in the market?

March 2023: In a significant development, Massachusetts General Hospital partnered with the American Sexually Transmitted Diseases Association to launch a pioneering pilot randomized controlled trial. The trial's primary aim was to assess the efficacy of a rapid 30-minute desktop assay, designed as a point-of-care gram stain. This innovative approach served as a potential replacement for the current standard of care. The trial specifically targeted the clinical management of patients exhibiting symptoms of urethritis or cervicitis, marking a crucial step forward in the field of sexually transmitted disease diagnostics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gram Staining Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gram Staining Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gram Staining Systems Market?

To stay informed about further developments, trends, and reports in the Gram Staining Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence