Key Insights

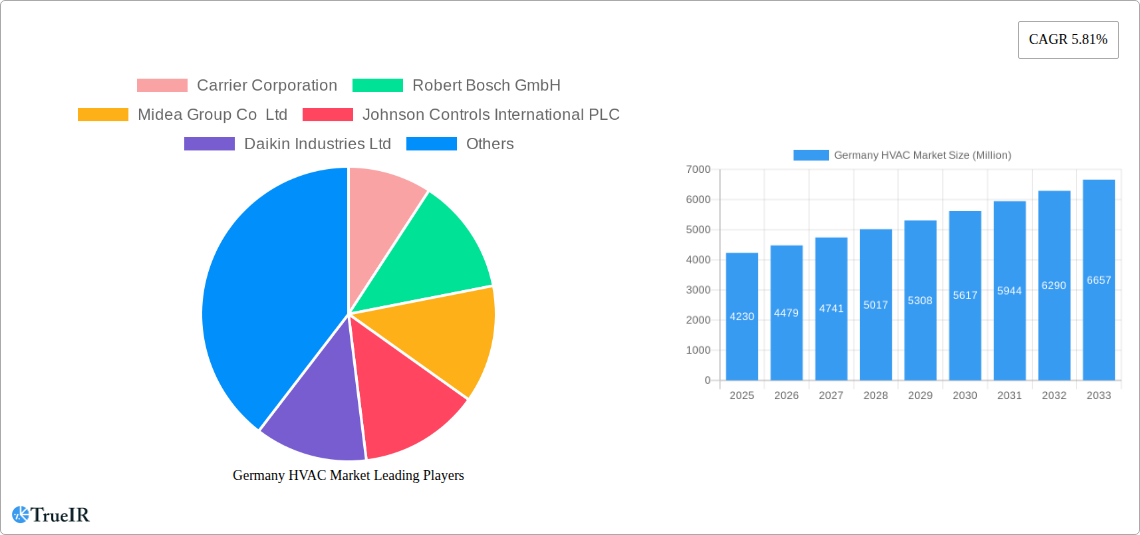

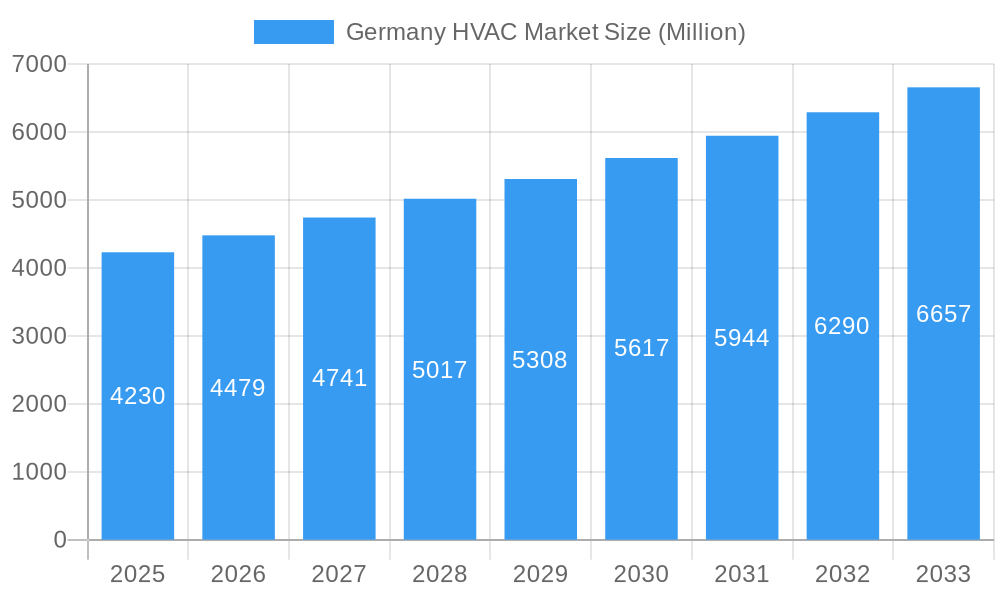

The German HVAC (Heating, Ventilation, and Air Conditioning) market is poised for robust expansion, currently valued at approximately $4.23 billion in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.81% through 2033. This significant market size underscores Germany's consistent demand for advanced climate control solutions. Key drivers fueling this growth include increasingly stringent energy efficiency regulations, a growing emphasis on indoor air quality, and the ongoing renovation of existing building stock to meet modern standards. Furthermore, the widespread adoption of smart and connected HVAC systems, driven by the Internet of Things (IoT) and advancements in building automation, is a significant trend, enhancing comfort, optimizing energy consumption, and enabling remote monitoring and control. The demand for sustainable and eco-friendly HVAC solutions, including heat pumps and energy-efficient ventilation systems, is also a powerful growth catalyst, aligning with Germany's ambitious climate goals.

Germany HVAC Market Market Size (In Billion)

The market is segmented across various HVAC components and services, with HVAC equipment, including heating, air conditioning, and ventilation systems, holding a dominant share. Services related to installation, maintenance, and repair are also experiencing substantial growth as the installed base of complex HVAC systems expands. The end-user industry landscape is diverse, with the residential sector demonstrating significant demand driven by new construction and retrofitting projects. The commercial sector, encompassing offices, retail spaces, and hospitality, is investing in upgrading HVAC systems for improved occupant comfort and operational efficiency. The industrial sector's demand is influenced by the need for precise environmental control in manufacturing processes and data centers. Despite these positive growth indicators, the market faces certain restraints, such as the high initial investment cost of advanced HVAC technologies and a shortage of skilled labor for installation and maintenance, which could temper the pace of growth in specific segments.

Germany HVAC Market Company Market Share

Gain unparalleled insights into the dynamic Germany HVAC market with this in-depth report. Covering the study period 2019–2033, including a base year of 2025, estimated year of 2025, and a forecast period of 2025–2033, this analysis delves deep into the historical period of 2019–2024. We dissect key segments like HVAC Equipment (Heating Equipment, Air Conditioning /Ventilation Equipment) and HVAC Services, alongside critical end-user industries including Residential, Commercial, and Industrial. Leverage high-volume keywords such as "Germany HVAC market size," "HVAC solutions Germany," "heating and cooling systems Germany," "energy-efficient HVAC Germany," "building automation Germany," and "renewable energy HVAC Germany" to optimize your understanding and strategy. This report is essential for stakeholders seeking to navigate the complexities of one of Europe's most significant HVAC markets.

Germany HVAC Market Market Structure & Competitive Landscape

The Germany HVAC market exhibits a moderately concentrated structure, characterized by the presence of both global giants and specialized domestic players. Innovation drivers are primarily fueled by stringent environmental regulations, a growing demand for energy efficiency, and advancements in smart building technologies. Regulatory impacts are significant, particularly concerning emissions standards and the promotion of heat pumps and renewable energy integration. Product substitutes, such as direct electric heating or traditional boiler systems, are gradually being displaced by more sustainable and efficient HVAC solutions. The end-user segmentation reveals a balanced demand across Residential, Commercial, and Industrial sectors, each with unique requirements and adoption rates for advanced HVAC technologies. Mergers and acquisition (M&A) trends are on the rise as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the last few years have seen several key acquisitions aimed at consolidating market share and fostering innovation in areas like smart controls and heat pump technology. The concentration ratio in the top 5 players is estimated to be around 60-70%, reflecting a competitive yet consolidated landscape. Investment in R&D for lower-GWP refrigerants and integrated building management systems is a crucial factor influencing competitive advantages.

Germany HVAC Market Market Trends & Opportunities

The Germany HVAC market is on a robust growth trajectory, projected to witness significant expansion throughout the forecast period. This surge is underpinned by a confluence of factors, including increasing awareness regarding energy conservation, government incentives promoting the adoption of eco-friendly heating and cooling solutions, and the continuous drive for enhanced indoor comfort and air quality. The market size is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% to reach an estimated value of over 20,000 Million by 2033. Technological shifts are predominantly leaning towards the deployment of heat pumps, which are gaining substantial traction as a primary heating and cooling source due to their energy efficiency and compatibility with renewable energy grids. The integration of Internet of Things (IoT) and Building Management Systems (BMS) is another pivotal trend, enabling smarter control, remote monitoring, and optimized performance of HVAC systems. Consumer preferences are increasingly skewed towards smart, connected, and energy-efficient appliances, driving demand for high-performance units with lower operating costs and environmental impact. Competitive dynamics are intensifying, with companies focusing on product differentiation through advanced features, superior efficiency ratings, and comprehensive service offerings. Opportunities abound in the retrofitting of existing buildings with energy-efficient HVAC systems, the development of district heating and cooling networks, and the integration of HVAC with smart home ecosystems. The market penetration of high-efficiency heat pumps is estimated to increase from around 25% in 2025 to over 50% by 2033 in new constructions. Furthermore, the increasing demand for localized climate control solutions and the growing importance of industrial process cooling present further avenues for market expansion. The emphasis on decarbonization and the phasing out of fossil fuel-based heating systems are creating a fertile ground for innovative HVAC solutions.

Dominant Markets & Segments in Germany HVAC Market

The Germany HVAC market is characterized by the dominance of specific segments driven by policy, economic development, and consumer behavior. Within the Type of Component, HVAC Equipment holds a commanding share, further subdivided into Heating Equipment and Air Conditioning /Ventilation Equipment. Heating Equipment, particularly heat pumps, is experiencing exponential growth due to government subsidies and the push for decarbonization. The Residential end-user industry is a significant contributor, fueled by renovations and new construction projects prioritizing energy efficiency and comfort. The Commercial sector, encompassing office buildings, retail spaces, and hospitality, also presents substantial demand, driven by the need for sophisticated climate control systems and compliance with building energy codes. The Industrial sector, while smaller in volume, demands highly specialized and robust HVAC solutions for process control and environmental regulation.

- Leading Segment - HVAC Equipment: This segment, particularly heat pumps, is projected to be the fastest-growing due to governmental incentives and the phasing out of fossil fuel heating.

- Dominant End-User Industry - Residential: Driven by retrofit projects and new builds focused on sustainability and energy cost savings, the residential sector is a consistent driver of HVAC demand. Policies encouraging energy-efficient home upgrades are a key factor.

- Growth Driver - Air Conditioning /Ventilation Equipment: With increasing awareness of indoor air quality and rising temperatures, demand for advanced ventilation and air conditioning solutions is steadily climbing, especially in commercial and industrial settings.

- Emerging Segment - HVAC Services: As HVAC systems become more complex, the demand for installation, maintenance, and smart management services is growing, presenting significant opportunities for service providers.

- Policy Influence: Germany's strong commitment to climate targets, including the Renewable Energy Act (EEG) and the Federal Building Energy Act (GEG), directly influences the dominance and growth patterns of various HVAC segments, particularly favoring renewable-powered heating and cooling.

Germany HVAC Market Product Analysis

Product innovation in the Germany HVAC market is heavily focused on enhancing energy efficiency, reducing environmental impact, and integrating smart capabilities. Heat pumps, especially air-to-water and water-to-water variants, are at the forefront, leveraging advancements in compressor technology and refrigerant formulations. The incorporation of smart controls, IoT connectivity, and AI-driven algorithms allows for optimized performance, predictive maintenance, and seamless integration into Building Management Systems. Competitive advantages are being built on lower operating costs, quieter operation, and extended lifespan. For example, Daikin's EWT-Q-X-A1 heat pumps offer high temperature output for heating and wide temperature ranges for cooling, showcasing versatility. Johnson Controls' York HH8 series, with its R-454B refrigerant and impressive SEER/HSPF ratings, demonstrates a commitment to balancing performance, efficiency, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Germany HVAC Market

Key Drivers:

- Stringent Environmental Regulations: Germany's ambitious climate targets and building energy efficiency standards are the primary catalysts, driving demand for low-emission HVAC solutions like heat pumps.

- Government Incentives and Subsidies: Generous financial support for the installation of energy-efficient systems, particularly heat pumps, significantly boosts market adoption.

- Rising Energy Costs: Increasing electricity and gas prices incentivize consumers and businesses to invest in more energy-efficient HVAC systems to reduce operational expenditures.

- Technological Advancements: Innovations in heat pump technology, smart controls, and integration with renewable energy sources are making HVAC systems more efficient and user-friendly.

Barriers & Challenges:

- High Initial Investment Costs: While long-term savings are evident, the upfront cost of advanced, energy-efficient HVAC systems can be a barrier for some consumers and small businesses.

- Skilled Labor Shortage: The growing demand for installation and maintenance of sophisticated HVAC systems is facing challenges due to a shortage of qualified technicians.

- Grid Capacity and Infrastructure: The widespread adoption of electric heat pumps requires robust and often upgraded electricity grids, which can pose a challenge in certain regions.

- Consumer Awareness and Education: While growing, a segment of the population still requires education on the benefits and operation of modern HVAC technologies, particularly heat pumps.

- Supply Chain Disruptions: Like many industries, the HVAC sector can be susceptible to global supply chain issues affecting component availability and pricing.

Growth Drivers in the Germany HVAC Market Market

The Germany HVAC market is propelled by a powerful combination of technological innovation, economic imperatives, and robust policy frameworks. Government mandates, such as those aimed at reducing carbon emissions and promoting renewable energy, are fundamentally reshaping the heating and cooling landscape, making energy-efficient technologies like heat pumps increasingly attractive. Financial incentives, including direct subsidies and tax credits for the installation of sustainable HVAC systems, further accelerate adoption rates across residential and commercial sectors. Coupled with rising energy prices, these drivers create a compelling economic case for investing in modern, energy-saving HVAC solutions. The ongoing development of smart building technologies and the increasing consumer demand for connected, automated home and building management systems also contribute significantly to market growth.

Challenges Impacting Germany HVAC Market Growth

Despite the strong growth outlook, the Germany HVAC market faces several significant challenges that could impede its expansion. The high upfront cost associated with installing advanced, energy-efficient HVAC systems remains a primary barrier for a considerable portion of the population, even with subsidies. Furthermore, a persistent shortage of skilled labor capable of installing and maintaining these sophisticated systems poses a logistical and operational hurdle. The integration of a large number of electric heat pumps into the existing power grid necessitates significant infrastructure upgrades to ensure stability and reliability, a process that can be slow and costly. Finally, while consumer awareness is growing, a segment of the market still requires comprehensive education on the benefits, operation, and long-term value proposition of modern HVAC technologies, especially in comparison to traditional heating methods.

Key Players Shaping the Germany HVAC Market Market

- Carrier Corporation

- Robert Bosch GmbH

- Midea Group Co Ltd

- Johnson Controls International PLC

- Daikin Industries Ltd

- System Air AB

- LG Electronics Inc

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Flaktgroup Inc

- Danfoss Inc

Significant Germany HVAC Market Industry Milestones

- April 2024: Daikin introduced its latest innovation: the EWT-Q-X-A1 range of water-to-water heat pumps, featuring its signature Daikin design scroll compressors. These advanced heat pumps, sourced from water, offer versatile heating and cooling capabilities. The heat pumps can deliver hot water up to +60°C and provide chilled water ranging from -15°C (with a water-glycol mixture) to +30°C for the evaporator, leaving water temperature. This development highlights advancements in high-temperature heat pump technology for broader application.

- April 2024: Johnson Controls introduced its latest residential heat pump series, the York HH8. These heat pumps promise high-tier efficiency and cutting-edge technology, all at a price point typically associated with mid-tier units. Notably, the York HH8 Side-Discharge models are equipped with R-454B refrigerant and are available in sizes ranging from 2 to 5 tons. The system offers a seasonal energy efficiency ratio (SEER) of up to 19 and a heating seasonal performance factor (HSPF) of up to 9.0. This launch signifies a trend towards making advanced efficiency more accessible in the residential market.

Future Outlook for Germany HVAC Market Market

The future outlook for the Germany HVAC market is exceptionally bright, driven by a persistent commitment to sustainability and energy independence. Strategic opportunities lie in the continued expansion of the heat pump market, fueled by both new installations and the extensive retrofitting of existing buildings. The integration of advanced digital technologies, such as AI and IoT for smart building management, will create further value and efficiency gains. The increasing focus on hybrid systems that combine heat pumps with other renewable energy sources will also be a key growth catalyst. As Germany pushes towards its climate goals, demand for innovative, energy-efficient, and environmentally friendly HVAC solutions will remain paramount, positioning the market for sustained growth and technological evolution.

Germany HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Germany HVAC Market Segmentation By Geography

- 1. Germany

Germany HVAC Market Regional Market Share

Geographic Coverage of Germany HVAC Market

Germany HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Construction and Retrofit Activity to Aid Demand; Supportive Government Regulations Including Subsidies

- 3.2.2 Incentives for Saving Energy through Tax Credit Programs

- 3.3. Market Restrains

- 3.3.1 Increased Construction and Retrofit Activity to Aid Demand; Supportive Government Regulations Including Subsidies

- 3.3.2 Incentives for Saving Energy through Tax Credit Programs

- 3.4. Market Trends

- 3.4.1. Residential Sector to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany HVAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carrier Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Robert Bosch GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Midea Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls International PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daikin Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 System Air AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Flaktgroup Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carrier Corporation

List of Figures

- Figure 1: Germany HVAC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany HVAC Market Share (%) by Company 2025

List of Tables

- Table 1: Germany HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: Germany HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 3: Germany HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Germany HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Germany HVAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Germany HVAC Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Germany HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 8: Germany HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 9: Germany HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Germany HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Germany HVAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany HVAC Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany HVAC Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the Germany HVAC Market?

Key companies in the market include Carrier Corporation, Robert Bosch GmbH, Midea Group Co Ltd, Johnson Controls International PLC, Daikin Industries Ltd, System Air AB, LG Electronics Inc, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Flaktgroup Inc, Danfoss Inc.

3. What are the main segments of the Germany HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Construction and Retrofit Activity to Aid Demand; Supportive Government Regulations Including Subsidies. Incentives for Saving Energy through Tax Credit Programs.

6. What are the notable trends driving market growth?

Residential Sector to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increased Construction and Retrofit Activity to Aid Demand; Supportive Government Regulations Including Subsidies. Incentives for Saving Energy through Tax Credit Programs.

8. Can you provide examples of recent developments in the market?

April 2024: Daikin introduced its latest innovation: the EWT-Q-X-A1 range of water-to-water heat pumps, featuring its signature Daikin design scroll compressors. These advanced heat pumps, sourced from water, offer versatile heating and cooling capabilities. The heat pumps can deliver hot water up to +60°C and provide chilled water ranging from -15°C (with a water-glycol mixture) to +30°C for the evaporator, leaving water temperature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany HVAC Market?

To stay informed about further developments, trends, and reports in the Germany HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence