Key Insights

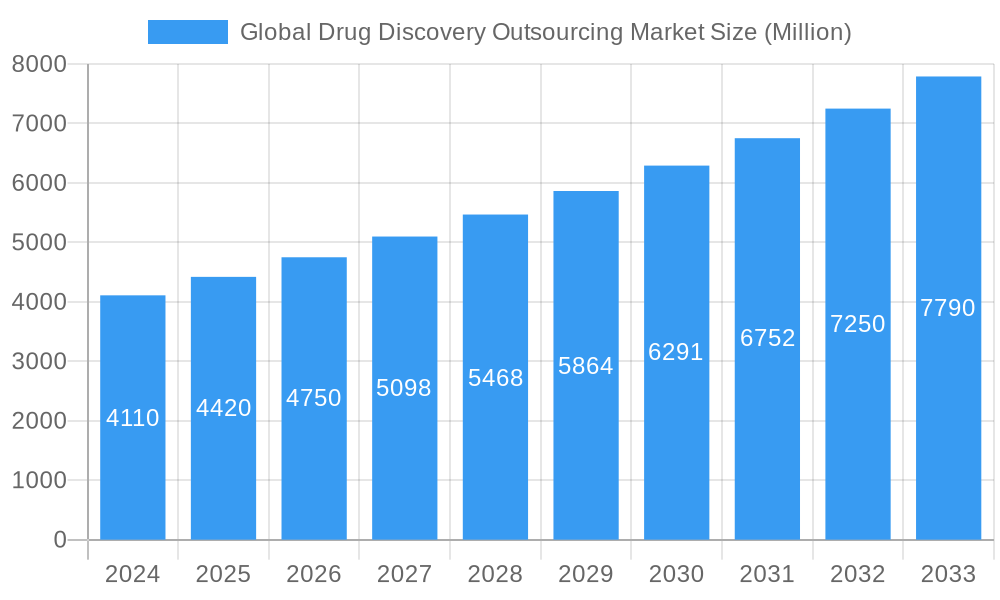

The Global Drug Discovery Outsourcing Market is experiencing robust expansion, with an estimated market size of $4.11 billion in 2024. This growth is fueled by a significant compound annual growth rate (CAGR) of 7.53%, projected to continue through 2033. Pharmaceutical and biotechnology companies are increasingly leveraging outsourcing partners to accelerate their R&D pipelines, reduce costs, and access specialized expertise. Key drivers include the rising complexity of drug development, the need for faster clinical trial timelines, and the increasing prevalence of chronic diseases demanding novel therapeutic solutions. The market is characterized by a growing demand for advanced research methodologies and cutting-edge technologies, pushing CROs to invest in innovation and expand their service portfolios.

Global Drug Discovery Outsourcing Market Market Size (In Billion)

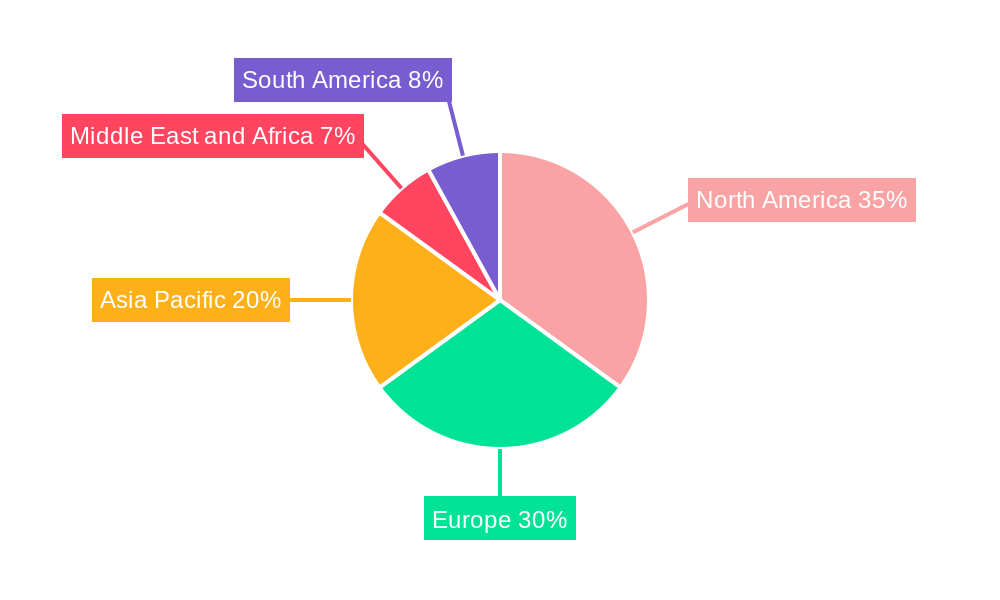

The market is segmented across various service types, including Medical Chemistry Services and Biology Services, and drug types such as Small Molecules and Large Molecules (Biopharmaceuticals). Therapeutic areas like Oncology, Infectious Diseases, and Cardiovascular conditions are at the forefront of outsourcing activities, reflecting global health priorities. North America and Europe currently dominate the market, driven by substantial R&D investments and the presence of leading pharmaceutical giants. However, the Asia Pacific region, particularly China and India, is emerging as a significant growth hub due to cost-effectiveness and a rapidly developing research infrastructure. Despite its strong growth trajectory, the market faces restraints such as intellectual property concerns and the need for stringent regulatory compliance. Nevertheless, the persistent need for innovative drug development ensures a dynamic and promising future for the drug discovery outsourcing sector.

Global Drug Discovery Outsourcing Market Company Market Share

This in-depth report provides an exhaustive analysis of the global drug discovery outsourcing market, offering critical insights and strategic intelligence for stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025, the study meticulously examines market dynamics, key trends, dominant segments, competitive landscapes, and future growth prospects. Leveraging high-volume keywords essential for SEO, this report is designed to enhance search engine rankings and engage a broad spectrum of industry professionals, including pharmaceutical and biotechnology companies, contract research organizations (CROs), investors, and market analysts.

Global Drug Discovery Outsourcing Market Market Structure & Competitive Landscape

The global drug discovery outsourcing market exhibits a moderately concentrated structure, with a few dominant players and a substantial number of specialized CROs. Innovation drivers are primarily fueled by advancements in artificial intelligence (AI), machine learning (ML), and personalized medicine, leading to the development of more efficient and targeted drug discovery pipelines. Regulatory impacts are significant, with stringent guidelines from bodies like the FDA and EMA influencing R&D processes and market entry strategies. Product substitutes are limited in the core drug discovery phases, but advancements in in-house capabilities and novel research platforms pose indirect competition. End-user segmentation includes large pharmaceutical companies, emerging biotechnology firms, and academic research institutions, each with unique outsourcing needs. Mergers and acquisitions (M&A) are a consistent trend, with larger CROs acquiring niche service providers to expand their capabilities and market reach. For instance, recent years have seen numerous strategic acquisitions aimed at bolstering expertise in areas like AI-driven drug design and biologics development. The market's competitive intensity is further shaped by a growing demand for cost-effective solutions and faster development timelines.

Global Drug Discovery Outsourcing Market Market Trends & Opportunities

The global drug discovery outsourcing market is experiencing robust growth, driven by an escalating need for specialized expertise, cost efficiencies, and accelerated development timelines within the pharmaceutical and biotechnology industries. The market size is projected to reach astronomical figures, with a compounded annual growth rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This expansion is largely attributed to the increasing complexity of drug development, the rising costs associated with in-house research, and the growing pipeline of novel therapeutics. Technological shifts are profoundly impacting the landscape. The integration of artificial intelligence (AI) and machine learning (ML) in drug discovery is revolutionizing target identification, lead optimization, and preclinical testing. Companies are increasingly leveraging AI platforms to analyze vast datasets, predict drug efficacy, and identify potential side effects, thereby streamlining the R&D process and reducing attrition rates. This has opened up significant opportunities for CROs offering AI-powered drug discovery services.

Consumer preferences are evolving, with a growing demand for targeted therapies and personalized medicine. This trend necessitates sophisticated drug discovery approaches that can identify patient subgroups and develop tailor-made treatments. Outsourcing partners with expertise in genomics, bioinformatics, and precision medicine are well-positioned to capitalize on this demand. The competitive dynamics within the market are characterized by intense rivalry among established global CROs and specialized niche players. Strategic collaborations and partnerships are becoming increasingly prevalent as companies seek to combine complementary strengths and expand their service offerings. For example, the November 2022 deal between Sanofi and Insilico Medicine, valued at USD 1200 million, highlights the significant investments being made in AI-driven drug development. Similarly, the October 2022 collaboration between Amphista Therapeutics and Domainex exemplifies the trend of specialized companies partnering to provide integrated drug discovery services, focusing on areas like targeted protein degradation.

The growing emphasis on biologics and novel modalities, such as gene and cell therapies, is also driving market expansion. Outsourcing these complex areas requires specialized infrastructure and highly skilled personnel, which many smaller biotechs may not possess in-house. This creates a substantial opportunity for CROs equipped to handle these advanced research and development challenges. Furthermore, the sustained pressure to reduce R&D expenditure while maintaining innovation pipelines compels pharmaceutical companies to outsource non-core functions, further fueling market growth. The increasing prevalence of chronic diseases and the ongoing threat of emerging infectious diseases also contribute to a sustained demand for new drug discoveries, underpinning the long-term growth potential of the drug discovery outsourcing market. The penetration rate of outsourcing services is expected to climb steadily as more organizations recognize the strategic advantages of leveraging external expertise and resources.

Dominant Markets & Segments in Global Drug Discovery Outsourcing Market

The global drug discovery outsourcing market is characterized by several dominant regions and segments, each exhibiting unique growth drivers and market penetration. North America, particularly the United States, stands as a leading region due to its robust pharmaceutical industry, significant R&D investments, and the presence of major biopharmaceutical companies and academic research institutions. Favorable government policies supporting innovation, coupled with a well-established ecosystem of CROs and advanced research infrastructure, further solidify its dominance. Asia-Pacific, on the other hand, is emerging as a rapidly growing market, driven by cost-effectiveness, expanding clinical trial capabilities, and increasing government support for the life sciences sector in countries like China and India.

Within the Type segment, Medical Chemistry Service currently holds a significant market share. This is attributed to the fundamental role of medicinal chemistry in identifying and optimizing drug candidates. However, Biology Service is witnessing rapid growth, fueled by advancements in molecular biology, genomics, and cell-based assays, enabling a deeper understanding of disease mechanisms and drug targets.

In terms of Drug Type, Small Molecules continue to represent a substantial portion of the market, owing to their established therapeutic applications and relatively lower development complexity compared to biologics. Nevertheless, Large Molecules (Biopharmaceuticals), including monoclonal antibodies, therapeutic proteins, and vaccines, are experiencing a surge in demand. This growth is propelled by their increasing efficacy in treating complex diseases and the burgeoning field of biologics.

The Therapeutic Area landscape reveals Oncology as the largest and fastest-growing segment. The high unmet medical need, significant R&D investments, and the continuous discovery of novel cancer targets and treatment modalities contribute to its dominance. Infectious Disease also holds a prominent position, especially in light of global health concerns and the ongoing need for new antiviral and antibacterial agents. Cardiovascular and Respiratory Disease segments are stable, driven by an aging population and the prevalence of these chronic conditions. The Gastrointestinal segment is also expanding, driven by advancements in understanding gut microbiome and its impact on health. Other therapeutic areas, including neurology, metabolic disorders, and rare diseases, are also contributing to market growth as research expands into these complex fields. Key growth drivers across these segments include:

- Infrastructure Development: Significant investments in state-of-the-art research facilities and advanced analytical equipment by both CROs and pharmaceutical companies.

- Favorable Policies: Government initiatives and tax incentives aimed at promoting R&D and life sciences innovation.

- Technological Advancements: Integration of AI, ML, and automation in drug discovery processes, enhancing efficiency and accuracy.

- Talent Pool: Availability of skilled scientists and researchers specializing in various aspects of drug discovery.

- Unmet Medical Needs: Persistent demand for novel and effective treatments for a wide range of diseases, particularly in oncology and infectious diseases.

- Increasing R&D Expenditure: Growing investments by pharmaceutical and biotechnology companies in pipeline expansion and the development of innovative therapies.

- Rise of Biologics: The expanding use of biopharmaceuticals, requiring specialized outsourcing expertise.

Global Drug Discovery Outsourcing Market Product Analysis

The product portfolio within the drug discovery outsourcing market encompasses a wide array of services designed to accelerate the identification, validation, and optimization of novel drug candidates. Key innovations revolve around the application of cutting-edge technologies such as artificial intelligence for target identification and drug design, high-throughput screening (HTS) for lead discovery, and advanced analytical techniques for drug characterization. These technological advancements are instrumental in reducing the time and cost associated with preclinical research. The competitive advantage for service providers lies in their ability to offer integrated, end-to-end solutions, from early target validation to preclinical efficacy studies. Companies like Thermo Fisher Scientific (PPD Inc.) and Laboratory Corporation of America Holdings offer comprehensive service suites, while specialized firms like GenScript Biotech Corporation and WuXi AppTec excel in specific areas such as gene synthesis and biologics manufacturing. The market fit is driven by the increasing need for specialized expertise and cost-effective solutions by pharmaceutical and biotechnology companies seeking to streamline their R&D pipelines and bring life-saving drugs to market faster.

Key Drivers, Barriers & Challenges in Global Drug Discovery Outsourcing Market

The global drug discovery outsourcing market is propelled by several key drivers. Technologically, the rapid advancement and integration of AI and ML in drug discovery are significantly enhancing efficiency and accuracy in target identification and lead optimization. Economically, the escalating costs of in-house drug R&D and the need for specialized expertise are pushing companies to seek external solutions. Policy-driven factors, such as government incentives for R&D and the increasing focus on public health, also contribute positively. For example, increased funding for infectious disease research has boosted outsourcing in that domain.

However, the market faces significant barriers and challenges. Regulatory complexities, including stringent approval processes and evolving compliance requirements across different geographies, can create hurdles. Supply chain issues, particularly concerning the sourcing of specialized reagents and advanced equipment, can lead to delays. Competitive pressures from both established global CROs and emerging niche players, coupled with pricing sensitivities, can impact profitability. Furthermore, intellectual property protection concerns and the need for robust data security when outsourcing sensitive research are critical challenges that require careful management.

Growth Drivers in the Global Drug Discovery Outsourcing Market Market

Key growth drivers in the global drug discovery outsourcing market include the relentless pursuit of innovative therapeutics for unmet medical needs, especially in areas like oncology and rare diseases. The economic imperative for cost optimization in R&D operations compels pharmaceutical and biotechnology companies to leverage the specialized expertise and infrastructure of contract research organizations (CROs). Technological advancements, such as the widespread adoption of artificial intelligence and machine learning in drug design and target identification, are accelerating discovery timelines and improving success rates. Furthermore, the growing pipeline of complex biologics and novel modalities necessitates specialized outsourcing capabilities that many organizations lack in-house. Supportive government policies and increased venture capital funding for early-stage biotech companies also contribute to a vibrant outsourcing ecosystem.

Challenges Impacting Global Drug Discovery Outsourcing Market Growth

Challenges impacting global drug discovery outsourcing market growth are multifaceted. Regulatory complexities, including varying international standards and the time-consuming approval processes, can create significant hurdles for global operations. Supply chain disruptions, particularly for specialized reagents, advanced equipment, and critical raw materials, can lead to project delays and increased costs. Intense competitive pressures among a large number of CROs, leading to price erosion and a constant need for differentiation, are also a significant factor. Furthermore, concerns surrounding intellectual property protection and data security during outsourced research necessitate robust contractual agreements and stringent security protocols, adding to the operational burden. Maintaining consistent quality across diverse outsourcing partners also presents a continuous challenge.

Key Players Shaping the Global Drug Discovery Outsourcing Market Market

- Thermo Fisher Scientific (PPD Inc.)

- Eurofins Scientific

- Laboratory Corporation of America Holdings

- Charles River Laboratories International Inc

- GenScript Biotech Corporation

- Oncodesign

- WuXi AppTec

- Evotec SE

- Dalton Pharma Services

- Curia Inc

- Jubilant Life Sciences Limited

Significant Global Drug Discovery Outsourcing Market Industry Milestones

- November 2022: Sanofi and Insilico Medicine, a clinical-stage biotechnology company, inked USD 1200 million Drug Development Deal. The agreement will see Sanofi use Insilico's AI platform, Pharma.AI, to advance drug development in up to six new targets. This partnership highlights the increasing integration of AI in drug discovery and the substantial financial commitments involved.

- October 2022: Amphista Therapeutics, a biotechnology company focusing on drug discovery projects that use targeted protein degradation (TPD), collaborated with Domainex, a medicines research service partner, as a partner to provide integrated drug discovery services for its research programs. Amphista will be benefitted from the expertise in protein production, assay biology, and medicinal chemistry of Domainex. This collaboration showcases the trend of specialized companies partnering to offer comprehensive drug discovery solutions.

Future Outlook for Global Drug Discovery Outsourcing Market Market

The future outlook for the global drug discovery outsourcing market is exceptionally promising, driven by persistent innovation and strategic adaptations. The increasing adoption of AI and ML for predictive analytics and de-novo drug design will continue to be a significant growth catalyst, enabling faster and more efficient discovery processes. The expanding biopharmaceutical sector, with its focus on complex biologics, gene therapies, and personalized medicine, will further boost demand for specialized outsourcing services. Strategic collaborations and mergers between CROs offering complementary expertise are expected to intensify, leading to more integrated service offerings. Furthermore, the continuous pressure on pharmaceutical companies to optimize R&D spending while navigating complex regulatory landscapes will ensure a sustained reliance on external partners. The market is poised for substantial growth, offering significant opportunities for companies that can deliver cutting-edge technologies, specialized scientific expertise, and reliable, cost-effective solutions.

Global Drug Discovery Outsourcing Market Segmentation

-

1. Type

- 1.1. Medical Chemistry Service

- 1.2. Biology Service

-

2. Drug Type

- 2.1. Small Molecule

- 2.2. Large Molecules (Biopharmaceuticals)

-

3. Therapeutic Area

- 3.1. Oncology

- 3.2. Infectious Disease

- 3.3. Respiratory Disease

- 3.4. Cardiovascular

- 3.5. Gastrointestinal

- 3.6. Others

Global Drug Discovery Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Drug Discovery Outsourcing Market Regional Market Share

Geographic Coverage of Global Drug Discovery Outsourcing Market

Global Drug Discovery Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Drug Development and Stringent Regulations for Drug Manufacturing

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Medical Chemistry Service

- 5.1.2. Biology Service

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Small Molecule

- 5.2.2. Large Molecules (Biopharmaceuticals)

- 5.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.3.1. Oncology

- 5.3.2. Infectious Disease

- 5.3.3. Respiratory Disease

- 5.3.4. Cardiovascular

- 5.3.5. Gastrointestinal

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Medical Chemistry Service

- 6.1.2. Biology Service

- 6.2. Market Analysis, Insights and Forecast - by Drug Type

- 6.2.1. Small Molecule

- 6.2.2. Large Molecules (Biopharmaceuticals)

- 6.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.3.1. Oncology

- 6.3.2. Infectious Disease

- 6.3.3. Respiratory Disease

- 6.3.4. Cardiovascular

- 6.3.5. Gastrointestinal

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Medical Chemistry Service

- 7.1.2. Biology Service

- 7.2. Market Analysis, Insights and Forecast - by Drug Type

- 7.2.1. Small Molecule

- 7.2.2. Large Molecules (Biopharmaceuticals)

- 7.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.3.1. Oncology

- 7.3.2. Infectious Disease

- 7.3.3. Respiratory Disease

- 7.3.4. Cardiovascular

- 7.3.5. Gastrointestinal

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Medical Chemistry Service

- 8.1.2. Biology Service

- 8.2. Market Analysis, Insights and Forecast - by Drug Type

- 8.2.1. Small Molecule

- 8.2.2. Large Molecules (Biopharmaceuticals)

- 8.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.3.1. Oncology

- 8.3.2. Infectious Disease

- 8.3.3. Respiratory Disease

- 8.3.4. Cardiovascular

- 8.3.5. Gastrointestinal

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Medical Chemistry Service

- 9.1.2. Biology Service

- 9.2. Market Analysis, Insights and Forecast - by Drug Type

- 9.2.1. Small Molecule

- 9.2.2. Large Molecules (Biopharmaceuticals)

- 9.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.3.1. Oncology

- 9.3.2. Infectious Disease

- 9.3.3. Respiratory Disease

- 9.3.4. Cardiovascular

- 9.3.5. Gastrointestinal

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Medical Chemistry Service

- 10.1.2. Biology Service

- 10.2. Market Analysis, Insights and Forecast - by Drug Type

- 10.2.1. Small Molecule

- 10.2.2. Large Molecules (Biopharmaceuticals)

- 10.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10.3.1. Oncology

- 10.3.2. Infectious Disease

- 10.3.3. Respiratory Disease

- 10.3.4. Cardiovascular

- 10.3.5. Gastrointestinal

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific (PPD Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Laboratory Corporation of America Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charles River Laboratories International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GenScript Biotech Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oncodesign

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WuXi AppTec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evotec SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dalton Pharma Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Curia Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jubilant Life Sciences Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific (PPD Inc )

List of Figures

- Figure 1: Global Global Drug Discovery Outsourcing Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 5: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 6: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 7: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 8: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 13: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 14: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 15: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 16: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 21: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 23: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 24: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 29: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 30: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 31: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 32: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 37: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 38: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 39: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 40: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 3: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 4: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 7: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 8: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 14: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 15: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 24: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 25: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 34: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 35: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 41: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 42: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Drug Discovery Outsourcing Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Global Drug Discovery Outsourcing Market?

Key companies in the market include Thermo Fisher Scientific (PPD Inc ), Eurofins Scientific, Laboratory Corporation of America Holdings, Charles River Laboratories International Inc, GenScript Biotech Corporation, Oncodesign, WuXi AppTec, Evotec SE, Dalton Pharma Services, Curia Inc, Jubilant Life Sciences Limited.

3. What are the main segments of the Global Drug Discovery Outsourcing Market?

The market segments include Type, Drug Type, Therapeutic Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drug Development and Stringent Regulations for Drug Manufacturing.

8. Can you provide examples of recent developments in the market?

November 2022: Sanofi and Insilico Medicine, a clinical-stage biotechnology company, inked USD 1200 million Drug Development Deal. The agreement will see Sanofi use Insilico's AI platform, Pharma.AI, to advance drug development in up to six new targets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Drug Discovery Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Drug Discovery Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Drug Discovery Outsourcing Market?

To stay informed about further developments, trends, and reports in the Global Drug Discovery Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence