Key Insights

The global Hyaluronic Acid Raw Material Market is projected for significant expansion. With a base year of 2025, the market is estimated at 245.62 million and is poised to grow at a robust Compound Annual Growth Rate (CAGR) of 5.25% through 2033. This dynamic growth is propelled by escalating demand across diverse applications, notably in orthopedics for joint disease management and ophthalmology for dry eye treatments and surgical aids. The burgeoning cosmetic and aesthetic industry, leveraging hyaluronic acid's moisturizing and anti-aging properties, continues to fuel market demand. Advancements in drug delivery systems, where hyaluronic acid serves as an excipient for targeted and sustained release, also contribute significantly to its market penetration. The inherent biocompatibility and biodegradability of hyaluronic acid are key attributes underpinning its widespread adoption and driving innovation.

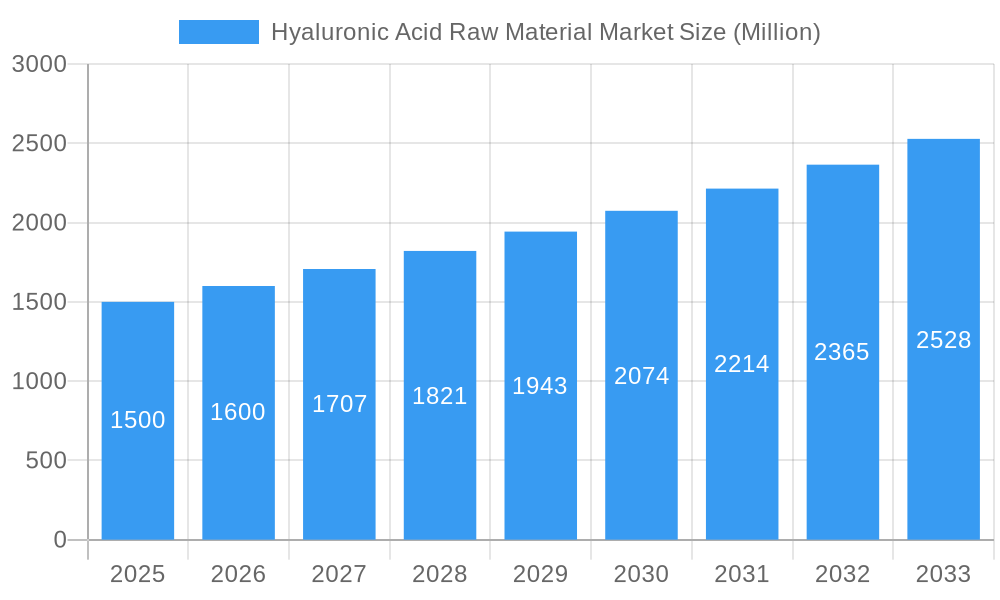

Hyaluronic Acid Raw Material Market Market Size (In Million)

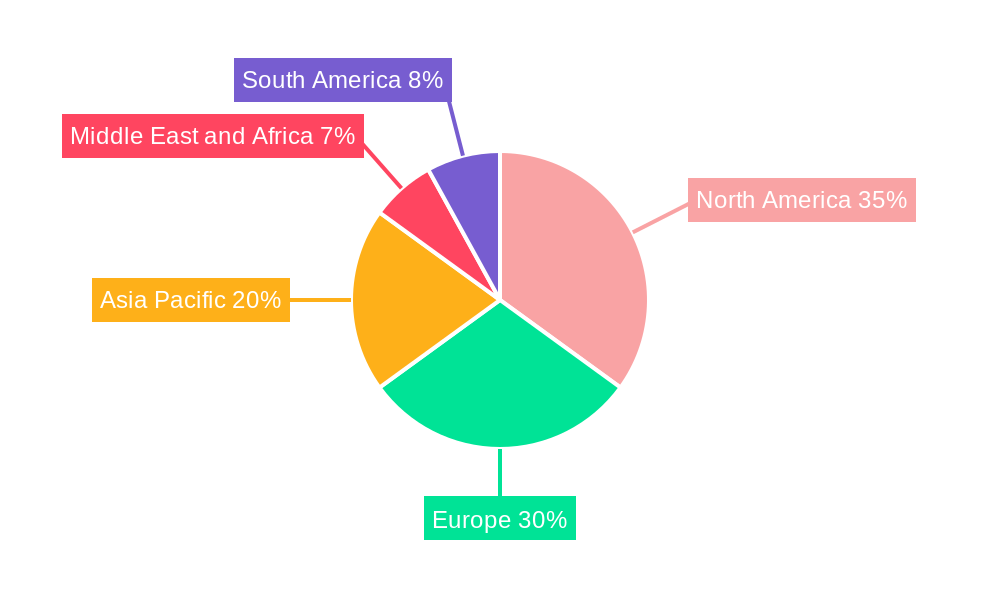

Restraints such as the high cost of raw material extraction and purification, coupled with stringent regulatory approvals, can temper growth. However, the increasing prevalence of age-related degenerative diseases, a growing consumer focus on aesthetic treatments, and ongoing research into novel therapeutic uses are expected to outweigh these limitations. Geographically, North America and Europe currently lead the market, driven by advanced healthcare infrastructure and high disposable incomes. The Asia Pacific region is anticipated to witness the fastest growth due to its expanding healthcare sector and increasing awareness of cosmetic procedures. Key players are actively engaged in research and development, strategic collaborations, and mergers and acquisitions to expand their product portfolios and market reach.

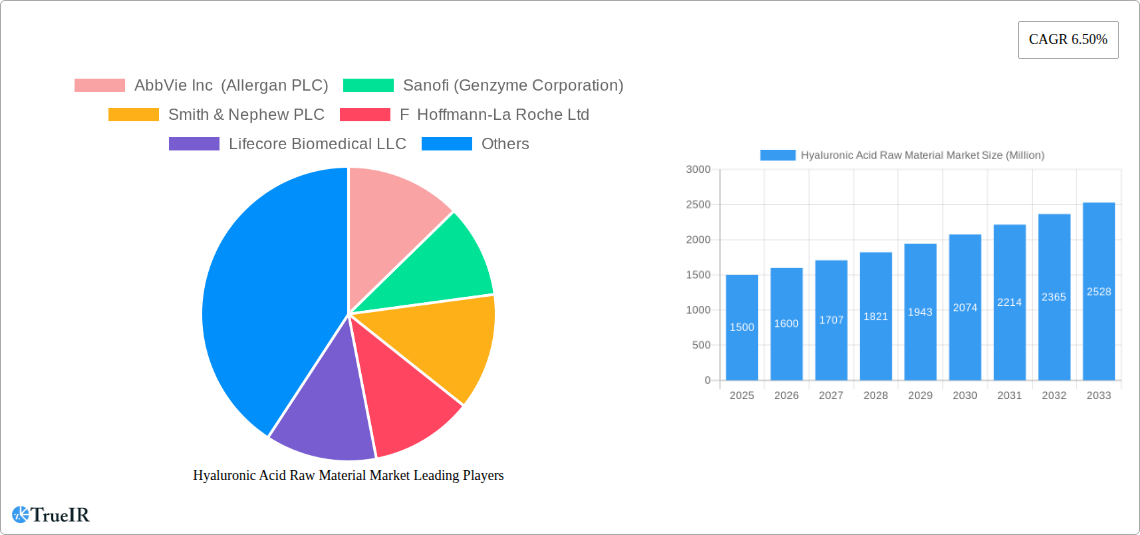

Hyaluronic Acid Raw Material Market Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the global Hyaluronic Acid Raw Material Market. Leveraging high-volume keywords such as "hyaluronic acid market," "HA raw material," "dermal filler ingredients," and "cosmetic ingredients," this report is designed to enhance search rankings and engage industry professionals, formulators, researchers, and market strategists. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers granular insights into market size, trends, opportunities, and competitive strategies.

Hyaluronic Acid Raw Material Market Market Structure & Competitive Landscape

The Hyaluronic Acid Raw Material Market is characterized by a moderately concentrated competitive landscape, with key players investing heavily in research and development to drive innovation. Regulatory bodies play a significant role, influencing product approvals and manufacturing standards, thereby impacting market entry barriers. The presence of established pharmaceutical and cosmetic giants alongside specialized biotechnology firms indicates a dynamic interplay of market forces. Product substitutes, while existing in some niche applications, are largely outweighed by the unique properties of hyaluronic acid. End-user segmentation reveals a strong reliance on the cosmetics and pharmaceuticals industries, with increasing penetration into medical devices. Mergers and acquisitions (M&A) trends, while not at peak levels, are strategic, often aimed at consolidating market share or acquiring novel technologies. For instance, the period between 2019-2024 saw approximately 5-8 significant M&A activities within the broader cosmetic and pharmaceutical ingredients space, with a notable portion involving HA-related entities.

- Market Concentration: Moderate, with top 5 players holding an estimated 40-50% market share.

- Innovation Drivers: Advancements in fermentation technology for higher purity HA, development of cross-linked HA for extended efficacy, and exploration of novel delivery systems.

- Regulatory Impacts: Stringent quality control and approval processes for pharmaceutical-grade HA, leading to higher production costs but ensuring product safety and efficacy.

- Product Substitutes: Limited direct substitutes for HA's viscoelastic and moisture-retaining properties, but alternative ingredients are explored for specific functional benefits.

- End-User Segmentation: Dominance of Pharmaceuticals (orthopedics, ophthalmology) and Cosmetics (dermatology, anti-aging), with growth in other applications like drug delivery.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios, accessing new markets, and strengthening technological capabilities.

Hyaluronic Acid Raw Material Market Market Trends & Opportunities

The global Hyaluronic Acid Raw Material Market is projected to experience robust growth, driven by escalating demand for aesthetically pleasing skin, increasing prevalence of age-related disorders, and advancements in medical applications. The market size for hyaluronic acid raw material is estimated to reach approximately $2.5 Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% to 7.5% during the forecast period of 2025-2033. Technological shifts, particularly in fermentation processes, are enabling the production of higher molecular weight and purity hyaluronic acid, catering to diverse application needs. Consumer preferences are increasingly leaning towards natural and scientifically-backed skincare ingredients, placing hyaluronic acid at the forefront of the cosmetic industry. Furthermore, the expanding use of hyaluronic acid in ophthalmic surgeries, osteoarthritis treatments, and advanced wound care presents significant growth opportunities. The competitive dynamics are evolving, with companies focusing on developing specialized HA grades with tailored properties and exploring new therapeutic avenues. Market penetration rates in emerging economies are expected to rise due to increasing disposable incomes and growing awareness of the benefits of hyaluronic acid. The ongoing exploration of novel applications, such as in tissue engineering and regenerative medicine, further fuels the market's expansion.

The demand for hyaluronic acid raw material is intricately linked to the growth of its primary end-user industries. In orthopedics, the rising incidence of osteoarthritis and the preference for minimally invasive treatments are significant growth catalysts. The global osteoarthritis treatment market is expected to surpass $15 Billion by 2027, with hyaluronic acid injections forming a substantial part of this. In ophthalmology, the increasing number of cataract surgeries and the use of HA in viscoelastic solutions for protecting ocular tissues during procedures are driving demand. The global cataract surgery market is projected to reach over $5 Billion by 2026. Dermatology remains a cornerstone of the HA market, with dermal fillers and topical skincare formulations experiencing sustained popularity. The global dermal filler market alone is estimated to be worth over $4 Billion by 2026, with HA-based fillers dominating this segment. The drug delivery segment, though smaller, shows promising growth potential as researchers explore HA's biocompatibility and ability to encapsulate and deliver therapeutic agents effectively, particularly in targeted cancer therapies and controlled drug release systems. The "Other Applications" segment, encompassing areas like tissue engineering, veterinary medicine, and food additives, while currently niche, offers untapped potential for future market expansion. The continuous innovation in production technologies, such as microbial fermentation, is not only increasing the yield and purity of hyaluronic acid but also making it more cost-effective, thereby broadening its accessibility and application range. The development of varying molecular weights of HA allows for targeted efficacy, with lower molecular weight HA penetrating deeper into the skin for hydration and higher molecular weight HA providing surface-level benefits and lubrication. This level of customization is a key trend shaping the market.

Dominant Markets & Segments in Hyaluronic Acid Raw Material Market

The Hyaluronic Acid Raw Material Market demonstrates strong dominance in North America and Europe, driven by advanced healthcare infrastructure, high consumer spending on aesthetic treatments, and a well-established pharmaceutical industry. However, the Asia Pacific region is emerging as a rapid growth engine, fueled by increasing disposable incomes, a growing aging population, and a burgeoning cosmetic and pharmaceutical sector.

Dominant Region: North America currently holds the largest market share, estimated at 35-40%, owing to significant investments in research and development, a high prevalence of aesthetic procedures, and widespread adoption of HA-based medical treatments.

Key Growth Drivers in North America:

- High Disposable Income: Enables consumers to invest in premium skincare and aesthetic procedures.

- Advanced Healthcare Infrastructure: Facilitates the widespread use of HA in orthopedics and ophthalmology.

- Regulatory Support for Innovation: Fosters the development and adoption of new HA-based products.

Emerging Growth Region: Asia Pacific is projected to witness the highest CAGR, driven by a rapidly expanding middle class, increasing awareness of cosmetic enhancements, and government initiatives supporting the healthcare sector.

Key Growth Drivers in Asia Pacific:

- Growing Middle Class: Leading to increased demand for cosmetic and dermatological products.

- Aging Population: Fuels demand for anti-aging treatments and osteoarthritis management.

- Favorable Manufacturing Costs: Attracts investment in raw material production.

Dominant Application Segment: Orthopedics currently represents the largest application segment, accounting for an estimated 30-35% of the total market. The rising incidence of osteoarthritis and the effectiveness of intra-articular hyaluronic acid injections in managing pain and improving joint function are primary drivers.

Key Growth Drivers in Orthopedics:

- Aging Population: Increases the prevalence of degenerative joint diseases like osteoarthritis.

- Preference for Non-Surgical Treatments: HA injections offer a less invasive alternative to surgery.

- Improved HA Formulations: Development of higher viscosity and longer-lasting HA products.

Dominant End User Segment: Hospitals constitute the largest end-user segment, accounting for approximately 45-50% of the market share, primarily due to their extensive use of HA in orthopedic procedures, ophthalmic surgeries, and various drug delivery applications.

Key Growth Drivers for Hospitals:

- Increasing Volume of Surgeries: Particularly orthopedic and ophthalmic procedures.

- Advancements in Medical Devices: Incorporating HA for improved patient outcomes.

- Adoption of Advanced Therapies: Including HA-based drug delivery systems.

Promising Growth Application Segment: Dermatology is a rapidly growing segment, driven by the sustained popularity of HA-based dermal fillers, mesotherapy, and advanced skincare formulations for hydration and anti-aging. The global cosmetic injectables market is a testament to this growth.

Key Growth Drivers in Dermatology:

- Growing Aesthetic Consciousness: Increasing demand for facial rejuvenation and wrinkle reduction.

- Minimally Invasive Procedures: HA fillers offer a safe and effective alternative to surgical facelifts.

- Technological Advancements: Development of new HA formulations with enhanced efficacy and longevity.

Promising Growth End User Segment: Cosmetic Clinics are witnessing significant growth as the demand for non-surgical aesthetic treatments escalates. These clinics are key procurers of HA raw materials for use in a wide range of dermal fillers and skincare treatments.

Key Growth Drivers for Cosmetic Clinics:

- Increasing Consumer Demand for Aesthetics: Driven by social media influence and celebrity trends.

- Accessibility and Affordability: Compared to surgical procedures.

- Innovations in Aesthetic Treatments: Constantly evolving range of HA-based products.

Hyaluronic Acid Raw Material Market Product Analysis

Hyaluronic acid raw material is distinguished by its exceptional viscoelastic properties, biocompatibility, and remarkable ability to retain moisture. Innovations in its production, primarily through advanced microbial fermentation, have led to the development of various molecular weights and purity levels, catering to specific application needs. For instance, high molecular weight HA excels in surface hydration and lubrication in cosmetics and joint injections, while low molecular weight HA penetrates deeper for cellular regeneration. Cross-linking technologies further enhance its longevity and efficacy, particularly in dermal fillers. These product advancements provide a significant competitive advantage, enabling tailored solutions for the orthopedics, ophthalmology, drug delivery, and dermatology sectors, ensuring superior performance and patient outcomes.

Key Drivers, Barriers & Challenges in Hyaluronic Acid Raw Material Market

Key Drivers:

- Rising Demand for Aesthetic Procedures: Fueled by growing consumer awareness and the desire for anti-aging solutions, particularly in dermatology.

- Increasing Prevalence of Osteoarthritis and Ophthalmic Disorders: Driving demand for HA in orthopedic and ophthalmic treatments.

- Technological Advancements in Production: Microbial fermentation yields higher purity and cost-effectiveness.

- Biocompatibility and Safety Profile: Makes HA a preferred ingredient in medical and cosmetic applications.

Barriers & Challenges:

- High Production Costs: Especially for pharmaceutical-grade HA, impacting affordability in certain markets.

- Stringent Regulatory Approvals: Varying by region, adding complexity and time to market entry.

- Supply Chain Volatility: Potential disruptions in raw material sourcing and manufacturing can impact availability.

- Intense Competition: From both established players and emerging manufacturers, leading to price pressures.

Growth Drivers in the Hyaluronic Acid Raw Material Market Market

The Hyaluronic Acid Raw Material Market is propelled by a confluence of significant growth drivers. Technologically, advancements in microbial fermentation have revolutionized the production of high-purity hyaluronic acid, making it more cost-effective and accessible. Economically, the increasing global disposable income, particularly in emerging markets, directly translates to higher consumer spending on aesthetic treatments and advanced healthcare solutions, thereby boosting demand for HA. Policy-driven factors, such as government initiatives promoting domestic manufacturing and R&D in the biopharmaceutical sector, also play a crucial role in market expansion. For instance, supportive regulatory frameworks for medical devices and cosmetics in countries like South Korea and India are fostering innovation and market growth. The growing preference for minimally invasive procedures across various medical disciplines, from orthopedics to dermatology, further solidifies HA's position as a key ingredient.

Challenges Impacting Hyaluronic Acid Raw Material Market Growth

Several challenges can impact the growth trajectory of the Hyaluronic Acid Raw Material Market. Regulatory complexities across different geographical regions can create hurdles for market entry and product commercialization, leading to extended approval timelines and increased compliance costs. Supply chain issues, including the sourcing of high-quality raw materials and potential disruptions due to geopolitical events or unforeseen circumstances, can affect product availability and pricing. Competitive pressures are also significant, with a crowded market and the constant threat of new entrants and innovative substitutes. Quantifiable impacts include potential price erosion due to oversupply or intense competition, and delays in product launches due to regulatory bottlenecks. For instance, a protracted approval process in a key market can result in an estimated loss of revenue of several million dollars.

Key Players Shaping the Hyaluronic Acid Raw Material Market Market

- AbbVie Inc (Allergan PLC)

- Sanofi (Genzyme Corporation)

- Smith & Nephew PLC

- F Hoffmann-La Roche Ltd

- Lifecore Biomedical LLC

- Bausch Health Companies Inc (Salix Pharmaceuticals)

- Galderma SA

- Anika Therapeutics Inc

- Seikagaku Corporation

- Zimmer Biomet

Significant Hyaluronic Acid Raw Material Market Industry Milestones

- August 2022: Iris and Romeo launched the Reset Hyaluronic Acid + Niacinamide Serum Spray, an all-in-one skin-plumping serum spray that combines niacinamide, ceramides, and hyaluronic acid, which increases cell membrane fluidity by 40% to visibly plump skin. This launch signifies the trend of multi-functional skincare formulations and the continued innovation in the cosmetic ingredient space.

- August 2022: Laneige launched the Water Bank Hyaluronic range in India. It aids in retaining moisture and achieving healthier and more supple skin. The range includes 11 products, such as cleansing oil, cleansing foam, toner, and essence. This expansion into a key emerging market highlights the growing global demand for HA-infused skincare and demonstrates effective market penetration strategies.

Future Outlook for Hyaluronic Acid Raw Material Market Market

The future outlook for the Hyaluronic Acid Raw Material Market is exceptionally bright, driven by sustained growth catalysts. The increasing focus on regenerative medicine and tissue engineering presents significant untapped opportunities for novel HA applications. Continuous advancements in bio-fermentation and purification techniques will further enhance product quality and reduce manufacturing costs, making HA more competitive and accessible. Strategic collaborations between raw material suppliers and formulators, coupled with expanded R&D investments, will lead to the development of next-generation HA-based products with enhanced efficacy and targeted delivery mechanisms. The growing demand for preventative and restorative anti-aging solutions, coupled with the expanding medical applications in areas like wound healing and drug delivery, will ensure a robust and expanding market for hyaluronic acid raw material in the coming years. The market is poised for substantial growth, projected to reach over $4.5 Billion by 2030.

Hyaluronic Acid Raw Material Market Segmentation

-

1. Application

- 1.1. Orthopedics

- 1.2. Ophthalmology

- 1.3. Drug Delivery

- 1.4. Dermatology

- 1.5. Other Applications

-

2. End User

- 2.1. Hospitals

- 2.2. Cosmetic Clinics

- 2.3. Other End Users

Hyaluronic Acid Raw Material Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hyaluronic Acid Raw Material Market Regional Market Share

Geographic Coverage of Hyaluronic Acid Raw Material Market

Hyaluronic Acid Raw Material Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Anti-aging Solutions and Minimally Invasive Aesthetic Treatments; Demographic Shift in Developed and Developing Countries; Growing Usage of Hyaluronic Acid in Cosmetic and Medical Field

- 3.3. Market Restrains

- 3.3.1. High Costs and Side Effects Associated with the Use of Hyaluronic Acid

- 3.4. Market Trends

- 3.4.1. Orthopedics Segment Expected to Witness Significant Growth in the Hyaluronic Acid Raw Material Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Orthopedics

- 5.1.2. Ophthalmology

- 5.1.3. Drug Delivery

- 5.1.4. Dermatology

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Cosmetic Clinics

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Orthopedics

- 6.1.2. Ophthalmology

- 6.1.3. Drug Delivery

- 6.1.4. Dermatology

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Cosmetic Clinics

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Orthopedics

- 7.1.2. Ophthalmology

- 7.1.3. Drug Delivery

- 7.1.4. Dermatology

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Cosmetic Clinics

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Orthopedics

- 8.1.2. Ophthalmology

- 8.1.3. Drug Delivery

- 8.1.4. Dermatology

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Cosmetic Clinics

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Orthopedics

- 9.1.2. Ophthalmology

- 9.1.3. Drug Delivery

- 9.1.4. Dermatology

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Cosmetic Clinics

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Hyaluronic Acid Raw Material Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Orthopedics

- 10.1.2. Ophthalmology

- 10.1.3. Drug Delivery

- 10.1.4. Dermatology

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Cosmetic Clinics

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AbbVie Inc (Allergan PLC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sanofi (Genzyme Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smith & Nephew PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lifecore Biomedical LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bausch Health Companies Inc (Salix Pharmaceuticals)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Galderma SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anika Therapeutics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Seikagaku Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zimmer Biomet

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AbbVie Inc (Allergan PLC)

List of Figures

- Figure 1: Global Hyaluronic Acid Raw Material Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Hyaluronic Acid Raw Material Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Hyaluronic Acid Raw Material Market Revenue (million), by Application 2025 & 2033

- Figure 4: North America Hyaluronic Acid Raw Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Hyaluronic Acid Raw Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Hyaluronic Acid Raw Material Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Hyaluronic Acid Raw Material Market Revenue (million), by End User 2025 & 2033

- Figure 8: North America Hyaluronic Acid Raw Material Market Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Hyaluronic Acid Raw Material Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Hyaluronic Acid Raw Material Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Hyaluronic Acid Raw Material Market Revenue (million), by Country 2025 & 2033

- Figure 12: North America Hyaluronic Acid Raw Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Hyaluronic Acid Raw Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Hyaluronic Acid Raw Material Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Hyaluronic Acid Raw Material Market Revenue (million), by Application 2025 & 2033

- Figure 16: Europe Hyaluronic Acid Raw Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 17: Europe Hyaluronic Acid Raw Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Hyaluronic Acid Raw Material Market Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Hyaluronic Acid Raw Material Market Revenue (million), by End User 2025 & 2033

- Figure 20: Europe Hyaluronic Acid Raw Material Market Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Hyaluronic Acid Raw Material Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Hyaluronic Acid Raw Material Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Hyaluronic Acid Raw Material Market Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Hyaluronic Acid Raw Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Hyaluronic Acid Raw Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Hyaluronic Acid Raw Material Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Hyaluronic Acid Raw Material Market Revenue (million), by Application 2025 & 2033

- Figure 28: Asia Pacific Hyaluronic Acid Raw Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: Asia Pacific Hyaluronic Acid Raw Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Hyaluronic Acid Raw Material Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Hyaluronic Acid Raw Material Market Revenue (million), by End User 2025 & 2033

- Figure 32: Asia Pacific Hyaluronic Acid Raw Material Market Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Hyaluronic Acid Raw Material Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Hyaluronic Acid Raw Material Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Hyaluronic Acid Raw Material Market Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Hyaluronic Acid Raw Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Hyaluronic Acid Raw Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Hyaluronic Acid Raw Material Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue (million), by Application 2025 & 2033

- Figure 40: Middle East and Africa Hyaluronic Acid Raw Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 41: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East and Africa Hyaluronic Acid Raw Material Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue (million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Hyaluronic Acid Raw Material Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Hyaluronic Acid Raw Material Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Hyaluronic Acid Raw Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Hyaluronic Acid Raw Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Hyaluronic Acid Raw Material Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Hyaluronic Acid Raw Material Market Revenue (million), by Application 2025 & 2033

- Figure 52: South America Hyaluronic Acid Raw Material Market Volume (K Unit), by Application 2025 & 2033

- Figure 53: South America Hyaluronic Acid Raw Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: South America Hyaluronic Acid Raw Material Market Volume Share (%), by Application 2025 & 2033

- Figure 55: South America Hyaluronic Acid Raw Material Market Revenue (million), by End User 2025 & 2033

- Figure 56: South America Hyaluronic Acid Raw Material Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Hyaluronic Acid Raw Material Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Hyaluronic Acid Raw Material Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Hyaluronic Acid Raw Material Market Revenue (million), by Country 2025 & 2033

- Figure 60: South America Hyaluronic Acid Raw Material Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Hyaluronic Acid Raw Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Hyaluronic Acid Raw Material Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 22: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Germany Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 40: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: China Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Japan Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: India Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 56: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 57: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 58: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: GCC Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Application 2020 & 2033

- Table 68: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by End User 2020 & 2033

- Table 70: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Hyaluronic Acid Raw Material Market Revenue million Forecast, by Country 2020 & 2033

- Table 72: Global Hyaluronic Acid Raw Material Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Hyaluronic Acid Raw Material Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Hyaluronic Acid Raw Material Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hyaluronic Acid Raw Material Market?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Hyaluronic Acid Raw Material Market?

Key companies in the market include AbbVie Inc (Allergan PLC), Sanofi (Genzyme Corporation), Smith & Nephew PLC, F Hoffmann-La Roche Ltd, Lifecore Biomedical LLC, Bausch Health Companies Inc (Salix Pharmaceuticals), Galderma SA, Anika Therapeutics Inc, Seikagaku Corporation, Zimmer Biomet.

3. What are the main segments of the Hyaluronic Acid Raw Material Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 245.62 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Anti-aging Solutions and Minimally Invasive Aesthetic Treatments; Demographic Shift in Developed and Developing Countries; Growing Usage of Hyaluronic Acid in Cosmetic and Medical Field.

6. What are the notable trends driving market growth?

Orthopedics Segment Expected to Witness Significant Growth in the Hyaluronic Acid Raw Material Market During the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs and Side Effects Associated with the Use of Hyaluronic Acid.

8. Can you provide examples of recent developments in the market?

In August 2022, Iris and Romeo launched the Reset Hyaluronic Acid + Niacinamide Serum Spray, an all-in-one skin-plumping serum spray that combines niacinamide, ceramides, and hyaluronic acid, which increases cell membrane fluidity by 40% to visibly plump skin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hyaluronic Acid Raw Material Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hyaluronic Acid Raw Material Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hyaluronic Acid Raw Material Market?

To stay informed about further developments, trends, and reports in the Hyaluronic Acid Raw Material Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence