Key Insights

The India biostimulants market is projected for significant expansion, forecasted to reach 410.78 million by 2025, with a Compound Annual Growth Rate (CAGR) of 15.64% through 2033. This growth is propelled by rising farmer awareness of sustainable agriculture and biostimulant benefits for crop enhancement. Government initiatives and supportive policies for bio-based agricultural inputs further bolster the market. India's diverse agricultural sector offers extensive segmentation opportunities across cash, horticultural, and row crops. Amino acids, fulvic acid, humic acid, and seaweed extracts are anticipated to lead market performance due to their proven efficacy and widespread adoption.

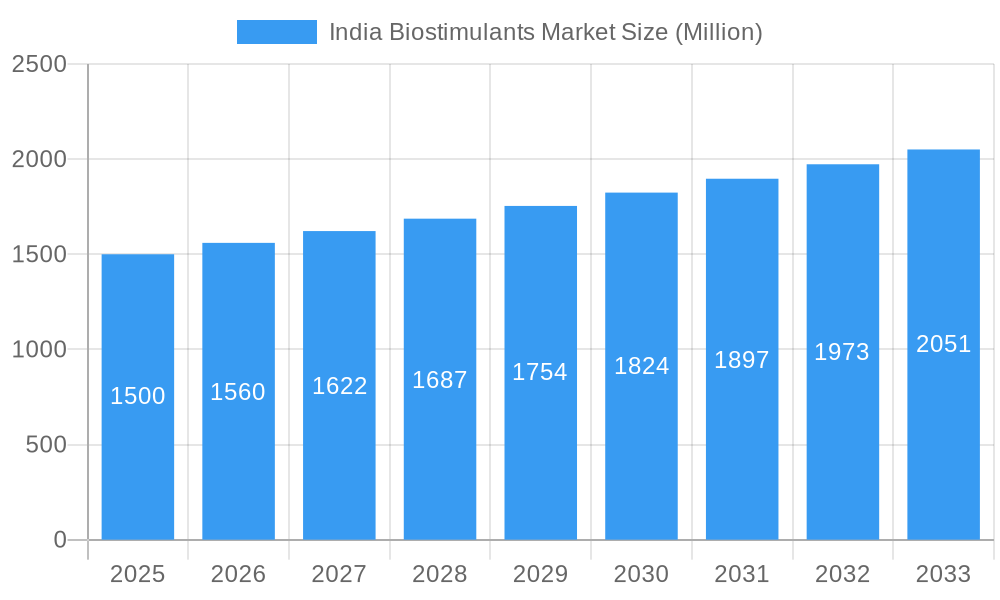

India Biostimulants Market Market Size (In Million)

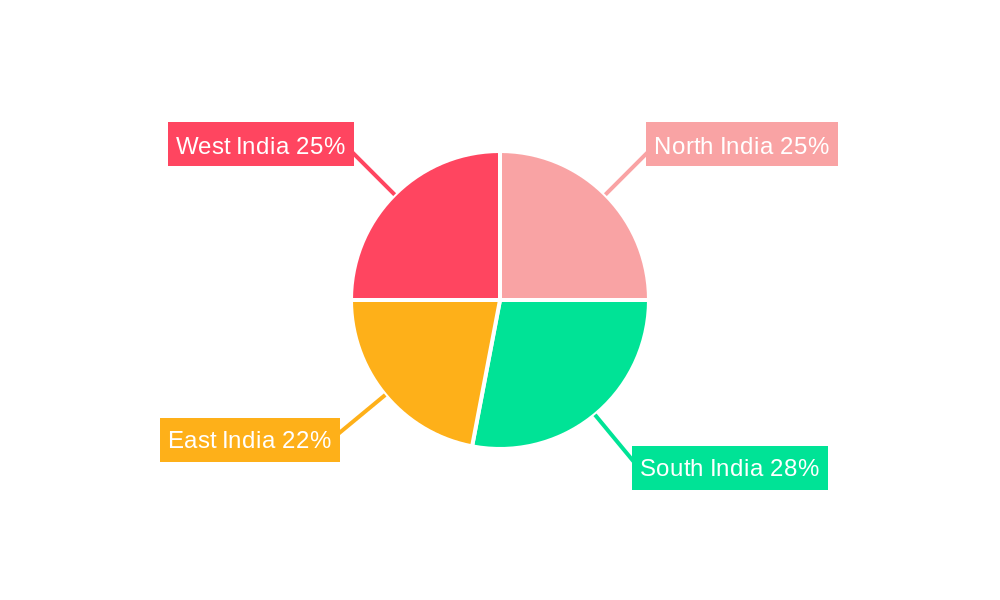

Despite potential restraints like higher costs compared to conventional fertilizers and the need for farmer education, advancements in production technology promise improved efficacy and cost-effectiveness. Customized biostimulant solutions tailored to specific crop needs and regional conditions will also drive market growth. Collaborative efforts between manufacturers, research institutions, and government bodies will accelerate the adoption of advanced biostimulant technologies across all Indian regions (North, South, East, and West). The market features a dynamic competitive landscape with established and emerging players, indicating substantial growth potential.

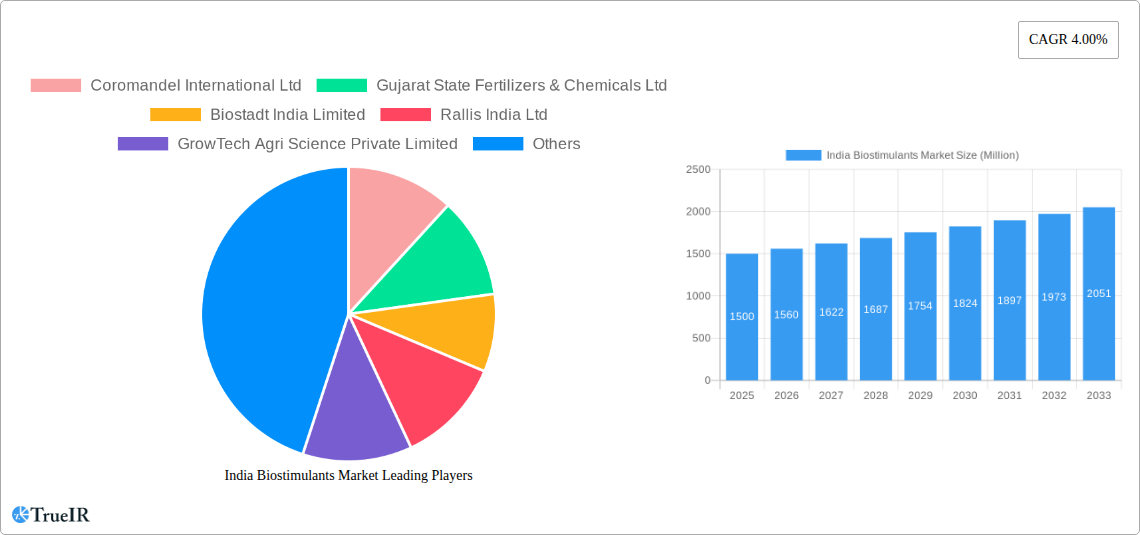

India Biostimulants Market Company Market Share

This report provides a comprehensive analysis of the India Biostimulants Market, offering critical insights for agricultural stakeholders. Covering 2019-2033 with a focus on 2025, it details market trends, competitive strategies, and future growth projections, serving as an essential resource for businesses aiming to capitalize on this burgeoning market.

India Biostimulants Market Market Structure & Competitive Landscape

The India Biostimulants Market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the market displays considerable dynamism, driven by continuous innovation in product formulations and application technologies. Regulatory frameworks, while evolving, present both opportunities and challenges for market participants. The presence of substitute products, such as traditional fertilizers, necessitates strategic differentiation and value proposition building. The market witnesses significant end-user segmentation across diverse crop types (cash crops, horticultural crops, row crops) and farming practices.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: R&D investments in developing novel biostimulant formulations tailored to specific crop needs and environmental conditions are significant drivers.

- Regulatory Impacts: Government policies promoting sustainable agriculture and reducing reliance on chemical fertilizers are shaping the market landscape.

- Product Substitutes: Traditional chemical fertilizers pose a competitive threat, requiring biostimulant producers to demonstrate superior efficacy and value.

- End-User Segmentation: The market caters to diverse end-users including large-scale commercial farms, smallholder farmers, and horticultural businesses.

- M&A Trends: The market has witnessed a growing number of mergers and acquisitions (M&As), particularly in the last five years, with an estimated xx M&A deals concluded between 2019 and 2024. These strategic moves aim to expand product portfolios, enhance market reach, and consolidate market share.

India Biostimulants Market Market Trends & Opportunities

The India Biostimulants Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors including increasing awareness among farmers about the benefits of biostimulants, rising demand for higher crop yields, stringent regulations on chemical fertilizers, and supportive government initiatives promoting sustainable agriculture. Technological advancements are leading to the development of more efficient and targeted biostimulant formulations. Consumer preferences are shifting towards eco-friendly and sustainable agricultural practices, bolstering the demand for biostimulants. Competitive dynamics are characterized by both intense competition and collaborative partnerships, driving innovation and market expansion. Market penetration of biostimulants is increasing steadily, with xx% of farmers currently using biostimulants in India.

Dominant Markets & Segments in India Biostimulants Market

The India Biostimulants Market demonstrates strong growth across various segments, with some showing particularly high potential.

Leading Regions: The states of Punjab, Haryana, Uttar Pradesh, and Maharashtra represent key markets due to their extensive agricultural activities and favorable climatic conditions.

Dominant Forms: Seaweed extracts, amino acids, and humic acid are currently the dominant biostimulant forms due to their proven efficacy and widespread availability.

High-Growth Crop Types: Horticultural crops are showing the most rapid growth, driven by the high value and sensitivity of these crops to environmental stress. Row crops and cash crops also present significant market opportunities.

Key Growth Drivers:

- Expanding agricultural land under cultivation: The growth of the agricultural sector is increasing the market for biostimulants.

- Government support for sustainable agriculture: The Indian government's initiatives to promote sustainable agriculture are driving the adoption of biostimulants.

- Rising awareness among farmers: Increased awareness among farmers about the benefits of biostimulants is positively impacting market growth.

- Favorable climatic conditions: The diverse climatic conditions in India make it suitable for growing a wide range of crops, benefiting the biostimulants market.

India Biostimulants Market Product Analysis

Significant advancements in biostimulant technology are leading to the development of products with enhanced efficacy, targeted delivery systems, and improved environmental compatibility. These innovations are tailored to specific crop needs and environmental conditions, enhancing crop yield, resilience, and quality. Competitive advantages are achieved through superior product performance, cost-effectiveness, and strong distribution networks. The market is witnessing a gradual shift towards specialized biostimulant formulations designed for precision agriculture applications.

Key Drivers, Barriers & Challenges in India Biostimulants Market

Key Drivers:

The market is propelled by factors such as increasing awareness among farmers regarding the benefits of biostimulants (improved yield, stress tolerance, and nutrient uptake), government initiatives promoting sustainable agriculture, and growing demand for high-quality produce. Technological advancements, leading to the development of more targeted and efficient biostimulant formulations, further accelerate market growth. The rising adoption of precision farming techniques also contributes to market expansion.

Challenges & Restraints:

High initial investment costs, the lack of awareness among smallholder farmers, and the complexity of regulatory approvals present significant challenges. Supply chain inefficiencies, including inconsistent product quality and inadequate storage facilities, further hinder market development. The competition from traditional fertilizers and the need for strong extension services to educate farmers about biostimulant applications add to these obstacles. The market faces an estimated xx Million loss annually due to supply chain issues.

Growth Drivers in the India Biostimulants Market Market

The market’s growth is driven by the increasing adoption of sustainable agricultural practices, supportive government policies promoting the use of bio-based inputs, and technological advancements leading to more effective and targeted biostimulant formulations. The rising demand for high-quality produce and the growing awareness among farmers about the benefits of biostimulants are also key drivers.

Challenges Impacting India Biostimulants Market Growth

High input costs, a lack of widespread farmer awareness, and inconsistent product quality pose significant challenges. Regulatory complexities and the need for substantial investment in research and development (R&D) further hinder market growth. Competition from established fertilizer manufacturers adds another layer of difficulty.

Key Players Shaping the India Biostimulants Market Market

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Biostadt India Limited

- Rallis India Ltd

- GrowTech Agri Science Private Limited

- T Stanes and Company Limited

- Indian Farmers Fertiliser Cooperative Limited

- Valagr

- Corteva Agriscience

- Southern Petrochemical Industries Corporation

Significant India Biostimulants Market Industry Milestones

- February 2022: Gujarat State Fertilizers & Chemicals Ltd launched Urban Sardar organic fertilizer.

- July 2022: Corteva Agriscience introduced Sosdia Stress, an abiotic stress mitigator.

- September 2022: Corteva Agriscience signed an agreement to acquire Symborg.

Future Outlook for India Biostimulants Market Market

The India Biostimulants Market is poised for continued strong growth, driven by favorable government policies, technological innovations, and increasing farmer adoption. Strategic opportunities exist in developing specialized biostimulant formulations for specific crops and regions, expanding distribution networks, and investing in research and development to improve product efficacy and sustainability. The market's potential is substantial, given the increasing demand for sustainable agriculture and high-quality food production in India.

India Biostimulants Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Biostimulants Market Segmentation By Geography

- 1. India

India Biostimulants Market Regional Market Share

Geographic Coverage of India Biostimulants Market

India Biostimulants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coromandel International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gujarat State Fertilizers & Chemicals Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biostadt India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rallis India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GrowTech Agri Science Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 T Stanes and Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Farmers Fertiliser Cooperative Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valagr

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Southern Petrochemical Industries Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Coromandel International Ltd

List of Figures

- Figure 1: India Biostimulants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Biostimulants Market Share (%) by Company 2025

List of Tables

- Table 1: India Biostimulants Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Biostimulants Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Biostimulants Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Biostimulants Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Biostimulants Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Biostimulants Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Biostimulants Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Biostimulants Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Biostimulants Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Biostimulants Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Biostimulants Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Biostimulants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Biostimulants Market?

The projected CAGR is approximately 15.64%.

2. Which companies are prominent players in the India Biostimulants Market?

Key companies in the market include Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Biostadt India Limited, Rallis India Ltd, GrowTech Agri Science Private Limited, T Stanes and Company Limited, Indian Farmers Fertiliser Cooperative Limited, Valagr, Corteva Agriscience, Southern Petrochemical Industries Corporation.

3. What are the main segments of the India Biostimulants Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 410.78 million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

September 2022: Corteva Agriscience signed an agreement to acquire Symborg, a biologicals-based company, as a part of its strategy to expand its biologicals portfolio. The move was aimed at helping Corteva Agriscience in achieving its aim to become a global leader in the agricultural biologicals market.July 2022: Corteva Agriscience introduced Sosdia Stress, an abiotic stress mitigator, to help farmers better manage drought-stressed crops. This product is derived from amino acids of natural origin.February 2022: Gujarat State Fertilizers & Chemicals Ltd launched the Urban Sardar organic fertilizer, an eco-friendly and non-toxic product containing organic sources of nutrients best suitable for all flowering plants and ornamental plants, gardens, and kitchen gardening.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Biostimulants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Biostimulants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Biostimulants Market?

To stay informed about further developments, trends, and reports in the India Biostimulants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence