Key Insights

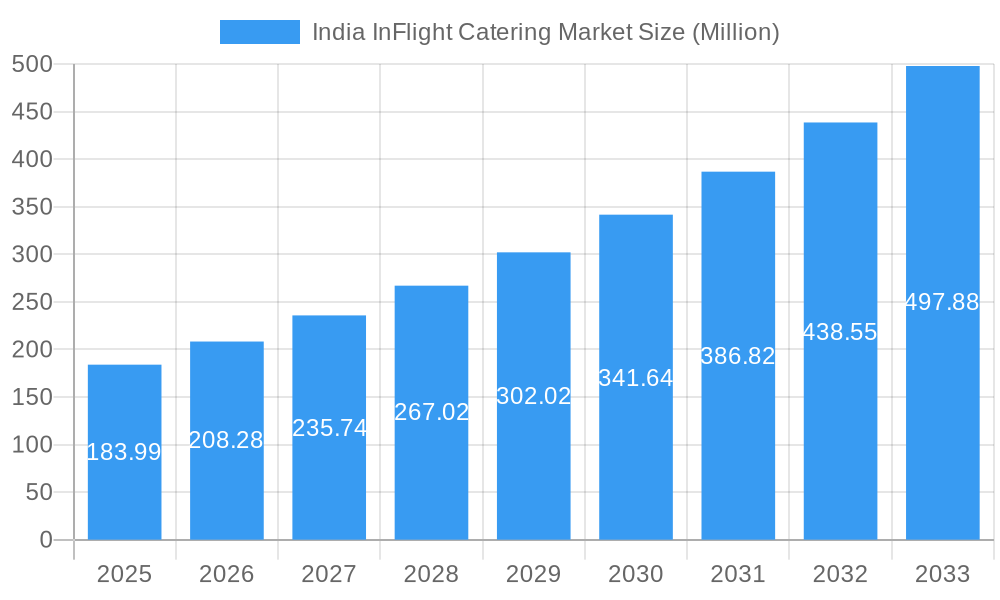

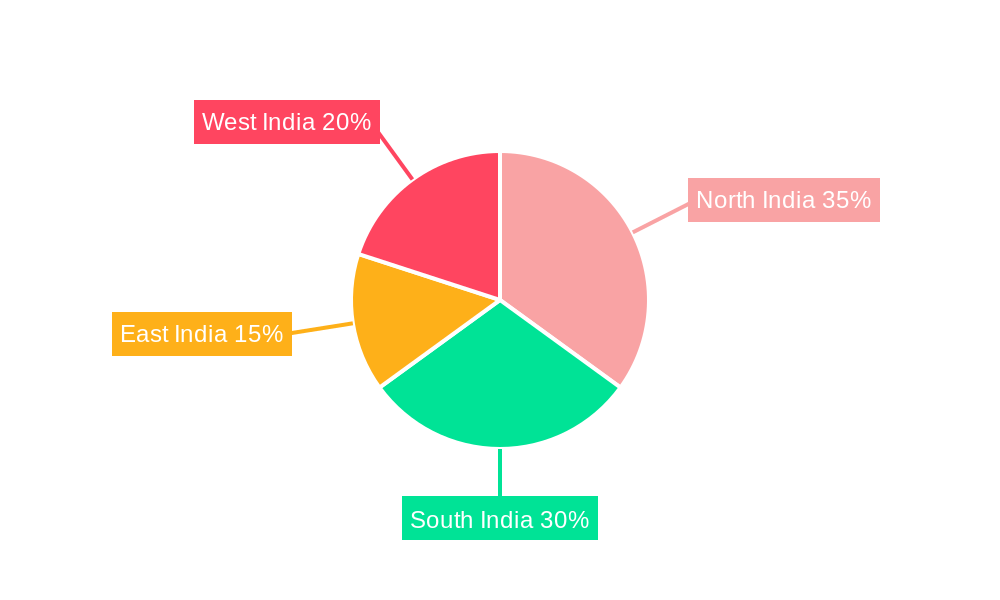

The India in-flight catering market, valued at $183.99 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 13.16% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning Indian aviation industry, characterized by increasing passenger numbers and a rise in both domestic and international flights, significantly boosts demand for in-flight meals and beverages. Furthermore, the growing preference for premium travel experiences, including enhanced meal options in business and first class, contributes to market expansion. The diversification of food offerings, encompassing specialized dietary needs and a wider range of cuisines, caters to the evolving preferences of air travelers. The presence of both full-service carriers and low-cost carriers, each with specific catering requirements, further fuels market segmentation and growth. Competition among established players like TajSATS, Lulu Flight Kitchen, and Ambassador's Sky Chef, alongside emerging companies, fosters innovation and drives down prices, benefiting consumers. Regional variations exist, with North and South India potentially exhibiting higher growth due to larger airport hubs and higher passenger traffic.

India InFlight Catering Market Market Size (In Million)

However, certain challenges exist. Fluctuations in fuel prices and economic downturns can impact airline profitability and, subsequently, their catering budgets. Maintaining consistent food quality and hygiene standards across diverse locations is crucial for customer satisfaction and regulatory compliance. Furthermore, the need to manage logistics efficiently and ensure timely delivery of catering services to airports across India poses a logistical hurdle. Despite these restraints, the overall outlook for the India in-flight catering market remains positive, driven by the continued expansion of the aviation sector and a rising middle class with a growing disposable income and inclination for air travel. The market is poised for significant expansion through strategic partnerships, technological advancements in food preparation and distribution, and a focus on sustainable practices.

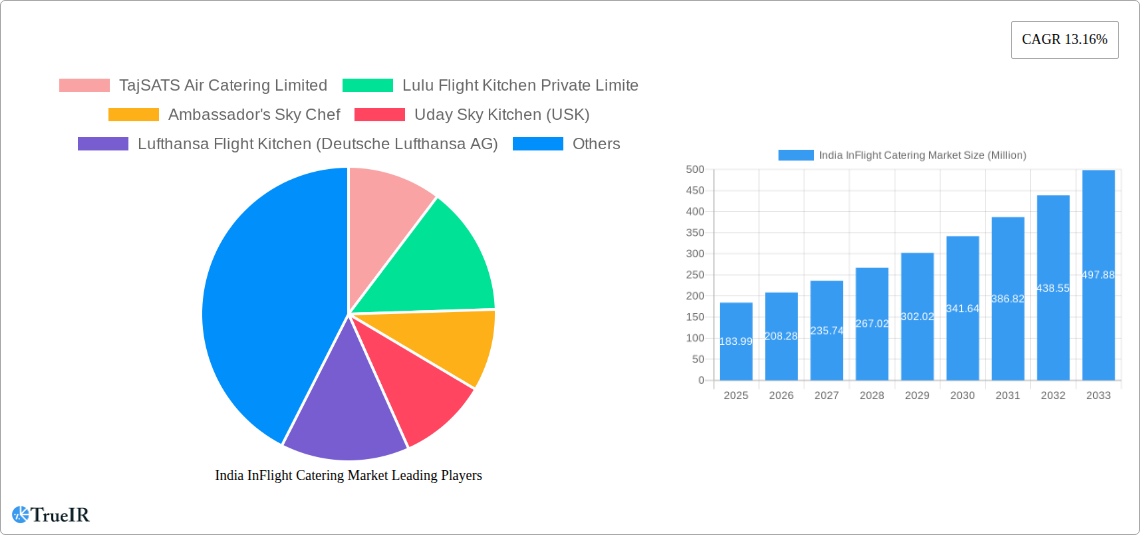

India InFlight Catering Market Company Market Share

India InFlight Catering Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the India InFlight Catering Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive research and data analysis covering the period from 2019 to 2033 (with a base year of 2025 and forecast period 2025-2033), this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. The report delves into key segments, including aircraft class, flight service type, and food type, while profiling major players such as TajSATS Air Catering Limited, Lulu Flight Kitchen Private Limited, and others. Discover crucial data points, including market size, CAGR, and market penetration rates, to gain a competitive edge in this rapidly evolving sector.

India InFlight Catering Market Market Structure & Competitive Landscape

The Indian InFlight Catering market is characterized by a moderately concentrated structure, with a few large players holding significant market share in 2025. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include the adoption of advanced food preservation techniques, customized meal options, and sustainable packaging solutions. Stringent regulatory frameworks concerning food safety and hygiene significantly impact market operations. Product substitutes, such as pre-packaged meals and on-board snacks, exert competitive pressure, although the demand for customized in-flight catering remains strong. The market is further segmented by end-users into full-service carriers, low-cost carriers, and other flight service types, each with distinct catering requirements. Mergers and acquisitions (M&A) activity has been moderate over the historical period (2019-2024), with approximately xx deals recorded, primarily focused on enhancing service capacity and geographical reach. This trend is expected to continue during the forecast period.

- Market Concentration: Moderately concentrated, with HHI estimated at xx in 2025.

- Innovation Drivers: Advanced food preservation, customized meals, sustainable packaging.

- Regulatory Impacts: Stringent food safety and hygiene regulations.

- Product Substitutes: Pre-packaged meals, onboard snacks.

- End-User Segmentation: Full-service carriers, low-cost carriers, hybrid and other.

- M&A Trends: Moderate activity (xx deals in 2019-2024), focused on capacity and reach.

India InFlight Catering Market Market Trends & Opportunities

The India InFlight Catering market is projected to experience robust growth during the forecast period (2025-2033), driven by a surge in air passenger traffic and increasing disposable incomes. The market size is estimated at xx Million in 2025 and is expected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, such as automated meal preparation systems and advanced packaging, are revolutionizing efficiency and reducing waste. Consumer preferences are shifting towards healthier and more customized meal options, creating opportunities for specialized catering services. The competitive landscape is dynamic, with existing players investing in capacity expansion and innovation, and new entrants exploring niche segments. Market penetration rates are expected to increase steadily, particularly in underserved regions. The growth is further fueled by the rising demand for premium in-flight dining experiences in business and first classes, alongside increased focus on sustainable practices and reduced environmental impact.

Dominant Markets & Segments in India InFlight Catering Market

The Indian InFlight Catering market is predominantly steered by the Full-Service Carrier (FSC) segment, which commanded a significant share, estimated at approximately 65-70% of the market value in 2023. Projections indicate this dominance will continue. The Business Class segment is showcasing the highest growth trajectory, propelled by an escalating demand for premium and personalized catering experiences. Among food types, Meals continue to represent the largest segment, encompassing a wide variety of offerings. Geographically, metropolitan hubs such as Mumbai, Delhi, and Bengaluru stand out as the leading regional markets, largely due to their higher air traffic density and a greater concentration of premium travel. The Low-Cost Carrier (LCC) segment is also experiencing robust growth, driven by increased passenger volumes and the demand for affordable yet appealing onboard food options.

- Leading Segment: Full-Service Carriers (FSC) by Flight Service Type, exhibiting sustained market leadership.

- Fastest Growing Segment: Business Class by Aircraft Class, driven by a growing preference for premium services and a desire for enhanced passenger experience. The Premium Economy segment is also emerging as a notable growth area.

- Largest Food Type: Meals, encompassing a comprehensive range from basic to gourmet options. Snacks and beverages also hold significant, albeit smaller, shares.

- Key Growth Drivers:

- Exponential Growth in Air Passenger Traffic: Both domestic and international air travel continue to witness substantial increases, directly translating to a higher demand for inflight catering services.

- Rising Disposable Incomes and Aspirations: An expanding middle class and higher disposable incomes are making air travel more accessible and fostering a greater willingness to opt for premium services and better onboard dining.

- Enhancements in Airport and Aviation Infrastructure: Continuous investments in modernizing airports and expanding airline fleets are supporting higher passenger volumes and sophisticated catering operations.

- Government Initiatives and Policy Support: Supportive government policies aimed at boosting the aviation sector, promoting tourism, and improving air connectivity are significant catalysts for market expansion.

- Increasing Demand for Diverse and Healthy Options: A growing passenger awareness about dietary needs and preferences is pushing catering providers to offer a wider variety of healthy, vegetarian, vegan, and culturally diverse meal choices.

India InFlight Catering Market Product Analysis

The Indian InFlight Catering market is characterized by a diverse and evolving range of product offerings. Beyond the standard economy meals, there is a distinct upward trend in demand for customized gourmet options, special dietary meals, and experiential dining for premium classes (Business and First Class). Key areas of innovation are centered around enhancing the shelf-life and quality of food, improving taste profiles and presentation, and importantly, adopting sustainable materials for packaging and reducing food waste. Technological advancements are playing a pivotal role, with the implementation of advanced preservation techniques, intelligent inventory management systems, and automated production lines to boost efficiency, maintain stringent quality control, and reduce operational costs. Achieving a competitive edge in this market hinges on a multi-faceted approach, including unwavering adherence to international food safety and hygiene standards, offering flexible and personalized menu options, ensuring punctuality and reliability in delivery, and building robust, resilient supply chains capable of navigating dynamic logistical landscapes.

Key Drivers, Barriers & Challenges in India InFlight Catering Market

Key Drivers:

- Sustained Growth in Air Passenger Traffic: The relentless expansion of air travel in India is the primary engine driving demand for inflight catering.

- Airline Industry Expansion and Fleet Modernization: The continuous growth of airline fleets and the introduction of new routes necessitate an increased capacity and sophistication in catering services.

- Rising Disposable Incomes and Consumer Spending Power: A growing affluent population is willing to spend more on premium travel experiences, including enhanced onboard dining.

- Technological Advancements in Food Production and Logistics: Innovations in food processing, preservation, and supply chain management are improving efficiency and quality.

- Supportive Government Policies and Infrastructure Development: Government focus on aviation infrastructure, tourism, and ease of doing business creates a conducive environment for market growth.

- Demand for Speciality and Health-Conscious Food Options: The increasing passenger awareness and demand for diverse dietary options (e.g., vegan, gluten-free, low-calorie) is a significant driver for menu diversification.

Barriers & Challenges:

- Stringent and evolving food safety and hygiene regulations necessitate continuous investment in compliance and quality control, thereby increasing operational costs.

- Potential supply chain disruptions, whether due to logistical issues, geopolitical factors, or seasonal availability, can lead to inconsistent ingredient sourcing and impact menu planning and execution.

- Intense competition from both established, large-scale players and agile new entrants exerts significant pricing pressure. This competitive landscape has, in recent years, led to a notable pressure on profit margins, with some reports indicating an average decrease of around 5-10% in profit margins for smaller and mid-sized players over the past five years, primarily due to the need to maintain competitive pricing.

- Managing fluctuating fuel prices can impact airline operational costs, indirectly affecting catering budgets and contract negotiations.

- The need to adapt to diverse passenger preferences across different demographics and flight routes adds complexity to menu development and operational planning.

- Ensuring the sustainability of operations, including waste reduction and the use of eco-friendly packaging, presents an ongoing challenge and an area requiring continuous innovation and investment.

Growth Drivers in the India InFlight Catering Market Market

The Indian InFlight Catering market is propelled by rapid growth in air passenger numbers, rising disposable incomes increasing demand for premium inflight services, and continuous technological advancements in food preparation and preservation. Government initiatives boosting the aviation sector further fuel market expansion.

Challenges Impacting India InFlight Catering Market Growth

Challenges include stringent food safety regulations, potential supply chain disruptions due to infrastructural limitations and geopolitical factors, and fierce competition requiring continuous innovation and cost optimization to maintain market share and profitability.

Key Players Shaping the India InFlight Catering Market Market

- TajSATS Air Catering Limited: A joint venture between Tata Group and SATS Ltd., it is a leading player with extensive operations across major Indian airports.

- Lulu Flight Kitchen Private Limited: A significant player in the South Indian market, known for its comprehensive catering solutions.

- Ambassador's Sky Chef: A well-established provider with a strong presence in catering to various airlines.

- Uday Sky Kitchen (USK): An emerging player focusing on quality and innovation in inflight catering services.

- Lufthansa Flight Kitchen (Deutsche Lufthansa AG): While a global entity, its operations in India are crucial, reflecting international standards.

- Skygourmet Catering Private Limited: Known for its commitment to quality and customer satisfaction.

- Gate Group: A global leader in inflight services, with a growing footprint in the Indian market.

- Casino Air Caterers & Flight Services: A long-standing provider with a reputation for reliable service.

- Oberoi Flight Services (Oberoi Group): Leveraging the Oberoi Group's legacy of hospitality to offer premium inflight dining experiences.

- Muthoot Skychef (Muthoot Finance Ltd): A diversified player extending its reach into the aviation catering sector.

Significant India InFlight Catering Market Industry Milestones

- 2021: TajSATS launches new sustainable packaging initiative.

- 2022: Lulu Flight Kitchen expands operations to a new airport.

- 2023: New regulations regarding food safety come into effect.

- 2024: A significant merger takes place between two smaller catering companies.

Future Outlook for India InFlight Catering Market Market

The India InFlight Catering Market is on a robust growth trajectory, significantly propelled by the sustained expansion of the Indian aviation sector and a burgeoning demand for high-quality, diverse, and convenient inflight meals and services. The market is ripe with opportunities for providers who can effectively cater to niche demands, such as personalized meals tailored to individual dietary preferences and health requirements, and those who champion sustainable practices throughout their operations, from sourcing to packaging. Investing in advanced technologies for enhanced operational efficiency, improved food safety, and a superior customer experience will be paramount. The future success of players in this market will be intricately linked to their ability to proactively address persistent supply chain challenges, adapt swiftly to evolving regulatory landscapes, and keenly anticipate and respond to the dynamic preferences of the modern air traveler. Innovation in areas like contactless service, smart packaging, and the integration of digital ordering platforms will likely shape the future of inflight dining in India.

India InFlight Catering Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India InFlight Catering Market Segmentation By Geography

- 1. India

India InFlight Catering Market Regional Market Share

Geographic Coverage of India InFlight Catering Market

India InFlight Catering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Low Cost Carriers are Expected to Show Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India InFlight Catering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TajSATS Air Catering Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu Flight Kitchen Private Limite

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ambassador's Sky Chef

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uday Sky Kitchen (USK)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lufthansa Flight Kitchen (Deutsche Lufthansa AG)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Skygourmet Catering Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gate Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Casino Air Caterers & Flight Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oberoi Flight Services (Oberoi Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Muthoot Skychef (Muthoot Finance Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TajSATS Air Catering Limited

List of Figures

- Figure 1: India InFlight Catering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India InFlight Catering Market Share (%) by Company 2025

List of Tables

- Table 1: India InFlight Catering Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India InFlight Catering Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India InFlight Catering Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India InFlight Catering Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India InFlight Catering Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India InFlight Catering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India InFlight Catering Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India InFlight Catering Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India InFlight Catering Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India InFlight Catering Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India InFlight Catering Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India InFlight Catering Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India InFlight Catering Market?

The projected CAGR is approximately 13.16%.

2. Which companies are prominent players in the India InFlight Catering Market?

Key companies in the market include TajSATS Air Catering Limited, Lulu Flight Kitchen Private Limite, Ambassador's Sky Chef, Uday Sky Kitchen (USK), Lufthansa Flight Kitchen (Deutsche Lufthansa AG), Skygourmet Catering Private Limited, Gate Group, Casino Air Caterers & Flight Services, Oberoi Flight Services (Oberoi Group), Muthoot Skychef (Muthoot Finance Ltd).

3. What are the main segments of the India InFlight Catering Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Low Cost Carriers are Expected to Show Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India InFlight Catering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India InFlight Catering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India InFlight Catering Market?

To stay informed about further developments, trends, and reports in the India InFlight Catering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence