Key Insights

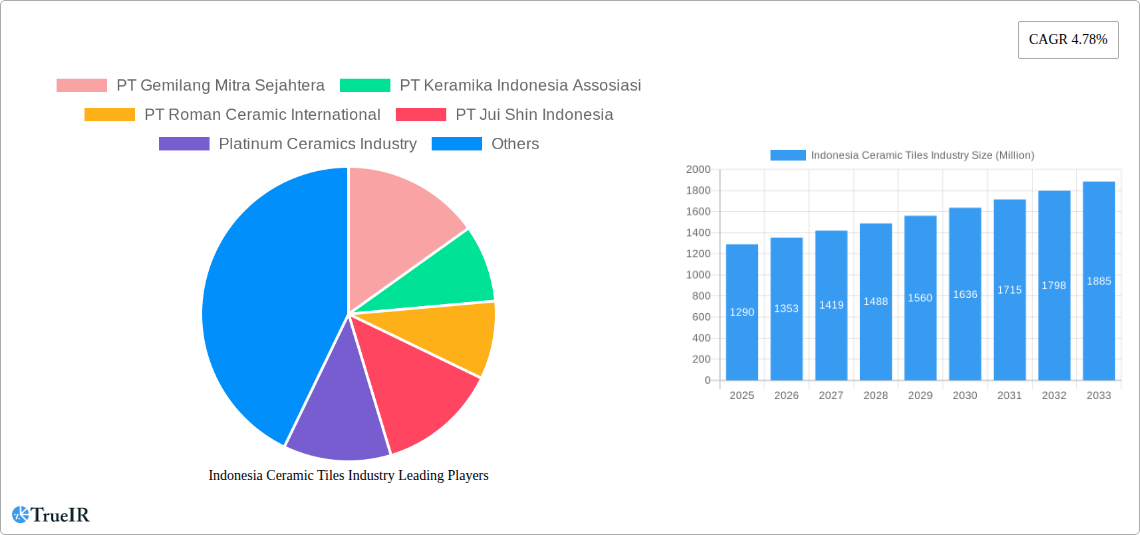

The Indonesian ceramic tile industry, valued at $1.29 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.78% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the nation's burgeoning construction sector, driven by increasing urbanization and infrastructure development, significantly boosts demand for ceramic tiles in both residential and commercial projects. The rise of modern architectural styles favoring aesthetically pleasing and durable tiling further contributes to market growth. Secondly, a shift towards higher-quality, innovative products like glazed and porcelain tiles, alongside a growing preference for scratch-free options, is stimulating premium segment expansion. The increasing availability of online distribution channels also enhances market accessibility and facilitates growth. However, the industry faces challenges such as fluctuating raw material prices and potential competition from alternative flooring materials. Despite these headwinds, the strong underlying growth in construction and consumer preference for ceramic tiles suggests a positive outlook for the Indonesian ceramic tile market over the forecast period.

Indonesia Ceramic Tiles Industry Market Size (In Billion)

Segmentation analysis reveals that the residential sector currently dominates the market, yet the commercial sector is experiencing faster growth, propelled by the construction of large-scale infrastructure and commercial buildings. New construction projects account for a larger share compared to replacement and renovation, indicating opportunities for sustained growth as the Indonesian housing market expands and older buildings undergo renovation. While the offline distribution channel still holds significant market share, the online segment's rapid growth showcases the evolving consumer buying behavior, presenting potential for further online penetration. The market share of various tile types reflects a gradual shift towards higher-value products, with glazed and porcelain tiles witnessing increasing demand due to their superior durability and aesthetics. Key players in the market are actively investing in production capacity and technological upgrades to maintain a competitive edge.

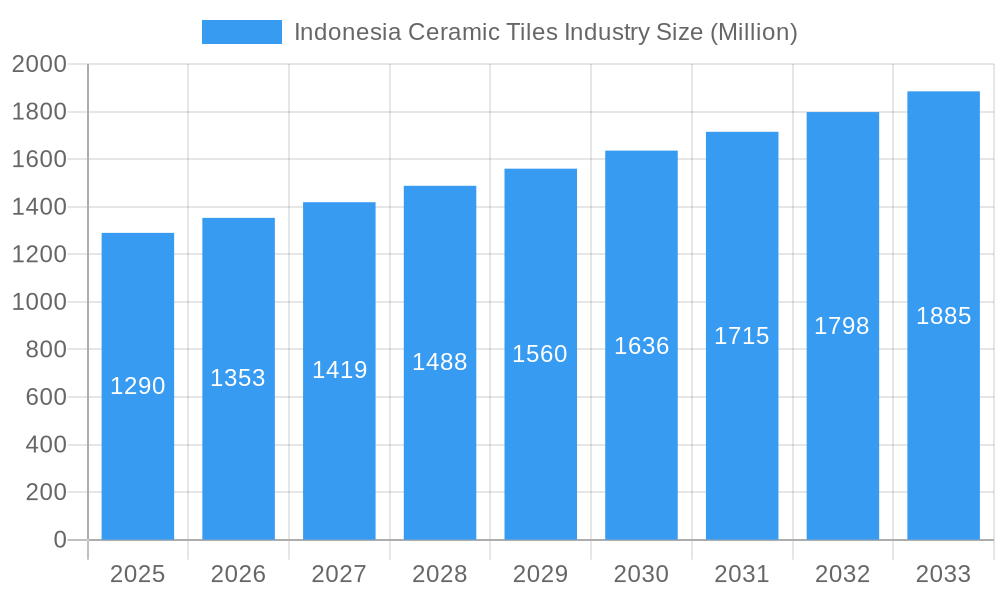

Indonesia Ceramic Tiles Industry Company Market Share

Indonesia Ceramic Tiles Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Indonesian ceramic tiles industry, offering invaluable insights for investors, manufacturers, and industry professionals. Leveraging extensive market research and data analysis spanning the period 2019-2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this report unveils the market's structure, trends, challenges, and future prospects. The Indonesian ceramic tile market, valued at xx Million USD in 2025, is projected to experience significant growth, reaching xx Million USD by 2033, exhibiting a robust CAGR of xx%.

Indonesia Ceramic Tiles Industry Market Structure & Competitive Landscape

The Indonesian ceramic tile market exhibits a moderately concentrated structure, with several key players dominating the landscape. Concentration ratios, while not precisely quantified for this report, suggest a relatively oligopolistic market. Innovation is a crucial driver, with companies constantly investing in new technologies to improve product quality, efficiency, and aesthetics. Government regulations regarding building codes and environmental standards play a significant role, influencing material choices and production processes. Substitute materials, such as wood, vinyl, and natural stone, present competition, albeit with varying degrees of impact depending on the specific application and consumer preference.

End-user segmentation significantly influences market dynamics, with residential construction accounting for the largest share. The M&A activity in the Indonesian ceramic tile industry, while not exceptionally high in recent years, demonstrates strategic maneuvering among players to expand market reach and diversify product portfolios. A notable example is the investment from PT Keramika Indonesia Assosiasi, which may lead to further consolidation. The qualitative insights point towards an increasing demand for higher-quality, more sustainable products and a preference towards modern aesthetics.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Technological advancements in production and design.

- Regulatory Impacts: Building codes and environmental regulations are significant factors.

- Product Substitutes: Wood, vinyl, and natural stone pose some competitive pressure.

- End-User Segmentation: Residential construction forms the largest segment.

- M&A Trends: Limited but strategic activity observed, including the KIAS investment.

Indonesia Ceramic Tiles Industry Market Trends & Opportunities

The Indonesian ceramic tiles market is characterized by robust growth fueled by several key factors. The expanding construction industry, particularly in residential and commercial sectors, is a primary driver, contributing significantly to increased demand. Technological advancements, such as the adoption of digital printing and improved glaze technology, have led to enhanced product aesthetics and performance. Changing consumer preferences, with a greater emphasis on style, durability, and sustainability, are also shaping market dynamics. Competitive dynamics are intense, with companies striving for differentiation through innovation, brand building, and efficient distribution networks. Market penetration rates in emerging regions are high, indicating considerable room for growth.

The report meticulously examines these factors, providing detailed insights into market size projections, CAGR, and market penetration rates for various segments. The increasing adoption of sophisticated manufacturing processes by companies like Platinum Ceramics, for example, exemplifies the push for efficiency and quality enhancement within the industry. These advancements contribute to the overall positive growth outlook for the market, particularly driven by a strong emphasis on infrastructural development.

Dominant Markets & Segments in Indonesia Ceramic Tiles Industry

The Indonesian ceramic tile market showcases strong growth across various segments.

- By Application: Floor tiles dominate, followed by wall tiles, with "other applications" representing a niche but steadily growing segment.

- By End User: Residential construction contributes significantly to market size, while commercial sectors, such as hospitality and retail, show increasing demand.

- By Construction Type: New construction dominates the market, with replacement and renovation activities representing a substantial secondary segment.

- By Distribution Channel: Offline channels, such as traditional distributors and retailers, continue to hold significant market share, but online sales are exhibiting substantial growth.

- By Product: Glazed tiles maintain the largest market share, while porcelain tiles are gaining popularity due to their durability. Scratch-free tiles represent a premium segment, reflecting increasing consumer preference for high-quality products.

Key Growth Drivers:

- Infrastructure Development: Government investments in infrastructure projects fuel demand.

- Rising Disposable Incomes: Increased purchasing power boosts consumer spending on home improvement.

- Urbanization: Growing urbanization increases demand for housing and commercial spaces.

- Government Policies: Supportive policies related to construction and housing initiatives are positive catalysts.

The analysis delves into the specific characteristics of each dominant segment, highlighting their growth drivers and exploring their future potential. The expanding middle class and government initiatives play a crucial role in this widespread growth across various market segments.

Indonesia Ceramic Tiles Industry Product Analysis

Product innovations are key to competitiveness. Technological advancements, such as improved glaze technology, digital printing, and the development of scratch-free and larger-format tiles, are driving product differentiation. These innovations cater to diverse consumer preferences and enhance product appeal. The market prioritizes products with improved aesthetics, durability, and functionality, aligning with the evolving needs of residential and commercial customers.

Key Drivers, Barriers & Challenges in Indonesia Ceramic Tiles Industry

Key Drivers:

The Indonesian ceramic tile market is propelled by strong economic growth, rising urbanization, and expanding construction activity. Government infrastructure development projects significantly stimulate demand. Technological advancements in manufacturing processes lead to cost efficiencies and improved product quality. Supportive government policies and favorable credit conditions further fuel market expansion.

Challenges and Restraints:

The industry faces challenges including fluctuating raw material prices, intense competition, and potential supply chain disruptions. Regulatory hurdles and environmental concerns also pose constraints. Furthermore, the increasing cost of labor and energy can impact profitability. Addressing these challenges is crucial for the sustainable growth of the Indonesian ceramic tile industry. The impact of these restraints needs specific quantifiable assessment which is not available at this time.

Growth Drivers in the Indonesia Ceramic Tiles Industry Market

The key drivers are consistent with the previously outlined factors, with an emphasis on strong economic growth, construction boom, rising disposable incomes, and government initiatives boosting infrastructure projects. Technological advancements are again highlighted, this time focusing on their impact on lowering production costs and increasing product quality. Moreover, favorable credit conditions and supportive government policies continue to facilitate expansion.

Challenges Impacting Indonesia Ceramic Tiles Industry Growth

The significant challenges include volatility in raw material prices, which directly influences production costs and profit margins. Intense competition among numerous players requires companies to constantly innovate and improve efficiency. Supply chain disruptions, whether due to logistics or raw material scarcity, could significantly impact production and delivery timelines. Environmental regulations can also add operational costs. The specific quantitative impact of these challenges, such as the percentage loss in revenue or increase in production costs, requires more precise data.

Key Players Shaping the Indonesia Ceramic Tiles Industry Market

- PT Gemilang Mitra Sejahtera

- PT Keramika Indonesia Assosiasi

- PT Roman Ceramic International

- PT Jui Shin Indonesia

- Platinum Ceramics Industry

- PT Eleganza Tile Indonesia

- PT Arwana Citramulia TBK

- PT Terracotta Indonesia

- PT Muliakeramik Indahraya

- PT Niro Ceramic Nasional Indonesia

Significant Indonesia Ceramic Tiles Industry Industry Milestones

- September 2023: PT Keramika Indonesia Assosiasi Tbk (KIAS) secured a IDR 30 billion loan to expand its ceramic business line. This signifies an investment in capacity expansion and potentially market share growth.

- November 2022: Platinum Ceramics initiated a plant modernization project in partnership with System Ceramics. This investment in advanced technology should improve productivity and product quality, enhancing competitiveness.

Future Outlook for Indonesia Ceramic Tiles Industry Market

The Indonesian ceramic tile industry is poised for continued growth, driven by sustained economic expansion, rising urbanization, and ongoing infrastructure development. Strategic opportunities exist for companies to leverage technological advancements, focus on sustainable products, and expand into new market segments. The market's future trajectory is positive, with potential for increased exports and continued dominance in the domestic market. The consistent growth of the construction sector serves as the cornerstone of this positive outlook.

Indonesia Ceramic Tiles Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Ceramic Tiles Industry Segmentation By Geography

- 1. Indonesia

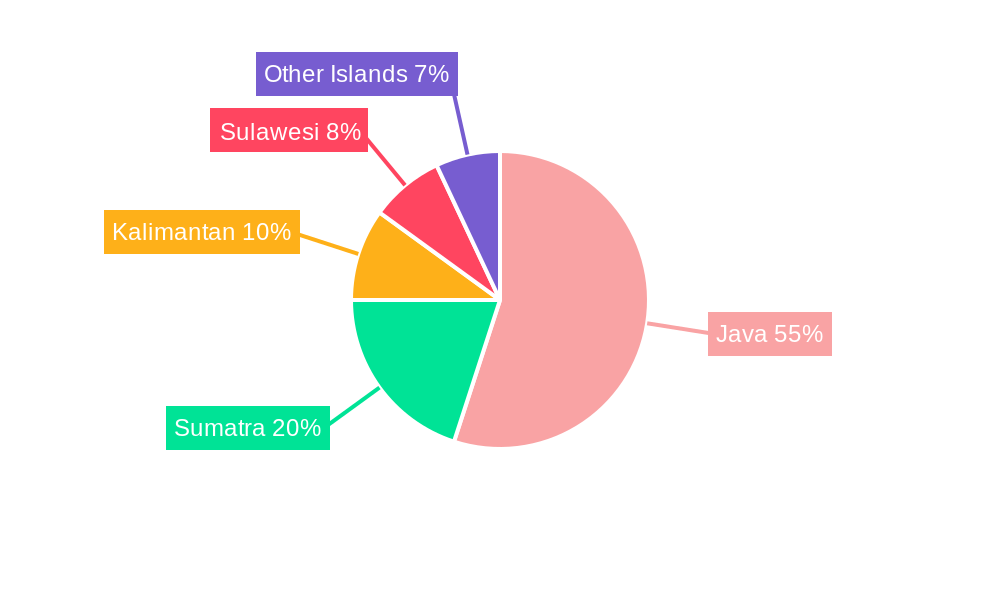

Indonesia Ceramic Tiles Industry Regional Market Share

Geographic Coverage of Indonesia Ceramic Tiles Industry

Indonesia Ceramic Tiles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Real Estate Construction is Driving the Market; Rise in Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Installation is Difficult

- 3.3.2 Pricey

- 3.3.3 and Time-Consuming; Long-term Heat Retention is Difficult

- 3.4. Market Trends

- 3.4.1. Consumption of Ceramic Tiles in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Ceramic Tiles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Gemilang Mitra Sejahtera

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Keramika Indonesia Assosiasi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Roman Ceramic International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Jui Shin Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Platinum Ceramics Industry

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Eleganza Tile Indonesia**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Arwana Citramulia TBK

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Terracotta Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Muliakeramik Indahraya

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Niro Ceramic Nasional Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Gemilang Mitra Sejahtera

List of Figures

- Figure 1: Indonesia Ceramic Tiles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Ceramic Tiles Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Ceramic Tiles Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Ceramic Tiles Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the Indonesia Ceramic Tiles Industry?

Key companies in the market include PT Gemilang Mitra Sejahtera, PT Keramika Indonesia Assosiasi, PT Roman Ceramic International, PT Jui Shin Indonesia, Platinum Ceramics Industry, PT Eleganza Tile Indonesia**List Not Exhaustive, PT Arwana Citramulia TBK, PT Terracotta Indonesia, PT Muliakeramik Indahraya, PT Niro Ceramic Nasional Indonesia.

3. What are the main segments of the Indonesia Ceramic Tiles Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Real Estate Construction is Driving the Market; Rise in Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Consumption of Ceramic Tiles in Indonesia.

7. Are there any restraints impacting market growth?

Installation is Difficult. Pricey. and Time-Consuming; Long-term Heat Retention is Difficult.

8. Can you provide examples of recent developments in the market?

In September 2023, PT Keramika Indonesia Assosiasi Tbk (KIAS) secured a loan of IDR 30 billion to expand its ceramic business line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Ceramic Tiles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Ceramic Tiles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Ceramic Tiles Industry?

To stay informed about further developments, trends, and reports in the Indonesia Ceramic Tiles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence