Key Insights

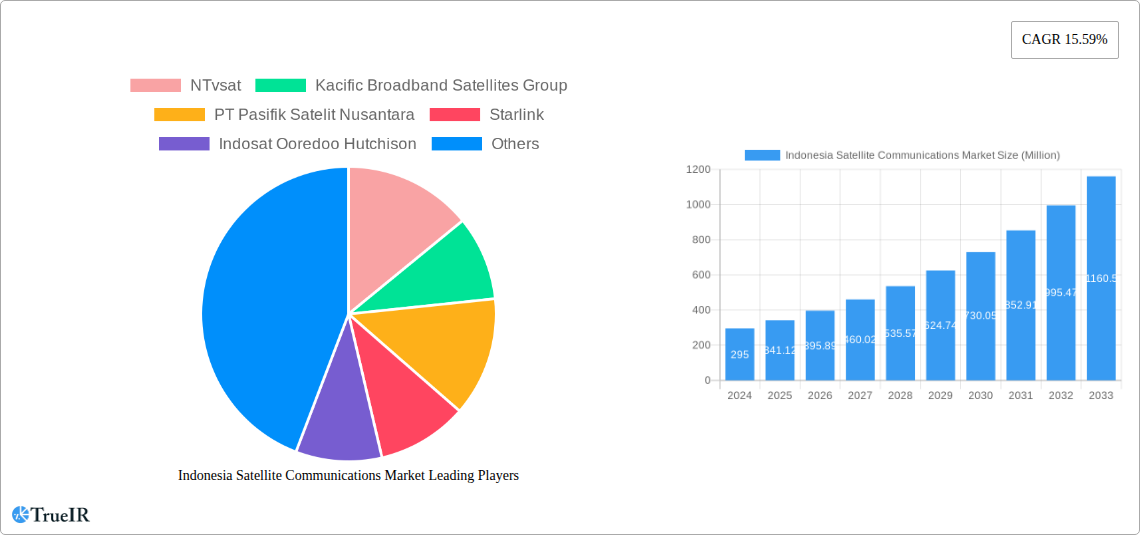

The Indonesian satellite communications market is experiencing robust growth, with a projected market size of USD 341.12 Million in 2025, expanding at a remarkable Compound Annual Growth Rate (CAGR) of 15.59% through 2033. This dynamic expansion is primarily driven by the increasing demand for reliable and widespread internet connectivity across the archipelago, particularly in remote and underserved areas where terrestrial infrastructure is challenging to deploy. The "Palapa Ring" project, aimed at connecting all districts and cities with high-speed internet, is a significant government initiative bolstering this demand. Furthermore, the burgeoning digital economy, fueled by the growth of e-commerce, online education, and digital services, necessitates robust satellite backhaul solutions. The defense and government sectors are also key contributors, leveraging satellite technology for secure communication and national security initiatives. The Maritime and Defense and Government end-user verticals are particularly influential, highlighting the critical role of satellite communications in these sectors.

Indonesia Satellite Communications Market Market Size (In Million)

The market is witnessing significant trends, including the increasing adoption of High Throughput Satellites (HTS) offering greater capacity and speed, and the growing integration of satellite services with terrestrial networks for hybrid solutions. The Ground Equipment segment, encompassing user terminals and ground stations, is seeing substantial investment as more users gain access to satellite services. Similarly, the Services segment, including data transmission, voice, and broadband internet, is expanding rapidly to meet diverse user needs. While the market is poised for strong growth, potential restraints could include the high initial cost of satellite infrastructure deployment and the availability of skilled personnel for managing advanced satellite systems. However, the continuous innovation in satellite technology and the competitive landscape, with key players like Starlink, SES S.A., and local entities such as Telkom Satelit Indonesia actively participating, are expected to mitigate these challenges and propel the market forward.

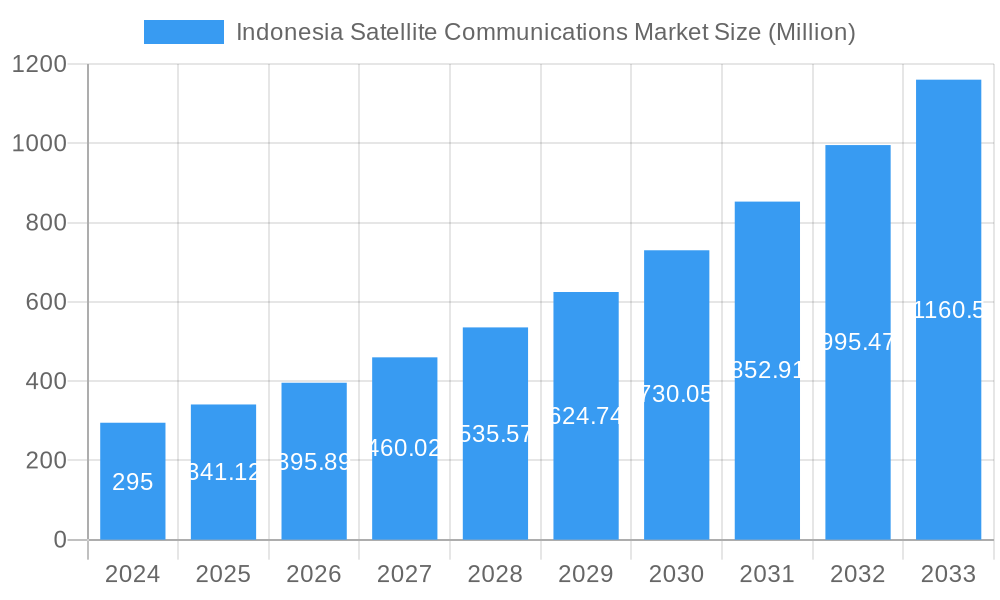

Indonesia Satellite Communications Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Indonesia Satellite Communications Market:

Indonesia Satellite Communications Market: Comprehensive Market Analysis, Trends, Opportunities, and Future Outlook (2019-2033)

Unlock deep insights into the burgeoning Indonesia satellite communications market with this definitive report. Covering the historical period of 2019–2024 and extending through an extensive forecast period of 2025–2033, with a base and estimated year of 2025, this analysis provides unparalleled strategic intelligence. Explore market dynamics, key players, and future growth trajectories for Indonesia's satellite internet, VSAT services, and broadband satellite connectivity. This report is an essential resource for stakeholders navigating the rapidly evolving Indonesian telecommunications landscape, focusing on high-volume keywords like satellite broadband Indonesia, Indonesia VSAT market, maritime satellite communication Indonesia, government satellite solutions Indonesia, and enterprise satellite connectivity Indonesia.

Indonesia Satellite Communications Market Market Structure & Competitive Landscape

The Indonesia satellite communications market exhibits a moderately concentrated structure, with a blend of established incumbents and agile new entrants driving innovation. Key companies like NTvsat, Kacific Broadband Satellites Group, PT Pasifik Satelit Nusantara, and Indosat Ooredoo Hutchison are prominent players, alongside the disruptive force of Starlink. Regulatory frameworks play a crucial role, with ongoing efforts to expand internet access influencing market dynamics. Product substitutes, such as terrestrial fiber optic networks, present a competitive challenge, yet the unique reach of satellite technology, particularly in archipelagic Indonesia, ensures its sustained relevance. End-user segmentation is diverse, spanning critical sectors like maritime, defense and government, enterprises, and media and entertainment. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate market share and expand service offerings, particularly in high-demand areas like rural internet Indonesia and remote connectivity solutions. The market's growth is further fueled by the increasing demand for reliable broadband across Indonesia's vast geography.

Indonesia Satellite Communications Market Market Trends & Opportunities

The Indonesia satellite communications market is poised for substantial growth, projected at a Compound Annual Growth Rate (CAGR) of over 12% from 2025 to 2033. This expansion is driven by a confluence of technological advancements, shifting consumer preferences for ubiquitous connectivity, and a robust competitive landscape. The introduction of Low Earth Orbit (LEO) constellations, exemplified by Starlink's impending operational launch and the successful deployment of satellites like Merah-Putih-2, is revolutionizing service delivery, offering lower latency and higher bandwidth. Consumer demand is increasingly focused on reliable, high-speed internet access, transcending urban centers to reach remote and underserved populations, making satellite internet for villages in Indonesia a significant opportunity. Enterprises are leveraging satellite communications for critical operations, including remote site connectivity, disaster recovery, and IoT deployments, highlighting the market for enterprise satellite solutions Indonesia. The media and entertainment sector also benefits from enhanced broadcasting capabilities. Government initiatives aimed at digital transformation and bridging the digital divide further catalyze market penetration. The demand for specialized solutions, such as maritime satellite communication Indonesia for the shipping industry and secure communication for defense, presents distinct growth avenues. The expansion of VSAT services Indonesia for businesses and government agencies continues to be a cornerstone of market development, supported by advancements in ground equipment and platform flexibility, including portable and land-based terminals.

Dominant Markets & Segments in Indonesia Satellite Communications Market

The Maritime and Defense and Government end-user verticals are emerging as dominant segments within the Indonesia satellite communications market. The archipelago's extensive coastline and vital shipping lanes create an insatiable demand for reliable maritime satellite communication Indonesia, enabling seamless vessel operations, crew welfare, and cargo tracking. Similarly, the strategic importance of national security and the government's commitment to digitalizing public services, particularly in remote areas, fuels the demand for secure and resilient satellite solutions for defense and government applications.

- Maritime: This segment is driven by the need for continuous connectivity for commercial shipping, fishing fleets, and offshore industries. Key growth drivers include:

- Enhanced vessel operational efficiency through real-time data transmission.

- Improved crew safety and communication capabilities.

- Regulatory requirements for fleet management and tracking.

- The expansion of offshore exploration and resource management.

- Defense and Government: This vertical is characterized by the demand for secure, robust, and often mobile communication networks for military operations, disaster response, and public administration in remote regions. Key growth drivers include:

- National security imperatives and border surveillance.

- Disaster preparedness and emergency communication infrastructure.

- Digital transformation initiatives for public services.

- The need for reliable connectivity in areas lacking terrestrial infrastructure.

- Enterprises: Businesses across various sectors are increasingly adopting satellite communications for their remote operational sites, branches, and critical data backhaul. The demand for stable internet for business continuity and digital operations is a primary driver.

- Media and Entertainment: This segment utilizes satellite for broadcasting, live event coverage, and content distribution, especially in areas where terrestrial networks are limited.

- Other End-user Verticals: This includes sectors like aviation, education, and healthcare, all of which are recognizing the value of satellite connectivity for expanding their reach and services.

In terms of platforms, Land and Portable solutions are experiencing significant traction due to their versatility. The Services offering, encompassing managed services, bandwidth provision, and integrated solutions, is also a critical growth area, often commanding a larger share of the market value compared to just Ground Equipment.

Indonesia Satellite Communications Market Product Analysis

Product innovation in the Indonesia satellite communications market is characterized by the development of advanced satellite terminals and integrated service platforms. The launch of high-throughput satellites (HTS) like Merah-Putih-2, operating on C-band and Ku-band, signifies a leap in capacity and efficiency, enabling faster and more reliable data transmission. Innovations in LEO satellite technology are bringing lower latency and more affordable broadband options to a wider audience. Competitive advantages lie in offering comprehensive solutions that combine robust ground equipment, flexible service plans, and responsive customer support tailored to the unique needs of Indonesian users, from remote enterprises to maritime vessels.

Key Drivers, Barriers & Challenges in Indonesia Satellite Communications Market

Key Drivers:

- Government Initiatives: The Indonesian government's focus on digital transformation and bridging the digital divide is a primary driver, pushing for expanded internet access across the archipelago.

- Technological Advancements: The advent of HTS and LEO constellations is enhancing capacity, speed, and affordability, making satellite services more competitive.

- Growing Demand for Connectivity: Increasing digitalization across all sectors, including enterprises, maritime, and government, fuels the need for reliable internet.

- Archipelagic Geography: Indonesia's vast expanse of islands makes satellite technology an indispensable solution for connecting remote and underserved regions.

Barriers & Challenges:

- Regulatory Hurdles: Navigating complex licensing and operational regulations can be challenging for new entrants and existing players.

- High Infrastructure Costs: The initial investment in satellite infrastructure and ground equipment can be substantial.

- Competition from Terrestrial Networks: In urban and semi-urban areas, fiber optic and mobile networks offer competitive alternatives.

- Supply Chain and Logistics: Managing the deployment and maintenance of equipment across a vast archipelago presents logistical complexities.

- Affordability for Rural Populations: While improving, the cost of satellite services can still be a barrier for some end-users in lower-income regions.

Growth Drivers in the Indonesia Satellite Communications Market Market

The Indonesia satellite communications market is propelled by strong growth drivers. Government mandates and investments aimed at achieving universal internet access are paramount. The increasing adoption of cloud computing and IoT by Indonesian businesses necessitates robust and reliable connectivity, which satellite communication provides, especially for remote operations. Furthermore, the burgeoning digital economy requires enhanced data transmission capabilities for sectors like e-commerce and fintech. The expansion of the maritime industry and the government's focus on national defense and security also contribute significantly to market expansion. Technological advancements, such as the deployment of new, high-capacity satellites, are critical enablers, improving service quality and reducing costs.

Challenges Impacting Indonesia Satellite Communications Market Growth

Several challenges impact the Indonesia satellite communications market growth. Regulatory complexities, including spectrum allocation and licensing procedures, can slow down market entry and service deployment. The significant capital expenditure required for launching and maintaining satellite constellations and ground infrastructure presents a substantial barrier. Competition from rapidly advancing terrestrial broadband technologies in more developed areas can limit market penetration. Supply chain disruptions and the logistical challenges of deploying and servicing equipment across Indonesia's vast archipelago also pose significant obstacles. Finally, ensuring the affordability of satellite services for end-users in less economically developed regions remains a persistent challenge.

Key Players Shaping the Indonesia Satellite Communications Market Market

- NTvsat

- Kacific Broadband Satellites Group

- PT Pasifik Satelit Nusantara

- Starlink

- Indosat Ooredoo Hutchison

- PT PRIMACOM INTERBUANA

- PT Telkom Satelit Indonesia

- Thaicom Public Company Limited

- SES S A

- PT Wahana Telekomunikasi Dirgantara

- PT SATELIT NUSANTARA TIG

Significant Indonesia Satellite Communications Market Industry Milestones

- April 2024: The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink, signaling a significant step towards bolstering internet accessibility in Indonesia as Starlink awaits regulatory approval for its operations.

- February 2024: SpaceX successfully launched the Merah-Putih-2 telecommunications satellite from Cape Canaveral, Florida, tailored for Indonesia. Constructed by Thales Alenia Space on the Spacebus 4000B2 platform, this satellite boasts a capacity of no less than 32 gigabits per second and operates on both C-band and Ku-band frequencies, poised to enhance connectivity across Indonesia.

Future Outlook for Indonesia Satellite Communications Market Market

The Indonesia satellite communications market is set for a period of robust growth and transformation. The increasing deployment of LEO constellations and the continuous evolution of HTS technology will drive innovation, leading to more affordable and higher-performance services. Strategic partnerships between satellite operators, service providers, and government agencies will be crucial in expanding reach to remote areas and underserved populations. Opportunities lie in the growing demand for specialized applications in sectors like maritime, defense, and enterprise mobility, as well as the potential for satellite-enabled IoT and digital transformation initiatives. The market's future is bright, characterized by enhanced connectivity, increased market penetration, and a significant contribution to Indonesia's digital economy.

Indonesia Satellite Communications Market Segmentation

-

1. Offering

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Indonesia Satellite Communications Market Segmentation By Geography

- 1. Indonesia

Indonesia Satellite Communications Market Regional Market Share

Geographic Coverage of Indonesia Satellite Communications Market

Indonesia Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.3. Market Restrains

- 3.3.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.4. Market Trends

- 3.4.1. Expansion of 5G Satellite Communication is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NTvsat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kacific Broadband Satellites Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Pasifik Satelit Nusantara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Starlink

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indosat Ooredoo Hutchison

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT PRIMACOM INTERBUANA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Telkom Satelit Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thaicom Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SES S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Telkom Satelit Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Wahana Telekomunikasi Dirgantara

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pasifik Satelit Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT SATELIT NUSANTARA TIG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NTvsat

List of Figures

- Figure 1: Indonesia Satellite Communications Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2020 & 2033

- Table 3: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2020 & 2033

- Table 5: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 7: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 10: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2020 & 2033

- Table 11: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2020 & 2033

- Table 13: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Indonesia Satellite Communications Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia Satellite Communications Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Satellite Communications Market?

The projected CAGR is approximately 15.59%.

2. Which companies are prominent players in the Indonesia Satellite Communications Market?

Key companies in the market include NTvsat, Kacific Broadband Satellites Group, PT Pasifik Satelit Nusantara, Starlink, Indosat Ooredoo Hutchison, PT PRIMACOM INTERBUANA, PT Telkom Satelit Indonesia, Thaicom Public Company Limited, SES S A, PT Telkom Satelit Indonesia, PT Wahana Telekomunikasi Dirgantara, PT Pasifik Satelit Nusantara, PT SATELIT NUSANTARA TIG.

3. What are the main segments of the Indonesia Satellite Communications Market?

The market segments include Offering, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 341.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

6. What are the notable trends driving market growth?

Expansion of 5G Satellite Communication is Driving the Market.

7. Are there any restraints impacting market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

8. Can you provide examples of recent developments in the market?

April 2024 - The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink. This collaboration seeks to bolster internet accessibility in Indonesia as Starlink, the LEO satellite operator, awaits the green light from regulators to kick off its operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Indonesia Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence