Key Insights

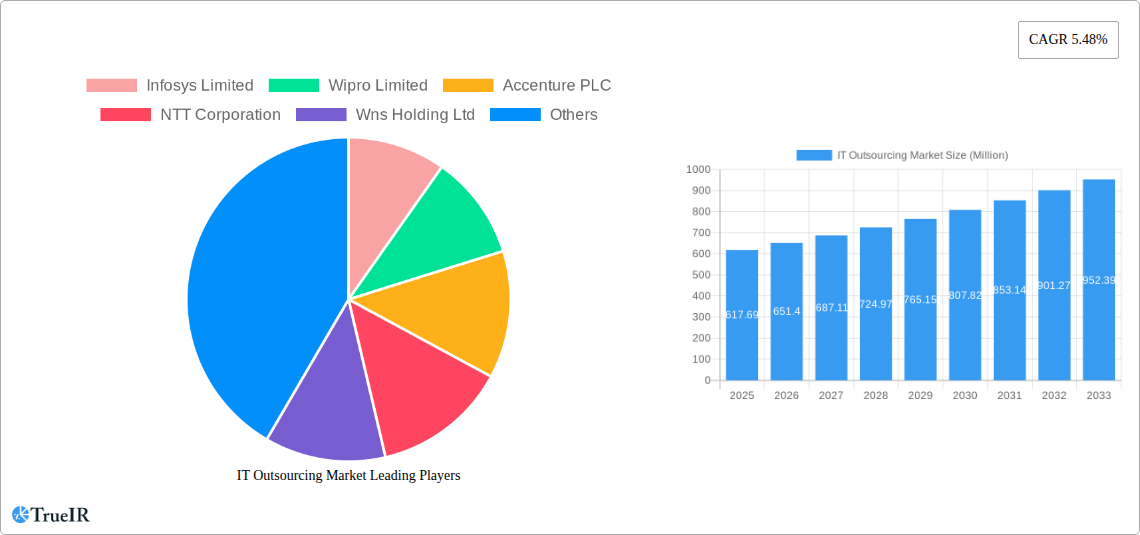

The global IT Outsourcing Market is poised for substantial growth, projected to reach $617.69 Million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.48% during the forecast period of 2025-2033. This robust expansion is primarily fueled by an increasing demand for cost optimization and access to specialized IT skills that businesses across various sectors are actively seeking. Large enterprises, in particular, are leveraging IT outsourcing to streamline operations, enhance efficiency, and focus on core competencies, while Small and Medium Enterprises (SMEs) are increasingly adopting these services to gain a competitive edge by accessing advanced technologies and expertise they might not possess internally. The BFSI and Healthcare sectors are leading the charge, driven by the need for enhanced data security, regulatory compliance, and digital transformation initiatives. Similarly, the Media and Telecommunications, Retail and E-commerce, and Manufacturing industries are witnessing significant adoption as they navigate the complexities of digital disruption and evolving customer expectations, making IT outsourcing a critical enabler of their growth strategies.

IT Outsourcing Market Market Size (In Million)

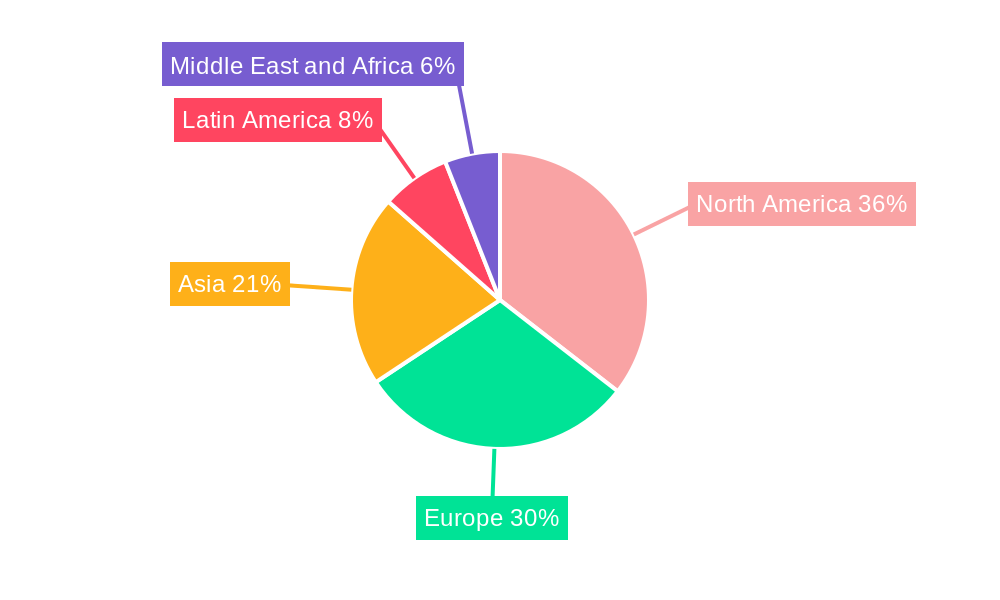

The market's upward trajectory is further supported by emerging trends such as the rise of cloud-based IT outsourcing, the increasing adoption of automation and artificial intelligence in service delivery, and the growing demand for cybersecurity and data analytics services. These advancements are not only improving the efficiency and effectiveness of outsourced IT functions but are also creating new avenues for growth. However, challenges such as data security concerns, potential vendor lock-in, and the complexities of managing offshore teams require careful consideration. Despite these hurdles, the inherent benefits of IT outsourcing, including cost savings, access to a wider talent pool, and improved scalability, are expected to outweigh the restraints. Geographically, North America and Europe currently dominate the market, with significant contributions from the United States, United Kingdom, and Germany. Asia, with its rapidly growing economies like China and India, is emerging as a key growth region, driven by a burgeoning IT talent pool and increasing foreign investment.

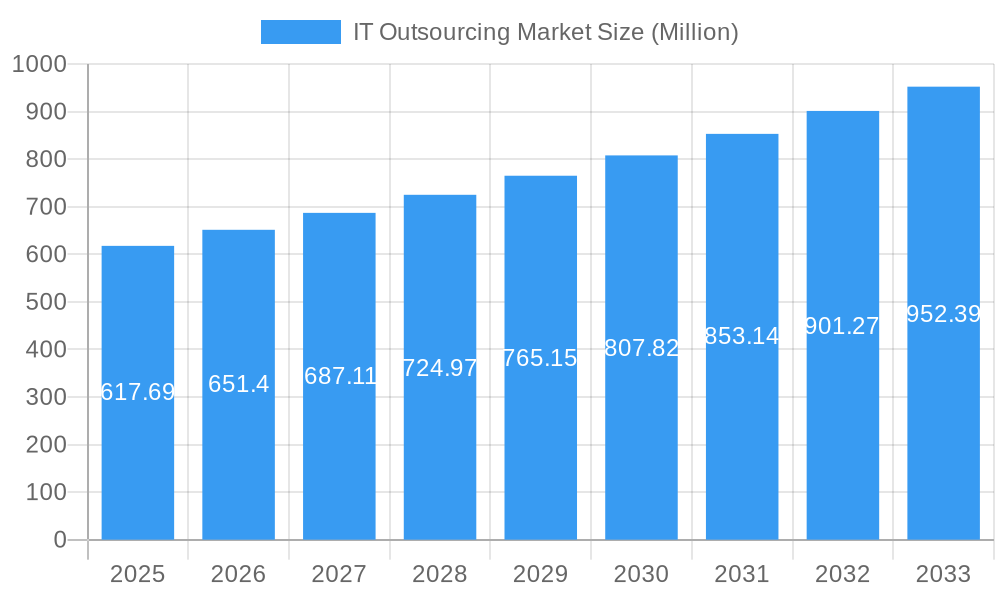

IT Outsourcing Market Company Market Share

Unveiling the IT Outsourcing Market: A Comprehensive Analysis (2019–2033)

This in-depth report provides a dynamic and SEO-optimized exploration of the global IT Outsourcing Market. Leveraging high-volume keywords such as "IT outsourcing," "digital transformation," "cloud services," "managed IT services," "business process outsourcing (BPO)," and "software development outsourcing," this analysis is crafted to engage industry professionals, decision-makers, and investors. Delving into the market's structure, trends, dominant segments, and competitive landscape, this report offers unparalleled insights from its base year of 2025 through an extensive forecast period ending in 2033. Historical data from 2019 to 2024 enriches the foundational understanding of market evolution, while detailed product analysis and a thorough examination of growth drivers, barriers, and challenges equip stakeholders with actionable intelligence. Featuring significant industry milestones and key player profiles, this report is the definitive guide to navigating the complexities and opportunities within the IT Outsourcing sector.

IT Outsourcing Market Market Structure & Competitive Landscape

The IT Outsourcing Market is characterized by a dynamic and evolving structure, marked by both intense competition and strategic collaborations. Market concentration varies across different service segments and geographical regions, with a discernible trend towards consolidation through mergers and acquisitions (M&A). The rise of advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing acts as significant innovation drivers, compelling service providers to continuously adapt and enhance their offerings. Regulatory impacts, while present, are largely focused on data privacy and security standards, influencing how outsourcing agreements are structured. Product substitutes are becoming increasingly sophisticated, with in-house development and platform-as-a-service (PaaS) solutions offering viable alternatives for certain IT functions. End-user segmentation plays a crucial role in shaping competitive strategies, with providers tailoring their services to meet the specific needs of BFSI, Healthcare, Media and Telecommunications, Retail and E-commerce, and Manufacturing sectors. M&A trends indicate a strategic push for market share expansion, vertical integration, and the acquisition of specialized technological capabilities. For instance, the volume of IT outsourcing related M&A deals in the historical period (2019-2024) is estimated to be in the high hundreds, demonstrating aggressive portfolio diversification and market consolidation efforts.

IT Outsourcing Market Market Trends & Opportunities

The IT Outsourcing Market is experiencing robust growth, driven by a confluence of technological advancements, evolving business strategies, and shifting global economic landscapes. The market size is projected to reach hundreds of billions of dollars by the end of the forecast period, exhibiting a significant Compound Annual Growth Rate (CAGR) in the xx% range. This expansion is fueled by the increasing demand for cost optimization, access to specialized skills, and the imperative for businesses to focus on core competencies. Digital transformation initiatives are at the forefront of this trend, with organizations worldwide increasingly relying on IT outsourcing partners to manage complex cloud migrations, implement advanced analytics, and develop custom software solutions. The surge in remote work and distributed teams has further amplified the need for scalable and flexible IT infrastructure, making cloud-based outsourcing models particularly attractive. Consumer preferences are also playing a pivotal role, with a growing expectation for seamless digital experiences, which necessitates continuous innovation in customer relationship management (CRM) and customer experience (CX) solutions, often delivered through BPO services. Competitive dynamics are intensifying, with established players investing heavily in AI-powered automation and cybersecurity to differentiate themselves. Opportunities abound in emerging markets and specialized niches such as cybersecurity outsourcing, AI-driven data analytics, and the development of blockchain-based solutions. Market penetration rates for managed IT services are expected to climb to over xx% globally within the forecast period, signaling a fundamental shift in how businesses approach their IT operations. The adoption of DevOps and Agile methodologies by outsourcing providers is also a significant trend, enabling faster deployment cycles and improved collaboration. The growing emphasis on sustainability and ESG (Environmental, Social, and Governance) factors is also creating new avenues for IT outsourcing providers to offer green IT solutions and responsible data management practices. The metaverse and Web3 technologies are also beginning to influence the IT outsourcing landscape, with companies seeking expertise in developing immersive experiences and decentralized applications.

Dominant Markets & Segments in IT Outsourcing Market

The IT Outsourcing Market exhibits significant dominance across several key regions and segments, driven by a combination of robust economic activity, favorable government policies, and established technological infrastructure. North America and Western Europe continue to be dominant markets, owing to their high adoption rates of advanced technologies and the presence of numerous large enterprises. However, the Asia-Pacific region, particularly countries like India, is rapidly emerging as a global powerhouse in IT outsourcing, fueled by a skilled workforce, cost advantages, and supportive government initiatives promoting digital transformation.

Organization Size:

- Large Enterprises: This segment represents a substantial portion of the IT outsourcing market. These organizations leverage outsourcing for a wide range of services, including complex software development, cloud management, data analytics, and cybersecurity. The drivers for large enterprises include the need for scalability, access to specialized expertise not available in-house, and the desire to reduce operational costs associated with maintaining large IT departments. Their demand for sophisticated, end-to-end solutions makes them attractive to established IT service providers.

- Small and Medium Enterprises (SMEs): While historically having a smaller market share, SMEs are increasingly embracing IT outsourcing to gain access to cutting-edge technologies and professional IT support that would otherwise be prohibitively expensive. The key growth drivers for SMEs include:

- Cost-Effectiveness: Outsourcing allows SMEs to access enterprise-grade IT solutions at a fraction of the cost of in-house development and maintenance.

- Scalability and Flexibility: SMEs can scale their IT resources up or down as needed, adapting to fluctuating business demands without significant capital investment.

- Focus on Core Business: By outsourcing IT functions, SMEs can concentrate their limited resources on their core business operations and strategic growth.

- Access to Expertise: SMEs often lack specialized IT skills in-house. Outsourcing provides them with access to a pool of experts in areas like cloud computing, cybersecurity, and digital marketing.

End-user Vertical:

- BFSI (Banking, Financial Services, and Insurance): This vertical is a leading consumer of IT outsourcing services, driven by the need for stringent security, regulatory compliance, digital innovation in customer experience, and the management of vast amounts of data. Outsourcing is crucial for:

- Developing and maintaining secure online banking platforms.

- Implementing advanced fraud detection and prevention systems.

- Migrating legacy systems to cloud-based infrastructures.

- Enhancing customer analytics for personalized financial products.

- Healthcare: The healthcare sector relies heavily on IT outsourcing for managing electronic health records (EHRs), improving patient care through telemedicine, ensuring data security and HIPAA compliance, and optimizing operational efficiency. Key growth drivers include:

- Telehealth and remote patient monitoring solutions.

- AI-powered diagnostic tools and drug discovery platforms.

- Secure data management and interoperability between healthcare systems.

- Streamlining administrative processes and patient billing.

- Media and Telecommunications: This sector outsources extensively for content management systems, network infrastructure management, customer support (CX), and the development of digital media platforms. The demand for personalized content delivery and seamless connectivity fuels outsourcing needs.

- Retail and E-commerce: The explosive growth of e-commerce has made this vertical a significant outsourcing segment. Companies outsource for:

- Developing and managing robust e-commerce platforms.

- Personalized customer experiences and recommendation engines.

- Supply chain management and logistics optimization.

- Data analytics for understanding consumer behavior and trends.

- Manufacturing: The manufacturing sector is increasingly adopting Industry 4.0 technologies, driving demand for IT outsourcing in areas such as:

- Industrial IoT (Internet of Things) integration.

- Supply chain visibility and optimization.

- Automation and robotics integration.

- Predictive maintenance for machinery.

IT Outsourcing Market Product Analysis

The IT Outsourcing Market is defined by a diverse and rapidly evolving range of products and services. Key innovations center around cloud computing solutions, including public, private, and hybrid cloud management, alongside Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) offerings. Managed IT services, encompassing infrastructure management, network monitoring, and cybersecurity solutions, represent a core product category. Custom software development, leveraging agile methodologies and cutting-edge programming languages, allows businesses to build tailored applications that meet specific operational needs. Business Process Outsourcing (BPO) continues to expand, incorporating advanced AI-driven customer support, data entry, and back-office operations. The competitive advantage for providers lies in their ability to offer integrated solutions, leverage emerging technologies like AI and machine learning for automation and predictive analytics, and ensure robust cybersecurity and data privacy compliance.

Key Drivers, Barriers & Challenges in IT Outsourcing Market

The IT Outsourcing Market is propelled by significant growth drivers, including the persistent need for cost reduction and operational efficiency across industries. The accelerating pace of digital transformation compels businesses to seek external expertise for implementing advanced technologies like AI, cloud computing, and big data analytics, which they may not possess in-house. The global shortage of skilled IT professionals further incentivizes outsourcing, providing access to a wider talent pool. Economic factors, such as fluctuating currency exchange rates, can also make outsourcing to specific regions more attractive.

However, the market faces considerable barriers and challenges. Regulatory hurdles, particularly concerning data privacy (e.g., GDPR, CCPA) and cross-border data transfer, can complicate outsourcing agreements and increase compliance costs. Cybersecurity threats remain a paramount concern, requiring robust protective measures and continuous vigilance from outsourcing providers. Supply chain disruptions, though less direct to IT services, can impact the availability of hardware and software components, indirectly affecting project timelines. Intense competitive pressures can lead to price wars and margin erosion, while managing remote teams effectively and ensuring seamless communication across different time zones and cultures present ongoing operational challenges. The risk of vendor lock-in and the need for stringent contract management are also significant considerations.

Growth Drivers in the IT Outsourcing Market Market

The IT Outsourcing Market is experiencing substantial growth fueled by several interconnected factors. The relentless pursuit of digital transformation across all industry verticals is a primary catalyst, necessitating specialized expertise in areas like cloud adoption, AI integration, and data analytics. Cost optimization remains a key driver, as businesses seek to leverage economies of scale and competitive labor markets offered by outsourcing partners. The growing scarcity of skilled IT talent globally pushes companies to outsource to access a broader and more specialized workforce. Furthermore, the increasing complexity of IT infrastructure and the rapid evolution of technology demand continuous innovation and adaptation, which outsourcing providers are well-positioned to deliver. Strategic partnerships and mergers are also contributing to market expansion, enabling providers to offer more comprehensive service portfolios.

Challenges Impacting IT Outsourcing Market Growth

Despite its robust growth, the IT Outsourcing Market grapples with several challenges. Stringent and evolving data privacy regulations worldwide pose significant compliance hurdles, demanding meticulous attention to data security and cross-border data handling. Cybersecurity threats continue to escalate, requiring substantial investment in advanced protective measures and a proactive risk management approach. The inherent complexities in managing global supply chains can indirectly affect IT project timelines and resource availability. Intense competition within the market can lead to price pressures and affect profitability margins. Furthermore, ensuring effective communication, cultural alignment, and seamless integration between internal teams and external outsourcing partners remains a persistent operational challenge. The potential for vendor lock-in also necessitates careful contract negotiation and ongoing relationship management.

Key Players Shaping the IT Outsourcing Market Market

- Infosys Limited

- Wipro Limited

- Accenture PLC

- NTT Corporation

- Wns Holding Ltd

- IBM Corporation

- ATOS SE

- Capgemini SE

- Andela Inc

- Pointwest Technologies

- Amadeus IT Group

- Tata Consultancy Services

- HCL Technologies Lt

- DXC Technologies

- Specialist Computer Centres (SCC)

- Cognizant Technology Solutions Corporation

Significant IT Outsourcing Market Industry Milestones

- May 2023: TDCX officially unveiled its plans for the expansion of its facility in Sao Paulo, Brazil, a move that underscores the growing importance of Latin America in the digital customer experience (CX) and IT services landscape. This expansion, driven by advancements in generative AI and other cutting-edge technologies, aims to enhance operational automation, predictive capabilities through data analysis, and overall service optimization for technology and blue-chip enterprises.

- April 2023: Atos SE announced the establishment of three state-of-the-art cloud centers in India (Pune and Bangalore) and Poland. These centers are strategically designed to support clients throughout their entire cloud journey, from migration to continuous optimization and innovation, all within a robust cybersecurity framework. The initiative caters to a diverse range of business sectors, including healthcare, financial services, manufacturing, and telecommunications, highlighting a commitment to providing comprehensive cloud solutions across industries.

Future Outlook for IT Outsourcing Market Market

The future outlook for the IT Outsourcing Market is exceptionally promising, driven by continued digital transformation imperatives and the accelerating adoption of emerging technologies. The increasing demand for cloud services, AI-driven solutions, cybersecurity expertise, and data analytics will fuel sustained growth. Emerging markets will play an increasingly significant role, offering new opportunities for both service providers and clients. The focus on customer experience (CX) will continue to be a major driver, with outsourcing partners playing a critical role in delivering personalized and efficient customer interactions. Strategic partnerships and the integration of advanced automation tools will further enhance service delivery capabilities. The market is poised for innovation, with significant potential in areas such as the metaverse, Web3 technologies, and sustainable IT solutions, ensuring a dynamic and evolving landscape for years to come.

IT Outsourcing Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium Enterprises

- 1.2. Large Enterprises

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. Healthcare

- 2.3. Media and Telecommunications

- 2.4. Retail and E-commerce

- 2.5. Manufacturing

- 2.6. Other End-user verticals

IT Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Poland

- 2.7. Belgium

- 2.8. Netherlands

- 2.9. Luxembourg

- 2.10. Sweden

- 2.11. Denmark

- 2.12. Norway

- 2.13. Finland

- 2.14. Iceland

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Indonesia

- 3.5. Vietnam

- 3.6. Malaysia

- 3.7. South Korea

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

-

5. Middle East and Africa

- 5.1. GCC

- 5.2. South Africa

- 5.3. Turkey

IT Outsourcing Market Regional Market Share

Geographic Coverage of IT Outsourcing Market

IT Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Efficiency and Scalable IT Infrastructure; Organization are Increasingly Focusing on IT as a means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. BFSI to be the Largest End-user Vertical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. Healthcare

- 5.2.3. Media and Telecommunications

- 5.2.4. Retail and E-commerce

- 5.2.5. Manufacturing

- 5.2.6. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Small and Medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. Healthcare

- 6.2.3. Media and Telecommunications

- 6.2.4. Retail and E-commerce

- 6.2.5. Manufacturing

- 6.2.6. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Small and Medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. Healthcare

- 7.2.3. Media and Telecommunications

- 7.2.4. Retail and E-commerce

- 7.2.5. Manufacturing

- 7.2.6. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Small and Medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. Healthcare

- 8.2.3. Media and Telecommunications

- 8.2.4. Retail and E-commerce

- 8.2.5. Manufacturing

- 8.2.6. Other End-user verticals

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Small and Medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. Healthcare

- 9.2.3. Media and Telecommunications

- 9.2.4. Retail and E-commerce

- 9.2.5. Manufacturing

- 9.2.6. Other End-user verticals

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East and Africa IT Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Small and Medium Enterprises

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. BFSI

- 10.2.2. Healthcare

- 10.2.3. Media and Telecommunications

- 10.2.4. Retail and E-commerce

- 10.2.5. Manufacturing

- 10.2.6. Other End-user verticals

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infosys Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wipro Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Accenture PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NTT Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wns Holding Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IBM Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ATOS SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Capgemini SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Andela Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pointwest Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amadeus IT Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tata Consultancy Services

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 HCL Technologies Lt

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 DXC Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Specialist Computer Centres (SCC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Cognizant Technology Solutions Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Infosys Limited

List of Figures

- Figure 1: IT Outsourcing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: IT Outsourcing Market Share (%) by Company 2025

List of Tables

- Table 1: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: IT Outsourcing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: IT Outsourcing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 10: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: IT Outsourcing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Poland IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Belgium IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Netherlands IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Luxembourg IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Sweden IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Denmark IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Norway IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Finland IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Iceland IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 27: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: IT Outsourcing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: China IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Japan IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Indonesia IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Vietnam IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Malaysia IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Korea IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 37: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 38: IT Outsourcing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Brazil IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Mexico IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Colombia IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: IT Outsourcing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 43: IT Outsourcing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 44: IT Outsourcing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: GCC IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Africa IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Turkey IT Outsourcing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Outsourcing Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the IT Outsourcing Market?

Key companies in the market include Infosys Limited, Wipro Limited, Accenture PLC, NTT Corporation, Wns Holding Ltd, IBM Corporation, ATOS SE, Capgemini SE, Andela Inc, Pointwest Technologies, Amadeus IT Group, Tata Consultancy Services, HCL Technologies Lt, DXC Technologies, Specialist Computer Centres (SCC), Cognizant Technology Solutions Corporation.

3. What are the main segments of the IT Outsourcing Market?

The market segments include Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 617.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Efficiency and Scalable IT Infrastructure; Organization are Increasingly Focusing on IT as a means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure.

6. What are the notable trends driving market growth?

BFSI to be the Largest End-user Vertical.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

May 2023: TDCX officially unveiled its plans for the expansion of its facility in Sao Paulo, Brazil. The company is a leading provider of digital customer experience (CX) solutions for technology and blue-chip enterprises. With the advent of cutting-edge technologies, including generative artificial intelligence (AI), TDCX is poised to revolutionize the CX landscape in various domains. These advancements empower service providers like TDCX to further automate their operations, offer enhanced predictive capabilities through data analysis, and optimize procedures for their valued clients. The decision to expand into Brazil underscores the country's growing appeal as a prime destination for digital customer experience solutions and IT services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Outsourcing Market?

To stay informed about further developments, trends, and reports in the IT Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence