Key Insights

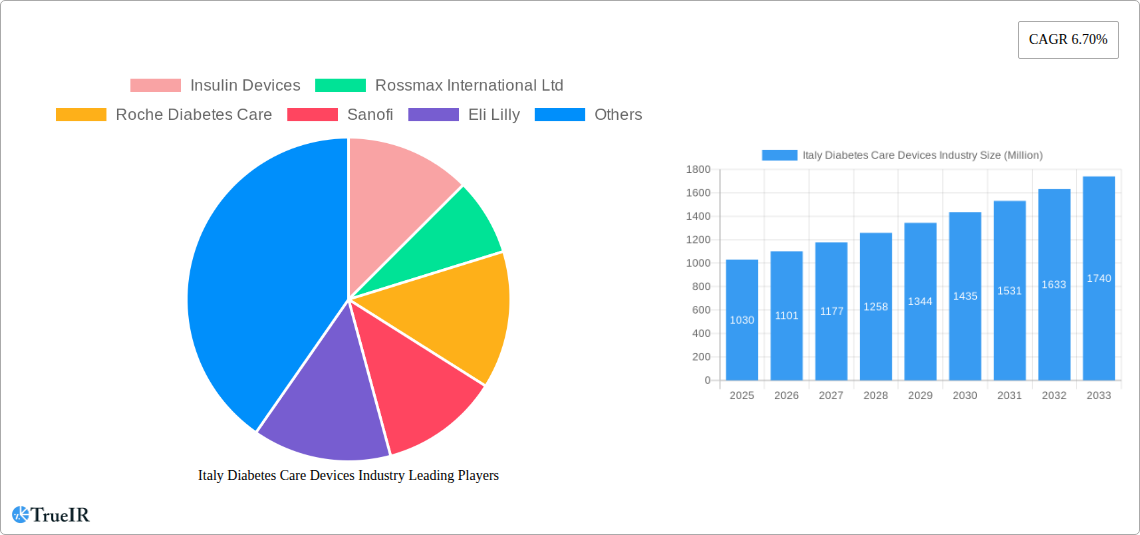

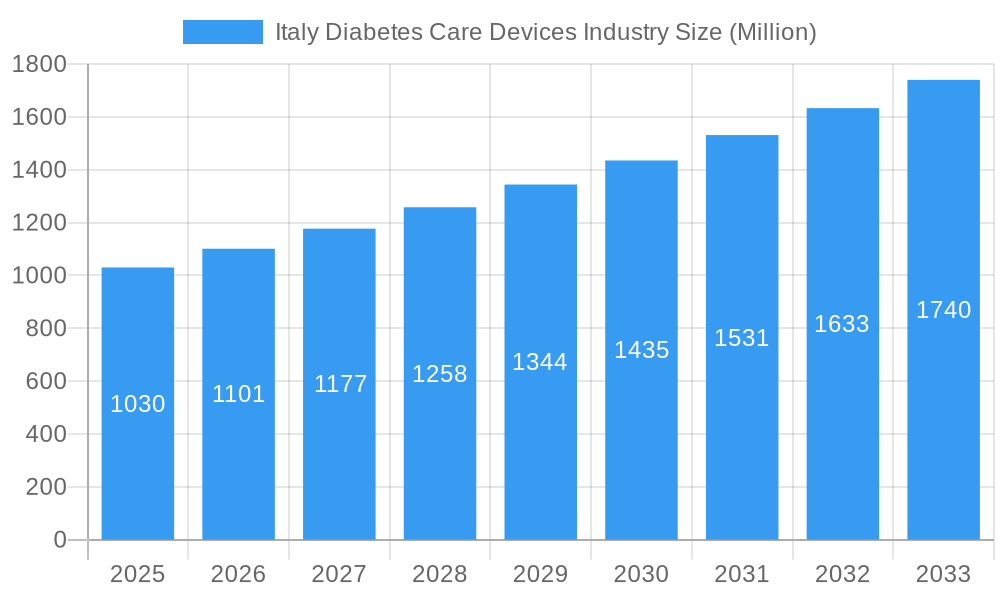

The Italian diabetes care devices market is poised for robust growth, projected to reach a substantial valuation by 2025 and maintain a healthy Compound Annual Growth Rate (CAGR) of 6.70% through 2033. This upward trajectory is fueled by several key drivers, including the increasing prevalence of diabetes in Italy, a growing awareness of advanced diabetes management techniques, and supportive government initiatives aimed at improving patient outcomes. The market is segmented into management devices and monitoring devices, both experiencing significant demand. Management devices encompass insulin pumps, syringes, cartridges, disposable pens, and jet injectors, catering to diverse patient needs and preferences for insulin delivery. Simultaneously, the monitoring segment, vital for effective diabetes control, includes self-monitoring blood glucose devices (glucometers, test strips, lancets) and continuous glucose monitoring systems (sensors, durables), reflecting a strong shift towards real-time glucose tracking and personalized care.

Italy Diabetes Care Devices Industry Market Size (In Billion)

The Italian healthcare landscape is increasingly prioritizing proactive diabetes management, leading to higher adoption rates of innovative devices. Trends such as the miniaturization of insulin pumps, the development of more accurate and user-friendly CGMs, and the integration of these devices with digital health platforms are shaping the market. Furthermore, the growing elderly population in Italy, which often presents with a higher burden of chronic diseases like diabetes, contributes to sustained demand for these essential devices. While the market is largely driven by technological advancements and increasing patient empowerment, potential restraints could include the cost of advanced devices for certain patient demographics and the need for continuous healthcare professional training to ensure optimal utilization. However, the overall outlook remains highly positive, with key players like Roche Diabetes Care, Sanofi, Eli Lilly, Novo Nordisk, Abbott, and Medtronic actively contributing to market expansion through product innovation and strategic partnerships within Italy.

Italy Diabetes Care Devices Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Italy Diabetes Care Devices Industry, designed for maximum impact and engagement:

Italy Diabetes Care Devices Industry: Market Analysis, Trends, and Forecast 2019–2033

This comprehensive report provides an in-depth analysis of the Italy diabetes care devices market, offering critical insights into its structure, trends, and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for understanding the dynamics of diabetes management devices in Italy. It delves into high-volume keywords such as diabetes devices Italy, insulin pumps Italy, continuous glucose monitoring (CGM) Italy, and blood glucose meters Italy, ensuring maximum visibility for industry stakeholders.

Italy Diabetes Care Devices Industry Market Structure & Competitive Landscape

The Italy diabetes care devices industry is characterized by a moderately concentrated market, driven by continuous innovation in diabetes technology. Key companies are investing heavily in research and development to introduce advanced insulin delivery systems and blood glucose monitoring solutions. Regulatory frameworks, while ensuring patient safety, also influence market entry and product approvals, shaping the competitive landscape. The presence of product substitutes and evolving end-user segmentation based on patient needs and technological adoption are critical factors. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to expand their product portfolios and market reach. For instance, the market has witnessed approximately 5 to 10 significant M&A activities within the last five years, impacting market share distribution. Key players are focusing on strategic collaborations to enhance their competitive edge.

- Market Concentration: Moderate, with a few dominant players and several niche manufacturers.

- Innovation Drivers: Technological advancements in miniaturization, connectivity, and user-friendliness.

- Regulatory Impacts: Stringent approval processes that prioritize safety and efficacy.

- Product Substitutes: Traditional methods alongside emerging digital health solutions.

- End-User Segmentation: Pediatric, adult, and geriatric diabetic populations with varying management needs.

- M&A Trends: Strategic acquisitions to gain market share and technological capabilities.

Italy Diabetes Care Devices Industry Market Trends & Opportunities

The Italy diabetes care devices market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This growth is fueled by a rising prevalence of diabetes across all age groups, increasing healthcare expenditure, and a growing awareness among patients and healthcare professionals regarding the benefits of advanced diabetes management solutions. Technological shifts are prominently visible, with a significant surge in the adoption of continuous glucose monitoring (CGM) systems and smart insulin pens due to their ability to provide real-time data and enhance treatment adherence. Consumer preferences are increasingly leaning towards user-friendly, connected devices that offer personalized insights and minimize the burden of diabetes management. The competitive dynamics are intensifying, with companies vying for market leadership through product differentiation, strategic partnerships, and market penetration strategies. The market is also ripe with opportunities for companies focusing on digital diabetes solutions and integrated care platforms, catering to the growing demand for remote patient monitoring and telemedicine. The penetration of advanced diabetes care devices is still evolving, presenting a substantial growth avenue for innovative products. The market size is expected to reach over €5,000 million by 2033.

Dominant Markets & Segments in Italy Diabetes Care Devices Industry

The Italy diabetes care devices industry is segmented into two primary categories: Management Devices and Monitoring Devices, each with its sub-segments. Within Management Devices, the Insulin Pump segment, encompassing Insulin Pump Devices, Insulin Pump Reservoirs, and Infusion Sets, is a dominant force, driven by its efficacy in providing precise insulin delivery and improving glycemic control. The Insulin Syringes, Cartridges in Reusable Pens, and Insulin Disposable Pens also hold significant market share, offering more traditional yet widely adopted methods of insulin administration. Jet Injectors represent a niche but growing segment for those seeking needle-free alternatives.

In the Monitoring Devices segment, Self-monitoring Blood Glucose (SMBG), which includes Glucometer Devices, Blood Glucose Test Strips, and Lancets, remains a cornerstone of diabetes management due to its accessibility and affordability. However, the Continuous Glucose Monitoring (CGM) segment, comprising Sensors and Durables, is experiencing exponential growth. This is attributed to its ability to provide continuous data streams, enabling proactive management and reducing the risk of hypoglycemia and hyperglycemia. Factors contributing to the dominance of these segments include:

- Infrastructure: Well-established healthcare infrastructure and a high density of healthcare facilities.

- Policies: Government initiatives promoting early diagnosis and effective diabetes management.

- Technological Advancements: Continuous improvements in the accuracy, convenience, and connectivity of these devices.

- Patient Compliance: Increasing patient engagement in self-management and preference for less invasive monitoring.

- Reimbursement Policies: Favorable reimbursement schemes for advanced diabetes care devices in certain regions.

The CGM segment is projected to witness the highest growth rate due to its advanced capabilities in providing comprehensive glycemic insights.

Italy Diabetes Care Devices Industry Product Analysis

Product innovations in the Italy diabetes care devices industry are revolutionizing diabetes management. Key advancements include ultra-thin, long-lasting CGM sensors offering improved accuracy and reduced wear time, alongside smart insulin pens that connect to mobile apps for dose tracking and trend analysis. Closed-loop insulin pump systems are further enhancing automated insulin delivery. These products offer distinct competitive advantages by providing real-time data, personalized feedback, and seamless integration with other health technologies, thereby empowering patients and improving treatment outcomes. The focus is on creating devices that are discreet, comfortable, and intuitive to use, making them a natural extension of daily life for individuals with diabetes.

Key Drivers, Barriers & Challenges in Italy Diabetes Care Devices Industry

Key Drivers propelling the Italy diabetes care devices industry include the rising global diabetes prevalence, leading to an increased demand for effective management tools. Technological advancements in miniaturization, connectivity, and data analytics are creating more sophisticated and user-friendly devices. Government initiatives and increasing healthcare expenditure also play a crucial role.

Barriers and Challenges include the high cost of advanced diabetes care devices, which can limit accessibility for some patient segments. Regulatory complexities and lengthy approval processes can hinder the timely market entry of new innovations. Furthermore, supply chain disruptions, as experienced globally, can impact the availability of essential components. Growing competition from both established players and emerging startups also presents a challenge, requiring companies to continuously innovate and optimize their strategies.

Growth Drivers in the Italy Diabetes Care Devices Industry Market

Key growth drivers for the Italy diabetes care devices market are the escalating prevalence of diabetes, driven by lifestyle changes and an aging population. Significant investments in healthcare infrastructure and a growing emphasis on preventative care and early diagnosis are creating a more favorable market environment. Technological advancements in smart devices, wearable technology, and artificial intelligence for diabetes management are opening up new avenues for growth. Furthermore, supportive government policies and reimbursement frameworks for innovative diabetes solutions are crucial catalysts. The increasing adoption of connected diabetes devices and the growing demand for personalized treatment approaches are also significant growth engines.

Challenges Impacting Italy Diabetes Care Devices Industry Growth

Challenges impacting the Italy diabetes care devices industry growth primarily stem from the substantial cost associated with advanced diabetes management and monitoring devices, which can pose a barrier to widespread adoption, especially for individuals with limited financial resources. Stringent and evolving regulatory landscapes in the medical device sector require significant investment in compliance and can prolong product development cycles. Moreover, the industry faces persistent supply chain vulnerabilities, which can lead to shortages of critical components and finished products. Intense competition among a growing number of players, coupled with the need for continuous innovation to stay ahead, adds further pressure on market participants.

Key Players Shaping the Italy Diabetes Care Devices Industry Market

- Insulin Devices

- Rossmax International Ltd

- Roche Diabetes Care

- Sanofi

- Eli Lilly

- Novo Nordisk A/S

- LifeScan Inc

- Abbott Diabetes Care

- Medtronic

- Dexcom

- Arkray Inc

- Ascensia Diabetes Care

- Insulet Corporation

Significant Italy Diabetes Care Devices Industry Industry Milestones

- June 2022: Cequr, a leader in wearable diabetes technology, launched its latest innovation, the Insulin Pen 2.0TM. This device is designed for continuous wear and features an integrated blood glucose meter, offering users real-time sugar tracking and convenient insulin delivery.

- January 2022: Roche introduced its new point-of-care blood glucose monitor, the Cobas pulse. Tailored for hospital professionals, this smartphone-like touchscreen device includes an automated glucose test strip reader and camera, facilitating the logging of other diagnostic results for patients of all ages, including those in intensive care.

Future Outlook for Italy Diabetes Care Devices Industry Market

The future outlook for the Italy diabetes care devices industry is exceptionally bright, fueled by persistent technological innovation and a growing understanding of personalized diabetes management. The market is poised for substantial growth as advanced CGM systems, smart insulin delivery devices, and digital health platforms become more integrated into mainstream healthcare. The increasing focus on remote patient monitoring and telehealth solutions will further accelerate the adoption of connected devices. Opportunities lie in developing more affordable, user-friendly, and data-driven solutions that empower patients and healthcare providers to achieve optimal glycemic control and improve the quality of life for individuals living with diabetes.

Italy Diabetes Care Devices Industry Segmentation

-

1. Management Devices

-

1.1. Insulin Pump

- 1.1.1. Insulin Pump Device

- 1.1.2. Insulin Pump Reservoir

- 1.1.3. Infusion Set

- 1.2. Insulin Syringes

- 1.3. Cartridges in Reusable Pens

- 1.4. Insulin Disposable Pens

- 1.5. Jet Injectors

-

1.1. Insulin Pump

-

2. Monitoring Devices

-

2.1. Self-monitoring Blood Glucose

- 2.1.1. Glucometer Devices

- 2.1.2. Blood Glucose Test Strips

- 2.1.3. Lancets

-

2.2. Continuous Glucose Monitoring

- 2.2.1. Sensors

- 2.2.2. Durables

-

2.1. Self-monitoring Blood Glucose

Italy Diabetes Care Devices Industry Segmentation By Geography

- 1. Italy

Italy Diabetes Care Devices Industry Regional Market Share

Geographic Coverage of Italy Diabetes Care Devices Industry

Italy Diabetes Care Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The continuous glucose monitoring segment is expected to witness the highest growth rate over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Diabetes Care Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 5.1.1. Insulin Pump

- 5.1.1.1. Insulin Pump Device

- 5.1.1.2. Insulin Pump Reservoir

- 5.1.1.3. Infusion Set

- 5.1.2. Insulin Syringes

- 5.1.3. Cartridges in Reusable Pens

- 5.1.4. Insulin Disposable Pens

- 5.1.5. Jet Injectors

- 5.1.1. Insulin Pump

- 5.2. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.2.1. Self-monitoring Blood Glucose

- 5.2.1.1. Glucometer Devices

- 5.2.1.2. Blood Glucose Test Strips

- 5.2.1.3. Lancets

- 5.2.2. Continuous Glucose Monitoring

- 5.2.2.1. Sensors

- 5.2.2.2. Durables

- 5.2.1. Self-monitoring Blood Glucose

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Insulin Devices

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rossmax International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roche Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanofi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novo Nordisk A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Diabetes Care

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Medtronic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dexcom

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arkray Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ascensia Diabetes Care

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Insulet Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Insulin Devices

List of Figures

- Figure 1: Italy Diabetes Care Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Diabetes Care Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 2: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 3: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 4: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 5: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 8: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Management Devices 2020 & 2033

- Table 9: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 10: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Monitoring Devices 2020 & 2033

- Table 11: Italy Diabetes Care Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy Diabetes Care Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Diabetes Care Devices Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Italy Diabetes Care Devices Industry?

Key companies in the market include Insulin Devices, Rossmax International Ltd , Roche Diabetes Care, Sanofi, Eli Lilly, Novo Nordisk A/S, LifeScan Inc, Abbott Diabetes Care, Medtronic, Dexcom, Arkray Inc, Ascensia Diabetes Care, Insulet Corporation.

3. What are the main segments of the Italy Diabetes Care Devices Industry?

The market segments include Management Devices, Monitoring Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

The continuous glucose monitoring segment is expected to witness the highest growth rate over the forecast period.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: Cequr, the leader in wearable diabetes technology, released their newest and most innovative insulin delivery device yet, the Insulin Pen 2.0TM. The pen is small enough to be always worn on the user's body. It also features a built-in blood glucose meter so users can track their blood sugar throughout the day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Diabetes Care Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Diabetes Care Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Diabetes Care Devices Industry?

To stay informed about further developments, trends, and reports in the Italy Diabetes Care Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence